|

市場調查報告書

商品編碼

1849892

北美企業資源規劃:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)North America Enterprise Resource Planning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

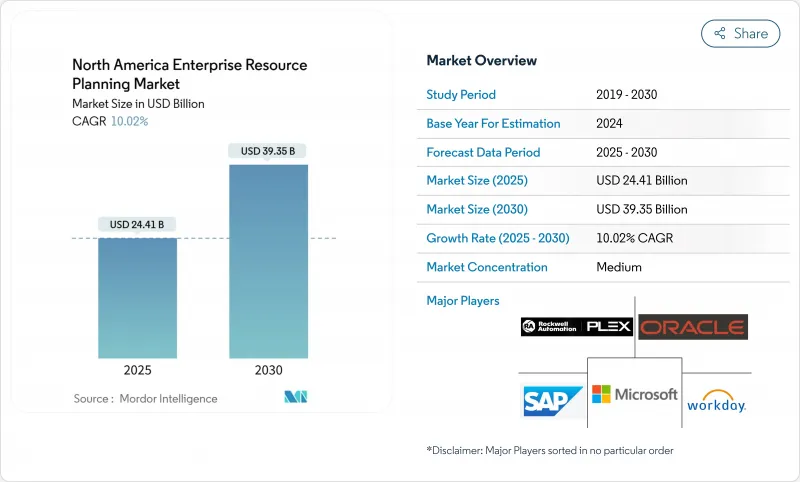

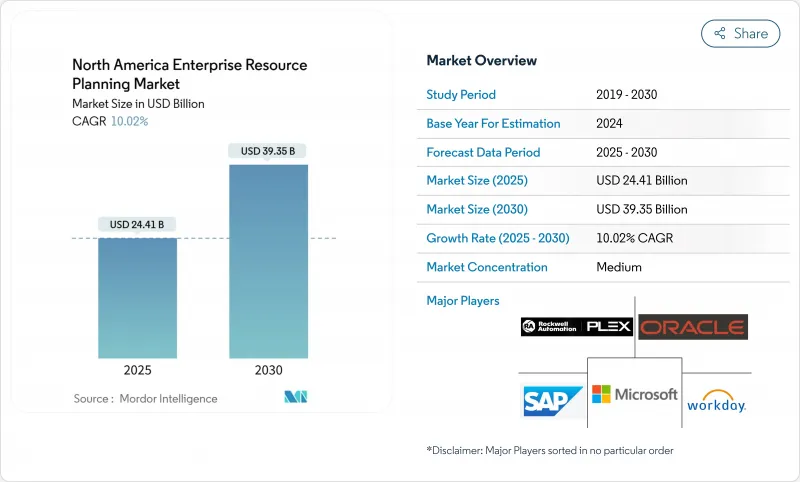

預計到 2025 年北美企業資源規劃市場規模將達到 244.1 億美元,到 2030 年將達到 393.5 億美元,複合年成長率高達 10.0%。

這項擴張反映了全部區域從傳統的本地套件向雲端原生平台的轉變,這些平台為企業提供了敏捷性、即時洞察和基於消費的成本結構。此外,強制性的環境、社會和管治(ESG) 資訊揭露也迫使企業對其財務合併流程進行現代化改造。Oracle將在 2024 年超越 SAP,成為該地區最大的 ERP 應用供應商,營收將達到 87 億美元,市佔率為 6.63%(北美企業資源規劃),這凸顯了一級供應商之間日益激烈的競爭。美國正在持續推進州和地方系統的現代化,加拿大的數位化應用計畫正在津貼製造業的 ERP 投資,墨西哥正在利用 USMCA 的數位貿易條款來簡化跨境資料流。

北美企業資源規劃市場趨勢與洞察

快速轉向雲端優先 ERP 部署模式

成本、擴充性和遠端工作支援正在推動本地部署的採用,使雲端採用成為新 ERP 實施的常態。華盛頓州克拉克縣在遷移到 Workday 後,薪資核算速度加快了 60%,核准的支出減少了 15%。混合架構仍然很常見,因為受到嚴格監管的公司將敏感資料保留在本地,同時在公共雲端中擴展邊緣和專用功能。製造公司的安全投資正在激增,訂閱定價使財務團隊能夠將資本預算分配給策略創新,而不是硬體更新周期。資訊長(CIO) 正在優先考慮相關人員培訓和技術升級,以使文化採用與架構轉型保持一致。

用於即時決策的人工智慧嵌入式分析的激增

生成模型和預測模型正在將 ERP 從交易記錄器再形成為智慧編配引擎。 IBM 和Oracle目前正在合作開發自主代理,為財務、供應鏈和人力資源工作流程推薦符合政策的行動。 NetSuite 基於機器學習的應付應付帳款流程。製造企業正在將人工智慧融入工廠級模組,以實現預測性維護,從而幫助 95% 已實施智慧工廠技術的企業減少非計畫性停機時間。醫療保健提供者正在利用分析技術來協調臨床數據和財務數據,以提高報銷準確性和合規性報告。所有舉措都依賴強力的管治,因為演算法偏差和陳舊數據會削弱人們對自動化決策的信任。

實施和變更管理的領先成本和生命週期成本

綜合 ERP計劃除了許可證和訂閱費用外,還會產生各種成本。正如浸信會醫療 (Baptist Health) 歷時多年的現代化改造計畫所示,資料遷移、業務流程重組和員工培訓費用往往使醫院和公共機構的原始預算翻倍。中小企業缺乏專業的 IT 能力,因此需要外部顧問,但人才短缺意味著高昂的每日津貼和緊張的工期。雲端傳輸雖然可以降低資本支出,但無法消除流程標準化所需的文化轉變。如果沒有強大的變革領導結構,昂貴的平台可能會無法充分利用,導致投資報酬率低落。

細分分析

到2024年,雲端原生套件將佔北美企業資源規劃市場總收入的60.5%,這意味著北美企業資源規劃市場擁有基準功能豐富的平台。然而,隨著企業尋求消費級使用者體驗,社交/協作型ERP將成長最快,到2030年的複合年成長率將達到11.4%。知識型員工將在財務和供應鏈交易中採用活動動態、共用儀表板和即時聊天功能,從而提高系統使用率並縮短核准週期。整合式行動應用程式將在現場和客戶現場提供相同的功能,增強始終線上工作流程。供應商藍圖擴大將社交元素預設捆綁,而不是作為可選模組,凸顯了其戰略價值。最終,內建在這些管道的人工智慧助理將推薦操作並標記異常情況,從而加深參與度和營運效率之間的連結。

到 2024 年,財務和會計將佔據北美企業資源規劃市場規模的 55.7%,這反映了強制性的報告和審核要求。儘管如此,供應鏈和營運模組仍將以 10.8% 的複合年成長率擴張。邊緣運算和物聯網將即時現場資料輸入規劃演算法,從而提高物料供給能力並降低營運成本。出貨預測 ETA 支持全通路承諾,自動品質檢查可降低退貨率。同時,對於面臨勞動力短缺和離職率上升的製造公司來說,人力資本模組是當務之急。客戶商務附加附加元件將訂單量與庫存連結起來,從而實現準確的交貨日期承諾,從而提高轉換率。雖然財務仍然充當記錄系統的作用,但營運資料集擴大推動損益結果。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 快速過渡到雲端優先 ERP 部署模式

- 用於即時決策的人工智慧嵌入式分析的激增

- 實施雙層 ERP 系統,協調總部與子公司之間的營運

- 中小企業對價格實惠的模組化 SaaS 套件的需求不斷成長

- ESG報告要求推動系統升級

- 邊緣/物聯網資料整合,實現閉合迴路營運

- 市場限制

- 實施和變更管理的初始成本和生命週期成本

- 多租戶雲端中的網路安全和資料主權問題

- 北美ERP人才和計劃能力短缺

- 內部支援週期縮短,增加了供應商鎖定的風險

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章市場規模及成長預測

- 按類型

- 雲端原生套件

- 行動優先 ERP

- 社交/協作 ERP

- 2層/邊緣ERP

- 按業務功能

- 財會

- 供應鍊和營運

- 人力資源管理

- 客戶關係和商業交易

- 製造執行和品質

- 按部署模型

- 本地部署

- 雲

- 按組織規模

- 主要企業

- 小型企業

- 按行業

- 製造業

- 零售與電子商務

- BFSI

- 政府和公共部門

- 資訊科技和通訊

- 醫療保健和生命科學

- 其他

- 按國家

- 美國

- 加拿大

- 墨西哥

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Workday Inc.

- Infor Inc.

- Epicor Software Corporation

- IBM Corporation

- The Sage Group plc

- Plex Systems Inc.(Rockwell Automation)

- FinancialForce.com Inc.

- Unit4 NV

- Deltek Inc.

- Deacom Inc.

- Acumatica Inc.

- IFS AB

- Syspro USA Inc.

- QAD Inc.

- Oracle NetSuite

- SAP Business One

- Odoo SA

第7章 市場機會與未來展望

The North America enterprise resource planning market size stands at USD 24.41 billion in 2025 and is projected to reach USD 39.35 billion by 2030, reflecting a sturdy 10.0% CAGR.

This expansion mirrors the region-wide migration from legacy on-premise suites to cloud-native platforms that give firms agility, real-time insights, and consumption-based cost structures. Heightened interest in AI-embedded analytics is reshaping implementation roadmaps, while mandatory environmental, social, and governance (ESG) disclosures push companies to modernize their financial consolidation processes. Oracle overtook SAP as the region's largest ERP application supplier in 2024 with USD 8.7 billion in revenue and 6.63% North America enterprise resource planning market share, underscoring a sharpening rivalry among tier-1 vendors. Governments also catalyze uptake: the United States continues to modernize state and local systems, whereas Canada's Digital Adoption Program subsidizes manufacturing ERP investments, and Mexico leverages USMCA digital-trade provisions to streamline cross-border data flows.

North America Enterprise Resource Planning Market Trends and Insights

Rapid Shift Toward Cloud-First ERP Deployment Models

Cloud adoption is now the baseline for new ERP rollouts as cost, scalability, and remote-work support eclipse entrenched on-premise preferences. Clark County, Washington, recorded 60% faster payroll runs and cut unapproved spending by 15% after moving to Workday. Hybrid architectures remain common because highly regulated firms keep sensitive data on-premise while extending edge or specialty functionality in public clouds. Security investments rose sharply in manufacturing corridors, and subscription-pricing lets finance teams reallocate capital budgets to strategic innovation rather than hardware refresh cycles. Alongside technology upgrades, chief information officers prioritize stakeholder training so cultural adoption matches architectural transformation.

Surge in AI-Embedded Analytics for Real-Time Decision-Making

Generative and predictive models are reshaping ERP from transaction recorders to intelligent orchestration engines. IBM and Oracle now co-develop autonomous agents that recommend policy-compliant actions across finance, supply chain, and HR workflows. NetSuite's machine-learning accounts-payable module reduces manual invoice entry and speeds reconciliation, easing month-end close pressure. Manufacturers embed AI in plant-level modules for predictive maintenance, driving shorter unplanned downtime across the 95% of firms that already deploy smart-factory technologies. Healthcare providers leverage analytics to reconcile clinical and financial data, improving reimbursement accuracy and compliance reporting. All initiatives rely on robust governance because algorithmic bias or stale data can erode trust in automated decisions.

Up-Front and Life-Cycle Costs of Implementation and Change-Management

Comprehensive ERP projects absorb expenses that extend well beyond license or subscription fees. Data migration, business-process re-engineering, and staff training frequently double original budgets for hospitals and public agencies, as seen in multi-year modernizations at Baptist Health. SMEs rely on external consultants because they lack dedicated IT capacity, but scarce talent drives day-rates higher and stretches timelines. Cloud delivery softens capital expenditure yet does not eliminate the cultural shifts required for process standardization. Without robust change-leadership structures, expensive platforms risk under-utilization and diminished ROI.

Other drivers and restraints analyzed in the detailed report include:

- Two-Tier ERP Adoption to Harmonize HQ and Subsidiary Operations

- Rising SMB Demand for Affordable, Modular SaaS Suites

- Cyber-Security and Data-Sovereignty Concerns in Multitenant Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-native suites accounted for 60.5% revenue in 2024, ensuring the North America enterprise resource planning market retains a strong baseline of broad-function platforms. Social/collaborative ERP, however, will grow fastest at 11.4% CAGR through 2030 as corporations seek consumer-grade user experiences. Knowledge workers adopt activity feeds, shared dashboards, and real-time chat inside finance and supply-chain transactions, lifting system usage rates and shortening approval cycles. Integrated mobile apps deliver the same capabilities at job sites or customer locations, reinforcing always-connected workflows. Vendor roadmaps increasingly bundle social elements by default rather than as optional modules, underscoring their strategic value. Over time, artificial-intelligence assistants embedded in these channels will recommend actions or flag exceptions, deepening the linkage between engagement and operational efficiency.

Finance and accounting maintained 55.7% of the North America enterprise resource planning market size in 2024, reflecting mandatory reporting and audit requirements. Nonetheless, supply-chain and operations modules will expand at a 10.8% CAGR. Edge computing and the Internet of Things feed real-time shop-floor data into planning algorithms, improving material availability and lowering working capital. Predictive shipment ETAs support omnichannel commitments, while automated quality-checks cut return rates. Human-capital modules meanwhile gain priority as manufacturers confront labour shortages and rising voluntary turnover. Customer-commerce add-ons connect order capture to inventory, letting firms promise exact delivery windows that boost conversion rates. Finance still acts as the system-of-record, but operational datasets increasingly drive profit-and-loss outcomes.

The North America Enterprise Resource Planning Market Report is Segmented by Type (Cloud-Native Suite, Mobile-First ERP, and More), Business Function (Finance and Accounting, and More), Deployment Model (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Industry Vertical (Manufacturing, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Workday Inc.

- Infor Inc.

- Epicor Software Corporation

- IBM Corporation

- The Sage Group plc

- Plex Systems Inc. (Rockwell Automation)

- FinancialForce.com Inc.

- Unit4 NV

- Deltek Inc.

- Deacom Inc.

- Acumatica Inc.

- IFS AB

- Syspro USA Inc.

- QAD Inc.

- Oracle NetSuite

- SAP Business One

- Odoo SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift toward cloud-first ERP deployment models

- 4.2.2 Surge in AI-embedded analytics for real-time decision-making

- 4.2.3 Two-tier ERP adoption to harmonise HQ and subsidiary operations

- 4.2.4 Rising SMB demand for affordable, modular SaaS suites

- 4.2.5 ESG-linked reporting mandates accelerating system upgrades

- 4.2.6 Edge/IoT data integration for closed-loop operations

- 4.3 Market Restraints

- 4.3.1 Up-front and life-cycle costs of implementation and change-management

- 4.3.2 Cyber-security and data-sovereignty concerns in multitenant clouds

- 4.3.3 Shortage of North America-based ERP talent and project bandwidth

- 4.3.4 Vendor lock-in risk amid shrinking on-premise support windows

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Cloud-native Suite

- 5.1.2 Mobile-first ERP

- 5.1.3 Social / Collaborative ERP

- 5.1.4 Two-Tier / Edge ERP

- 5.2 By Business Function

- 5.2.1 Finance and Accounting

- 5.2.2 Supply-Chain and Operations

- 5.2.3 Human Capital Management

- 5.2.4 Customer Relationship and Commerce

- 5.2.5 Manufacturing Execution and Quality

- 5.3 By Deployment Model

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Industry Vertical

- 5.5.1 Manufacturing

- 5.5.2 Retail and E-commerce

- 5.5.3 BFSI

- 5.5.4 Government and Public Sector

- 5.5.5 IT and Telecom

- 5.5.6 Healthcare and Life Sciences

- 5.5.7 Others

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 Workday Inc.

- 6.4.5 Infor Inc.

- 6.4.6 Epicor Software Corporation

- 6.4.7 IBM Corporation

- 6.4.8 The Sage Group plc

- 6.4.9 Plex Systems Inc. (Rockwell Automation)

- 6.4.10 FinancialForce.com Inc.

- 6.4.11 Unit4 NV

- 6.4.12 Deltek Inc.

- 6.4.13 Deacom Inc.

- 6.4.14 Acumatica Inc.

- 6.4.15 IFS AB

- 6.4.16 Syspro USA Inc.

- 6.4.17 QAD Inc.

- 6.4.18 Oracle NetSuite

- 6.4.19 SAP Business One

- 6.4.20 Odoo SA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment