|

市場調查報告書

商品編碼

1844546

義大利電力:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Italy Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

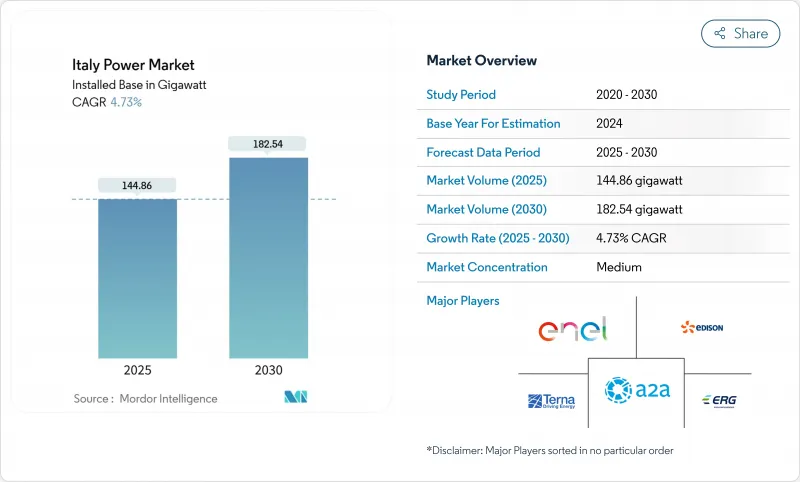

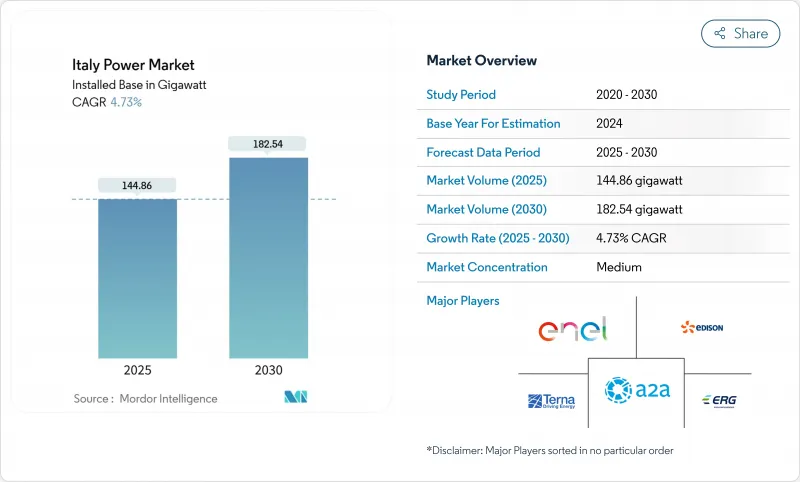

義大利電力市場規模預計將從 2025 年的 144.86 吉瓦擴大到 2030 年的 182.54 吉瓦,預測期內(2025-2030 年)的複合年成長率為 4.73%。

這項擴張得益於可再生能源的快速部署、到 2030 年 230 億歐元的電網現代化支出,以及透過有意減少對俄羅斯天然氣的依賴而實現的多元化。到 2024 年,可再生能源發電將滿足該國 41.2% 的電力需求,這得益於太陽能光電發電成長 19.3% 和水力發電成長 30.4%。雖然天然氣仍然是主要的可調度資源,但由於第 199/2021 號法令下的許可證簡化和企業購電協議,太陽能光電發電裝置正在加速發展。定於 2025 年 9 月舉行的全網電池競標會將在 2030 年前釋放 9 吉瓦的電池儲存容量,進一步支援間歇性再生能源。 2025 年 1 月的批發價格仍高達 143.03 歐元/兆瓦時,凸顯了再生能源對於供應多樣化和成本穩定的迫切性。

義大利電力市場趨勢與洞察

根據199/2021號法令加速授權改革

第199/2021號法規的實施,透過許可證入口數位化和「適宜區域」的明確分類,將可再生能源計劃的核准時間縮短了約三分之一。 2024年,太陽能發電容量限額提高,風電緩衝區縮小,申請數量增加。由於行政能力增強和認證安裝商數量增加,北部地區的計劃完成速度最快。 2024年8月頒布的FER2法令對改革進行了補充,引入了離岸風力發電雙邊差價合約,目標是到2028年達到4.6吉瓦。雖然仍有一個瓶頸,即超過30兆瓦計劃的環境影響評估,但整體框架降低了投資者的門檻,並加速了義大利電力市場的轉型。

電網規模電池容量市場競標(Terna)

Terna 的 MACSE 機制是歐洲首個專用儲能容量市場,旨在透過為期 15 年的計量型競標,到 2030 年簽訂 9 吉瓦的儲能容量合約。預計 2024 年電池安裝量將達到 2.1 兆瓦,佔新增電網連接的一半以上。 2025 年 9 月的首次競標預計將授予 10 吉瓦時,吸引尋求收益確定性的國際開發商。義大利南部由於可再生棄風率高而提供了極佳的套利價差,而北部的工業區則需要儲能來抑低尖峰負載和支持頻率。競標設計透過將容量、能源和配套服務收益,滿足了義大利電力市場的需求,使儲能成為加速可再生能源滲透的關鍵推動因素。

普利亞和Sicilia島電網擁塞(延遲超過 36 個月)

超過348吉瓦的可再生能源計劃正在等待併網,遠超過現有系統的137.53吉瓦。普利亞大區和Sicilia的排隊時間最長,開發商等待電網連接的時間超過36個月。這套頸源自於北向輸電走廊的弱點以及新線路複雜的環境核准。 Terna公司165億歐元的五年計畫撥出大量資金用於緩解南部地區的電網堵塞,但建設前置作業時間仍然很長。專案延誤導致資本成本上升,市場競爭力下降,太陽能和風電建設放緩,並限制了義大利電力市場的成長前景。

細分分析

到2024年,火力發電將佔義大利電力市場容量的59%,提供靈活的基本負載和平衡服務。可再生約佔發電量的41%,但由於組件價格下降和授權簡化,其成長速度最快,到2030年複合年成長率將達5.32%。 2024年陰雨天氣過後,水力發電佔可再生能源發電量的貢獻將恢復到35%,而受離岸風電顯著成長的推動,風電佔可再生能源發電量的比重將達到20%。煤炭發電量將降至總發電量的1.3%,並將在2025年逐步淘汰。

太陽能的成長主要由企業購電協議 (PPA) 和大型計劃推動,但日益激烈的價格競爭已促使 Enel 調整其新建設,到 2027 年,太陽能光伏發電裝置容量將達到 3.2 吉瓦,風電裝置容量將達到 5.7 吉瓦。生質能和地熱能提供基本負載可再生能源容量,隨著煤炭淘汰和天然氣成本上升,其價值日益凸顯。隨著儲能和需量反應規模的擴大,可調度天然氣在義大利電力市場的佔有率可能從 2028 年起下降,但在高壓直流輸電線路和電池消除間歇性影響之前,其作用仍將至關重要。

義大利電力市場報告按發電(火力發電和可再生)、終端用戶(公共產業、商業/工業、住宅)以及輸配電(僅定性分析)細分。市場規模和預測以裝置容量(吉瓦)為單位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 根據199/2021號法令加速許可改革

- 電網規模電池容量市場競標(Terna)

- 2025年煤炭淘汰將造成產能缺口

- REPowerEU 資助的 HVDC計劃(例如 Tyrrhenian Link)

- 奢侈品和快速消費品巨頭的企業購電協議激增

- 超級獎金為屋頂太陽能獎勵策略

- 市場限制

- 普利亞和Sicilia電網擁塞(延遲超過 36 個月)

- 離岸風力發電競標失敗(亞得里亞海地區)

- 天然氣進口受地緣政治衝擊(約90%)

- 風力發電廠景觀許可訴訟

- 2024年義大利可再生能源結構

- 監理展望

- 技術展望(數位化、高壓直流輸電、儲能)

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- PESTLE分析

第5章市場規模及成長預測

- 按來源分列的發電量

- 火力發電(天然氣、石油、煤炭)

- 可再生能源(太陽能、風能、水力發電、地熱等)

- 按最終用戶

- 公共產業

- 住房

- 商業和工業

- 電力傳輸和分配(定性)

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、聯盟、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- Enel SpA

- Terna SpA

- Edison SpA

- A2A SpA

- ERG SpA

- Acea SpA

- Sorgenia SpA

- Hera Group

- Eni Plenitude

- ENGIE SA(Italy)

- Renantis(Falck Renewables)

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Prysmian Group

- Sonnedix Power Holdings Ltd

- SunPower Corporation

- RWE Renewables Italia

- Iberdrola Renovables Italia

- InterGen SpA

- PLT Energia SRL

第7章 市場機會與未來展望

The Italy Power Market size in terms of installed base is expected to grow from 144.86 gigawatt in 2025 to 182.54 gigawatt by 2030, at a CAGR of 4.73% during the forecast period (2025-2030).

The expansion is anchored in rapid renewable energy deployment, grid-modernization spending of EUR 23 billion through 2030, and deliberate diversification away from Russian gas. Renewable generation satisfied a record 41.2% of national electricity demand in 2024, led by a 19.3% surge in solar output and a 30.4% rebound in hydro generation. Natural gas remains the dominant dispatchable resource, but streamlined permitting under Legislative Decree 199/2021 and corporate power-purchase agreements are accelerating photovoltaic additions. Grid-scale battery auctions scheduled for September 2025 will unlock 9 GW of storage by 2030, further supporting intermittent renewables. Persistently high wholesale prices-143.03 EUR/MWh in January 2025-underscore the urgency of supply diversification and cost-stable renewables.

Italy Power Market Trends and Insights

Accelerated Permitting Reforms under Legislative Decree 199/2021

Implementation of Legislative Decree 199/2021 has trimmed authorization timelines for renewable projects by about one third, thanks to digitalized permitting portals and clearer zoning of "suitable areas". Photovoltaic capacity caps were raised and wind-farm buffer zones narrowed, boosting application volumes in 2024. Northern regions clear projects fastest because of higher administrative capacity and greater availability of certified installers. The August 2024 FER2 decree complemented the reform by introducing two-way contracts-for-difference for offshore wind, targeting 4.6 GW by 2028. Remaining bottlenecks revolve around environmental impact assessments for projects exceeding 30 MW, yet the overall framework is lowering investor barriers and accelerating the Italy power market transition.

Grid-scale Battery Capacity Market Auctions (Terna)

Terna's MACSE mechanism is Europe's first dedicated storage capacity market, aiming to contract 9 GW by 2030 through 15-year pay-as-bid auctions. Battery additions reached 2.1 GW in 2024, representing over half of new grid connections. The inaugural September 2025 auction will award 10 GWh, attracting international developers seeking revenue certainty. Southern Italy offers superior arbitrage spreads due to high renewable curtailment, whereas industrialized northern zones require storage for peak-shaving and frequency support. The auction design complements Italy's power market needs by monetizing capacity, energy, and ancillary services, enabling storage to act as the critical enabler for higher renewable penetration.

Grid Congestion in Apulia & Sicily (>=36-month Delays)

More than 348 GW of renewable projects await interconnection, dwarfing the current 137.53 GW system. Apulia and Sicily suffer the longest queues, with developers waiting over 36 months for grid access. The bottleneck stems from weak north-bound transmission corridors and complex environmental approvals for new lines. Terna's EUR 16.5 billion five-year plan allocates significant funding to relieve southern congestion, yet construction lead times remain protracted. Delays raise capital costs, erode PPA competitiveness, and slow solar and wind build-outs, constraining the Italy power market growth outlook.

Other drivers and restraints analyzed in the detailed report include:

- Coal Phase-out by 2025 Creating Capacity Gap

- REPowerEU-funded HVDC Projects (Tyrrhenian Link)

- Offshore Wind Tender Under-realisation (Adriatic)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermal power generation controlled 59% of Italy's power market size in 2024, supplying flexible baseload and balancing services. Renewable, while accounting for roughly 41% of generation, is expanding fastest at a 5.32% CAGR through 2030 under declining module prices and streamlined permitting. Hydroelectric contribution rebounded to 35% of renewable output after wetter 2024 conditions, and wind reached 20% of renewable capacity with significant offshore upside. Coal slipped to 1.3% of total production and will exit by 2025.

Solar's growth owes much to corporate PPAs and utility-scale projects, yet price cannibalization drives Enel to tilt its new-build mix toward 5.7 GW of wind versus 3.2 GW of solar by 2027. Biomass and geothermal provide baseload renewable capacity, which is increasingly valuable as coal retires and gas costs rise. The Italy power market share of dispatchable gas may decline beyond 2028 as storage and demand-response scale, but its role remains pivotal until HVDC links and batteries neutralize intermittency.

The Italy Power Market Report is Segmented by Power Generation From Source (Thermal and Renewable Power), End-Users (Utilities, Commercial and Industrial, and Residential), and Power Transmission and Distribution (Qualitative Analysis Only). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Enel SpA

- Terna SpA

- Edison SpA

- A2A SpA

- ERG SpA

- Acea SpA

- Sorgenia SpA

- Hera Group

- Eni Plenitude

- ENGIE SA (Italy)

- Renantis (Falck Renewables)

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Prysmian Group

- Sonnedix Power Holdings Ltd

- SunPower Corporation

- RWE Renewables Italia

- Iberdrola Renovables Italia

- InterGen SpA

- PLT Energia SRL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Permitting Reforms under Legislative Decree 199/2021

- 4.2.2 Grid-scale Battery Capacity Market Auctions (Terna)

- 4.2.3 Coal Phase-out by 2025 Creating Capacity Gap

- 4.2.4 REPowerEU-funded HVDC Projects (e.g., Tyrrhenian Link)

- 4.2.5 Corporate PPAs Surge among Luxury & FMCG Majors

- 4.2.6 Superbonus 110 % Stimulus for Rooftop PV

- 4.3 Market Restraints

- 4.3.1 Grid Congestion in Apulia & Sicily (>=36-month Delays)

- 4.3.2 Offshore Wind Tender Under-realisation (Adriatic)

- 4.3.3 Gas-Import Exposure to Geopolitical Shocks (~90 %)

- 4.3.4 Landscape-related Permit Litigation for Wind Farms

- 4.4 Italy Renewable Energy Mix, 2024

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook (Digitalisation, HVDC, Storage)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 Power Generation by Source

- 5.1.1 Thermal Power (Natural Gas, Oil, Coal)

- 5.1.2 Renewable Power (Solar, Wind, Hydro, Geothermal, etc)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Residential

- 5.2.3 Commercial and Industrial

- 5.3 Power Transmission & Distribution (Qualitative)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Enel SpA

- 6.4.2 Terna SpA

- 6.4.3 Edison SpA

- 6.4.4 A2A SpA

- 6.4.5 ERG SpA

- 6.4.6 Acea SpA

- 6.4.7 Sorgenia SpA

- 6.4.8 Hera Group

- 6.4.9 Eni Plenitude

- 6.4.10 ENGIE SA (Italy)

- 6.4.11 Renantis (Falck Renewables)

- 6.4.12 Vestas Wind Systems A/S

- 6.4.13 Siemens Gamesa Renewable Energy SA

- 6.4.14 Prysmian Group

- 6.4.15 Sonnedix Power Holdings Ltd

- 6.4.16 SunPower Corporation

- 6.4.17 RWE Renewables Italia

- 6.4.18 Iberdrola Renovables Italia

- 6.4.19 InterGen SpA

- 6.4.20 PLT Energia SRL

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment