|

市場調查報告書

商品編碼

1846193

沸石:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Zeolites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

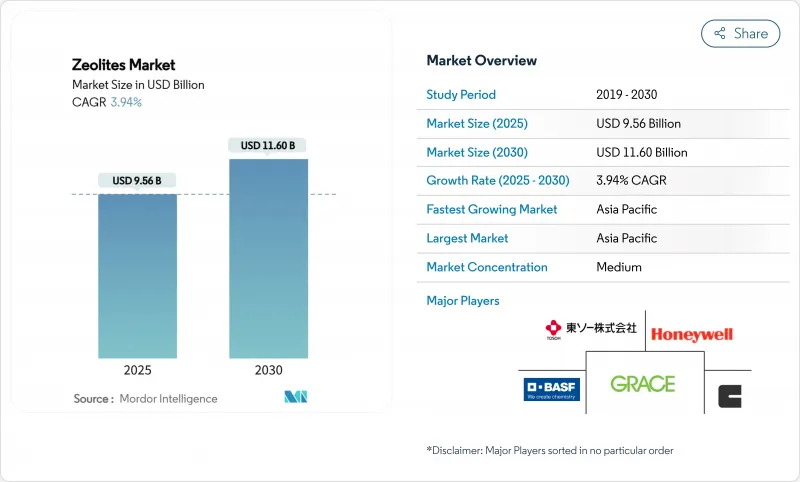

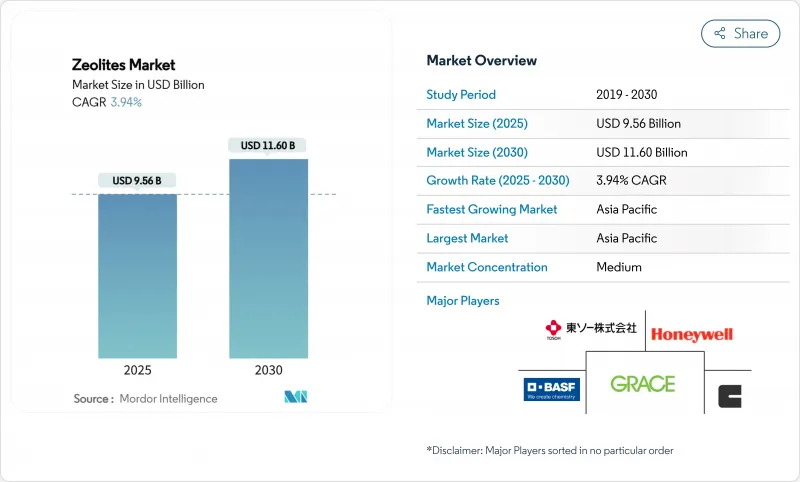

預計到 2025 年,沸石市場規模將達到 95.6 億美元,到 2030 年將達到 116 億美元,預測期(2025-2030 年)的複合年成長率為 3.94%。

來自水處理、石油化學催化劑和新一代薄膜技術的強勁需求支撐著沸石市場的穩定成長。亞太地區引領全球沸石市場,日益嚴格的環境法規推動了催化劑和吸附劑的應用。由於重金屬排放法規的日益嚴格,水處理仍然是最具活力的終端應用領域;而石油化工應用則佔據最大佔有率,這得益於其在流體化媒裂中的重要作用。

全球沸石市場趨勢與洞察

水處理產業的需求不斷成長

人們日益關注重金屬和新興污染物的排放,這促使公共產業公司採用高容量沸石吸附劑。氧化石墨烯改質沸石目前性能優於傳統吸附劑,在333 K下可去除高達119 mg g⁻¹的亞甲基藍。酸處理斜發沸石對Pb²⁺、Cd²⁺和As³⁺的去除率分別達到94%、86%和84%,這使得天然沸石成為市政系統中活性碳的一種經濟高效的替代品。同時,歐洲和亞洲的公共產業正在試驗使用沸石填充柱,以滿足即將到來的鉻和錳排放法規,這將推動沸石市場在未來幾年持續成長。

沸石作為低溫吸附劑的應用日益廣泛。

以沸石-水體系為基礎的吸附式冷氣機可降低能耗並消除高全球暖化潛勢(GWP)冷媒。沸石的微孔結構可在低分壓下吸附水蒸氣,從而利用約60°C的廢熱流進行冷卻。諸如導熱係數提高40%的塗層等創新技術可縮短循環時間並提高系統能效比(COP),使其更接近在離網低溫運輸和資料中心冷卻等領域的商業性化應用。

低成本矽膠和活性碳吸附劑的充足供應減少了沸石在工業乾燥中的使用。

矽膠的出現使沸石的價格降低了30-40%,引導通用乾燥用戶轉向這種更經濟的介質。沸石的性能優勢,例如在潮濕環境下的高容量和200°C以上的可再生,仍然常常被低估,這減緩了其在散裝化學品和穀物儲存領域的應用。生產商正在透過推出混合型產品來應對這項挑戰,這些產品在降低初始成本的同時,還能展現出全生命週期的成本節約,但市場教育仍然是當前面臨的一大障礙。

細分市場分析

2024年,天然沸石佔據了55%的市場佔有率,這主要得益於斜發沸石、菱沸石和絲光沸石的豐富礦床。這些礦物廣泛應用於農業、畜牧業和吸附等領域,使其在成本上比合成沸石具有持久優勢。酸改性斜發沸石目前可去除94%的Pb²⁺和84%的As³⁺,縮小了與人工合成沸石的性能差距。

合成沸石的複合年成長率為5.60%。精確控制矽鋁比和孔隙拓撲結構可使其在FCC、加氫裂解和氮氧化物減排等製程中表現出高活性。隨著重油加工量的增加,合成Y型沸石的市場規模預計將會擴大。供應商正致力於雙骨架設計的研發,以提高低碳烯烴的產率,同時維持溢價和穩定的利潤率。

預計2024年粉末狀沸石的銷售將維持60%的成長,主要應用於清潔劑、催化劑漿料和母粒等領域。其高外表面積確保了快速吸附和易於分散。市場對洗衣助劑和FCC催化劑的穩定需求將支撐沸石市場的這一細分領域。

儘管膜/塗層技術目前仍處於小眾市場,但預計其年成長率將達到6.11%。在陶瓷或金屬基板上製備的無縫、無缺陷的沸石層,目前可用於氫氣純化和乙醇脫水的分子篩分。二次生長技術的突破性進展使得取向ZSM-5膜的製備厚度小於100奈米,從而降低了滲透損失。歐洲多個針對燃燒後二氧化碳捕集的試點計畫表明,這種先進的外形規格將在整個沸石市場中佔據顯著佔有率。

區域分析

亞太地區石化產業空前擴張、都市化快速發展,且區域排放法規日益嚴格,預計2024年,該地區將佔全球沸石銷售額的45%。中國的「十四五」規劃支持區域觸媒技術創新,確保富丙烯裂解裝置的穩定供應,並帶動整個沸石市場需求的穩定成長。同時,推行的低氮氧化物燃燒和先進污水廠等政策也將促進沸石的廣泛應用。

歐洲已將環境績效置於優先地位,鼓勵汽車製造商採用銅-碳氫化合物(Cu-CHA)催化劑,並鼓勵煉油廠安裝基於沸石骨架的脫硫吸附裝置。歐洲綠色新政中的循環經濟措施,例如強制要求在2030年實現高達85%的廢油煉製目標,將增加未來對吸附劑的需求。

北美地區憑藉其完善的煉油網路以及沸石基選擇性催化還原(SCR)和溫室氣體轉化化學品(GHG-to-Chemicals)催化劑的日益普及,保持了強勁的消費需求。國內採購措施正推動高矽骨架沸石產能的提升,增強了特種應用領域的供應保障,並鞏固了北美沸石市場的穩定地位。

中東正利用其豐富的原油儲量,建造以高價值烯烴和芳烴為目標的綜合煉油廠。海灣合作理事會(GCC)的殘渣升級投資依賴耐硫耐金屬的沸石催化劑,確保了穩定的訂單。非洲和南美洲是新興但充滿潛力的地區。巴西計劃,反映了社區水處理的發展趨勢。這些地區共同推動了沸石市場的全球擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 水處理產業的需求不斷成長

- 沸石作為低溫吸附劑的應用日益廣泛。

- 石油工業中催化裂解沸石的廣泛應用

- 中國和中東地區石化產能的不斷擴張正在推動Y型沸石基FCC催化劑的需求。

- 催化劑需求不斷成長

- 市場限制

- 低成本矽膠和活性碳吸附劑的充足供應減少了沸石在工業乾燥中的使用。

- 由於礬土開採限制,鋁矽酸鹽成本出現波動。

- 歐盟催化劑處置法規導致廢棄沸石處理成本增加

- 價值鏈分析

- 監理展望

- 五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 天然沸石

- 合成沸石

- 按形狀

- 粉末

- 顆粒/丸劑

- 蜂巢/塊狀

- 薄膜/塗層

- 透過使用

- 吸附劑

- 催化劑

- 清潔劑

- 其他用途(精煉和沼氣)

- 按最終用戶產業

- 水處理

- 空氣淨化

- 農業

- 石化

- 建造

- 其他(醫療、核能)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- BASF

- Albemarle Corporation

- Arkema

- Blue Pacific Minerals

- Clariant

- GCMIL

- Honeywell International Inc.

- Huiying Chemical Industry(Quanzhou)Co.

- International Zeolite Corp.

- Interra Global

- KNT Group

- NINGBO JIAHE NEW MATERIALS TECHNOLOGY CO.,LTD

- PQ

- Resonac Holdings Corporation

- St. Cloud Mining

- TOSOH CORPORATION

- WR Grace & Co

- Zeochem

- Zeolyst International

- Zeotech

第7章 市場機會與未來展望

The Zeolites Market size is estimated at USD 9.56 billion in 2025, and is expected to reach USD 11.60 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

Robust demand from water treatment, petrochemical catalysis, and next-generation membrane technologies underpins steady growth. Asia-Pacific leads the global zeolite market as tightening environmental rules spur catalyst and adsorbent uptake. Water treatment is the most dynamic end-use, on the back of stricter heavy-metal discharge limits, while petrochemical applications retain the largest slice due to their entrenched role in fluid catalytic cracking.

Global Zeolites Market Trends and Insights

Increasing Demand from Water Treatment Industry

Heightened concern over heavy-metal and emerging contaminant discharge drives utilities to adopt high-capacity zeolite adsorbents. Graphene-oxide-modified zeolites now remove up to 119 mg g-1 of methylene blue at 333 K, outstripping conventional media. Acid-treated clinoptilolite achieves 94% Pb2+, 86% Cd2+ , and 84% As3+ removal, positioning natural zeolites as cost-effective substitutes for activated carbon in municipal systems. In parallel, utilities in Europe and Asia are piloting zeolite-packed columns to meet upcoming chromium and manganese limits, underpinning multi-year growth for the zeolite market.

Increasing Use of Zeolite as Refrigeration Adsorbents

Adsorption chillers based on zeolite-water pairs cut electricity use and eliminate high-GWP refrigerants. Zeolites' microporous framework adsorbs water vapor at low partial pressure, enabling cooling with waste heat streams around 60 °C. Innovations such as 40% better heat-transfer coatings shorten cycle time and lift system COP, bringing commercial adoption closer in off-grid cold-chain and data-center cooling These advances bolster medium-term demand and expand the zeolite market into energy-efficiency niches.

Abundant Availability of Low-Cost Silica Gel and Activated Carbon Adsorbents Reducing Zeolite Uptake in Industrial Drying

Silica gel undercuts zeolite pricing by 30-40%, steering commodity drying customers toward cheaper media. Performance advantages of zeolites, higher capacity under humid atmospheres and regenerability above 200 °C, often remain undervalued, delaying conversions in bulk chemicals and grain storage. Producers counter by launching hybrid blends that lower upfront cost while showcasing lifecycle savings, yet market education remains a near-term hurdle.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Petrochemical Capacity Additions in China and Middle East Elevating Demand for FCC Catalysts Based on Y-Zeolite

- Growing Demand in Catalysis

- Volatility in Aluminosilicate Feedstock Costs Due to Bauxite Mining Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural zeolites commanded 55% of the market in 2024 thanks to vast deposits of clinoptilolite, chabazite, and mordenite that require only crushing and sizing before use. These minerals support agriculture, livestock, and bulk adsorption, giving them a durable cost edge over synthetics. Acid-modified clinoptilolite now removes 94% Pb2+ and 84% As3+, narrowing the performance gap with engineered frameworks.

Synthetic zeolites will post a 5.60% CAGR. Precision control of Si/Al ratio and pore topology enables high activity in FCC, hydrocracking, and NOx reduction. The zeolite market size for synthetic Y-type catalysts alone is projected to expand with rising heavy-oil processing. Suppliers devote significant research and development to dual-framework designs that unlock higher light-olefin yields, sustaining premium pricing and margin resilience.

Powders retained 60% revenue in 2024, underpinning detergent, catalyst slurry, and master-batch applications. Their high external surface area guarantees rapid adsorption and easy dispersion. Stable demand from laundry builders and FCC catalysts anchors this segment of the zeolite market.

Membrane/coating formats, while still niche, will rise 6.11% annually. Seamless, defect-free zeolite layers on ceramic or metal substrates now deliver molecular sieving for hydrogen purification and ethanol dehydration. Breakthroughs in secondary growth techniques produce sub-100 nm oriented ZSM-5 films, slashing permeance loss. Several European pilot installations target post-combustion CO2 capture, hinting at sizeable upside for this advanced form factor within the broader zeolite market.

The Zeolite Market Report Segments the Industry by Product Type (Natural Zeolite and Synthetic Zeolites), Form (Powder, Granules/Pellets, and More), Application (Adsorbents, Catalysts, and More), End-User Industry (Water Treatment, Air Purification, Agriculture, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 45% of global sales in 2024, reflecting unrivaled petrochemical expansion, rapid urbanization, and stringent regional emission directives. China's 14th Five-Year Plan backs local catalyst innovation, ensuring secure supply for propylene-rich crackers and driving steady demand across the zeolite market. Parallel policies mandating low-NOx combustion and advanced wastewater plants catalyze broader uptake.

Europe prioritizes environmental performance, pushing automakers to adopt Cu-CHA catalysts and refiners to install desulfurization adsorbers that rely on zeolite frameworks. The European Green Deal's circular-economy measures, including mandatory waste-oil re-refining targets of up to 85% by 2030, elevate future adsorbent requirements.

North America maintains robust consumption through its established refinery network and rising adoption of zeolite-based SCR and GHG-to-chemicals catalysts. Domestic sourcing initiatives encourage capacity additions for high-silica frameworks, reinforcing supply security for specialty applications and supporting the zeolite market's steady North American footprint.

The Middle-East leverages abundant crude to build integrated complexes targeting higher-value olefins and aromatics. GCC investments in residue-upgrading hinge on zeolite catalysts able to tolerate sulfur and metals, ensuring consistent order flow. Africa and South America remain emerging but promising; Brazilian projects tackling groundwater contamination via clinoptilolite beds exemplify localized water treatment growth. Collectively, these regions add incremental volume that reinforces global zeolite market expansion.

- BASF

- Albemarle Corporation

- Arkema

- Blue Pacific Minerals

- Clariant

- GCMIL

- Honeywell International Inc.

- Huiying Chemical Industry (Quanzhou) Co.

- International Zeolite Corp.

- Interra Global

- KNT Group

- NINGBO JIAHE NEW MATERIALS TECHNOLOGY CO.,LTD

- PQ

- Resonac Holdings Corporation

- St. Cloud Mining

- TOSOH CORPORATION

- W. R. Grace & Co

- Zeochem

- Zeolyst International

- Zeotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Water Treatment Industry

- 4.2.2 Increasing Use of Zeolite as Refrigeration Adsorbents

- 4.2.3 Significant Usage of Zeolites for Catalytic Cracking in the Petroleum Industry

- 4.2.4 Growth of Petrochemical Capacity Additions in China and Middle East Elevating Demand for FCC Catalysts Based on Y-Zeolite

- 4.2.5 Growing Demand in Catalysis

- 4.3 Market Restraints

- 4.3.1 Abundant Availability of Low-Cost Silica Gel and Activated Carbon Adsorbents Reducing Zeolite Uptake in Industrial Drying

- 4.3.2 Volatility in Aluminosilicate Feedstock Costs Due to Bauxite Mining Restrictions

- 4.3.3 Catalyst Disposal Regulations in EU Increasing Spent Zeolite Handling Costs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Natural Zeolite

- 5.1.2 Synthetic Zeolite

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Granules / Pellets

- 5.2.3 Honeycomb / Blocks

- 5.2.4 Membranes / Coatings

- 5.3 By Application

- 5.3.1 Adsorbents

- 5.3.2 Catalysts

- 5.3.3 Detergents

- 5.3.4 Other Application (Refining and Biogas)

- 5.4 By End-user Industry

- 5.4.1 Water Treatment

- 5.4.2 Air Purification

- 5.4.3 Agriculture

- 5.4.4 Petrochemical

- 5.4.5 Construction

- 5.4.6 Others (Medical, Nuclear)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Albemarle Corporation

- 6.4.3 Arkema

- 6.4.4 Blue Pacific Minerals

- 6.4.5 Clariant

- 6.4.6 GCMIL

- 6.4.7 Honeywell International Inc.

- 6.4.8 Huiying Chemical Industry (Quanzhou) Co.

- 6.4.9 International Zeolite Corp.

- 6.4.10 Interra Global

- 6.4.11 KNT Group

- 6.4.12 NINGBO JIAHE NEW MATERIALS TECHNOLOGY CO.,LTD

- 6.4.13 PQ

- 6.4.14 Resonac Holdings Corporation

- 6.4.15 St. Cloud Mining

- 6.4.16 TOSOH CORPORATION

- 6.4.17 W. R. Grace & Co

- 6.4.18 Zeochem

- 6.4.19 Zeolyst International

- 6.4.20 Zeotech

7 Market Opportunities and Future Outlook

- 7.1 Increasing Demand for Compact Detergents

- 7.2 White-space and Unmet-need Assessment