|

市場調查報告書

商品編碼

1836724

噴塗膠:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Spray Adhesive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

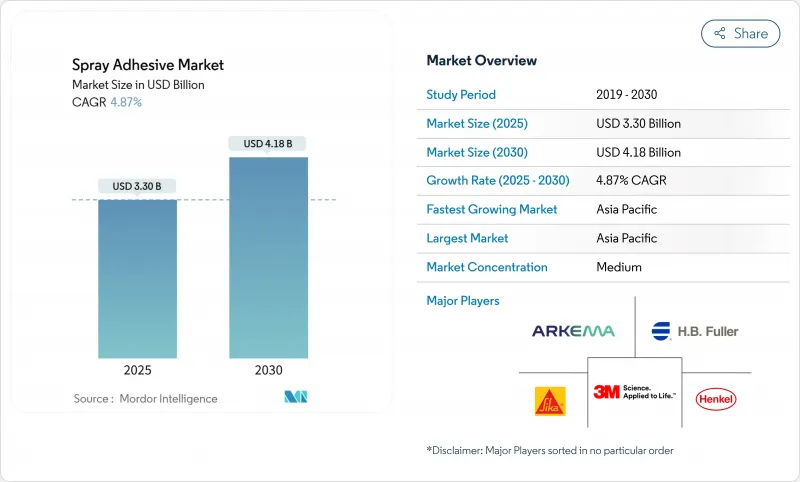

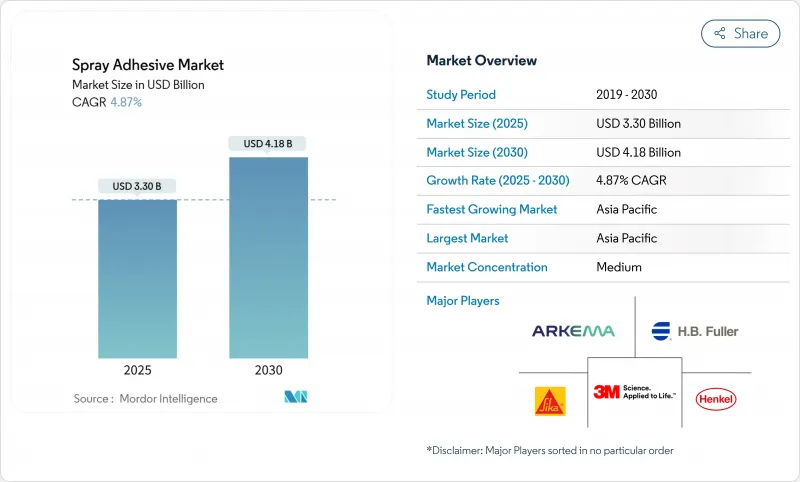

預計噴塗膠黏劑市場在 2025 年的價值將達到 33 億美元,到 2030 年預計將成長至 41.8 億美元,複合年成長率穩定在 4.87%。

儘管揮發性有機化合物 (VOC) 法規日益嚴格,但需求仍然強勁,因為生產商不斷改進水性和熱熔性化學品,使其黏合強度與傳統溶劑型產品相當。成長主要集中在亞太地區,該地區的大型基礎設施項目、不斷擴張的家具出口基地以及不斷深化的汽車供應鏈都需要快速、大批量的黏合劑解決方案。全球電商物流也蓬勃發展,履約中心指定使用氣霧劑和熱熔膠產品,以縮短包裝時間。雖然競爭壓力仍然適中,但價格敏感的買家可以從區域供應商那裡獲得新的選擇,這些供應商可以以更低的成本複製優質化學品,同時透過永續的性能升級實現差異化。汽車輕量化、預製建築和衛生食品包裝等結構性促進因素保護了噴塗膠合劑市場免受任何單一行業波動的影響,從而保持了終端用途的多樣性。

全球噴塗膠黏劑市場趨勢與洞察

新興國家建築業快速成長

中國、印度、印尼和海灣國家快速的公共和私人基礎設施投資正在推動建築化學品(包括噴塗膠)銷售的持續成長。預製牆板、吸音板和隔熱板都依靠高性能黏合劑來承受溫度變化和地震荷載。一些地方政府的住房計畫指定使用低VOC黏合劑以滿足綠色建築規範,這促使承包商轉向水性噴塗系統。模組化建築商青睞可攜式罐式鑽機,這可以減少過度噴塗和工時並提高大型計劃的吞吐量。隨著都市化的加速,當地公司正在採用即時固化熱熔噴塗線,以便在高層建築中快速組裝廚櫃和室內設備。這些共同的力量將噴塗膠市場與建築活動緊密聯繫在一起,特別是在亞太地區快速發展的特大城市。

轉向水性、低VOC黏合劑

三大洲的監管機構均降低了排放上限,促使膠合劑製造商推出黏性和耐熱性可與溶劑型系統相媲美的水性系統。德克薩斯州環境品質委員會修訂了其規則,要求休士頓地區每天減少 3.12 噸 VOC,加州有毒物質控制部將噴塗膠列入其 2024-2026 年優先產品行動計畫。陶氏的 PRIMAL CA 750 和 3M 的 Fastbond 1049 證明,水性聚合物無需昂貴的通風升級即可滿足工業產量目標。大型買家,尤其是向歐盟出口家具的出口商,現在正在將低 VOC 要求納入其採購契約,從而加速採用水性化學品。這些配方在固化爐中消耗更少的能量,為使用者直接節省水電費和範圍 2排放。

VOC排放問題

空氣品質機構正在收緊產品類型的限制,對仍依賴刺激性溶劑載體的品牌施加即時的合規負擔。加州空氣資源委員會降低了捲材噴霧劑和特殊用途配方的限量。新澤西州擬議的規則旨在將建築膠粘劑中允許的揮發性有機化合物 (VOC) 含量減少一半以上。每項新法規都要求對易爆空氣污染區的產品進行重新貼標、重新認證,有時甚至升級堆高機。全球生產者必須在多個司法管轄區內權衡閾值,導致生產分散,並削弱規模經濟效益。無力資助快速再製造的公司可能會失去貨架空間,從而暫時抑制噴霧膠合劑市場的成長。

報告中分析的其他促進因素和限制因素

- 汽車業的使用日益增多

- 衛生食品包裝需求不斷增加

- 來自替代產品的競爭

細分分析

到了2024年,水性產品將佔銷售額的42.78%,這印證該產業對低排放化學品的承諾。該細分市場受益於監管支援和升級的聚合物設計,這些設計使水分散體能夠耐受120°C以上的高溫,從而拓寬了其應用範圍。亞太地區的加工商已採用罐式噴霧系統,最大限度地減少清潔停機時間,從而有助於產品滲透到膠合板層壓生產線。同時,熱熔膠類別將錄得最快的複合年成長率,達到5.16%,這得益於強調即時處理強度和零乾燥爐的自動化家俱生產線。雖然溶劑型產品仍將佔據航太工業複合材料修復等利基市場,但隨著環保法規的日益嚴格,噴塗膠黏劑的市場規模預計將縮小。

推動水性膠合劑應用的第二個動力來自於可攜式設備的開發,該設備可以延長適用期並減少過度噴塗。 Worthington Enterprises 與 3M 合作,提供輕型加壓罐,即使在充滿電的情況下也能保持均勻的噴塗模式,將工廠內輸送效率提高高達 80%。這些改進使水性膠粘劑產品線在 2030 年前保持行業領先地位,並有助於在現有溶劑型膠粘劑用戶面前捍衛噴塗膠粘劑的市場佔有率。

區域分析

到 2024 年,亞太地區將佔銷售額的 46.76%,複合年成長率最快,為 5.91%。中國的經濟適用房獎勵策略和印度的高速公路走廊計劃將確保對板材層壓噴塗劑和瓷磚膠黏劑的穩定需求。當地加工商正在提高產能,以滿足對美國和歐盟的家具出口訂單,並納入符合目的地法規的低 VOC 指標。日本電子組裝青睞高固態的水性噴塗劑,以降低印刷基板凝結的風險,促使當地複合材料製造商為其分包合作夥伴擴展配方。韓國電池產業正在整合聚氨酯噴塗線,以確保高密度電動車電池組的抗振性。

北美依賴房屋翻新、商業屋頂翻修以及國內汽車生產的復甦。猶他州環境品質部門估計,一旦消費品法規生效,每年可能減少4,000噸揮發性有機化合物(VOC)。這是一個合規時鐘,目前已開始轉向購買水性罐。墨西哥一家出口裝潢工廠正在投資一個自動化熱熔噴漆室,以增加運往美國的劇院座椅和飯店家具的產能。加拿大一家預製房屋工廠正在指定符合嚴格州法律的阻燃噴霧劑,以支持噴霧膠合劑市場的區域多元化。

歐洲日趨成熟,但創新主導。德國高檔汽車原始設備製造商 (OEM) 需要無味駕駛座黏合劑,促使供應商客製化無單體聚氨酯分散體。英國正在採用低排放噴塗泡沫板,並用建築水性噴霧固定,以促進隔熱材料。西卡 (Sika) 在 EMEA 地區建築化學品的全球銷售額為 118 億瑞士法郎,成長了 7.3%,證明了黏合劑需求的彈性。義大利和波蘭的家具製造商正在實現排放氣體線自動化,以滿足線上零售商對更短前置作業時間的期望。歐盟的綠色交易協議加速了溶劑替代,確保歐洲仍然是噴塗膠黏劑市場永續性的基準。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 新興國家建築業快速成長

- 轉向水性、低VOC黏合劑

- 擴大在汽車產業的應用

- 衛生食品包裝需求不斷增加

- 履約中心對 FastTack 包裝黏合劑的需求不斷成長

- 市場限制

- VOC排放問題

- 由於配方先進,製造成本高

- 來自替代產品的競爭

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(金額)

- 按類型

- 溶劑型

- 水性

- 熱熔膠

- 依樹脂類型

- 環氧樹脂

- 聚氨酯

- 合成橡膠

- 醋酸乙烯-乙烯

- 按用途

- 建築/施工

- 包裝

- 家具

- 運輸

- 纖維

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- AFT Aerosols

- Arkema Group(Bostik)

- Avery Dennison Corporation

- BASF SE

- Blu-Sky UK Ltd

- Casa Adhesive Inc.

- Chemique Adhesives & Sealants Ltd

- Dow Inc.

- Gemini Adhesives Ltd

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Kissel+Wolf GmbH

- Philips Manufacturing

- Powerbond

- Quin Global

- Sika AG

- Soudal NV

- Spray-Lock Inc.

- The Kroger Co.

- Westech Aerosol Corporation

- Worthen Industries

第7章 市場機會與未來展望

The spray adhesive market is valued at USD 3.30 billion in 2025 and is forecast to climb to USD 4.18 billion by 2030 on a steady 4.87% CAGR.

Demand holds firm despite tightening VOC rules because producers continue to refine water-based and hot-melt chemistries that match the bonding strength of legacy solvent products. Growth concentrates in Asia-Pacific, where large-scale infrastructure programs, expanding furniture export hubs, and a deep automotive supply chain all require fast-tack, high-volume bonding solutions. Momentum also comes from global e-commerce logistics, which pushes fulfillment centers to specify aerosol and hot-melt variants that shorten pack-out time. Competitive pressure stays moderate, yet price-sensitive buyers have new choices from regional suppliers that replicate premium chemistries at lower cost while multinational leaders differentiate through sustainable performance upgrades. Structural drivers such as vehicle lightweighting, prefab construction, and hygienic food packaging keep end-use diversity wide, shielding the spray adhesive market from volatility in any single sector.

Global Spray Adhesive Market Trends and Insights

Rapid Growth of Construction in Emerging Economies

Surging public and private infrastructure investment across China, India, Indonesia, and the Gulf states is driving relentless volume growth for construction chemicals, including spray adhesives. Prefabricated wall panels, acoustic boards, and insulation sheathing all rely on high-performance bonding to withstand temperature swings and seismic loading. Several municipal housing programs specify low-VOC adhesives to meet green-building codes, nudging contractors toward water-based spray systems. Modular builders favor portable canister rigs that reduce overspray and labor time, increasing throughput on large projects. As urbanization accelerates, local firms adopt hot-melt spray lines that cure instantly, allowing rapid assembly of kitchen cabinets and interior fixtures inside high-rise developments. These combined forces keep the spray adhesive market deeply tied to building activity, particularly in Asia-Pacific's fast-growing megacities.

Transition to Water-Based, Low-VOC Formulations Adhesives

Regulators on three continents have enacted lower emission ceilings, prompting adhesive formulators to launch waterborne systems with comparable tack and heat resistance to solvent grades. The Texas Commission on Environmental Quality amended rules that will eliminate 3.12 tons per day of VOCs around Houston, while California's Department of Toxic Substances Control placed spray adhesives on its 2024-2026 priority product work plan. Dow's PRIMAL CA 750 and 3M's Fastbond 1049 demonstrate that water-based polymers can meet industrial throughput targets without costly ventilation upgrades. Large buyers, especially furniture exporters shipping into the EU, now embed low-VOC requirements in purchase contracts, accelerating penetration of waterborne chemistries. As curing ovens consume less energy with these formulations, users realize direct savings on utility expenses and scope-2 emissions.

Concerns Due to VOC Emissions

Air-quality agencies have tightened product-category caps, placing immediate compliance burdens on brands that still rely on strong-solvent carriers. The California Air Resources Board lowered limits on web-spray and special-purpose formulations. New Jersey's draft rule aims to cut allowable VOCs in construction adhesives by more than half. Every new limit triggers relabeling, re-qualification, and sometimes forklift upgrades for explosive-atmosphere zones. Global producers must juggle multiple jurisdictional thresholds, fragmenting volume runs and trimming economies of scale. Firms unable to finance rapid reformulation risk losing shelf space, temporarily suppressing growth in the spray adhesive market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization from the Automotive Industry

- Increasing Demand for Hygienic Food Packaging

- Competition from Alternative Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-based grades held the largest 42.78% portion of 2024 revenue, confirming industry commitment to low-emission chemistries. The segment benefits from regulatory support and from upgrades in polymer design that give water dispersions heat resistance above 120 °C, widening their application window. Asia-Pacific converters adopted canister spray systems that minimize cleaning downtime, advancing penetration across plywood lamination lines. In parallel, the hot-melt category is charting the quickest 5.16% CAGR, driven by automated furniture lines that value instant handling strength and zero drying ovens. Solvent products still occupy niche spaces such as aerospace composite repair, but their spray adhesive market size is set to shrink as environmental levies rise.

A second boost to water-based adoption comes from portable equipment developments that extend pot life and reduce overspray. Worthington Enterprises collaborated with 3M to deliver lightweight pressurized canisters that maintain uniform spray patterns for the full charge, lifting in-plant transfer efficiency to 80%. These improvements help the category defend its spray adhesive market share against entrenched solvent users, positioning water-based lines for sustained leadership through 2030.

The Spray Adhesive Market Report Segments the Industry by Type (Solvent-Based, Water-Based, and Hot Melt), Resin Type (Epoxy, Polyurethane, Synthetic Rubber, and More), Application (Building and Construction, Packaging, Furniture, Transportation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD Million)

Geography Analysis

Asia-Pacific dominates with 46.76% revenue in 2024 and exhibits the fastest 5.91% CAGR outlook. China's stimulus for affordable housing and India's highway corridor projects ensure consistent demand for panel lamination sprays and tile adhesives. Local converters boost capacity to satisfy furniture export orders to the United States and the European Union, embedding low-VOC metrics that align with destination regulations. Japan's electronics assemblers champion high-solids water-based sprays that reduce condensation risk on printed-circuit boards, spurring local compounders to scale formulations for subcontract partners. South Korea's battery vertical integrates polyurethane spray lines to secure vibration isolation in high-density EV packs.

North America relies on strong residential remodeling, commercial reroofing, and resurgent domestic auto production. The Utah Department of Environmental Quality estimates a potential 4,000-ton annual VOC cuts once its consumer-product rule takes effect. This sets a compliance clock that already shifts purchase preference toward water-based canisters. Mexico's export-oriented upholstery factories invest in automated hot-melt spray booths that boost throughput for theater seating and hospitality furniture destined for the United States. Canadian prefab home plants specify flame-retardant sprays that meet stringent provincial codes, underpinning regional diversification within the spray adhesive market.

Europe shows a mature yet innovation-driven profile. Germany's premium auto OEMs require odor-free cockpit adhesives, steering suppliers to tailor monomer-free polyurethane dispersions. The United Kingdom's retrofit insulation drive deploys low-emission spray foam panels secured with construction-grade water-based sprays. Sika's CHF 11.8 billion global sales, with 7.3% growth in EMEA construction chemicals, evidence adhesive demand resilience. Italian and Polish furniture clusters automate spray lines to meet shorter lead-time expectations from online retailers. EU Green Deal policies accelerate solvent replacement, ensuring that Europe remains a reference market for sustainability in the spray adhesive market.

- 3M

- AFT Aerosols

- Arkema Group (Bostik)

- Avery Dennison Corporation

- BASF SE

- Blu-Sky UK Ltd

- Casa Adhesive Inc.

- Chemique Adhesives & Sealants Ltd

- Dow Inc.

- Gemini Adhesives Ltd

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Kissel + Wolf GmbH

- Philips Manufacturing

- Powerbond

- Quin Global

- Sika AG

- Soudal NV

- Spray-Lock Inc.

- The Kroger Co.

- Westech Aerosol Corporation

- Worthen Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly Growth of Construction Sector in Emerging Economies

- 4.2.2 Transition to Water-based, Low-VOC Formulations Adhesives

- 4.2.3 Increasing Utilization from the Automotive Industry

- 4.2.4 Increasing Demand for Hygienic Food Packaging

- 4.2.5 Growth of E-Commerce Fulfilment Centers Requiring Fast-Tack Packaging Adhesives

- 4.3 Market Restraints

- 4.3.1 Concerns due to VOC Emissions

- 4.3.2 High Production Costs of Advanced Formulations

- 4.3.3 Competitions from Alternative Products

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Solvent-based

- 5.1.2 Water-based

- 5.1.3 Hot-Melt

- 5.2 By Resin Type

- 5.2.1 Epoxy

- 5.2.2 Polyurethane

- 5.2.3 Synthetic Rubber

- 5.2.4 Vinyl Acetate-Ethylene

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Packaging

- 5.3.3 Furniture

- 5.3.4 Transportation

- 5.3.5 Textile

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AFT Aerosols

- 6.4.3 Arkema Group (Bostik)

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF SE

- 6.4.6 Blu-Sky UK Ltd

- 6.4.7 Casa Adhesive Inc.

- 6.4.8 Chemique Adhesives & Sealants Ltd

- 6.4.9 Dow Inc.

- 6.4.10 Gemini Adhesives Ltd

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Illinois Tool Works Inc.

- 6.4.14 Kissel + Wolf GmbH

- 6.4.15 Philips Manufacturing

- 6.4.16 Powerbond

- 6.4.17 Quin Global

- 6.4.18 Sika AG

- 6.4.19 Soudal NV

- 6.4.20 Spray-Lock Inc.

- 6.4.21 The Kroger Co.

- 6.4.22 Westech Aerosol Corporation

- 6.4.23 Worthen Industries

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment