|

市場調查報告書

商品編碼

1836652

行動裝置使用者身分驗證服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Mobile Devices User Authentication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

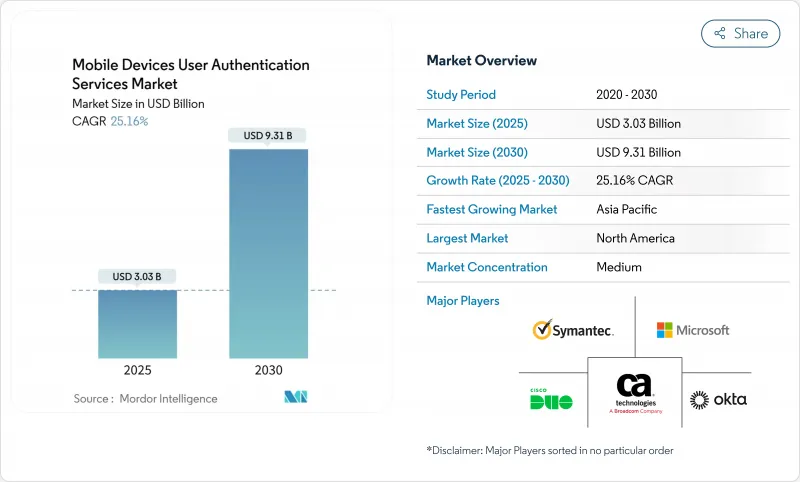

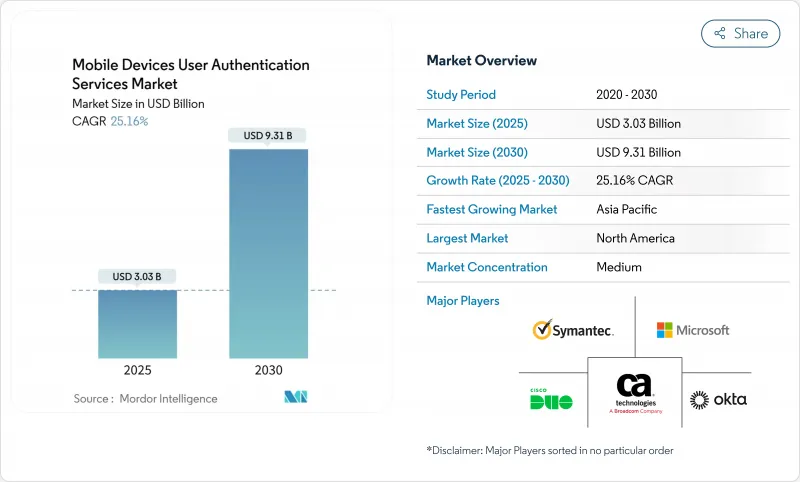

行動裝置用戶身份驗證服務市場預計在 2025 年達到 30.3 億美元,在 2030 年達到 93.1 億美元,複合年成長率為 25.16%。

結構性需求正在從密碼轉向防網釣魚身份驗證,預計到 2024 年密鑰採用率將激增 550%,而 2025 年至 2030 年期間無密碼平台的複合年成長率將達到 26%。從歐洲的強客戶身份驗證 (SCA) 法規到美國國防部的零信任藍圖,監管審查力度不斷加強,正在推動多因素採用以滿足區域合規性需求,同時也提高了供應商的績效標準。生態系統整合是競爭策略的核心。平台領導者正在推動廣泛的身分結構,而專家則在硬體金鑰、行為分析和營運商 API 中抓住成長點。在此背景下,企業意識到無密碼身份驗證的經濟效益,JumpCloud 報告稱,設備級生物辨識技術可降低憑證管理開銷和違規成本。

全球行動裝置用戶身份驗證服務市場趨勢與洞察

行動優先企業採用無密碼和 WebAuthn 標準

70% 的企業計劃或已實施無密碼身份驗證,這反映了 WebAuthn 如何改變安全基準。 Microsoft Entra ID 等現有平台的原生支援將金鑰功能直接嵌入裝置硬體,簡化了使用者流程,同時消除了共用機密的風險。隨著銀行、航空公司和旅遊入口網站在 2025 年採用符合 FIDO 標準的流程,無密碼身份驗證的勢頭可能會進一步增強,這證實了無密碼身份驗證將成為高價值行動交易的常態。能夠協調跨平台憑證移動性的供應商將在行動裝置用戶身份驗證服務市場中佔據相當大的佔有率。

金融科技和行動銀行(SCA 合規性)的激增將推動 MFA 的部署

歐洲銀行管理局 (EBSA) 的指導意見將設備解鎖生物識別排除在獨立的安全認證 (SCA) 之外,這加速了多因素身份驗證的採用,迫使發卡機構建立結合生物識別、持有因素和動態風險檢查的生物識別身份驗證。預期的 PSD3提案將進一步禁止僅限行動裝置的流程,迫使銀行整合帶頻寬驗證功能。電子商務、叫車和零工平台正在採用銀行級控制措施,以滿足消費者信任並維護監管公平性。這種需求的整合正在推動整個金融和準金融生態系統中行動裝置用戶身份驗證服務市場實現兩位數成長。

營運商分散地區的簡訊 OTP 延遲和失敗

全球簡訊動態密碼支出超過 16 億美元,但在多營運商市場中,一次性密碼的送達率低於企業門檻,導致購物車放棄和登入嘗試失敗。新加坡、印度和美國的監管機構已設定目標,到 2025 年逐步淘汰簡訊一次性密碼,這推動了對替代方案的需求。 NIST 目前不鼓勵將簡訊作為安全元素,而 Coinbase 等大型交易所已確認,95% 的帳戶接管都利用了 SIM 卡交換攻擊。雖然遷移成本可能會暫時阻礙中小企業,但推播通知和金鑰成本的下降將隨著時間的推移消除這一障礙。

報告中分析的其他促進因素和限制因素

- 亞洲中階智慧型手機生物辨識硬體採用情況

- 企業零信任安全架構加速行動身分驗證功能的採用

- GDPR下的生物特徵資料隱私問題

細分分析

到 2024 年,MFA 將佔總收入的 56%,這反映了對憑證盜竊的早期保護。在平台級 FIDO 支援和金鑰的廣泛採用的推動下,無密碼身份驗證正以 26% 的複合年成長率加速成長。預計到 2030 年,無密碼流程中行動裝置用戶身份驗證服務的市場規模將達到 38 億美元,幾乎是 2025 年的兩倍。雖然硬體安全金鑰屬於小眾市場,但它滿足了電訊和國防領域的高保證需求,隨著單位經濟效益的提高,正以兩位數的成長率擴張。行為和被動身份驗證增加了持續檢驗,減少了使用者提示並滿足了零信任要求。將硬體金鑰與隱形行為層結合的供應商完全有能力獲得企業的提升銷售預算。

雖然指紋辨識、臉部辨識和語音配對佔據了生物辨識應用的大多數,但當以行為為中心的模型融入現有的行動 SDK 中時,其成長速度將會更快。號碼匹配和設備信譽分析可以減少 MFA 疲勞,並關閉攻擊者操縱的漏洞路徑。這些趨勢的結合,將行動裝置使用者身分驗證服務市場定位為無縫數位體驗的推動者,而非查核點,從而增強了董事會層面投資的商業價值。

受快速 SaaS 部署和彈性擴展優勢的推動,雲端身分驗證即服務 (CAS) 收入將在 2024 年成長 60%。隨著受監管產業在保護資料駐留的同時利用雲端身分創新,邊緣和雲端混合選項將以 23% 的複合年成長率成長。部署 Microsoft 混合 Kerberos 信任模型的組織在透過本機目錄和雲端點驗證本機 Windows Hello 憑證時,展現出更低的延遲和更高的策略一致性。預計到 2030 年,本地架構的行動裝置用戶身份驗證服務的市場佔有率將降至 15% 以下,但只要主權資料授權仍然嚴格,這一比例將保持不變。

混合雲的採用遵循遷移浪潮:企業首先遷移簡單的 Web 工作負載,然後再遷移到雲端原生 FIDO仲介。這種漸進式遷移可以為整合商維持多年的業務收益,並延長平均合約期限。提供跨信任平面策略主導編配的供應商可以建立更牢固的關係,同時最大限度地降低客戶淘汰和替換的風險。

區域分析

受美國網路安全和基礎設施安全局(CSA)支持持續檢驗的零信任成熟度模型等監管催化劑的推動,北美將在2024年貢獻該行業38%的收益。半數美國公司已經實施了某種形式的無密碼身份驗證,這為後進企業加速採用該技術奠定了參考基礎。供應商實力雄厚,微軟、Okta和Yubico制定了標準,利基市場參與者則在行為分析領域開拓創新。公共部門契約,例如國防部的2027會計年度指令,提供了長期的採購量可視性,並促進了鄰近民用機構的溢出採購。因此,隨著零信任計畫的擴展,行動裝置用戶身份驗證服務市場競爭激烈且可擴展。

亞洲是成長最快的地區,受智慧型手機普及和政府數位身分識別計畫的推動,到2030年,複合年成長率將達到28.7%。中國原始設備製造商整合先進的生物識別感測器,加上印度與Aadhaar關聯的支付生態系統,將產生巨大的身份驗證吞吐量。儘管資料隱私立法尚不成熟,但東協五國市場正憑藉電子政府和數位銀行的部署蓬勃發展。基於通訊業者的SIM卡身份驗證API填補了頻寬受限地區的基礎設施空白,擴大了行動裝置用戶身份驗證服務市場的潛在需求,同時將通訊業者集團更深層地整合到價值鏈中。

在歐洲,嚴格的GDPR合規性和SCA的快速應用並進。歐洲銀行業監管機構對數位錢包的澄清將提高商業交易的多因素要求,為其他垂直行業樹立榜樣。預期的PSD3規則將禁止僅限行動裝置的流程,從而有利於擁有能夠動態提升因素的編配引擎的供應商。由於新興的數位身分認證方案,北歐國家的採用率將最高,而隨著開放銀行和電子身分認證框架的成熟,英國、德國和法國將實現強勁成長。即將基於歐盟數位身分錢包的跨境協調將開發新的用例,使歐洲繼續成為行動裝置用戶身份驗證服務市場中利潤豐厚但合規性至關重要的細分市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 行動優先企業採用無密碼和 WebAuthn 標準

- 金融科技和行動銀行(SCA 合規性)的激增推動了 MFA 的推出

- 亞洲中階智慧型手機生物辨識硬體採用情況

- 新興市場中營運商支援的基於 SIM 卡的身份驗證 API

- 全球監管規定(PSD2、CCPA、HIPAA)推動身分驗證支出

- 企業零信任安全架構加速行動驗證器的採用

- 市場限制

- 營運商分散地區的簡訊 OTP 延遲和失敗

- GDPR下的生物特徵資料隱私問題

- 傳統 SMB 行動應用程式的整合成本高

- 專有行動身分驗證 SDK 之間的互通性差距

- 價值/供應鏈分析

- 技術展望

- 投資分析

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測(金額)

- 按身份驗證類型

- 密碼和密碼

- 雙因素認證

- 多因素身份驗證

- 生物特徵認證

- 行為和被動身份驗證

- 基於風險/情境的身份驗證

- 軟令牌和身份驗證器應用程式

- 硬體安全金鑰/FIDO 令牌

- 依部署方式

- 雲端基礎的即服務身份驗證

- 本地部署

- 混合(邊緣+雲)

- 透過認證管道

- SMS OTP

- 推播通知

- 應用內生物辨識 API

- SIM/靜默行動網路驗證

- 電子郵件 OTP/魔術鏈接

- 按公司規模

- 中小型企業(員工人數少於1,000人)

- 主要企業

- 按行業

- BFSI

- 消費性電子產品與電子商務

- 政府及公共機構

- IT和通訊服務

- 醫療保健和生命科學

- 製造業和工業物聯網

- 教育和數位學習

- 旅遊與飯店

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 北歐的

- 瑞典

- 挪威

- 芬蘭

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- APAC

- 中國

- 印度

- 日本

- 韓國

- ASEAN-5

- 澳洲

- 紐西蘭

- 亞太地區其他國家

- 中東

- GCC

- 沙烏地阿拉伯

- UAE

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Symantec Corporation

- Broadcom Inc.(CA Technologies)

- Cisco Systems Inc.(Duo Security)

- Microsoft Corporation

- Okta Inc.

- Thales Group(Gemalto)

- RSA Security LLC(Dell Technologies)

- OneSpan Inc.

- Entrust Corporation

- HID Global Corporation

- IDEMIA

- NEC Corporation

- Ping Identity Holding Corp.

- ForgeRock Inc.

- Authy(Twilio Inc.)

- Yubico AB

- Trustwave Holdings Inc.

- Micro Focus International plc

- Google LLC

- IBM Corporation

- Nexus Group

- SecurEnvoy Ltd.

- Aware Inc.

- Fujitsu Limited

第7章 市場機會與未來展望

The mobile devices user authentication services market size is valued at USD 3.03 billion in 2025 and is on track to reach USD 9.31 billion by 2030, and is forecast to expand at a 25.16% CAGR.

Structural demand is shifting from passwords toward phishing-resistant verification, reflected in the 550% jump in passkey roll-outs during 2024 and the 26% CAGR expected for passwordless platforms between 2025-2030. Heightened regulatory scrutiny-ranging from Europe's Strong Customer Authentication (SCA) rules to the U.S. Department of Defense Zero Trust Roadmap-is catalyzing multi-factor deployments that satisfy regional compliance needs while raising the performance bar for vendors. Competitive strategies now center on ecosystem integration: platform leaders push broad identity fabrics while specialists capture growth pockets in hardware keys, behavioral analytics, and carrier APIs. Against this backdrop, enterprises recognise the economic upside of passwordless authentication, with JumpCloud reporting that device-level biometrics reduce credential management overhead and breach costs in equal measure.

Global Mobile Devices User Authentication Services Market Trends and Insights

Adoption of Passwordless & WebAuthn Standards Across Mobile-First Enterprises

Seventy percent of organisations either plan to adopt or have already introduced passwordless authentication, illustrating how WebAuthn shifts the security baseline. Native support from platform incumbents such as Microsoft Entra ID embeds passkey functionality directly into device hardware, eradicating shared-secret risk while simplifying user journeys. Consumer familiarity with passkeys rose to 57% in 2025, up from 39% three years earlier, signalling readiness for large-scale transition.Momentum will intensify as banks, airlines and travel portals adopt FIDO-compliant flows in 2025, confirming passwordless as a mainstream control for high-value mobile transactions. Vendors able to orchestrate cross-platform credential mobility stand to win disproportionate share in the mobile devices user authentication services market.

Surge in FinTech and Mobile Banking (SCA Compliance) Driving MFA Roll-outs

European Banking Authority guidance ruling out device-unlock biometrics as a standalone SCA accelerates multi-factor adoption, forcing issuers to build layered verification that combines biometrics, possession factors, and dynamic risk checks. The expected PSD3 proposal will further prohibit mobile-only flows, prompting banks to embed out-of-band authenticators. Spillover into adjacent digital commerce is material; e-commerce, ride-hailing, and gig-work platforms adopt banking-grade controls to satisfy consumer trust and regulatory parity. These converging demands underpin double-digit growth in the mobile devices user authentication services market across financial and quasi-financial ecosystems.

SMS OTP Latency & Failure in Carrier-Fragmented Regions

Global spend on SMS OTP exceeds USD 1.6 billion even though delivery rates fall below enterprise thresholds in multi-operator markets, triggering cart abandonment and failed logins. Regulators in Singapore, India and the United States aim to retire SMS OTP by 2025, amplifying urgency for alternatives. NIST now discourages SMS as a secure factor, while leading exchanges such as Coinbase confirm that 95% of account takeovers leveraged SIM-swap attacks. Transition costs may temporarily restrain small businesses, but declining push notification and passkey expenses neutralise the barrier over time.

Other drivers and restraints analyzed in the detailed report include:

- Mid-Range Smartphone Biometric Hardware Penetration in Asia

- Enterprise Zero-Trust Security Architecture Accelerating Mobile Authenticator Adoption

- Biometric Data Privacy Concerns under GDPR

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MFA dominated revenue with 56% in 2024, reflecting early defences against credential theft. Passwordless now sets the growth pace at 26% CAGR, powered by platform-level FIDO support and rising passkey familiarity. The mobile devices user authentication services market size for passwordless flows is projected to reach USD 3.8 billion by 2030, nearly doubling its 2025 base. Hardware security keys, while niche, address high-assurance needs in telecom and defence, expanding at double-digit rates as unit economics improve. Behavioural and passive authentication add continuous verification, reducing user prompts and aligning with zero-trust mandates. Vendors marrying hardware keys with invisible behavioural layers are well-positioned to capture enterprise up-sell budgets.

Fingerprints, facial recognition, and voice match account for the bulk of biometric adoption, yet behaviour-centric models grow faster by embedding in existing mobile SDKs. Number matching and device reputation analytics reduce MFA fatigue, closing an exploit path that attackers manipulate. The combination of these trends repositions the mobile devices user authentication services market as an enabler of seamless digital experience rather than a checkpoint, strengthening the business case for board-level investment

Cloud Authentication-as-a-Service delivered 60% revenue in 2024, driven by rapid SaaS roll-outs and elastic scaling advantages. The hybrid edge-plus-cloud option grows at 23% CAGR as regulated industries safeguard data residency while using cloud identity innovation. Organisations deploying Microsoft's hybrid Kerberos trust model demonstrate latency reductions and policy coherence when authenticating local Windows Hello credentials through both on-premises directory and cloud endpoint. The mobile devices user authentication services market share for on-premise architectures will slide below 15% by 2030, yet it persists wherever sovereign data mandates remain strict.

Hybrid adoption follows migration waves: firms lift simple web workloads first, then layer cloud-native FIDO brokers, leaving heritage mainframe authentications on-site until retirement. This staged transition sustains multi-year service revenue for integrators and lengthens average contract duration. Vendors offering policy-driven orchestration across trust planes achieve stickier relationships while minimising rip-and-replace risk for clients.

The Mobile Devices User Authentication Market is Segmented by Authentication Type (Passwords and PINs, Two-Factor Authentication, and More), Deployment Mode (Cloud-Based, On-Premise, and More), Authentication Channel (SMS OTP, Push Notification, and More), Enterprise Size (SMEs, Large Enterprises), End-User Vertical (BFSI, Consumer Electronics, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of 2024 sectoral revenue, anchored by regulatory catalysts like the Cybersecurity and Infrastructure Security Agency Zero Trust Maturity Model that champions continuous verification. Half of U.S. enterprises have already deployed some form of passwordless authentication, creating a reference base that accelerates late-mover adoption. Vendor presence is dense, with Microsoft, Okta, and Yubico shaping standards while niche players pioneer behaviour analytics. Public-sector contracts, notably the Department of Defense FY27 mandate, provide long-term volume visibility and drive spill-over purchases in adjacent civilian agencies. The mobile devices user authentication services market, therefore, remains highly competitive yet expandable as zero-trust programmes scale.

Asia is the fastest-growing theatre at 28.7% CAGR through 2030, propelled by smartphone ubiquity and government digital identity schemes. Chinese OEM integration of advanced biometric sensors combined with India's Aadhaar-linked payments ecosystem creates massive authentication throughput. ASEAN-5 markets add incremental momentum via e-government and digital banking roll-outs, even though data privacy legislation is still maturing, injecting both growth and complexity. Carrier-backed SIM authentication APIs fill infrastructure gaps in low-bandwidth geographies, enlarging the addressable demand for the mobile devices user authentication services market while embedding telecom groups deeper into the value chain.

Europe balances strict GDPR compliance with rapid SCA uptake. The European Banking Authority's clarification on digital wallets elevates multi-factor requirements across commerce and sets a playbook that other verticals can emulate. Anticipated PSD3 rules will forbid mobile-only flows, favouring vendors with orchestration engines capable of dynamic factor step-ups. Northern Europe demonstrates highest penetration due to early digital identity schemes, while the United Kingdom, Germany and France post robust growth as Open Banking and eID frameworks mature. Cross-border harmonisation under the forthcoming EU Digital Identity Wallet will unlock new use cases, maintaining Europe as a lucrative yet compliance-heavy segment of the mobile devices user authentication services market.

- Symantec Corporation

- Broadcom Inc. (CA Technologies)

- Cisco Systems Inc. (Duo Security)

- Microsoft Corporation

- Okta Inc.

- Thales Group (Gemalto)

- RSA Security LLC (Dell Technologies)

- OneSpan Inc.

- Entrust Corporation

- HID Global Corporation

- IDEMIA

- NEC Corporation

- Ping Identity Holding Corp.

- ForgeRock Inc.

- Authy (Twilio Inc.)

- Yubico AB

- Trustwave Holdings Inc.

- Micro Focus International plc

- Google LLC

- IBM Corporation

- Nexus Group

- SecurEnvoy Ltd.

- Aware Inc.

- Fujitsu Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Passwordless and WebAuthn Standards Across Mobile-First Enterprises

- 4.2.2 Surge in FinTech and Mobile Banking (SCA Compliance) Driving MFA Roll-outs

- 4.2.3 Mid-Range Smartphone Biometric Hardware Penetration in Asia

- 4.2.4 Carrier-Backed SIM-Based Authentication APIs in Emerging Markets

- 4.2.5 Global Regulatory Mandates (PSD2, CCPA, HIPAA) Boosting Authentication Spend

- 4.2.6 Enterprise Zero-Trust Security Architecture Accelerating Mobile Authenticator Adoption

- 4.3 Market Restraints

- 4.3.1 SMS OTP Latency and Failure in Carrier-Fragmented Regions

- 4.3.2 Biometric Data Privacy Concerns under GDPR

- 4.3.3 High Integration Cost for Legacy SME Mobile Applications

- 4.3.4 Interoperability Gaps among Proprietary Mobile Auth SDKs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Investment Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Authentication Type

- 5.1.1 Passwords and PINs

- 5.1.2 Two-Factor Authentication

- 5.1.3 Multi-Factor Authentication

- 5.1.4 Biometric Authentication

- 5.1.5 Behavioral and Passive Authentication

- 5.1.6 Risk-Based / Contextual Authentication

- 5.1.7 Soft Tokens and Authenticator Apps

- 5.1.8 Hardware Security Keys / FIDO Tokens

- 5.2 By Deployment Mode

- 5.2.1 Cloud-Based Authentication as-a-Service

- 5.2.2 On-Premise

- 5.2.3 Hybrid (Edge + Cloud)

- 5.3 By Authentication Channel

- 5.3.1 SMS OTP

- 5.3.2 Push Notification

- 5.3.3 In-App Biometric API

- 5.3.4 SIM / Silent Mobile Network Authentication

- 5.3.5 Email OTP / Magic Link

- 5.4 By Enterprise Size

- 5.4.1 SMEs (< 1,000 Employees)

- 5.4.2 Large Enterprises

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 Consumer Electronics and E-Commerce

- 5.5.3 Government and Public Sector

- 5.5.4 Telecommunications and IT Services

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Manufacturing and Industrial IoT

- 5.5.7 Education and eLearning

- 5.5.8 Travel and Hospitality

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Nordics

- 5.6.3.1.1 Sweden

- 5.6.3.1.2 Norway

- 5.6.3.1.3 Finland

- 5.6.3.2 Germany

- 5.6.3.3 United Kingdom

- 5.6.3.4 France

- 5.6.3.5 Italy

- 5.6.3.6 Spain

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN-5

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of APAC

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.2 Turkey

- 5.6.5.3 Israel

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Kenya

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)}

- 6.4.1 Symantec Corporation

- 6.4.2 Broadcom Inc. (CA Technologies)

- 6.4.3 Cisco Systems Inc. (Duo Security)

- 6.4.4 Microsoft Corporation

- 6.4.5 Okta Inc.

- 6.4.6 Thales Group (Gemalto)

- 6.4.7 RSA Security LLC (Dell Technologies)

- 6.4.8 OneSpan Inc.

- 6.4.9 Entrust Corporation

- 6.4.10 HID Global Corporation

- 6.4.11 IDEMIA

- 6.4.12 NEC Corporation

- 6.4.13 Ping Identity Holding Corp.

- 6.4.14 ForgeRock Inc.

- 6.4.15 Authy (Twilio Inc.)

- 6.4.16 Yubico AB

- 6.4.17 Trustwave Holdings Inc.

- 6.4.18 Micro Focus International plc

- 6.4.19 Google LLC

- 6.4.20 IBM Corporation

- 6.4.21 Nexus Group

- 6.4.22 SecurEnvoy Ltd.

- 6.4.23 Aware Inc.

- 6.4.24 Fujitsu Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment