|

市場調查報告書

商品編碼

1844539

無菌包裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Sterilized Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

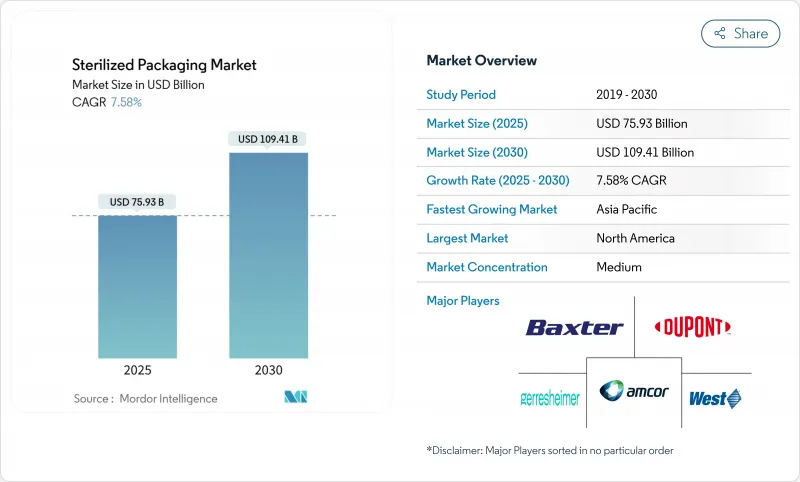

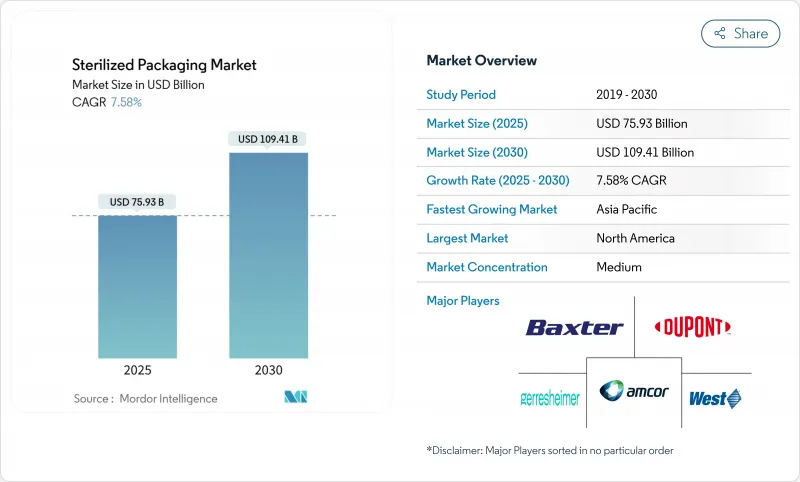

預計2025年滅菌包裝市場規模將達759.3億美元,2030年將達1,094.1億美元,複合年成長率為7.58%。

全球法規日益嚴格、生技藥品生產規模不斷擴大以及控制醫院內感染的壓力日益增大,這些因素共同推動了醫療用品的需求。醫院系統正在轉向一次性包裝,製藥商正在指定更高阻隔性的包裝,設備製造商則正在引入線上檢測以降低召回風險。美國) 新的環氧乙烷 (EtO)排放法規已促使資本轉向輻射和氣相替代品,材料供應商也在迅速升級Tyvek和不織布,以滿足下一波歐盟 PFAS 法規的要求。隨著全球企業尋求合規和自動化所需的規模,整合正在加劇。

全球無菌包裝市場趨勢與洞察

醫院內感染增加

每天,每31名美國住院患者中就有1人會感染醫療相關感染疾病,每年造成284億美元的損失。醫院強制要求關鍵器械使用阻隔性托盤和滅菌包裝,許多醫療機構正在從可重複使用的器械包過渡到一次性使用,以減少責任。由於抗生素抗藥性的存在,傳統清潔方法已無法滿足需求,一次性無菌包裝市場的需求正在成長。包裝加工商報告稱,透氣Tyvek蓋的訂單增加,這種蓋可承受多次環氧乙烷(ETO)循環,同時保持10-6的無菌保證水準。

生技藥品和注射劑的成長

到2030年,全球生技藥品銷售額可望達到8,560億美元,而注射劑型的需求需要不會排放顆粒的超潔淨容器。預填充式注射器的蓬勃發展迫使供應商認證更嚴格的容器密封測試,而細胞療法製造商則要求包裝在-196°C的低溫下仍能保持完整性。肖特製藥公司美國3.71億美元的注射器工廠正是針對這些治療方法而建,這表明其區域產能擴張與更嚴格的附件1法規相一致。

醫用級聚合物價格波動

醫用級樹脂需要專用添加劑和耗時的驗證,這限制了供應商的替代。地緣政治動盪和煉油廠停產推高了價格,使原本就面臨高成本環氧乙烷減量計劃的加工商更加捉襟見肘。在多個地區簽訂供應協議並擁有內部回收能力的公司可以獲得更多利潤。

細分分析

托盤和熱成型包裝能夠容納複雜的器械組,並允許即時目視檢查,在2024年佔據了無菌包裝市場26.71%的佔有率。醫院青睞透明蓋子,因為它可以加快計數/清點程序,並減少手術室的延誤。客製化的腔體可以限制產品移動,降低運輸過程中被刺破的風險。泡殼和安瓿將成為成長最快的產品類別,到2030年,複合年成長率將達到9.41%,這主要得益於單位劑量生技藥品,因為高價值劑量的藥物可能會因污染而損失。

泡殼包裝內先進阻隔膜的推廣標誌著優質化。安裝在熱成型生產線上的人工智慧攝影機可以全速檢查密封完整性,從而提高批次產量比率和文件記錄品質。對於某些劑型和可重複使用的設備而言,袋裝、瓶裝、輸液容器和泡殼仍然具有重要意義,但隨著單劑量包裝的普及,其成長正在放緩。記錄溫度和輻射暴露的智慧標籤正從試點階段走向大規模應用,反映出更廣泛的數位化。

塑膠在強度、透明度和成本方面取得了良好的平衡,到2024年仍將佔據滅菌包裝市場規模的62.24%。聚乙烯、聚丙烯和環烯烴共聚物具有耐環氧乙烷(ETO)、伽馬射線和電子束的特性,但日益嚴格的永續性法規和原生樹脂價格上漲正在推動其替代材料的發展。預計到2030年,不織布和Tyvek基材的複合年成長率將達到9.54%,因為它們的透氣性和纖維強度使其能夠與低殘留滅菌劑搭配使用。

當必須盡量減少藥物與產品之間的相互作用時,管瓶至關重要,尤其是對於低溫運輸較長的生技藥品。金屬托盤佔據較小的市場,例如需要牢固固定和屏蔽運輸的整形外科植入套件。雖然紙板在優先考慮生物分解性的二級紙盒中的應用正在增加,但一級滅菌仍然依賴高阻隔性。隨著全氟辛烷磺酸 (PFAS) 的有效期臨近,供應商擴大使用等離子塗層和氧化矽塗層來取代含氟聚合物。

區域分析

由於FDA的監管和高複雜藥物上市率,北美將在2024年佔據無菌包裝市場的33.19%。龐大的合約滅菌網路和主要的樹脂製造商保障了供應安全,而投資則集中在環氧乙烷(EtO)減排和新型電子束滅菌室。預計到2024年,Becton Dickinson的生物製藥部門的銷售額將超過10億美元,凸顯了該地區對高價值設備的偏好。

歐洲緊追在後,由於附件1的升級和早期採用不含PFAS的材料,其需求也趨於成熟。德國和愛爾蘭擁有眾多填充工廠,為全球生技藥品供應鏈提供產品。歐盟2026年氟聚合物法規正在推動替代塗料的快速認證,使歐洲加工商成為先驅。永續性目標也推動了可重複使用二次包裝的循環經濟試點。

隨著中國和印度擴大生物製藥和小分子產品的生產以滿足國內和出口市場的需求,到2030年,亞太地區將錄得最快的複合年成長率,達到9.24%。區域監管機構將與ICH指南保持一致,推動對更高級別潔淨室和輻射能力的投資。日本人口老化將推動居家醫療注射器的需求,而韓國和澳洲將成為智慧標籤低溫運輸包裝的試驗田。無菌包裝市場的在地化生產能力將縮短前置作業時間並降低外匯風險。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 市場定義與研究假設

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 醫院內感染增加

- 生技藥品和注射劑的成長

- 全球嚴格的滅菌規定

- 擴大門診病人和居家醫療環境

- 使用人工智慧進行線上無菌包裝檢測

- 細胞和基因治療的低溫運輸需求

- 市場限制

- 醫用級聚合物價格波動

- 環氧乙烷(EtO)排放合規成本

- 醫藥級伽瑪射線輻照能力的局限性

- 氟聚合物阻隔膜中 PFAS 的審查

- 價值/供應鏈分析

- 關鍵法規結構的評估

- 關鍵相關人員影響評估

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素的影響

第5章市場規模及成長預測

- 按產品

- 泡殼

- 小袋

- 瓶子

- 泡殼和安瓿

- 管瓶

- 托盤和熱成型包裝

- 輸液容器和輸液袋

- 其他

- 按材質

- 塑膠(HDPE、PP、PET、PVC等)

- 玻璃

- 金屬(鋁箔、不銹鋼)

- 紙和紙板

- 不織布/ Tyvek

- 按滅菌方法

- 化學(EtO、臭氧)

- 輻射(伽瑪射線、電子束、X光)

- 高溫/蒸氣

- 無菌灌裝和精加工

- 按最終用戶產業

- 醫療和手術器械

- 製藥和生物技術

- 體外診斷

- 飲食

- 獸醫和動物用藥品

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Amcor plc

- DuPont de Nemours, Inc.

- Baxter International Inc.

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- AptarGroup, Inc.

- Tekni-Plex, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- SteriPack Group

- Wipak Group

- Placon Corporation, Inc.

- SGD Pharma

- Becton, Dickinson and Company

- 3M Company

- Berry Global Group, Inc.

- Huhtamaki Oyj

- Sabert Corporation

- Winpak Ltd.

第7章 市場機會與未來趨勢

- 閒置頻段和未滿足需求評估

The sterilized packaging market reached USD 75.93 billion in 2025 and is projected to climb to USD 109.41 billion by 2030, expanding at a 7.58% CAGR.

Demand is fueled by stricter global regulations, the growth of biologics manufacturing, and mounting pressure to curb hospital-acquired infections. Hospital systems are switching to single-use packs, pharmaceutical producers are specifying higher barrier formats, and equipment makers are embedding inline inspection to cut recall risks. The EPA's new ethylene-oxide (EtO) emission rules are already shifting capital toward radiation and vapor-phase alternatives, while material suppliers are fast-tracking Tyvek and non-woven upgrades to meet the next wave of EU PFAS limits. Consolidation is picking up as global players seek the scale needed to fund compliance and automation.

Global Sterilized Packaging Market Trends and Insights

Rising Incidence of Hospital-Acquired Infections

Healthcare-associated infections affect 1 in 31 U.S. hospital patients on any day, costing the system USD 28.4 billion annually. Hospitals are therefore mandating higher barrier trays and sterile wraps for critical instruments, and many facilities are shifting reusable sets to single-use formats to mitigate liability. Single-use sterilized packaging market demand rises further as antibiotic-resistant organisms render legacy cleaning inadequate. Packaging converters report growing orders for breathable Tyvek lids that withstand multiple EtO cycles while maintaining a sterility assurance level of 10-6.

Growth in Biologics and Injectable Drugs

Global biologics revenue is moving toward USD 856 billion by 2030, and demand for injectable formats requires ultra-clean containers that do not shed particulates. The prefilled syringe boom is compelling suppliers to certify tougher container-closure tests, while cell-therapy producers need packs that hold integrity at -196 °C. SCHOTT Pharma's USD 371 million U.S. syringe plant targets these therapies and shows how regional capacity expansion aligns with tighter Annex 1 rules.

Volatile Medical-Grade Polymer Prices

Medical-grade resins require specialty additives and lengthy validation, limiting supplier substitution. Geopolitical disruptions and refinery outages have spiked prices, squeezing converters that already face costly EtO abatement projects. Firms with multi-region supply contracts and in-house recycling capacity have more margin cover, whereas single-source buyers risk shortages and expedited-freight expenses.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Sterilization Regulations

- Expansion of Outpatient and Home-Care Settings

- Cost of Ethylene Oxide Emission Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Trays and thermoform packs retained a 26.71% share of the sterilized packaging market in 2024 thanks to their ability to nest complex instrument sets and provide instant visual confirmation. Hospitals value clear lids that speed count-in and count-out procedures, reducing operating-room delays. Custom cavities lower product movement, cutting puncture risk in transit. Blisters and ampoules represent the fastest-rising product at a 9.41% CAGR through 2030, supported by unit-dose biologics where contamination can destroy high-value doses.

The push toward advanced barrier films within blisters illustrates premiumization. AI-equipped cameras on thermoform lines inspect seal integrity at full speed, improving batch yield and documentation. Pouches, bottles, IV containers, and clamshells remain relevant for specific dosage forms and reusable instruments, but growth is slower as unit-dose formats gain traction. Smart labels that log temperature or radiation exposure are migrating from trial to scale, reflecting broader digitization.

Plastics still accounted for 62.24% of sterilized packaging market size in 2024 because they balance strength, clarity, and cost. Polyethylene, polypropylene, and cyclic-olefin copolymers withstand EtO, gamma, and e-beam, yet rising sustainability rules and virgin-resin inflation encourage substitution. Non-woven and Tyvek substrates are forecast to rise 9.54% CAGR to 2030 as breathability and fiber strength help them pair with lower-residue sterilants.

Glass vials remain indispensable where drug-product interaction must approach zero, notably for biologics with long cold-chain legs. Metal trays occupy smaller niches such as orthopedic implant kits requiring rigid retention and shielded transport. Paperboard is gaining for secondary cartons where biodegradability is prized, though primary sterility still relies on higher barriers. As PFAS sunset dates approach, suppliers scale up plasma and silicon-oxide coatings to replace fluoropolymers.

The Sterilized Packaging Market Report is Segmented by Product (Clamshells, Pouches, Bottles, Blisters and Ampoules, Vials, and More), Material (Plastics, Glass, Metals, and More), Sterilization Method (Chemical, Radiation, and More), End-User Industry (Medical and Surgical Instruments, Pharmaceutical and Biological, In-Vitro Diagnostics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.19% of sterilized packaging market share in 2024, anchored by FDA oversight and a high proportion of complex drug launches. Large contract sterilization networks and leading resin producers underpin supply security, while investment focuses on EtO abatement and new e-beam vaults. Becton Dickinson's biologic-delivery segment surpassed USD 1 billion in 2024, highlighting the region's tilt toward higher-value devices .

Europe follows with mature demand, driven by Annex 1 upgrades and early adoption of PFAS-free materials. Germany and Ireland host numerous fill-finish plants that feed global biologic supply chains. The EU's 2026 fluoropolymer limits spur rapid qualification of alternative coatings, positioning European converters as first movers. Sustainability targets also push circular-economy pilots for reusable secondary packs.

Asia-Pacific posts the fastest 9.24% CAGR to 2030 as China and India scale biologic and small-molecule output for domestic and export markets. Regional regulators are harmonizing with ICH guidelines, prompting investment in higher-grade cleanrooms and radiation capacity. Japan's aging population drives home-care syringe demand, while South Korea and Australia serve as test beds for smart-label cold-chain packs. Localizing sterilized packaging market capacity cuts lead times and cushions currency risk.

- Amcor plc

- DuPont de Nemours, Inc.

- Baxter International Inc.

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- AptarGroup, Inc.

- Tekni-Plex, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- SteriPack Group

- Wipak Group

- Placon Corporation, Inc.

- SGD Pharma

- Becton, Dickinson and Company

- 3M Company

- Berry Global Group, Inc.

- Huhtamaki Oyj

- Sabert Corporation

- Winpak Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of hospital-acquired infections

- 4.2.2 Growth in biologics and injectable drugs

- 4.2.3 Stringent global sterilization regulations

- 4.2.4 Expansion of outpatient and home-care settings

- 4.2.5 AI-enabled inline sterile-pack inspection

- 4.2.6 Cell and gene-therapy cold-chain needs

- 4.3 Market Restraints

- 4.3.1 Volatile medical-grade polymer prices

- 4.3.2 Cost of ethylene oxide (EtO) emission compliance

- 4.3.3 Limited pharma-grade gamma irradiation capacity

- 4.3.4 PFAS scrutiny in fluoropolymer barrier films

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Clamshells

- 5.1.2 Pouches

- 5.1.3 Bottles

- 5.1.4 Blisters and Ampoules

- 5.1.5 Vials

- 5.1.6 Trays and Thermoform Packs

- 5.1.7 IV Containers and Bags

- 5.1.8 Others

- 5.2 By Material

- 5.2.1 Plastics (HDPE, PP, PET, PVC, Others)

- 5.2.2 Glass

- 5.2.3 Metals (Aluminum Foil, Stainless Steel)

- 5.2.4 Paper and Paperboard

- 5.2.5 Non-woven and Tyvek

- 5.3 By Sterilization Method

- 5.3.1 Chemical (EtO, Ozone)

- 5.3.2 Radiation (Gamma, e-Beam, X-Ray)

- 5.3.3 High Temperature / Steam

- 5.3.4 Aseptic Fill-Finish

- 5.4 By End-user Industry

- 5.4.1 Medical and Surgical Instruments

- 5.4.2 Pharmaceutical and Biological

- 5.4.3 In-Vitro Diagnostics

- 5.4.4 Food and Beverage

- 5.4.5 Veterinary and Animal Health

- 5.4.6 Other Industrial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 DuPont de Nemours, Inc.

- 6.4.3 Baxter International Inc.

- 6.4.4 Gerresheimer AG

- 6.4.5 SCHOTT AG

- 6.4.6 West Pharmaceutical Services, Inc.

- 6.4.7 AptarGroup, Inc.

- 6.4.8 Tekni-Plex, Inc.

- 6.4.9 Sealed Air Corporation

- 6.4.10 Sonoco Products Company

- 6.4.11 SteriPack Group

- 6.4.12 Wipak Group

- 6.4.13 Placon Corporation, Inc.

- 6.4.14 SGD Pharma

- 6.4.15 Becton, Dickinson and Company

- 6.4.16 3M Company

- 6.4.17 Berry Global Group, Inc.

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Sabert Corporation

- 6.4.20 Winpak Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment