|

市場調查報告書

商品編碼

1850004

硬焊焊合金:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Braze Alloys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

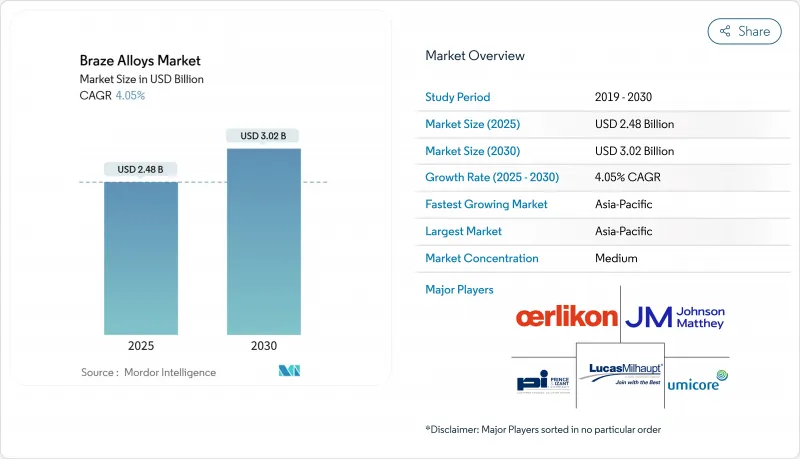

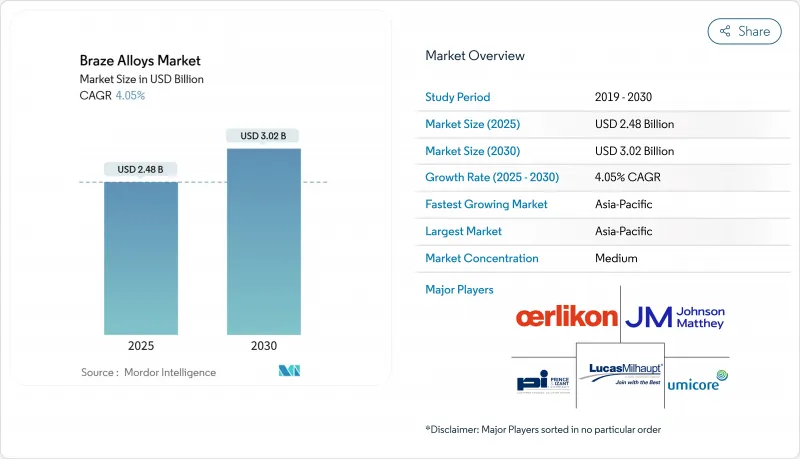

預計到 2025 年,硬焊合金市場規模將達到 24.8 億美元,到 2030 年將達到 30.2 億美元,年複合成長率為 4.05%。

汽車熱交換器、電動車電力電子設備和先進航太結構對精密金屬連接的需求不斷成長,推動了市場發展。在中溫作業中,硬焊逐漸取代焊接,維持了市場高銷售量;同時,新型非晶質箔合金的出現,也拓展了異種金屬連接的應用範圍。亞太地區在銷售和成長方面佔據主導地位,這主要得益於中國鋁二次加工的蓬勃發展以及該地區電子產品產能的擴張。供應鏈參與企業越來越傾向於選擇高性能配方而非價格敏感型產品,這預示著硬焊焊合金市場正在轉向品質驅動型採購模式。

全球硬焊市場趨勢與洞察

硬焊而非焊接或錫焊

硬焊因其能在低溫下連接材料,從而保持基材性能(這對於航太和電子應用中高精度裝配至關重要)而備受製造商青睞。爐內硬焊可在單次循環中完成多個接頭的連接,省去了焊接工序,減少了人工成本,並最大限度地減少了變形。改良的焊絲化學成分使其強度可與焊接接頭媲美,同時又具備高抗疲勞性,這使得硬焊成為複雜薄壁結構的首選工藝。汽車供應商表示,將手工硬焊修復改為批量釬焊,鋁製散熱器生產線的生產週期顯著縮短。隨著原始設備製造商 (OEM) 推行精實生產,這一趨勢正在推動中溫硬焊合金市場的發展。

汽車熱交換器中對鋁釬焊的需求迅速成長

電動車和渦輪增壓內燃機都需要小型溫度控管系統。鋁矽焊料可在不影響輕量化目標的前提下形成密封接頭,這對於提高續航里程和燃油經濟性至關重要。 A2L冷媒的引入提高了接頭完整性的要求,進一步增加了焊料用量。 NOCOLOK等助焊劑技術可在可控氣氛爐中均勻潤濕,從而滿足一級熱交換器工廠每年數百萬台設備的產能需求。這些因素將在短期內導致對鋁釬焊焊料的高需求,從而推動亞太地區、北美自由貿易組織(NAFTA)和歐洲汽車叢集的硬焊合金市場成長。

基底金屬價格波動

由於供應瓶頸和基礎設施需求,銅和銀的價格將出現劇烈波動。成本上升將擠壓對沖金屬或將成本轉嫁給客戶的焊料生產商的利潤淨利率,這可能導致對價格敏感的暖通空調和白色家電行業的訂單延遲。這種波動將迫使一些加工商考慮機械緊固,在短期內對硬焊焊合金市場構成下行壓力。均衡的籌資策略和改進低貴金屬含量的合金將部分抵消這種抑製作用,但無法完全消除風險。

細分市場分析

預計到2024年,銅基釬料的銷售額將佔總銷售額的35.86%,顯示其在汽車、暖通空調和一般工業應用等領域具有廣泛的應用潛力。客戶青睞銅的導熱性、適中的熔點以及與助焊劑的兼容性,這確保了硬焊釬料市場穩定。含銀釬料用於對接頭耐腐蝕性要求極高的高階電子產品,而金合金則符合嚴苛環境下的微腐蝕防護需求。

其他基底金屬,主要是鎳和鈷,由於其高溫穩定性,將以4.71%的複合年成長率快速成長至2030年,這使得它們非常適合用於電動車電池模組和渦輪機部件。亞利桑那州立大學的研究表明,銅-鉭-鋰合金在800 度C下保持1120 MPa的屈服強度長達10000小時,這預示著先進銅合金的發展方向。此類發展將擴大特種耐高溫合金的市場規模,但不會撼動銅的市場主導地位。

至2024年,棒材和線材產品將佔硬焊合金市場30.94%的佔有率。 MRO(維修、維修和大修)技術人員依賴這種常見的釬焊形式進行焊炬操作,而小批量製造商則看重其低廉的入門成本。粉末、膏狀和箔狀釬料則適用於電子和航太航太等特殊領域的連接,可在需要特定幾何形狀時實現合金的精確定位。

受汽車散熱器生產線(該行業對重複性要求極高)的推動,預成型環和預製件正以 4.97% 的複合年成長率快速成長。預成型環可將循環時間縮短高達 30%,並提供一致的焊角尺寸,從而減少檢驗後的返工。機器人技術的整合應用有利於可自動拾取和放置的預製件,這將推動硬焊合金市場在 2030 年前保持高於平均水平的成長。

區域分析

預計到2024年,亞太地區將貢獻全球46.28%的收入,年複合成長率達5.03%,成為規模最大且成長最快的地區。受新能源汽車和基礎建設的推動,中國再生鋁產品市場正以每年13%的速度成長,從而提振了對鋁基焊料的需求。日本精密製造商和韓國電子組裝正在安裝先進的爐線,進一步鞏固其在亞太地區的專業技術。儘管薪資上漲和環境、社會及公司治理(ESG)法規的實施正促使部分產能轉移至越南和泰國,但強大的供應鏈仍使亞太地區在硬焊合金市場佔據核心地位。

北美保持第二的位置,這主要得益於航太引擎和國防電子項目對高性能鎳鈷焊料的需求。美國的回流政策和通膨抑制法案正推動資本流入現代化熔爐升級改造,而墨西哥的汽車出口則刺激了鋁製散熱器的消費。儘管技術純熟勞工短缺和銅價間歇性上漲抑制了絕對成長,但硬焊合金市場仍然強勁。

歐洲成熟的工業基礎為汽車、暖通空調和通用工程領域提供了穩定的需求。嚴格的RoHS和REACH法規要求正在推動無鎘無鉛產品的快速普及。德國電動車平台的推廣應用刺激了鋁矽合金焊料的生產,而英國航太複合材料叢集則轉向使用非晶質箔材進行金屬-陶瓷連接。循環經濟指令為再生焊料開闢了新的市場空間,預示著該地區硬焊合金市場將呈現一條微妙的成長路徑。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 硬焊而非焊接或錫焊

- 汽車熱交換器中對鋁基釬硬焊的需求激增

- 非晶質箔合金的興起使得低溫異質接面的實現成為可能

- 電動車電力電子領域採用鎳基介電漿料

- 暖通空調和冷凍產業成長

- 市場限制

- 基底金屬價格波動

- 禁止對有害金屬(鎘、鉛)進行監管

- 積層製造替代方案

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按基底金屬

- 銅

- 銀

- 金子

- 鋁

- 其他基底金屬(鎳、鈷等)

- 透過填寫表格

- 粉末

- 貼上

- 箔紙/絲帶

- 棒材/線材

- 環和預成型件

- 按溫度範圍

- 低溫(低於 450°C)

- 中溫(450-800度C)

- 高溫(超過 800°C)

- 按最終用戶行業分類

- 車

- 航太與國防

- 電機與電子工程

- 建造

- 其他終端用戶產業(醫療設備、能源/電力等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Aimtek, Inc.

- Cupro Alloys Corporation

- Fusion, Inc.

- Indian Solder and Braze Alloys Pvt. Ltd.

- Johnson Matthey

- Lucas-Milhaupt Inc.

- Materion Corporation

- Morgan Advanced Materials plc

- Nihon Superior Co., Ltd.

- OC Oerlikon Management AG

- Prince & Izant Company

- Saru Silver Alloy Private Limited

- Sulzer Ltd

- The Lincoln Electric Company

- Umicore

- VBC Group

- Wieland Group

第7章 市場機會與未來展望

The braze alloys market size stands at USD 2.48 billion in 2025 and is on track to reach USD 3.02 billion by 2030, reflecting a 4.05% CAGR.

The market gains strength from growing demand for precision metal joining in automotive heat exchangers, EV power electronics, and advanced aerospace structures. Steady substitution of welding by brazing in medium-temperature operations keeps volumes high, while new amorphous foil alloys widen the application window into dissimilar metal assemblies. Asia-Pacific dominates volume and growth, supported by China's secondary aluminum boom and regional electronics capacity expansions. Supply chain participants now favor high-performance formulations over price-driven grades, indicating a shift toward quality-led purchasing across the braze alloys market.

Global Braze Alloys Market Trends and Insights

Adoption of Brazing Over Welding & Soldering

Manufacturers favor brazing because it joins materials at lower temperatures, which preserves base metal properties critical for tight-tolerance assemblies in aerospace and electronics applications. Furnace brazing consolidates multiple joints in a single cycle, eliminating sequential welding steps, cutting labor, and minimizing distortion. Improved filler chemistries now match welded joint strength while offering higher fatigue resistance, making brazing the process of choice for complex thin-wall structures. Automotive suppliers report shorter takt times in aluminum radiator lines after switching from manual weld repair to batch brazing. As OEMs push lean manufacturing, this driver strengthens the braze alloys market across medium-temperature ranges.

Surging Demand for Aluminum Brazes in Automotive Heat Exchangers

Electric vehicles and turbocharged combustion engines both require compact heat management systems. Aluminum-silicon fillers form leak-tight joints without compromising lightweight targets vital for range and fuel economy. Implementing A2L refrigerants has tightened joint integrity requirements, further boosting filler volumes. Flux technologies such as NOCOLOK deliver uniform wetting in controlled-atmosphere furnaces, supporting annual throughput in the millions of units at Tier-1 heat-exchanger plants. These factors translate into high short-term pull for aluminum brazes, lifting the braze alloys market in automotive clusters across APAC, NAFTA, and Europe.

Base-Metal Price Volatility

Copper and silver exhibit sharp price swings due to supply bottlenecks and infrastructure demand. Cost spikes compress margins for filler producers, who hedge metals or pass costs to customers, risking order deferrals in price-sensitive HVAC and white-goods sectors. The volatility prompts some fabricators to consider mechanical fastening, placing downward pressure on the braze alloys market during short-term cycles. Balanced sourcing strategies and alloy reformulations with lower noble-metal content partially offset the restraint, yet cannot fully neutralize exposure.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Amorphous-Foil Alloys Enabling Low-Temperature Dissimilar Joins

- EV Power-Electronics Uptake of Nickel-Based Induction Pastes

- Toxic-Metal Regulatory Bans

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Copper-based fillers generated 35.86% of revenue in 2024, underscoring their broad applicability in automotive, HVAC, and general industrial lines. Users value copper's thermal conductivity, moderate melting point, and compatibility with fluxes, which keep the braze alloys market anchored in this metal class. Silver-bearing grades serve premium electronics where joint resistivity matters, and gold alloys fill micro-corrosion niches in harsh environments.

Other base metals, chiefly nickel and cobalt, will expand briskly at a 4.71% CAGR to 2030 as their high-temperature stability suits EV battery modules and turbine components. Arizona State University demonstrated a copper-tantalum-lithium alloy sustaining 1120 MPa yield strength after 10,000 hours at 800 °C, validating the trajectory toward advanced copper variants. These developments enlarge the braze alloys market size for specialty high-heat grades without eclipsing copper's volume leadership.

Rod and wire products accounted for 30.94% of the braze alloys market in 2024. MRO technicians rely on these familiar forms for torch work, and small batch fabricators appreciate their low entry cost. Powder, paste, and foil formats address niche electronics and aerospace joints, offering precise alloy placement when geometry demands.

Rings and preforms are advancing at a 4.97% CAGR, propelled by automotive radiator lines that value repeatability. Pre-shaped rings cut cycle time by up to 30% and deliver consistent fillet size, which reduces post-inspection rework. Robotics integration favors preforms that can be picked and placed automatically, sustaining above-average growth in the braze alloys market through 2030.

The Braze Alloys Market Report Segments the Industry by Base Metal (Copper, Silver, and More), Filler Form (Powder, Paste, and More), Temperature Range (Low-Temperature, Medium-Temperature, and More), End-User Industry (Automotive, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 46.28% of global revenue in 2024 and is forecast to grow at 5.03% CAGR, making it the largest and fastest region simultaneously. China's secondary aluminum segment is expanding 13% per year, driven by new energy vehicles and infrastructure, which elevates demand for aluminum-based fillers. Japanese precision manufacturers and Korean electronics assemblers install advanced furnace lines, deepening regional expertise. Rising wages and ESG regulations are starting to nudge some capacity toward Vietnam and Thailand, but entrenched supply chains keep APAC at the center of the braze alloys market.

North America holds a solid second tier, propelled by aerospace engine and defense electronics programs that specify high-performance nickel and cobalt fillers. US reshoring policies and the Inflation Reduction Act funnel capital into modern furnace upgrades, while Mexico's auto exports accelerate aluminum radiator consumption. Skilled labor shortages and intermittent copper price spikes temper absolute growth but do not derail the braze alloys market momentum.

Europe's mature industrial base delivers steady demand across automotive, HVAC, and general engineering. Strict RoHS and REACH requirements push quick adoption of cadmium-free and lead-free variants. Germany's EV platform rollout stimulates aluminum-silicon filler volumes, and the UK's aerospace composites cluster turns to amorphous foils for metal-ceramic joints. Circular-economy directives open niches for recycled filler metals, signaling a nuanced growth path for the braze alloys market in the region.

- Aimtek, Inc.

- Cupro Alloys Corporation

- Fusion, Inc.

- Indian Solder and Braze Alloys Pvt. Ltd.

- Johnson Matthey

- Lucas-Milhaupt Inc.

- Materion Corporation

- Morgan Advanced Materials plc

- Nihon Superior Co., Ltd.

- OC Oerlikon Management AG

- Prince & Izant Company

- Saru Silver Alloy Private Limited

- Sulzer Ltd

- The Lincoln Electric Company

- Umicore

- VBC Group

- Wieland Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of brazing over welding & soldering

- 4.2.2 Surging demand for aluminum based brazes in automotive heat-exchangers

- 4.2.3 Rise of amorphous-foil alloys enabling low-temp dissimilar joins

- 4.2.4 EV power-electronics uptake of Ni-based induction pastes

- 4.2.5 Growth of the HVAC and refrigeration industry

- 4.3 Market Restraints

- 4.3.1 Base-metal price volatility

- 4.3.2 Toxic-metal (Cd, Pb) regulatory bans

- 4.3.3 Substitution by additive-manufacturing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Base Metal

- 5.1.1 Copper

- 5.1.2 Silver

- 5.1.3 Gold

- 5.1.4 Aluminum

- 5.1.5 Other Base Metals (Nickel,Cobalt, etc.)

- 5.2 By Filler Form

- 5.2.1 Powder

- 5.2.2 Paste

- 5.2.3 Foil / Ribbon

- 5.2.4 Rod / Wire

- 5.2.5 Rings & Preforms

- 5.3 By Temperature Range

- 5.3.1 Low-Temperature (Less than 450 °C)

- 5.3.2 Medium-Temperature (450-800 °C)

- 5.3.3 High-Temperature (Greater than 800 °C)

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Electrical and Electronics

- 5.4.4 Construction

- 5.4.5 Other End-User Industries(Medical Devices, Energy and Power, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Aimtek, Inc.

- 6.4.2 Cupro Alloys Corporation

- 6.4.3 Fusion, Inc.

- 6.4.4 Indian Solder and Braze Alloys Pvt. Ltd.

- 6.4.5 Johnson Matthey

- 6.4.6 Lucas-Milhaupt Inc.

- 6.4.7 Materion Corporation

- 6.4.8 Morgan Advanced Materials plc

- 6.4.9 Nihon Superior Co., Ltd.

- 6.4.10 OC Oerlikon Management AG

- 6.4.11 Prince & Izant Company

- 6.4.12 Saru Silver Alloy Private Limited

- 6.4.13 Sulzer Ltd

- 6.4.14 The Lincoln Electric Company

- 6.4.15 Umicore

- 6.4.16 VBC Group

- 6.4.17 Wieland Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Development of Vacuum Brazing Technology