|

市場調查報告書

商品編碼

1846266

抗菌包裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Antimicrobial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

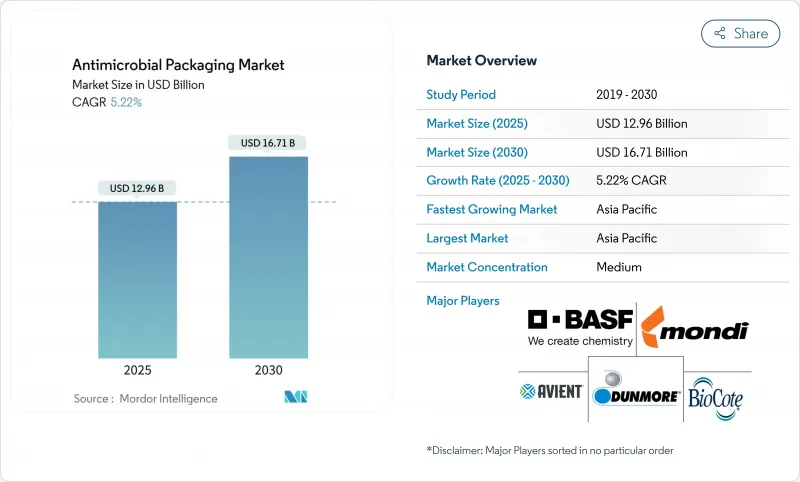

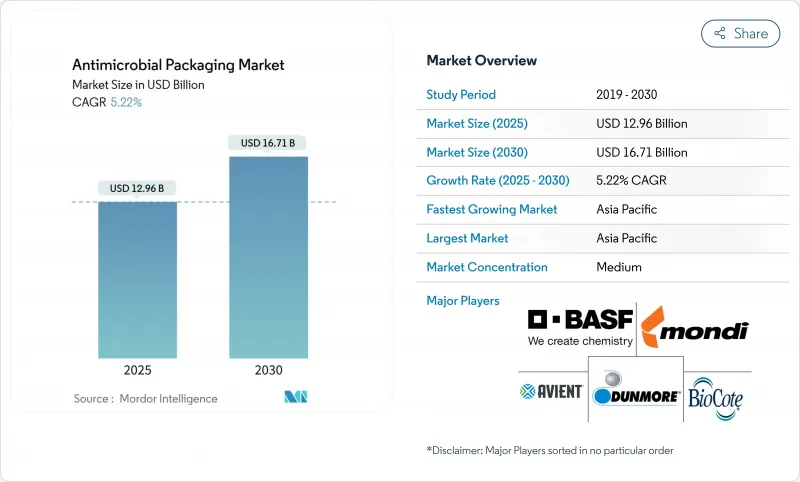

根據目前的數據,抗菌包裝市場預計在2025年價值為129.6億美元,到2030年將達到167.1億美元,複合年成長率為5.22%。

更嚴格的食品接觸法規、PFAS物質的逐步淘汰以及企業永續性將抗菌功能提升到主流包裝要求,這些因素推動了需求成長。監管勢頭促使人們轉向生物基抗菌劑,以平衡微生物功效與環保要求。在不斷完善的衛生法規、蓬勃發展的電子雜貨行業以及快速升級的低溫運輸的推動下,亞太地區繼續成為成長的支點。控制釋放奈米銀薄膜、天然化合物的整合以及與智慧感測器的組合等平行技術進步正在改變競爭創新的重點。因此,抗菌包裝市場在材料、技術和最終用途領域持續呈現多元化發展。

全球抗菌包裝市場趨勢與洞察

後疫情時代食品安全監理趨嚴

全球食品接觸監測的重啟正在推動抗菌解決方案的推廣。美國人類食品計劃署目前正在重新評估其遺留的PFAS通知,並探索更安全的替代抗菌劑。歐洲機構也同時發布了關於李斯特菌等持久性病原體的警告,鼓勵加工者採用增加微生物屏障的包裝。這些規定正在刺激對符合安全性和「潔淨標示」要求的天然抗菌劑的投資。對於能夠證明其功效和可回收性的供應商來說,加強監管將為抗菌包裝市場帶來明顯的成長潛力。

加速對電子雜貨低溫運輸的投資

線上食品雜貨需求的激增給溫控物流帶來了前所未有的壓力。亞太地區數千個微型倉配倉庫需要能夠在漫長的最後一哩運輸過程中保持品質的包裝。當冷藏性能下降時,抗菌層可作為關鍵的二次保障,減少腐敗索賠。新型智慧包裝融合了時間-溫度指示器和抗菌劑,使平台能夠根據數據管理新鮮度。隨著當日送達時限的縮短,零售商擴大將抗菌功能作為採購的先決條件,尤其是對於高風險生鮮食品。這種電子商務動能正在鞏固抗菌包裝市場的短期成長。

歐盟除生物劑法規(BPR)對奈米金屬構成障礙

歐洲除生物劑產品法規要求,奈米銀和奈米銅進入食品接觸管道前必須提供大量文件。目前尚無任何奈米金屬獲準直接用於食品或飼料,這使得創新者面臨多年的毒理學研究計畫。大量的數據要求延長了產品上市時間,促使一些公司轉向能夠更快通過監管批准的植物來源活性成分。這種阻礙因素正在限制抗菌包裝市場金屬解決方案的短期成長。

細分分析

目前,塑膠在抗菌包裝市場佔據主導地位,得益於可擴展的擠出生產線和強大的阻隔性能,到2024年將佔據60.32%的收入佔有率。然而,受2030年強制全面回收的政策目標推動,生物聚合物的複合年成長率將達到8.32%,成為所有材料中最快的。聚乳酸和聚羥基烷酯的混合物,透過幾丁聚醣或精油增強,其微生物殺滅率現已與石化薄膜相當,同時支持可堆肥的報廢處理方式。

封閉式收集方案的投資正在加速,旨在回收生物聚合物邊角料,同時不犧牲抗菌活性。研究還表明,塗有富含酚的多醣的紙纖維保持了可回收性,並具有廣譜抗菌活性。這種先進的包裝將使生物聚合物繼續蠶食塑膠的市場佔有率,並重塑抗菌包裝市場的供應商組合。

由於監管合規性和成本效益,有機酸將在2024年佔銷售額的45.63%。然而,細菌素和酵素的複合年成長率將達到7.53%,這反映出人們正轉向消費者可識別且標籤友好的添加劑。細菌素與奈米銀的協同體係可使消毒劑功效加倍,同時減少金屬用量。

環糊精鍵結保護的精油可透過控制蒸氣釋放來抑制潮濕農產品中的腐敗菌。隨著除生物劑受到越來越嚴格的審查,植物來源的殺菌劑正日益受到策略重視,天然活性劑已成為未來抗菌包裝市場差異化的關鍵。

抗菌包裝市場按材料(塑膠、生物聚合物等)、抗菌劑類型(有機酸、細菌素和酵素等)、技術(活性表面塗層等)、包裝類型(袋和包、薄膜和包裝紙等)、終端用戶行業(食品飲料、醫療保健和醫療設備等)和地區細分。市場預測以美元計算。

區域分析

2024年,亞太地區將以41.22%的營收引領全球市場,至2030年,複合年成長率最高,達8.96%。中國修訂的《食品安全法》和印度食品安全監督管理局(FSSAI)的衛生法規均要求採取微生物安全措施,這推動資本轉向先進包裝。日本加工商正在為高階水產品出口添加智慧指示器和控制釋放抗菌劑,以提高單位利潤率。地方政府為因應抗菌素抗藥性所舉措將進一步影響亞太地區抗菌包裝市場。

歐盟包裝廢棄物法規強制要求遵守可回收性和再生成分標準,歐洲正在塑造其發展軌跡。德國和法國在生物基界面活性劑的研發方面處於領先地位,地中海出口商正在引入抗菌紙盒,以確保農產品跨境運輸時的保存期限。雖然生物基廢棄物法規減緩了奈米金屬的推廣,但它加速了植物來源創新,使歐洲處於技術領導的中心。

在FDA監管和強勁的醫療保健需求的支持下,北美市場保持穩定成長。美國正在向PFAS替代品提供津貼,間接擴大了天然界面活性劑抗菌包裝的市場規模。一家加拿大研究機構正在試驗注入酵素混合物的纖維素基薄膜,目標是水產品供應鏈。墨西哥正利用近岸外包趨勢,擴大為國內品牌和美國零售商生產的抗菌包裝袋。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 後疫情時代食品安全監理趨嚴

- 加速對電子雜貨低溫運輸的投資

- 控制釋放奈米銀薄膜的突破

- 將抗菌功能納入 ESG 記分卡

- 醫院開始使用可重複使用的醫療設備托盤

- 生鮮食品出口採用可食用抗菌塗層

- 市場限制

- 歐盟除生物劑法規(BPR)對奈米金屬的阻礙

- 銀和銅原料價格波動

- 消費者對合成包裝防腐劑的強烈反對

- 生物基抗菌聚合物的擴大挑戰

- 供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按材質

- 塑膠

- 生物聚合物

- 紙和紙板

- 玻璃

- 金屬

- 按抗菌劑類型

- 有機酸

- 細菌素和酶

- 銀和銅奈米顆粒

- 精油和植物萃取物

- 依技術

- 活性表面塗層

- 控制釋放系統

- 按包裝類型

- 袋子和包包

- 薄膜和包裝

- 托盤和蓋子

- 紙箱包裝

- 按最終用戶產業

- 飲食

- 肉類、家禽、魚貝類

- 烘焙和糖果甜點

- 水果和蔬菜

- 醫療保健和醫療設備

- 個人護理和化妝品

- 飼料和寵物食品

- 其他最終用戶產業

- 飲食

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措和發展

- 市佔率分析

- 公司簡介

- Amcor Plc

- Mondi Group

- Sealed Air Corporation

- BASF SE

- Avient Corporation

- BioCote Limited

- Sciessent LLC

- Microban International

- Covestro AG

- Takex Labo Co., Ltd.

- Dunmore Corporation

- Sonoco Products Company

- Constantia Flexibles

- Toppan Printing Co., Ltd.

- Toyochem Co., Ltd.

- Nissen Chemitec Corporation

- Parx Materials NV

- Tekni-Plex Inc.

- Plastipak Holdings Inc.

第7章 市場機會與未來展望

Current data indicate the antimicrobial packaging market is valued at USD 12.96 billion in 2025 and is forecast to reach USD 16.71 billion by 2030, expanding at a 5.22% CAGR.

Demand is propelled by stricter food-contact regulations, the phase-out of PFAS substances, and corporate sustainability mandates that elevate antimicrobial functionality to a mainstream packaging requirement. Regulatory momentum has sparked a pivot toward bio-based antimicrobial agents that balance microbial efficacy with environmental credentials. Asia-Pacific remains the fulcrum of growth, driven by evolving sanitation laws, a booming e-grocery sector, and rapid cold-chain upgrades. Parallel advances in controlled-release nano-silver films, natural compound integration, and smart-sensor pairing are reshaping competitive innovation priorities. As a result, the antimicrobial packaging market continues to diversify across materials, technologies, and end-use sectors.

Global Antimicrobial Packaging Market Trends and Insights

Stringent Post-COVID Food-Safety Regulations

The global reset of food-contact oversight is amplifying uptake of antimicrobial solutions. The United States Human Foods Program now reassesses legacy PFAS notifications, creating an opening for safer antimicrobial alternatives. European agencies simultaneously flag persistent pathogens such as Listeria monocytogenes, compelling processors to adopt packaging that adds an extra microbial barrier. These converging mandates accelerate investment in naturally-derived agents that fulfil both safety and "clean-label" expectations. For suppliers able to document efficacy and recyclability, regulatory tightening translates into clear growth runway within the antimicrobial packaging market.

Acceleration of E-Grocery Cold-Chain Investments

Explosive demand for online groceries places unprecedented stress on temperature-controlled logistics. In Asia-Pacific, thousands of micro-fulfilment warehouses now require packaging that maintains quality over extended last-mile journeys. When refrigeration falters, antimicrobial layers serve as a critical secondary safeguard, reducing spoilage claims. Emerging smart packs pair time-temperature indicators with embedded antimicrobials, giving platforms data-driven control over freshness. As same-day delivery windows shrink, retailers increasingly make antimicrobial functionality a procurement prerequisite, particularly for high-risk perishables. This e-commerce momentum solidifies near-term gains for the antimicrobial packaging market.

EU Biocide Regulation (BPR) Hurdles for Nano-Metals

Europe's Biocidal Products Regulation requires exhaustive dossiers before nano-silver or nano-copper can enter food-contact channels. With no nano-metal yet authorised for direct food or feed applications, innovators face multi-year toxicology programs. Wide-ranging data demands inflate time-to-market, prompting some firms to pivot toward plant-based actives that clear regulatory pathways more swiftly. The deterrent effect narrows near-term growth for metallic solutions inside the antimicrobial packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Breakthroughs in Controlled-Release Nano-Silver Films

- Inclusion of Antimicrobial Features in ESG Scorecards

- Price Volatility in Silver and Copper Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics currently anchor the antimicrobial packaging market size, capturing 60.32% revenue share in 2024 due to scalable extrusion lines and robust barrier performance. Yet policy targets that mandate full recyclability by 2030 propel biopolymers to an 8.32% CAGR, the fastest among materials. Poly-lactic acid and polyhydroxyalkanoate blends enhanced with chitosan or essential oils now match microbial kill rates seen in petrochemical films while supporting compostable end-of-life routes.

Investment is accelerating in closed-loop collection schemes that recover biopolymer offcuts without sacrificing antimicrobial potency. Research also evidences that paper fibres coated with phenolic-rich polysaccharides retain recyclability and deliver broad-spectrum bacterial inhibition. These advances ensure biopolymers will continue eroding plastic share, reshaping supplier portfolios throughout the antimicrobial packaging market.

Organic acids command 45.63% of 2024 revenue owing to regulatory familiarity and cost efficiency. However, bacteriocins and enzymes accelerate at 7.53% CAGR, mirroring consumer migration to recognizable, label-friendly additives. Synergistic systems marry bacteriocins with nano-silver, doubling kill efficiency while curbing metal dosage.

Essential oils protected within cyclodextrin cages provide controlled vapor release that suppresses spoilage organisms in high-moisture produce. As biocide scrutiny intensifies, plant-derived agents gain strategic heft, positioning natural actives as pivotal to future differentiation in the antimicrobial packaging market.

Antimicrobial Packaging Market is Segmented by Material (Plastics, Biopolymers, and More), Antimicrobial Agent Type (Organic Acids, Bacteriocins and Enzymes, and More), Technology (Active Surface Coating, and More), Pack Type (Pouches and Bags, Films and Wraps, and More), End-User Industry (Food and Beverages, Healthcare and Medical Devices, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific tops the global leaderboard, holding 41.22% revenue in 2024 and registering the highest 8.96% CAGR to 2030. China's Food Safety Law amendments and India's FSSAI hygiene codes mandate microbiological safeguards that funnel capital toward advanced packs. Japanese converters add smart indicators and controlled-release antimicrobials to premium seafood exports, elevating unit margins. Regional government initiatives to counter antimicrobial resistance further incentivise adoption, reinforcing Asia-Pacific's pull on the antimicrobial packaging market.

Europe follows, its trajectory shaped by the EU Packaging and Packaging Waste Regulation that forces recyclability and recycled-content compliance. Germany and France spearhead R&D into bio-based actives, whereas Mediterranean exporters deploy antimicrobial cartons to secure shelf life during cross-border produce shipments. While the BPR slows nano-metal roll-outs, it simultaneously accelerates botanical innovation, keeping Europe central to technology leadership.

North America sustains steady gains anchored by FDA oversight and robust healthcare demand. The United States channels grant funding toward PFAS alternatives, indirectly uplifting antimicrobial packaging market size for natural actives. Canadian institutes pilot cellulose-based films infused with enzyme cocktails, targeting seafood supply chains. Mexico, leveraging near-shoring trends, scales antimicrobial pouch production for both domestic brands and US retailers.

- Amcor Plc

- Mondi Group

- Sealed Air Corporation

- BASF SE

- Avient Corporation

- BioCote Limited

- Sciessent LLC

- Microban International

- Covestro AG

- Takex Labo Co., Ltd.

- Dunmore Corporation

- Sonoco Products Company

- Constantia Flexibles

- Toppan Printing Co., Ltd.

- Toyochem Co., Ltd.

- Nissen Chemitec Corporation

- Parx Materials N.V.

- Tekni-Plex Inc.

- Plastipak Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent post-COVID food-safety regulations

- 4.2.2 Acceleration of e-grocery cold-chain investments

- 4.2.3 Breakthroughs in controlled-release nano-silver films

- 4.2.4 Inclusion of antimicrobial features in ESG scorecards

- 4.2.5 Shift to reusable medical-device trays in hospitals

- 4.2.6 Adoption of edible, antimicrobial coatings for fresh-produce export

- 4.3 Market Restraints

- 4.3.1 EU biocide regulation (BPR) hurdles for nano-metals

- 4.3.2 Price volatility in silver and copper feedstocks

- 4.3.3 Consumer push-back on synthetic preservatives in packaging

- 4.3.4 Scale-up challenges for bio-based antimicrobial polymers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Biopolymers

- 5.1.3 Paper and Paperboard

- 5.1.4 Glass

- 5.1.5 Metals

- 5.2 By Antimicrobial Agent Type

- 5.2.1 Organic Acids

- 5.2.2 Bacteriocins and Enzymes

- 5.2.3 Silver and Copper Nanoparticles

- 5.2.4 Essential Oils and Plant Extracts

- 5.3 By Technology

- 5.3.1 Active Surface Coating

- 5.3.2 Controlled-Release Systems

- 5.4 By Pack Type

- 5.4.1 Pouches and Bags

- 5.4.2 Films and Wraps

- 5.4.3 Trays and Lids

- 5.4.4 Carton Packages

- 5.5 By End-user Industry

- 5.5.1 Food and Beverages

- 5.5.1.1 Meat, Poultry and Seafood

- 5.5.1.2 Bakery and Confectionery

- 5.5.1.3 Fruits and Vegetables

- 5.5.2 Healthcare and Medical Devices

- 5.5.3 Personal Care and Cosmetics

- 5.5.4 Animal Feed and Pet Food

- 5.5.5 Other End-User Industry

- 5.5.1 Food and Beverages

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor Plc

- 6.4.2 Mondi Group

- 6.4.3 Sealed Air Corporation

- 6.4.4 BASF SE

- 6.4.5 Avient Corporation

- 6.4.6 BioCote Limited

- 6.4.7 Sciessent LLC

- 6.4.8 Microban International

- 6.4.9 Covestro AG

- 6.4.10 Takex Labo Co., Ltd.

- 6.4.11 Dunmore Corporation

- 6.4.12 Sonoco Products Company

- 6.4.13 Constantia Flexibles

- 6.4.14 Toppan Printing Co., Ltd.

- 6.4.15 Toyochem Co., Ltd.

- 6.4.16 Nissen Chemitec Corporation

- 6.4.17 Parx Materials N.V.

- 6.4.18 Tekni-Plex Inc.

- 6.4.19 Plastipak Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment