|

市場調查報告書

商品編碼

1844510

漂白劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Bleaching Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

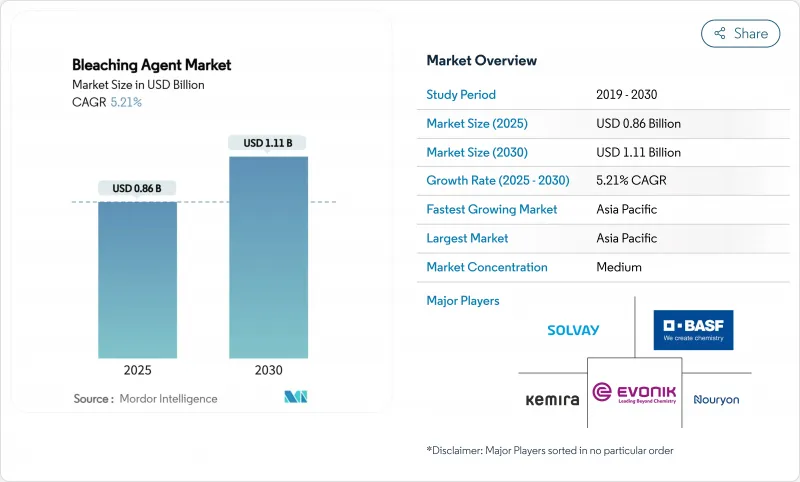

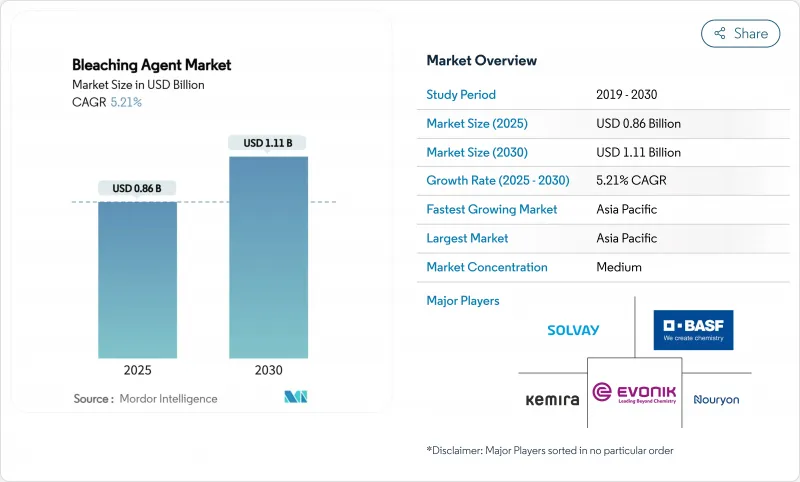

漂白水市場規模預計在 2025 年達到 8.6 億美元,預計到 2030 年將達到 11.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.21%。

這項預測成長證明了漂白水市場規模的穩定成長,以及該產業在供應鏈中斷和環保審查日益嚴格的情況下仍然保持的適應能力。市政和工業水處理的持續需求、氯製劑因其成本和有效性而持續受到青睞,以及現場二氧化氯製備技術的快速普及,這些因素支撐了市場的發展勢頭。此外,亞太地區龐大的生產基地以及紙漿、紙張和紡織品中漂白劑消費量的不斷成長,將繼續引領該地區的成長。

全球漂白水市場趨勢與洞察

市政和工業水處理需求不斷成長

為了在抑制三鹵甲烷形成的同時實現更強的病原體控制,世界各地的公共產業正在用二氧化氯溶液取代傳統的氯化系統。由於營運商致力於避免運輸危險化學品並提高劑量準確性,現場發生器的安裝量每年成長超過20%。食品、飲料和製藥廠的工業用戶也出現了同步成長,這些用戶必須滿足更嚴格的微生物標準。新冠疫情期間衛生意識的增強,推動了醫療機構和機構的用量增加。在缺水地區,公用事業公司更青睞漂白劑,因為它可以在不增加產品成本的情況下處理日益污染的水源。

亞太地區紙漿和造紙產量快速成長

快速的都市化和電子商務正在推動包裝需求,從而推動中國、印度、日本和韓國的紙漿和紙張生產以及相關漂白劑的消費量。工廠營運商正在從單質氯過渡到二氧化氯和酶輔助工藝,以在保持目標白度的同時降低化學氧消費量。隨著生產商將白度從ISO 88提高到92或更高,過氧化氫在無氯製程中發揮關鍵作用。區域生產商也持續投資安全維修,以減少高壓氧化器的事故。

對氯漂白劑急性和慢性毒性的擔憂

一些司法管轄區已將二氧化氯蒸氣的職業暴露限值設定為0.1 ppm(8小時時間加權平均值),這促使工業用戶安裝先進的通風和洩漏檢測系統。疫情期間的中毒事件加劇了消費者的擔憂,促使零售商提供危害較小的象徵性替代品。儘管過氧化物和過乙酸混合物,但醫療保健和食品行業越來越青睞它們,以減少員工培訓和倉儲管理。

細分分析

到 2024 年,氯氣部分將佔據漂白劑市場 35.11% 的佔有率,這主要歸功於完善的基礎設施、低廉的原料成本以及垂直整合的氯鹼製造商的多元化供應控制。氯鹼熱電汽電共生確保了氯氣的持續供應,使大型公司能夠簽訂長期供應協議,特別是針對市政消毒廠。儘管對氯化副產品進行了嚴格審查,但由於許多工廠缺乏新反應器和安全維修的資金,替代速度仍然很慢。過氧化氫和過碳酸鈉的複合年成長率最快,為 5.76%,這得益於紙漿和造紙廠轉向無元素氯產品以及洗衣配方製造商銷售生態標籤。催化過氧化物分解為水和氧氣,對尋求無殘留衛生的食品、飲料和製藥加工商具有吸引力。高錳酸鉀和活性漂白土等特殊氧化劑填補了半導體、石油精煉和食用油精煉等高價值、低銷售量的細分市場。

區域分析

2024年,亞太地區將佔據45.22%的收入佔有率,這將支持製造規模的擴大和本地消費的成長。政府對紙張回收的激勵措施,加上出口導向紡織叢集的發展,支撐了6.21%的複合年成長率。中國沿海的工廠正在升級為多級二氧化氯工藝,以提高亮度,同時減少吸附性有機鹵化物的排放。在新建氯酸鈉和過氧化氫工廠的支持下,印度下游的造紙和服飾正在推動該地區強勁的需求成長。

北美正受益於先進的製程控制、日益增強的監管意識以及近期減少對運輸氯氣依賴的資本計劃。亞利桑那州一家耗資7,000萬美元的工廠將鹽水轉化為次氯酸鈉,代表著一種在岸化趨勢,提高了西部公用事業的供應安全性。醫療機構青睞使用二氧化氯對熱水管道進行消毒。約翰霍普金斯醫院數十年的業績記錄表明,該醫院能夠持續抑制退伍軍人菌,且不會腐蝕管道。

歐洲面臨最昂貴的合規負擔。 REACH 申請費和即將訂定的排放上限正在推動生產商轉向危害性較低的配方,從而增加了人們對生物基和酶漂白的興趣。斯堪地那維亞的紙漿廠已經證明,用漆酶介導的步驟取代初始鹼性萃取步驟可以減少 25% 的化學品使用量。拉丁美洲和中東的市場規模仍然相對較小,但透過擴大飲用水網路和纖維素纖維產能的基礎設施計劃,它們仍有成長潛力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 市政和工業水處理需求不斷成長

- 亞太地區紙漿和造紙產量快速成長

- 擴大紡織品加工能力

- 加強飲用水中餘氯的監管

- 二氧化氯發生器在分散消毒的快速應用

- 市場限制

- 對氯漂白劑急性和慢性毒性的擔憂

- 嚴格的環境法規

- 原料成本波動

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依產品類型

- 氯

- 過氧化物

- 鈉

- 鈣

- 其他活動(高錳酸鹽、活性漂白土等)

- 按形式

- 粉末

- 液體

- 按最終用戶產業

- 紙漿和造紙

- 紡織品

- 建造

- 電氣和電子

- 衛生保健

- 水處理

- 其他(食品、石油和天然氣等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Accepta Water Treatment

- Aditya Birla Group

- ANSA McAL

- Arkema

- Ashland

- BASF

- Chemtrade International Corporation

- Chlorum Solutions

- Clariant

- Dow

- Ecolab Inc

- Erco Worldwide

- Evonik Industries AG

- Gujarat Alkalies and Chemicals Limited

- Hawkins

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Nouryon

- Olin Corporation

- Solenis

- Solvay

第7章 市場機會與未來展望

The Bleaching Agent Market size is estimated at USD 0.86 billion in 2025, and is expected to reach USD 1.11 billion by 2030, at a CAGR of 5.21% during the forecast period (2025-2030).

This projected expansion underscores a steady rise in the bleaching agent market size and the sector's ability to adapt despite supply-chain disruptions and stricter environmental oversight. Persistent demand from municipal and industrial water treatment, continued preference for chlorine formulations because of cost and efficacy, and rapid uptake of on-site chlorine-dioxide generation underpin market momentum. Powder products, which offer logistical and dosing advantages, deepen manufacturers' cost leadership, while Asia Pacific's sizable production base and escalating consumption of bleaching agents in pulp, paper, and textiles keep the region at the forefront of growth.

Global Bleaching Agent Market Trends and Insights

Rising Demand for Municipal & Industrial Water Treatment

Utilities worldwide are replacing legacy chlorination systems with chlorine-dioxide solutions because these deliver stronger pathogen control while curbing trihalomethane formation. Installations of on-site generators are growing more than 20% each year as operators aim to bypass hazardous chemical transport and enhance dosage precision. Parallel growth stems from industrial users in food, beverage, and pharmaceutical plants that must meet tighter microbial standards. Heightened hygiene awareness that emerged during the COVID-19 pandemic sustains elevated consumption in health-care and institutional settings. In regions experiencing water scarcity, utilities favor bleaching agents that can treat increasingly contaminated sources without escalating byproducts.

Surging Pulp & Paper Output in APAC

Rapid urbanization and e-commerce have boosted packaging demand, lifting pulp and paper output and, consequently, bleaching agent consumption across China, India, Japan, and South Korea. Mill operators are transitioning from elemental chlorine to chlorine-dioxide and enzyme-aided sequences, which cut chemical oxygen-demand while maintaining brightness targets. Hydrogen peroxide remains pivotal in elemental-chlorine-free processes as producers raise brightness from 88 to more than 92 ISO. Regional producers also continue to invest in safety retrofits to curb incidents in high-pressure oxidation units.

Acute & Chronic Toxicity Concerns of Chlorinated Bleaches

Occupational-exposure limits for chlorine-dioxide vapors are set at 0.1 ppm (8-hour TWA) in several jurisdictions, prompting industrial users to install advanced ventilation and leak-detection systems. Publicized poisoning events during the pandemic reinforced consumer skepticism and spurred retailers to offer alternatives with lower hazard symbols. Healthcare and food sectors increasingly favor peroxide or peracetic-acid blends, even at higher unit costs, to reduce staff training and storage controls.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Textile Processing CapacityExpanding Textile Processing Capacity

- Tightening Potable-Water Residual-Chlorine Regulations

- Stringent Environmental Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The chlorine segment retained 35.11% of bleaching agent market share in 2024-largely due to entrenched infrastructure, low raw-material cost, and diversified supply controlled by vertically integrated chlor-alkali producers. Chlor-alkali cogeneration ensures continuous chlorine gas availability, allowing large players to honor long-term supply contracts, especially for municipal disinfection plants. Despite scrutiny over chlorinated byproducts, replacement remains gradual because many facilities lack immediate capital for new reactors or safety retrofits. Hydrogen peroxide and sodium percarbonate together posted the fastest 5.76% CAGR, buoyed by pulp and paper mills striving for elemental-chlorine-free status and laundry formulators marketing eco-labels. Catalyzed peroxide, which decomposes into water and oxygen, appeals to food, beverage, and pharmaceutical processors seeking residue-free sanitation. Specialty oxidants such as potassium permanganate and activated bleaching earth fill high-value but lower-volume niches in semiconductor, oil-refining, and edible-oil purification.

The Bleaching Agent Market Report is Segmented by Product Type (Chlorine, Peroxides, Sodium, Calcium, Others), Form (Powder, Liquid), End-User Industry (Pulp and Paper, Textile, Construction, Electrical and Electronics, Healthcare, Water Treatment, Others), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 45.22% revenue share in 2024 underscores its combined manufacturing scale and rising local consumption. Government incentives for paper recycling, coupled with export-oriented textile clusters, underpin a 6.21% CAGR outlook. Mills across coastal China have upgraded to multi-stage chlorine-dioxide sequences that raise brightness while cutting adsorbable-organic-halide discharge. India's downstream paper and garment sectors, supported by new sodium-chlorate and hydrogen-peroxide plants, contribute to steady regional demand growth.

North America benefits from advanced process control, high regulatory awareness, and recent capital projects that reduce reliance on transported chlorine gas. A USD 70 million plant in Arizona converting salt brine to sodium hypochlorite typifies the on-shoring trend, which enhances supply security for western utilities. Healthcare facilities favor chlorine-dioxide for hot-water-line disinfection; Johns Hopkins Hospital's multi-decade performance record demonstrates sustained Legionella suppression without pipe corrosion.

Europe confronts the costliest compliance burden. REACH dossier fees and upcoming emissions ceilings push producers toward lower-hazard formulations and raise interest in bio-based or enzyme-aided bleaching. Pilot installations in Scandinavian pulp mills demonstrate 25% chemical-consumption cuts when replacing the first alkaline extraction with laccase-mediated steps. Latin American and Middle-Eastern markets remain comparatively small but present upside through infrastructure projects that expand potable-water networks and cellulose fiber capacity.

- Accepta Water Treatment

- Aditya Birla Group

- ANSA McAL

- Arkema

- Ashland

- BASF

- Chemtrade International Corporation

- Chlorum Solutions

- Clariant

- Dow

- Ecolab Inc

- Erco Worldwide

- Evonik Industries AG

- Gujarat Alkalies and Chemicals Limited

- Hawkins

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Nouryon

- Olin Corporation

- Solenis

- Solvay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for municipal & industrial water treatment

- 4.2.2 Surging pulp & paper output in APAC

- 4.2.3 Expanding textile processing capacity

- 4.2.4 Tightening potable-water residual-chlorine regulations

- 4.2.5 Rapid uptake of chlorine-dioxide generators in decentralized disinfection

- 4.3 Market Restraints

- 4.3.1 Acute & chronic toxicity concerns of chlorinated bleaches

- 4.3.2 Stringent environmental regulations

- 4.3.3 Volatility in raw material costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Chlorine

- 5.1.2 Peroxides

- 5.1.3 Sodium

- 5.1.4 Calcium

- 5.1.5 Others (Permanganate, Activated Bleaching Earth, etc.)

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By End-user Industry

- 5.3.1 Pulp and Paper

- 5.3.2 Textile

- 5.3.3 Construction

- 5.3.4 Electrical and Electronics

- 5.3.5 Healthcare

- 5.3.6 Water Treatment

- 5.3.7 Others (Food, Oil and Gas, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Accepta Water Treatment

- 6.4.2 Aditya Birla Group

- 6.4.3 ANSA McAL

- 6.4.4 Arkema

- 6.4.5 Ashland

- 6.4.6 BASF

- 6.4.7 Chemtrade International Corporation

- 6.4.8 Chlorum Solutions

- 6.4.9 Clariant

- 6.4.10 Dow

- 6.4.11 Ecolab Inc

- 6.4.12 Erco Worldwide

- 6.4.13 Evonik Industries AG

- 6.4.14 Gujarat Alkalies and Chemicals Limited

- 6.4.15 Hawkins

- 6.4.16 Kemira

- 6.4.17 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.18 Nouryon

- 6.4.19 Olin Corporation

- 6.4.20 Solenis

- 6.4.21 Solvay

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment