|

市場調查報告書

商品編碼

1846151

工業泵:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Industrial Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

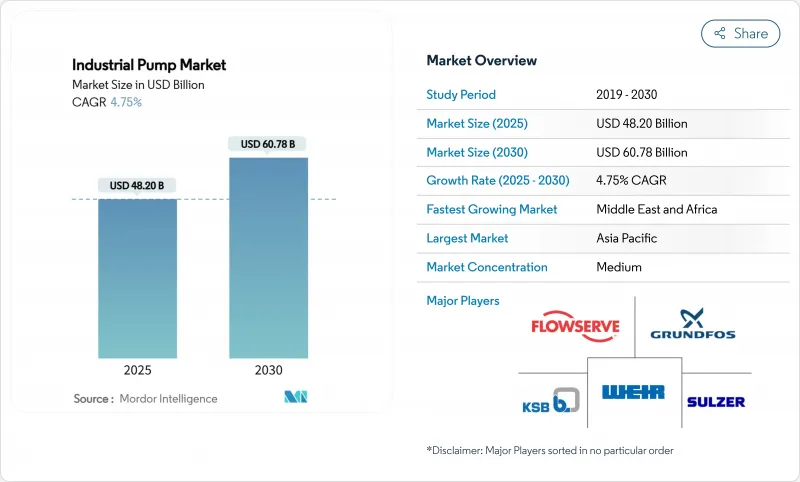

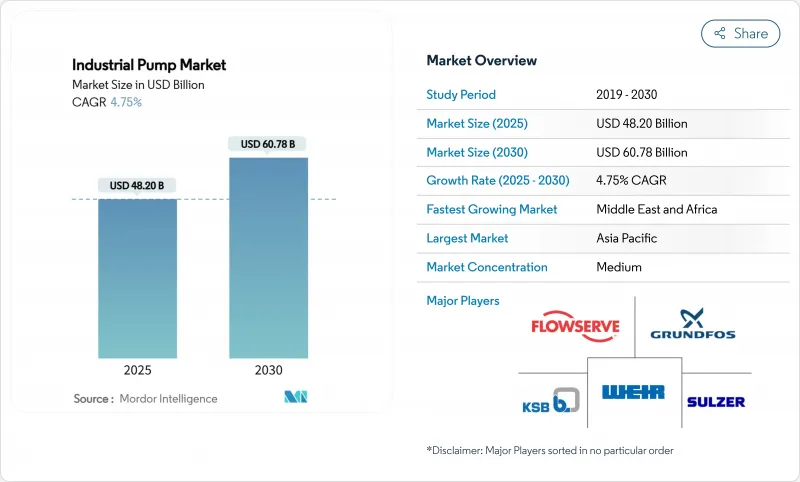

預計工業泵浦市場規模到 2025 年將達到 482 億美元,到 2030 年將達到 607.8 億美元,複合年成長率為 4.75%。

老化市政管網的持續更新換代、石化產能的擴張以及能源效率法規的加強,支撐了市場在長期供應鏈波動中的韌性。水處理領域的資本投資仍是最大的需求驅動力,光是美國就在2022年至2026年期間投入超過500億美元用於水基礎設施升級。卡達和沙烏地阿拉伯的大型企劃繼續推動高規格泵浦的訂單,這些泵浦能夠處理乙烯裂解裝置和天然氣處理機組的腐蝕性高溫介質。在中國、印度和東南亞大規模工業化的推動下,亞太地區維持了產量領先地位;而中東和非洲則在石化多元化加速的推動下,錄得最快的成長軌跡。

全球工業泵市場趨勢與洞察

全球用水和污水處理成本不斷上升

2024 年和 2025 年初宣布的破紀錄地方政府預算推動了大容量離心式幫浦和潛水污水泵的競標增加。美國環保署估計長期維修需求超過 7,440 億美元,促使人們進行多階段維修,例如蘇城 4.65 億美元的區域設施和 Cape Fear 2.39 億美元的南區工廠。先進的處理要求引起了人們對高壓逆滲透機組的興趣,蘇爾壽的垂直多級系統支持埃及的 Al Mahsamah 污水回收計劃。公用事業公司擴大採用無線感測器,將振動和溫度數據傳輸到雲端儀表板,從而減少了關鍵設備的平均維修時間。採購框架更重視整體擁有成本運算,優先考慮節能設計,引導買家選擇輕鬆超過歐盟 MEI 門檻的超高效馬達。加強監控要求也擴大了售後市場的收益池,支持了 OEM 的經常性服務合約。

擴大中東和非洲地區的石化生產能力

海灣地區的石化製造商正在向下游多元化發展,簽署了裂解裝置、聚合物裝置和天然氣處理生產線的 EPC 合約。卡達的拉斯拉凡聚合物綜合體預算為 60 億美元,包含一個計劃於 2027 年投入運作的 208 萬噸/年的乙烷裂解裝置。沙烏地阿拉伯投資 110 億美元的阿米拉爾計劃與 SATORP 煉油廠整合,增加了 165 萬噸乙烯標示容量,這增加了對符合 API 610 標準、能夠承受 400°F 排放溫度的泵浦的需求。競標中納入在地採購條款增強了國際原始設備製造商在地化機殼加工和最終組裝的獎勵。最終用戶優先考慮變頻驅動器以降低電力消耗,並擴大採用智慧馬達控制以符合該地區的能源效率目標。

鋼鐵和銅價格波動推動TCO

銅價預計在2024年突破每噸10,000美元,並在供不應求迫在眉睫的情況下逼近11,000美元,這將導致銅密集型定子和繞組的生產商投入成本上漲3.5-4.2%。碳中和計劃將與氫能生產相關的綠色附加額外費用轉嫁給鋼廠,進一步增加了不確定性。製造商的應對措施包括加強對沖計劃、重新設計外殼以節省材料,並在供應合約中實施動態定價條款。同時,終端用戶推遲了非必要的更換,延長了設備預期壽命,並抑制了工業泵市場的近期出貨量。

細分分析

離心泵將佔 2024 年銷售額的 62.4%,透過在供水、化學品輸送和 HVAC 迴路中展示其性價比來支持工業泵市場。考慮到地方政府工作週期的典型三年平均大修間隔,該細分市場產生了穩定的售後市場銷售。然而,在黏稠漿體處理的特殊需求導致螺桿設計的佔有率增加,預計到 2030 年,螺桿設計的複合年成長率將達到 7.8%。螺桿設計擴大了工業泵浦市場,迎合了優先考慮低剪切輸送的石化和採礦客戶的需求。同時,往復泵和隔膜泵分別在高壓注入和衛生生產中保持重要(儘管是小眾)的作用。物聯網改裝對於傳統離心式幫浦也變得越來越普遍,可以實現預測性振動分析並將計劃外停機時間減少高達 30%。

一家螺桿幫浦製造商在耐磨轉子塗層方面投入巨資,將高磨損應用中的運行間隔延長至8000小時以上。旋轉齒輪幫浦和蠕動幫浦解決了電池材料生產線中新的微量分配任務,凸顯了終端應用創新的廣度。基於感測器遙測技術建構的數位雙胞胎使操作員能夠模擬整個液壓系統的氣蝕風險,從而改進製程控制以保護葉輪。供應商持續強調模組化筒式密封,以簡化維護並減少備件庫存。隨著能源強度成為監管焦點,提高殼體蝸殼和擴壓葉片的效率已成為廣泛工業泵市場中所有泵類型的競爭要務。

到2024年,電力驅動組件的市佔率將達到78.5%,這得益於工業化經濟體近乎普及的電網接入以及變頻驅動帶來的效率提升。固瑞克QUANTM平台記錄的現場數據顯示,得益於橫流拓樸結構,馬達效率高達85%,進一步證明了電力驅動的生命週期成本優勢。然而,在非洲和南亞農村灌溉計劃的推動下,工業泵浦產業正經歷太陽能解決方案的激增,複合年成長率高達11.5%。安裝成本從76.23歐元(89.13美元)到1,219.59歐元(1,425.95美元)不等,這反映了競爭因素的均化成本優勢,尤其是在考慮到柴油引擎組的燃油物流溢價的情況下。

柴油引擎組在油田水力壓裂作業和緊急雨水排放方面仍保持著戰略意義,因為在這些領域,電網的彈性仍有疑問。液壓和氣壓驅動裝置繼續用於危險區域以及對功率密度和點火安全性至關重要的移動設備。結合太陽能光伏陣列和鋰離子電池的混合微電網解決方案已在印尼的多個礦場進入測試階段,實現了全天候運作無需補充柴油。對現有電動車隊進行變頻驅動 (VFD)維修,可在連續運作的海水淡化應用中將能源成本降低高達 20%。總體而言,電力組合體現了終端用戶的務實態度,但預計電動式在工業泵市場的領先地位將在整個預測期內持續保持。

工業泵市場按泵類型(離心式、往復式、旋轉式、其他)、動力源(電力、柴油、太陽能、其他)、最終用戶行業(石油和天然氣、水和污水、化學和石化、發電、採礦、食品和飲料、其他)、泵方向(潛水式、地面式)和地區(北美、南美、歐洲、亞太地區、中東和非洲)。

區域分析

經過數十年的工業建設、大規模市政升級以及政策主導的製造業本地化,亞太地區在2024年的銷售成長中佔據主導地位,增幅達45.3%。福建新建的乙烯裂解裝置和澳洲的大型海水淡化專案推動了高效多級泵浦的採購。中國的污水再利用獎勵策略和印度的化學品生產連結獎勵計畫計劃繼續推動全球和國內泵製造商的訂單。電力強度和碳足跡的監管壓力促使營運商維修變頻器,從而推動市場規模向工業泵浦市場的高效產品線發展。

中東和非洲的複合年成長率最高,達到6.3%,這得益於沙烏地阿拉伯、卡達和阿拉伯聯合大公國總計170億美元的石化投資。 NEOM的100萬立方公尺/日海水淡化計劃等海水淡化工程需要耐氯化物應力腐蝕的高壓雙相不鏽鋼幫浦。贊比亞和剛果民主共和國的非洲採礦業擴張帶動了耐磨泥漿裝置的訂單增加。在地採購舉措促使原始設備製造商在阿曼和南非開設服務中心,從而縮短了大修週轉時間並增強了品牌忠誠度。

在《水基礎設施法案》的推動下,北美地區經歷了穩定的更新周期,加州、德克薩斯州和佛羅裡達州在離心式幫浦和立式渦輪泵的替換競標中佔據主導地位。能源政策激勵措施支持了氫電解的早期應用,並刺激了耐腐蝕循環泵的利基訂單。歐洲嚴格的MEI法規刺激了對超高效設計的需求,並促使工廠所有者重新評估整體擁有成本指標。拉丁美洲的智利和秘魯對農業灌溉泵浦和採礦業的小規模需求穩步成長。以預測性維護為特色的數位化服務提案成為各地區競標評估的決定性因素,進一步塑造了工業泵浦市場的競爭格局。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 全球水和污水處理支出不斷增加

- 擴大中東和非洲地區的石化生產能力

- 亞太地區產業基礎建設快速發展

- 綠色氫電解槽對耐腐蝕泵浦的需求

- 利用預測性維護物聯網服務模式增加售後市場收益

- 市場限制

- 鋼鐵和銅價格波動推高TCO

- 更嚴格的泵浦效率指令延遲了資本投資週期

- 乾旱經濟體轉向無動力重力微灌溉系統

- 價值鏈分析

- 技術展望

- 監管狀況

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素的影響

第5章市場規模及成長預測

- 按泵類型

- 離心式

- 往復式

- 旋轉

- 隔膜

- 進展型齲洞

- 其他

- 按動力來源

- 電動式的

- 柴油引擎

- 太陽的

- 油壓

- 氣壓

- 按最終用戶產業

- 石油和天然氣

- 水和污水

- 化工/石化

- 發電

- 礦業

- 飲食

- 製藥

- 紙漿和造紙

- 其他

- 按泵浦位置

- 水下

- 表面

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 台灣

- 其他亞太地區

- 中東和非洲

- 中東

- 土耳其

- 以色列

- 海灣合作理事會國家

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Flowserve Corporation

- Grundfos Holding A/S

- Xylem Inc.

- Sulzer Ltd.

- KSB SE & Co. KGaA

- ITT Inc.

- Ebara Corporation

- The Weir Group PLC

- Schlumberger NV(REDA Pump)

- Baker Hughes Company

- SPX FLOW Inc.

- Wilo SE

- Dover Corporation

- Pentair plc

- Franklin Electric Co. Inc.

- Tsurumi Manufacturing Co. Ltd.

- Kirloskar Brothers Ltd.

- Atlas Copco AB

- Ruhrpumpen Group

- Zoeller Company

- Roto Pumps Ltd.

- Gardner Denver LLC(Ingersoll Rand)

- ClydeUnion Pumps(Celeros Flow Tech)

- LEWA GmbH

- Graco Inc.

第7章 市場機會與未來展望

The industrial pump market size stood at USD 48.2 billion in 2025 and is set to reach USD 60.78 billion by 2030, reflecting a 4.75% CAGR.

Sustained replacement of aging municipal networks, petrochemical capacity additions, and tighter efficiency rules underpinned the market's resilience through prolonged supply-chain volatility. Capital spending on water treatment remained the single largest pull-forward of demand, with the United States alone earmarking more than USD 50 billion for water infrastructure upgrades between 2022 and 2026. Mega-projects in Qatar and Saudi Arabia continued to lift orders for high-specification pumps capable of handling corrosive, high-temperature media in ethylene crackers and gas-processing trains. Asia-Pacific retained volumetric leadership on the back of large-scale industrialization across China, India, and Southeast Asia, while the Middle East and Africa posted the fastest growth trajectory as petrochemical diversification accelerated.

Global Industrial Pump Market Trends and Insights

Rising Water and Wastewater Treatment Spending Globally

Record municipal budgets released in 2024 and early 2025 translated into larger tender volumes for high-capacity centrifugal and submersible sewage pumps. The US Environmental Protection Agency estimated long-term rehabilitation needs above USD 744 billion, prompting multi-phase upgrades such as Sioux City's USD 465 million regional facility and Cape Fear's USD 239 million Southside plant. Advanced treatment mandates drove interest in high-pressure reverse-osmosis trains, with Sulzer's vertical multistage systems underpinning Egypt's Al Mahsama drainage reclamation project. Utilities are increasingly embedding wireless sensors that stream vibration and temperature data into cloud dashboards, shortening mean-time-to-repair on critical units. Procurement frameworks began weighting total-cost-of-ownership calculations that favor energy-efficient designs, nudging buyers toward premium efficiency motors that comfortably clear EU MEI thresholds. Heightened monitoring obligations also expanded aftermarket revenue pools, anchoring recurring service contracts for OEMs.

Expansion of Petrochemical Capacity in MEA

Gulf producers pushed downstream diversification agendas, awarding EPC contracts for crackers, polymer units, and gas-processing trains that collectively require thousands of corrosion-resistant pumps. Qatar's Ras Laffan polymers complex, budgeted at USD 6 billion, incorporated a 2,080 KTA ethane cracker slated for 2027 on-stream dates. Saudi Arabia's USD 11 billion Amiral project added 1.65 million tons of ethylene nameplate capacity integrated with SATORP's refinery, multiplying demand for API 610 compliant pumps that withstand 400°F discharge temperatures. Local-content clauses inside procurement tenders intensified incentives for international OEMs to localize casing machining and final assembly. End-users prioritized variable-frequency drives to curb power draw, reinforcing adoption of smart motor controls that align with regional energy-efficiency ambitions.

Volatility in Steel and Copper Prices Inflating TCO

Copper cleared USD 10,000 per metric ton in 2024 and flirted with USD 11,000 amid looming supply deficits, hiking producer input costs by 3.5%-4.2% on copper-intensive stators and windings. Carbon-neutral steel initiatives added further unpredictability as mills passed on green-premium surcharges linked to hydrogen-based production. Manufacturers responded by tightening hedging programs, redesigning casings for material thrift, and introducing dynamic price clauses into supply contracts. End-users, meanwhile, deferred discretionary replacements, stretching the mean equipment life and tempering near-term shipment volumes in the industrial pump market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Industrial Infrastructure Build-out Across Asia-Pacific

- Demand for Corrosion-Resistant Pumps in Green-Hydrogen Electrolyzers

- Stricter Pump-Efficiency Directives Delaying Cap-ex Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Centrifugal units retained 62.4% of 2024 revenue, anchoring the industrial pump market through their proven cost-performance balance in water supply, chemical transfer, and HVAC loops. The segment generated steady aftermarket volumes, given typical mean-time-between-overhauls of three years in municipal duty cycles. However, specialty demands in viscous slurry handling shifted incremental share toward progressing cavity designs, which are projected to clock 7.8% CAGR through 2030. The progressing cavity cohort captured a rising slice of the industrial pump market size for petrochemical and mining customers that prize low-shear conveyance. Meanwhile, reciprocating and diaphragm pumps preserved critical roles in high-pressure injection and sanitary production, respectively, albeit with niche footprints. IoT retrofits became common even on legacy centrifugal sets, enabling predictive vibration analytics that cut unscheduled downtime by up to 30%.

Progressing cavity manufacturers invested heavily in wear-resistant rotor coatings to extend service intervals beyond 8,000 hours under abrasive duty. Rotary gear and peristaltic pumps addressed emerging micro-dosing tasks within battery-materials manufacturing lines, underscoring the breadth of end-use innovation. Digital twins built from sensor telemetry allowed operators to simulate cavitation risk across the hydraulic envelope, driving process-control refinements that protect impellers. Suppliers continued to emphasize modular cartridge seals that simplify maintenance and shrink spare inventory. With regulatory spotlight fixed on energy intensity, efficiency upgrades in casing volutes and diffuser vanes became a competitive must-have across all pump types in the broader industrial pump market.

Electric-driven assemblies held a commanding 78.5% share in 2024, benefitting from near-universal grid access in industrialized economies and the incremental efficiency yields of variable-frequency drives. Field data logged by Graco's QUANTM platform demonstrated up to 85% motor efficiency thanks to transverse-flux topology, reinforcing the narrative of electricity-based lifecycle cost advantage. Solar-powered solutions, however, emerged as the fastest expanding slice of the industrial pump industry, advancing at an 11.5% CAGR on the back of rural irrigation projects in Africa and South Asia. Installation costs ranging from EUR 76.23 (USD 89.13) to EUR 1,219.59 (USD 1,425.95) translated to competitive levelized costs, particularly once fuel-logistics premiums on diesel sets were factored in.

Diesel-engine packages retained strategic relevance for oilfield fracturing and emergency stormwater evacuation, where grid resilience remained questionable. Hydraulic and pneumatic drives continued to serve hazardous-area placements and mobile plant equipment that prized power density and ignition safety. Hybrid microgrid solutions that pair PV arrays with lithium-ion storage entered the pilot stage at several Indonesian mines, offering 24/7 uptime without diesel supplementation. VFD retrofits on existing electric fleets shaved energy bills by up to 20% in continuous-duty desalination applications. Altogether, the power-source mix illustrated end-user pragmatism, but electric leadership in the industrial pump market is expected to persist through the forecast horizon.

Industrial Pump Market is Segmented by Pump Type (Centrifugal, Reciprocating, Rotary, and More), Power Source (Electric, Diesel, Solar, and More), End-User Industry (Oil and Gas, Water and Waste-Water, Chemicals and Petrochemicals, Power Generation, Mining, Food and Beverage, and More), Pump Orientation (Submersible, and Surface), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated with 45.3% revenue in 2024 after decades of industrial build-out, extensive municipal upgrades, and policy-driven manufacturing localization. New ethylene cracker complexes in Fujian and large-scale desalination schemes in Australia magnified the procurement of high-efficiency multistage pumps. China's stimulus for wastewater reuse and India's Production Linked Incentive program for chemicals continued to channel orders toward both global and domestic pump manufacturers. Regulatory pushes around electricity intensity and carbon footprints incentivized operators to retrofit VFDs, nudging market volume toward premium-efficiency product lines within the industrial pump market.

The Middle East and Africa posted the fastest 6.3% CAGR, propelled by USD 17 billion in combined petrochemical investments across Saudi Arabia, Qatar, and the United Arab Emirates. Desalination, such as NEOM's 1 million m3/day seawater project, demanded high-pressure duplex-steel pumps tolerant to chloride stress-corrosion. African mining expansions in Zambia and the Democratic Republic of Congo increased orders for abrasion-resistant slurry units. Local content frameworks pushed OEMs to open service hubs in Oman and South Africa, shortening turnaround times on overhauls and reinforcing brand loyalty.

North America experienced a steady replacement cycle driven by water infrastructure bills, with California, Texas, and Florida aggregating the bulk of tenders for replacement centrifugal and vertical turbine pumps. Energy policy incentives supported early adoption of hydrogen electrolysis, sparking niche orders for corrosion-resistant circulation pumps. Europe's stringent MEI regulations stimulated demand for ultra-high-efficiency designs and encouraged plant owners to reassess total-cost-of-ownership metrics. Latin America, though smaller, witnessed steady uptake in agricultural irrigation pumps and mining-related demand in Chile and Peru. Across all regions, digital service propositions featuring predictive maintenance became a decisive factor in bid evaluations, further shaping competitive standings in the industrial pump market.

- Flowserve Corporation

- Grundfos Holding A/S

- Xylem Inc.

- Sulzer Ltd.

- KSB SE & Co. KGaA

- ITT Inc.

- Ebara Corporation

- The Weir Group PLC

- Schlumberger NV (REDA Pump)

- Baker Hughes Company

- SPX FLOW Inc.

- Wilo SE

- Dover Corporation

- Pentair plc

- Franklin Electric Co. Inc.

- Tsurumi Manufacturing Co. Ltd.

- Kirloskar Brothers Ltd.

- Atlas Copco AB

- Ruhrpumpen Group

- Zoeller Company

- Roto Pumps Ltd.

- Gardner Denver LLC (Ingersoll Rand)

- ClydeUnion Pumps (Celeros Flow Tech)

- LEWA GmbH

- Graco Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising water and waste-water treatment spending globally

- 4.2.2 Expansion of petrochemical capacity in MEA

- 4.2.3 Rapid industrial infrastructure build-out across Asia-Pacific

- 4.2.4 Demand for corrosion-resistant pumps in green-hydrogen electrolyzers

- 4.2.5 Predictive-maintenance IoT service models unlocking aftermarket revenue

- 4.3 Market Restraints

- 4.3.1 Volatility in steel and copper prices inflating TCO

- 4.3.2 Stricter pump-efficiency directives delaying cap-ex cycles

- 4.3.3 Shift to motor-less gravity micro-irrigation systems in arid economies

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Pump Type

- 5.1.1 Centrifugal

- 5.1.2 Reciprocating

- 5.1.3 Rotary

- 5.1.4 Diaphragm

- 5.1.5 Progressing Cavity

- 5.1.6 Others

- 5.2 By Power Source

- 5.2.1 Electric

- 5.2.2 Diesel

- 5.2.3 Solar

- 5.2.4 Hydraulic

- 5.2.5 Pneumatic

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Water and Waste-water

- 5.3.3 Chemicals and Petrochemicals

- 5.3.4 Power Generation

- 5.3.5 Mining

- 5.3.6 Food and Beverage

- 5.3.7 Pharmaceuticals

- 5.3.8 Pulp and Paper

- 5.3.9 Others

- 5.4 By Pump Orientation

- 5.4.1 Submersible

- 5.4.2 Surface

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Taiwan

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Turkey

- 5.5.5.1.2 Israel

- 5.5.5.1.3 GCC Countries

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Flowserve Corporation

- 6.4.2 Grundfos Holding A/S

- 6.4.3 Xylem Inc.

- 6.4.4 Sulzer Ltd.

- 6.4.5 KSB SE & Co. KGaA

- 6.4.6 ITT Inc.

- 6.4.7 Ebara Corporation

- 6.4.8 The Weir Group PLC

- 6.4.9 Schlumberger NV (REDA Pump)

- 6.4.10 Baker Hughes Company

- 6.4.11 SPX FLOW Inc.

- 6.4.12 Wilo SE

- 6.4.13 Dover Corporation

- 6.4.14 Pentair plc

- 6.4.15 Franklin Electric Co. Inc.

- 6.4.16 Tsurumi Manufacturing Co. Ltd.

- 6.4.17 Kirloskar Brothers Ltd.

- 6.4.18 Atlas Copco AB

- 6.4.19 Ruhrpumpen Group

- 6.4.20 Zoeller Company

- 6.4.21 Roto Pumps Ltd.

- 6.4.22 Gardner Denver LLC (Ingersoll Rand)

- 6.4.23 ClydeUnion Pumps (Celeros Flow Tech)

- 6.4.24 LEWA GmbH

- 6.4.25 Graco Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment