|

市場調查報告書

商品編碼

1844572

亞太地區服務機器人:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Asia-Pacific Service Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

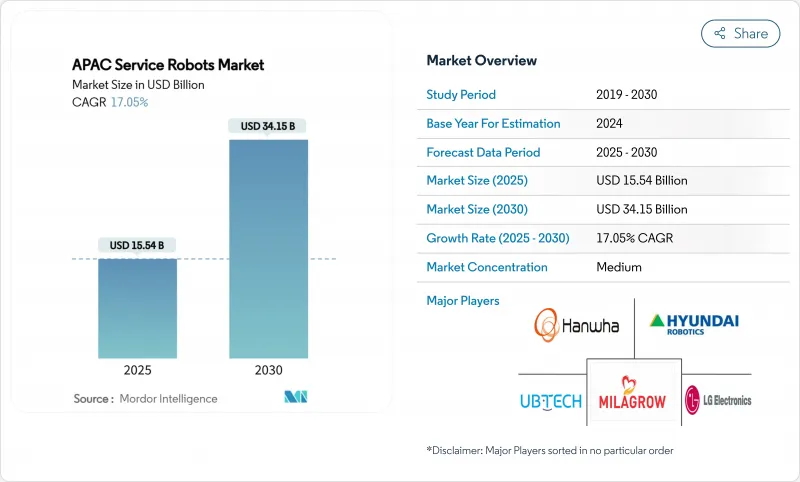

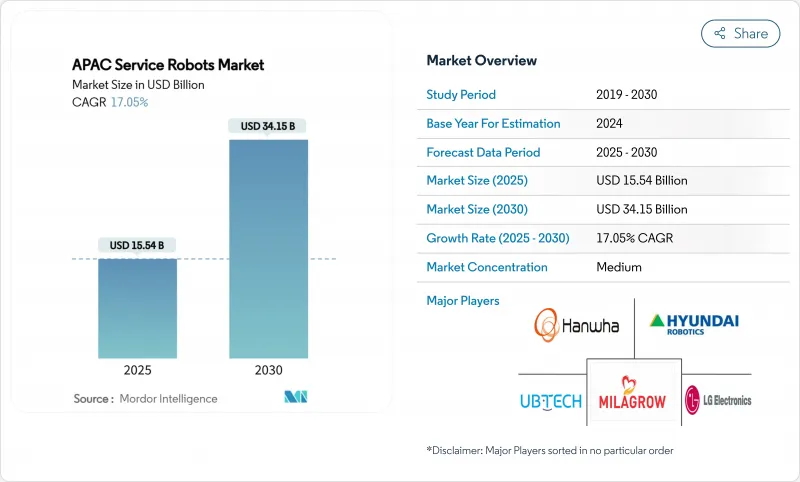

預計2025年亞太服務機器人市場規模將達到155.4億美元,到2030年將擴大至341.5億美元,2025年至2030年的複合年成長率為17.05%。

自動化專案在中國、日本和韓國蓬勃發展,重新定義了勞動力策略,而電子商務、醫療保健現代化和政府支持的數位化議程也加速了自動化的普及。隨著勞動力市場緊張和「最後一哩路」配送壓力的不斷增加,物流自動化已不再是一項效率提升措施,而是一項營運必需品。醫療服務提供者如今將機器人視為核心臨床資產,旨在改善患者治療效果並緩解人員短缺。 5G 與車載人工智慧的融合實現了即時遠端操作和數據分析,拓展了公共服務和關鍵基礎設施檢查的部署選項。雖然高昂的整合成本和碎片化的安全標準阻礙了中小企業的採用,但「機器人即服務」模式正開始縮小可負擔性差距。

亞太服務機器人市場趨勢與洞察

電子商務繁榮推廣物流AMR

隨著亞洲各地線上零售額的不斷成長,倉庫營運商紛紛轉向自主移動機器人 (AMR),以縮短履約時間並緩解勞動力短缺。中國供應商 Syrius Robotics 計劃每年向其日本基地出貨 3,000 台 AMR。 Liviao Robotics 的本地生產展示了近岸生產如何避免供應鏈摩擦和進口關稅。由於 AMR 的投資回收期平均不到 2.5 年,AMR 已成為中型經銷商的可行選擇。因此,監管變化正在成為需求的催化劑,將 AMR 轉變為亞太服務機器人市場必不可少的基礎設施。

老齡化社會的醫療保健需求

日本65歲及以上人口的老化率預計到2025年將達到27.3%,促使醫院和養老院部署機器人來協助病人扶起、更換尿布和藥物物流。早稻田大學的「AIREC」護理機器人展示了超越基本監護的先進物理輔助功能。機器人整合減少了員工離職率,使員工能夠專注於更需要同理心的工作。自動送餐每年還能為診所節省9,596歐元(約10,356美元)。中國老年護理機器人的全新國際標準使國內供應商在全球應用領域佔據領先地位,並加速亞太服務機器人市場向醫療保健價值創造邁進。

實施和整合成本高

儘管硬體價格持續下降,預計到2025年,人形機器人的平均價格將在2萬至3萬美元之間,但由於場地維修和人員培訓,整合總成本往往是購買成本的兩到三倍。許多中小企業(SME)的資金限制正在減緩亞太服務機器人產業的採用。 RaaS供應商現在提供涵蓋維護和更新的訂閱模式,使客戶避免了高昂的前期成本。

細分分析

到2024年,商用機器人將佔據亞太地區服務機器人市場69%的佔有率,並佔據主要收入來源。其領先地位源自於實際的投資報酬率:AMR機器人車隊可將揀貨時間縮短50%,動力外骨骼機器人可減少工傷。受全通路零售和當日送達需求的推動,物流系統仍然是收入最高的細分市場。醫療機器人因其手術精準度和醫院物流而價格不菲,而外骨骼機器人則解決了組裝上的起重和疲勞問題。公關機器人在酒店業提供禮賓服務,但文化接受度和語言差異阻礙了它們的普及。

個人機器人市場正在迅速擴張,預計到2030年複合年成長率將達到22.46%。家用清潔機器人的出貨量領先,而科沃斯的銷售額在2024年將達到165.4億元人民幣(約23億美元)。隨著老齡化社會的需求成長,老年照護伴侶和穿戴式輔助設備有望成為下一個成長領域。娛樂型機器人(寵物機器人和STEM教育套件)將增強亞太服務機器人市場的長尾銷售,從而完善這一細分市場。

到2024年,硬體將佔銷售額的64%。隨著扭矩密度的提高,致動器仍將是最昂貴的元件,而感測器融合將提高雷射雷達和深度攝影機的平均售價。Johnson Electric報告稱,亞洲與機器人相關的運動系統需求實現了兩位數成長。

軟體正在鞏固其作為價值引擎的作用,預計到2030年複合年成長率將達到24.21%。雲端連線編配、感知演算法和車隊管理儀錶板將原始硬體轉化為適應性強的解決方案。OMRON計劃在2027年實現數據解決方案銷售額超過1,000億日圓(6.82億美元),這意味著公司將從產品供應商轉型為平台編排者。服務——維護、分析和培訓——將成為亞太服務機器人產業持續收益的關鍵。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 電子商務繁榮推廣物流AMR

- 老齡化社會的醫療保健需求

- 政府獎勵和亞太製造計劃

- 透過5G/AI融合實現遠端自治

- 電動車電池生產線人形機器人(低調)

- 用於老化資產的隱藏基礎設施檢查機器人

- 市場限制

- 安裝和整合成本高

- 安全/認證系統碎片化

- 資料隱私和網路安全問題

- 依賴精密致動器和感測器的進口(秘密)

- 價值鏈分析

- 技術展望

- 監管狀況

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 評估影響市場的宏觀經濟趨勢

第5章 市場規模及成長預測(金額)

- 按機器人類型

- 商用機器人

- 物流系統

- 醫療機器人

- 人外骨骼機器人

- 公共機器人

- 個人機器人

- 家用機器人

- 娛樂

- 為老年人和殘障人士提供支持

- 商用機器人

- 按用途

- 軍事/國防

- 農業、建築、採礦

- 運輸/物流

- 衛生保健

- 政府機構

- 其他用途

- 按組件

- 硬體

- 致動器

- 感應器

- 控制器

- 軟體

- 服務

- 硬體

- 按運轉環境

- 地面以上

- 空氣

- 海

- 透過移動

- 移動機器人

- 固定式機器人

- 按國家

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- UBTECH Robotics Inc.

- Ecovacs Robotics Co. Ltd.

- SIASUN Robot and Automation Co. Ltd.

- LG Electronics Inc.

- SoftBank Robotics Corp.

- Omron Corp.

- Hyundai Robotics Co. Ltd.

- Panasonic Holdings-Robotics BU

- DJI Innovations

- Geek+Robotics Co. Ltd.

- Milagrow HumanTech

- Reeman Intelligent Tech

- Rainbow Robotics Co. Ltd.

- Roborock Technology Co. Ltd.

- UB-Tech(Shanghai)Intelligent

- Yamaha Motor-Robotics BU

- Doosan Robotics Inc.

- Hanwha Robotics

- Keenon Robotics

- TMi Robotics(TMiRob)

第7章 市場機會與未來展望

The Asia Pacific Service Robotics Market was worth USD 15.54 billion in 2025 and is forecast to expand to USD 34.15 billion by 2030, posting a 17.05% CAGR during 2025-2030.

A surge in automation programs across China, Japan and South Korea is redefining workforce strategies, while e-commerce, healthcare modernization and government-backed digital agendas accelerate adoption. Logistics automation is no longer an efficiency play-it has become an operational necessity as tight labor markets and last-mile delivery pressures intensify. Healthcare providers now treat robots as core clinical assets that improve patient outcomes and relieve staff shortages. Convergence of 5G and on-board AI is enabling real-time remote control and data analytics, broadening deployment options into public services and critical infrastructure inspection. Although high integration costs and fragmented safety standards still temper uptake among SMEs, Robotics-as-a-Service models are starting to close the affordability gap.

Asia-Pacific Service Robots Market Trends and Insights

E-commerce boom driving logistics AMRs

Rising online retail volumes across Asia have pushed warehouse operators toward autonomous mobile robots (AMRs) that shrink fulfillment times and mitigate labor shortages. Chinese vendor Syrius Robotics plans to ship 3,000 AMRs annually to Japanese sites-10 times its current run-rate-as local overtime caps restrict driver availability. Localized manufacturing by Libiao Robotics further illustrates how near-shore production sidesteps supply-chain friction and import duties. Payback periods now average under 2.5 years, making AMRs a viable option for mid-sized distributors. Regulatory changes therefore act as a demand catalyst, turning AMRs into essential infrastructure within the APAC Service Robots Market.

Aging-population healthcare demand

Japan's share of citizens aged 65+ reached 27.3% in 2025, prompting hospitals and care homes to deploy robots for patient lifting, diaper changing and medication logistics. The AIREC caregiving robot from Waseda University showcases advanced physical assistance that surpasses basic monitoring. Robot integration has cut staff turnover and freed personnel for empathy-intensive tasks, while automated meal transport yields EUR 9,596 (USD 10,356) in annual savings per clinic. China's new international standard for elderly-care robots positions domestic suppliers for leadership in global applications, accelerating the Asia Pacific Service Robotics Market toward healthcare value creation.

High installation and integration cost

Although hardware prices keep falling-the average humanoid is projected to reach USD 20,000-30,000 in 2025-total integration outlays often run two to three times the purchase cost due to site retrofits and staff training. For many SMEs, capital constraints delay adoption in the APAC Service Robots industry. RaaS vendors now offer subscription models covering maintenance and updates, helping customers bypass large upfront expense.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives and Made-in-APAC programs

- 5G/AI convergence enabling remote autonomy

- Fragmented safety/certification regimes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional robots generated the bulk of 2024 revenues, holding 69% of APAC Service Robots market share. Their leadership rests on tangible ROI: AMR fleets cut picking time by 50% while powered exoskeletons reduce workplace injuries. Logistics systems remain the highest-revenue subsegment, propelled by omnichannel retail and same-day delivery obligations. Medical robots command premium prices for surgical precision and hospital logistics, whereas exoskeletons address lifting and fatigue issues on assembly lines. Public-relation robots offer concierge services in hospitality but adoption is moderated by cultural acceptance and language nuance.

Personal robots are scaling quickly, posting a 22.46% CAGR forecast through 2030. Domestic cleaning units lead shipments, illustrated by Ecovacs hitting RMB 16.54 billion (USD 2.3 billion) in 2024 revenue despite margin pressure. Elderly-care companions and wearable assistance devices promise the next leg of growth as aging societies drive demand. Entertainment models-pet-inspired bots and STEM education kits-round out the segment, enhancing long-tail sales across the APAC Service Robots Market.

Hardware captured 64% of 2024 revenue. Actuators remain the costliest element as torque density advances, and sensor fusion raises ASPs for LiDAR and depth cameras. Johnson Electric reported double-digit Asian growth in motion systems linked to robotics demand.

Software is cementing its role as the value engine, set to post 24.21% CAGR to 2030. Cloud-connected orchestration, perception algorithms and fleet-management dashboards convert raw hardware into adaptable solutions. OMRON intends to surpass JPY 100 billion (USD 682 million) in data-solution sales by 2027, symbolizing the transition from product vendor to platform orchestrator. Services-maintenance, analytics, training-unlock recurring revenue in the APAC Service Robots industry.

The Asia-Pacific Service Robots Market Report is Segmented by Type (Professional Robots, Personal Robots), Application (Military and Defense, Agriculture, Construction and Mining, and More), Component (Hardware, Software, and Services), Operating Environment (Ground, Aerial, and Marine), Mobility (Mobile Robots, and Stationary Robots), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- UBTECH Robotics Inc.

- Ecovacs Robotics Co. Ltd.

- SIASUN Robot and Automation Co. Ltd.

- LG Electronics Inc.

- SoftBank Robotics Corp.

- Omron Corp.

- Hyundai Robotics Co. Ltd.

- Panasonic Holdings - Robotics BU

- DJI Innovations

- Geek+ Robotics Co. Ltd.

- Milagrow HumanTech

- Reeman Intelligent Tech

- Rainbow Robotics Co. Ltd.

- Roborock Technology Co. Ltd.

- UB-Tech (Shanghai) Intelligent

- Yamaha Motor - Robotics BU

- Doosan Robotics Inc.

- Hanwha Robotics

- Keenon Robotics

- TMi Robotics (TMiRob)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving logistics AMRs

- 4.2.2 Aging-population healthcare demand

- 4.2.3 Government incentives and Made-in-APAC programs

- 4.2.4 5G/AI convergence enabling remote autonomy

- 4.2.5 Humanoid robots for EV-battery lines (under-the-radar)

- 4.2.6 Infrastructure-inspection robots for aging assets (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 High installation and integration cost

- 4.3.2 Fragmented safety / certification regimes

- 4.3.3 Data-privacy and cyber-security concerns

- 4.3.4 Import dependence on precision actuators and sensors (under-the-radar)

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Robots Type

- 5.1.1 Professional Robots

- 5.1.1.1 Logistic Systems

- 5.1.1.2 Medical Robots

- 5.1.1.3 Powered Human Exoskeletons

- 5.1.1.4 Public-Relation Robots

- 5.1.2 Personal Robots

- 5.1.2.1 Domestic

- 5.1.2.2 Entertainment

- 5.1.2.3 Elderly and Handicap Assistance

- 5.1.1 Professional Robots

- 5.2 By Application

- 5.2.1 Military and Defense

- 5.2.2 Agriculture, Construction and Mining

- 5.2.3 Transportation and Logistics

- 5.2.4 Healthcare

- 5.2.5 Government

- 5.2.6 Other Applications

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.1.1 Actuators

- 5.3.1.2 Sensors

- 5.3.1.3 Controllers

- 5.3.2 Software

- 5.3.3 Services

- 5.3.1 Hardware

- 5.4 By Operating Environment

- 5.4.1 Ground

- 5.4.2 Aerial

- 5.4.3 Marine

- 5.5 By Mobility

- 5.5.1 Mobile Robots

- 5.5.2 Stationary Robots

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 UBTECH Robotics Inc.

- 6.4.2 Ecovacs Robotics Co. Ltd.

- 6.4.3 SIASUN Robot and Automation Co. Ltd.

- 6.4.4 LG Electronics Inc.

- 6.4.5 SoftBank Robotics Corp.

- 6.4.6 Omron Corp.

- 6.4.7 Hyundai Robotics Co. Ltd.

- 6.4.8 Panasonic Holdings - Robotics BU

- 6.4.9 DJI Innovations

- 6.4.10 Geek+ Robotics Co. Ltd.

- 6.4.11 Milagrow HumanTech

- 6.4.12 Reeman Intelligent Tech

- 6.4.13 Rainbow Robotics Co. Ltd.

- 6.4.14 Roborock Technology Co. Ltd.

- 6.4.15 UB-Tech (Shanghai) Intelligent

- 6.4.16 Yamaha Motor - Robotics BU

- 6.4.17 Doosan Robotics Inc.

- 6.4.18 Hanwha Robotics

- 6.4.19 Keenon Robotics

- 6.4.20 TMi Robotics (TMiRob)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment