|

市場調查報告書

商品編碼

1836697

陶瓷基複合材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Ceramic Matrix Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

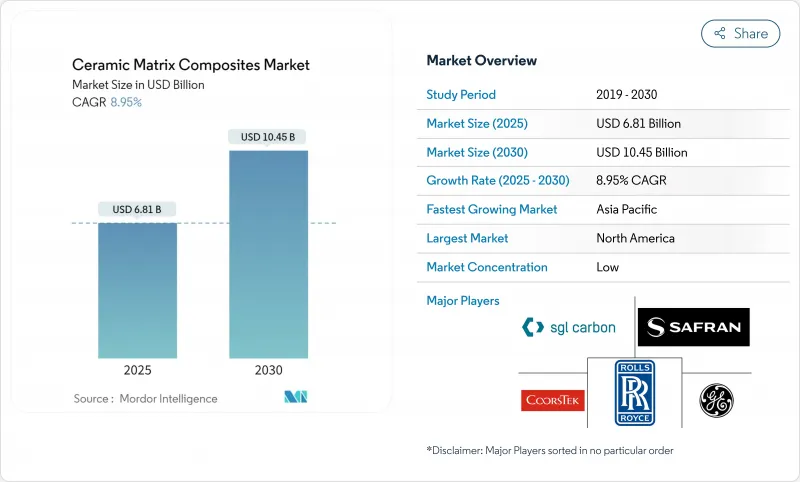

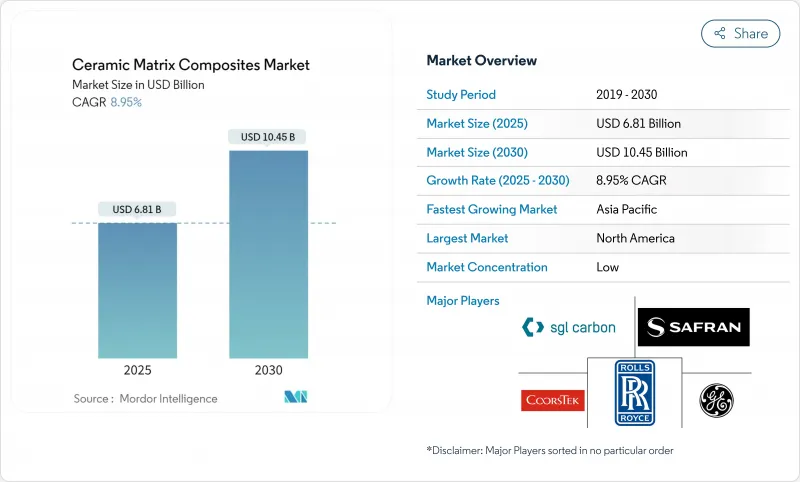

預計到 2025 年全球陶瓷基複合材料市場規模將達到 68.1 億美元,到 2030 年將達到 104.5 億美元,複合年成長率為 8.95%。

這一市場擴張取決於該材料能否將金屬的韌性與陶瓷的耐熱性相結合,有助於提升航太引擎、高超音速系統和工業燃氣渦輪機的性能。輕量化推進系統的投資、燃油燃燒標準的收緊、可變燃料渦輪機的採用以及對更持久耐高溫部件的追求,正在塑造當前的需求前景。自動化纖維鋪放和反應熔體滲透技術的成本驅動型進步正在縮短生產週期,並縮小與鎳基高溫合金的成本差距。從化學加工商到核融合能源開發商,越來越多的終端用戶正在指定使用陶瓷基複合材料 (CMC),這反映出多元化的機會組合,有助於支撐其長期成長韌性。

全球陶瓷基複合材料市場趨勢與洞察

增加國防級隔熱的使用

國防機構現在將熱性能作為主要的設計過濾器。美國高超音速彈藥計畫要求材料在2000 度C以上仍能保持結構穩定,而這個閾值將大多數高溫合金排除在外。洛克希德馬丁公司的一系列測試凸顯了陶瓷基複合材料(CMC)在電子設備加強和氣動外殼防護方面的重要性。優質國防承包商願意接受的生存能力加速了CMC的早期認證,從而創造了一條惠及其他行業的學習曲線。碳纖維增強碳化矽複合材料在多次高溫循環後已展現出可重複使用的性能,這一優勢改變了生命週期成本方程式。

對輕量化汽車平臺的需求

電動車和自動駕駛汽車專案正在積極追求減重目標,因為每減輕一公斤重量,就能提升續航里程和燃氣渦輪機鋪放,該工藝可將數小時的積層法轉化為幾分鐘的循環。

製造成本高於超合金

由於高溫纖維拉伸和較長的浸潤步驟,CMC零件的價格仍然比同類金屬零件高出三到五倍。 SCANCUT計劃透過創新的銑削路徑將加工時間縮短了70%,類似的自動化突破正在縮小差距。隨著CMC使用壽命的延長,整體擁有成本有所改善,但對於價格敏感的電力和汽車用戶來說,初始購買價格仍然是一個障礙。通用電氣公司斥資2億美元在阿拉巴馬州建造的工廠旨在平衡航太領域的成本。

報告中分析的其他促進因素和限制因素

- 不斷成長的可再生燃氣渦輪機維修超音速

- 加速汽車研發

- 複雜的多階段製造路線

細分分析

2024年,SiC/SiC複合材料佔據了陶瓷基複合材料市場佔有率的55.19%,預計到2030年將以11.05%的複合年成長率成長。細間距纖維的整合使強度達到2GPa以上,正在擴大其結構應用範圍。隨著新型噴射引擎核心零件對罩殼、燃燒室襯套和噴嘴延伸件的合格越來越高,SiC/SiC應用的陶瓷基複合材料市場規模預計將大幅成長。碳/碳系統在可控制氧化的火箭噴嘴領域仍佔有一席之地,而氧化物/氧化物系統在工業熱交換器領域正日益受到青睞,因為在工業熱交換器中,固有的氧化穩定性比峰值溫度更為重要。

製程改進包括奈米工程界面,可減輕熱循環過程中的纖維損傷。三菱化學集團的碳纖維基C/SiC可耐受1500°C的高溫,展現了混合化學如何拓展太空船應用的溫度上限。將SiC漿料沉澱到織物預製件上,可實現傳統積層法無法實現的複雜冷卻通道。這些創新技術維持了SiC/SiC系列的領先地位,並吸引了渦輪機主廠商的投資。

區域分析

憑藉其密集的航太和國防生態系統,預計北美將在2024年佔據陶瓷基複合材料市場收益的37.96%。該地區擁有垂直整合的供應鏈,涵蓋碳化矽纖維拉擠、零件積層法、機械加工和引擎組裝。先進複合材料製造創新研究所等政府舉措正在津貼試驗生產線並支持區域產能。勞斯萊斯和通用電氣已簽訂多年期訂單,以平滑需求週期並為進一步的工廠擴張提供理由。

隨著中國和日本加大戰略材料項目的力度,到2030年,亞太地區將迎來最快的複合年成長率,達到10.84%。各國政府計畫實現高性能纖維的供應獨立,並將2035年定為里程碑目標。汽車電氣化也將刺激該地區對輕量化、耐熱部件的需求。勞動力成本下降和積極的補貼使出口價格具有競爭力,使該地區成為全球陶瓷基複合材料市場的重要消費國和供應國。

歐洲透過支援可再生電網的渦輪機維修以及勞斯萊斯UltraFan等新型飛機引擎的演示,保持了穩定的市場佔有率。歐盟研究網路匯集公共和私人資金,用於成熟適用於工業爐的氧化物材料,從而拓寬了其應用範圍。嚴格的排放法規為陶瓷基複合材料(CMC)等增效材料創造了有利的政策環境,從而增強了歐洲的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 增加國防級隔熱的使用

- 對輕量化汽車平臺的需求

- 陶瓷基複合材料在國防領域的應用不斷擴大

- 可再生燃氣渦輪機改裝正在興起

- 加速高超音速飛行器研發

- 市場限制

- 與高溫合金相比製造成本更高

- 複雜的多階段製造路線

- 加強纖維粉塵排放監管

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(金額)

- 依產品類型

- C/C

- C/SiC

- Oxide/Oxide

- SiC/SiC

- 按最終用戶產業

- 車

- 航太

- 防禦

- 能源和電力

- 電氣和電子

- 其他終端用戶產業(醫療等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- applied thin films inc.

- CeramTec GmbH

- COIC

- CoorsTek Inc.

- General Electric Company

- KYOCERA Corporation

- LANCER SYSTEMS

- Mitsubishi Chemical Group Corporation

- Pratt & Whitney

- Rolls-Royce

- Safran

- SGL Carbon

- Starfire Systems Inc.

- TORAY INDUSTRIES, INC.

- UBE Corporation

第7章 市場機會與未來展望

The global ceramic matrix composites market is valued at USD 6.81 billion in 2025 and is forecast to reach USD 10.45 billion by 2030, registering an 8.95% CAGR through the period.

Expansion rests on the material's ability to combine the toughness of metals with the heat resistance of ceramics, a balance that unlocks performance gains for aerospace engines, hypersonic systems, and industrial gas turbines. Investment in lightweight propulsion, stricter fuel-burning standards, adoption of variable-fuel turbines, and the search for longer-life high-temperature parts shape the current demand outlook. Cost-down progress in automated fiber placement and reactive melt infiltration is compressing cycle times and closing the cost gap with nickel super-alloys, while government grants for advanced-materials plants are de-risking capacity additions. A wider set of end users-from chemical processors to fusion-energy developers-now specify CMCs, reflecting a more diversified opportunity mix that supports long-term growth resilience.

Global Ceramic Matrix Composites Market Trends and Insights

Increasing Defense-Grade Thermal Barrier Applications

Defense agencies now treat thermal capability as a primary design filter. Hypersonic munitions programs in the United States require materials that remain structurally stable above 2,000 °C, a threshold that eliminates most super-alloys. Lockheed Martin's test series highlights the need for CMCs in electronics ruggedization and aero-shell protection. The premium prices defense contractors accept for survivability accelerate early CMC qualification, generating learning curves that benefit other sectors. Carbon-fiber reinforced silicon carbide composites have demonstrated reusable performance after multiple high-heat cycles, an advantage that shifts life-cycle cost equations.

Lightweight Vehicle Platforms Demand

Electric and autonomous vehicle programs pursue aggressive mass-reduction targets because every kilogram saved improves driving range and cooling efficiency. Ceramic matrix composites weigh up to 65% less than nickel-based alloys yet retain functional strength at exhaust temperatures. Demonstration ceramic gas turbines in Japan reached thermal efficiencies above 40% while cutting component weight by double-digit percentages. Automotive production volumes push suppliers toward near-net-shape processes such as automated fiber placement that convert hours-long layups into minute-level cycles.

High Production Cost vs. Super-Alloys

CMC parts still cost 3-5 times more than comparable metallic parts due to high-temperature fiber draw and lengthy infiltration steps. The SCANCUT project cut machining time by 70% through novel milling paths, and similar automation breakthroughs are narrowing the gap. Total cost of ownership improves as CMC lifetimes lengthen, but initial acquisition price remains a hurdle for price-sensitive power and automotive users. GE's USD 200 million Alabama facility targets cost parity at scale geaerospace.

Other drivers and restraints analyzed in the detailed report include:

- Growing Renewable Gas-Turbine Retrofits

- Hypersonic Vehicle R&D Acceleration

- Complex Multi-Step Manufacturing Routes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SiC/SiC composites held 55.19% ceramic matrix composites market share in 2024 and are projected to grow at an 11.05% CAGR to 2030. Integration of finer pitch fibers delivering strengths above 2 GPa has expanded their structural envelope. The ceramic matrix composites market size for SiC/SiC applications is forecast to rise sharply as new jet engine cores qualify shrouds, combustor liners, and nozzle extensions. Carbon/carbon systems maintain niches in rocket nozzles where oxidation can be controlled, and oxide/oxide grades gain traction in industrial heat exchangers that value inherent oxidation stability over peak temperature.

Process advances include nano-engineered interphases that mitigate fiber damage during thermal cycling. Mitsubishi Chemical Group's carbon-fiber-based C/SiC, qualified for 1,500 °C exposure, shows how hybrid chemistries extend temperature ceilings for space vehicles. The additive deposition of SiC slurry onto woven preforms makes complex cooling passages not feasible with legacy layups. Such innovations maintain the lead of the SiC/SiC family and attract investment from turbine primes.

The Ceramic Matrix Composites Market Report Segments the Industry by Product Type (C/C, C/SiC, Oxide/Oxide, and More), End-User Industry (Automotive, Aerospace, Defense, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Due to dense aerospace and defense ecosystems, North America commanded 37.96% of the ceramic matrix composites market revenue in 2024. The region houses vertically integrated supply chains that span SiC fiber draw, component layup, machining, and engine assembly. Government initiatives like the Institute for Advanced Composites Manufacturing Innovation funnel grants toward pilot lines, underpinning local capacity. Rolls-Royce and GE place multi-year orders that smooth demand cycles and justify further plant expansions.

Asia-Pacific delivers the fastest 10.84% CAGR through 2030 as China and Japan escalate strategic materials programs. National plans seek supply independence for high-performance fibers, with milestone targets set for 2035. Automotive electrification also stimulates regional demand for lightweight, thermally resilient parts. Lower labor costs and proactive subsidies enable competitive export pricing, positioning the region as a significant consumer and global ceramic matrix composites market supplier.

Europe maintains a steady share through turbine retrofits that support renewable-heavy grids and through new aircraft engine demonstrators such as Rolls-Royce UltraFan. EU research networks pool public and private funds to mature oxide-oxide grades suitable for industrial furnaces, widening application scope. Strict emission regulations create a positive policy environment for efficiency-raising materials like CMCs, reinforcing European demand.

- 3M

- applied thin films inc.

- CeramTec GmbH

- COIC

- CoorsTek Inc.

- General Electric Company

- KYOCERA Corporation

- LANCER SYSTEMS

- Mitsubishi Chemical Group Corporation

- Pratt & Whitney

- Rolls-Royce

- Safran

- SGL Carbon

- Starfire Systems Inc.

- TORAY INDUSTRIES, INC.

- UBE Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing defense-grade thermal barrier applications

- 4.2.2 Lightweight vehicle platforms demand

- 4.2.3 Increasing Application of Ceramic Matrix Composites in Defense Sector

- 4.2.4 Growing renewable gas-turbine retrofits

- 4.2.5 Hypersonic vehicle R&D acceleration

- 4.3 Market Restraints

- 4.3.1 High production cost vs. super-alloys

- 4.3.2 Complex multi-step manufacturing routes

- 4.3.3 Stricter fibre-dust emission norms

- 4.4 ValueChain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 C/C

- 5.1.2 C/SiC

- 5.1.3 Oxide/Oxide

- 5.1.4 SiC/SiC

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace

- 5.2.3 Defense

- 5.2.4 Energy & Power

- 5.2.5 Electrical & Electronics

- 5.2.6 Other End-User Industries (Medical, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 applied thin films inc.

- 6.4.3 CeramTec GmbH

- 6.4.4 COIC

- 6.4.5 CoorsTek Inc.

- 6.4.6 General Electric Company

- 6.4.7 KYOCERA Corporation

- 6.4.8 LANCER SYSTEMS

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 Pratt & Whitney

- 6.4.11 Rolls-Royce

- 6.4.12 Safran

- 6.4.13 SGL Carbon

- 6.4.14 Starfire Systems Inc.

- 6.4.15 TORAY INDUSTRIES, INC.

- 6.4.16 UBE Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment