|

市場調查報告書

商品編碼

1849888

活動管理軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Event Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

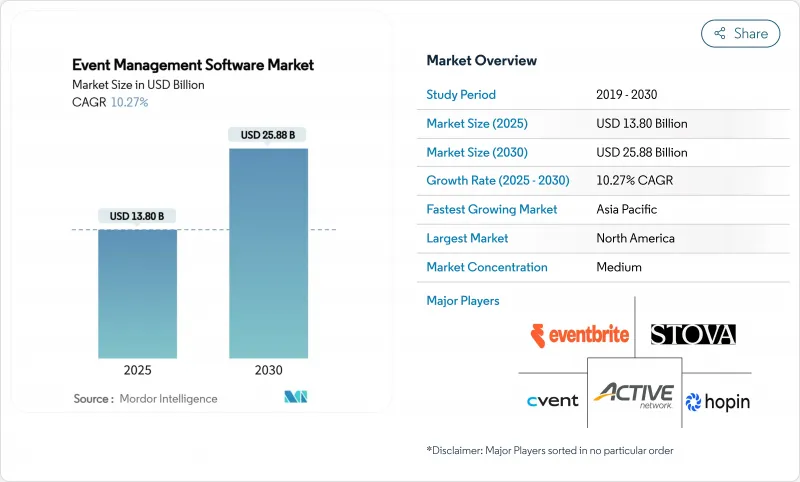

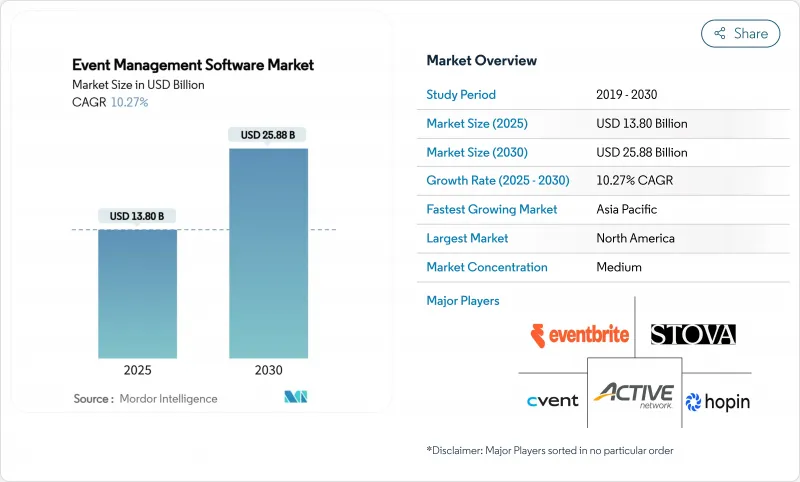

預計活動管理軟體市場規模到 2024 年將達到 138 億美元,到 2030 年將達到 258.8 億美元,2025 年至 2030 年的複合年成長率為 10.27%。

虛擬和混合活動中對人工智慧個人化的強勁需求、向雲端交付的快速轉變以及對永續性報告日益增加的監管壓力正在推動成長勢頭。供應商正在透過收購來加速擴張,將規劃、行銷和分析功能捆綁到整合套件中,從而提高進入門檻。隨著中小型企業 (SMB) 大規模採用自助票務工具,競爭日益激烈,迫使現有供應商改善其定價和整合策略。在亞太地區,5G 和光纖到府 (FTTX) 等基礎設施升級正在實現即時富媒體互動並擴大可尋址用戶群,支援兩位數成長。然而,大型企業舊有系統整合挑戰和 SaaS 訂閱疲勞正在抑制整體成長。

全球活動管理軟體市場趨勢與洞察

人工智慧驅動的個人化改變虛擬和混合活動

北美平台整合了一個行為分析引擎,可以即時匯總客製化議程、會議提案和網路配對。 Bizzabo 的人工智慧活動助理於 2024 年 12 月推出,可自動執行重複的規劃任務,同時提高與會者的參與度分數,展示了 Bizzabo 超個人化旅程對收益的影響。早期採用者報告虛擬與會者轉化為合格潛在客戶的轉換率更高,促使行銷團隊將與數據豐富的體驗相關的活動預算翻倍。這種轉變也加速了註冊、內容和社群模組與機器學習管道的整合,重塑了供應商藍圖。隨著生成工具變得更加實惠,小型供應商正在迅速將它們納入其中以避免客戶流失。結果是,各方競相透過更深入的即時個人化來實現核心物流能力以外的差異化,競爭日益激烈。

自助票務系統在歐洲中小企業中越來越受歡迎

歐洲中小企業擴大採用低代碼票務平台,以消除對IT的依賴並加快產品上市時間。根據Verizon的一項調查,77%的中小企業認為高速連線是提高生產力的關鍵槓桿,這促使供應商提供簡化的分級定價和直覺的使用者介面。敏捷挑戰者市場佔有率的不斷成長,正迫使現有企業擴展免費增值模式,並整合入門嚮導以保持競爭力。由於中小企業佔該地區就業人口的大多數,它們的採用曲線將顯著影響活動管理軟體市場。能夠在功能豐富性和易用性之間取得平衡的供應商正在獲得不成比例的市場佔有率,從而強化產品反饋和快速迭代的良性循環。

整合舊有系統的挑戰阻礙了廣泛採用

新興經濟體的許多場館仍然依賴缺乏現代 API 的專有物業管理系統。整合現代平台需要繁瑣的中間件,從而延長引進週期並增加整體擁有成本。資料同步滯後會減慢自動化速度,並讓期待統一儀表板的規劃人員感到沮喪。儘管領先的供應商提供旨在連接傳統資料庫和雲端架構的連接器市場和專業服務,但發展中地區的成本敏感度減緩了採用速度。政府對數位化現代化的補貼將有助於推動採用,但這在短期內仍將阻礙希望實現地理擴張的供應商。

細分分析

活動策劃應用程式創造了最大的收入,佔2024年活動管理軟體市場的29.97%。此細分市場的複合年成長率預測為兩位數,達到13.12%,顯示工作流程編配功能仍是數位轉型的核心。在實踐中,自動化任務清單、集中式資產庫和相關人員協作區可以壓縮生產計劃並提高一致性。 RainFocus的活動基準評估工具使客戶能夠根據同儕基準評估其績效,並指導最佳化策略,並將回饋回饋到策劃模組。

隨著相關模組(預算管理、內容管理、場地採購)整合到單一儀表板,活動管理軟體市場中規劃產品的規模預計將進一步成長。供應商正在分層添加預測分析功能,根據歷史參與度評分推薦理想的會議形式和演講者組合。由此形成了一個強化循環:更豐富的洞察推動了對更詳細規劃功能的需求,而更深入的採用則創建了資料集,從而提高了預測的準確性。

預計到 2024 年,雲端解決方案將佔據活動管理軟體市場 75% 的佔有率,並以 13.10% 的穩健複合年成長率成長。快速部署、彈性擴展和無縫功能推出取代了對資料持久性和離線存取的擔憂。隨著人工智慧處理需求轉向中央運算叢集而非本地伺服器,雲端解決方案的活動管理軟體市場規模將大幅成長。

雖然中小企業率先邁向雲端,但大型企業出於環境和成本方面的考慮,正在加速從傳統資料中心遷移。供應商紛紛推出單一租戶和主權雲端模式,以滿足產業特定的合規性要求。邊緣快取和漸進式 Web 應用程式等創新正在降低遠端位置的連線風險,並擴大地理覆蓋範圍。

活動管理軟體市場按軟體類型(活動規劃、活動行銷、其他)、組織規模(中小型企業、大型企業)、部署類型(雲端、本地)、最終用戶垂直領域(企業、政府、其他)和地區細分。市場預測以美元計算。

區域分析

2024年,北美將佔全球收入的39.85%,並將繼續保持絕對支出最高的地區地位,這得益於其早期的技術採用、成熟的供應商總部以及成熟的讚助市場。 Eventbrite在2023年處理了3.02億張門票,總票務價值達36億美元,展現了其生態系統的規模。中小企業對生成式人工智慧的採用在一年內加倍,目前有40%的企業正在使用此類工具。日益成長的隱私預期將推動對SOC 2和歐盟-美國資料隱私框架認證的需求,使合規領導力成為競爭優勢。

預計亞太地區將經歷最快的成長速度,複合年成長率達14.30%,這得益於5G的廣泛應用、數位支付的激增以及政府主導的智慧城市計畫。 GSMA表示,該地區單場5G影院直播就吸引了250萬遠端觀眾,凸顯了可靠的高清串流媒體所釋放的潛在受眾。由於消費者對集票務、串流媒體和社交商務於一體的超級應用的熟悉程度,預計韓國、日本和印度的表現將超越地區平均水平。對於尋求市場佔有率的國際供應商而言,本地化(貨幣、語言和監管細節)仍將至關重要。

儘管影響產品藍圖的法規日益複雜,歐洲仍是一個重要的市場。碳排放揭露要求和符合GDPR的資料處理要求,迫使供應商整合精細的同意管理和永續性儀表板。 Cvent與VOK DAMS合作,以加強其在DACH叢集的本地服務。同時,中小企業自助購票的普及正在加速,這重新分配了通路經濟,並加劇了價格競爭。

隨著各國政府投入大量資金建設與現有會議中心相媲美的大型場館,中東和非洲地區的重要性日益凸顯。巴林耗資2.2185億美元的會展中心和杜拜展覽中心的擴建項目,持續不斷的活動行程表都離不開企業級業務編配平台Zawya。提供阿拉伯語介面、多幣種支付和大容量徽章列印功能的供應商是早期成功的理想選擇。雖然傳統的PMS整合挑戰仍然存在,但我們預計,新建場館從一開始就採用現代化的飯店服務堆疊,可以緩解這些挑戰。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 虛擬和混合活動中人工智慧個性化的興起(北美)

- 中小型場館快速採用自助售票系統(歐洲)

- 大規模 5G/FTTX 部署推動互動直播功能(亞洲)

- 企業活動中強制性的永續性報告推動了對分析的需求增加(歐盟)

- 海灣合作理事會各國政府(中東)積極投資會展基礎設施

- 高等教育聯盟越來越青睞校園範圍的活動套房(大洋洲)

- 市場限制

- 發展中地區場館與傳統PMS整合的摩擦

- 大型企業客戶對 SaaS 訂閱的疲勞感日益加重

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

第5章市場規模及成長預測

- 依軟體類型

- 活動企劃

- 活動行銷

- 場地和票務管理

- 分析和報告

- 其他

- 按部署

- 雲

- 本地部署

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶

- 公司

- 政府

- 教育

- 媒體和娛樂

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他拉丁美洲地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- Cvent Inc.

- Stova(Aventri+MeetingPlay)

- Eventbrite Inc.

- Tripleseat

- ACTIVE Network

- Momentus Technologies

- Certain Inc.

- SignUpGenius

- EMS Software

- Hopin

- Bizzabo

- Whova

- vFairs

- Splash

- Eventzilla

- Brown Paper Tickets

- idloom

- TryBooking

- Hubb

- MeetApp

第7章 市場機會與未來展望

The event management software size market is valued at USD 13.80 billion in 2024 and is forecast to reach USD 25.88 billion in 2030, advancing at a 10.27% CAGR between 2025 and 2030.

Strong demand for AI-powered personalization in virtual and hybrid events, the rapid transition to cloud delivery, and rising regulatory pressure for sustainability reporting are reinforcing growth momentum. Vendors are accelerating capability expansion through acquisitions that bundle planning, marketing, and analytics features into unified suites, strengthening barriers to entry. Competitive intensity is rising as small and medium-sized businesses (SMBs) adopt self-service ticketing tools at scale, compelling incumbents to refine pricing and integration strategies. Infrastructure upgrades such as 5G and fiber-to-the-x (FTTX) in Asia-Pacific unlock real-time rich-media engagement, widening addressable user bases and underpinning double-digit regional growth. Meanwhile, legacy system integration issues and mounting SaaS subscription fatigue among large enterprises temper the overall trajectory.

Global Event Management Software Market Trends and Insights

AI-powered personalization transforms virtual and hybrid events

North American platforms now embed behavioral analytics engines that assemble bespoke agendas, session suggestions, and networking matches in real time. Bizzabo's AI-driven event assistant, launched in December 2024, automates repetitive planning tasks while raising attendee engagement scores, demonstrating the revenue impact of hyper-personalized journeys Bizzabo. Early adopters report higher conversion of virtual participants into qualified leads, encouraging marketing teams to double event budgets tied to data-rich experiences. The shift is also reshaping vendor roadmaps, prompting accelerated integration of machine learning pipelines with registration, content, and community modules. As generative tools become affordable, smaller providers rapidly embed them to avoid churn. The net effect is a competitive race toward deeper, real-time personalization that differentiates offerings beyond core logistics features.

Self-service ticketing systems gain traction among European SMBs

European SMBs increasingly deploy low-code ticketing platforms that remove IT dependence and compress go-to-market timelines. A Verizon survey shows that 77% of small businesses consider high-speed connectivity a key productivity lever, a figure that has pushed vendors to launch simplified, tiered pricing and intuitive user interfaces Verizon. Market share gains by agile challengers are pressuring incumbents to extend freemium models and embed onboarding wizards to sustain relevance. Because SMBs account for the majority of regional employment, their adoption curve exerts outsized influence on the event management software market. Providers able to balance feature depth with ease of use are capturing disproportionate wallet share, reinforcing a virtuous cycle of product feedback and rapid iteration.

Legacy system integration challenges hinder adoption

Many venues in emerging economies still rely on proprietary property-management systems lacking modern APIs. Integrating contemporary platforms requires labor-intensive middleware that extends deployment cycles and inflates total cost of ownership. Data synchronization lags limit automation, frustrating planners who expect unified dashboards. Forward-thinking vendors offer connector marketplaces and professional services targeted at bridging archaic databases with cloud architectures, but cost sensitivity in developing regions slows uptake. Where governments subsidize digital modernization, adoption rebounds, yet the near-term drag remains material for vendors counting on geographic expansion.

Other drivers and restraints analyzed in the detailed report include:

- 5G/FTTX infrastructure enables interactive live-stream innovations

- Sustainability reporting requirements drive analytics demand

- SaaS subscription fatigue impacts enterprise clients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Event planning applications generated the largest revenue slice at 29.97% of the event management software market in 2024. The segment's double-digit 13.12% CAGR forecast shows that workflow orchestration capabilities remain the nucleus of digital transformation. In practice, automated task lists, centralized asset libraries, and stakeholder collaboration zones compress production schedules and elevate consistency. RainFocus' Event Benchmark Assessment tool lets customers evaluate performance against peer benchmarks, guiding optimization strategies that feed back into planning modules.

The event management software market size for planning products is projected to widen further as adjacent modules-budgeting, content management, and venue sourcing-are embedded into single dashboards. Vendors are layering predictive analytics that recommend ideal session formats or speaker mixes based on historical engagement scores. The result is a reinforcing loop: richer insights drive demand for more detailed planning features, and deeper adoption yields datasets that sharpen predictive accuracy.

Cloud options secured 75% share of the event management software market in 2024 and are growing at a healthy 13.10% CAGR. Fast deployment, elastic scalability, and seamless feature rollouts override residual concerns around data residency and offline access. The event management software market size for cloud solutions is set to surge as AI processing needs favor central compute clusters over on-premise servers.

SMBs spearheaded the migration, yet large enterprises now accelerate moves to sunset legacy data centers for environmental and cost reasons. Providers respond with single-tenant and sovereign-cloud variants that meet sector-specific compliance mandates. Innovations such as edge caching and progressive web applications mitigate connectivity risks at remote venues, widening addressable geographies.

Event Management Software Market Segments Into by Software Type (Event Planning, Event Marketing, and More), by Organization Size (Small and Medium Enterprises, Large Enterprises), by Deployment Type (Cloud, On-Premise), by End-User Vertical (Corporate, Government, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 39.85% of global revenue in 2024 and continues to command the highest absolute spend thanks to early technology adoption, entrenched vendor headquarters, and mature sponsorship markets. Eventbrite processed USD 3.6 billion in gross ticket value across 302 million passes in 2023, illustrating ecosystem scale Eventbrite. Generative AI penetration in small businesses doubled in a year, with 40% now using such tools, a statistic that drives aggressive feature launches in regional platforms . Heightened privacy expectations spur demand for SOC 2 and EU-U.S. Data Privacy Framework certifications, positioning compliance leadership as a competitive wedge.

Asia-Pacific registers the fastest trajectory at a 14.30% CAGR, supported by sweeping 5G coverage, surging digital payments, and government-led smart-city programs. The region attracted 2.5 million remote viewers to a single 5G-enabled theatre broadcast, highlighting latent audience pools unlocked by reliable high-definition streams GSMA. South Korea, Japan, and India are forecast to outpace regional averages, propelled by consumer familiarity with super-apps that bundle ticketing, streaming, and social commerce. Localization-currency, language, and regulatory nuances-remains decisive for foreign vendors targeting share capture.

Europe sustains meaningful volume amid regulatory complexity shaping product roadmaps. Mandatory carbon disclosure and GDPR-aligned data handling push vendors to embed granular consent controls and sustainability dashboards. Cvent's alliance with VOK DAMS deepens local service provision in the DACH cluster, signaling the importance of culturally attuned support vehicles for mid-market accounts Cvent. Meanwhile, self-service ticketing adoption among SMBs accelerates, redistributing channel economics and intensifying price competition.

The Middle East and Africa witness rising relevance as governments channel funds into mega-venue construction that rivals established convention hubs. Bahrain's USD 221.85 million center and Dubai Exhibition Centre's expansion will generate continuous event calendars that necessitate enterprise-grade orchestration platforms Zawya. Providers offering Arabic interfaces, multicurrency settlement, and high-volume badge printing are best placed to win early contracts. Legacy PMS integration challenges linger yet are expected to ease as newly built facilities deploy modern hospitality stacks from inception.

- Cvent Inc.

- Stova (Aventri+MeetingPlay)

- Eventbrite Inc.

- Tripleseat

- ACTIVE Network

- Momentus Technologies

- Certain Inc.

- SignUpGenius

- EMS Software

- Hopin

- Bizzabo

- Whova

- vFairs

- Splash

- Eventzilla

- Brown Paper Tickets

- idloom

- TryBooking

- Hubb

- MeetApp

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of AI-powered personalization across virtual and hybrid events (North America)

- 4.2.2 Rapid adoption of self-service ticketing systems by SMB venues (Europe)

- 4.2.3 Large-scale roll-out of 5G/FTTX driving interactive live-stream features (Asia)

- 4.2.4 Mandatory sustainability reporting for corporate events boosting analytics demand (EU)

- 4.2.5 Aggressive MICE infrastructure investments by GCC governments (Middle East)

- 4.2.6 Growing preference for campus-wide event suites in higher-education consortia (Oceania)

- 4.3 Market Restraints

- 4.3.1 Friction from venue-legacy PMS integrations in developing regions

- 4.3.2 Rising SaaS subscription fatigue among large enterprise clients

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Software Type

- 5.1.1 Event Planning

- 5.1.2 Event Marketing

- 5.1.3 Venue and Ticket Management

- 5.1.4 Analytics and Reporting

- 5.1.5 Others

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Vertical

- 5.4.1 Corporate

- 5.4.2 Government

- 5.4.3 Education

- 5.4.4 Media and Entertainment

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of Latin America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Cvent Inc.

- 6.3.2 Stova (Aventri+MeetingPlay)

- 6.3.3 Eventbrite Inc.

- 6.3.4 Tripleseat

- 6.3.5 ACTIVE Network

- 6.3.6 Momentus Technologies

- 6.3.7 Certain Inc.

- 6.3.8 SignUpGenius

- 6.3.9 EMS Software

- 6.3.10 Hopin

- 6.3.11 Bizzabo

- 6.3.12 Whova

- 6.3.13 vFairs

- 6.3.14 Splash

- 6.3.15 Eventzilla

- 6.3.16 Brown Paper Tickets

- 6.3.17 idloom

- 6.3.18 TryBooking

- 6.3.19 Hubb

- 6.3.20 MeetApp

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment