|

市場調查報告書

商品編碼

1683422

印刷軟性感測器市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Printed Flexible Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

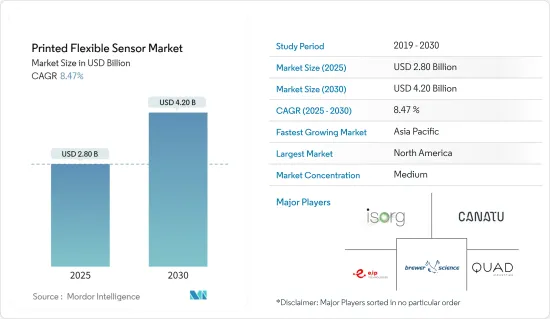

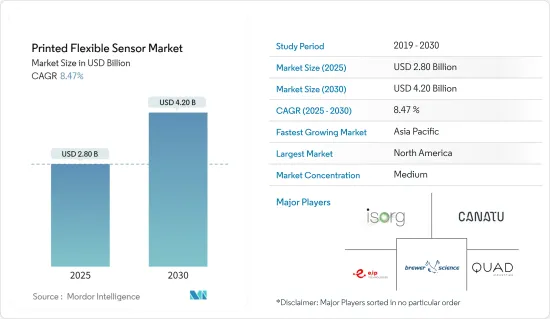

印刷軟性感測器市場規模預計在 2025 年將達到 28 億美元,預計到 2030 年將達到 42 億美元,預測期內(2025-2030 年)的複合年成長率為 8.47%。

關鍵亮點

- 印刷和軟性電子產品使用先進的電子印刷方法在各種基板上創建感測器和其他設備。油墨、基板和印刷技術創造了獨特的功能,可實現更大的靈活性、更低的擁有成本和更高的速度。

- 最近的趨勢包括有機半導體、導電聚合物、非晶質和導電油墨的發展,這些都大大提高了可加工性和靈活性。因此,這些材料正在成為開發印刷軟性電子設備(如感測器)的基礎,用於需要滾打、彎曲、折疊和拉伸的應用,而這些功能是傳統電子產品難以實現的。

- 市場成長主要得益於對節能、更輕薄、更靈活的家用電子電器產品日益成長的需求。小型化趨勢在消費性電子、醫療設備和汽車等各種終端使用者產業中普遍存在,也是預期對市場成長產生正面影響的主要因素。預計未來幾年材料類型的進一步發展和製造流程的進步將降低印刷和軟性感測器的價格,這也將促進市場成長。

- 近年來,消費性電子產品的滲透率大幅提升。都市化、生活方式的改變、對便利產品的需求不斷成長以及技術進步導致消費品更便宜是推動這一成長的一些關鍵因素。

- 隨著材料科學、控制科學、通訊技術等學科的發展,軟性感測器不斷取得突破。這些感測器提供了多方向的資訊獲取能力,並能在具有不同靈敏度、探測範圍、最小探測閾值的複雜環境中保持優異的性能。

- 此外,隨著適應性、便攜性和可分解材料的發展以及自供電生物細胞的出現,各種軟性和印刷感測器設備不斷湧現。基於紡織品的穿戴式活動感測器,例如壓力和應變感測器,由於其獨特的特性和便攜性,已被開發用於監測各種與健康相關的生物特徵參數。

- 此外,市場參與企業經常開發新產品以擴大其在新市場的滲透率。例如,2023 年 2 月,Brewer Science Inc. 推出了一種混合印刷感測器,用於在德國 LOPEC 進行高效的即時水質監測,可測量鉛、硝酸鹽和 pH 值。這些感測器是透過結合印刷電子和下一代材料而實現的。結果是一個可以利用多感測器陣列和相關的多方面感測器解決方案的即時連續監控平台。

印刷軟性感測器市場趨勢

預計醫療保健和醫療保健終端用戶產業將實現成長

- 印刷電子是一種革命性的、不斷發展和改進的技術,它徹底改變了醫療設備和感測器的設計和製造。先進的印刷感測器可以同時感知多個參數,展示多模態感知能力。例如,單一感測器可以測量溫度和壓力,從而對患者的狀況進行全面評估。

- 醫療終端用戶產業是印刷軟性感測器市場的主要消費者之一。產業中敏捷流程、數位化和無縫技術的出現迫使參與企業將重點轉向先進和智慧的感測器技術。印刷軟性感測器廣泛應用於工業領域,因為它們可以放置在患者的身上並用於詳細監測患者的生理狀況。這些感測器用於電子皮膚貼片中,以追蹤心率、呼吸頻率、肌肉活動、體溫和運動等重要的生物特徵參數。

- 印刷軟性感測器環保,並且能夠適應各種小型和不同外形的電子醫療設備。生物感測器預計將在醫療終端使用者產業中獲得越來越多的需求,因為它們可以測量體液和酵素之間的反應,例如糖尿病患者的血糖試紙。此外,此感測器還可用於收集唾液、汗液和血液的資訊。溫度感測器有助於檢測溫度敏感材料響應溫度變化而產生的電訊號變化。

- 具有無線通訊功能的印刷感測器可以即時傳輸資料給醫療保健提供者,實現遠端患者監控。這項突破性的技術為遠端醫療開闢了新的可能性,改善了患者護理,特別是在偏遠地區和居家醫療。

- 印刷電子產品可以輕鬆地與微控制器或電池等其他組件整合,從而提高印刷感測器的整體功能。這種整合使得更複雜、功能更豐富的醫療設備的開發成為可能。

- 印刷感測器既可以設計用於長期使用,也可以設計用於一次性應用,後者廣泛用於醫療保健領域,以降低感染風險並防止病原體的傳播。一次性感測器所使用的材料無毒且易於生物分解,因此既經濟又環保。

亞太地區佔市場主導地位

- 亞太地區包括中國、日本、韓國、新加坡、印度、澳洲和亞太其他地區。亞太地區客戶已經習慣使用軟性顯示器,推動了對智慧型手機、平板電腦、個人電腦和其他小工具等創新、軟性產品的需求。印刷軟性感測器能夠有效檢測與特定生物和環境物種相關的各種刺激,由於其在穿戴式電子產品和物聯網(IoT)應用方面具有巨大潛力,近年來引起了學術界的廣泛關注。因此,預計預測期內市場將快速成長。

- 消費性電子產品是該地區的主要終端用戶產業之一。智慧型手機產業的成長、智慧和穿戴式裝置的日益普及以及消費者物聯網設備的日益普及是推動消費性電子產品發展的關鍵因素。

- 中國也是消費性電子產品的主要市場之一,智慧設備的普及推動了對印刷軟性感測器的需求。根據中國國家統計局的數據,2023年11月全國家用電子電器及家用電子電器零售額為946.1億元人民幣(約133億美元)。

- 印刷軟性感測器已經開始出現在日常生活中。例子包括印刷汽車天線、帶有壓力感測器以識別座位居住的智慧紡織品、以及帶有診斷電極的醫療測試條。與此相符,東京大學的研究人員開發出了一種光子皮膚,它具有超薄、軟性的 LED 顯示螢幕,可以戴在手背上。

- 在汽車領域,印刷感測器對於電動車和監控電池狀態尤其重要。此外,壓力感測器薄膜可以整合到汽車座椅中,利用人工智慧和模式識別來區分人和其他物體。駕駛員存在資訊構成了各種安全系統和駕駛輔助的基礎,例如安全帶警告和事故發生時的緊急呼叫系統。

- 根據日本汽車經銷商協會和輕型汽車和摩托車協會發布的資料,2023年日本領先的輕型車將售出43,991輛標準尺寸電動車和44,544輛電動版。電動車在汽車總銷量中的比例將為標準型汽車的1.7%和輕型汽車的3.3%,高於2022年的1.4%和2.2%。在預測期內,電動車採用率的成長趨勢將推動該地區印刷軟性感測器市場的成長。

印刷軟性感測器產業概況

印刷軟性感測器市場是半靜態的,由少數重要參與企業組成。從市場佔有率來看,目前市場主要被少數幾家大公司佔據。各公司都專注於有機和無機成長策略,例如產品發布、產品核可、專利、收購和合作。這些擁有較大市場佔有率的領導參與企業正致力於擴大海外基本客群。我們也正在尋求策略合作,以增加我們的市場佔有率並增強收益。

- 2024 年 3 月,Naxnova 宣布以 9 億印度盧比(1,085 萬美元)收購 Quad Industries,旨在加強其針對汽車產業的產品供應。此次收購使 Quad 能夠擴大其在印刷電子領域的業務,並為這些領域提供創新、靈活的感測器解決方案。

- 2024年2月,Tekscan宣布發布一款新型壓力感測器,專門用於解決電池研究、開發和製造中介面壓力測量的挑戰。該系統透過識別潛在的電池設計問題為客戶提供可操作的資訊,從而實現更好、更可靠和更安全的能源儲存。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 節能、輕薄、軟性消費性電子產品的需求日益成長

- 印刷感測器在醫療穿戴裝置的整合度不斷提高

- 市場限制

- 需要技術改進才能廣泛採用

- 市場機會

- 物聯網帶來新的成長機會

- 觸控電子產品的普及率不斷提高

第6章 市場細分

- 類型

- 生物感測器

- 觸摸感應器

- 光電探測器

- 溫度感測器

- 壓力感測器

- 其他

- 最終用戶產業

- 車

- 家用電子電器

- 醫療

- 國防與航太

- 其他

- 地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Canatu Oy

- Brewer Science

- ISORG

- E2IP Technologies

- Quad Industries

- Pressure Profile Systems Inc.

- Butler Technologies Inc.

- Tekscan Inc.

- PST Sensors

- PolyIC GmbH & Co. KG

- Memtronik

- Linepro Controls Pvt. Ltd

- ForcIoT

- Nissha Co. Ltd

第8章投資分析

第9章 市場機會與未來趨勢

The Printed Flexible Sensor Market size is estimated at USD 2.80 billion in 2025, and is expected to reach USD 4.20 billion by 2030, at a CAGR of 8.47% during the forecast period (2025-2030).

Key Highlights

- Printed and flexible electronics use advanced electronic printing methods to create devices such as sensors on different substrates. The inks, substrate, and printing techniques create a unique technology, allowing greater flexibility, lower cost of ownership, and speed.

- In recent decades, the development of organic semiconductors, conductive polymers, amorphous silicon, and conductive inks has led to huge strides toward processability and flexibility. Thus, these materials have become the base for the development of printed and flexible electronic devices, such as sensors, in applications that require rolling, bending, folding, and stretching, among other properties that conventional electronics find hard to fulfill.

- A significant driving factor behind the market's growth is the progression in demand for energy-efficient, thin, and flexible consumer electronics products. The trend of miniaturization is becoming prevalent across various end-user industries, such as consumer electronics, medical devices, and automotive, which is another major factor expected to positively influence the growth of the market. In the next few years, the prices of printed and flexible sensors are anticipated to decline owing to further development in material types and advancements in manufacturing processes, which are also likely to enhance the market's growth.

- Over the years, the penetration of consumer electronic products has increased significantly. Urbanization, changing lifestyles, the growing demand for convenience products, and technological advancement bringing the price of consumer products down are among the major factors driving this growth.

- With the development of disciplines such as material and control science and communication technology, there has been a series of breakthroughs in flexible sensors. These sensors have achieved multi-directional information acquisition capabilities and the ability to maintain excellent performance in complex environments, with varying degrees of sensitivity, detection ranges, and minimum detection values.

- Additionally, the development of adaptive, implantable, and degradable materials and the emergence of self-powered bio-cells have led to the emergence of a wide range of flexible and printed sensor devices. Textile-based wearable activity sensors such as pressure and strain sensors were developed to monitor various health-related biometric parameters due to their unique properties and portability.

- Furthermore, the market players frequently develop new products to expand their reach into new markets. For instance, in February 2023, Brewer Science Inc. announced the launch of hybrid printed sensors for efficient, real-time water quality monitoring to measure lead, nitrate, and pH at LOPEC in Germany. These sensors are made possible by combining printed electronics with next-generation materials. The result is a real-time continuous monitoring platform that can leverage multi-sensor arrays and associated multi-faceted sensor solutions.

Printed Flexible Sensor Market Trends

The Medical and Healthcare End-user Industry is Expected to Witness Growth

- Printed electronics is an innovative, constantly evolving, and improving technology that has revolutionized the design and production of medical devices and sensors. Advanced printed sensors can sense multiple parameters simultaneously, offering multimodal sensing capabilities. For example, a single sensor can measure temperature and pressure, comprehensively assessing a patient's condition.

- The medical and healthcare end-user industry is one of the prominent consumers of the printed and flexible sensors market. The advent of agile procedures, digital technologies, and seamless techniques in the industry has forced the players to shift their focus toward advanced and smart sensor technology. Printed and flexible sensors are widely used in the industry as they are arranged on a patient's body and can be used to closely monitor the patient's physiological condition. These sensors are used in electronic skin patches to track vital biometric parameters such as heart rate, respiration rate, muscle activity, temperature, and movement.

- Printed and flexible sensors are eco-friendly in nature and have the ability to fit onto various small, differently shaped electronic medical devices. The demand for biosensors is expected to grow in the medical and healthcare end-user industry as they can measure the reaction between a bodily fluid and an enzyme, such as a blood glucose strip for diabetes patients. Moreover, this sensor can be used to gather information from saliva, sweat, and blood. Temperature sensors help detect the change in the electrical signal of the thermos-sensitive material in response to a change in temperature.

- Printed sensors with wireless communication capabilities can transmit real-time data to healthcare providers, enabling remote patient monitoring. This breakthrough expanded the capabilities of telemedicine and improved patient care, particularly in remote or home care settings.

- Printed electronics can be easily integrated with other components, such as microcontrollers or batteries, increasing the overall functionality of printed sensors. This integration enables the development of more complex and versatile medical devices.

- Printed sensors can be designed for both long-term use and single-use applications, the latter of which is widely used in healthcare to reduce the risk of infection and prevent the transmission of pathogens. The materials used in disposable sensors are non-toxic and easily biodegradable, making them cost-effective and environment-friendly.

Asia-Pacific Holds a Dominant Position in the Market

- Asia-Pacific comprises China, Japan, South Korea, Singapore, India, Australia, and the Rest of Asia-Pacific. Asia-Pacific customers are accustomed to utilizing flexible displays, driving the demand for innovative, flexible products, including smartphones, tablets, PCs, and other gadgets. Printed and flexible sensors that can efficiently detect a range of stimuli associated with certain biological or environmental species have gained substantial attention from academics in recent years due to their huge potential for wearable electronics and Internet of Things (IoT) applications. The market is thus expected to grow rapidly during the forecast period.

- Consumer electronics is one of the major end-user industries in the region. The growth of the smartphone industry, the increasing adoption of smart and wearable devices, and the growing penetration of consumer IoT devices are important factors promoting the development of consumer electronics.

- China is also among the major markets for consumer electronics, wherein the proliferation of smart devices is driving the demand for printed flexible sensors. According to the National Bureau of Statistics of China, in November 2023, the country's retail sales revenue for consumer electronics and household appliances stood at CNY 94.61 billion (USD 13.3 billion).

- Flexible and printed sensors have already begun to appear in daily life. For instance, printed aerials for automobiles, smart textiles with pressure sensors to identify seat occupancy, and medical test stripes with diagnostic electrodes are some examples. In accordance with that, researchers at the University of Tokyo developed an optoelectronic skin with an ultra-thin, flexible LED display that can be worn on the back of the hand.

- In automotive, printed sensors are particularly important for monitoring e-mobility and battery status. Also, by integrating pressure sensor films into car seats, artificial intelligence and pattern recognition can be used to distinguish between people and other objects. This driver presence information forms the basis for various safety systems and driver assistance, such as seat belt warnings and emergency call systems in the event of an accident.

- According to data published by the Japan Automobile Dealers Association and the Japan Light Motor Vehicle and Motorcycle Association, in 2023, 43,991 standard-size EVs and 44,544 electric versions of Japan's signature lightweight kei minicars were sold. The ratio of EVs to total car sales was 1.7% for standard-size vehicles and 3.3% for kei cars, up from 1.4% and 2.2%, respectively, in 2022. This increasing adoption trend for electric vehicles will boost the growth of the printed and flexible sensor market in the region during the forecast period.

Printed Flexible Sensor Industry Overview

The printed flexible sensor market is semi-consolidated and consists of a few significant players. In terms of market share, few major players currently dominate the market. Various companies are focusing on organic and inorganic growth strategies such as product launches, product approvals, patents, acquisitions, and partnerships. These influential players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. They are also leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- March 2024: Naxnova announced the acquisition of Quad Industries for INR 90 crore (USD 10.85 million), which aims to strengthen product offerings for the automotive industry. Through this acquisition, Quad expanded its activities in the field of printed electronics so that it can provide these sectors with innovative, flexible sensor solutions.

- February 2024: Tekscan announced the release of a new pressure sensor specifically tailored to the challenges of interfacial pressure measurement in battery research, development, and manufacturing. This system provides customers with actionable information by identifying potential battery design issues, resulting in better, more reliable, and safer energy storage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Progression in Demand for Energy-efficient, Thin, and Flexible Consumer Electronics Products

- 5.1.2 Rising Integration of Printed Sensors in Medical Wearable Devices

- 5.2 Market Restraint

- 5.2.1 Requirement of Technological Improvements for Wider Adoption

- 5.3 Market Opportunities

- 5.3.1 IoT to Open Up New Growth Opportunities

- 5.3.2 Expanding Adoption of Touch-enabled Electronic Devices

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Biosensor

- 6.1.2 Touch Sensor

- 6.1.3 Photodetectors

- 6.1.4 Temperature Sensor

- 6.1.5 Pressure Sensor

- 6.1.6 Other Types

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Medical and Healthcare

- 6.2.4 Defense and Aerospace

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Canatu Oy

- 7.1.2 Brewer Science

- 7.1.3 ISORG

- 7.1.4 E2IP Technologies

- 7.1.5 Quad Industries

- 7.1.6 Pressure Profile Systems Inc.

- 7.1.7 Butler Technologies Inc.

- 7.1.8 Tekscan Inc.

- 7.1.9 PST Sensors

- 7.1.10 PolyIC GmbH & Co. KG

- 7.1.11 Memtronik

- 7.1.12 Linepro Controls Pvt. Ltd

- 7.1.13 Forciot

- 7.1.14 Nissha Co. Ltd