|

市場調查報告書

商品編碼

1716674

工業幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

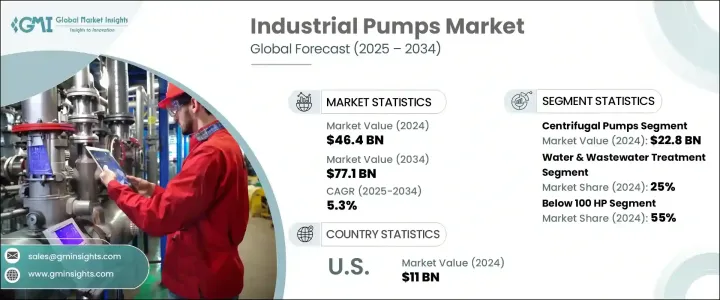

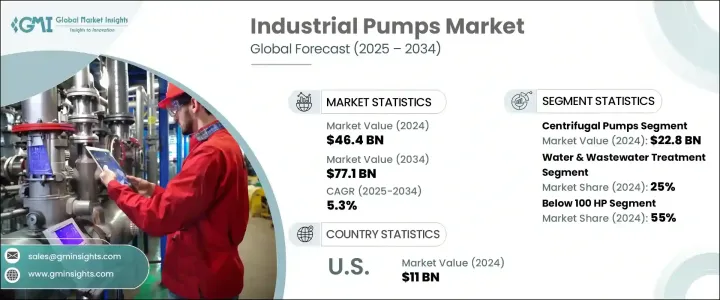

全球工業幫浦市場規模在 2024 年將達到 464 億美元,預計 2025 年至 2034 年的複合年成長率為 5.3%。這一成長主要得益於各行各業需求的不斷成長、泵送系統的技術進步以及全球工業化的快速發展。隨著經濟擴張和製造業蓬勃發展,對高效、耐用、高性能工業泵的需求不斷增加。石油和天然氣、水和廢水處理、採礦和化學品等領域的應用日益增多,推動著市場的成長。此外,向永續水管理實踐的轉變,加上日益嚴格的環境法規,進一步提升了對現代節能幫浦的需求。新興市場,尤其是亞太和拉丁美洲的新興市場,由於城市化進程加快和基礎設施建設投資增加,對工業泵的需求激增。智慧泵技術和物聯網系統的採用正在重塑產業格局,使各行各業能夠提高營運效率並降低能源消耗。

市場按泵類型細分,包括離心泵、容積泵、隔膜泵、齒輪泵、螺桿泵等。 2024 年,離心泵浦市場創造了 228 億美元的收入,這得益於其在石油和天然氣、水管理和化學加工等行業的廣泛應用。容積泵以其處理黏性流體的高效性而聞名,預計在水力壓裂應用日益增多和老化基礎設施更換的推動下,容積泵將實現穩步成長。這一趨勢在大力投資能源領域的國家尤其明顯,高性能泵浦對於最佳化開採、精煉和運輸流程至關重要。隨著各行各業都專注於提高生產力和減少停機時間,對可靠性和運作效率高的先進泵送系統的需求不斷上升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 464億美元 |

| 預測值 | 771億美元 |

| 複合年成長率 | 5.3% |

工業泵市場進一步按最終用途行業細分,包括水和廢水處理、化學品、石化產品、採礦、食品和飲料、建築、石油和天然氣、製藥、海洋、紙漿和造紙等。 2024 年,水和廢水處理將佔據 25% 的市場佔有率,反映出在快速城市化和工業成長的背景下,對清潔水管理的需求日益成長。隨著人口的成長,特別是在發展中地區,對高效水處理和廢水管理解決方案的需求不斷增加。泵浦在採礦業中也發揮著至關重要的作用,其中排水泵可以排出礦井中多餘的水,以確保安全和營運效率。此外,食品和飲料行業嚴重依賴專用泵進行衛生加工並保持產品完整性。

美國工業泵浦市場佔 80% 的佔有率,2024 年產值達 110 億美元。這種主導地位歸因於技術進步、工業活動日益活躍以及對永續水管理的日益關注。美國石油和天然氣行業,特別是頁岩油生產,仍然是工業泵需求的重要驅動力,工業泵廣泛用於開採、精煉和運輸等過程。此外,採礦業對美國經濟的貢獻,加上其在為建築、汽車和航太等行業供應必需材料方面發揮的關鍵作用,進一步支持了對工業泵的強勁需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 終端使用產業需求不斷成長

- 全球工業化和製造業擴張

- 產業陷阱與挑戰

- 高資本投入

- 能耗高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按泵類型,2021-2034

- 主要趨勢

- 離心泵

- 容積泵

- 隔膜泵

- 齒輪泵浦

- 螺桿泵

- 其他(活塞泵、螺桿泵等)

第6章:市場估計與預測:按電源,2021-2034

- 主要趨勢

- 電動和太陽能泵

- 柴油泵

- 其他(汽油、太陽能等)

第7章:市場估計與預測:按流量,2021-2034

- 主要趨勢

- 低於100立方米/小時

- 100 - 500 立方米/小時

- 高於500立方米/小時

第8章:市場估計與預測:按功率,2021-2034

- 主要趨勢

- 低於100 HP

- 100 - 500 馬力

- 500 以上

第9章:市場估計與預測:依技術,2021-2034

- 主要趨勢

- 傳統的

- 聰明的

第 10 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 水和廢水處理

- 化學品和石化產品

- 礦業

- 食品和飲料

- 建造

- 石油和天然氣

- 製藥

- 海洋

- 紙漿和造紙

- 其他(農業、紡織等)

第 11 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第13章:公司簡介

- Atlas Copco

- Ebara

- Flowserve

- Gardner Denver

- Gorman-Rupp

- Grundfos

- ITT

- Kirloskar

- KSB

- SPX Flow

- Sulzer

- Tsurumi

- Weir

- Wilo

- Xylem

The Global Industrial Pumps Market, valued at USD 46.4 billion in 2024, is projected to grow at a CAGR of 5.3% from 2025 to 2034. This growth is primarily driven by rising demand across various industries, technological advancements in pumping systems, and rapid industrialization worldwide. As economies expand and manufacturing sectors thrive, the need for efficient, durable, and high-performance industrial pumps continues to escalate. Increasing applications in sectors such as oil and gas, water and wastewater treatment, mining, and chemicals are fueling market growth. Moreover, the transition toward sustainable water management practices, coupled with rising environmental regulations, has further elevated the need for modern and energy-efficient pumps. Emerging markets, especially in Asia Pacific and Latin America, are witnessing surging demand for industrial pumps due to rapid urbanization and increasing investments in infrastructure development. The adoption of smart pump technologies and IoT-enabled systems is reshaping the landscape, allowing industries to improve operational efficiency and reduce energy consumption.

The market is segmented by pump type, including centrifugal pumps, positive displacement pumps, diaphragm pumps, gear pumps, screw pumps, and others. In 2024, the centrifugal pumps segment generated USD 22.8 billion, owing to its widespread application in industries such as oil and gas, water management, and chemical processing. Positive displacement pumps, known for their efficiency in handling viscous fluids, are expected to witness steady growth, driven by increasing use in hydraulic fracturing and the replacement of aging infrastructure. This trend is particularly noticeable in countries investing heavily in their energy sectors, where high-performance pumps are essential for optimizing extraction, refining, and transportation processes. As industries focus on enhancing productivity and minimizing downtime, the demand for advanced pumping systems that offer reliability and operational efficiency continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.4 Billion |

| Forecast Value | $77.1 Billion |

| CAGR | 5.3% |

The industrial pumps market is further segmented by end-use industries, including water and wastewater treatment, chemicals, petrochemicals, mining, food and beverages, construction, oil and gas, pharmaceuticals, marine, pulp and paper, and others. Water and wastewater treatment accounted for a 25% market share in 2024, reflecting the growing need for clean water management amid rapid urbanization and industrial growth. As population increases, especially in developing regions, the need for efficient water treatment and wastewater management solutions continues to intensify. Pumps also play a critical role in the mining industry, where dewatering pumps remove excess water from mines to ensure safety and operational efficiency. Additionally, the food and beverage sector relies heavily on specialized pumps for hygienic processing and maintaining product integrity.

The United States Industrial Pumps Market commanded an 80% share, generating USD 11 billion in 2024. This dominance is attributed to technological advancements, growing industrial activity, and an increasing focus on sustainable water management. The U.S. oil and gas industry, particularly shale oil production, remains a significant driver of demand for industrial pumps, which are used extensively in processes such as extraction, refining, and transportation. Additionally, the mining sector's contributions to the U.S. economy, coupled with its critical role in supplying essential materials to industries like construction, automotive, and aerospace, further support the robust demand for industrial pumps.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand from end use industries

- 3.6.1.2 Global industrialization and manufacturing expansion

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High capital investment

- 3.6.2.2 High energy consumption

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Centrifugal pumps

- 5.3 Positive displacement pumps

- 5.4 Diaphragm pumps

- 5.5 Gear pumps

- 5.6 Screw pumps

- 5.7 Others (piston pumps, progressive cavity pumps, etc.)

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric & solar pumps

- 6.3 Diesel pumps

- 6.4 Others (gasoline solar etc.)

Chapter 7 Market Estimates & Forecast, By Flow Rate, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 100 m³/h

- 7.3 100 - 500 m³/h

- 7.4 Above 500 m³/h

Chapter 8 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 100 HP

- 8.3 100 - 500 HP

- 8.4 Above 500 HP

Chapter 9 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Conventional

- 9.3 Smart

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Water & wastewater treatment

- 10.3 Chemicals and petrochemicals

- 10.4 Mining

- 10.5 Food and beverages

- 10.6 Construction

- 10.7 Oil & gas

- 10.8 Pharmaceutical

- 10.9 Marine

- 10.10 Pulp & paper

- 10.11 Others (agricultural, textile etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Atlas Copco

- 13.2 Ebara

- 13.3 Flowserve

- 13.4 Gardner Denver

- 13.5 Gorman-Rupp

- 13.6 Grundfos

- 13.7 ITT

- 13.8 Kirloskar

- 13.9 KSB

- 13.10 SPX Flow

- 13.11 Sulzer

- 13.12 Tsurumi

- 13.13 Weir

- 13.14 Wilo

- 13.15 Xylem