|

市場調查報告書

商品編碼

1844492

聚合物奈米複合材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Polymer Nanocomposite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

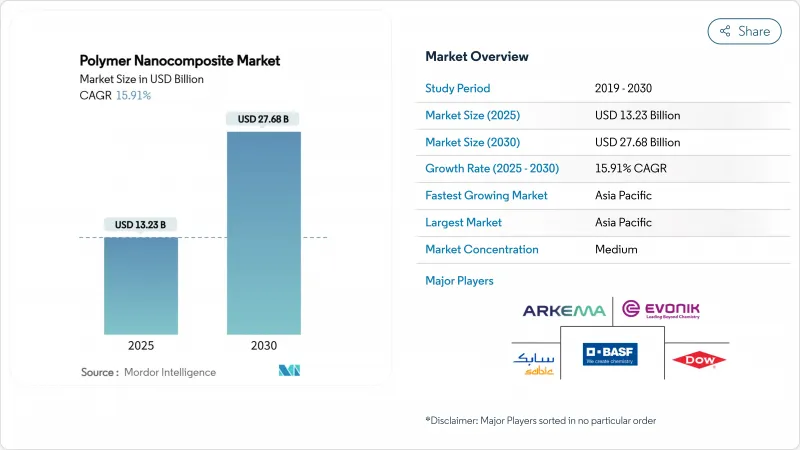

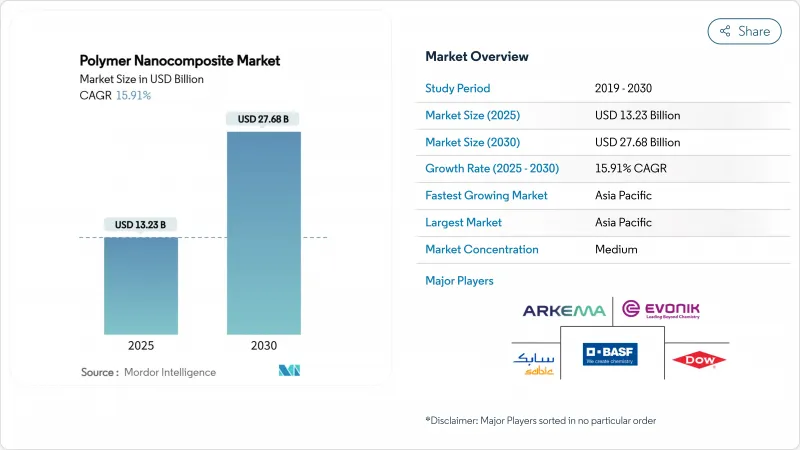

聚合物奈米複合材料市場規模預計在 2025 年為 132.3 億美元,預計到 2030 年將達到 276.8 億美元,預測期內(2025-2030 年)的複合年成長率為 15.91%。

隨著奈米填充材能夠同時提升強度、導熱性和阻隔性能,使其成為輕量化電動車零件、高密度電子產品和下一代封裝的核心材料,其需求將加速成長。雖然汽車專案正在推動近期產量成長,但蓬勃發展的5G基礎設施和無鹵化阻燃法規正在擴大客戶群。石墨烯和奈米碳管生產成本的降低帶來了經濟效益的提升,而亞太地區供應鏈則持續縮短前置作業時間並保持成長勢頭。對可回收熱塑性基質的投資進一步將聚合物奈米複合材料市場定位為實現循環經濟目標的首選解決方案。

全球聚合物奈米複合材料市場趨勢與洞察

食品和藥品對高阻隔包裝的需求不斷成長

聚合物奈米複合材料可將氧氣透過率降低至0.1 cc/m²/天以下,從而實現多層複合,同時將薄膜厚度減少高達40%。抗菌金屬氧化物奈米顆粒可延長保存期限,使食品加工商能夠從化學防腐劑轉向活性包裝形式。對濕氣敏感的藥品也受益匪淺,可實現簡化回收流程的單層泡殼設計。 FDA關於奈米材料風險評估的指導縮短了核准週期,生產線整合則省去了層壓步驟,從而提高了產量並降低了廢品率。

汽車和移動複合材料的輕量化目標

碳纖維增強熱塑性奈米複合材料比鋼材減輕了40%的重量,並支援自動化纖維鋪放生產線,以支援大批量電動車專案。其可回收性提高了整體生命週期的經濟性,並滿足了循環經濟的要求。除了減輕重量外,奈米級填料還能增強碰撞能量吸收、降低噪音振動 (NVH) 並實現薄壁設計。歐洲原始設備製造商計劃在2030年實現20-25%的減重,這將推動對樹脂和增強材料的投資。

配方和分散成本高

高長寬比填料的均勻分散需要高剪切雙螺桿擠出機,與標準聚合物相比,加工成本會增加200-400%。為防止奈米管團聚而進行的功能化處理需要額外的步驟和許可費用。乾粉和母粒降低了資本投資,但增加了供應鏈的複雜性。在實現規模經濟之前,成本壓力將限制其在價格敏感型包裝和消費品領域的滲透。

細分分析

受低成本和成熟的薄膜擠出技術推動,奈米黏土將在2024年佔據聚合物奈米複合材料市場佔有率的38.13%。更高的阻隔性使其能夠在零嘴零食包裝中實現5-7微米的凹槽,且不會影響保存期限。奈米碳管佔據高階市場,其10^3 S/m的電導率抵消了價格因素的影響,而金屬氧化物填料則滿足了防紫外線、抗菌和阻燃的需求。其他填料類別,包括可擴展的石墨烯和奈米鑽石等級,將實現19.44%的複合年成長率,因為它們提供了電磁屏蔽和導熱通道。綜上所述,這些趨勢表明配方的多樣性正在不斷增強,而不是單一填料的主導地位。

區域分析

到2024年,亞太地區聚合物奈米複合材料的市場佔有率將達到40.35%,這體現了其深厚的製造業生態系統和積極的國家項目。中國正在擴大石墨烯奈米管的生產規模並壓縮成本曲線,而印度的積層製造藍圖瞄準了全球5%的市場佔有率,這將刺激下游需求。日本正在資助一個纖維素奈米纖維試點項目,該項目將永續性與高模量相結合,吸引了家電和汽車製造商。

北美將利用汽車輕量化法案和航太認證管道。 USMCA貿易框架將促進複合顆粒的跨境供應,支援在墨西哥組裝並在美國銷售的汽車平台。在歐洲,嚴格的環境、健康和安全法規與循環經濟目標相結合,正在加速無鹵奈米複合材料在建築板材和鐵路內飾的應用。中東和非洲將透過綠色建築標準和石化產品多元化迎來需求成長,而南美將受益於巴西的包裝加工商和新興的電動車零件生產線。預測期內,區域差異化將推動聚合物奈米複合材料市場的均衡擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 食品和藥品對高阻隔包裝的需求不斷成長

- 汽車和移動出行複合材料的輕量化目標

- 5G和電力電子的溫度控管需求

- 對阻燃和無鹵材料的監管更加嚴格

- 電動汽車電池外殼材料

- 市場限制

- 混合和分散成本高

- 奈米毒性/EHS合規不確定性

- 石墨烯和碳奈米管供應規模化挑戰

- 價值鏈分析

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第5章市場規模及成長預測

- 按填料類型

- 奈米碳管

- 金屬氧化物

- 奈米黏土

- 奈米纖維

- 其他填充劑

- 按聚合物基質

- 熱塑性塑膠

- 熱固性樹脂

- 生物基聚合物

- 按最終用戶產業

- 車

- 包裝

- 航太/國防

- 電氣和電子

- 能源與儲存

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- 3D Systems Inc.

- Altana

- Arkema

- AxiPolymer Inc.

- BASF

- Birla Carbon

- Dow

- DuPont

- Evonik Industries AG

- Foster, LLC

- Hybrid Plastics Inc.

- Inframat Corporation

- Mitsubishi Chemical Group Corporation

- Nanocyl SA

- Powdermet Inc.

- RTP Company

- SABIC

- ShayoNano Singapore Private Ltd.

- Solesence

- Sumitomo Chemical Co. Ltd.

- TORAY INDUSTRIES, INC.

第7章 市場機會與未來展望

The Polymer Nanocomposite Market size is estimated at USD 13.23 billion in 2025, and is expected to reach USD 27.68 billion by 2030, at a CAGR of 15.91% during the forecast period (2025-2030).

Demand accelerates as nanoscale fillers unlock simultaneous gains in strength, thermal conductivity, and barrier performance, making the material central to lightweight electric-vehicle parts, high-density electronics, and next-generation packaging. Automotive programs anchor near-term volumes, while fast-moving 5G infrastructure and halogen-free flame-retardant regulations broaden the customer base. Cost-down progress in graphene and carbon-nanotube production improves economics, and regional supply chains in Asia-Pacific shorten lead times, sustaining momentum. Investments in recycling-friendly thermoplastic matrices further position the polymer nanocomposites market as a preferred solution for circular-economy goals.

Global Polymer Nanocomposite Market Trends and Insights

Growing Demand for High-Barrier Packaging in Food and Pharma

Polymer nanocomposites lower oxygen transmission below 0.1 cc/m2/day, matching multilayer laminates while cutting film thickness by up to 40%. Antimicrobial metal-oxide nanoparticles extend shelf life, so food processors shift from chemical preservatives to active-packaging formats. Moisture-sensitive pharmaceuticals also benefit, allowing single-layer blister designs that simplify recycling. FDA guidance on nanomaterial risk assessment shortens approval cycles, and line integration eliminates lamination steps, improving throughput and waste ratios.

Lightweighting Targets in Automotive and Mobility Composites

Carbon-fiber-reinforced thermoplastic nanocomposites yield 40% mass savings versus steel and support automated fiber-placement lines, aligning with high-volume e-mobility programs. Recyclability boosts total-life economics, meeting circular mandates. Beyond mass reduction, nanoscale fillers enhance crash energy absorption and damp NVH, enabling thin-wall designs. European OEMs plan 20-25% weight cuts by 2030, catalyzing resin and reinforcement investment.

High Compounding and Dispersion Costs

Uniform distribution of high-aspect-ratio fillers demands twin-screw extruders with intensified shear, adding 200-400% to processing cost versus standard polymers. Functionalization to curb nanotube agglomeration introduces extra steps and licensing fees. Dry-powder and masterbatch routes lower capex but widen supply-chain complexity. Cost pressure limits penetration into price-sensitive packaging and consumer goods until scale economies materialize.

Other drivers and restraints analyzed in the detailed report include:

- Thermal Management Needs in 5G and Power Electronics

- Regulatory Push for Flame-Retardant, Halogen-Free Materials

- Nanotoxicity/EHS Compliance Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nanoclay held 38.13% polymer nanocomposites market share in 2024 on the strength of low cost and established film-extrusion know-how. Barrier gains allow 5-7 µm downgauging in snack packaging without compromising shelf life. Carbon nanotubes occupy premium niches where 10^3 S/m conductivity offsets price, while metal-oxide fillers address UV, antimicrobial, and flame-retardant needs. The other-filler category captures 19.44% CAGR as scalable graphene and nanodiamond grades unlock EMI shielding and thermal paths. Combined, these trends suggest widening formulation diversity rather than one-filler dominanc.

The Polymer Nanocomposites Market Report is Segmented by Filler Type (Carbon Nanotube, Metal Oxide, Nanoclay, and More), Polymer Matrix (Thermoplastics, Thermosets, and Bio-Based Polymers), End-User Industry (Automotive, Packaging, Aerospace and Defense, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 40.35% polymer nanocomposites market share in 2024 mirrors deep manufacturing ecosystems and proactive state programs. China's scale in graphene nanotube production compresses cost curves, while India's additive-manufacturing roadmap targets a 5% global stake, stimulating downstream demand. Japan funds cellulose nanofiber pilots that blend sustainability with high modulus, drawing appliance and auto tier-ones.

North America leverages automotive lightweighting legislation and aerospace certification pipelines. The USMCA trade framework eases cross-border supply of compounded pellets, aiding vehicle platforms assembled in Mexico yet sold in the United States. Europe couples stringent EHS rules with circular-economy targets, accelerating halogen-free nanocomposite adoption in building panels and rail interiors. The Middle East and Africa open pockets of demand through green-building codes and petrochemical diversification, while South America's progress hinges on Brazilian packaging converters and nascent EV component lines. Collectively, regional differentiation ensures balanced expansion for the polymer nanocomposites market over the forecast horizon.

- 3D Systems Inc.

- Altana

- Arkema

- AxiPolymer Inc.

- BASF

- Birla Carbon

- Dow

- DuPont

- Evonik Industries AG

- Foster, LLC

- Hybrid Plastics Inc.

- Inframat Corporation

- Mitsubishi Chemical Group Corporation

- Nanocyl SA

- Powdermet Inc.

- RTP Company

- SABIC

- ShayoNano Singapore Private Ltd.

- Solesence

- Sumitomo Chemical Co. Ltd.

- TORAY INDUSTRIES, INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for High-Barrier Packaging in Food and Pharma

- 4.2.2 Lightweighting Targets in Automotive and Mobility Composites

- 4.2.3 Thermal Management Needs in 5G and Power Electronics

- 4.2.4 Regulatory Push for Flame-Retardant, Halogen-Free Materials

- 4.2.5 Battery-Housing Materials for Electric Vehicles

- 4.3 Market Restraints

- 4.3.1 High Compounding and Dispersion Costs

- 4.3.2 Nanotoxicity/EHS Compliance Uncertainty

- 4.3.3 Scale-Up Challenges for Graphene and CNT Supply

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Patent Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Filler Type

- 5.1.1 Carbon Nanotube

- 5.1.2 Metal Oxide

- 5.1.3 Nanoclay

- 5.1.4 Nanofiber

- 5.1.5 Other Filler Types

- 5.2 By Polymer Matrix

- 5.2.1 Thermoplastics

- 5.2.2 Thermosets

- 5.2.3 Bio-based Polymers

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Packaging

- 5.3.3 Aerospace and Defense

- 5.3.4 Electrical and Electronics

- 5.3.5 Energy and Storage

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3D Systems Inc.

- 6.4.2 Altana

- 6.4.3 Arkema

- 6.4.4 AxiPolymer Inc.

- 6.4.5 BASF

- 6.4.6 Birla Carbon

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 Evonik Industries AG

- 6.4.10 Foster, LLC

- 6.4.11 Hybrid Plastics Inc.

- 6.4.12 Inframat Corporation

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 Nanocyl SA

- 6.4.15 Powdermet Inc.

- 6.4.16 RTP Company

- 6.4.17 SABIC

- 6.4.18 ShayoNano Singapore Private Ltd.

- 6.4.19 Solesence

- 6.4.20 Sumitomo Chemical Co. Ltd.

- 6.4.21 TORAY INDUSTRIES, INC.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment