|

市場調查報告書

商品編碼

1844646

中東和非洲的雷射雷達:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Middle East And Africa LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

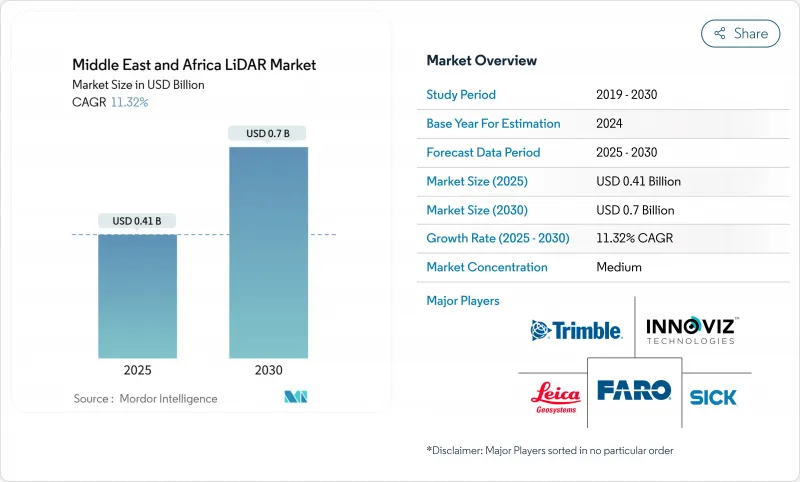

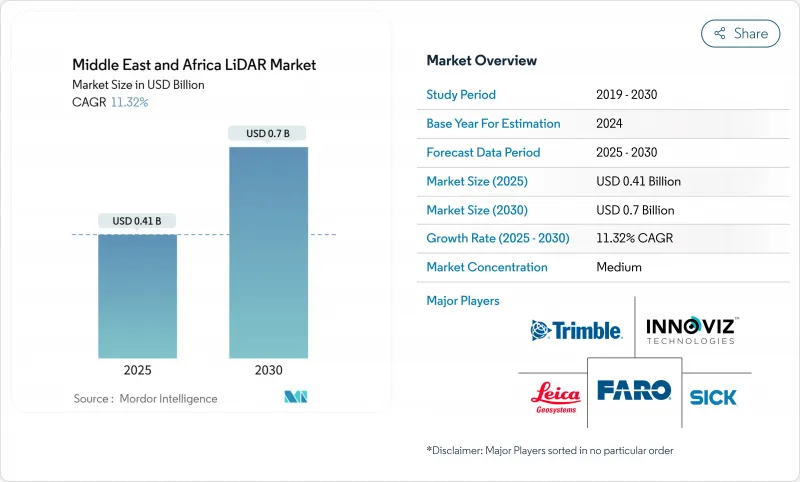

中東和非洲雷射雷達市場預計到 2025 年將達到 4.1 億美元,到 2030 年將達到 7 億美元,複合年成長率為 11.32%。

沙烏地阿拉伯「2030願景」下計劃的快速推進、海灣地區智慧城市計畫的擴張以及南部非洲持續的基礎設施支出,正在推動對高精度3D空間數據的需求。雷射雷達正擴大與人工智慧相結合,用於自動特徵提取,從而縮短了施工監控和資產檢查的計劃週期。蓋格模式感測器等固態技術的進步正在減小尺寸、重量、功耗和成本,使其能夠部署在能夠承受沙漠酷熱和塵土的無人機上。汽車製造商正在將雷射雷達納入高級駕駛輔助系統 (ADAS),以支持阿拉伯聯合大公國到2030年將25%的城市出行轉向自動駕駛汽車的計畫。

中東和非洲 LiDAR 市場趨勢與洞察

海灣合作理事會 (GCC) 智慧城市數位雙胞胎強制使用LiDAR

海灣國家政府目前要求對城市資產進行亞厘米級數位複製,這使得雷射雷達成為地下公用設施測繪、交通流量最佳化和碳足跡分析的關鍵技術。杜拜市政府正在利用行動掃描器對地下管道和電纜進行建模,以減少計劃外停電和挖掘返工。在卡達,盧薩爾市政府耗資6000萬美元的智慧城市平台處理持續的雷射雷達數據,以管理45萬居民的服務。公共計劃正在強制採用建築資訊模型(BIM),其中雷射雷達點雲資料直接流入標準化施工模型,從而消除資料格式瓶頸。由此產生的統一規劃方法可以加快核准並減少生命週期成本超支。海灣合作理事會(GCC)當局也將雷射雷達採購與雲端分析捆綁在一起,並鼓勵當地資料中心遵守主權法規。

沙烏地阿拉伯計劃中基於無人機的線路測量製圖激增

像 NEOM 長達 170 公里的「線狀城市」這樣備受矚目的項目,需要每週對大片區域進行地形更新,而傳統測繪技術根本無法及時覆蓋。配備中程LiDAR的旋翼無人機現在每天可以繪製多達 100 英畝的地圖,精度可達 1-3 厘米,將進度追蹤週期縮短了 70%。像 Aeromotus 這樣的專業承包商提供承包即服務套餐,將飛行計劃、掃描和雲端處理融為一體。由此產生的數位雙胞胎使承包商能夠將設計意圖與竣工狀況進行比較,從而能夠及早發現土方工程的偏差。對於高速鐵路支線和海水淡化管道等線性基礎設施,快速的走廊更新可以減少變更單的頻率,並滿足交付里程碑。

缺乏本地校準實驗室延長了前置作業時間

由於利雅德和約翰尼斯堡之間僅有少數幾家獲得認證的實驗室,大多數業者被迫將感測器送往歐洲進行年度重新校準。物流延誤可能長達12週,導致施工高峰期的車隊運轉率降低。大型承包商的應對措施是從ClearSkies Geomatics等供應商租用預校準設備。瓶頸問題也阻礙了先進固態雷射雷達的普及,這類設備通常需要較短的服務週期才能保持保證的規格。一些海灣自由區已宣佈為外國稱重設備製造商開設分店提供激勵措施,但預計要到2027年才能實現有效產能。

細分分析

到2024年,機載平台將佔據中東和非洲雷射雷達市場規模的55%,這得益於其能夠勘測乾旱地區大型計劃的足跡。沙烏地阿拉伯的工程公司使用直升機和固定翼宣傳活動每週更新挖填工程量,並透過儀表板標記進度延誤。傾斜攝影測量結合密集點雲數據,可視覺化影響道路走向的岩壁和沙漠乾谷。航空掃描技術也有助於監測奈米比亞的海岸侵蝕,利用綠色波長雷射脈衝測量旅遊海灘沿岸的流動沙丘。

地面掃描儀的市佔率較小,但隨著市政當局對下水道、橋樑和歷史建築建築幕牆數位化,其複合年成長率將達到14.11%。穿戴式系統無需GPS即可繪製多層隧道地圖,使檢查員能夠檢測瓷磚後面剝落的混凝土。中東和非洲的雷射雷達市場正受益於即時記錄掃描數據的SLAM演算法,這使得碰撞檢測報告能夠在一夜之間發布,而之前需要一周時間。微型硬體現在允許兩名工人在一夜之間捕捉整個地鐵站,從而使頂級承包商以外的人也能獲得高精度文件。

飛行時間(ToF) 相機佔 2024 年銷售額的 63%,這得益於其在阿拉伯半島塵土飛揚的風和強烈陽光下的出色表現。電力公司正在採用 ToF 設備進行電力線路走廊的間隙檢查,以避免因植被相關的停電而導致煉油廠停產。此外,供應商的藍圖還包括推出人眼安全的 1550 nm 雷射器,其作用距離超過 3 公里,從而擴大其在露天礦邊坡分析中的應用。

蓋格模式感測器的預期複合年成長率為 13.11%,而超高點密度技術則加速了環境建模。加蓬森林碳計劃利用此技術來最佳化生物量估算。高空作業支援 366 平方公里/小時的覆蓋範圍,只需一次飛機飛行即可完成全國範圍的 DEM 更新。正在進行的壓縮感知研究預計將在不增加資料量的情況下將解析度提高 64 倍,使其適用於即時洪水模擬。

中東和非洲LiDAR市場佔有率報告按產品(機載LiDAR、地基LiDAR、其他)、技術(飛行時間、蓋格模式、其他)、組件(雷射掃描儀、GPS、其他)、部署平台(基於無人機、其他)、測量範圍(短程、其他)、終端行業(工程、其他)和國家(沙烏地阿拉伯、其他)細分。市場規模和預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 海灣合作理事會 (GCC) 智慧城市數位雙胞胎強制使用LiDAR

- 沙烏地阿拉伯計劃中基於無人機的線路測量製圖激增

- 奈米比亞和南非離岸風力發電的水深測量需求

- 阿拉伯聯合大公國關鍵地點的安全主導周邊監控

- 銅金露天礦高解析度地形測量

- 尼羅河流域氣候變遷適應洪氾區模型

- 市場限制

- 缺乏本地校準實驗室會增加前置作業時間

- 非海灣合作理事會非洲國家 3B 類雷射進口關稅

- 海灣國家以外的 GNSS 參考站密度低

- 北非衝突後公共部門資本支出低

- 價值/供應鏈分析

- 監管和技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 投資分析

第5章市場規模及成長預測

- 按產品

- 機載LiDAR

- 機械掃描

- 固體掃描

- 依技術

- 地基LiDAR

- 飛行時間

- 蓋格模式

- 相移

- 閃光雷射雷達

- 按組件

- 雷射掃描儀

- GPS/GNSS接收器

- 慣性測量單元

- 攝影機和 MEMS 鏡

- 其他組件

- 按部署平台

- 地面型靜力三腳架

- 基於無人機/無人駕駛飛機

- 移動式製圖(車載)

- 水深測量/航空水文測量

- 按距離

- 短距離

- 中距離

- 遠距

- 按行業

- 工程與建築

- 石油和天然氣

- 航太/國防

- 汽車和ADAS

- 採礦和採石業

- 農業/林業

- 按國家

- 沙烏地阿拉伯

- 卡達

- 科威特

- 阿拉伯聯合大公國

- 南非

- 肯亞

- 其他中東和非洲地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Leica Geosystems AG

- Sick AG

- Ouster Inc.

- Cepton Technologies Inc.

- Hexagon AB

- MENA 3D

- Sandvik Mining and Rock Solutions

- Trimble Inc.

- FARO Technologies Inc.

- RIEGL Laser Measurement Systems

- Quanergy Systems Inc.

- LightWare LiDAR LLC

- GlobalScan Technologies LLC

- Microdrones GmbH

- Innoviz Technologies Ltd

- Velodyne Lidar Inc.

- Teledyne Optech

- Topcon Positioning Group

- Falcon-3D

- Sitech Gulf

- DJI Enterprise

第7章 市場機會與未來展望

The Middle East and Africa LiDAR market stands at USD 0.41 billion in 2025 and is projected to reach USD 0.7 billion by 2030, reflecting an 11.32% CAGR.

Rapid rollout of giga-projects under Saudi Vision 2030, expanding smart-city programs across the Gulf, and sustained infrastructure spending in Southern Africa are intensifying demand for high-precision, three-dimensional spatial data. Increased pairing of LiDAR with artificial intelligence for automated feature extraction is shortening project cycles in construction monitoring and asset inspection. Solid-state advances such as Geiger-mode sensors are reducing size, weight, power, and cost, enabling deployment on drones that can tolerate harsh desert heat and dust. Automotive original-equipment manufacturers are incorporating LiDAR into advanced driver assistance systems, supported by the UAE plan that requires 25% of city journeys to shift to autonomous vehicles by 2030.

Middle East And Africa LiDAR Market Trends and Insights

LiDAR Mandate for Smart-City Digital Twins in GCC

Gulf governments now require sub-centimeter digital replicas of city assets, making LiDAR indispensable for underground-utility mapping, traffic-flow optimisation, and carbon-footprint analysis. Dubai Municipality is applying mobile scanners to model buried pipes and cables, cutting unplanned outages and excavation re-works. In Qatar, a USD 60 million smart-city platform for Lusail City processes continuous LiDAR feeds to manage 450,000 residents' services. Mandatory BIM adoption in public projects ensures that LiDAR point clouds flow directly into standardised construction models, removing data-format bottlenecks. The result is a unified planning approach that speeds permit approvals and reduces lifecycle cost overruns. GCC authorities also bundle LiDAR procurement with cloud analytics, encouraging local data-centres that comply with sovereignty rules.

Surge in UAV-Borne Corridor Mapping for Saudi Giga-Projects

High-profile programmes such as NEOM's 170 km linear city require weekly topographic updates over vast tracts that conventional surveys cannot cover in time. Rotary-wing drones equipped with medium-range LiDAR now map up to 100 acres per day at 1-3 cm accuracy, slashing progress-tracking cycles by 70%. Specialist operators like Aeromotus supply turnkey drone-as-a-service packages that combine flight planning, scanning, and cloud processing. Resulting digital twins allow contractors to compare design intent with as-built conditions, catching earthwork deviations early. For linear infrastructure such as high-speed rail spines and desalination pipelines, rapid corridor updates reduce change-order frequency and safeguard delivery milestones.

Scarcity of Regional Calibration Labs Inflating Lead-Times

Only a handful of accredited laboratories exist between Riyadh and Johannesburg, forcing most operators to ship sensors to Europe for annual recalibration. Logistics lags can stretch to 12 weeks, freezing fleet availability during peak construction phases. Larger contractors respond by leasing pre-calibrated units from providers such as ClearSkies Geomatics, while smaller firms idle crews and absorb liquidated damages. The bottleneck also hampers adoption of advanced solid-state LiDAR, which often requires shorter service cycles to uphold warranty specifications. Several Gulf free-zones have announced incentives for foreign metrology houses to open branches, yet timelines suggest meaningful capacity will not arrive before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Offshore Wind-Farm Bathymetry Needs Off Namibia and South Africa

- Security-Driven Perimeter Surveillance at UAE Critical Sites

- Limited GNSS Reference-Station Density Outside Gulf States

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aerial platforms generated 55% of the Middle East and Africa LiDAR market size in 2024, a position rooted in their ability to survey giga-project footprints that sprawl across arid terrains. Saudi engineering firms rely on helicopter and fixed-wing campaigns to update cut-and-fill quantities weekly, feeding dashboards that flag schedule slippage. The combination of oblique photogrammetry with high-density point clouds helps planners visualise rock-cut faces and desert wadis that influence road alignments. Aerial scanning also underpins coastal-erosion monitoring in Namibia, where green-wavelength laser pulses measure dune migration along tourist beaches.

Ground-based scanners, though holding a smaller share, are slated for 14.11% CAGR as municipalities digitise sewers, bridges, and heritage facades. Wearable systems map multistorey tunnels without GPS, letting inspectors detect spalling concrete behind tiles. The Middle East and Africa LiDAR market benefits from SLAM algorithms that register scans in real time, permitting overnight issuance of clash-detection reports that would once take a week. Hardware miniaturisation means a two-person crew can now capture an entire metro station in an evening, democratising high-precision documentation beyond tier-one contractors.

Time-of-Flight remained the workhorse with 63% revenue in 2024, prized for robust performance under dust-laden winds and intense solar glare typical of the Arabian Peninsula. Power utilities employ ToF units for corridor clearance checks on transmission lines, avoiding vegetation-related outages that could stall refinery production. Vendor roadmaps introduce eye-safe 1,550 nm lasers that extend range past 3 km, widening use in open-pit mine slope analysis.

Geiger-mode sensors post a 13.11% CAGR forecast because ultra-high-point densities accelerate environmental modelling. Forestry-carbon projects in Gabon use the technology to refine biomass estimates, an attractive quality as voluntary carbon markets tighten verification standards. Elevated altitude operation supports 366 km2/h coverage, enabling national-scale DEM refreshes on single aircraft sorties. Continued research into compressive sensing promises 64-fold resolution gains without heavier data volumes, enhancing suitability for real-time flood simulations.

Middle East and Africa LiDAR Market Share Report is Segmented by Product (Aerial LiDAR, Ground-Based and More), Technology (Time-Of-Flight, Geiger-Mode and More), Component (Laser Scanners, GPS and More), Deployment Platform (UAV-Based, and More), Range (Short-Range, and More), End-Use Industry (Engineering, and More), and Country (Saudi Arabia, and More). The Market Size and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Leica Geosystems AG

- Sick AG

- Ouster Inc.

- Cepton Technologies Inc.

- Hexagon AB

- MENA 3D

- Sandvik Mining and Rock Solutions

- Trimble Inc.

- FARO Technologies Inc.

- RIEGL Laser Measurement Systems

- Quanergy Systems Inc.

- LightWare LiDAR LLC

- GlobalScan Technologies LLC

- Microdrones GmbH

- Innoviz Technologies Ltd

- Velodyne Lidar Inc.

- Teledyne Optech

- Topcon Positioning Group

- Falcon-3D

- Sitech Gulf

- DJI Enterprise

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 LiDAR mandate for smart-city digital twins in GCC

- 4.2.2 Surge in UAV-borne corridor mapping for Saudi giga-projects

- 4.2.3 Offshore wind-farm bathymetry needs off Namibia and South Africa

- 4.2.4 Security-driven perimeter surveillance at UAE critical sites

- 4.2.5 High-resolution topography for copper and gold open-pit mines

- 4.2.6 Climate-resilience flood-plain modelling across Nile basin

- 4.3 Market Restraints

- 4.3.1 Scarcity of regional calibration labs inflating lead-times

- 4.3.2 Customs duties on Class-3B laser imports in non-GCC Africa

- 4.3.3 Limited GNSS reference-station density outside Gulf states

- 4.3.4 Low public-sector CAPEX in post-conflict North Africa

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Aerial LiDAR

- 5.1.2 Mechanical Scanning

- 5.1.3 Solid-state Scanning

- 5.2 By Technology

- 5.2.1 Ground-based LiDAR

- 5.2.2 Time-of-Flight

- 5.2.3 Geiger-Mode

- 5.2.4 Phase-Shift

- 5.2.5 Flash LiDAR

- 5.3 By Component

- 5.3.1 Laser Scanners

- 5.3.2 GPS/GNSS Receiver

- 5.3.3 Inertial Measurement Unit

- 5.3.4 Cameras and MEMS Mirrors

- 5.3.5 Other Components

- 5.4 By Deployment Platform

- 5.4.1 Terrestrial Static Tripod

- 5.4.2 UAV-/Drone-based

- 5.4.3 Mobile Mapping (Vehicle-mounted)

- 5.4.4 Bathymetric/Airborne Hydrographic

- 5.5 By Range

- 5.5.1 Short-Range

- 5.5.2 Medium-Range

- 5.5.3 Long-Range

- 5.6 By End-Use Industry

- 5.6.1 Engineering and Construction

- 5.6.2 Oil and Gas

- 5.6.3 Aerospace and Defense

- 5.6.4 Automotive and ADAS

- 5.6.5 Mining and Quarrying

- 5.6.6 Agriculture and Forestry

- 5.7 By Country

- 5.7.1 Saudi Arabia

- 5.7.2 Qatar

- 5.7.3 Kuwait

- 5.7.4 United Arab Emirates

- 5.7.5 South Africa

- 5.7.6 Kenya

- 5.7.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Leica Geosystems AG

- 6.4.2 Sick AG

- 6.4.3 Ouster Inc.

- 6.4.4 Cepton Technologies Inc.

- 6.4.5 Hexagon AB

- 6.4.6 MENA 3D

- 6.4.7 Sandvik Mining and Rock Solutions

- 6.4.8 Trimble Inc.

- 6.4.9 FARO Technologies Inc.

- 6.4.10 RIEGL Laser Measurement Systems

- 6.4.11 Quanergy Systems Inc.

- 6.4.12 LightWare LiDAR LLC

- 6.4.13 GlobalScan Technologies LLC

- 6.4.14 Microdrones GmbH

- 6.4.15 Innoviz Technologies Ltd

- 6.4.16 Velodyne Lidar Inc.

- 6.4.17 Teledyne Optech

- 6.4.18 Topcon Positioning Group

- 6.4.19 Falcon-3D

- 6.4.20 Sitech Gulf

- 6.4.21 DJI Enterprise

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment