|

市場調查報告書

商品編碼

1844477

殘留物檢測:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Residue Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

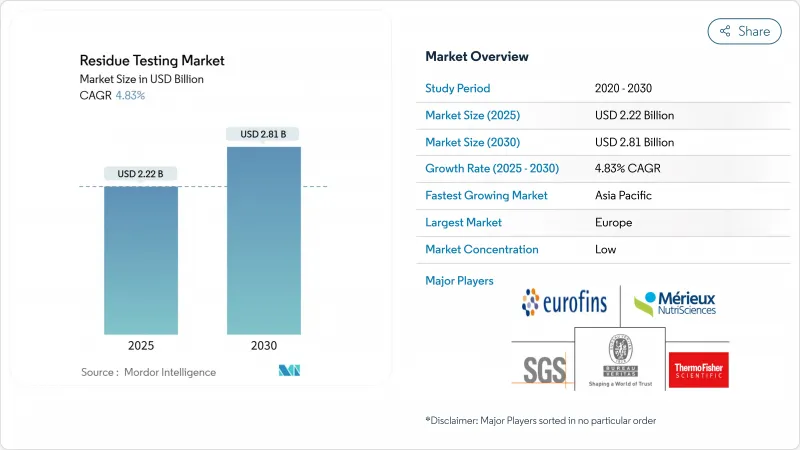

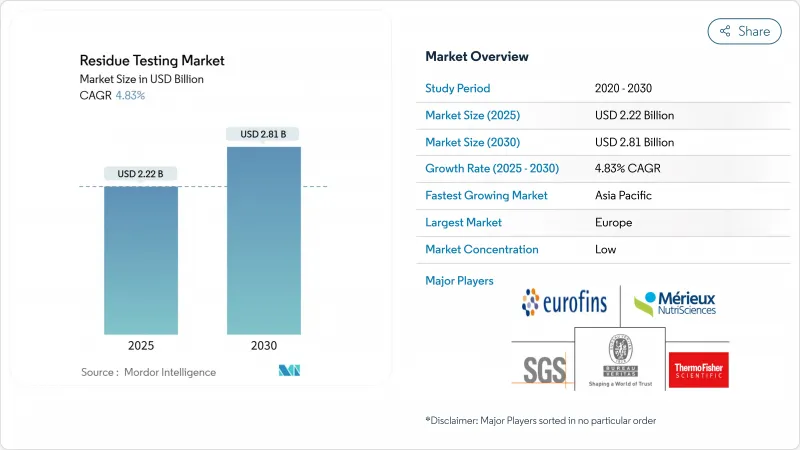

預計到 2025 年,食品殘留檢測市場收益將達到 22.2 億美元,到 2030 年將擴大到 28.1 億美元,複合年成長率為 4.83%。

成長的動力來自全球最大殘留基準值收緊、技術的快速升級以及消費者對食品純度不斷成長的需求。根據歐洲食品安全局 2023 年的年度報告,99% 的食品樣本符合歐盟法規,但 2% 的食品樣本超過最大殘留基準值,凸顯了對強大檢測基礎設施的迫切需求。政府收緊法規的速度超過了大多數生產商的適應速度,將強制性檢測範圍擴大到新的殘留類別,並要求對整個進口和國內供應鏈進行即時監控。質譜、定序和生物感測器平台的融合正在縮短分析週期,而食品召回的加速成長使檢測需求保持在結構性的高位。食品殘留檢測市場仍然分散,隨著服務提供者尋求在設備投資、數據分析和地理覆蓋方面獲得規模優勢,這為有意義的整合創造了空間。

全球殘留檢測市場趨勢與洞察

嚴格的全球食品安全法規

隨著各國政府實施更嚴格的殘留限量並擴大監測範圍,日益嚴格的法規加速了檢測需求。歐盟法規 2023/915 的實施設立了全面的污染物閾值,FDA 更新後的黴菌毒素監測計畫現在包括使用多黴菌毒素分析方法的 T-2/HT-2 毒素和Zearalenone。中國在 2024 年發布了 47 項新的國家食品安全標準,其中包括七種專用檢測方法,顯示監管與國際最佳實踐趨同。台灣於 2024 年 7 月引入了寵物食品中五種黴菌毒素(包括嘔吐毒素和Fumonisins)的新安全耐受水平,標誌著監管範圍擴大到人類消費之外。 FDA 食品分析實驗室認可 (LAAF) 計劃下的強制性黴菌毒素檢測要求將於 2024 年 12 月開始實施,這將對認可的檢測能力產生結構性需求。巴西採用新的食品法規結構並修訂其食品接觸金屬技術法規,進一步體現了全球監管的協調一致,從而推動了系統性檢測要求的提升。這些新興市場的監管發展要求增加對檢測基礎設施和分析能力的投資。國際標準的協調一致為檢測服務提供者創造了機遇,同時確保了全球供應鏈中食品安全實踐的一致性。

潔淨標示食品和飲料的需求激增

消費者對透明、低加工食品的偏好促使製造商實施全面的殘留檢測通訊協定,以檢驗清潔標籤的聲明。這一趨勢對高階食品行業影響尤為顯著,因為該行業的品牌以經過認證的純度水平和不含合成殘留物為特色。清潔標籤運動的範圍已超越農藥,涵蓋重金屬、加工助劑和包裝污染物,從而擴大了產品特定檢測的範圍。零售商越來越要求第三方檢驗清潔標籤聲明,這催生了對整個供應鏈進行系統性檢測的需求。潔淨標示標籤產品的高昂價格證明了增加檢測投入的合理性,對於以注重健康的消費者為目標的製造商而言,全面的殘留分析在經濟上也是可行的。社群媒體和即時資訊共用的興起提高了消費者對產品成分的審查力度,迫使企業保持嚴格的檢測標準。此外,食品安全事件和召回事件的增加也提高了人們對殘留檢測的認知,使其成為品質保證計劃的重要組成部分。

先進測試技術高成本

資本密集分析設備對小型實驗室和食品製造商構成了障礙,尤其是在價格敏感的市場中。先進的 LC-MS/MS 系統需要大量的前期投資和持續的維護成本,這給中型實驗室的營運預算帶來了壓力。現代測試平台的複雜性需要專門的技術知識並增加了人事費用。設備驗證和校準的監管合規性要求產生了額外的成本層級,尤其對服務於本地市場的實驗室影響更大。然而,技術提供者擴大提供租賃模式和共用存取平台,使高級測試功能民主化。這些財務限制導致了市場整合,大型實驗室在殘留測試領域中佔據主導地位。小型企業通常將其測試需求外包給第三方實驗室,為測試服務創造了次市場。

細分分析

到2024年,農藥將佔據44.94%的市場佔有率,這反映了其在全球食品體系中的廣泛使用和全面的監管。重金屬仍將是第二大類別,這得益於環境污染問題以及食品中鉛、鎘和汞監管力度的加強。毒素將成為成長最快的類別,到2030年,其複合年成長率將達到5.08%,這得益於黴菌毒素檢測要求的不斷提高以及對新型生物毒素檢測的需求。 「其他」類別,包括藥物、抗生素和化學污染物,將受益於對動物用藥品殘留和PFAS等新興污染物的嚴格審查。

歐盟最新黴菌毒素法規(包括2024年7月生效的2024/1022號法規)是監管因素加速毒素檢測需求的一個例子,該法規將設定嘔吐基準值(DON)、T-2毒素和HT-2毒素的新最高限量。台灣已對寵物食品中的五種黴菌毒素設定了允許限量,其中包括狗糧中2 ppm的催吐毒素和貓糧中5 ppm的催吐毒素。脂多醣印跡聚合物等先進檢測方法可使沙門氏菌檢測靈敏度達到10 CFU/mL,無需複雜的樣品製備即可快速鑑定病原體。

基於液相層析串聯質譜 (LC-MS/MS) 的技術將在 2024 年保持市場領導,市場佔有率達 35.54%,這得益於監管部門的核准以及其在多種殘留類型中經過驗證的分析性能。基於高效液相層析 (HPLC) 的方法適用於成本敏感的應用,在這些應用中,高通量篩檢比最終靈敏度更重要。氣相層析串聯質譜 (GC-MS/MS) 平台在揮發性化合物分析方面表現出色,尤其是加工食品中的農藥殘留。基於電感耦合等離子體質譜 (ICP-MS) 的技術可滿足重金屬檢測需求,並具有優異的微量元素分析準確度。

到2030年,NGS/生物感測器技術將以5.44%的複合年成長率加速發展,這得益於快速檢測能力和多重分析潛力,這些潛力將改變實驗室工作流程。 FDA對Q20+奈米孔定序用於細菌疫情調查的評估表明,監管機構對即時病原體鑑定的興趣,這有可能將目前2-4週的測序時間縮短至近乎即時的結果。 CRISPR-Cas系統能夠快速、高度特異性且經濟高效地檢測致病性大腸桿菌,從而突破了傳統耗時方法的限制。基於免疫測量的平台將繼續用於常規篩檢應用,而包括表面增強拉曼散射和電化學感測器在內的「其他」技術將提供可攜式檢測功能。

區域分析

到 2024 年,歐洲將以 34.78% 的佔有率保持市場領先地位,這得益於歐盟全面的法規結構,包括更新的《污染物法規 (EU) 2023/915》,該法規規定了各種食品污染物的最高含量。該地區的檢測基礎設施受益於統一的分析標準和強力的執行機制,這些機制促進了成員國的系統採用。德國、英國和法國的分析能力處於領先地位,而荷蘭和比利時是重要的進口門戶,需要廣泛的測試通訊協定。根據歐洲食品安全局 (EFSA) 的數據,其 2023 年年度報告顯示合規率為 99%,僅 2% 超過最大殘留基準值,突顯了該地區嚴格的監控方法。最近的監管更新,包括氟唑菌醯胺、Lambda-Cyhalothrin、Metalaxyl和尼古丁的新最大殘留基準值,將於 2025 年 1 月生效,表明安全標準不斷完善。

受監管現代化努力和主要經濟體糧食生產能力不斷擴大的推動,亞太地區正加速成為成長最快的地區,到 2030 年複合年成長率將達到 5.24%。中國將於 2024 年發布 47 項新的國家食品安全標準,其中包括 7 種專用檢測方法,標誌著其監管與國際最佳實踐的接軌。印度食品安全局 (FSSAI) 重新實施食品標籤標準(將於 2023 年 1 月生效)將加強監督機制,而安捷倫與 ICAR-國家葡萄研究中心的戰略夥伴關係將開發針對新興污染物(包括 PFAS 和極性農藥)的先進分析工作流程。日本修訂了農藥和動物用藥品的最大殘留基準值,使其與國際標準接軌,而韓國更新的農藥抗藥性標準和食品標籤要求則加強了消費者保護。隨著出口導向經濟體實施更嚴格的檢測通訊協定以滿足國際市場要求,澳洲和印尼代表著巨大的成長機會。

在 FDA 和 USDA 嚴格監管機制的支持下,北美透過對國內和進口食品供應進行全面檢測,維持了重要的市場佔有率。 FDA 的 2022 年農藥殘留監測報告顯示,國內樣品的合規率為 96.2%,進口樣品的合規率為 89.5%,凸顯了檢測在全球食品貿易中的重要作用。該地區受益於先進的實驗室基礎設施和技術創新,SGS 等公司透過升級主要製造地的設施來擴展食品檢測能力。隨著巴西採用新的法規結構和修訂的食品接觸材料技術法規,南美洲已成為一個成長機會,而阿根廷、哥倫比亞和智利正在加強其出口檢測能力以滿足國際要求。中東和非洲代表新興市場,隨著食品安全意識的提高和出口需求的擴大,基礎設施投資和製定法規結構提供了長期成長潛力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 世界各地嚴格的食品安全法規

- 潔淨標示食品和飲料的需求激增

- 測試技術的進步

- 食物中毒發生率增加

- 農藥在農業上的廣泛使用

- 食品召回增加

- 市場限制

- 先進測試技術高成本

- 各地區殘留基準值缺乏標準化

- 新興國家基礎建設有限

- 小農和生產者缺乏意識

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按殘留物類型

- 殺蟲劑

- 重金屬

- 危險物質

- 其他

- 依技術

- 基於LC-MS/MS

- 基於HPLC

- 基於GC-MS/MS

- 基於ICP-MS

- 基於免疫檢測測定

- NGS/生物感測器

- 其他

- 按用途

- 農作物

- 飼料和寵物食品

- 飲食

- 肉類/家禽

- 乳製品

- 水果和蔬菜

- 加工食品

- 飲料

- 按檢驗方式

- 實驗室考試

- 檢測套組

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市場排名分析

- 公司簡介

- SGS Societe Generale de Surveillance SA

- Eurofins Scientific

- Bureau Veritas

- Intertek Group plc

- Tuv Sud EV(TUV SUD)

- NSF

- Merieux Nutrisciences Corporation

- ALS Global

- AsureQuality

- SCIEX(Danaher)

- Thermo Fisher Scientific

- Hewlett-Packard(Agilent Technologies, Inc.)

- Waters Corporation

- Shimadzu Corporation

- PerkinElmer NV

- Neogen Corporation

- Charm Sciences

- DSM-Firmenich(Romer Labs)

- Labcorp Crop

- Symbio Labs

第7章 市場機會與未來展望

The food residue testing market size is expected to reach USD 2.22 billion in revenue by 2025 and is forecast to expand to USD 2.81 billion by 2030, registering a 4.83% CAGR.

Growth is fuelled by stricter global maximum residue limits, rapid technology upgrades, and rising consumer insistence on verifiable food purity. The European Food Safety Authority's 2023 annual report indicated that 99% of food samples complied with EU regulations, yet 2% exceeded maximum residue levels, underscoring the critical need for robust testing infrastructure . Governments tighten rules faster than most producers can adapt, extending mandatory testing to new residue classes and mandating real-time monitoring across import and domestic supply chains. Convergence of mass-spectrometry, sequencing and biosensor platforms shortens analysis cycles, while the accelerating cadence of food recalls keeps testing demand structurally high. The food residue testing market remains fragmented, creating meaningful scope for consolidation as service providers seek scale advantages in instrumentation investment, data analytics, and geographic reach.

Global Residue Testing Market Trends and Insights

Stringent Global Food Safety Regulations

Regulatory tightening accelerates testing demand as governments implement more restrictive maximum residue limits and expand monitoring scope. The EU's implementation of Regulation 2023/915 established comprehensive contaminant thresholds, while the FDA's updated mycotoxin monitoring program now includes T-2/HT-2 toxins and zearalenone using multi-mycotoxin analytical methods. China's release of 47 new national food safety standards in 2024, including 7 dedicated testing methodologies, signals regulatory convergence toward international best practices. In July 2024 Taiwan's introduction of safety tolerance levels for 5 additional mycotoxins in pet food, including vomitoxin and fumonisin, demonstrates expanding regulatory scope beyond human consumption. The FDA's Laboratory Accreditation for Analyses of Foods (LAAF) program mandate for mycotoxin testing starting December 2024 creates structural demand for accredited testing capabilities. Brazil's adoption of new regulatory frameworks for food products and revised technical regulations for food contact metals further exemplifies global regulatory harmonization driving systematic testing requirements. These regulatory developments across major markets necessitate increased investment in testing infrastructure and analytical capabilities. The harmonization of international standards creates opportunities for testing service providers while ensuring consistent food safety measures across global supply chains.

Surge in Demand for Clean-label Food and Beverage Products

Consumer preference for transparent, minimally processed foods drives manufacturers to implement comprehensive residue testing protocols that verify clean-label claims. This trend particularly impacts premium food segments where brands differentiate through certified purity levels and absence of synthetic residues. The clean-label movement extends beyond pesticides to encompass heavy metals, processing aids, and packaging contaminants, expanding the testing scope per product. Retailers increasingly require third-party verification of clean-label assertions, creating systematic testing demand across supply chains. The premium pricing associated with clean-label products justifies enhanced testing investments, making comprehensive residue analysis economically viable for manufacturers targeting health-conscious consumers. The rise of social media and instant information sharing has amplified consumer scrutiny of product ingredients, forcing companies to maintain rigorous testing standards. Additionally, the growing number of food safety incidents and recalls has heightened awareness about residue testing, making it an essential component of quality assurance programs.

High Cost of Advanced Testing Technologies

Capital-intensive analytical equipment creates barriers for smaller laboratories and food producers, particularly in price-sensitive markets. Advanced LC-MS/MS systems require substantial upfront investments and ongoing maintenance costs that strain operational budgets for mid-tier testing facilities. The complexity of modern testing platforms demands specialized technical expertise, adding personnel costs that compound equipment expenses. Regulatory compliance requirements for instrument validation and calibration create additional cost layers that particularly impact laboratories serving local markets. However, technology providers increasingly offer leasing models and shared-access platforms that democratize advanced testing capabilities. These financial constraints have led to market consolidation, with larger laboratories dominating the residue testing landscape. Small and medium-sized enterprises often resort to outsourcing their testing needs to third-party laboratories, creating a secondary market for testing services.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Testing Techniques

- Rise in Outbreaks of Foodborne Illnesses

- Limited Infrastructure in Developing Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pesticides commanded 44.94% market share in 2024, reflecting widespread agrochemical usage and comprehensive regulatory monitoring across global food systems. Heavy metals represent the second-largest category, driven by environmental contamination concerns and tightening limits for lead, cadmium, and mercury in food products. Toxins emerge as the fastest-growing segment at 5.08% CAGR through 2030, propelled by expanding mycotoxin testing requirements and novel biotoxin detection needs. The "Others" category, encompassing drugs, antibiotics, and chemical contaminants, benefits from increased scrutiny of veterinary drug residues and emerging contaminants like PFAS.

The EU's updated mycotoxin regulations, including Regulation 2024/1022 setting new maximum levels for DON, T-2, and HT-2 toxins effective July 2024, exemplify regulatory drivers accelerating toxin testing demand. Taiwan's introduction of tolerance levels for 5 additional mycotoxins in pet food, including 2 ppm vomitoxin for dog food and 5 ppm for cat food, demonstrates expanding regulatory scope beyond human consumption. Advanced detection methods like lipopolysaccharide-imprinted polymers achieve 10 CFU/mL sensitivity for Salmonella detection, enabling rapid on-site pathogen identification without complex preprocessing

LC-MS/MS-based technology maintains market leadership with 35.54% share in 2024, supported by regulatory acceptance and proven analytical performance across diverse residue types. HPLC-based methods serve cost-sensitive applications where high-throughput screening takes precedence over ultimate sensitivity. GC-MS/MS platforms excel in volatile compound analysis, particularly for pesticide residues in processed foods. ICP-MS-based technology addresses heavy metal detection requirements with exceptional precision for trace elemental analysis.

NGS/biosensor technology accelerates at 5.44% CAGR through 2030, driven by rapid detection capabilities and multiplex analysis potential that transforms laboratory workflows. The FDA's evaluation of Q20+ Nanopore Sequencing for bacterial outbreak investigations demonstrates regulatory interest in real-time pathogen identification, potentially reducing current 2-4 week sequencing timelines to near real-time results. CRISPR-Cas systems enable rapid pathogenic E. coli detection with high specificity and cost-effectiveness, addressing limitations of traditional time-consuming methods. Immunoassay-based platforms continue serving routine screening applications, while "Others" encompass emerging technologies like surface-enhanced Raman scattering and electrochemical sensors that offer portable detection capabilities.

The Residue Testing Market Report is Segmented by Residue Type (Pesticides, Heavy Metals, and More), Technology (HPLC-Based, LC-MS/MS-based, and More), Application (Feed and Pet Food, Agricultural Crops, and Food and Beverage), Testing Mode (Lab Testing and Testing Kits) and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintains market leadership with 34.78% share in 2024, anchored by the EU's comprehensive regulatory framework including the updated Contaminants Regulation 2023/915 that establishes maximum levels for various food contaminants. The region's testing infrastructure benefits from harmonized analytical standards and robust enforcement mechanisms that drive systematic adoption across member states. Germany, United Kingdom, and France lead in analytical capabilities, while Netherlands and Belgium serve as critical import gateways requiring extensive testing protocols. The EFSA's 2023 annual report indicating 99% regulatory compliance yet 2% exceedance of maximum residue levels underscores the region's rigorous monitoring approach according to European Food Safety Authority. Recent regulatory updates include new maximum residue levels for fluxapyroxad, lambda-cyhalothrin, metalaxyl, and nicotine effective January 2025, demonstrating ongoing refinement of safety standards.

Asia-Pacific accelerates as the fastest-growing region at 5.24% CAGR through 2030, driven by regulatory modernization initiatives and expanding food production capacity across major economies. China's release of 47 new national food safety standards in 2024, including 7 dedicated testing methodologies, signals regulatory convergence toward international best practices. India's FSSAI re-operationalization of food labeling standards effective January 2023 strengthens oversight mechanisms, while Agilent's strategic partnership with ICAR-National Research Centre for Grapes develops advanced analytical workflows for emerging contaminants including PFAS and polar pesticides. Japan's revision of maximum residue limits for pesticides and veterinary drugs aligns with international standards, while South Korea's updates to pesticide tolerance standards and food labeling requirements enhance consumer protection. Australia and Indonesia represent significant growth opportunities as export-oriented economies implement stricter testing protocols to meet international market requirements.

North America maintains substantial market presence supported by stringent FDA and USDA oversight mechanisms that drive comprehensive testing across domestic and imported food supplies. The FDA's FY 2022 Pesticide Residue Monitoring Report revealed 96.2% compliance for domestic samples versus 89.5% for imports, highlighting the critical role of testing in global food trade. The region benefits from advanced laboratory infrastructure and technological innovation, with companies like SGS expanding food testing capacity through facility upgrades in key manufacturing hubs . South America emerges as a growth opportunity driven by Brazil's adoption of new regulatory frameworks and revised technical regulations for food contact materials, while Argentina, Colombia, and Chile enhance export testing capabilities to meet international requirements. Middle East and Africa represent developing markets where infrastructure investments and regulatory framework development create long-term growth potential as food safety awareness increases and export ambitions expand.

- SGS Societe Generale de Surveillance SA

- Eurofins Scientific

- Bureau Veritas

- Intertek Group plc

- Tuv Sud E.V. (TUV SUD)

- NSF

- Merieux Nutrisciences Corporation

- ALS Global

- AsureQuality

- SCIEX (Danaher)

- Thermo Fisher Scientific

- Hewlett-Packard (Agilent Technologies, Inc.)

- Waters Corporation

- Shimadzu Corporation

- PerkinElmer NV

- Neogen Corporation

- Charm Sciences

- DSM-Firmenich (Romer Labs)

- Labcorp Crop

- Symbio Labs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Global Food Safety Regulations

- 4.2.2 Surge in Demand for Clean-label Food and Beverage Products

- 4.2.3 Technological Advancements in Testing Techniques

- 4.2.4 Rise in Outbreaks of Foodborne Illnesses

- 4.2.5 Widespread Use of Agrochemicals in Farming

- 4.2.6 Increased Incidence of Food Recalls

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Testing Technologies

- 4.3.2 Lack of Standardization in Residue Limits Across Regions

- 4.3.3 Limited Infrastructure in Developing Countries

- 4.3.4 Lack of Awareness Among Small-Scale Farmers and Producers

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Residue Type

- 5.1.1 Pesticides

- 5.1.2 Heavy Metals

- 5.1.3 Toxins

- 5.1.4 Others

- 5.2 By Technology

- 5.2.1 LC-MS/MS-based

- 5.2.2 HPLC-based

- 5.2.3 GC-MS/MS-based

- 5.2.4 ICP-MS-based

- 5.2.5 Immunoassay-based

- 5.2.6 NGS/Biosensor

- 5.2.7 Others

- 5.3 By Application

- 5.3.1 Agricultural Crops

- 5.3.2 Feed and Pet Food

- 5.3.3 Food and Beverage

- 5.3.3.1 Meat and Poultry

- 5.3.3.2 Dairy

- 5.3.3.3 Fruits and Vegetables

- 5.3.3.4 Processed Food

- 5.3.3.5 Beverages

- 5.4 By Testing Mode

- 5.4.1 Lab Testing

- 5.4.2 Testing Kits

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SGS Societe Generale de Surveillance SA

- 6.4.2 Eurofins Scientific

- 6.4.3 Bureau Veritas

- 6.4.4 Intertek Group plc

- 6.4.5 Tuv Sud E.V. (TUV SUD)

- 6.4.6 NSF

- 6.4.7 Merieux Nutrisciences Corporation

- 6.4.8 ALS Global

- 6.4.9 AsureQuality

- 6.4.10 SCIEX (Danaher)

- 6.4.11 Thermo Fisher Scientific

- 6.4.12 Hewlett-Packard (Agilent Technologies, Inc.)

- 6.4.13 Waters Corporation

- 6.4.14 Shimadzu Corporation

- 6.4.15 PerkinElmer NV

- 6.4.16 Neogen Corporation

- 6.4.17 Charm Sciences

- 6.4.18 DSM-Firmenich (Romer Labs)

- 6.4.19 Labcorp Crop

- 6.4.20 Symbio Labs