|

市場調查報告書

商品編碼

1876556

電子產業聚醯亞胺薄膜市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Polyimide Films for Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

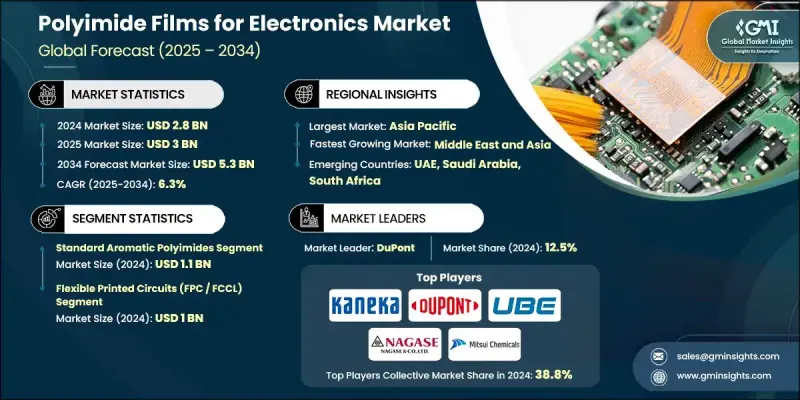

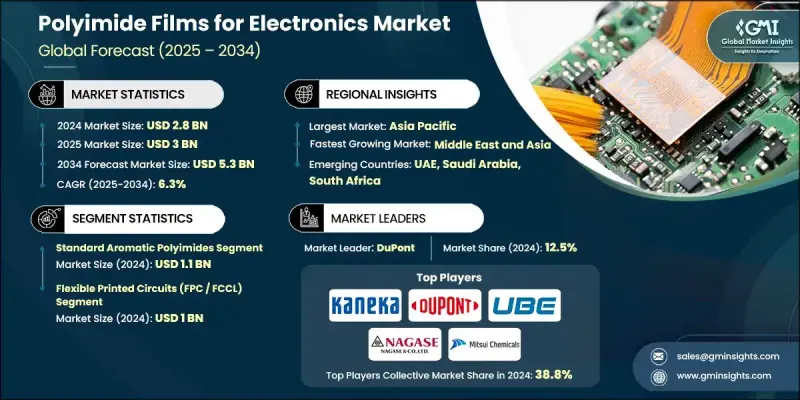

2024 年全球電子聚醯亞胺薄膜市場價值為 28 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長至 53 億美元。

聚醯亞胺薄膜是一種先進的聚合物材料,因其卓越的熱穩定性、耐化學性和機械強度而廣受認可。由於其在極端溫度下仍能保持絕緣性能,這些薄膜在電子行業中已廣泛應用。聚醯亞胺薄膜由二胺和二酐聚合而成,具有優異的柔韌性和尺寸穩定性,使其成為軟性印刷電路、絕緣膠帶和各種顯示組件的理想選擇。受小型化趨勢、軟性穿戴裝置以及5G整合等因素的推動,電子製造技術的不斷進步正在加速對聚醯亞胺薄膜的需求。製造商也在開發新一代聚醯亞胺薄膜,以滿足軟性混合電子產品對高可靠性和高性能的需求。隨著各產業向輕量化、高性能和節能材料轉型,聚醯亞胺薄膜在消費性電子產品、通訊設備和先進電路應用領域的需求持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 6.3% |

2024年,標準芳香族聚醯亞胺市場規模達11億美元。其市場主導地位源自於其在軟性電路、導線絕緣和顯示器基板等各種電子應用領域的廣泛應用。這些材料的可靠性和成本效益使其成為大規模生產的首選。同時,導熱聚醯亞胺的需求也在不斷成長,因為它們能夠有效散熱,應用於高功率電子產品、電動車零件和小型半導體裝置。導電和耐電暈聚醯亞胺在需要更高耐壓性和更優異電性能的特殊應用中越來越受歡迎,尤其是在汽車、工業和航太電子領域。

2024年,軟性印刷電路(FPC/FCCL)市場規模預計將達到10億美元。隨著緊湊型和高密度電子元件的日益普及,該市場將持續成長。聚醯亞胺薄膜具有柔韌性、耐熱性和電絕緣性等獨特優勢,使其成為先進電路設計和現代電子組件中不可或缺的材料。此外,在電動車、自動化技術和工業系統等領域對高溫材料的日益需求推動下,聚醯亞胺薄膜在電線電纜絕緣、馬達和磁線絕緣等其他關鍵應用領域也展現出巨大的發展潛力。

2024年,美國電子聚醯亞胺薄膜市場規模預估為4.018億美元。在北美,由於軟性電子、航太系統、半導體和汽車技術的進步,市場需求持續成長。美國市場受益於高性能、低介電常數和無色聚醯亞胺薄膜的創新。強大的研發投入、主要電子產品製造商的入駐以及對永續材料生產的日益重視,進一步鞏固了該地區作為聚醯亞胺薄膜開發和應用中心的地位。

全球電子聚醯亞胺薄膜市場的主要參與者包括Apical Film Solutions、荒川化學工業株式會社、CAPLINQ Corporation、CS Hyde Company、杜邦公司、Dunmore Corporation、弘毅工程塑膠有限公司、Kaneka Corporation、三井化學株式會社、長瀨班株式會社、高性能工程塑膠有限公司、Qnity Eiblelectics、Rogernity Corporation,x, Roger Inc.、Taimide Tech Inc.、宇部興產株式會社、武漢華星光電、優山科技有限公司和3M公司。電子用聚醯亞胺薄膜市場的領導企業正著力於創新、產品差異化和永續發展,以鞏固其市場地位。許多公司正大力投資研發,以生產具有更優異的電學、熱學和機械性能的高性能聚醯亞胺薄膜。此外,各公司也正在擴大產能,並與電子元件製造商建立合作關係,以開發客製化的薄膜解決方案。該公司的一項關鍵策略重點是環保和可回收材料,以符合全球永續發展目標。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對軟性穿戴電子產品的需求不斷成長

- 5G和高頻電子產品的擴展

- 材料科學的技術進步

- 產業陷阱與挑戰

- 製造和加工工藝複雜度高

- 可回收性和永續性方面的挑戰

- 市場機遇

- 電動車和先進汽車電子產品的擴張

- 先進顯示技術的出現

- 整合到新興半導體封裝技術中

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 標準芳香族聚醯亞胺

- 基於PMDA/ODA的系統

- 導熱聚醯亞胺

- 增強型導熱係數變體

- 導電和電阻薄膜

- 可控制表面電阻率

- 防靜電和電磁干擾屏蔽

- 耐電暈聚醯亞胺

- 高壓交流電

- 電力電子

- 氟化聚醯亞胺

- 低介電常數

- 5G和高頻通訊系統

- 複合增強聚醯亞胺

- 奈米顆粒增強型變異體

- 機械性質增強

- 塗層和金屬化變體

- FEP塗層薄膜

- 鋁和ITO金屬化薄膜

- 特種塗層和表面處理

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 軟性印刷電路(FPC/FCCL)

- 電線電纜絕緣

- 溫度電氣絕緣

- 航太與國防

- 工業電機

- 電動汽車電池系統

- 電池組絕緣和熱管理

- 顯示和觸控面板基板

- OLED和軟性顯示器

- 觸控感應器面板

- 馬達和磁線絕緣

- 高溫電機

- 工業和汽車電機

- 航太航太

- 多層保溫系統

- 衛星和太空船電子設備

- 熱控制與保護系統

- 半導體封裝

- 晶片貼裝與封裝

- 先進包裝技術

- 濕度敏感性和可靠性

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Apical Film Solutions

- Arakawa Chemical Industries Ltd.

- CAPLINQ Corporation

- CS Hyde Company

- DuPont

- Dunmore Corporation

- Hony Engineering Plastics Limited

- Kaneka Corporation

- Mitsui Chemicals Inc.

- NAGASE & Co. Ltd.

- Polyonics Inc.

- Qnity Electronics

- Rogers Corporation

- Saint-Gobain Performance Plastics

- Sheldahl Flexible Technologies Inc.

- SKC Kolon PI Inc.

- Taimide Tech Inc.

- Toyobo Co. Ltd.

- UBE Industries Ltd.

- Wuhan China Star Optoelectronics

- Yousan Technology Co. Ltd.

- 3M Company

The Global Polyimide Films for Electronics Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 5.3 billion by 2034.

Polyimide films are advanced polymer materials widely recognized for their exceptional thermal stability, chemical resistance, and mechanical strength. These films are used extensively in the electronics industry due to their ability to maintain insulation properties under extreme temperatures. Produced through the polymerization of diamines and dianhydrides, polyimide films offer superior flexibility and dimensional stability, making them ideal for use in flexible printed circuits, insulation tapes, and various display components. Continuous progress in electronics manufacturing, driven by miniaturization trends, flexible and wearable devices, and 5G integration, is accelerating demand for these films. Manufacturers are also developing next-generation polyimide films to meet the needs of flexible hybrid electronics, which require high reliability and performance. As industries shift toward lightweight, high-performance, and energy-efficient materials, the demand for polyimide films continues to expand across consumer electronics, communication equipment, and advanced circuitry applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.3% |

The standard aromatic polyimides segment generated USD 1.1 billion in 2024. Their dominance stems from extensive usage across various electronic applications such as flexible circuits, wire insulation, and display substrates. The reliability and cost-effectiveness of these materials make them the preferred choice in mass production. Meanwhile, thermally conductive polyimides are witnessing growing demand due to their ability to efficiently dissipate heat in high-power electronics, electric vehicle components, and compact semiconductor devices. Electrically conductive and corona-resistant polyimides are gaining traction in specialized applications that require enhanced voltage resistance and electrical properties, particularly in automotive, industrial, and aerospace electronics.

The flexible printed circuits (FPC/FCCL) segment was valued at USD 1 billion in 2024. This segment continues to expand with the increasing adoption of compact and high-density electronic components. The unique attributes of polyimide films, such as flexibility, heat endurance, and electrical insulation, make them essential in advanced circuit designs and modern electronic assemblies. Other key applications, including wire and cable insulation and motor and magnet wire insulation, also show strong potential, driven by the transition toward high-temperature materials in electric vehicles, automation technologies, and industrial systems.

U.S. Polyimide Films for Electronics Market was valued at USD 401.8 million in 2024. In North America, demand continues to grow due to advances in flexible electronics, aerospace systems, semiconductors, and automotive technologies. The U.S. market benefits from innovation in high-performance, low-dielectric, and colorless polyimide films. Strong R&D investment, the presence of major electronics manufacturers, and the increasing shift toward sustainable material production further enhance the region's position as a hub for polyimide film development and application.

Key players in the Global Polyimide Films for Electronics Market include Apical Film Solutions, Arakawa Chemical Industries Ltd., CAPLINQ Corporation, CS Hyde Company, DuPont, Dunmore Corporation, Hony Engineering Plastics Limited, Kaneka Corporation, Mitsui Chemicals Inc., NAGASE & Co. Ltd., Polyonics Inc., Qnity Electronics, Rogers Corporation, Saint-Gobain Performance Plastics, Sheldahl Flexible Technologies Inc., SKC Kolon PI Inc., Taimide Tech Inc., UBE Industries Ltd., Wuhan China Star Optoelectronics, Yousan Technology Co. Ltd., and 3M Company. Leading companies in the Polyimide Films for Electronics Market are emphasizing innovation, product differentiation, and sustainability to strengthen their market foothold. Many firms are heavily investing in research and development to produce high-performance polyimide films with enhanced electrical, thermal, and mechanical properties. Companies are also expanding production capacity and forming partnerships with electronic component manufacturers to develop customized film solutions. A key strategic focus is on eco-friendly and recyclable materials, aligning with global sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for flexible and wearable electronics

- 3.2.1.2 Expansion of 5G and high-frequency electronics

- 3.2.1.3 Technological advancements in material science

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and processing complexity

- 3.2.2.2 Challenges in recyclability and sustainability

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric vehicles (EVs) and advanced automotive electronics

- 3.2.3.2 Emergence of advanced display technologies

- 3.2.3.3 Integration into emerging semiconductor packaging technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Million Meters)

- 5.1 Key trends

- 5.2 Standard aromatic polyimides

- 5.2.1 PMDA/ODA-based systems

- 5.3 Thermally conductive polyimides

- 5.3.1 Enhanced thermal conductivity variants

- 5.4 Electrically conductive & resistive films

- 5.4.1 Controlled surface resistivity

- 5.4.2 Anti-static & EMI shielding

- 5.5 Corona-resistant polyimides

- 5.5.1 High-voltage ac

- 5.5.2 Power electronics

- 5.6 Fluorinated polyimides

- 5.6.1 Low dielectric constant

- 5.6.2 5G & high-frequency communication systems

- 5.7 Composite & reinforced polyimides

- 5.7.1 Nanoparticle-enhanced variants

- 5.7.2 Mechanical property enhancement

- 5.8 Coated & metallized variants

- 5.8.1 FEP-coated films

- 5.8.2 Aluminum & ITO metallized films

- 5.8.3 Specialty coatings & surface treatments

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Million Meters)

- 6.1 Flexible printed circuits (FPC / FCCL)

- 6.2 Wire & cable insulation

- 6.2.1 Temperature electrical insulation

- 6.2.2 Aerospace & defense

- 6.2.3 Industrial motor

- 6.3 Electric vehicle battery systems

- 6.3.1 Battery pack insulation & thermal management

- 6.4 Display & touch panel substrates

- 6.4.1 OLED & flexible display

- 6.4.2 Touch sensor panel

- 6.5 Motor & magnet wire insulation

- 6.5.1 High-temperature motor

- 6.5.2 Industrial & automotive motor

- 6.6 Aerospace & space

- 6.6.1 Multilayer insulation systems

- 6.6.2 Satellite & spacecraft electronics

- 6.6.3 Thermal control & protection systems

- 6.7 Semiconductor packaging

- 6.7.1 Die attach & encapsulation

- 6.7.2 Advanced packaging technologies

- 6.7.3 Moisture sensitivity & reliability

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Million Meters)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Apical Film Solutions

- 8.2 Arakawa Chemical Industries Ltd.

- 8.3 CAPLINQ Corporation

- 8.4 CS Hyde Company

- 8.5 DuPont

- 8.6 Dunmore Corporation

- 8.7 Hony Engineering Plastics Limited

- 8.8 Kaneka Corporation

- 8.9 Mitsui Chemicals Inc.

- 8.10 NAGASE & Co. Ltd.

- 8.11 Polyonics Inc.

- 8.12 Qnity Electronics

- 8.13 Rogers Corporation

- 8.14 Saint-Gobain Performance Plastics

- 8.15 Sheldahl Flexible Technologies Inc.

- 8.16 SKC Kolon PI Inc.

- 8.17 Taimide Tech Inc.

- 8.18 Toyobo Co. Ltd.

- 8.19 UBE Industries Ltd.

- 8.20 Wuhan China Star Optoelectronics

- 8.21 Yousan Technology Co. Ltd.

- 8.22 3M Company