|

市場調查報告書

商品編碼

1871245

車輛即平台硬體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Vehicle-as-a-Platform Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

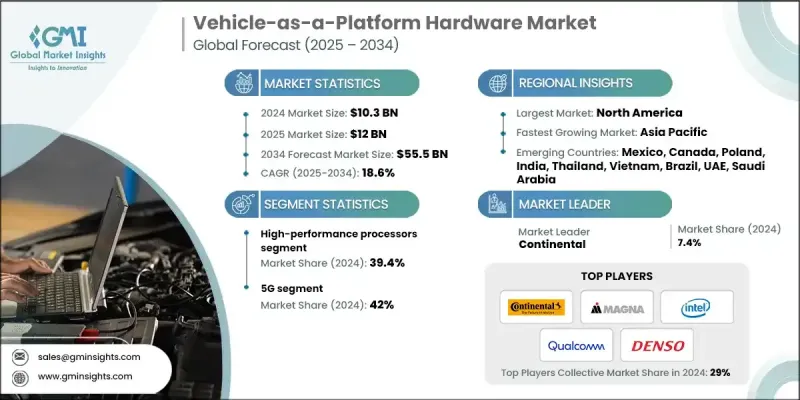

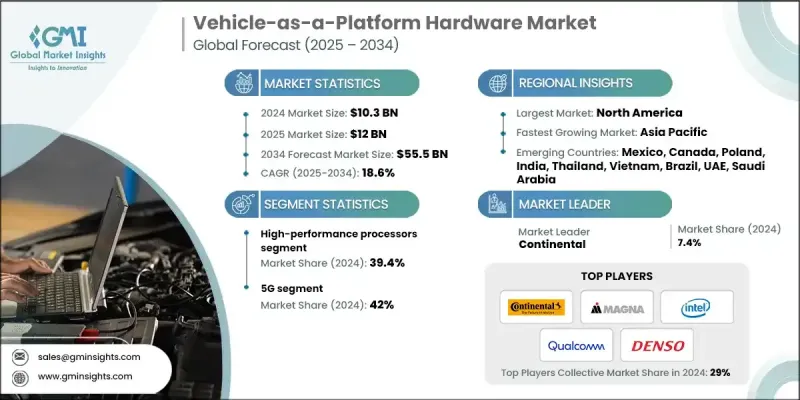

2024 年全球車輛即平台硬體市場價值為 103 億美元,預計到 2034 年將以 18.6% 的複合年成長率成長至 555 億美元。

隨著汽車向智慧平台演進,以滿足用戶不斷變化的需求,汽車產業正經歷一場重大的技術變革。車輛即平台(VaaS)硬體在提升駕駛員和乘客體驗方面發揮核心作用,它支援資訊娛樂、車輛互聯和駕駛輔助技術等先進系統。道路安全日益成為當務之急,整合式雷達、LiDAR、超音波感測器和攝影機等先進駕駛輔助系統(ADAS)可確保對車道、交通號誌和周圍環境進行精準監控。消費者對互聯和智慧功能的興趣日益濃厚,促使汽車製造商(OEM)和售後市場供應商提供整合解決方案,以提升舒適性、安全性和便利性。不斷擴展的自動駕駛汽車領域正在創造新的投資機遇,而對連網汽車日益成長的需求也持續推動市場發展。為了實現車輛、基礎設施和雲端平台之間的無縫通訊,製造商正致力於開發能夠支援超高速資料處理、安全連接和高效邊緣運算功能的高性能硬體系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 103億美元 |

| 預測值 | 555億美元 |

| 複合年成長率 | 18.6% |

高性能處理器預計在2024年佔據39.4%的市場佔有率,這主要得益於其處理人工智慧工作負載的能力,以及確保車輛系統安全、集中處理資料的能力。這些處理器能夠管理攝影機、感測器和雷射雷達技術產生的大量資料流,使車輛能夠高精度地做出即時駕駛決策。它們能夠瞬間執行複雜的演算法,這對於自動駕駛功能和高級車輛操作至關重要,尤其是在行業向更高自動化水平轉型之際。

由於5G技術在商用車和乘用車領域的快速整合,預計到2024年,5G硬體市場佔有率將達到42%。汽車製造商正在將低延遲的5G組件嵌入到車輛運算架構中,實現即時通訊、空中系統更新和雲端輔助智慧。這種轉變使得連網和自動駕駛汽車能夠以最小的網路延遲執行高階感測器融合和決策。越來越多的車輛採用內建Wi-Fi Mesh硬體進行設計,以連接多個模組、感測器和控制單元,以實現無縫運作。

預計到2024年,美國車輛即平台硬體市場規模將達29.1億美元。美國憑藉先進的研發基礎設施以及科技公司與原始設備製造商之間的緊密合作,仍然是汽車硬體創新的中心。人工智慧、高效能運算和感測器技術的持續進步,使美國成為智慧汽車開發的全球領導者。國內市場受益於網域控制器、區域架構和基於晶片組的系統單晶片(SoC)的整合,這些技術能夠實現即時資料處理和完全自動駕駛功能。

在全球車輛即平台硬體市場中,博世、電裝、德州儀器、英偉達、大陸集團、英特爾、瑞薩電子、高通技術和麥格納國際等知名企業佔據主導地位。這些領導企業正積極推行創新驅動型成長策略,以增強自身的競爭優勢。各公司正投入大量資金用於研發,以打造可擴展、節能高效的硬體系統,從而支援基於人工智慧的自動駕駛和進階連網功能。與汽車製造商、半導體生產商和軟體開發商的策略合作和長期夥伴關係,有助於他們加速新產品發布並更快地實現商業化。許多企業正透過併購和區域擴張來提升產能和擴大全球影響力。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 高級駕駛輔助系統(ADAS)的日益普及

- 有利於自動駕駛汽車的政府政策

- 消費者對先進資訊娛樂系統的興趣日益濃厚

- 互聯汽車生態系統

- 產業陷阱與挑戰

- 網路安全和資料隱私問題

- 先進硬體組件成本高昂

- 市場機遇

- 電動車(EV)的成長

- 出行即服務 (MaaS) 的擴展

- 人工智慧和邊緣運算的進展

- 5G和V2X通訊的興起

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 市場進入與擴張策略

- 新的市場滲透模式

- 區域擴張路線圖

- 投資環境及市場機遇

- 投資生態系概況及市場動態

- 創投與私募股權活動分析

- 策略投資機會及優先事項

- 市場進入策略及時機分析

- 合作與協作機會分析

- 策略實施與執行路線圖

- 策略市場進入與定位策略

- 技術投資優先事項及分配

- 夥伴關係與生態系統發展策略

- 風險緩解與緊急應變計畫框架

- 實施時間表和里程碑計劃

- 數位轉型與創新生態系統

- 數位轉型策略及路線圖

- 創新管理與發展流程

- 科技探索與新興趨勢分析

- 創業生態系統及合作機會

- 開放式創新與協作平台

- 客戶體驗與市場接受度

- 客戶旅程圖與體驗設計

- 市場採納模式與行為分析

- 客戶區隔與目標定位策略

- 價值主張的發展與溝通

- 客戶決策過程分析

- 風險管理與業務連續性

- 綜合風險評估與識別

- 風險分類與優先排序框架

- 風險緩解策略及實施

- 業務連續性計劃與準備

- 供應鏈風險管理與韌性

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 高效能處理器

- GPU

- 邊緣運算模組

- 感應器

- 相機

- LiDAR

- 雷達

- 車載資訊設備

- 其他

第6章:市場估算與預測:以連結方式分類,2021-2034年

- 主要趨勢

- 5G

- 無線上網

- V2X

- 衛星通訊系統

第7章:市場估算與預測:依介面類型分類,2021-2034年

- 主要趨勢

- 電子控制單元(ECU)

- 港口

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- SUV

- 商用車輛

- 低容量性狀

- MCV

- C型肝炎

- 電動車

- 純電動車

- 插電式混合動力汽車

- 燃料電池電動車

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 波蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 越南

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Global companies

- NVIDIA

- Qualcomm Technologies

- Intel

- Mobileye (Intel Company)

- Bosch

- Infineon Technologies

- STMicroelectronics

- Texas Instruments

- Regional companies

- Continental

- Denso

- Aptiv

- Visteon

- Magna International

- ZF Friedrichshafen

- Valeo

- Hyundai Mobis

- Panasonic Automotive Systems

- Emerging companies

- Horizon Robotics

- Black Sesame Technologies

- Hailo Technologies

- Ambarella

- Renesas Electronics

- NXP Semiconductors

- Xilinx (AMD Company)

- Arm

The Global Vehicle-as-a-Platform Hardware Market was valued at USD 10.3 Billion in 2024 and is estimated to grow at a CAGR of 18.6% to reach USD 55.5 Billion by 2034.

The automotive sector is undergoing a major technological transformation as vehicles evolve into intelligent platforms designed to meet changing user expectations. Vehicle-as-a-platform hardware plays a central role in enhancing driver and passenger experiences by enabling advanced systems such as infotainment, vehicle connectivity, and driver assistance technologies. As road safety becomes an urgent priority, the integration of advanced driver assistance systems (ADAS) featuring radar, lidar, ultrasonic sensors, and cameras ensures accurate monitoring of lanes, traffic signals, and surrounding objects. The increasing consumer interest in connected and intelligent features is driving OEMs and aftermarket suppliers to deliver integrated solutions that improve comfort, safety, and convenience. The expanding autonomous vehicle landscape is creating new opportunities for investment, while growing demand for connected cars continues to propel market momentum. To achieve seamless communication between vehicles, infrastructure, and cloud platforms, manufacturers are focusing on developing high-performance hardware systems capable of supporting ultra-fast data processing, secure connectivity, and efficient edge computing functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.3 Billion |

| Forecast Value | $55.5 Billion |

| CAGR | 18.6% |

The high-performance processors segment held 39.4% share in 2024, driven by their ability to handle artificial intelligence workloads and ensure secure, centralized processing across vehicle systems. These processors manage massive data flows generated by cameras, sensors, and LiDAR technologies, allowing vehicles to make real-time driving decisions with high precision. Their capacity to execute complex algorithms instantly makes them essential for autonomous driving functions and advanced vehicle operations, especially as industry transitions toward higher levels of automation.

The 5G hardware segment held a 42% share in 2024, owing to rapid integration across both commercial and passenger vehicles. Automakers are embedding low-latency 5G components into vehicle compute architectures, enabling real-time communication, over-the-air system updates, and cloud-assisted intelligence. This shift allows connected and self-driving vehicles to perform advanced sensor fusion and decision-making with minimal network delays. Vehicles are increasingly being designed with in-built Wi-Fi mesh hardware that links multiple modules, sensors, and control units for seamless operation.

U.S. Vehicle-as-a-Platform Hardware Market USD 2.91 Billion in 2024. The country remains a hub for automotive hardware innovation, supported by advanced research infrastructure and strong collaborations between technology firms and original equipment manufacturers. Continuous advancements in artificial intelligence, high-performance computing, and sensor technologies have positioned the U.S. as a global leader in smart vehicle development. The domestic market benefits from the integration of domain controllers, zonal architecture, and chiplet-based systems-on-chip (SoCs) that enable real-time data processing and fully autonomous capabilities.

Prominent companies shaping the Global Vehicle-as-a-Platform Hardware Market include Bosch, Denso, Texas Instruments, NVIDIA, Continental, Intel, Renesas Electronics, Qualcomm Technologies, and Magna International. Leading companies in the Vehicle-as-a-Platform Hardware Market are actively pursuing innovation-driven growth strategies to strengthen their competitive edge. Firms are channeling significant investments into research and development to create scalable, energy-efficient hardware systems capable of supporting AI-based autonomous driving and advanced connectivity. Strategic collaborations and long-term partnerships with automakers, semiconductor producers, and software developers are helping them accelerate new product launches and achieve faster commercialization. Many players are expanding their production capabilities and global presence through mergers, acquisitions, and regional expansion.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Connectivity

- 2.2.4 Interface

- 2.2.5 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Profit margin

- 3.2.2 Cost structure

- 3.2.3 Value addition at each stage

- 3.2.4 Factor affecting the value chain

- 3.2.5 Disruptions

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing adoption of Advanced Driver Assistance Systems (ADAS)

- 3.3.1.2 Favorable Government Policies for Autonomous Vehicles

- 3.3.1.3 Increasing Consumer Interest in Advanced Infotainment Systems

- 3.3.1.4 Connected Vehicle Ecosystem

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Cybersecurity and Data Privacy Concerns

- 3.3.2.2 High Cost of Advanced Hardware Components

- 3.3.3 Market opportunities

- 3.3.3.1 Growth of Electric Vehicles (EVs)

- 3.3.3.2 Expansion of Mobility-as-a-Service (MaaS)

- 3.3.3.3 Advancements in AI and Edge Computing

- 3.3.3.4 Emergence of 5G and V2X Communication

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Market entry & expansion strategies

- 3.14.1 New market penetration models

- 3.14.2 Regional expansion roadmaps

- 3.15 Investment landscape & market opportunities

- 3.15.1 Investment ecosystem overview & market dynamics

- 3.15.2 Venture capital & private equity activity analysis

- 3.15.3 Strategic investment opportunities & priorities

- 3.15.4 Market entry strategies & timing analysis

- 3.15.5 Partnership & collaboration opportunity mapping

- 3.16 Strategic implementation & execution roadmap

- 3.16.1 Strategic market entry & positioning strategies

- 3.16.2 Technology investment priorities & allocation

- 3.16.3 Partnership & ecosystem development strategies

- 3.16.4 Risk mitigation & contingency planning framework

- 3.16.5 Implementation timeline & milestone planning

- 3.17 Digital transformation & innovation ecosystem

- 3.17.1 Digital transformation strategy & roadmap

- 3.17.2 Innovation management & development processes

- 3.17.3 Technology scouting & emerging trend analysis

- 3.17.4 Startup ecosystem & partnership opportunities

- 3.17.5 Open innovation & collaboration platforms

- 3.18 Customer experience & market adoption

- 3.18.1 Customer journey mapping & experience design

- 3.18.2 Market adoption patterns & behavior analysis

- 3.18.3 Customer segmentation & targeting strategies

- 3.18.4 Value proposition development & communication

- 3.18.5 Customer decision-making process analysis

- 3.19 Risk management & business continuity

- 3.19.1 Comprehensive Risk Assessment & Identification

- 3.19.2 Risk Categorization & Prioritization Framework

- 3.19.3 Risk Mitigation Strategies & Implementation

- 3.19.4 Business Continuity Planning & Preparedness

- 3.19.5 Supply Chain Risk Management & Resilience

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 High performance processors

- 5.3 GPU

- 5.4 Edge computing modules

- 5.5 Sensors

- 5.5.1 Cameras

- 5.5.2 LiDAR

- 5.5.3 RADAR

- 5.5.4 Telematics devices

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 5G

- 6.3 Wi-Fi

- 6.4 V2X

- 6.5 Satellite communication systems

Chapter 7 Market Estimates & Forecast, By Interface, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Electronic Control Units (ECU)

- 7.3 Ports

Chapter 8 Market Estimates & Forecast, By End use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicle

- 8.2.1 Sedan

- 8.2.2 Hatchback

- 8.2.3 SUV

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Electric vehicle

- 8.4.1 BEV

- 8.4.2 PHEV

- 8.4.3 FCEV

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 NVIDIA

- 10.1.2 Qualcomm Technologies

- 10.1.3 Intel

- 10.1.4 Mobileye (Intel Company)

- 10.1.5 Bosch

- 10.1.6 Infineon Technologies

- 10.1.7 STMicroelectronics

- 10.1.8 Texas Instruments

- 10.2 Regional companies

- 10.2.1 Continental

- 10.2.2 Denso

- 10.2.3 Aptiv

- 10.2.4 Visteon

- 10.2.5 Magna International

- 10.2.6 ZF Friedrichshafen

- 10.2.7 Valeo

- 10.2.8 Hyundai Mobis

- 10.2.9 Panasonic Automotive Systems

- 10.3 Emerging companies

- 10.3.1 Horizon Robotics

- 10.3.2 Black Sesame Technologies

- 10.3.3 Hailo Technologies

- 10.3.4 Ambarella

- 10.3.5 Renesas Electronics

- 10.3.6 NXP Semiconductors

- 10.3.7 Xilinx (AMD Company)

- 10.3.8 Arm