|

市場調查報告書

商品編碼

1849852

統一通訊即服務 (UCaaS):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

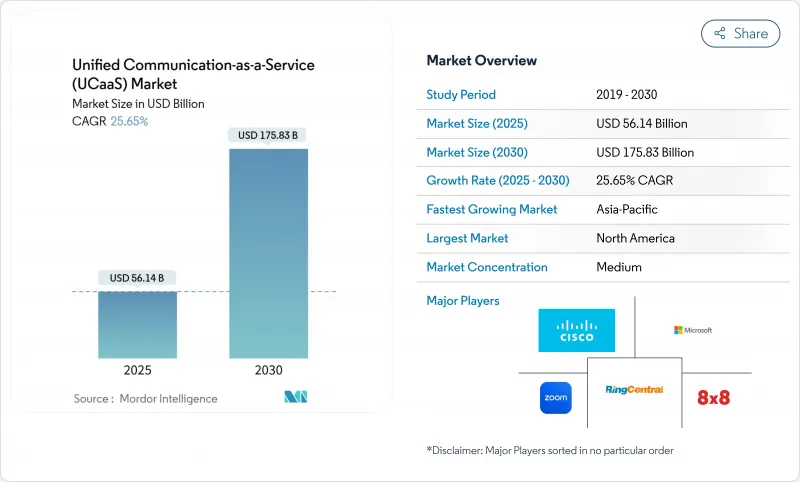

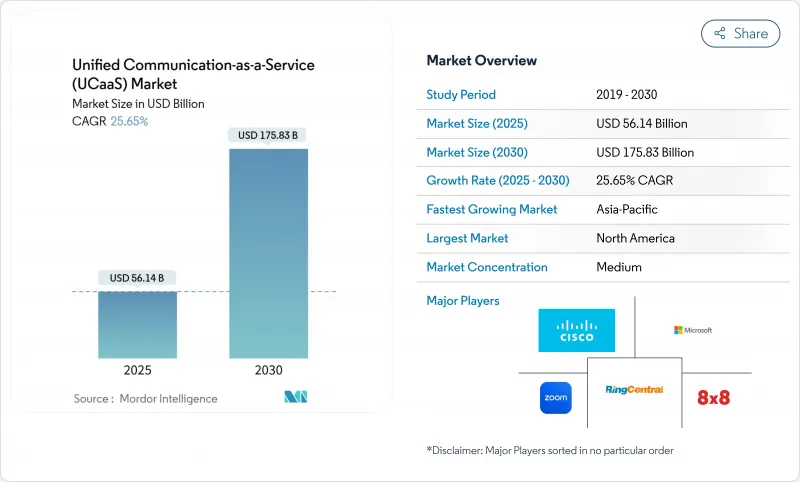

UCaaS 市場預計在 2025 年達到 561.4 億美元,到 2030 年將達到 1,758.3 億美元,複合年成長率為 25.65%。

這種快速擴張的驅動力源於企業範圍內碎片化通訊工具的整合、人工智慧驅動的生產力功能帶來的可衡量的投資回報率,以及雲端語音通訊應用的曲折點,而雲端電話的應用範圍遠超基本的語音替代。雖然北美公司仍然佔據最大的區域佔有率,但隨著5G網路和行動優先策略解鎖前沿用例,亞太地區正以兩位數的速度成長。大型企業仍然是主要的收益來源,但注重成本的中小企業正在採用計量收費模式,這種模式既能減輕資本支出,又能增強彈性。將統一通訊即服務 (UCaaS) 與通訊即服務 (CCaaS) 和通訊即服務 (CPaaS) 整合的供應商正在擴大其市場佔有率,而以安全主導的區域資料駐留框架正成為塑造全球擴張的基本要求。

全球統一通訊即服務 (UCaaS) 市場趨勢與洞察

計量收費的OPEX 模式吸引了注重成本的中小企業

託管式 UCaaS 解決方案使中小企業能夠以可預測的月費取代資本密集的 PBX 系統,與本地電話相比,可節省高達 55% 的成本。因此,中小企業將成為成長最快的使用者群體,2024 年至 2030 年的複合年成長率將達到 27.8%。 51.3% 的中小企業將網路防禦視為其首要技術重點,認為企業級雲端防禦優於本地防禦。在亞太和拉丁美洲的新興市場,網路防禦的採用尤為強勁,這些地區的本地連接合作夥伴正在提供將語音、視訊和通訊與 5G 行動存取相結合的全託管服務。

遠距和混合式工作政策強化了對隨時隨地工作的需求

91% 的雇主已實施彈性工作時間,98% 的會議至少有一名遠距參與者。整合語音、視訊、聊天和文件共用的平台已成為關鍵任務基礎設施,而非可有可無的工具。員工每天在多個應用程式之間切換浪費 36 分鐘,這迫使資訊長整合重疊的服務。北美公司正在使用人工智慧輔助設備對過時的會議室進行現代化改造,這些設備可以自動框選發言者並產生即時字幕;而歐洲公司則優先考慮符合《通用資料保護規範》(GDPR)的隱私主導資料處理。

多供應商 UC 堆疊中的技能差距延長了遷移週期

企業認為,雲端原生語音工程師和 API 整合專家的短缺是遷移的主要障礙,62% 的 IT 領導者表示遷移有延遲。大型企業難以在不停機的情況下整合傳統的 PBX、SIP 中繼和新的 AI 服務,這迫使他們轉向成本高昂的系統整合商。這種瓶頸在銀行業和醫療保健行業尤其明顯,因為這些行業的安全監管正在延長計劃進度。

細分分析

到2024年,語音通訊將佔據UCaaS市場佔有率的38.3%,而協作平台的複合年成長率將達到28.3%,這反映出其從純語音轉向整合視訊、聊天和內容共用的轉變。隨著資訊長追求生產力的提升,統一通訊和多方會議工具將繼續成為預算優先事項。人工智慧增強功能(例如即時翻譯、即時白板和自動行動追蹤)的投資正在進行中,這些功能可將會議轉化為企業知識。

預計到 2030 年,協作平台的 UCaaS 市場規模將達到 820 億美元,這反映了所有垂直產業的應用。語音通訊對於受監管的通話記錄和緊急服務仍然至關重要,但商品化壓力仍然強勁。供應商正在透過內建分析、服務水準保證和區域資料駐留來打造差異化,以滿足公共部門的需求。

統一通訊即服務 (UCaaS) 市場按組件(語音通訊、統一通訊等)、最終用戶公司規模(大型企業、中小型企業)、垂直行業(BFSI、零售/電子商務、教育等)和地區細分。市場預測以美元計算。

區域分析

到2024年,北美將以43.4%的收入佔有率引領UCaaS市場,這得益於雲端運算的廣泛成熟、強大的寬頻基礎設施以及Microsoft Teams的普及。美國將進一步受益於FedRAMP授權產品帶來的公共部門合約解鎖。隨著採用率接近飽和,成長已放緩至兩位數的低位,但人工智慧整合、客服中心整合和第一線員工解決方案將繼續推動支出成長動能。

在歐洲,英國、德國和法國的採用率正在穩定上升。 《一般資料保護規範》(GDPR)、《數位市場法案》以及即將推出的國家雲端運算法規,促使企業更傾向於選擇擁有本地資料中心和跨平台互通性的供應商。獨立服務提供者透過提供符合語言要求和垂直合規法規的解決方案,正在贏得市場佔有率,尤其是在醫療保健和政府領域。

到2030年,亞太地區的複合年成長率將達到30.4%,位居榜首。 5G的全國普及、純行動辦公的勞動力以及政府主導的數位化議程,正在推動日本、韓國、新加坡和澳洲等國的5G應用。東南亞國家正在突破固網的限制,而雲端原生UCaaS則能夠滿足中小企業的多語言需求和價格分佈。如果目前的動能持續下去,預計到2030年,亞太地區的UCaaS市場規模將與北美匹敵。拉丁美洲、中東和非洲地區目前落後,但隨著光纖和4G/5G的普及降低雲端通訊的存取成本,預計未來機會將會增加。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 計量型的OPEX 模式吸引了注重成本的中小企業

- 遠距和混合工作政策正在推動對隨時隨地工作的需求

- UCaaS、CCaaS 和 CPaaS 整合將增加錢包佔有率

- 人工智慧生產力(會議摘要、語音機器人)提高投資報酬率

- 適用於前線/現場作業的 5G 移動優先 UCaaS

- FedRAMP 級安全 UCaaS 推動受監管產業的採用

- 市場限制

- 多供應商 UC 堆疊中的技能差距延長了遷移週期

- 話費詐騙和 SIP 中繼安全漏洞增加導致 TCO 上升

- 公共網際網路Over-the-Top中的語音品質變化

- 國家資料主權法限制全球席次部署

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按組件

- 電話

- 統一通訊

- 音訊/視訊會議

- 協作平台

- 按最終用戶公司規模

- 小型企業

- 主要企業

- 按最終用戶

- BFSI

- 零售與電子商務

- 醫療保健和生命科學

- 政府和公共部門

- 資訊科技和通訊

- 教育

- 其他(製造業、旅館業等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 瑞士

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 越南

- 印尼

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 奈及利亞

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft Corp.

- Cisco Systems Inc.

- Zoom Video Communications Inc.

- RingCentral Inc.

- 8x8 Inc.

- Mitel Networks Corp.

- Verizon Communications Inc.

- BT Group plc

- Vodafone Group plc

- NTT Communications Corp.

- Telstra Corp. Ltd.

- Deutsche Telekom AG(T-Systems)

- Orange Business Services

- ATandT Inc.

- Nextiva Inc.

- Gamma Communications plc

- KPN NV

- Telia Co. AB

- PCCW Global

- Maxis Bhd.

- PLDT Enterprise

- Wildix

- Avaya LLC

第7章 市場機會與未來展望

The UCaaS market is valued at USD 56.14 billion in 2025 and is projected to reach USD 175.83 billion in 2030, advancing at a 25.65% CAGR.

The rapid expansion is fueled by enterprise-wide consolidation of fragmented communication tools, measurable ROI from AI-powered productivity functions, and an inflection point in cloud telephony adoption that now extends well beyond basic voice replacement. North American enterprises still account for the largest regional share, yet Asia-Pacific is growing at double-digit rates as 5G networks and mobile-first strategies unlock frontline use cases. Large organizations remain the primary revenue contributors, but cost-sensitive SMEs are embracing pay-as-you-go models that free them from capital outlays while enhancing resilience. Providers that integrate UCaaS with CCaaS and CPaaS are expanding wallet share, and security-driven regional data residency frameworks are becoming a baseline requirement that shapes global roll-outs.

Global Unified Communication-as-a-Service (UCaaS) Market Trends and Insights

Pay-as-you-go OPEX Model Attracts Cost-Sensitive SMEs

Hosted UCaaS solutions let smaller businesses replace capital-heavy PBX systems with predictable monthly fees, yielding up to 55% cost savings over premises-based telephony. SMEs consequently represent the fastest-growing user cohort, posting a 27.8% CAGR from 2024 to 2030. Security matters just as much as cost: 51.3% of SMEs cite cyber protection as their top technology priority, viewing enterprise-grade cloud defenses as superior to in-house safeguards. Uptake is particularly strong in emerging Asia-Pacific and Latin America, where local connectivity partners bundle voice, video, and messaging with 5G mobile access to deliver a fully managed service.

Remote and Hybrid Work Policies Cement Work-from-Anywhere Demand

Hybrid schedules are now permanent, with 91% of employers offering flexible work and 98% of meetings featuring at least one remote participant. A unified platform that combines voice, video, chat, and file sharing has become mission-critical infrastructure, not a discretionary tool. Employees lose 36 minutes daily when forced to juggle multiple apps, prompting CIOs to consolidate overlapping services. North American enterprises are modernizing outdated meeting rooms with AI-assisted devices that auto-frame speakers and generate live captions, while European firms emphasize privacy-led data handling in compliance with GDPR.

Skills Gap in Multi-Vendor UC Stacks Prolongs Migration Cycles

Enterprises cite a lack of cloud-native voice engineers and API integration specialists as the main impediment to migration, with 62% of IT leaders reporting delays. Larger organizations struggle to mesh legacy PBX, SIP trunking, and new AI services without downtime, forcing reliance on costly systems integrators. This bottleneck is particularly visible in banking and healthcare, where security scrutiny extends project timelines.

Other drivers and restraints analyzed in the detailed report include:

- Integration of UCaaS with CCaaS and CPaaS Broadens Wallet Share

- AI-Powered Productivity Features Lift ROI

- Rising Toll-Fraud and SIP-Trunk Security Breaches Inflate TCO

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telephony accounted for 38.3% of UCaaS market share in 2024, yet collaboration platforms are growing at a 28.3% CAGR, echoing the pivot from stand-alone voice to integrated video, chat, and content sharing. Unified messaging and multi-party conferencing tools secure ongoing budget priority as CIOs seek productivity gains. Investments flow toward AI-enhanced features such as live translation, real-time whiteboarding, and automated action tracking that convert meetings into corporate knowledge.

The UCaaS market size for collaboration platforms is forecast to reach USD 82 billion by 2030, reflecting adoption across all verticals. Telephony remains essential for regulated call recording and emergency services, but commoditization pressures persist. Vendors differentiate via embedded analytics, guaranteed quality-of-service, and regional data residency that satisfy public-sector requirements.

Unified Communication-As-A-Service (UCaaS) Market is Segmented by by Component (Telephony, Unified Messaging and More), End-User Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Vertical (BFSI, Retail and E-Commerce, Education and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the UCaaS market with 43.4% revenue share in 2024 thanks to widespread cloud maturity, robust broadband infrastructure, and entrenched Microsoft Teams deployments. The United States further benefits from FedRAMP-certified offerings that unlock public-sector contracts. Growth is slowing to low-double digits as penetration nears saturation, yet AI integration, contact-center convergence, and frontline worker solutions keep spending momentum intact.

Europe follows with steady uptake in the United Kingdom, Germany, and France. GDPR, the Digital Markets Act, and impending national cloud regulations prompt enterprises to favor providers with local data centers and cross-platform interoperability. Independent service providers gain share by tailoring solutions to linguistic requirements and vertical compliance rules, especially in health and public administration.

Asia-Pacific delivers the strongest trajectory at a 30.4% CAGR through 2030. National 5G coverage, mobile-only workforces, and government-sponsored digital agendas propel adoption in Japan, South Korea, Singapore, and Australia. Southeast Asian nations are leapfrogging fixed-line limitations, with cloud-native UCaaS meeting multilingual needs and price points for SMEs. The UCaaS market size in Asia-Pacific is forecast to match North America by 2030 if current momentum continues. Latin America and the Middle East and Africa trail but show rising opportunity through fiber and 4G/5G roll-outs that lower access costs for cloud communications.

- Microsoft Corp.

- Cisco Systems Inc.

- Zoom Video Communications Inc.

- RingCentral Inc.

- 8x8 Inc.

- Mitel Networks Corp.

- Verizon Communications Inc.

- BT Group plc

- Vodafone Group plc

- NTT Communications Corp.

- Telstra Corp. Ltd.

- Deutsche Telekom AG (T-Systems)

- Orange Business Services

- ATandT Inc.

- Nextiva Inc.

- Gamma Communications plc

- KPN N.V.

- Telia Co. AB

- PCCW Global

- Maxis Bhd.

- PLDT Enterprise

- Wildix

- Avaya LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Pay-as-you-go OPEX model attracts cost-sensitive SMEs

- 4.2.2 Remote and hybrid work policies cement work-from-anywhere demand

- 4.2.3 Integration of UCaaS with CCaaS and CPaaS broadens wallet-share

- 4.2.4 AI-powered productivity (meeting summaries, voice bots) lifts ROI

- 4.2.5 5G-enabled mobile-first UCaaS in frontline/field operations

- 4.2.6 FedRAMP-grade secure-UCaaS unlocks regulated-industry adoption

- 4.3 Market Restraints

- 4.3.1 Skills gap in multi-vendor UC stacks prolongs migration cycles

- 4.3.2 Rising toll-fraud and SIP-trunk security breaches inflate TCO

- 4.3.3 Voice-quality variance on over-the-top public internet links

- 4.3.4 National data-sovereignty laws constrain global seat roll-outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Unified Messaging

- 5.1.3 Audio / Video Conferencing

- 5.1.4 Collaboration Platforms

- 5.2 By End-user Enterprise Size

- 5.2.1 Small and medium enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Retail and e-Commerce

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Government and Public Sector

- 5.3.5 IT and Telecom

- 5.3.6 Education

- 5.3.7 Others (Manufacturing, Hospitality, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Switzerland

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Malaysia

- 5.4.4.6 Singapore

- 5.4.4.7 Vietnam

- 5.4.4.8 Indonesia

- 5.4.4.9 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 Nigeria

- 5.4.5.2.2 South Africa

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Zoom Video Communications Inc.

- 6.4.4 RingCentral Inc.

- 6.4.5 8x8 Inc.

- 6.4.6 Mitel Networks Corp.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 BT Group plc

- 6.4.9 Vodafone Group plc

- 6.4.10 NTT Communications Corp.

- 6.4.11 Telstra Corp. Ltd.

- 6.4.12 Deutsche Telekom AG (T-Systems)

- 6.4.13 Orange Business Services

- 6.4.14 ATandT Inc.

- 6.4.15 Nextiva Inc.

- 6.4.16 Gamma Communications plc

- 6.4.17 KPN N.V.

- 6.4.18 Telia Co. AB

- 6.4.19 PCCW Global

- 6.4.20 Maxis Bhd.

- 6.4.21 PLDT Enterprise

- 6.4.22 Wildix

- 6.4.23 Avaya LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment