|

市場調查報告書

商品編碼

1844719

風力發電機複合材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Wind Turbine Composite Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

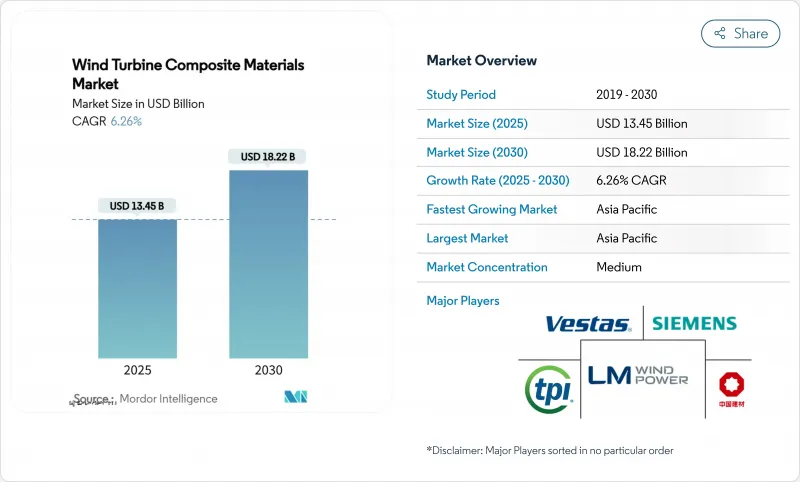

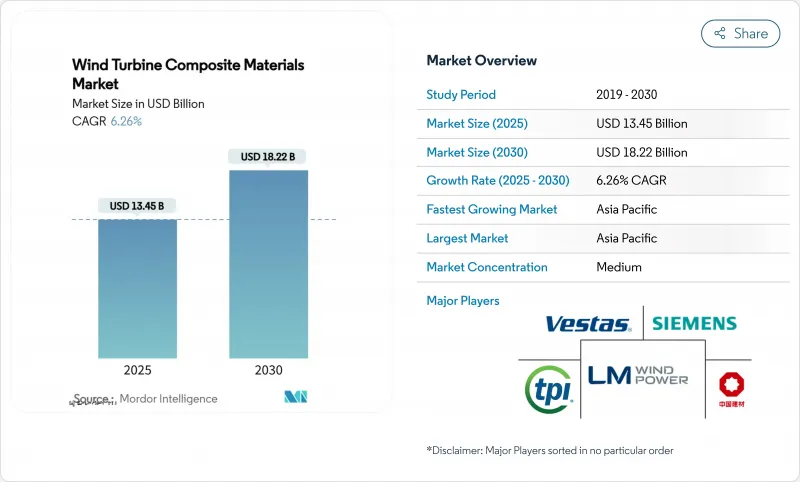

風力發電機複合材料市場規模預計在 2025 年為 134.5 億美元,預計到 2030 年將達到 182.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.26%。

長度超過100公尺的葉片的廣泛應用,以及更輕的玻璃纖維、碳纖維和混合纖維架構,正在推動每台渦輪機的材料含量不斷提高,並鼓勵供應商擴大亞太和歐洲地區的產能。英國的差價合約 (CfD) 預算以及中國2024年新增裝置容量117吉瓦的目標等政策獎勵,確保了多年的訂單前景,並加速了整個風力發電機複合材料市場的自動化和垂直整合策略。

全球風力發電機複合材料市場趨勢與洞察

陸上和離岸風力渦輪機容量的增加推動了對先進複合材料的需求

目前,全球風力發電機的額定功率通常超過15兆瓦,葉片長度超過115米,結構負荷也隨之增加,只有先進的複合材料才能承受。維斯塔斯V236-15兆瓦平台上115.5米長的葉片和西門子歌美颯保密的21.5兆瓦原型機體現了這種規模的擴大,這需要增加每個轉子的複合材料用量,同時需要更輕的碳纖維增強翼梁帽來提高剛度和抗疲勞性。英國的目標是到2030年將其海上發電能力提升至50吉瓦,這鞏固了其對高性能層壓系統(可在高腐蝕性海洋環境中提供25年的設計壽命)的長期支持。

政府脫碳政策加速複合材料的採用

英國12億美元差價合約融資輪專注於離岸風力發電,中國將在2024年實現創紀錄的117吉瓦風電裝置容量,等一系列支持性框架確保了數吉瓦的競標管道,並降低了新複合材料工廠的投資風險。清潔產業獎勵計畫旨在獎勵低碳供應鏈,鼓勵本地葉片生產和更環保的樹脂化學。 《歐洲綠色交易》的2030年可再生能源目標,加上德國80%的清潔電力目標,正在加強風力發電機複合材料的整體需求前景,激勵維斯塔斯、艾爾姆風電和中國玻璃纖維巨頭擴大產能。碳定價和可再生能源證書進一步提高了計劃經濟性,確保了對輕質、耐用和可回收複合材料的持續需求。

碳纖維價格波動抑制高階用途

由於對長度超過100公尺的葉片的需求激增,預計到2027年,碳消費量將增加兩倍,但產能擴張緩慢導致價格上漲,阻礙了成本敏感型渦輪機的廣泛應用。中國市場在2023年吸收了6.9萬噸碳纖維,但由於出口限制和地緣政治摩擦擾亂了供應鏈,市場波動劇烈。因此,原始設備製造商正在尋求玻璃-碳混合架構,並透過在地採購來對沖波動性。在2030年全球風力發電機複合材料產量達到預計的45萬噸之前,風力發電機複合材料市場將不得不應對波動的投入成本。

細分分析

由於有利的成本和強勁的供應鏈,玻璃纖維將在2024年繼續佔風力發電機複合材料市場71.66%的主導佔有率。然而,由於原始設備製造商追求減重,以使更長的轉子能夠承受更高的葉尖速度且不會產生過大負荷,碳纖維的複合年成長率將達到7.11%。 LM Wind Power的88.4公尺葉片採用碳纖維/玻璃纖維混合翼梁帽,在不增加成本的情況下減輕了重量。

此外,編織碳纖維的成本比航太級碳纖維低40%,其應用正在推動中型渦輪機市場的採用率上升。天然纖維混紡提供了一個永續的利基市場,棕櫚和亞麻混紡纖維既能滿足關鍵的機械指標,又能降低能耗。在預測期內,風力發電機複合材料市場將繼續在剛度、疲勞壽命和經濟性之間尋求平衡,而混合策略仍然至關重要。

環氧樹脂系統憑藉其獨特的性能,到2024年將佔據34.88%的收入佔有率,其中聚酯/乙烯基酯和聚氨酯共混物的複合年成長率最高,為7.45%。聚氨酯注射成型製程經驗證可縮短10-25%的循環時間,並改善浸潤性,是無需大量資本投入即可提高年產量的有力選擇。

對可減少30-40%生命週期排放的生物基化學品的需求正在推動配方研發,用於風力渦輪機複合材料的綠色風力發電機市場也在不斷擴大,尤其是在歐洲,那裡的競標中已經採用了碳足跡披露。 Baxodur固化劑和降低放熱峰的添加劑包將進一步增強環氧樹脂的競爭力,使多種樹脂類別能夠共存到2030年。

風力發電機複合材料報告按纖維類型(玻璃纖維、碳纖維、天然/混合纖維)、樹脂類型(環氧樹脂、聚酯/乙烯基酯樹脂、聚氨酯、熱塑性樹脂)、技術(真空灌注、預浸料等)、應用(風力葉片、機艙、鼻錐等)和地區(亞太地區、北美、歐洲等)細分。市場預測以美元計算。

區域分析

亞太地區仍將是風力發電機複合材料市場的主導地區,到2024年,該地區將佔全球總收入的46.44%,複合年成長率為6.99%。中國預計2024年新增117吉瓦的風力發電機,創歷史新高。此外,中國國內木材法規對中國巨石和太平洋保險有利,這將支撐其無與倫比的供應鏈佈局,使其能夠在全球範圍內出口原料和成品葉片。

歐洲也緊隨其後,採用成熟的技術並制定嚴格的永續性法規。英國計畫在2030年部署50吉瓦的離岸風力發電,德國設定了80%清潔電力的目標,法國則大力推行循環經濟,這些舉措正在推動歐洲製造商轉向可回收熱塑性塑膠和閉模成型。

在北美,聯邦稅額扣抵和州政府採購相結合,正在擴大大平原陸上風電船隊規模,並為沿海風力發電廠提供電力。美國能源局預測,到2027年,複合複合材料需求將成長三倍,這將促使TPI Composites和GE Burnova等公司投資於翼梁帽和根部插件的本地化生產。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場促進因素

- 陸上和離岸風力渦輪機容量的增加將推動對更輕、更長葉片的需求。

- 政府的脫碳目標和 CFD競標加速了風力發電的發展。

- 節省成本的聚氨酯灌注樹脂縮短了週期時間

- 生物基/可回收熱塑性系統為 ESG 融資開啟了新的可能性

- 智慧織物相容複合材料促進葉片數位雙胞胎

- 市場限制

- 碳纖維價格和供應波動

- 即將推出的複合材料雙酚A和苯乙烯排放限制

- 新興樞紐缺乏技術純熟勞工來注入尖端技術

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依纖維類型

- 玻璃纖維

- 碳纖維

- 天然/混合纖維

- 依樹脂類型

- 環氧樹脂

- 聚酯/乙烯基酯

- 聚氨酯

- 熱塑性樹脂

- 依技術

- 真空灌注

- 預浸料

- 手工積層

- 纏繞成型

- 按用途

- 風刃

- 引擎室和鼻錐

- 輪圈、蓋板、輔助零件

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 策略舉措

- 市佔率分析

- 公司簡介

- AVIC Huiteng Windpower

- BASF

- China Jushi Co., Ltd.

- Covestro AG

- Exel Composites

- Gurit Holding AG

- Hexcel Corporation

- INCA Renewtech

- Lianyungang Zhongfu Lianzhong Composite Material Group Co., Ltd

- LM WIND POWER

- Molded Fiber Glass Companies

- Owens Corning

- Reliance Industries Limited

- SGL Carbon

- Siemens AG

- Sinoma Science & Technology Co.,Ltd.

- Teijin Limited

- TORAY INDUSTRIES, INC.

- TPI Composites

- Vestas

- Zhongfu Lianzhong Group

第7章 市場機會與未來展望

The Wind Turbine Composite Materials Market size is estimated at USD 13.45 billion in 2025, and is expected to reach USD 18.22 billion by 2030, at a CAGR of 6.26% during the forecast period (2025-2030).

Widespread adoption of blades longer than 100 m, supported by lighter glass-, carbon- and hybrid-fiber architectures, is raising material content per turbine and pushing suppliers to expand capacity in Asia Pacific and Europe. Policy incentives such as the United Kingdom's Contracts for Difference (CfD) budget and China's 117 GW of new 2024 installations assure multi-year order visibility and accelerate automation and vertical integration strategies across the wind turbine composites market.

Global Wind Turbine Composite Materials Market Trends and Insights

Increasing Onshore and Offshore Turbine Capacities Drive Demand for Advanced Composites

Global turbine ratings now routinely exceed 15 MW offshore, pushing blade lengths past 115 m and multiplying structural loads that only advanced composites can withstand. Vestas' 115.5 m-long blades on the V236-15 MW platform and Siemens Gamesa's confidential 21.5 MW prototype exemplify the scale-up that magnifies composite volume per rotor while simultaneously mandating lighter carbon-reinforced spar caps for stiffness and fatigue resistance. The United Kingdom alone aims to raise offshore capacity to as much as 50 GW by 2030, a target that cements long-term pull for high-performance laminate systems able to deliver a 25-year design life in corrosive marine environments.

Government Decarbonization Policies Accelerate Composite Material Adoption

Supportive frameworks, such as the United Kingdom's USD 1.2 billion CfD round dedicated to offshore wind and China's record 117 GW of 2024 wind installations, lock in multi-gigawatt auction pipelines and de-risk investments in new composite plants. Clean-industry bonus mechanisms that reward low-carbon supply chains are encouraging local blade production and greener resin chemistries. The European Green Deal's binding 2030 renewables targets, along with Germany's 80% clean-power ambition, consolidate demand visibility across the wind turbine composites market and motivate capacity expansions from Vestas, LM Wind Power, and Chinese glass-fiber majors. Carbon pricing and renewable energy certificates further boost project economics, ensuring sustained pull for lightweight, durable, and recyclable composites.

Carbon Fiber Price Volatility Constrains Premium Applications

Surging demand for 100 m-plus blades is expected to triple carbon consumption by 2027, yet capacity expansions lag, creating price spikes that discourage wider uptake in cost-sensitive turbines. China's market, which absorbed 69,000 t of carbon fiber in 2023, saw sharp swings as export restrictions and geopolitical frictions disrupted supply chains. OEMs, therefore, pursue hybrid glass-carbon architectures and localized sourcing to hedge volatility. Until additional lines lift global output toward the 450,000 tons predicted for 2030, the wind turbine composites market must navigate erratic input costs.

Other drivers and restraints analyzed in the detailed report include:

- Polyurethane Infusion Resins Transform Manufacturing Economics

- Bio-based Thermoplastic Systems Enable Circular-Economy Transition

- Regulatory Emission Limits Drive Manufacturing-Process Transformation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass fiber retained a dominant 71.66% share of the wind turbine composites market in 2024, underpinned by favorable cost and robust supply chains. Carbon, however, is growing at 7.11% CAGR as OEMs chase mass reductions that let longer rotors survive higher tip speeds without excess loads. LM Wind Power's hybrid carbon/glass spar caps on its 88.4 m blade validated weight cuts without cost blowouts.

Incremental uptake also stems from textile-based carbon fibers that are 40% cheaper than aerospace grades, unlocking mid-tier turbine segments. Natural-fiber blends offer sustainable niches, with palm or flax hybrids matching key mechanical metrics while lowering embodied energy. Over the forecast horizon, hybridization strategies will remain pivotal as the wind turbine composites market balances stiffness, fatigue life and affordability.

Epoxy systems held 34.88% revenue share in 2024, thanks to well-characterized performance, yet polyester/vinyl-ester and polyurethane blends are tracking the fastest 7.45% CAGR. Proven 10-25% cycle-time savings and improved wet-out make polyurethane infusion the prime candidate for stretching annual output without large capex.

Demand for bio-based chemistries that curb life-cycle emissions by 30-40% will steer formulation research and development, broadening the wind turbine composites market size for greener resins, particularly in Europe, where carbon-footprint disclosures already feature in tenders. Baxxodur curing agents and additive packages that cut exotherm peaks further enhance epoxy competitiveness, ensuring multiple resin classes co-exist through 2030.

The Wind Turbine Composite Materials Report is Segmented by Fiber Type (Glass Fiber, Carbon Fiber, Natural/Hybrid Fibers), Resin Type (Epoxy, Polyester/Vinyl-Ester, Polyurethane, Thermoplastic Resins), Technology (Vacuum Infusion, Prepreg, and More), Application (Wind Blades, Nacelles and Nose Cones, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific, at 46.44% of 2024 revenue, remains the anchor region for the wind turbine composites market and posts a leading 6.99% CAGR. China's record 117 GW of 2024 additions, supported by local-content rules favoring China Jushi and CPIC, underpin an unrivaled supply-chain footprint that exports both raw fabrics and finished blades worldwide.

Europe follows with mature technology adoption and rigorous sustainability regulations. The United Kingdom's ambition to reach up to 50 GW of offshore wind by 2030, Germany's 80% clean-power target, and France's circular-economy mandates push European makers toward recyclable thermoplastics and closed molding.

North America couples federal tax credits with state procurement to expand onshore fleets in the Great Plains and repower coastal wind zones. The U.S. Department of Energy forecasts composite demand tripling by 2027, propelling investments from TPI Composites and GE Vernova that localize spar-cap and root-insert production.

- AVIC Huiteng Windpower

- BASF

- China Jushi Co., Ltd.

- Covestro AG

- Exel Composites

- Gurit Holding AG

- Hexcel Corporation

- INCA Renewtech

- Lianyungang Zhongfu Lianzhong Composite Material Group Co., Ltd

- LM WIND POWER

- Molded Fiber Glass Companies

- Owens Corning

- Reliance Industries Limited

- SGL Carbon

- Siemens AG

- Sinoma Science & Technology Co.,Ltd.

- Teijin Limited

- TORAY INDUSTRIES, INC.

- TPI Composites

- Vestas

- Zhongfu Lianzhong Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Increasing Onshore and Offshore Turbine Capacities Drive the Need for Lighter, Longer Blades.

- 4.1.2 Government Decarbonization Goals and CFD Auctions are Speeding Up Wind Energy Development.

- 4.1.3 Cost-Saving Polyurethane Infusion Resins Shorten Cycle Time

- 4.1.4 Bio-Based/Recyclable Thermoplastic Systems Unlock ESG Finance

- 4.1.5 Composites Compatible with Smart Fabrics Facilitate Digital Twinning of Blades.

- 4.2 Market Restraints

- 4.2.1 Carbon-Fiber Price and Supply Volatility

- 4.2.2 Upcoming BPA and Styrene Emission Limits for Composites

- 4.2.3 Skilled-Labour Deficit in Advanced Infusion for Emerging Hubs

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Fiber Type

- 5.1.1 Glass Fiber

- 5.1.2 Carbon Fiber

- 5.1.3 Natural/Hybrid Fibers

- 5.2 By Resin Type

- 5.2.1 Epoxy

- 5.2.2 Polyester/Vinyl-Ester

- 5.2.3 Polyurethane

- 5.2.4 Thermoplastic Resins

- 5.3 By Technology

- 5.3.1 Vacuum Infusion

- 5.3.2 Prepreg

- 5.3.3 Hand Lay-up

- 5.3.4 Filament Winding / Pultrusion

- 5.4 By Application

- 5.4.1 Wind Blades

- 5.4.2 Nacelles and Nose Cones

- 5.4.3 Hubs, Covers and Ancillary Parts

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 AVIC Huiteng Windpower

- 6.3.2 BASF

- 6.3.3 China Jushi Co., Ltd.

- 6.3.4 Covestro AG

- 6.3.5 Exel Composites

- 6.3.6 Gurit Holding AG

- 6.3.7 Hexcel Corporation

- 6.3.8 INCA Renewtech

- 6.3.9 Lianyungang Zhongfu Lianzhong Composite Material Group Co., Ltd

- 6.3.10 LM WIND POWER

- 6.3.11 Molded Fiber Glass Companies

- 6.3.12 Owens Corning

- 6.3.13 Reliance Industries Limited

- 6.3.14 SGL Carbon

- 6.3.15 Siemens AG

- 6.3.16 Sinoma Science & Technology Co.,Ltd.

- 6.3.17 Teijin Limited

- 6.3.18 TORAY INDUSTRIES, INC.

- 6.3.19 TPI Composites

- 6.3.20 Vestas

- 6.3.21 Zhongfu Lianzhong Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Government net-zero targets are accelerating global wind power installations.