|

市場調查報告書

商品編碼

1844464

次氯酸鹽漂白劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Hypochlorite Bleaches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

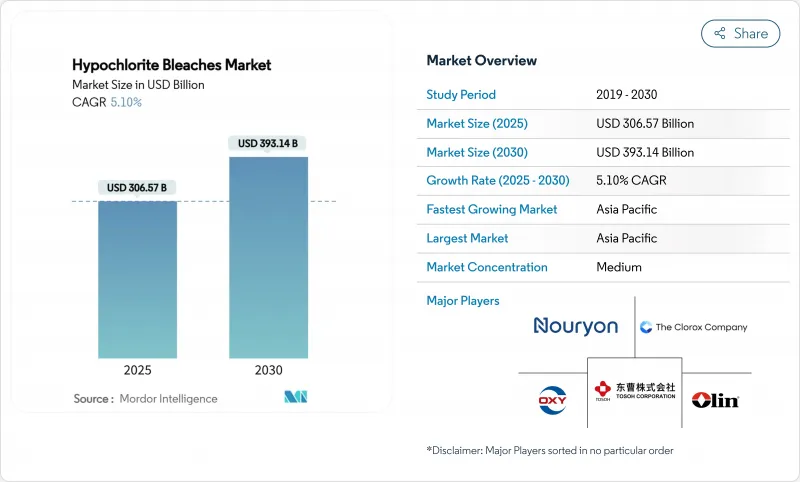

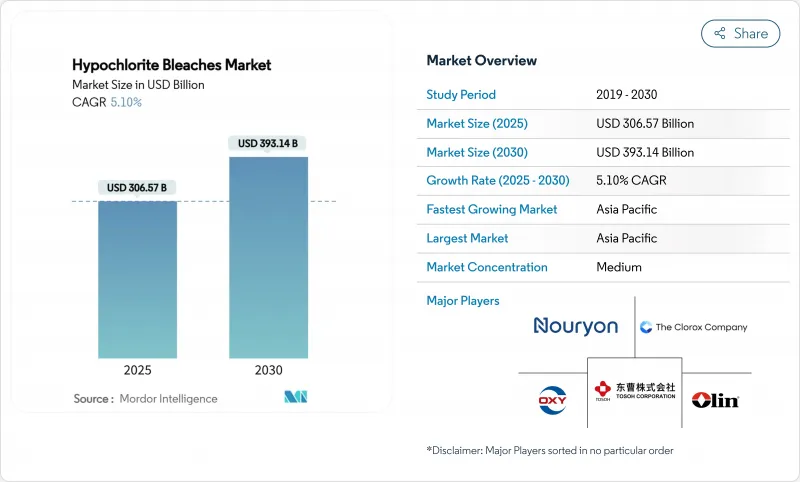

次氯酸鹽漂白劑市場規模預計在 2025 年達到 3,065.7 億美元,預計到 2030 年將達到 3,931.4 億美元,預測期內(2025-2030 年)的複合年成長率為 5.10%。

隨著公共從氯氣過渡到更安全的次氯酸鈉溶液,市政用水和污水系統的基礎設施投資(尤其是在亞太地區)正在推動需求。對本地製造業的投資(通常每家工廠超過7000萬美元)也增強了供應鏈的韌性,節能的膜電解與開孔電解槽相比,可減少15%的用電量。次氯酸鹽漂白劑市場也受益於監管的明確性。美國環保署2024年的修正案簡化了次氯酸鹽的運輸,歐盟已批准次氯酸鈣生物殺滅劑產品系列有效期至2035年,這兩項法案都有利於採用溶液法。然而,隨著過氧化物基替代品在紡織品和紙漿漂白領域越來越受歡迎,以及危險品法規提高了氧化劑的物料輸送成本,競爭壓力仍然存在。

全球次氯酸鹽漂白劑市場趨勢與洞察

增加水處理和衛生支出

2033年,全球水務基礎設施支出預計將達到1兆美元,成長率為5.9%。市政和工業領域消毒需求的不斷成長,將直接推動次氯酸鹽漂白劑市場的發展。預計到2025年,受「水利使者」等政府計畫的推動,印度對水處理化學品的需求將達到28億美元。布拉格的一家工廠處理水量為3000公升/秒,同時將氯殘留量保持在0.2-0.4 ppm,保護了80萬居民的安全。智慧加藥控制和人工智慧遠端檢測如今已非常普及,鞏固了次氯酸鹽在現代水網中的地位。

新興亞洲地區紙漿和造紙產量快速成長

2024年,中國將消耗1300萬噸木漿,其中60%以上將依賴進口;到2030年,印度的需求量可能達到920萬噸,這將推動亞洲造紙廠次氯酸鹽漂白劑市場的發展。趨勢分析顯示,造紙廠正在從氯氣工藝轉向更安全的次氯酸鹽或二氧化氯工藝,以在滿足白度目標的同時減少廢水中的AOX(有機氧化物)。 RISE的一項初步研究發現,最佳化的次氯酸鹽製程順序能夠維持紙張強度並減少化學品用量,從而為造紙廠帶來成本和合規效益。東南亞許多新建造紙廠正在採用基於薄膜的電解裝置,並將次氯酸鹽供應整合到造紙廠公用設施中。

過氧化物漂白化學的日益普及

過氧化氫分解成水和氧氣,消除了氯副產物,對尋求環保標章的工廠和染廠來說極具吸引力。結合紫外線/過氧化氫或臭氧的高級氧化過程在處理持久性有機物方面優於次氯酸鹽,這使得次氯酸鹽漂白劑市場成為一個專業的利基市場。歐洲高階紡織品製造商已經為過氧化物漂白棉支付了更高的永續性溢價,這給次氯酸鹽配方帶來了市場佔有率壓力。

細分分析

次氯酸鈉將在 2024 年佔據次氯酸鹽漂白劑市場的 58.91%,這得益於其在市政消毒和家庭清潔領域的成熟應用,而次氯酸鈣預計將在 2035 年之前以每年 5.73% 的速度成長,這得益於歐盟批准其用於泳池和飲用水處理。

鈉鹽的優點在於其液體供應鏈和日趨成熟的現場發電技術。膜電解系統可將濃度提高至7% w/w,同時降低15%的電力成本,進而為投資電化學升級的工廠營運商擴大次氯酸鹽漂白劑的市場規模。相反,鈣鹽的高穩定性和65-70%的有效氯使其適用於需要長期儲存的偏遠地區。鋰鹽和氯化鉀仍屬於小眾市場,受成本和特殊工業需求的限制。

區域分析

預計到2024年,亞太地區將佔據次氯酸鹽漂白市場的43.26%,到2030年,該地區的複合年成長率將達到5.67%,因為各國政府將向供水管網投入創紀錄的資金,而該地區的紙漿廠也將轉向更安全的漂白過程。光是中國造紙業每年就消耗1,300萬噸木漿,對次氯酸鹽溶液的需求龐大。印度的「水利工程」(Jal Jeevan Mission)正在刺激對這種化學品的需求,而迪諾拉在香港推出的20台CECHLO裝置則顯示了市政部門對現場發電的熱情。

北美次氯酸漂白劑市場雖然成熟,但仍在不斷發展。美國環保署2024年頒布的《危險物質法規》將收緊氯氣的使用,這推動了一系列社區漂白劑工廠的建設,投資額超過7000萬美國,從而提升了綜合製造商的收益。奧林公司的氯鹼部門在2025年第一季的銷售額超過9.245億美元,年增4.5%。該公司的膜電解池維修正在提高能源效率,並幫助其在國內市場保持競爭優勢。

儘管歐洲氯鹼產業鏈面臨約5,500億美元的脫碳壓力,但監管機構仍在透過鈣的批准來支持次氯酸鈉的研發。布拉格的次氯酸鈉現場轉換項目,為80萬居民提供了3000公升/秒的次氯酸鈉處理量,凸顯了安全性的提升。儘管中東和非洲仍處於發展階段,但對紡織品整理的投資以及應對水資源短缺的措施預計將推動次氯酸鈉漂白劑市場高於平均水平的成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 增加水處理和衛生支出

- 新興亞洲地區紙漿和造紙產量快速成長

- 提升非洲紡織品加工能力

- 為偏遠的公共設施部署現場次氯酸鹽產生器

- 氯氣淘汰法規有利於次氯酸鹽

- 市場限制

- 過氧化物漂白化學的日益普及

- 嚴格的氧化化學品運輸和儲存規定

- 高級氧化過程(臭氧/AOP)的成長

- 氯鹼價值鏈脫碳的壓力

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按產品

- 次氯酸鈉

- 次氯酸鈣

- 次氯酸鋰

- 次氯酸鉀

- 按形式

- 液體

- 固體(顆粒、片劑、粉末)

- 按用途

- 紙漿和造紙

- 消毒劑

- 紡織產品

- 水產養殖

- 洗衣漂白劑

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析(%)/排名分析

- 公司簡介

- Aditya Birla Chemicals

- AGC Chemicals

- Arkema SA

- Chlorum Solutions USA

- Cleanwater1 Inc.

- Clorox Company

- COVENTYA Group

- Ecoviz Kft

- Electrolytic Technologies LLC

- Hangzhou ASIA Chemical Engineering Co., Ltd

- HTH Pools(Arch Chemicals)

- Inovyn

- JSC AVANGARD

- Lanxess AG

- Lonza Group

- Nouryon

- Occidental Chemical(OxyChem)

- Odyssey Manufacturing Co.

- Olin Corporation

- Osaka Soda Co. Ltd.

- Shijiazhuang Xinlongwei Chemical

- Shouguang Tianwei Chemical

- Tianjin Yufeng Chemical

- Tosoh Corporation

- Union Overseas Enterprise Ltd.

第7章 市場機會與未來展望

The Hypochlorite Bleaches Market size is estimated at USD 306.57 billion in 2025, and is expected to reach USD 393.14 billion by 2030, at a CAGR of 5.10% during the forecast period (2025-2030), which underscores the sector's capacity to adapt to shifting regulations and technological advances.

Infrastructure spending on municipal water and wastewater systems, particularly in Asia Pacific, is vaulting demand as utilities transition from chlorine gas to safer sodium hypochlorite solutions. Investment in localized production-often upwards of USD 70 million per plant-also strengthens supply-chain resilience, while energy-efficient membrane-cell electrolysis is lowering power use by 15% compared with open-cell units. The Hypochlorite bleaches market further benefits from regulatory clarity: the EPA's 2024 revisions streamline hypochlorite transport, and the European Union has authorized calcium hypochlorite biocidal product families through 2035, both of which favor solution adoption. Competitive pressures persist, however, as peroxide-based alternatives gain popularity in textile and pulp bleaching, and hazardous-materials rules raise handling costs for oxidizers.

Global Hypochlorite Bleaches Market Trends and Insights

Escalating Water-Treatment & Sanitation Spending

Global water-infrastructure outlays are trending toward USD 1 trillion by 2033, advancing at 5.9% and directly lifting the Hypochlorite bleaches market through higher municipal and industrial disinfection needs. India exemplifies this surge, as government programs such as Jal Jeevan Mission push the nation's water-chemicals demand toward USD 2.8 billion by 2025. Remote facilities increasingly favor on-site sodium hypochlorite generation, eliminating chlorine-gas transport; Prague's installation treats 3,000 L s-1 while keeping residual chlorine within 0.2-0.4 ppm, protecting 800,000 residents. Smart dosing controls and AI-enabled telemetry are now common, cementing hypochlorite's role in modern water grids.

Surging Pulp & Paper Output in Emerging Asia

China consumed 13 million t of wood pulp in 2024, over 60% imported, and India may require 9.2 million t by 2030, driving the Hypochlorite bleaches market across Asia's paper mills. Trend analysis shows mills swapping chlorine gas for safer hypochlorite or chlorine-dioxide stages that cut effluent AOX while meeting brightness targets. Pilot studies by RISE reveal that optimized hypochlorite sequences preserve paper strength and curb chemical usage, providing mills with cost and compliance advantages. New capacity across Southeast Asia frequently incorporates membrane-based electrochlorination units, embedding hypochlorite supply within mill utilities.

Rising Shift Toward Peroxide-Based Bleaching Chemistries

Hydrogen peroxide decomposes into water and oxygen, eliminating chlorinated by-products and appealing to mills and dye-houses pursuing eco-labels. Advanced oxidation processes pairing UV/H2O2 or ozone outperform hypochlorite for difficult organics, nudging the Hypochlorite bleaches market toward specialty niches. Premium textile houses in Europe already pay a sustainability premium for peroxide-bleached cotton, exerting market-share pressure on hypochlorite formulations.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Additions in African Textile Finishing

- Roll-out of On-Site Hypochlorite Generators for Remote Utilities

- Strict Transport & Storage Rules for Oxidizing Chemicals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sodium hypochlorite contributed 58.91% to the Hypochlorite bleaches market in 2024, supported by entrenched use in municipal disinfection and household cleaning. Calcium hypochlorite, however, is forecast to grow 5.73% annually, buoyed by its EU authorization for pool and potable-water treatment through 2035.

Sodium's supremacy rests on liquid supply chains and maturing on-site generation. Membrane-cell systems uplift concentration to 7% w/w with 15% lower electricity bills, enriching the Hypochlorite bleaches market size for plant operators investing in electrochemical upgrades. Conversely, calcium's stability and 65-70% available chlorine endear it to remote installations needing long shelf life. Lithium and potassium salts remain niche, limited by cost and specialized industrial needs.

The Hypochlorite Bleaches Market Report is Segmented by Product (Sodium Hypochlorite, Calcium Hypochlorite, Lithium Hypochlorite, Potassium Hypochlorite), Form (Liquid, Solid), Application (Pulp and Paper, Disinfectants, Textiles, Aquaculture, Laundry Bleach, Others), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific generated 43.26% of Hypochlorite bleaches market revenue in 2024 and will likely rise at 5.67% CAGR to 2030 as governments channel record sums into water networks and as regional pulp mills pivot to safer bleaching routes. China's paper industry alone consumes 13 million t of wood pulp yearly, creating a sizable pull for hypochlorite solutions. India's Jal Jeevan Mission stokes chemical demand while De Nora's 20-unit CECHLO deployment in Hong Kong shows municipal enthusiasm for on-site generation.

North America is a mature yet evolving arena for the Hypochlorite bleaches market. The EPA's 2024 hazmat rules tighten chlorine-gas usage, catalyzing a wave of USD 70 million-plus local bleach plants and buoying revenue at integrated producers; Olin's Chlor Alkali segment topped USD 924.5 million in Q1 2025, up 4.5% year on year. Membrane-cell retrofits bolster energy efficiency, ensuring domestic competitiveness.

Europe faces decarbonization pressure worth an estimated USD 550 billion across the chlor-alkali chain, yet regulatory backing for hypochlorite continues via calcium authorization. Prague's conversion to on-site sodium hypochlorite highlights safety gains, processing 3,000 L s-1 for 800,000 residents. The Middle East and Africa are nascent, but textile-finishing investments and water-scarcity countermeasures suggest above-average growth potential for the Hypochlorite bleaches market.

- Aditya Birla Chemicals

- AGC Chemicals

- Arkema SA

- Chlorum Solutions USA

- Cleanwater1 Inc.

- Clorox Company

- COVENTYA Group

- Ecoviz Kft

- Electrolytic Technologies LLC

- Hangzhou ASIA Chemical Engineering Co., Ltd

- HTH Pools (Arch Chemicals)

- Inovyn

- JSC AVANGARD

- Lanxess AG

- Lonza Group

- Nouryon

- Occidental Chemical (OxyChem)

- Odyssey Manufacturing Co.

- Olin Corporation

- Osaka Soda Co. Ltd.

- Shijiazhuang Xinlongwei Chemical

- Shouguang Tianwei Chemical

- Tianjin Yufeng Chemical

- Tosoh Corporation

- Union Overseas Enterprise Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating water-treatment and sanitation spending

- 4.2.2 Surging pulp and paper output in emerging Asia

- 4.2.3 Capacity additions in African textile finishing

- 4.2.4 Roll-out of on-site hypochlorite generators for remote utilities

- 4.2.5 Chlorine-gas phase-out regulations benefitting hypochlorites

- 4.3 Market Restraints

- 4.3.1 Rising shift toward peroxide-based bleaching chemistries

- 4.3.2 Strict transport and storage rules for oxidising chemicals

- 4.3.3 Growth of advanced oxidative processes (ozone/AOP)

- 4.3.4 Decarbonisation pressure on chlor-alkali value chain

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts(Value)

- 5.1 By Product

- 5.1.1 Sodium Hypochlorite

- 5.1.2 Calcium Hypochlorite

- 5.1.3 Lithium Hypochlorite

- 5.1.4 Potassium Hypochlorite

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid (Granular/Tablets/Powder)

- 5.3 By Application

- 5.3.1 Pulp and Paper

- 5.3.2 Disinfectants

- 5.3.3 Textiles

- 5.3.4 Aquaculture

- 5.3.5 Laundry Bleach

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 AGC Chemicals

- 6.4.3 Arkema SA

- 6.4.4 Chlorum Solutions USA

- 6.4.5 Cleanwater1 Inc.

- 6.4.6 Clorox Company

- 6.4.7 COVENTYA Group

- 6.4.8 Ecoviz Kft

- 6.4.9 Electrolytic Technologies LLC

- 6.4.10 Hangzhou ASIA Chemical Engineering Co., Ltd

- 6.4.11 HTH Pools (Arch Chemicals)

- 6.4.12 Inovyn

- 6.4.13 JSC AVANGARD

- 6.4.14 Lanxess AG

- 6.4.15 Lonza Group

- 6.4.16 Nouryon

- 6.4.17 Occidental Chemical (OxyChem)

- 6.4.18 Odyssey Manufacturing Co.

- 6.4.19 Olin Corporation

- 6.4.20 Osaka Soda Co. Ltd.

- 6.4.21 Shijiazhuang Xinlongwei Chemical

- 6.4.22 Shouguang Tianwei Chemical

- 6.4.23 Tianjin Yufeng Chemical

- 6.4.24 Tosoh Corporation

- 6.4.25 Union Overseas Enterprise Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Demand from the Aquaculture Industry