|

市場調查報告書

商品編碼

1848293

聚醯亞胺薄膜:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Polyimide Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

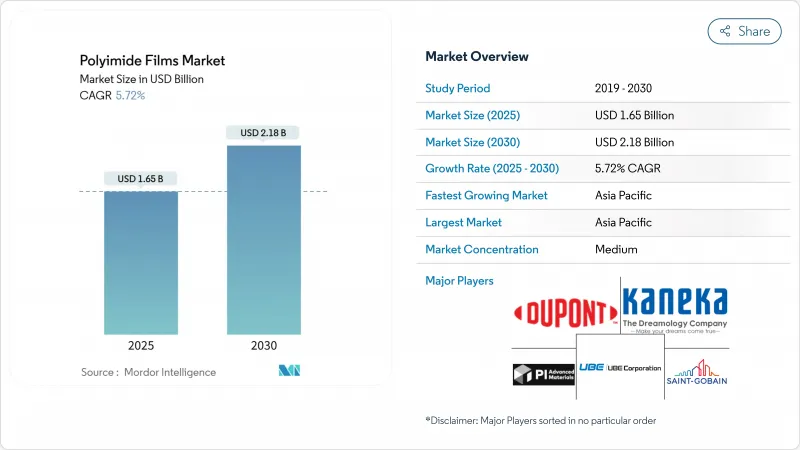

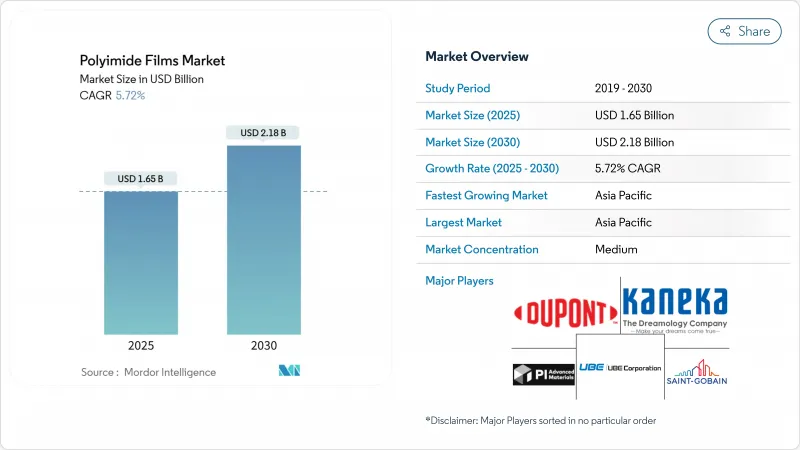

預計2025年全球聚醯亞胺薄膜市場規模將達到16.5億美元,到2030年將達到21.8億美元,2025年至2030年的複合年成長率為5.72%。

微型消費性電子產品、電氣化交通和高溫航太電子產品是需求的主要驅動力。 5G基礎設施的持續投資以及向SiC/GaN功率元件的轉型將增強高可靠性薄膜的長期消費。此外,與PFAS相關的監管壓力可能會重塑樹脂化學和採購模式。

全球聚醯亞胺薄膜市場趨勢與洞察

折疊式和可捲曲顯示器將加速無色聚醯亞胺薄膜的採用

隨著智慧型手機製造商將第二代折疊式設備商業化,可折疊半徑不超過3毫米的透明基板的需求日益成長。無色基板在450奈米波長下的透光率超過85%,並在超過10萬次折疊循環中保持機械完整性,使原始設備製造商(OEM)能夠採用超薄玻璃替代品並減輕鉸鏈重量。一家韓國供應商推出了一種星形紫外線吸收劑,可抑制光劣化並延長汽車儀錶板的戶外使用壽命。中國和韓國對面板的持續投資支持了穩定的供應。此外,旋轉性電視的投產拓寬了應用基礎,聚醯亞胺薄膜市場也持續向高階顯示器領域拓展。

導熱聚醯亞胺薄膜可實現高密度電動車電池組

隨著汽車平台向800V架構過渡,產生的熱負荷也隨之增加,因此,具有增強平面熱導率的薄型電隔離器至關重要。含石墨的聚醯亞胺層壓板如今的熱傳導率接近0.5 W/m*K,同時維持超過200 kV/mm的介電擊穿強度,滿足嚴格的安全裕度。受北極熊啟發,中空二氧化矽結構的研究已達到0.041 W/m*K,降低了寒冷氣候的失控風險。這些進展支持了中國、美國和德國積極的電池組緻密化計劃,使聚醯亞胺薄膜市場在動力傳動系統鏈中站穩了腳跟。

低成本替代品的可用性

琥珀色聚醯亞胺的價格溢價是同類PEN薄膜的兩倍以上。 Kaladex PEN的機械RTI為160°C,適用於家用電器和標準汽車線束。對於電容器和中階軟性電路而言,由於買家會權衡熱裕度和元件成本,PEN的經濟性正成為採購的促進因素。在下一代顯示器和功率元件的性能再次提升之前,成本敏感地區(尤其是東南亞和拉丁美洲)加強對高溫聚酯的研發力度,可能會減少聚醯亞胺薄膜市場的銷售量。

細分分析

傳統琥珀色產品憑藉其在傳統電線絕緣和軟性電路領域的優勢,將在2024年佔據聚醯亞胺薄膜市場佔有率的45%。儘管這一細分市場佔據了聚醯亞胺薄膜市場的最大佔有率,但隨著新化學技術的興起,其成長率低於市場平均值。無色PI泡棉的複合年成長率將達到6.14%,這得益於折疊式行動電話、可捲曲電視和透明觸控介面的普及。聚醯亞胺薄膜產業正在見證混合紫外線阻隔添加劑的研發,這些添加劑旨在保護主幹免受太陽光劣化的影響,並填補曾經支撐玻璃蓋板主導地位的性能缺口。

導熱等級為電動車電池提供平面絕緣,分散局部熱點,石墨或陶瓷微填料支援平面路徑。氟塗層等級繼續用於對酸穩定性至關重要的利基化學加工設備。雙向拉伸薄膜的分子排列使其尺寸重複性在0.1%以內,仍然是軟性航太感測器的首選。雖然雙向拉伸薄膜在聚醯亞胺薄膜市場中僅佔一小部分,但其超高利潤率正獎勵日本和比利時的產能擴張。所有產品類型的技術創新正在支撐聚醯亞胺薄膜市場的韌性。

區域分析

預計到2024年,亞太地區將佔聚醯亞胺薄膜市場收入的44%,到2030年,複合年成長率將達到6.00%。中國當地面板製造商將在2025年至2026年期間擴大其軟性OLED產能,以支援區域消費。國內樹脂製造商曾經一度僅限於琥珀色電氣級產品,如今正瞄準電子級聚醯亞胺,以減少對進口的依賴並提高成本競爭力。日本和韓國憑藉超淨反應器和多級溶劑回收系統保持領先地位,從而能夠滿足高階智慧型手機OEM廠商所需的一致光學透明度。印度作為專業電子代工中心的崛起正在吸引外國直接投資,擴大當地對軟式電路板的需求。

北美在航太、國防和先進半導體應用領域佔據著巨大的佔有率。杜邦公司斥資2.2億美元在俄亥俄州瑟克爾維爾的擴建項目將增強高階Kapton和Pyralux的國內供應,緩解地緣政治供應擔憂,並縮短國防部項目的前置作業時間。新興企業,利用聚醯亞胺與MEMS感測器陣列和microLED背板的兼容性,擴大聚醯亞胺薄膜市場的區域覆蓋範圍。

歐洲正在推動穩定的工業需求,這得益於歐洲大陸的汽車和可再生能源設備的結構性支撐。圍繞PFAS的監管勢頭正在加速配方的重新設計,並鼓勵當地供應商投資綠色溶劑系統和無氟單體。這種適應性保護了該地區的聚醯亞胺薄膜市場免受整體萎縮的影響,同時向採用類似法規的其他司法管轄區輸出環保解決方案。南美、中東和非洲仍然是規模較小的終端市場,但巴西蓬勃發展的電子產業叢集和海灣地區的國防衛星計畫將推動需求成長。雖然這些地區普遍存在依賴進口的供應模式,但合資企業的洽談表明,它們正逐漸轉向本地化加工業務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 折疊式和可捲曲顯示器加速無色聚醯亞胺薄膜的採用

- 用於高密度電動車電池組的導熱聚醯亞胺薄膜

- 衛星「新太空」電子設備需要耐輻射聚醯亞胺絕緣體

- 擴展5G基礎設施

- 航太領域向高溫 SiC/GaN 電力電子技術的過渡

- 市場限制

- 低成本替代品的可用性

- 醯亞胺化和溶劑回收生產線的資本投資較高

- 影響聚醯亞胺等級的PFAS逐步淘汰法規

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依產品類型

- 常規(琥珀色)PI薄膜

- 無色PI膜

- 氟塗層PI薄膜

- 導熱/石墨填充PI薄膜

- 雙向拉伸PI薄膜

- 按用途

- 軟性印刷電路板(FPCB)

- 特殊加工產品

- 感壓膠帶

- 電線電纜

- 電動機/發電機

- 按最終用途行業

- 電子產品

- 車

- 航太

- 標籤

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、合資、產能擴張)

- 市佔率分析

- 公司簡介

- 3M

- AGC Inc.

- Arakawa Chemical Industries,Ltd.

- DuPont

- IST Corporation

- KANEKA CORPORATION

- Kolon Industries, Inc.

- Mitsui Chemicals, Inc.

- PI Advanced Materials Co., Ltd.

- Saint-Gobain

- Taimide Tech. Inc.

- TORAY INDUSTRIES, INC.

- UBE Corporation

- Von Roll

- Wuhan Imide New Materials Technology Co.,LTD

- Zhejiang Hecheng Smart Electric Co., Ltd.

第7章 市場機會與未來展望

The global polyimide films market reached USD 1.65 billion in 2025 and is projected to advance to USD 2.18 billion by 2030, reflecting a 5.72% CAGR over 2025-2030.

Miniaturized consumer electronics, electrified transportation, and high-temperature aerospace electronics are the principal engines of demand, while colorless formulations unlock opportunities in foldable displays. Persistent investment in 5G infrastructure and the transition toward SiC/GaN power devices reinforce long-term consumption of high-reliability films. Supply security remains a strategic issue because capacity additions lag the speed at which downstream sectors scale, and PFAS-related regulatory pressures could realign resin chemistry and sourcing patterns.

Global Polyimide Films Market Trends and Insights

Foldable and rollable displays accelerating colorless polyimide film uptake

Demand for transparent substrates that can fold below a 3 mm radius has intensified as smartphone makers commercialize second-generation foldable devices. Colorless substrates deliver more than 85% transmittance at 450 nm and retain mechanical integrity for more than 100,000 folding cycles, allowing original-equipment makers to integrate ultra-thin glass alternatives while achieving lighter hinges. Korean suppliers have introduced star-shaped UV absorbers that inhibit photodegradation and extend outdoor service life in automotive dashboards. Ongoing panel investments across China and South Korea underpin steady offtake, and the pipeline for rollable televisions is widening the application base, ensuring the polyimide films market continues to expand into premium display niches.

Thermally-conductive polyimide films enabling high-density EV battery packs

Vehicle platforms transitioning to 800 V architectures generate higher heat loads, making thin electrical isolators with enhanced in-plane thermal conductivity indispensable. Graphite-laden polyimide laminates now offer thermal conductivities approaching 0.5 W/m*K while sustaining dielectric breakdown strengths above 200 kV/mm, satisfying stringent safety margins. Research into polar-bear-inspired hollow SiO2 constructs achieved 0.041 W/m*K to mitigate cold-climate runaway risk. These advances support aggressive battery-pack densification programs in China, the United States, and Germany, giving the polyimide films market a solid foothold in power-train value chains.

Availability of low-cost substitutes

Amber polyimide commands a price premium that can exceed 2X comparable PEN films. Kaladex PEN delivers a mechanical RTI of 160 °C, adequate for consumer appliances and standard automotive harnesses. In capacitors and mid-range flex circuits, buyers weigh thermal margins against component cost, and PEN's economics increasingly sway procurement. Intensified research and development into higher-temperature polyester variants could peel volume away from the polyimide films market in cost-sensitive regions, particularly Southeast Asia and Latin America, until next-generation displays and power devices lift performance thresholds again.

Other drivers and restraints analyzed in the detailed report include:

- Satellite New-Space electronics requiring radiation-hard polyimide insulators

- Expansion of 5G infrastructure

- PFAS-phase-out regulations affecting polyimide grades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional amber products generated 45% of polyimide films market share in 2024 on the strength of legacy wire insulation and flex circuitry. The segment constitutes the largest slice of polyimide films market size, yet its growth rate stays below the market average as newer chemistries capture attention. Colorless PI Form are on track for a 6.14% CAGR, riding the adoption curve in folding phones, rollable televisions, and transparent touch interfaces. The polyimide films industry witnesses a pipeline of hybrid UV-blocking additives that protect the backbone against solar aging, closing performance gaps that once anchored glass cover-window dominance.

Thermally-conductive grades supply electric-vehicle batteries with planar insulation that distributes localized hotspots, supported by graphite or ceramic micro-fillers for in-plane pathways. Fluorine-coated variants continue to serve niche chemical-processing equipment where acid stability is decisive. Biaxially stretched films, whose molecular alignment delivers dimensional repeatability within 0.1%, remain favored for aerospace sensor flexes. Although they hold a smaller slice of polyimide films market size, their ultra-high margins incentivize capacity additions in Japan and Belgium. Collective innovation across all product types sustains the resilience of the broader polyimide films market.

The Polyimide Film Market Report Segments the Industry by Product Type (Conventional PI Film, Colorless PI Film, and More), Application (Flexible Printed Circuit Boards, Specialty Fabricated Products, and More), End-Use Industry (Electronics, Automotive, Aerospace, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 44% of 2024 revenue for the polyimide films market and is projected to deliver a 6.00% CAGR through 2030. Mainland Chinese panel makers expand flexible OLED capacity during 2025-2026, underpinning regional consumption. Domestic resin suppliers, once confined to amber electrical grades, now target electronic-grade polyimide, narrowing import reliance and improving cost competitiveness. Japan and South Korea maintain a lead in ultra-clean reactors and multi-stage solvent-recovery systems, enabling consistent optical clarity demanded by premium smartphone OEMs. India emerges as a focal point for contract electronics manufacturing, drawing foreign direct investment that enlarges local pull for flexible substrates.

North America holds a prominent share attributable to aerospace, defense, and advanced semiconductor applications. DuPont's USD 220 million expansion in Circleville, Ohio deepens domestic supply of high-end Kapton and Pyralux variants, mitigating geopolitical supply concerns and shortening lead times for Department of Defense programs. Start-ups clustered around Silicon Valley exploit polyimide's compatibility with MEMS sensor arrays and micro-LED backplanes, injecting innovation that broadens the regional application canvas within the polyimide films market.

Europe commands stable industrial demand, structurally underpinned by continental automotive and renewable-energy equipment. Regulatory momentum around PFAS accelerates formulation redesign, prompting local suppliers to invest in green solvent systems and fluorine-free monomers. This adaptive capacity shields the regional polyimide films market from outright contraction while exporting environmental solutions to other jurisdictions adopting similar restrictions. South America and the Middle East and Africa remain smaller end-markets, yet Brazil's budding electronics clusters and Gulf defense satellite programs seed incremental demand. Import-reliant supply models dominate these regions, though joint-venture talks indicate gradual movement toward local converting operations.

- 3M

- AGC Inc.

- Arakawa Chemical Industries,Ltd.

- DuPont

- I.S.T Corporation

- KANEKA CORPORATION

- Kolon Industries, Inc.

- Mitsui Chemicals, Inc.

- PI Advanced Materials Co., Ltd.

- Saint-Gobain

- Taimide Tech. Inc.

- TORAY INDUSTRIES, INC.

- UBE Corporation

- Von Roll

- Wuhan Imide New Materials Technology Co.,LTD

- Zhejiang Hecheng Smart Electric Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Foldable and Rollable Displays Accelerating Colorless PolyImide Film Uptake

- 4.2.2 Thermally-Conductive Poly Imide Films Enabling High-Density EV Battery Packs

- 4.2.3 Satellite "New-Space" Electronics Requiring Radiation-Hard Poly Imide Insulators

- 4.2.4 Expansion of 5G infrastructure

- 4.2.5 Shift to High-Temperature SiC/GaN Power Electronics in Aerospace

- 4.3 Market Restraints

- 4.3.1 Availability of low-cost substitutes

- 4.3.2 High CapEx for Imidisation and Solvent-Recovery Lines

- 4.3.3 PFAS-Phase-out Regulations Affecting Poly Imide Grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Conventional (Amber) PI Film

- 5.1.2 Colorless PI Film

- 5.1.3 Fluorine-Coated PI Film

- 5.1.4 Thermally-Conductive/Graphite-Filled PI Film

- 5.1.5 Biaxially-Stretched PI Film

- 5.2 By Application

- 5.2.1 Flexible Printed Circuit Boards (FPCB)

- 5.2.2 Specialty Fabricated Products

- 5.2.3 Pressure Sensitive Tapes

- 5.2.4 Wire and Cable

- 5.2.5 Motor/Generator

- 5.3 By End-use Industry

- 5.3.1 Electronics

- 5.3.2 Automotive

- 5.3.3 Aerospace

- 5.3.4 Labelling

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Capacity Adds)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arakawa Chemical Industries,Ltd.

- 6.4.4 DuPont

- 6.4.5 I.S.T Corporation

- 6.4.6 KANEKA CORPORATION

- 6.4.7 Kolon Industries, Inc.

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 PI Advanced Materials Co., Ltd.

- 6.4.10 Saint-Gobain

- 6.4.11 Taimide Tech. Inc.

- 6.4.12 TORAY INDUSTRIES, INC.

- 6.4.13 UBE Corporation

- 6.4.14 Von Roll

- 6.4.15 Wuhan Imide New Materials Technology Co.,LTD

- 6.4.16 Zhejiang Hecheng Smart Electric Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Increased Research and Development in aerospace and space tech