|

市場調查報告書

商品編碼

1844458

汽車座椅:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Seats - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

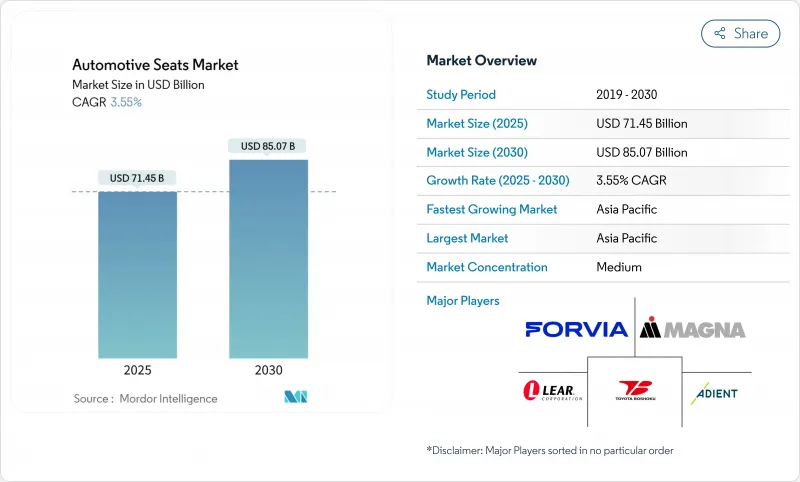

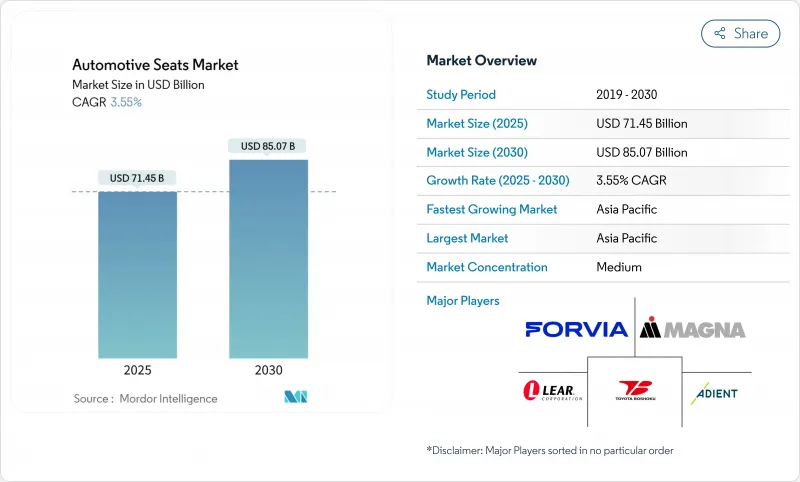

預計汽車座椅市場規模到 2025 年將達到 714.5 億美元,到 2030 年將達到 850.7 億美元,複合年成長率高達 3.55%。

由於電氣化、自動駕駛能力以及對高階舒適性日益成長的追求,座椅框架、坐墊和電子設備的重新設計推動了座椅框架、坐墊和電子設備的持續成長。汽車製造商繼續採用更輕的結構來彌補電池重量的不足,消費者也青睞電動通風和按摩功能,這推高了平均售價。原料波動和嚴格的安全法規給整個價值鏈帶來了成本壓力,但一級供應商憑藉其與汽車項目的深度整合,保持了定價能力。亞太地區在產量需求和技術應用方面處於領先地位,中國、印度和日本的工廠正在擴大內燃機和電動式平台的產能。

全球汽車座椅市場趨勢與洞察

全球輕型汽車產量正在增加,尤其是SUV

到2024年,SUV將佔全球汽車銷售的54%,這將推動對增加單車座位數、加強型側墊、多排座椅配置和高階內裝的需求。可支配收入和都市化將推動SUV的普及,使亞太地區的製造商受益。 2023年,20%的SUV銷量將是純電動的,這將推動對輕量化車架和整合溫度控管的新需求,以抵消電池重量的增加。根據國際能源總署(IEA)的報告,大多數SUV仍然使用石化燃料驅動,這為整合主動冷卻、加熱和重量最佳化外殼的電動座椅帶來了巨大的創新潛力。

消費者對電動、通風和按摩座椅的需求不斷增加

曾經專屬於豪華品牌的高階功能如今已在中階車型上亮相。李爾的ComfortMax平台將加熱和通風系統的回應時間縮短了40%,並將組裝複雜度降低了一半,從而為原始設備製造商(OEM)實現了大規模部署。通風座椅是成長最快的技術領域,複合年成長率高達6.12%。按摩系統如今融入了生物回饋技術,以減輕乘員的壓力,將座椅轉變為健康中心,並透過軟體升級產生經常性收益。

皮革、發泡體和高級聚合物的價格波動

2020年至2021年,鋼材價格上漲了一倍多,導致每輛車的原料成本從2,200美元上漲至4,125美元,擠壓了座椅供應商的利潤空間。聚氨酯泡棉佔座椅坐墊的90%以上,其價格波動與原油價格波動密切相關,導致製造商面臨難以在工程中期轉嫁的成本上漲。為此,供應商正在重新設計坐墊形狀以減少泡棉用量,並使用經過認證的再生聚合物共混物。

細分分析

預計到2024年,合成皮革將佔據汽車座椅市場佔有率的48.75%,複合年成長率為5.44%。原廠配套專案重視合成皮革一致的粒面、耐污性和便利的清潔性能,從而減少車隊維修中的保固索賠。織物布料在入門級車型中仍然佔據主導地位,而真皮在高階車型中仍然存在,但面臨永續性問題和採購不確定性。隨著原始設備製造商追求可循環材料,亞麻和大麻等天然纖維正被用於座椅靠背和坐墊的加固,但價格溢價仍然是其大規模應用的限制。

與真皮內裝相比,豐田的SofTex內裝在製造過程中可減少85%的二氧化碳排放,幫助該公司達到車輛平均排放目標。大陸集團和麥格納正在開發生物泡沫墊片原型,透過消除混合材料中的黏合劑,使回收更加便捷。這些新興經濟體正發出訊號,轉向單一材料發泡,以便在車輛報廢後易於拆卸,以滿足歐洲循環經濟指令的要求。

到2024年,手排調節器仍將佔據全球58.25%的市場佔有率,這反映了新興市場和基礎車型的成本敏感度。然而,通風車型的複合年成長率將達到6.12%,這表明消費者無論在炎熱或寒冷的氣候條件下都非常重視熱舒適性。在北美,加熱選項仍然是標配,而電動調節器則彌補了經濟型和豪華型之間的差距,提供記憶配置和腰部模組,無需複雜的暖通空調整合。

追蹤姿勢和生命徵象的智慧座椅在高階電動車中正在迅速發展。現代Transys已在起亞EV9中整合了低能耗碳纖維加熱器、動態身體保養演算法和可傾斜的步入式功能,為完全軟體定義的舒適性量產開闢了道路。供應商也在整合支援無線下載 (OTA) 的控制單元,使其能夠解鎖未來將銷售點以外的收益擴展至其他領域的功能。

區域分析

受中國電動車熱潮、印度小型SUV市場蓬勃發展以及日本對座椅電子產品持續投入的推動,亞太地區以46.85%的銷售額和預計3.75%的複合年成長率領先市場。預計到2025年,電動車在中國新車銷售的滲透率將達到45%,這將推動座椅製造商開發輕量化框架和整合式冷卻設計。印度對電動三輪車和送貨貨車的補貼政策將加速對耐用、低維護、適合高負載循環的座椅的需求。豐田紡織等日本創新企業推出了帶有搖椅運動和個性化音響的休閒座椅,體現了該地區對乘客整體舒適度的追求。

在歐洲,排放氣體和可回收性日益重要。相關法規已訂定,旨在加強材料可追溯性和生命週期碳計量,鼓勵使用生物基發泡材和易於拆卸的椅套製成的座椅。 Forbia 的卡車座椅平台與傳統設計相比,二氧化碳排放減少了 40%,證明了合規性和駕駛舒適性可以同時實現。在皮卡和 SUV 占主導地位的北美,通風和加熱座椅正成為中型車型的標準配備。供應商正在利用其位於底特律和墨西哥的製造地的地理位置,實現金屬金屬衝壓和坐墊生產的本地化,從而降低物流風險並遵守美國《汽車、汽車和零件法案》(MCA) 的本地化內容法規。

中東、非洲和南美洲具有長期擴張潛力。各國政府正在支持本地組裝,以發展汽車生態系統,為滿足崎嶇道路要求的簡化、經濟高效的長排座椅和折疊座椅創造機會。叫車和小型巴士領域的車隊採購將推動對易於清潔的合成皮革和快速更換座椅模組的需求,這些模組可以在服務基礎設施有限的環境中保持運作。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 全球輕型車(主要是SUV)產量增加

- 消費者對電動、通風和按摩座椅的需求不斷增加

- 汽車製造商推廣輕量化座椅以滿足二氧化碳排放目標

- 電動滑板平台,可實現靈活的座艙佈局

- 需要易於清潔、耐用內裝的移動即服務車隊

- 人工智慧乘客監控系統需要配備智慧感測器的座椅

- 市場限制

- 皮革、發泡體和高級聚合物的價格波動

- 嚴格的安全和認證測試成本

- 傳統汽車製造商的座椅架構更新周期較慢

- 由於替代舒適系統的興起,對高級座椅的需求下降

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 依材料類型

- 合成皮革

- 真皮

- 織物

- 天然纖維等

- 依技術

- 標準(手動)座椅

- 電動座椅

- 通風座椅

- 加熱座椅

- 按摩座

- 智慧表

- 按銷售管道

- OEM

- 售後市場

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 二輪車/三輪車

- 依座位類型

- 長條座椅/分離式長條座椅

- 凹背單人座椅

- 船長座位/個人座位

- 兒童安全座椅

- 折疊式/折疊座椅

- 按地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Adient PLC

- Lear Corporation

- Forvia SE

- Toyota Boshoku Corporation

- Magna International Inc.

- NHK Spring Co. Ltd

- Recaro Holding GmbH

- TS Tech Co. Ltd

- Tachi-S Co. Ltd

- Yanfeng Seating

- Hyundai Transys

- Gentherm Inc.

- Martur Fompak

- Grammer AG

- Freedman Seating

第7章 市場機會與未來展望

The automotive seat market size is valued at USD 71.45 billion in 2025 and is expected to reach USD 85.07 billion by 2030, reflecting a steady 3.55% CAGR.

Growth stays positive as electrification, autonomous driving features, and a rising preference for premium comfort push redesigns of seat frames, cushions, and electronics. Automakers continue to specify lighter structures to compensate for battery weight, while consumers favor powered, ventilated, and massage functions that lift average selling prices. Raw-material volatility and stringent safety rules place cost pressure across the value chain, yet Tier-1 suppliers maintain pricing leverage because of their deep integration with vehicle programs. Asia Pacific leads volume demand and technology adoption as Chinese, Indian, and Japanese plants expand capacity for both internal-combustion and electric platforms.

Global Automotive Seats Market Trends and Insights

Rising Global Light-Vehicle Production, Especially SUVs

SUVs reached 54% of global car sales in 2024, increasing seat content per vehicle and lifting demand for reinforced side bolsters, multi-row configurations, and premium trim. Asia Pacific manufacturers benefit as disposable income and urbanization lift SUV penetration. Electric SUVs draw further momentum; 20% of 2023 SUV sales were fully electric, triggering new orders for lightweight frames and integrated thermal management that offset battery mass. The International Energy Agency reports that most SUVs still run on fossil fuel, leaving substantial potential for electrified seat innovation that integrates active cooling, heating, and weight-optimized shells .

Growing Consumer Demand for Powered, Ventilated & Massage Seats

Premium features once limited to luxury brands increasingly appear in mid-segment models. Lear Corporation's ComfortMax platform cuts heating and ventilation response times by 40% and halves assembly complexity, enabling OEM rollouts at scale . Ventilated seats represent the fastest-growing technology slice at 6.12% CAGR because thermal comfort helps EVs preserve driving range. Massage systems now incorporate biometric feedback to reduce occupant stress, transforming seats into wellness hubs and opening recurring revenue through software-enabled upgrades.

Volatile Prices of Leather, Foam & Advanced Polymers

Steel prices more than doubled between 2020 and 2021, and raw-material content per vehicle rose from USD 2,200 to USD 4,125, compressing margins for seat suppliers. Polyurethane foam, covering more than 90% of seat cushions, tracks oil price swings, exposing manufacturers to cost spikes that are difficult to pass through mid-program. Suppliers respond by redesigning cushion geometries to reduce foam volume and by qualifying recycled polymer blends.

Other drivers and restraints analyzed in the detailed report include:

- Automaker Push for Lightweight Seats to Meet CO2 Targets

- Electrified Skateboard Platforms Enabling Flexible Cabin Layouts

- Stringent Safety & Homologation Testing Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic leather held 48.75% of the automotive seat market share in 2024 and is projected to grow at a 5.44% CAGR, underscoring its dual appeal of affordability and premium look. Original-equipment programs value their consistent grain, stain resistance, and simplified cleaning, which lowers warranty claims in fleet service. Fabric remains entrenched in entry models, whereas genuine leather persists at the top end but faces sustainability concerns and sourcing volatility. Natural fibers such as flax and hemp enter seat backs and cushion reinforcements as OEMs pursue circular materials, but price premiums still limit volume deployment.

Toyota's SofTex trim produces 85% lower CO2 during manufacture than genuine leather, helping the company align with fleet-average emissions goals. Continental and Magna prototype bio-foam pads that ease recycling by eliminating mixed material adhesives. Such developments signal a shift toward mono-material cushions designed for straightforward disassembly at vehicle end-of-life to meet European circular-economy directives.

Manual adjusters still anchor 58.25% of global share in 2024, reflecting cost sensitivity in emerging markets and base trims. Ventilated variants, however, post a 6.12% CAGR, showing how buyers reward thermal comfort in both hot and cold climates. Heated options remain a staple in North America, while power adjusters form a bridge between economy and luxury lines, offering memory profiles and lumbar modules without complex HVAC integration.

Smart seats that track posture and vital signs are advancing quickly in premium EVs. Hyundai Transys packages low-energy carbon-fiber heaters, dynamic body-care algorithms, and tilt-away walk-in functions within the Kia EV9, proving a mass-production path for fully software-defined comfort. Suppliers are also embedding over-the-air-enabled control units, allowing future features unlock that spread revenue beyond the point of sale.

The Automotive Seat Market Report is Segmented by Material Type (Synthetic Leather, Fabric, and More), Technology (Standard (Manual) Seats, Powered Seats, and More), Sales Channel (OEM and Aftermarket), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Seat Type (Bench/Split-Bench Seats, Bucket Seats, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific leads with 46.85% revenue and a 3.75% CAGR outlook, fueled by China's electric-vehicle boom, India's fast-growing compact-SUV segment, and Japan's sustained investment in seat electronics. China is forecast to reach 45% EV penetration in new-car sales in 2025, keeping seat suppliers busy with lighter frames and integrated cooling designs. Indian policies that subsidize electric three-wheelers and delivery vans accelerate demand for durable, low-maintenance trim suited to high-usage duty cycles. Japanese innovators such as Toyota Boshoku unveil relaxation seats with swing-chair motion and personalized audio, demonstrating the region's push toward holistic passenger comfort.

Europe focuses on emissions reduction and recyclability. Regulations tighten material traceability and lifecycle carbon accounting, encouraging seats built from bio-based foams and easily separable covers. FORVIA's truck seat platform claims 40% lower CO2 than conventional designs, proving compliance can coexist with driver comfort. North America, characterized by high pickup and SUV share, shows rising standardization of ventilated and heated seats in mid-trim models. Suppliers leverage proximity to Detroit and Mexico fabrication hubs to localize metal stamping and cushion production, reducing logistics risk and meeting US-MCA regional-content rules.

The Middle East, Africa, and South America provide long-run expansion potential. Governments support local assembly to develop automotive ecosystems, creating opportunities for simplified, cost-efficient bench and jump seats that meet rugged-road requirements. Fleet purchases in ride-hailing and mini-bus sectors open demand for easy-clean synthetic leather and quick-swap seat modules that preserve uptime in environments with limited-service infrastructure.

- Adient PLC

- Lear Corporation

- Forvia SE

- Toyota Boshoku Corporation

- Magna International Inc.

- NHK Spring Co. Ltd

- Recaro Holding GmbH

- TS Tech Co. Ltd

- Tachi-S Co. Ltd

- Yanfeng Seating

- Hyundai Transys

- Gentherm Inc.

- Martur Fompak

- Grammer AG

- Freedman Seating

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global light-vehicle production, especially SUVs

- 4.2.2 Growing consumer demand for powered, ventilated & massage seats

- 4.2.3 Automaker push for lightweight seats to meet CO2 targets

- 4.2.4 Electrified skateboard platforms enabling flexible cabin layouts

- 4.2.5 Mobility-as-a-Service fleets needing easy-clean, high-durability trim

- 4.2.6 AI-driven occupant-monitoring systems requiring smart sensor-laden seats

- 4.3 Market Restraints

- 4.3.1 Volatile prices of leather, foam & advanced polymers

- 4.3.2 Stringent safety & homologation testing costs

- 4.3.3 Slow refresh cycles for seat architectures at legacy OEMs

- 4.3.4 Rise of alternative comfort systems reducing demand for premium seats

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Material Type

- 5.1.1 Synthetic Leather

- 5.1.2 Genuine Leather

- 5.1.3 Fabric

- 5.1.4 Natural Fiber and Others

- 5.2 By Technology

- 5.2.1 Standard (Manual) Seats

- 5.2.2 Powered Seats

- 5.2.3 Ventilated Seats

- 5.2.4 Heated Seats

- 5.2.5 Massage Seats

- 5.2.6 Smart / AI-Integrated Seats

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.4.4 Two-Wheelers and Three-Wheelers

- 5.5 By Seat Type

- 5.5.1 Bench / Split-Bench Seats

- 5.5.2 Bucket Seats

- 5.5.3 Captain / Individual Seats

- 5.5.4 Child Safety Seats

- 5.5.5 Folding / Jump Seats

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Adient PLC

- 6.4.2 Lear Corporation

- 6.4.3 Forvia SE

- 6.4.4 Toyota Boshoku Corporation

- 6.4.5 Magna International Inc.

- 6.4.6 NHK Spring Co. Ltd

- 6.4.7 Recaro Holding GmbH

- 6.4.8 TS Tech Co. Ltd

- 6.4.9 Tachi-S Co. Ltd

- 6.4.10 Yanfeng Seating

- 6.4.11 Hyundai Transys

- 6.4.12 Gentherm Inc.

- 6.4.13 Martur Fompak

- 6.4.14 Grammer AG

- 6.4.15 Freedman Seating

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment