|

市場調查報告書

商品編碼

1849904

企業內容管理:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Enterprise Content Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

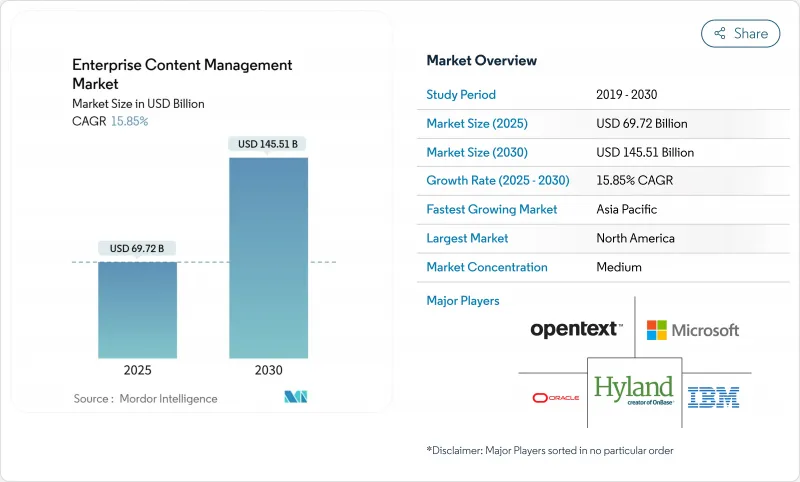

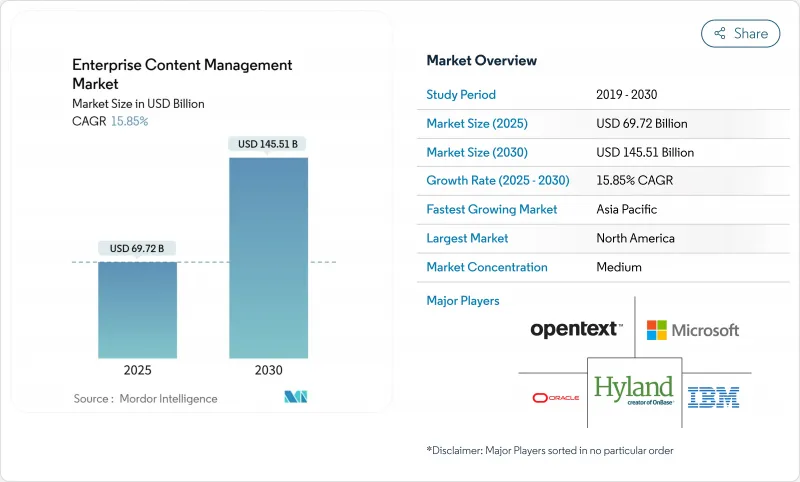

目前的市場估計和預測表明,企業內容管理市場到 2025 年將達到 697.2 億美元,到 2030 年將達到 1,455.1 億美元,複合年成長率為 15.85%。

快速成長反映了從傳統文件儲存庫向人工智慧平台的決定性轉變,這些平台將非結構化資料轉化為可用的智慧。監管要求、遠距辦公的普及以及向雲端原生架構的轉變,共同構成了一條彈性需求曲線。將合規能力與可擴展雲端服務相結合的供應商可以抓住巨大的商機,而儘早現代化的組織將受益於生產力的提升和成本的節約。內建分析功能以及與協作套件的整合將內容管理嵌入到日常工作流程中,進一步推動了競爭格局。

全球企業內容管理市場趨勢與洞察

內容生命週期管治的監理要求

日益增多的資料保護法已將內容管治提升至董事會層面。歐洲《一般資料保護規範》(GDPR)的實施表明,違規將帶來財務和聲譽損失,這促使企業採用能夠自動執行資料保留、刪除和審核記錄的平台。目前正在討論的人工智慧新法要求透明的數據處理,這加劇了升級週期的迫切性。金融機構必須獲得不可篡改的審核線索才能滿足《巴塞爾協議III》的要求,醫療保健提供者必須根據《健康保險流通與責任法》(HIPAA)保護遠端醫療記錄。隨著處罰力道的加大,企業優先考慮整合解決方案而非分散的儲存庫,以確保政策執行的一致性並降低法律風險。

非結構化企業資料爆炸性成長

Petabyte的多媒體檔案、感測器日誌和社交互動讓傳統的檔案共用不堪負荷。銀行存檔數百萬筆客戶聊天記錄和視訊通話,製造商管理 CAD 設計和偵測影像,全球設計團隊產生即時回饋循環。遠端辦公意味著內容分散在個人設備和不同的雲端應用程式中,導致搜尋延遲和重複勞動。應用機器學習對內容進行分類和呈現的現代平台使企業能夠將分散的資料轉化為可存取的知識,從而改善協作並加快決策週期。

雲端/行動 ECM 中的安全和隱私問題

規避風險的產業不願將受監管的內容遷移到本地。加密金鑰管理、司法管轄權控制和供應商鎖定仍然是首席資訊安全長 (CISO) 最關心的問題。行動訪問會引入缺乏企業強化的端點,從而擴大攻擊面。雲端供應商投資於持續滲透測試和機密運算,但認知落後於現實,導致核准週期延長,部署速度減慢,尤其是在存在嚴格資料保留條款的歐洲。

細分分析

到2024年,文件管理將以32.3%的佔有率繼續在企業內容管理市場中保持領先地位,凸顯其作為受監管記錄和日常文件支柱的地位。金融、醫療保健和公共部門組織對簽入/簽出、版本控制和審核功能的需求保持穩定。隨著負責人在全通路宣傳活動中精心策劃富媒體,與數位資產管理相關的企業內容管理市場規模將以16.2%的複合年成長率加速成長,直到2030年。

隨著供應商將資料存取管理 (DAM)、工作流程編配和記錄管理整合到單一介面,混合平台正在模糊傳統的界限。這種融合反映了買家對統一許可和低整合成本的偏好。案件管理工具服務於訴訟團隊、保險公司和公共福利項目,而工作流程管理則與更廣泛的流程自動化套件連結。記錄管理繼續確保能源、製藥和航太等行業的長期歸檔,這些行業的保留期可能長達數十年,丟失的罰款也十分嚴厲。

到2024年,本地部署將佔企業內容管理市場規模的57.1%,證明了基礎設施的穩固性和嚴格的合規性約束。即便如此,雲端合約的成長速度仍將超過所有其他部署方式,複合年成長率達15.3%。日本政府要求在2025年前完成核心系統的遷移,這是推動採用雲端內容管理的政策動力之一,迫使各機構在緊迫的時間內對其老化的系統進行現代化升級。

如今,企業更重視營運彈性和即時協作,而非歷史資本支出。隨著供應商提供客戶管理金鑰和區域資料中心,安全方面的異議正在減少。混合部署,即利用 SaaS 進行協作,同時將敏感檔案儲存在本地資料中心,正逐漸普及。這種分階段的方法通常可以彌補技能差距和預算規劃的不足,並成為最終全面遷移到雲端平台的橋樑。

企業內容管理市場按元件(內容管理、文件管理等)、解決方案類型(本地部署、雲端等)、部署模式(本地部署、雲端等)、公司規模(中小企業、大型企業等)、最終用戶垂直領域(通訊和IT、金融服務和保險業等)和地區細分。市場預測以美元計算。

區域分析

北美仍將是技術最成熟的地區,佔2024年收入的31.6%,這得益於其深厚的合作夥伴生態系統和清晰的法規環境,從而降低了計劃核准風險。美國銀行對傳統影像系統進行了現代化改造,醫療保健提供者則將患者記錄數位化,以滿足互通性法規的要求。加拿大聯邦和省級政府機構將紙本檔案遷移到雲端,以提高透明度。墨西哥製造商採用ECM進行跨境供應鏈文件記錄,展現了對美墨加協定(USMCA)走廊的連鎖反應。

到2030年,亞太地區的複合年成長率預計將達到17.4%,位居榜首。日本的公共雲計畫正在加速政府各部門和地方政府的採用。印度的「數位印度」舉措正在國家部門和公立大學部署企業內容管理 (ECM)。韓國和澳洲正在努力增強現有部署中的人工智慧 (AI)。這些因素共同推動了亞太地區企業內容管理市場最具活力的擴張。

在歐洲,商業機會與合規複雜性正在平衡。 GDPR 繼續推動確保資料主權的解決方案支出,而擬議的人工智慧法規將加強文件管理。德國工業基礎正在將 ECM 納入工業 4.0 工作流程,英國金融業正在推行無紙化房屋抵押貸款承保,法國正在升級醫院和大學的儲存庫。北歐等較小的經濟體正在投資能源和生命科學領域的垂直解決方案,尋求適合高度專業化出口的彈性且可追蹤的工作流程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 內容生命週期管治的監理合規義務

- 非結構化企業資料爆炸性成長

- 加速您的雲端原生 ECM 採用之旅

- 人工智慧驅動的內容智慧和超自動化

- ECM 和協作中心整合(Teams、Slack)

- 歐盟數位主權託管要求

- 市場限制

- 雲端/行動 ECM 中的安全和隱私問題

- MandA 之後整合遺留儲存庫的複雜性

- 跨境資料傳輸限制(GDPR、DPDPA 等)

- 資訊管治專業人員短缺

- 供應鏈分析

- 監管格局

- 技術展望

- 影響市場的宏觀經濟因素

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按解決方案類型

- 內容管理

- 文件管理

- 案件管理

- 工作流程管理

- 記錄管理

- 數位資產管理

- 其他

- 依部署方式

- 本地部署

- 雲

- 按公司規模

- 小型企業

- 主要企業

- 按最終用戶產業

- 通訊/IT

- BFSI

- 零售與電子商務

- 教育

- 製造業

- 媒體和娛樂

- 政府和公共部門

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft Corporation

- OpenText Corporation

- IBM Corporation

- Hyland Software Inc.

- Oracle Corporation

- Box Inc.

- Adobe Inc.

- Xerox Corporation

- M-Files Corp.

- Alfresco Software Inc.(Hyland)

- DocuWare GmbH

- Datamatics Global Services Ltd.

- Hewlett Packard Enterprise Co.

- Capgemini SE

- Newgen Software Technologies Ltd.

- Laserfiche Inc.

- SER Group

- Fabasoft AG

- Everteam Global Services

- KnowledgeLake Inc.

- iManage LLC

- Egnyte Inc.

第7章 市場機會與未來展望

Current estimates place the enterprise content management market size at USD 69.72 billion in 2025 and forecast it to reach USD 145.51 billion by 2030, expanding at a 15.85% CAGR.

Rapid gains reflect a decisive move from traditional file repositories toward AI-enabled platforms that transform unstructured data into usable intelligence. Regulatory mandates, the surge in remote work, and a pivot to cloud-native architectures combine to create a resilient demand curve. Vendors that marry compliance capabilities with scalable cloud offerings stand to capture outsized opportunities, while organizations that modernize early benefit from productivity lifts and cost avoidance. Intensifying competition centers on embedded analytics and integration with collaboration suites that embed content management inside daily workflows.

Global Enterprise Content Management Market Trends and Insights

Regulatory compliance mandates for content lifecycle governance

Growing data-protection laws turn content governance into a board-level obligation. GDPR enforcement in Europe demonstrated the financial and reputational costs of non-compliance, motivating enterprises to adopt platforms that automate retention, deletion, and audit logging. New AI legislation now under debate requires transparent data handling, adding urgency to the upgrade cycle. Financial institutions must capture immutable audit trails to satisfy Basel III, while healthcare providers secure telemedicine records under HIPAA.As penalties tighten, enterprises prioritize unified solutions over fragmented repositories, ensuring consistent policy execution and lowering legal exposure.

Explosion of enterprise unstructured data volumes

Petabytes of multimedia files, sensor logs, and social interactions overwhelm legacy file shares. Banks archive millions of customer chats and video calls, manufacturers manage CAD designs and inspection images, and global design teams generate real-time feedback loops.Remote work has scattered content across personal devices and disparate cloud apps, causing retrieval delays and duplicated effort. Modern platforms that apply machine learning to classify and surface content give organizations a path to transform data sprawl into accessible knowledge, unlocking collaboration gains and faster decision cycles.

Security and privacy concerns in cloud/mobile ECM

Risk-averse sectors hesitate to move regulated content off-premises. Encryption key management, jurisdictional control, and vendor lock-in remain top questions for CISOs. Mobile access introduces endpoints lacking enterprise hardening, expanding the attack surface. Although cloud providers invest in continuous penetration testing and confidential computing, perception lags reality, adding extra approval cycles and slowing rollouts, especially in Europe where data-residency clauses are stringent.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated shift to cloud-native ECM deployments

- AI-driven content intelligence and hyper-automation

- Complexity of merging legacy repositories post-M&A

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Document Management retained a 32.3% leading share of the enterprise content management market in 2024, underscoring its role as the backbone for regulated records and everyday files. Demand remains steady among finance, healthcare, and public agencies that require check-in/out, version control, and audit capabilities. The enterprise content management market size linked to Digital Asset Management is accelerating at a 16.2% CAGR through 2030 as marketers orchestrate rich media across omnichannel campaigns.

Hybrid platforms blur traditional boundaries because vendors embed DAM, workflow orchestration, and records management inside a single interface. This convergence reflects buyer preference for unified licensing and lower integration overhead. Case Management tools serve litigation teams, insurers, and public benefits programs, while Workflow Management aligns with broader process automation suites. Record Management continues to secure long-term archives in energy, pharmaceutical, and aerospace sectors where retention spans decades and penalties for loss are severe.

On-premises deployments held 57.1% of the enterprise content management market size in 2024, a testament to entrenched infrastructure and strict compliance constraints. Nevertheless, cloud subscriptions registered a 15.3% CAGR that outpaced all other modes. The Japanese government's mandate to migrate core systems by 2025 exemplifies the policy push behind adoption, forcing agencies to modernize aging stacks under tight timelines.

Organizations now weigh operational resilience and real-time collaboration more heavily than historical capex accounting. Security objections decline as providers offer customer-managed keys and regional data centers. Hybrid patterns persist, keeping sensitive archives in internal data centers while leveraging SaaS for collaboration. This phased approach eases skills gaps and budget planning yet often serves as a bridge to eventual full-cloud commitment.

Enterprise Content Management Market is Segmented by Component by Solution Type (Content Management, Document Management, and More), by Deployment Mode (On-Premises, Cloud), by Enterprise Size (Small and Medium Enterprises and Large Enterprises), by End-User Industry (Telecom and IT, BFSI, and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 31.6% revenue in 2024 and remains the most mature territory, supported by a deep partner ecosystem and clarified regulatory environment that de-risks project approvals. United States banks modernize legacy imaging systems, and healthcare providers digitize patient records to meet interoperability rules. Canadian federal and provincial agencies migrate their paper archives to the cloud to enhance transparency. Mexican manufacturers adopt ECM for cross-border supply-chain documentation, illustrating spillover effects across the USMCA corridor.

Asia-Pacific delivers the highest 17.4% CAGR through 2030. Japan's public cloud program accelerates adoption across ministries and prefectures. India's Digital India initiative brings ECM to state services and public universities, while South Korea and Australia push AI enhancements in established deployments. These factors combine to give the enterprise content management market its most dynamic regional expansion in Asia-Pacific.

Europe balances opportunity with compliance complexity. GDPR continues to direct spending toward solutions that guarantee data sovereignty, and proposed AI rules tighten documentation controls. Germany's industrial base embeds ECM in Industry 4.0 workflows, the United Kingdom's finance sector pursues paperless mortgage underwriting, and France upgrades hospital and university repositories. Smaller economies such as the Nordics invest in vertical solutions for energy and life sciences, seeking resilience and traceable workflows suitable for highly specialized exports.

- Microsoft Corporation

- OpenText Corporation

- IBM Corporation

- Hyland Software Inc.

- Oracle Corporation

- Box Inc.

- Adobe Inc.

- Xerox Corporation

- M-Files Corp.

- Alfresco Software Inc. (Hyland)

- DocuWare GmbH

- Datamatics Global Services Ltd.

- Hewlett Packard Enterprise Co.

- Capgemini SE

- Newgen Software Technologies Ltd.

- Laserfiche Inc.

- SER Group

- Fabasoft AG

- Everteam Global Services

- KnowledgeLake Inc.

- iManage LLC

- Egnyte Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory compliance mandates for content lifecycle governance

- 4.2.2 Explosion of enterprise unstructured data volumes

- 4.2.3 Accelerated shift to cloud-native ECM deployments

- 4.2.4 AI-driven content intelligence and hyper-automation

- 4.2.5 Convergence of ECM with collaboration hubs (Teams, Slack)

- 4.2.6 EU digital-sovereignty hosting requirements

- 4.3 Market Restraints

- 4.3.1 Security and privacy concerns in cloud/mobile ECM

- 4.3.2 Complexity of merging legacy repositories post-MandA

- 4.3.3 Cross-border data-transfer restrictions (GDPR, DPDPA, etc.)

- 4.3.4 Talent gap in information-governance professionals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macro Economic Factors on the Market

- 4.8 Porters Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Content Management

- 5.1.2 Document Management

- 5.1.3 Case Management

- 5.1.4 Workflow Management

- 5.1.5 Record Management

- 5.1.6 Digital Asset Management

- 5.1.7 Others

- 5.2 By Deployment Mode

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises (SME)

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Telecom and IT

- 5.4.2 BFSI

- 5.4.3 Retail and E-commerce

- 5.4.4 Education

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Government and Public Sector

- 5.4.8 Others

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Kenya

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 OpenText Corporation

- 6.4.3 IBM Corporation

- 6.4.4 Hyland Software Inc.

- 6.4.5 Oracle Corporation

- 6.4.6 Box Inc.

- 6.4.7 Adobe Inc.

- 6.4.8 Xerox Corporation

- 6.4.9 M-Files Corp.

- 6.4.10 Alfresco Software Inc. (Hyland)

- 6.4.11 DocuWare GmbH

- 6.4.12 Datamatics Global Services Ltd.

- 6.4.13 Hewlett Packard Enterprise Co.

- 6.4.14 Capgemini SE

- 6.4.15 Newgen Software Technologies Ltd.

- 6.4.16 Laserfiche Inc.

- 6.4.17 SER Group

- 6.4.18 Fabasoft AG

- 6.4.19 Everteam Global Services

- 6.4.20 KnowledgeLake Inc.

- 6.4.21 iManage LLC

- 6.4.22 Egnyte Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment