|

市場調查報告書

商品編碼

1846220

冶金焦:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Metallurgical Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

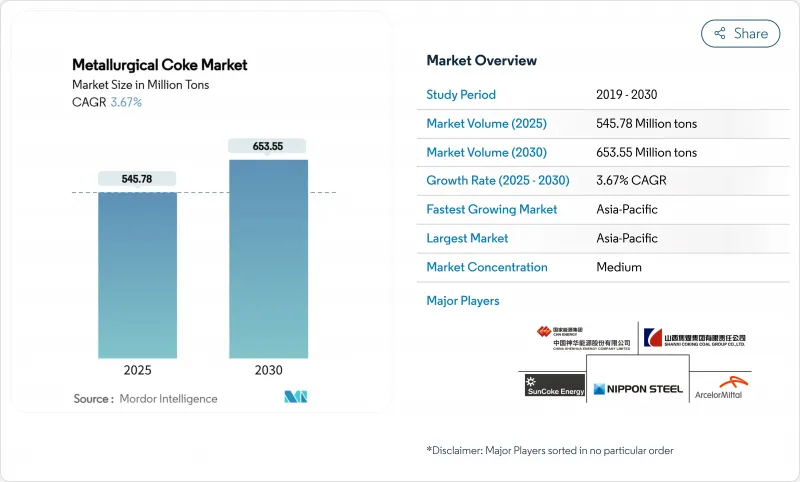

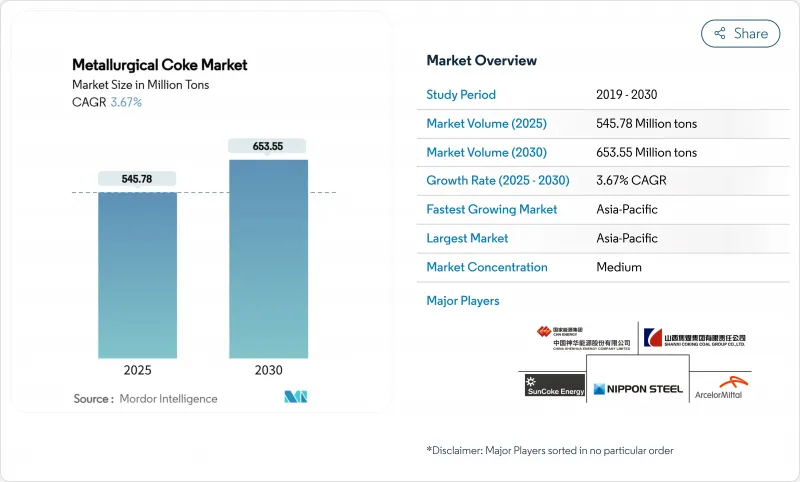

預計到 2025 年冶金焦市場規模將達到 5.4578 億噸,到 2030 年將達到 6.5355 億噸,在預測期(2025-2030 年)內複合年成長率為 3.67%。

亞太地區鋼鐵產量的成長、北美公共基礎設施投資的持續增加,以及保護綜合鋼廠免受短期價格波動影響的長期契約,都支撐著這一擴張趨勢。儘管面臨脫碳帶來的不利因素,但對低灰分優質焦炭的需求依然強勁,因為高爐煉鋼製程相對於其他煉鋼路線仍具有經濟優勢。隨著美國和歐盟環境法規的日益嚴格,熱回收焦爐有助於大型企業降低合規成本並確保淨利率。供應鏈的韌性正變得越來越重要,垂直整合的鋼鐵企業更傾向於選擇擁有穩定焦炭產能和地理分散資產的供應商。

全球冶金焦市場趨勢與洞察

公共基礎設施對鋼鐵的需求不斷成長

大型公共工程項目可提供多年期的鋼鐵採購承諾,直接轉化為冶金焦市場穩定的需求。政府合約提供可預測的訂單,使焦炭生產商能夠最佳化爐窯運轉率和物流規劃。公共計劃即使在景氣衰退時期也往往能夠持續進行,從而緩解需求波動並保障供應商的長期收益。基礎建設與國內鋼鐵政策協調一致的地區,例如美國和印度,擁有更具韌性的供應鏈。這種協調性促使鋼鐵廠續簽長期採購協議,以確保獲得優質低灰焦的供應。

擴大汽車產能

汽車產量不斷成長,尤其是在中國、印度、墨西哥和東南亞地區,推動了對鑄造焦炭的需求,這些焦炭用於精密鑄件和加熱先進高強度鋼。電動車平台需要輕量化且堅固的電池外殼,這反過來又提高了對焦炭原料中碳含量穩定性的品質要求。汽車工廠的地理集結導致了焦炭供應基地的本地化,這為擁有多種交通途徑的地區的生產商帶來了成本優勢。隨著汽車製造商本地化生產零件以降低供應鏈風險,附近焦炭廠的需求模式變得更加可預測。然而,汽車需求的周期性波動迫使焦炭供應商保持靈活的產能,而這種產能會在每月合約配額和現貨市場之間波動。

焦化廠需遵守嚴格的環境法規

美國已在其《國家有害空氣污染物排放標準》中最終確定了更低的洩漏限值,強制要求在圍擋線上進行連續苯監測並採用先進的洩漏檢測通訊協定。歐盟目前也強制要求在整個煤炭價值鏈中進行甲烷測量和報告,這為焦化設施增加了一層額外的合規要求。脫硫、苯提取和除塵設備的資本支出可能超過每噸產能100美元,對於小型獨立生產商融資成本過高。因此,監管負擔正在加速產業整合,提高進入門檻,並減緩冶金焦市場的成長。

細分市場分析

高爐級焦炭佔冶金焦炭市場的64.22%。穩定的鐵水產量目標穩定了年度訂單量,而製程控制的升級提高了煉廠對冷態強度和碳鋼比(CSR)的預期要求。儘管塊狀焦炭的等級較低,但由於鑄造和有色金屬行業對10至25毫米粒度的精確需求,其複合年成長率仍高達4.20%,超過了整體成長速度。

由於一體化製造商簽訂多年期批量合約以維持爐子的效率,運作餘熱回收爐的供應商因其可預測的品質而獲得溢價。該領域的成長支撐了更廣泛的冶金焦市場,儘管環境問題日益受到關注,但冶金焦的產能擴張仍然主要由傳統的桶式沖壓焦塊構成。

預計到 2024 年,低灰分(灰分含量 8-12%)產品將佔冶金焦市場的 70.78%,到 2030 年將以 4.55% 的複合年成長率成長。

印度對低灰分煤炭的進口限額為每半年140萬噸,凸顯了該等級煤炭對供應安全的戰略重要性。投資先進煤炭洗選和配煤技術的生產商最有優勢搶佔這一高階市場,並透過與大型煉焦廠簽訂長期供應協議,進一步滲透到冶金焦產業。

冶金焦炭報告按焦炭類型(高爐焦炭、鑄造焦炭、其他)、等級(低灰分 8-12%、高灰分 15% 及以上)、應用(煉鋼、鑄造、製糖、其他)、最終用戶行業(綜合鋼鐵製造商、小型鋼廠/電弧爐營運商、其他)和北美地區(亞洲地區、其他地區)和北美地區細分。

區域分析

亞太地區預計到2024年將佔全球銷售量的69.66%,並在2030年之前保持4.12%的複合年成長率,這主要得益於印度產能的積極擴張以及東南亞基礎設施計劃的持續需求。中國暫停發放新的煤鋼生產授權抑制了綠地計畫的積極性,而現有煉鋼爐則因維護停機和效率提升而消耗大量優質焦炭。

北美地區的經濟發展得益於長期基礎設施投資,這些投資穩定了鋼鐵訂單。墨西哥的汽車叢集和加拿大的自然資源管道正在促進鋼鐵生產,並支撐焦炭在整個北美大陸的流通。

歐洲對瑞典、德國和法國仍然至關重要,因為在氫氣直接還原鐵產能達到規模之前,高等級焦炭不可或缺。歐盟的甲烷排放法規2024/1787將引入新的監測成本,並可能導致不經濟的煉鐵裝置關閉,加劇區域供應緊張,並維持進口依賴。南美洲(以巴西的綜合鋼鐵產業為支撐)以及中東和非洲(以新興的綠色鋼鐵中心為支撐)共同構成了一個多元化發展的前沿陣地,為那些尋求擺脫傳統高爐煉鐵中心束縛的生產商提供了廣闊的市場空間。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 公共基礎設施對鋼鐵的需求不斷成長

- 擴大汽車產能

- 擴大亞太地區的綜合鋼鐵廠產能

- 新興國家的都市建設熱潮

- 餘熱回收焦爐的商業化程度不斷提高。

- 市場限制

- 冶金焦價格波動

- 焦化廠需遵守嚴格的環境法規

- 轉向氫基直接還原鐵

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(銷售)

- 按可樂類型

- 高爐焦炭

- 鑄造焦

- 堅果可樂

- 可口可樂的微風

- 按年級

- 灰分含量低(灰分含量8-12%)

- 高灰分含量(灰分含量15%或以上)

- 透過使用

- 鋼鐵

- 晶圓代工廠

- 糖加工

- 玻璃製造

- 其他方法(化學還原等)

- 按最終用戶產業

- 綜合鋼鐵製造商

- 小型磨機/電弧爐操作員

- 晶圓代工廠

- 有色冶金

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- ArcelorMittal

- BlueScope Steel Ltd.

- China Baowu Steel Group

- China Shenhua Energy Co. Ltd.

- Drummond Company Inc.

- Gujarat NRE Coke Ltd.(GNCL)

- Hickman-Williams & Company

- Jiangsu Surung High-Carbon Co. Ltd.

- JSW Steel Ltd.

- Mahalaxmi Ennore Coke Pvt Ltd

- Mechel PAO

- Nippon Steel Corporation

- OKK Koksovny as

- POSCO

- Shanxi Coking Coal Group

- SunCoke Energy Inc.

- Tata Steel Ltd.

- United States Steel Corporation

第7章 市場機會與未來展望

The Metallurgical Coke Market size is estimated at 545.78 Million tons in 2025, and is expected to reach 653.55 Million tons by 2030, at a CAGR of 3.67% during the forecast period (2025-2030).

Escalating steel production in Asia Pacific, steady public-infrastructure investment in North America, and long-term contracts that shield integrated mills from short-term price swings underpin this expansion. Blast-furnace operations retain economic advantages over alternative ironmaking routes, so demand for premium low-ash coke remains firm despite decarbonization headwinds. Environmental regulation is tightening across the United States and the European Union, yet heat-recovery coke ovens help large operators contain compliance costs and safeguard margins. Supply-chain resilience is rising in strategic importance, pushing vertically integrated steel producers to secure captive coke capacity and favor suppliers with geographically diversified assets.

Global Metallurgical Coke Market Trends and Insights

Rising Demand for Steel in Public Infrastructure

Large public-works programs have locked in multi-year steel offtake commitments that translate directly into steady metallurgical coke market demand. Government contracts provide predictable order books, helping coke producers optimize oven utilization rates and logistics planning. Because public projects often proceed even in downturns, they soften demand volatility and protect long-term supplier revenues. Regions with synchronized infrastructure and domestic steel policy, such as the United States and India, enjoy superior supply-chain resilience. This alignment encourages mills to renew long-term offtake agreements that secure premium low-ash coke supplies.

Expanding Automotive Production Capacity

Vehicle output growth, particularly in China, India, Mexico, and Southeast Asia, lifts foundry coke requirements for precision castings and heats advanced high-strength steel grades. Electric-vehicle platforms demand lightweight yet rigid battery housings that intensify quality requirements for consistent carbon levels in coke feedstock. Geographic clustering of automotive plants fosters localized coke-supply hubs, giving regional producers with multimodal transport access a cost edge. As automakers localize components to mitigate supply-chain risk, demand patterns become more predictable for nearby coke plants. Nevertheless, cyclical vehicle demand still obliges coke suppliers to keep flexible capacity that can swing between monthly contract allocations and spot markets.

Stringent Environmental Regulations on Coking Plants

The United States finalized lower leak limits under the National Emission Standards for Hazardous Air Pollutants, mandating continuous benzene monitoring at fencelines and advanced leak-detection protocols. The European Union now requires methane measurement and reporting across the coal value chain, adding compliance layers for coke facilities. Capital expenditure for desulfurization, benzene extraction, and dust-capture equipment can exceed USD 100 per-ton of capacity, costs that smaller independent producers struggle to finance. Consequently, the regulatory burden accelerates industry consolidation and raises barriers to entry, moderating metallurgical coke market growth.

Other drivers and restraints analyzed in the detailed report include:

- Urban Construction Boom in Emerging Economies

- Increasing Commercialization of Heat-Recovery Coke Ovens

- Shift Toward Hydrogen-Based Direct Reduced Iron

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blast-furnace varieties hold a 64.22% slice of the metallurgical coke market. Stable hot-metal production targets keep annual call-offs steady, while process-control upgrades raise the cold-strength and CSR specifications mills expect. Nut coke, though a lower-volume grade, is eclipsing aggregate growth at a 4.20% CAGR due to foundry and non-ferrous use cases that require precise 10-25 mm sizing.

Integrated producers contract multi-year volumes to safeguard furnace efficiency, so suppliers running heat-recovery ovens capture premiums for predictable quality. The segment's incremental growth continues to anchor the broader metallurgical coke market, ensuring that capacity expansions still centre on traditional drum-stamp batteries despite mounting environmental scrutiny.

Low-ash (8-12% ash) product occupied 70.78% of the metallurgical coke market in 2024 and is forecast to record a 4.55% CAGR through 2030, reflecting tighter furnace slag limits and emission caps.

Import restrictions in India that cap low-ash cargoes at 1.4 million tons per half-year underscore the grade's strategic importance for supply security. Producers investing in advanced coal washing and blending technology are best positioned to seize this premium segment and secure long-term supply agreements with large mills, thereby deepening penetration within the metallurgical coke industry.

The Metallurgical Coke Report is Segmented by Coke Type (Blast-Furnace Coke, Foundry Coke, and More), Grade (Low Ash 8 To 12% Ash and High Ash More Than 15% Ash), Application (Iron and Steel Making, Foundry Castings, Sugar Processing, and More), End-User Industry (Integrated Steel Producers, Mini-mills/EAF Operators, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific delivered 69.66% of global volume in 2024 and will maintain a 4.12% CAGR through 2030 owing to India's vigorous capacity build-out and ongoing demand from Southeast Asian infrastructure projects. China's moratorium on new coal-based steel permits curbs greenfield projects, yet existing furnaces still consume high-quality coke for maintenance outages and efficiency upgrades.

North America is driven by long-life infrastructure spending that stabilized steel orders. Mexico's automotive clusters and Canada's natural-resource pipelines add incremental volume and sustain intracontinental coke flows.

Europe remains significant because high-grade coke is indispensable for Sweden, Germany, and France until hydrogen DRI facilities scale. The EU Methane Regulation 2024/1787 ushers in new monitoring costs that could shutter sub-economic batteries, tightening internal supply and sustaining import dependence. South America, underpinned by Brazilian integrated mills, and the Middle-East and Africa, buoyed by emerging green-steel hubs, collectively form a diversification frontier for producers seeking exposure beyond traditional blast-furnace heartlands.

- ArcelorMittal

- BlueScope Steel Ltd.

- China Baowu Steel Group

- China Shenhua Energy Co. Ltd.

- Drummond Company Inc.

- Gujarat NRE Coke Ltd. (GNCL)

- Hickman-Williams & Company

- Jiangsu Surung High-Carbon Co. Ltd.

- JSW Steel Ltd.

- Mahalaxmi Ennore Coke Pvt Ltd

- Mechel PAO

- Nippon Steel Corporation

- OKK Koksovny a.s.

- POSCO

- Shanxi Coking Coal Group

- SunCoke Energy Inc.

- Tata Steel Ltd.

- United States Steel Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Steel in Public Infrastructure

- 4.2.2 Expanding Automotive Production Capacity

- 4.2.3 Increasing Capacity Additions in Integrated Steel Mills in Asia Pacific

- 4.2.4 Urban Construction Boom in Emerging Economies

- 4.2.5 Increasing Commercialisation of Heat-Recovery Coke Ovens

- 4.3 Market Restraints

- 4.3.1 Metallurgical Coke Price Volatility

- 4.3.2 Stringent Environmental Regulations on Coking Plants

- 4.3.3 Shift Toward Hydrogen?Based Direct Reduced Iron

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts ( Volume)

- 5.1 By Coke Type

- 5.1.1 Blast-Furnace Coke

- 5.1.2 Foundry Coke

- 5.1.3 Nut Coke

- 5.1.4 Coke Breeze

- 5.2 By Grade

- 5.2.1 Low Ash (8 to 12% Ash)

- 5.2.2 High Ash (more than 15% Ash)

- 5.3 By Application

- 5.3.1 Iron and Steel Making

- 5.3.2 Foundry Castings

- 5.3.3 Sugar Processing

- 5.3.4 Glass Manufacturing

- 5.3.5 Others (Chemical Reduction and Others)

- 5.4 By End-User Industry

- 5.4.1 Integrated Steel Producers

- 5.4.2 Mini-mills/EAF Operators

- 5.4.3 Foundries

- 5.4.4 Non-ferrous Metallurgy

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ArcelorMittal

- 6.4.2 BlueScope Steel Ltd.

- 6.4.3 China Baowu Steel Group

- 6.4.4 China Shenhua Energy Co. Ltd.

- 6.4.5 Drummond Company Inc.

- 6.4.6 Gujarat NRE Coke Ltd. (GNCL)

- 6.4.7 Hickman-Williams & Company

- 6.4.8 Jiangsu Surung High-Carbon Co. Ltd.

- 6.4.9 JSW Steel Ltd.

- 6.4.10 Mahalaxmi Ennore Coke Pvt Ltd

- 6.4.11 Mechel PAO

- 6.4.12 Nippon Steel Corporation

- 6.4.13 OKK Koksovny a.s.

- 6.4.14 POSCO

- 6.4.15 Shanxi Coking Coal Group

- 6.4.16 SunCoke Energy Inc.

- 6.4.17 Tata Steel Ltd.

- 6.4.18 United States Steel Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment