|

市場調查報告書

商品編碼

1849889

財務分析:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Financial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

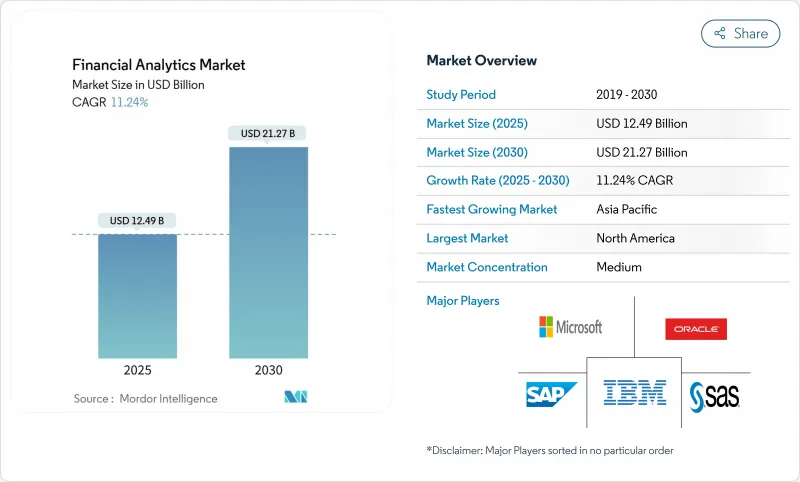

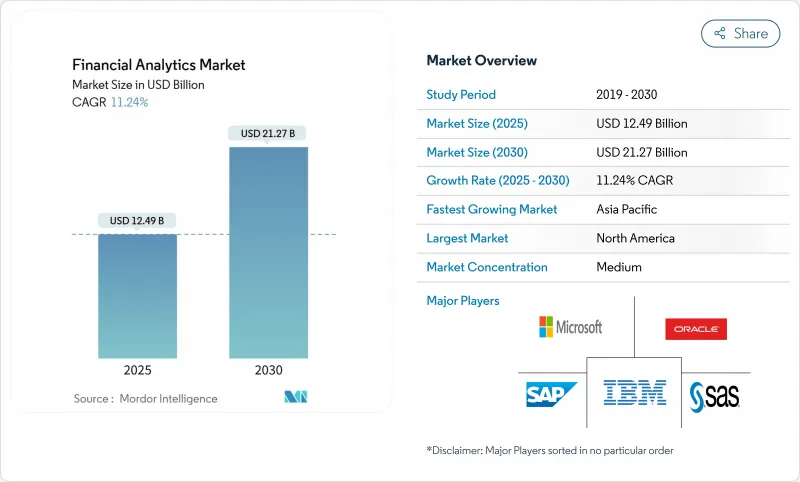

2025年金融分析市值為124.9億美元,預計2030年將成長至212.7億美元。

快速的雲端原生核心轉型、即時風險管控和人工智慧驅動的決策系統正在推動銀行、保險和企業財務團隊採用雲端原生技術。北美金融機構持續最佳化成熟的數據資產,而亞太地區的銀行則正從舊有系統遷移到能夠提供奈秒交易洞察的雲端平台。儘管風險規避型一級銀行仍主要採用本地部署,但隨著資訊長將資本支出與計量收費的營運模式結合,加速的雲端遷移正在重塑供應商策略。雖然日益嚴格的網路安全需求、數百萬美元的資料外洩事件以及資料科學家短缺等因素阻礙了雲端遷移的步伐,但對嵌入式人工智慧的重點投資正在降低總體擁有成本,並向中小企業開放金融分析市場。

全球金融分析市場趨勢與洞察

雲端優先核心銀行現代化的爆炸性發展

從單體架構遷移到雲端原生架構的金融機構,在第一年就實現了 45% 的營運效率提升和高達 40% 的成本節約。這種轉型減少了以往用於維護的預算,並支援將資料即時串流到分析引擎的微服務。北美的一級銀行正在向混合雲架構轉型,而印度和印尼的中型銀行則直接遷移到公有雲核心。能夠隨日內交易量彈性擴展的容器化分析模組,如今已成為各大廠商藍圖的核心。監管機構也認可彈性擴展的優勢,因為雲端網格能夠實現快速災難復原和近乎零停機時間。這一發展勢頭顯著擴大了金融分析市場的潛在需求。

整合到財務套件中的人工智慧/機器學習功能可降低整體擁有成本

將人工智慧引擎嵌入財務、貸款和投資組合工具中,無需建立獨立的數據科學架構。部署人工智慧嵌入式平台的金融機構平均每年可節省 190 萬美元,這得益於自動化對帳、超精準的現金流預測以及更少的誤報。最新的套件包含預先配置的預測模型,可從 ERP 和 CRM 系統中提取數據,從而縮短缺乏分析人才的區域銀行的引進週期。諸如人工智慧引導的營運成本最佳化等應用可將預測誤差降低 50%,從而釋放流動性,用於再投資創收產品。最終,整體擁有成本降低,加速了金融分析市場向成本敏感型細分市場的滲透。

網路攻擊責任日益增加

銀行每次資料外洩事件平均損失高達 608 萬美元,比跨行業平均高出近 25%。攻擊潛伏期通常超過五個月,導致憑證和客戶記錄被大規模竊取。 2024 年,美國一家大型健康保險公司遭受勒索軟體攻擊,每次洩漏事件的賠償金額高達 2,200 萬美元。董事會目前正將資金從分析升級轉向安全性增強,減緩了更新週期。網路保險費也以兩位數的速度成長,進一步加劇了 IT 預算的壓力。因此,供應商必須在其分析平台中整合零信任控制,以消除買家的疑慮,並維持金融分析市場的成長。

細分市場分析

到2024年,本地部署的金融分析將佔據61.2%的市場佔有率,凸顯了該產業在資料駐留和延遲管理方面採取的謹慎態度。然而,公有雲和私有雲端的採用率正以13.2%的複合年成長率成長,隨著監管機構正式確立共用框架,預計兩者之間的差距將會縮小。金融機構正在考慮分階段過渡,從預算沙箱等非核心應用過渡到即時風險引擎。隨著供應商建構主權雲端區域以滿足國家合規要求,雲端平台在金融分析市場的佔有率預計將顯著成長。銀行也採用容器編配,根據成本和延遲在本地和雲端節點之間遷移工作負載。此外,多重雲端連接工具和可攜式許可正在幫助緩解這些限制,並促進更廣泛的雲端採用。

隨著工作負載的變化,營運模式也隨之改變。站點可靠性工程師取代了硬體團隊,而按需付費模式則使 IT 支出與交易量掛鉤。規模較小的金融機構開始使用計量收費模式,存取先前僅限於全球性銀行的機器學習庫。雲端平台整合了威脅分析功能,可以監控租戶間的網路流量,從而增強網路彈性。此外,可擴展的運算能力使得無需大量固定投資即可進行投資組合風險的蒙特卡羅模擬。因此,對於依賴大型主機的傳統機構而言,敏捷性的壓力日益增大,這加速了預算向雲端基礎的金融分析市場解決方案的重新分配。

收入分析和彙報套件在2024年的市場展望中佔據主導地位,預計將佔據33.6%的收入佔有率,因為財務團隊需要整合式儀錶板來加快結算週期。多營業單位公司需要單一版本的統一帳簿來應對複雜的國際財務報告準則(IFRS)和美國通用會計準則(GAAP)。這些模組可以自動完成貨幣轉換和公司間交易抵銷,從而減少70%的手動會計分錄。供應商利用人工智慧技術來偵測集團結算期間的異常差異,並提出糾正措施建議,從而縮短報告週期。隨著監管機構收緊氣候和稅務透明度方面的取證要求,與合併相關的財務分析市場規模預計將顯著擴大。

資料庫管理和規劃工具構成了分析引擎的基礎,而風險和合規模組則整合了情境建模和監管分類。 ESG評分分析和量子賦能的衍生性商品平台佔據了新的「其他解決方案」細分市場。隨著企業尋求端到端的財務轉型,供應商正在將帳戶核對和資訊揭露管理等相關功能捆綁到更大的平台中。融合趨勢正在推動併購,供應商競相提供全端式解決方案,加劇了金融分析市場的競爭。

金融分析市場報告按部署類型(本地部署、雲端部署)、解決方案類型(資料庫管理和規劃、分析和彙報、其他)、應用程式(風險管理、預算和預測、其他)、分析類型(說明分析、其他)、組織規模(大型企業、中小企業)、最終用戶行業(市場細分、金融服務和保險、醫療保健、其他)和地區進行細分。

區域分析

北美地區在2024年將以38.7%的收入佔有率領跑,這得益於資本雄厚的銀行對人工智慧核心、雲端彈性以及整合合規工作平台的早期投資。美國監管機構已就模型風險管理提供了明確的指導,允許金融機構在明確的監管框架內進行試驗。加拿大銀行率先推出了開放銀行API,可將豐富的交易資料流傳輸至第三方分析層。紐約和多倫多的資本市場公司正在部署低延遲網格,以微秒速度完成衍生性商品定價。超大規模雲端區域的存在減少了資料主權方面的摩擦,從而維持了該全部區域在金融分析市場的主導地位。

亞太地區預計到2030年將以12.5%的複合年成長率成長,這主要得益於積極的數位化、扶持政策以及中階對金融服務日益成長的需求。中國兆豐銀行正在雲端預算上投入數十億美元,印度公共銀行則加入帳戶聚合網路,從而獲取用於信用評分的新資料集。日本金融巨頭正在探索量子運算聯盟,以緩解利率波動。東南亞金融科技公司正在為無銀行帳戶人群提供銀行帳戶管道,並將即時分析工作負載推向邊緣。預計到2028年,該地區人工智慧支出將達到1,100億美元,延續長期成長動能。

歐洲憑藉其先進的ESG報告標準和成熟的批發市場,正在產生巨大的影響。法國銀行正在將碳計量納入其信貸模型,德國保險公司正在實施將氣候變遷風險納入考量的精算引擎。歐盟資料法正在加強隱私合規性,並鼓勵採用諸如安全飛地等保護隱私的分析技術。同時,隨著歐洲央行考慮採用後量子密碼技術來保護支付系統,量子安全準備工作也不斷加強。儘管南美洲、中東和非洲目前的市場佔有率較小,但隨著行動支付、數位身分和開放銀行等措施的日益成熟,這些地區的市場佔有率預計將實現兩位數成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 雲端優先核心銀行現代化浪潮

- 財務套件中嵌入的人工智慧/機器學習技術可降低整體擁有成本

- 監管機構要求即時報告風險和資本。

- 中小企業對數據主導財務規劃和分析的需求激增

- ESG評分掛鉤債券發行分析

- 用於 VAR 的量子蒙特卡羅引擎

- 市場限制

- 網路安全漏洞責任增加

- 缺乏先進的分析能力

- 不斷上漲的雲端出口費用和供應商鎖定

- 演算法偏差合規性調查

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 透過部署模式

- 本地部署

- 雲

- 按解決方案類型

- 資料庫管理與規劃

- 分析與報告

- 金融一體化

- 風險與合規

- 其他解決方案

- 透過使用

- 風險管理

- 預算和預測

- 收益管理

- 詐欺偵測

- 現金流量和財務分析

- 合規與報告

- 財富與投資組合分析

- 按分析類型

- 說明分析

- 診斷分析

- 預測分析

- 指示性分析

- 按公司規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- BFSI

- 衛生保健

- 製造業

- 政府

- 資訊科技和通訊

- 零售與電子商務

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 澳洲和紐西蘭

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- FICO

- Hitachi Vantara

- SAS Institute

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Teradata Corporation

- Salesforce(Tableau)

- Qlik Tech

- TIBCO Software

- Alteryx

- ThoughtSpot

- Domo

- MicroStrategy

- Sisense

- Anaplan

- Workday Adaptive Planning

- Moody's Analytics

- SandP Global Market Intelligence

- BlackLine

- Infor

- Wolters Kluwer

- Datarails

第7章 市場機會與未來展望

The financial analytics market is currently valued at USD 12.49 billion in 2025 and is forecast to rise to USD 21.27 billion by 2030, reflecting an 11.2% CAGR during the period.

Rapid cloud-native core conversions, real-time risk mandates, and AI-enabled decision systems are pushing adoption across banking, insurance, and corporate finance teams. North American institutions continue to optimize mature data estates, while Asia-Pacific banks leap from legacy systems to cloud stacks that deliver nanosecond transaction insights. On-premise deployments remain prevalent among risk-averse tier-1 banks, yet accelerating cloud migrations are reshaping vendor strategies as CIOs align capital outlays with operational pay-as-you-go models. Intensifying cyber resiliency requirements, multimillion-dollar breach exposures, and a shortage of data scientists are restraining the pace, but heavy investment in embedded AI is lowering the total cost of ownership and opening the financial analytics market to small and midsize enterprises.

Global Financial Analytics Market Trends and Insights

Explosion in Cloud-First Core-Banking Modernizations

Financial institutions that migrate from monolithic cores to cloud-native architectures record 45% jumps in operational efficiency and up to 40% cost savings within the first year. The shift frees budgets historically consumed by maintenance and enables microservices that stream data into analytics engines in real time. North American tier-1 banks are executing hybrid moves, while mid-tier lenders in India and Indonesia leap directly to public cloud cores. Vendor roadmaps now center on containerized analytics modules that scale elastically with intraday transaction volumes. Regulators acknowledge the resilience benefit because cloud grids allow faster disaster recovery and near-zero downtime. This momentum greatly enlarges addressable demand in the financial analytics market.

AI/ML Embedded in Finance Suites Lowers TCO

Embedding AI engines inside treasury, lending, and portfolio tools removes the need for separate data science stacks. Institutions deploying AI-infused platforms save an average of USD 1.9 million annually through automated reconciliations, hyper-accurate cash forecasts, and fewer false-positive alerts. Modern suites come pre-configured with predictive models that pull data from ERP and CRM pipes, shrinking implementation cycles for regional banks lacking deep analytics talent. Applications such as AI-guided working capital optimization reduce forecast errors by 50%, unlocking liquidity that can be redeployed into revenue-generating products. The resulting lower total cost of ownership accelerates penetration of the financial analytics market into cost-sensitive segments.

Escalating Cyber-Breach Liabilities

Banks average USD 6.08 million in loss per breach, nearly 25% above cross-sector norms. Attack dwell time often exceeds five months, amplifying theft of credentials and customer records. The 2024 ransomware strike on a leading U.S. health insurer showed how a single breach can trigger USD 22 million in payouts. Boards now divert capital from analytics upgrades to security hardening, slowing refresh cycles. Cyber insurance premiums also rise by double digits, squeezing IT budgets further. Vendors must therefore embed zero-trust controls inside analytics platforms to assuage buyer concerns and sustain growth in the financial analytics market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Real-Time Risk and Capital Reporting

- Surge in Data-Driven Financial Planning and Analysis Across SMBs

- Shortage of Advanced Analytics Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise setups retained 61.2% of the financial analytics market share in 2024, underscoring the sector's cautious stance on data residency and latency control. However, public and private cloud deployments are advancing at 13.2% CAGR and will narrow the gap as regulators formalize shared-responsibility frameworks. Institutions weigh staged migrations beginning with non-core applications, such as budgeting sandboxes, before moving real-time risk engines. The financial analytics market size attributed to cloud platforms is forecast to climb markedly as vendors build sovereign cloud regions to satisfy local compliance. Banks also adopt container orchestration that allows workloads to swing between on-premise and cloud nodes based on cost or latency. Although data-egress fees and vendor lock-in fears linger, multicloud connectivity tools and portable licensing help alleviate these restraints and propel broader cloud adoption.

Once workloads shift, operating models change. Site-reliability engineers replace hardware teams, and consumption pricing aligns IT spend with transaction volumes. Smaller lenders exploit the pay-as-you-go model to access machine-learning libraries previously limited to global banks. Cloud platforms integrate threat analytics that monitor network traffic across tenants, strengthening cyber resilience. Scalable compute further enables Monte Carlo simulations for portfolio risk without large fixed investments. The resulting agility places added pressure on incumbents still anchored to mainframes, encouraging an accelerated reallocation of budgets toward cloud-based financial analytics market solutions.

Analysis and reporting suites led the 2024 landscape with 33.6% revenue share as finance teams demanded unified dashboards for faster close cycles. Financial consolidation suites exhibit 12.7% CAGR because multi-entity corporations require single-version-of-truth ledgers to meet complex IFRS and GAAP obligations. These modules automate currency translation and intercompany eliminations, reducing manual journal entries by 70%. Vendors embed AI that flags anomalous variances during group close and recommends corrective actions, shaving days off reporting timelines. The financial analytics market size associated with consolidation is projected to expand significantly as regulators intensify disclosure demands for climate and tax transparency.

Database management and planning tools form the substrate on which analytical engines run, while risk and compliance modules integrate scenario modeling with regulatory taxonomy. ESG-score analytics and quantum-ready derivatives platforms occupy the emerging "other solutions" niche. As corporations seek end-to-end financial transformation, vendors bundle adjacent capabilities such as account reconciliation and disclosure management into larger platforms. The convergence trend fuels mergers and acquisitions as providers race to offer full-stack coverage, amplifying competition within the financial analytics market.

The Financial Analytics Market Report is Segmented by Deployment Mode (On-Premise and Cloud), Solution Type (Database Management and Planning, Analysis and Reporting, and More), Application (Risk Management, Budgeting and Forecasting, and More), Analytics Type (Descriptive Analytics, and More), Organization Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (BFSI, Healthcare, and More), and Geography.

Geography Analysis

North America led with 38.7% revenue share in 2024 as well-capitalized banks invested early in AI cores, cloud resilience, and integrated compliance workbenches. U.S. regulators provide clear guidance on model risk management, allowing institutions to experiment within well-defined guardrails. Canadian banks pioneer open-banking APIs that stream enriched transaction data into third-party analytics layers. Capital markets firms in New York and Toronto deploy low-latency grids that price derivatives in microseconds. The presence of hyperscale cloud regions reduces data-sovereignty friction, sustaining dominance of the financial analytics market across the region.

Asia-Pacific is expected to post a 12.5% CAGR through 2030 on the back of aggressive digitization, supportive policy, and expanding middle-class demand for financial services. China's megabanks commit multi-billion-dollar cloud budgets, while India's public-sector banks join account-aggregator networks that unleash new data sets for credit scoring. Japan's financial giants explore quantum computing consortiums to mitigate interest-rate volatility. Southeast Asian fintechs unlock credit access for the unbanked, pushing real-time analytics workloads to the edge. Regional AI spend is forecast to hit USD 110 billion by 2028, reinforcing long-term momentum.

Europe maintains a sizeable footprint with advanced ESG reporting norms and sophisticated wholesale markets. French banks integrate carbon accounting into credit models, while German insurers deploy actuarial engines that factor climate risk. The EU Data Act elevates privacy compliance, prompting wider adoption of privacy-preserving analytics such as secure enclaves. Meanwhile, quantum readiness gains traction after the European Central Bank explored post-quantum cryptography to safeguard payment rails. South America, and Middle East, and Africa contribute smaller shares today but register double-digit growth as mobile money, digital ID, and open banking initiatives mature.

- FICO

- Hitachi Vantara

- SAS Institute

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Teradata Corporation

- Salesforce (Tableau)

- Qlik Tech

- TIBCO Software

- Alteryx

- ThoughtSpot

- Domo

- MicroStrategy

- Sisense

- Anaplan

- Workday Adaptive Planning

- Moody's Analytics

- SandP Global Market Intelligence

- BlackLine

- Infor

- Wolters Kluwer

- Datarails

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion in cloud-first core-banking modernisations

- 4.2.2 AI/ML embedded in finance suites lowers TCO

- 4.2.3 Regulatory push for real-time risk and capital reporting

- 4.2.4 Surge in data-driven financial planning and analysis across SMBs

- 4.2.5 ESG-score-linked debt issuance analytics

- 4.2.6 Quantum-ready Monte-Carlo engines for VAR

- 4.3 Market Restraints

- 4.3.1 Escalating cyber-breach liabilities

- 4.3.2 Shortage of advanced analytics talent

- 4.3.3 Rising cloud egress fees and vendor lock-in

- 4.3.4 Algorithmic bias compliance investigations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution Type

- 5.2.1 Database Management and Planning

- 5.2.2 Analysis and Reporting

- 5.2.3 Financial Consolidation

- 5.2.4 Risk and Compliance

- 5.2.5 Other Solutions

- 5.3 By Application

- 5.3.1 Risk Management

- 5.3.2 Budgeting and Forecasting

- 5.3.3 Revenue Management

- 5.3.4 Fraud Detection

- 5.3.5 Cash-flow and Treasury Analytics

- 5.3.6 Compliance and Reporting

- 5.3.7 Wealth and Portfolio Analytics

- 5.4 By Analytics Type

- 5.4.1 Descriptive Analytics

- 5.4.2 Diagnostic Analytics

- 5.4.3 Predictive Analytics

- 5.4.4 Prescriptive Analytics

- 5.5 By Organisation Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Medium Enterprises

- 5.6 By End-user Industry

- 5.6.1 BFSI

- 5.6.2 Healthcare

- 5.6.3 Manufacturing

- 5.6.4 Government

- 5.6.5 IT and Telecom

- 5.6.6 Retail and eCommerce

- 5.6.7 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN

- 5.7.3.6 Australia and New Zealand

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 UAE

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 FICO

- 6.4.2 Hitachi Vantara

- 6.4.3 SAS Institute

- 6.4.4 IBM Corporation

- 6.4.5 Microsoft Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 SAP SE

- 6.4.8 Teradata Corporation

- 6.4.9 Salesforce (Tableau)

- 6.4.10 Qlik Tech

- 6.4.11 TIBCO Software

- 6.4.12 Alteryx

- 6.4.13 ThoughtSpot

- 6.4.14 Domo

- 6.4.15 MicroStrategy

- 6.4.16 Sisense

- 6.4.17 Anaplan

- 6.4.18 Workday Adaptive Planning

- 6.4.19 Moody's Analytics

- 6.4.20 SandP Global Market Intelligence

- 6.4.21 BlackLine

- 6.4.22 Infor

- 6.4.23 Wolters Kluwer

- 6.4.24 Datarails

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment