|

市場調查報告書

商品編碼

1846315

管道隔熱材料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Pipe Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

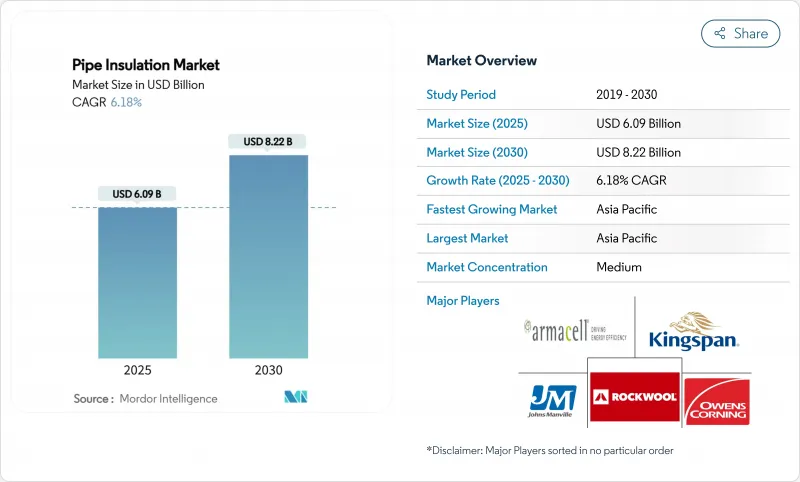

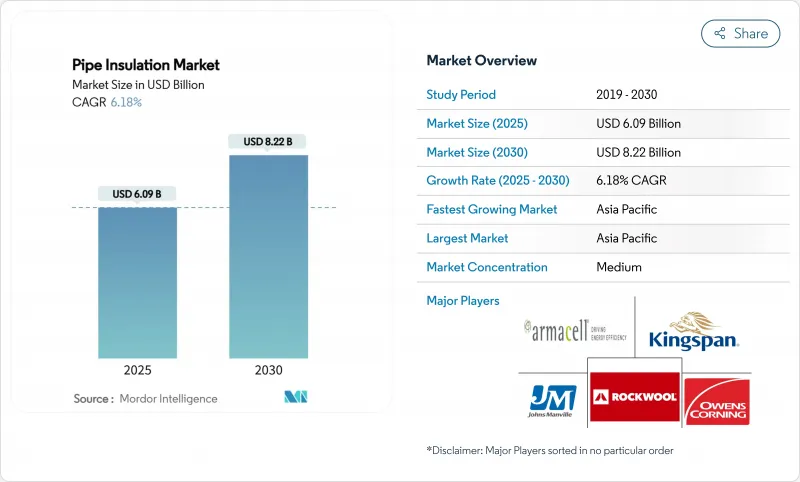

預計到 2025 年,管道隔熱材料市場規模將達到 60.9 億美元,到 2030 年將達到 82.2 億美元,預測期(2025-2030 年)複合年成長率為 6.18%。

受日益嚴格的建築節能法規、行業脫碳要求以及基礎設施升級浪潮的推動,管道隔熱材料市場持續保持強勁成長。北美和歐洲的建築法規要求使用更厚、性能更高的隔熱材料,而亞太地區各國政府則將公共部門融資與可衡量的節能目標掛鉤。液化天然氣出口能力的提升和第四代區域供熱網路的建設,使得管道保溫市場的應用範圍遠遠超出傳統建築。隨著主要企業整合區域競爭對手、投資智慧感測器平台以及授權先進氣凝膠技術,市場競爭日益激烈。儘管短期淨利率受到石化原料價格波動和薄壁塑膠管道普及的擠壓,但擁有多元化材料組合和預製安裝解決方案的製造商,在全球碳中和進程加速推進之際,仍有望抓住市場成長機會。

全球管道隔熱材料市場趨勢與洞察

嚴格的節能建築規範

建築規範正將管道隔熱材料從可選項轉變為強制性要求。 2024 年國際節能規範 (IECC) 規定熱水管道保溫層的最大厚度為 5 英寸,預計這項規定將使美國住宅的能源消耗降低 7.80% 。美國州正在逐步實施 2024 年 IECC,東北能源效率合作組織預測,率先採用該規範的業主可實現 6.80% 的能源消耗降低。商業不動產也正在效仿這些要求,鼓勵業主優先考慮全生命週期的節能效益,而非前期成本。

液化天然氣和低溫管道計劃擴建

美國墨西哥灣沿岸的液化天然氣出口終端需要超過19,800英里的新建或更換管道,其中大部分管道的設計動作溫度為-160 度C 。常壓氣凝膠管中管設計可降低安裝成本,同時將收縮應力控制在可接受的範圍內。隨著亞太地區浮體式天然氣樞紐的運作,對長期海底保溫管道的需求不斷成長,並推高了優質材料的價格。擁有低溫級聚氨酯和泡沫玻璃產品線的製造商正享受更高的利潤,並在多年期大型企劃中率先贏得合約。

安裝成本高,勞力密集

現場噴塗聚氨酯泡沫和多層護套需要合格的工人和專用設備,導致在大都市地區,每線性英尺的施工成本超過 15 美元。雖然維修可以降低 30% 的能源費用,但「更佳建築社區」的數據顯示,每投入 1 美元,第一年僅能節省 0.08 美元,從而延長了屋主的投資回收期。預製管段在一定程度上緩解了技能缺口,但直徑超過 12 英吋的管段運輸受限,阻礙了其廣泛應用。北歐的勞動力短缺問題最為嚴重,老化技工的退休速度超過了學徒進入訓練計畫的速度。生產商已推出卡扣式礦物纖維外殼和自黏氣凝膠包裹層,可減少高達 40% 的現場施工,但推廣速度緩慢。

細分市場分析

玻璃纖維憑藉其低成本和接近0.04 W/(m*K)的導熱係數λ值,在管道隔熱材料領域保持領先地位,預計到2024年將佔據39.65%的市場佔有率。 Rockwool品牌利用其固有的耐火性和循環利用特性,將其2023年的銷售額轉化為預計的818 TWh的終身節能效益。岩絨用於600°C以上的特定煉油廠和發電廠管道,而採用生物基配方的硬質聚氨酯泡棉則可實現低於0.02 W/(m*K)的導熱係數。橡膠發泡體因其在熱循環中具有良好的柔韌性,仍然是暖通空調(HVAC)領域的主要材料。

其他類型的隔熱材料(主要是氣凝膠毯和蜂窩玻璃)將以7.51%的複合年成長率快速成長,直至2030年,因為計劃對超低熱損耗的需求日益成長。新一代Si3N4增強氣凝膠的密度低至0.033克/立方厘米,可承受893攝氏度的溫差。蜂巢玻璃具有零吸水率,設計壽命長達100年,適用於液化天然氣和低溫管道。高昂的資本支出可透過節省維護成本來抵消,這促使專案業主在基於性能的競標中優先選擇優質材料。

區域分析

亞太地區在管道隔熱材料市場佔據主導地位,其龐大的市場規模以及政策支持是其發展的關鍵因素。中國省級政府已將建築許可與檢驗的熱能模型掛鉤,《國家節能三年行動計劃》也將管道保溫列為一級節能措施。印度大力推動可再生能源併網,促使製程工業減少蒸氣管道損耗,推動了對礦物纖維層壓板外殼的需求。亞洲開發銀行的聯合融資機制降低了風險,並確保了待開發區供熱管網計劃的材料供應穩定。

北美將受益於液化天然氣管道的擴建和法規的更新。美國能源部確認了基於2024年國際節能規範(IECC)的7.80%的住宅能源效率目標,這使得各省無需進行冗長的成本效益討論即可推進相關工作。聯邦政府提供的涵蓋30%隔熱材料成本的稅額扣抵進一步縮短了投資回收期。加拿大各省正在利用低利率維修貸款,而亞伯達的行業相關人員則透過改用高效隔熱層來應對原料價格波動,從而緩衝燃料成本。

歐洲的目標是到2042年將巴黎等城市的區域供冷管道數量增加兩倍,同時歐盟也發起了一項翻新浪潮,旨在到2030年維修3500萬棟建築。使用生物黏合劑的負碳隔熱材料正在斯堪地那維亞市場進行試驗,並為專業製造商帶來了早期收益。公共產業正在將隔熱材料合約與熱泵採購捆綁在一起,將與供應商的談判重點轉移到總擁有成本(TCO)指標上。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的節能建築規範

- 液化天然氣和低溫管道計劃擴建

- 區域供熱和製冷投資快速成長

- 內建感測器的智慧隔熱材料

- 碳價格主導的工業維修

- 市場限制

- 安裝成本高,勞力密集

- 石油化工原料價格波動劇烈

- 過渡到薄壁塑膠管道

- 價值鏈分析

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 玻璃纖維

- 岩絨

- 矽酸鹽

- 聚氨酯

- 橡膠發泡體

- 其他類型(氣凝膠毯、蜂巢玻璃等)

- 按最終用戶行業分類

- 建築/施工

- 石油和天然氣

- 運輸

- 一般工業

- 其他終端用戶產業(發電和公共產業、化學和石化加工等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Armacell

- Aspen Aerogels, Inc.

- BASF

- Beijing Coowor Network Technology Co., Ltd.

- Cellofoam North America Inc.

- Covestro AG

- Frost King Weatherization Products/Thermwell Products Co., Inc.

- Huamei Energy-saving Technology Group Co., Ltd.

- Huntsman International LLC

- Isoclima SpA

- Johns Manville

- Kingspan Group

- Knauf Insulation, Inc.

- L'Isolante K-Flex SpA

- NMC sa

- ODE YalItIm AS

- Owens Corning

- Polyguard

- Rockwool International

- Saint-Gobain

- Thermaflex

- Zotefoams plc.

第7章 市場機會與未來展望

The Pipe Insulation Market size is estimated at USD 6.09 billion in 2025, and is expected to reach USD 8.22 billion by 2030, at a CAGR of 6.18% during the forecast period (2025-2030).

Tighter building-energy codes, industrial decarbonization mandates, and a wave of infrastructure upgrades keep the pipe insulation market on a firm growth footing. North American and European building regulations demand thicker, higher-performance insulation, while Asia-Pacific governments link public-sector lending to demonstrable energy-savings targets. LNG export capacity additions and fourth-generation district heating networks extend the addressable opportunity well beyond conventional buildings. Competitive intensity has risen as large incumbents consolidate regional players, invest in smart-sensor platforms, and license advanced aerogel technologies. Although price volatility for petrochemical feedstocks and the spread of thin-wall plastic piping temper short-term margins, manufacturers with diversified materials portfolios and prefabricated installation solutions remain positioned to capture upside as global carbon-neutrality timetables accelerate.

Global Pipe Insulation Market Trends and Insights

Stringent Energy-Efficiency Building Codes

Building codes are turning pipe insulation from a discretionary line item into a legal requirement. The 2024 International Energy Conservation Code (IECC) mandates thicknesses of up to 5 inches for hot-water pipelines, a rule expected to cut residential site-energy use by 7.80% in the United States. California's Title 24 and similar European directives specify minimum R-values, effectively sidelining low-performance wraps. With 14 U.S. states already on the 2024 IECC path, Northeast Energy Efficiency Partnerships forecasts 6.80% source-energy savings for early adopters. Commercial facilities mirror these requirements, pushing owners to favor lifecycle energy savings over upfront costs-another lever that expands the pipe insulation market.

Expansion of LNG and Cryogenic Pipeline Projects

Liquefied-natural-gas export terminals along the U.S. Gulf Coast require more than 19,800 miles of new or replacement piping, much of it designed for -160 °C operating temperatures. Ambient-pressure aerogel pipe-in-pipe designs cut installation costs while keeping contraction stresses within allowable limits. As Asia-Pacific commissions floating LNG hubs, demand for long-run subsea insulation miles pushes premium material pricing. Manufacturers with cryogenic-grade polyurethane or cellular glass lines enjoy margin upside and early-mover contracts on multi-year megaprojects.

High Installed Cost and Labour Intensity

Field application of spray polyurethane foam and multi-layer jacketing requires certified crews and specialized rigs, pushing installation charges above USD 15/linear foot in large metro markets. Although energy bills can drop 30% post-retrofit, Better Buildings Neighborhood data show that every USD 1 invested yields only USD 0.08 in first-year savings, stretching homeowner payback horizons. Prefabricated pipe spools partially solve the skills gap, yet transport limits hamper uptake for diameters above 12 inches. Labor scarcity is most acute in Northern Europe, where aging tradespeople retire faster than apprentices enter vocational programs. Producers respond with snap-fit mineral-fiber shells and self-adhesive aerogel wraps that cut site labor by up to 40%, but widespread adoption lags.

Other drivers and restraints analyzed in the detailed report include:

- Surging District Heating and Cooling Investments

- Smart Insulation with Embedded Sensors

- Volatile Petrochemical Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiberglass maintained the leading 39.65% pipe insulation market share in 2024, underpinned by low cost and a λ-value near 0.04 W/(m*K). Rockwool leverages inherent fire resistance and circularity claims; the brand's 2023 sales translated to anticipated lifetime energy savings of 818 TWh. Silicate wraps own niche refinery and power-plant lines above 600 °C, while rigid polyurethane foams post sub-0.02 W/(m*K) conductivities in bio-based formulations. Rubber foams remain HVAC staples because they flex with thermal cycling.

Other Types-primarily aerogel blankets and cellular glass-grow fastest at 7.51% CAGR through 2030 as mega-projects demand ultra-low heat loss. Next-gen Si3N4-reinforced aerogels come in at densities as low as 0.033 g/cm3 withstanding 893 °C differentials. Cellular glass appeals to LNG and cryogenic pipelines for zero water absorption and 100-year design life. Higher capex is offset by maintenance savings, leading process owners to specify performance-based tenders that favor premium materials.

The Pipe Insulation Market Report is Segmented by Type (Fiberglass, Rockwool, Silicates, Polyurethane, Rubber Foams, Other Types), End-User Industry (Buildings and Construction, Oil and Gas, Transportation, General Industrial, Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the pipe insulation market, pairing volume scale with policy support. Chinese provincial authorities now tie building permits to verified thermal-energy models, and the national Three-Year Action Plan for energy conservation identifies pipework insulation as a Tier-1 measure. India's renewable-integration drive requires process industries to cut steam line losses, sending demand toward laminated mineral-fiber shells. The Asian Development Bank's blended-financing tools de-risk greenfield heat-network projects, assuring steady material off-take.

North America benefits from LNG pipeline rollouts and code updates. The U.S. DOE's confirmation of 7.80% residential energy savings from the 2024 IECC emboldens states to adopt without lengthy cost-effectiveness debates. Federal tax credits covering 30% of insulation spend further shorten paybacks. Canadian provinces tap low-interest retrofit loans, while industrial players in Alberta hedge feedstock volatility by switching to higher-efficiency jacketing to buffer fuel bills.

Europe's ambition is to treble district cooling pipes by 2042 in cities like Paris, intertwining with the EU Renovation Wave that targets 35 million building upgrades by 2030. Scandinavian markets trial carbon-negative insulation made with biogenic binders, providing early revenue for specialty manufacturers. Utilities bundle insulation contracts with heat-pump procurement, shifting supplier negotiations toward total-cost-of-ownership metrics.

- Armacell

- Aspen Aerogels, Inc.

- BASF

- Beijing Coowor Network Technology Co., Ltd.

- Cellofoam North America Inc.

- Covestro AG

- Frost King Weatherization Products / Thermwell Products Co., Inc.

- Huamei Energy-saving Technology Group Co., Ltd.

- Huntsman International LLC

- Isoclima S.p.A.

- Johns Manville

- Kingspan Group

- Knauf Insulation, Inc.

- L'Isolante K-Flex S.p.A.

- NMC sa

- ODE YalItIm A.S.

- Owens Corning

- Polyguard

- Rockwool International

- Saint-Gobain

- Thermaflex

- Zotefoams plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Energy-Efficiency Building Codes

- 4.2.2 Expansion of LNG and Cryogenic Pipeline Projects

- 4.2.3 Surging District Heating and Cooling Investments

- 4.2.4 Smart Insulation with Embedded Sensors

- 4.2.5 Carbon-Pricing Led Industrial Retrofits

- 4.3 Market Restraints

- 4.3.1 High Installed Cost and Labour Intensity

- 4.3.2 Volatile Petrochemical Feedstock Prices

- 4.3.3 Shift to Thin-Wall Plastic Piping Alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Fiberglass

- 5.1.2 Rockwool

- 5.1.3 Silicates

- 5.1.4 Polyurethane

- 5.1.5 Rubber Foams

- 5.1.6 Other Types (Aerogel Blankets,Cellular Glass, etc.)

- 5.2 By End-User Industry

- 5.2.1 Buildings and Construction

- 5.2.2 Oil and Gas

- 5.2.3 Transportation

- 5.2.4 General Industrial

- 5.2.5 Other End-user Industries (Power Generation and Utilities, Chemical and Petrochemical Processing, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Armacell

- 6.4.2 Aspen Aerogels, Inc.

- 6.4.3 BASF

- 6.4.4 Beijing Coowor Network Technology Co., Ltd.

- 6.4.5 Cellofoam North America Inc.

- 6.4.6 Covestro AG

- 6.4.7 Frost King Weatherization Products / Thermwell Products Co., Inc.

- 6.4.8 Huamei Energy-saving Technology Group Co., Ltd.

- 6.4.9 Huntsman International LLC

- 6.4.10 Isoclima S.p.A.

- 6.4.11 Johns Manville

- 6.4.12 Kingspan Group

- 6.4.13 Knauf Insulation, Inc.

- 6.4.14 L'Isolante K-Flex S.p.A.

- 6.4.15 NMC sa

- 6.4.16 ODE YalItIm A.S.

- 6.4.17 Owens Corning

- 6.4.18 Polyguard

- 6.4.19 Rockwool International

- 6.4.20 Saint-Gobain

- 6.4.21 Thermaflex

- 6.4.22 Zotefoams plc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment