|

市場調查報告書

商品編碼

1848334

汽車軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

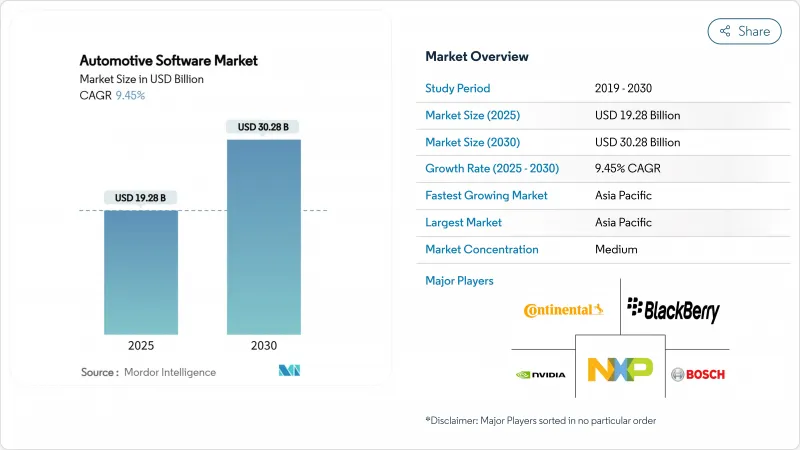

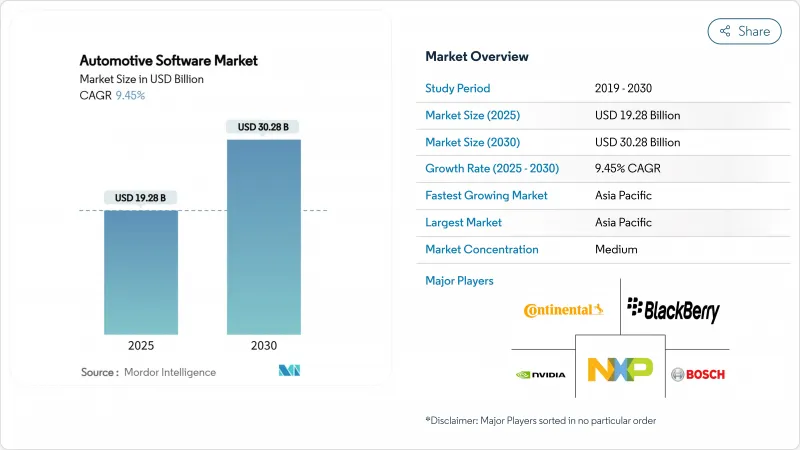

預計汽車軟體市場規模到 2025 年將達到 192.8 億美元,到 2030 年將達到 302.8 億美元,到 2030 年的複合年成長率為 9.45%。

這一成長反映了汽車產業從以硬體為中心的平台向軟體定義平台的穩步轉型。在軟體定義平台中,從電池最佳化到自動駕駛等關鍵功能都存在於程式碼中,而非機械部件中。分區電子/電氣架構的日益普及,使線束重量減輕了高達30%,從而釋放了更多運算能力以支援新功能。全球汽車製造商正在迅速推進無線 (OTA) 更新功能,以符合歐盟 WP.29 網路安全和軟體更新法規的要求,而基於訂閱的「按需功能」服務則開始釋放高利潤的售後收益來源。半導體供應商、超大規模資料中心業者和一級軟體公司日益成長的興趣加劇了競爭,並刺激了旨在保護作業系統、中介軟體和安全堆疊資產的收購激增。這些趨勢,加上政府推動電氣化的舉措,正在推動資本持續流入電池管理軟體、邊緣雲端連接以及人工智慧主導的程式碼產生工具。

全球汽車軟體市場趨勢與洞察

中國汽車廠商推出L2+自動駕駛技術,推動亞洲ADAS代碼量成長

敏捷開發框架使比亞迪、小鵬汽車和Zeekr等品牌的功能發布週期縮短了高達60%,推動了ADAS程式碼行數的激增,並加速了西方競爭對手的追趕。感知、感測器融合和路徑規劃演算法的快速迭代正在推動對冗餘計算的需求,促使晶片製造商設計封裝在中國製造的集中式ECU中的特定領域加速器。產業觀察家指出,合規的OTA流程對於維持這些車隊的更新至關重要,而安全的DevOps是維持市場領先地位的先決條件。

隨著 OEM 轉向以區域為中心的 E/E 架構,全球中介軟體支出增加

用四到六個區域控制器取代數十個域 ECU(例如特斯拉 Model 3 等車型),可以顯著簡化佈線、減輕重量並降低功率損耗。然而,這種分散式佈局將複雜性轉移到了軟體層,該層必須抽象化異質感測器、管理確定性通訊並強制執行功能安全分區。中間件供應商報告稱,由於原始設備製造商競相協調 AUTOSAR Classic 和 Adaptive 堆疊、即時 POSIX 核心和雲端 API,整合計劃陷入停滯。恩智浦斥資 6.25 億美元收購 TTTech Auto,凸顯了可擴展至車輛系列之外的認證中間件的價值。

中介軟體標準的碎片化阻礙了OEM廠商之間的重複使用

缺乏統一的 API 迫使一級供應商將相同的功能移植到多個專有堆疊中,這推高了檢驗成本並減緩了創新。 AUTOSAR 和 SOAFEE 等聯盟提案協調以服務為導向的框架,但品牌策略的差異阻礙了融合,尤其是在客製化層根深蒂固的歐洲 OEM 中。因此,中間件製造商正在建造可配置的適配器,犧牲效能來換取可移植性。

細分分析

應用軟體收入仍將保持最高水平,到2024年將佔汽車軟體市場的48.53%,這反映了客戶對ADAS、資訊娛樂和個人化無線升級的需求。隨著OEM廠商採用基於Linux且功能安全性增強的發行版,作業系統平台是成長最快的細分市場,複合年成長率達9.71%。隨著整合運算技術能夠加快功能部署,應用層程式碼的市場規模預計將穩定擴大。中間件的戰略價值也將同樣提升,它將成為POSIX核心與更高等級應用程式之間經過安全認證的橋樑。

對開放原始碼元件的日益依賴正在重塑供應商的議價能力。晶片供應商捆綁參考鏡像以加速客戶入職,軟體整合商則透過長期維護、網路強化和變體管理來創造收益。隨著汽車軟體市場向共用程式碼庫發展,相關人員透過合規性、整合工具和即時確定性來實現差異化。諸如恩智浦收購中間件之類的整合表明,平台的廣度將決定能否贏得即將推出的電動車和自動駕駛汽車的合約。

2024年,ADAS和安全系統將佔汽車軟體市場收入的33.76%,主要得益於歐盟通用安全法規強制要求的智慧速度輔助、車道維持和自動緊急煞車(AEB)。該叢集受益於高採用率和頻繁的功能升級,使ADAS軟體成為5G資料管道的核心。由於OEM廠商致力於延長純電動車續航里程、保護鋰離子電池並實現雙向充電,動力傳動系統和電池管理應用將佔據主導地位,複合年成長率將達到13.25%。

資訊娛樂和遠端資訊處理平台消耗 5G頻寬,整合串流媒體合作夥伴,並擷取車輛使用資料以進行預測性維護,從而推動經常性收益的成長。車身控制模組遷移到中央運算節點,共用晶片可以降低組件成本,但同時也增加了可靠隔離的需求。日益成長的跨域編配模糊了過去的界限,而監管壓力則要求將安全邏輯錨定在確定性核心中,並將非關鍵軟體遷移到容器化的微服務中。

區域分析

預計到2024年,亞洲將佔據汽車軟體市場的最大佔有率,達到39.04%,複合年成長率為11.66%。敏捷的發布週期使中國OEM能夠以比傳統OEM快60%的速度整合L2+功能,從而培育出國內中間件和感知堆疊生態系統。韓國率先採用G-V2X技術,實現了邊緣雲端分析,而日本則透過其AI模型檢驗實驗室專注於功能安全的領先地位。區域電池供應鏈正在加速軟體定義能源管理系統的發展,確保亞洲繼續成為汽車軟體市場的重心。

北美排名第二,正在利用通膨控制補貼來推動電池管理軟體和家庭充電最佳化器的需求。訂閱主導的功能正在激增,使汽車製造商能夠在售後很長一段時間內將駕駛輔助升級和資訊娛樂應用程式收益。矽谷新興企業正在推出縮短程式碼發布週期的人工智慧工具,而底特律的現有企業則正在採用與消費性電子產品節奏同步的DevOps流程。這些因素共同作用,導致車載軟體的內容成本居高不下,並牢牢地將該地區定位為汽車軟體市場產生收入模式的試驗場。

歐洲在聯合國WP.29公約下,憑藉嚴格的網路安全和OTA授權,保持強大的地位,並正在推廣採用經過認證的軟體更新管理系統。以瑞典為首的北歐國家預測,受電動車普及和數位化服務準備的推動,歐洲軟體更新的複合年成長率將達到11%。然而,開發人員短缺,尤其是AUTOSAR認證人才短缺,可能導致薪資上漲和專案進度延誤。對專業培訓學院的投資反映了其對國內製造能力的戰略關注,並凸顯了歐洲在擴大軟體產量的同時確保品質的決心。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 中國OEM廠商推出L2+自動駕駛,推動亞洲ADAS代碼量成長

- 隨著 OEM 轉向集中式區域 E/E 架構,全球中介軟體支出將上升

- 歐盟WP.29 OTA更新授權加速歐洲安全軟體堆疊的發展

- 基於訂閱的「按需功能」模式推動北美售後軟體收益成長

- 美國IRA 電動車獎勵推動電池管理軟體需求

- 韓國部署5G-V2X網路,實現邊緣雲端服務

- 市場限制

- 分散的中介軟體標準阻礙了 OEM 之間的重複使用

- 歐洲 AUTOSAR Classic 和 Adaptive 開發人員短缺導致成本增加

- R155/R156 網路認證考試費用緩慢的計畫進度

- 傳統 CAN 架構限制了新興市場的 SDV 採用

- 價值/供應鏈分析

- 監管展望(UNECE R155/R156、美國OTA法規、歐盟網路彈性法案)

- 技術展望(區域架構、AI工具鏈、無線管道)

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模與成長預測(價值(美元))

- 軟體層

- 應用軟體

- 中介軟體

- 作業系統

- 韌體/基本輸入/輸出軟體

- 按用途

- ADAS 與安全系統

- 資訊娛樂和遠端資訊處理

- 動力傳動系統和電池管理

- 身體控制和舒適度

- 聯網汽車服務

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型商用車

- 透過推進力

- 內燃機汽車(ICE)

- 純電動車(BEV)

- 混合動力電動車(HEV/PHEV)

- 按部署

- 板載(嵌入式)

- 外部(雲/邊緣)

- 按地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- Elektrobit

- BlackBerry Limited(QNX)

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- Wind River Systems

- NXP Semiconductors NV

- NVIDIA Corporation

- Aptiv PLC

- TTTech Auto AG

- Vector Informatik GmbH

- Infineon Technologies AG

- Intel Corporation

- LG Electronics Vehicle Solutions

- DENSO Corporation

- Panasonic Automotive Systems

- KPIT Technologies Ltd.

- Intellias Ltd.

- Tata Elxsi Ltd.

- Airbiquity Inc.

- MontaVista Software LLC

- Renesas Electronics Corporation

- HARMAN International

- GlobalLogic Inc.

第7章 市場機會與未來展望

The automotive software market size stood at USD 19.28 billion in 2025 and is set to reach USD 30.28 billion by 2030, advancing at a 9.45% CAGR by 2030.

Growth reflects the steady shift from hardware-centric vehicles to software-defined platforms where key functions, ranging from battery optimisation to automated driving, reside in code rather than mechanical parts. The rising adoption of zonal electronic/electrical architectures is trimming harness weight by up to 30% and freeing computing power for new features. Global automakers are fast-tracking over-the-air (OTA) update capabilities to comply with EU WP.29 cybersecurity and software-update rules, while subscription-based "functions-on-demand" services are starting to unlock high-margin, post-sale revenue streams. Heightened interest from semiconductor suppliers, hyperscalers, and Tier-1 software firms is intensifying competition, prompting a surge of acquisitions to secure operating-system, middleware, and safety-stack assets. These moves and government incentives for electrification keep capital flowing into battery-management software, edge-cloud connectivity, and AI-driven code-generation tools.

Global Automotive Software Market Trends and Insights

Level-2+ Autonomous Launches by Chinese OEMs Boosting ADAS Code Volume in Asia

Agile development frameworks allow brands such as BYD, Xpeng, and Zeekr to trim feature-release cycles by up to 60%, driving an explosion in ADAS code lines and accelerating competitive catch-up by Western rivals. Rapid iteration on perception, sensor fusion, and path-planning algorithms fuels demand for redundant compute, leading chipmakers to design domain-specific accelerators packaged within Chinese-built centralized ECUs. Industry observers note that compliant OTA pipelines are mandatory to keep those fleets current, making secure DevOps a prerequisite for sustained market leadership.

OEM Shift to Centralized Zonal E/E Architectures Raising Middleware Spend Globally

Replacing dozens of domain ECUs with four to six zone controllers simplifies wiring significantly, as exemplified in models such as Tesla Model 3, cuts weight, and reduces power loss. Yet decentralised layout shifts complexity toward software layers that must abstract heterogeneous sensors, manage deterministic communication, and enforce functional-safety partitions. Middleware vendors report a backlog of integration projects as OEMs race to harmonise AUTOSAR Classic and Adaptive stacks, real-time POSIX kernels, and cloud APIs. NXP's USD 625 million purchase of TTTech Auto highlighted the premium on certified middleware that can scale across vehicle families.

Fragmented Middleware Standards Hindering Cross-OEM Re-use

Lack of unified APIs forces Tier-1s to port identical functions to multiple proprietary stacks, elevating validation expense and slowing innovation. Consortia such as AUTOSAR and SOAFEE have proposed harmonised service-oriented frameworks, yet diverging brand strategies stall convergence, particularly among European OEMs with entrenched bespoke layers. Middleware houses thus build configurable adapters that sacrifice performance for portability, a compromise that adds runtime overhead and complicates safety certification.

Other drivers and restraints analyzed in the detailed report include:

- EU WP.29 OTA-Update Mandate Accelerating Secure Software Stacks in Europe

- Subscription-Based 'Functions-on-Demand' Models Expanding Post-Sale Software Revenues in North America

- Shortage of AUTOSAR Classic and Adaptive Developers in Europe Inflating Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Application software still delivers the highest revenue at 48.53% of the automotive software market in 2024, mirroring customer appetite for ADAS, infotainment, and personalised over-the-air upgrades. Operating-system platforms are the fastest-growing slice, advancing at 9.71% CAGR as OEMs embrace Linux-based distributions hardened for functional safety. The market size for application-layer code is projected to climb steadily as consolidated compute unlocks faster feature roll-outs. Middleware's strategic value climbs in step, acting as a safety-certified bridge between POSIX kernels and high-level apps; Aptiv calls it the "orchestrator" of zonal traffic.

Growing reliance on open-source components reshapes vendor bargaining power. Silicon suppliers bundle reference images to accelerate customer entry, while software integrators monetise long-term maintenance, cyber-hardening, and variant management. As the automotive software market evolves toward shared code bases, stakeholders differentiate via compliance, integration tooling, and real-time determinism. Consolidation, exemplified by NXP's middleware acquisition, signals that platform breadth will determine contract wins for forthcoming electric and autonomous vehicle launches.

ADAS and safety systems delivered 33.76% revenue of the automotive software market in 2024, thanks to mandatory intelligent-speed assist, lane-keeping, and AEB under the EU General Safety Regulation. The cluster benefits from high attach rates and frequent feature upgrades, keeping ADAS software at the heart of 5 G-enabled data pipelines. Powertrain and battery-management applications are forecasted to outpace all others at 13.25% CAGR as OEMs race to extend BEV range, safeguard lithium-ion cells, and orchestrate bidirectional charging.

Infotainment and telematics platforms absorb 5G bandwidth, integrate streaming partners, and harvest vehicle-usage data for predictive maintenance, fuelling recurring revenue ambitions. Body-control modules migrate to central compute nodes, where shared silicon slashes bill-of-materials cost yet magnifies the need for robust isolation. Increasing cross-domain orchestration blurs historical boundaries, but regulatory pressure keeps safety logic anchored in deterministic cores while non-critical software shifts toward containerised microservices.

The Automotive Software Market Report is Segmented by Software Layer (Application Software, Middleware, and More), Application (ADAS and Safety Systems and More), Vehicle Type (Passenger Cars and More), Propulsion (Internal Combustion Engine Vehicles (ICE) and More), Deployment (On-Board (Embedded) and Off-Board (Cloud / Edge)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia commanded the largest regional share at 39.04% of the automotive software market in 2024, and is projected to grow at an 11.66% CAGR, propelled by China's fast-track deployment of software-defined vehicles and government incentives for autonomous navigation modules. Agile release cycles let Chinese OEMs integrate Level-2+ functions at a pace 60% quicker than traditional counterparts, catalysing domestic middleware and perception-stack ecosystems. South Korea's early roll-out of 5 G-V2X enables edge-cloud analytics, while Japan focuses on functional-safety leadership through AI-model verification labs. Regional battery supply chains accelerate software-enhanced energy-management systems, ensuring that Asia remains the gravitational centre of the automotive software market.

North America sits second, leveraging the Inflation Reduction Act credits to swell demand for battery-management software and home-charging optimisers. Subscription-driven features have proliferated, allowing automakers to monetise driver-assistance upgrades and infotainment apps long after the point of sale. Silicon Valley start-ups inject AI tooling that shortens code-release cycles, and Detroit incumbents adopt DevOps pipelines mirroring consumer-electronics cadence. Together, these factors sustain high per-vehicle software content, cementing the region as a testbed for revenue-generation models in the automotive software market.

Europe maintains a formidable position anchored by stringent cybersecurity and OTA mandates under UN WP.29, driving uptake of certified software-update management systems. The Nordics, spearheaded by Sweden, are pegged for a 11% CAGR on the back of EV prevalence and digital-service readiness. Nonetheless, developer shortages, particularly AUTOSAR-certified talent, impose wage inflation and risk schedule slippage. Investment in dedicated training academies reflects a strategic pivot to home-grown capability, underscoring Europe's resolve to safeguard quality while scaling software output.

- Robert Bosch GmbH

- Continental AG

- Elektrobit

- BlackBerry Limited (QNX)

- Google LLC (Alphabet Inc.)

- Microsoft Corporation

- Wind River Systems

- NXP Semiconductors N.V.

- NVIDIA Corporation

- Aptiv PLC

- TTTech Auto AG

- Vector Informatik GmbH

- Infineon Technologies AG

- Intel Corporation

- LG Electronics Vehicle Solutions

- DENSO Corporation

- Panasonic Automotive Systems

- KPIT Technologies Ltd.

- Intellias Ltd.

- Tata Elxsi Ltd.

- Airbiquity Inc.

- MontaVista Software LLC

- Renesas Electronics Corporation

- HARMAN International

- GlobalLogic Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Level-2+ Autonomous Launches by Chinese OEMs Boosting ADAS Code Volume in Asia

- 4.2.2 OEM Shift to Centralized Zonal E/E Architectures Raising Middleware Spend Globally

- 4.2.3 EU WP.29 OTA-Update Mandate Accelerating Secure Software Stacks in Europe

- 4.2.4 Subscription-Based 'Functions-on-Demand' Models Expanding Post-Sale Software Revenues in North America

- 4.2.5 U.S. IRA EV Incentives Driving Battery-Management Software Demand

- 4.2.6 Roll-out of 5G-V2X Networks Enabling Edge-Cloud Automotive Software Services in South Korea

- 4.3 Market Restraints

- 4.3.1 Fragmented Middleware Standards Hindering Cross-OEM Re-use

- 4.3.2 Shortage of AUTOSAR Classic & Adaptive Developers in Europe Inflating Costs

- 4.3.3 R155/R156 Cyber-Homologation Testing Costs Delaying Program Timelines

- 4.3.4 Legacy CAN Architectures in Emerging Markets Limiting SDV Adoption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (UNECE R155/R156, U.S. OTA Rules, EU Cyber Resilience Act)

- 4.6 Technological Outlook (Zonal Architecture, AI Tool-chains, Over-the-Air Pipelines)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Software Layer

- 5.1.1 Application Software

- 5.1.2 Middleware

- 5.1.3 Operating System

- 5.1.4 Firmware / Basic Input-Output Software

- 5.2 By Application

- 5.2.1 ADAS and Safety Systems

- 5.2.2 Infotainment and Telematics

- 5.2.3 Powertrain and Battery-Management

- 5.2.4 Body Control and Comfort

- 5.2.5 Connected Vehicle Services

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.4 By Propulsion

- 5.4.1 Internal Combustion Engine Vehicles (ICE)

- 5.4.2 Battery Electric Vehicles (BEV)

- 5.4.3 Hybrid Electric Vehicles (HEV/PHEV)

- 5.5 By Deployment

- 5.5.1 On-Board (Embedded)

- 5.5.2 Off-Board (Cloud / Edge)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of the Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Elektrobit

- 6.4.4 BlackBerry Limited (QNX)

- 6.4.5 Google LLC (Alphabet Inc.)

- 6.4.6 Microsoft Corporation

- 6.4.7 Wind River Systems

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 NVIDIA Corporation

- 6.4.10 Aptiv PLC

- 6.4.11 TTTech Auto AG

- 6.4.12 Vector Informatik GmbH

- 6.4.13 Infineon Technologies AG

- 6.4.14 Intel Corporation

- 6.4.15 LG Electronics Vehicle Solutions

- 6.4.16 DENSO Corporation

- 6.4.17 Panasonic Automotive Systems

- 6.4.18 KPIT Technologies Ltd.

- 6.4.19 Intellias Ltd.

- 6.4.20 Tata Elxsi Ltd.

- 6.4.21 Airbiquity Inc.

- 6.4.22 MontaVista Software LLC

- 6.4.23 Renesas Electronics Corporation

- 6.4.24 HARMAN International

- 6.4.25 GlobalLogic Inc.