|

市場調查報告書

商品編碼

1836645

高性能電動車:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive High Performance Electric Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

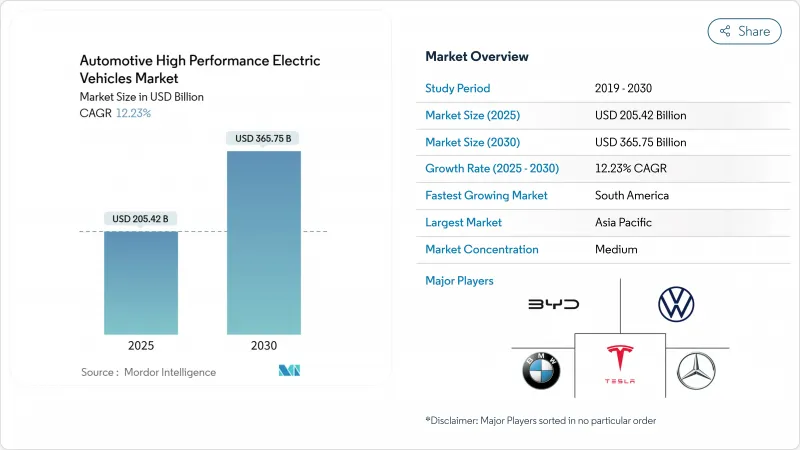

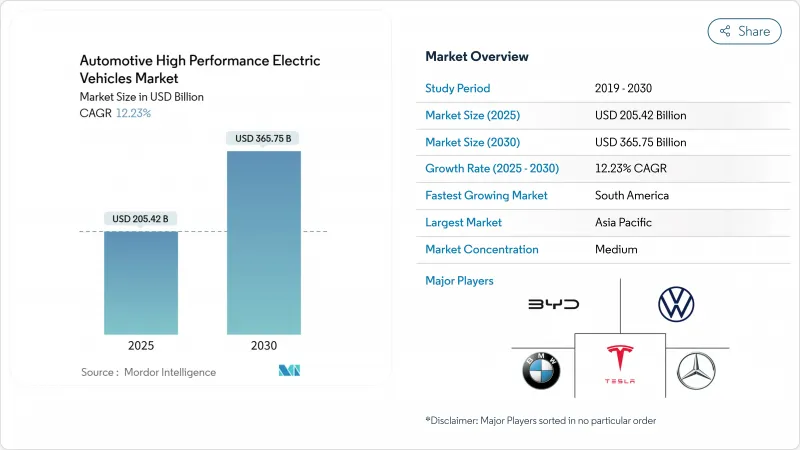

高性能電動車市場規模預計在 2025 年為 2,054.2 億美元,預計到 2030 年將達到 3,657.5 億美元,預測期內(2025-2030 年)的複合年成長率為 12.23%。

高性能電動車市場預計將持續保持兩位數成長,這得益於電池組成本的持續下降、800V平台的快速普及以及三電機和四電機車型的興起。消費者對兼具近乎靜音駕駛和超級跑車級加速性能的汽車的興趣正在增強高階車型的定價能力,而各國政府則正在利用零排放強制規定和購車補貼來刺激需求。

全球高性能電動車市場趨勢與洞察

電池成本下降和800V的採用

隨著特斯拉4680系列產品線投入量產,中國供應商實現6C充電包商業化,以及電池包級成本結構實現兩位數縮減,NMC和NCA電芯價格將在2025年保持在90千瓦時以下。保時捷Taycan率先採用的800伏特架構現已滲透至高階市場,將直流快速充電器的數量減少了40%,並實現了更輕的線纜,以抵消增加的馬達重量。英飛凌和Wolfspeed的碳化矽MOSFET逆變器降低了三馬達和四馬達佈局中的開關損耗,支援10分鐘充滿電且不會出現熱性能下降。這些共同效應將推動高性能電動車市場在維持高功率的同時,進一步提升其價格承受能力。

政府獎勵和排放控制

美國《通膨削減法案》規定每輛車最高可獲得7,500美元的津貼,政府退稅則額外降低了15,000美元的實際交易價格。歐盟的「Fit-for-55」(適合55歲)計畫規定,到2030年,車輛平均二氧化碳排放量將減少55%,這迫使汽車製造商專注於生產高性能電動車,以抵消剩餘的內燃機汽車產量。中國的雙積分計畫使比亞迪在2024年實現了427萬輛汽車的出貨量,兩年內電動車數量增加了一倍多。

溫度控管限制

目前的鋰離子電池組在60°C以上時容量會迅速衰減,而多重馬達配置的極端工作循環會在幾分鐘內將電池單元推至此溫度閾值。液體冷卻板、相變複合材料和基於冷媒的冷卻器會增加成本、重量和服務複雜性。在波斯灣地區,夏季環境溫度在硬啟動期間已導致續航里程縮短高達20%。原始設備製造商正在探索結構冷卻和浸沒式冷卻方法,但短期資本投資仍然是高性能電動車市場發展的一大障礙。

報告中分析的其他促進因素和限制因素

- 超快充走廊

- 卡車用 SiC 逆變器

- 稀土價格風險

細分分析

到2024年,純電動車將佔71.27%的收益,證實了買家對純電動驅動和簡化傳動系統的偏好。純電動車的優勢在於瞬時扭力和精準的功率調節,小米SU7至尊版在紐柏林賽道的標竿圈速就反映了這一點。這一細分市場也受惠於低維護成本和無線效能調校。同時,插電式混合動力車的複合年成長率高達13.26%,對缺乏350kW公共充電樁的地區愛好者極具吸引力。

在歐洲,更嚴格的二氧化碳排放平均值使得插電式混合動力車(PHEV)在合規方面更具吸引力,高階車型整合了賽道導向的電動增壓模式,可提供持續的單圈性能。德國和英國的稅收制度有利於企業車隊使用插電式混合動力車,從而鼓勵高階主管購買。

到2024年,乘用車將佔據高性能電動車市場84.74%的佔有率,其中運動型轎車和豪華SUV將超越傳統超級跑車。落地式電池降低了重心,扭力向量控制則提升了操控性,使梅賽德斯-AMG、寶馬M和奧迪運動版車型能夠實現0-60英里/小時加速時間低於3秒,並兼具四門版的實用性。客戶願意為軟體解鎖的附加功能付費,這進一步提升了淨利率。

以性能為導向的皮卡和送貨車為主導的商用車,到2030年將達到12.75%的複合年成長率。車隊管理者看重扭矩,以提升牽引力和負載容量,同時也能從更低的燃油和服務成本中受益。 Rivian的R1T和福特的F-150 Lightning證明了,主力車隊可以從專為極端使用而設計的推進系統中獲得更高的價值。隨著工作週期資料被用於預測性維護,殘值將會提升,從而吸引機構資本進入高性能電動車市場。

區域分析

2024年,亞太地區將佔46.85%的銷售佔有率,其中中國將佔據主導地位。日本仍偏向混合動力車,但韓國和澳洲由於擴大購車返利政策以及350千瓦高速公路充電樁的部署,實現了兩位數的成長。一體化供應鏈正在整合該地區的電池、逆變器和晶片供應商,從而縮短了前置作業時間,並確保了該地區高性能電動車市場的結構性價格優勢。

在公私合作的支持下,歐洲的純電動車銷量在2024年暴跌後,於2025年第一季復甦,成長約30%。受益於殘值擔保和公共方程式賽車的技術溢出效應,德國和英國均實現了小幅成長。墨西哥計劃於2030年建成的微型電動車中心將整合北美自由貿易組織(NAFTA)的內容規則和低廉的勞動力成本,以創造一個持續的供應帶,從而增強區域競爭力。這種本地化建設趨勢符合國家安全理念,可以保護高性能電動車市場免受遠端供應中斷的影響。

預計南美的複合年成長率將達到13.17%,該地區電動車註冊量到2024年將翻倍。巴西已下調進口關稅,以加速國內組裝計劃,巴拉圭則著眼於水力發電電池級鋰離子電池業務。然而,大都市以外的充電普及率仍然較低,車隊優先考慮在停車場充電。隨著可再生能源發電的擴張,高性能電動車市場應該會為瞄準高階進口車的清潔能源品牌找到肥沃的土壤。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 電池成本下降和800V的採用

- 政府獎勵和排放控制

- 超快充走廊

- 卡車用 SiC 逆變器

- Halo 專為純電動車賽車設計

- OTA性能改進收益

- 市場限制

- 溫度控管限制

- 稀土價格風險

- 保險費上漲

- 兆瓦級充電樁的電網瓶頸

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資/融資趨勢

第5章市場規模與成長預測:價值(美元)

- 按驅動類型

- 純電動車 (BEV)

- 插電式混合動力車(PHEV)

- 按車輛類型

- 搭乘用車

- 商用車

- 依馬達類型

- 永磁同步型

- 就職

- 開關磁阻

- 軸流

- 按電池化學

- 鋰離子(NMC/NCA)

- 磷酸鋰鐵(LFP)

- 固體/固體

- 按動力傳動系統架構

- 單馬達FR

- 雙馬達全輪驅動

- 三/四馬達全輪驅動

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Tesla

- BYD Auto

- Volkswagen Group

- BMW Group

- Mercedes-Benz Group

- General Motors

- Ford Motor Company

- Stellantis NV

- Hyundai Motor Group

- Toyota Motor Corporation

- Nissan Motor Co.

- Lucid Group

- Rivian Automotive

- Rimac Automobili

第7章 市場機會與未來展望

The Automotive High Performance Electric Vehicles Market size is estimated at USD 205.42 billion in 2025, and is expected to reach USD 365.75 billion by 2030, at a CAGR of 12.23% during the forecast period (2025-2030).

Continued cost declines in battery packs, rapid 800 V platform diffusion, and a new wave of tri- and quad-motor models position the automotive high performance EVs market for sustained double-digit expansion. Consumer interest in vehicles that deliver both near-silent operation and super-car-level acceleration is reinforcing premium pricing power, while governments use zero-emission mandates and purchase subsidies to pull forward demand.

Global Automotive High Performance Electric Vehicles Market Trends and Insights

Battery Cost Decline & 800 V Adoption

NMC and NCA cell prices continued falling below USD 90 kWh in 2025 as Tesla's 4680 line hit volume production and Chinese suppliers commercialized 6C-charge packs, shrinking pack-level cost structures by double digits. Eight-hundred-volt architectures pioneered by the Porsche Taycan now permeate premium segments, slicing DC fast-charge sessions by 40% and allowing lighter cabling that offsets added motor mass. Silicon-carbide MOSFET inverters from Infineon and Wolfspeed drop switching losses for tri- and quad-motor layouts, supporting 10-minute full charges without thermal derate. The combined effect propels the automotive high performance EVs market toward broader affordability while sustaining ultra-high power outputs.

Government Incentives & Emission Norms

The U.S. Inflation Reduction Act grants up to USD 7,500 per vehicle, complemented by state rebates that trim effective transaction prices by as much as USD 15,000. The European Union's Fit-for-55 package legally binds a 55% fleet-average CO2 cut by 2030, compelling OEMs to lean into high performance EV volume to counterbalance residual ICE output. China's dual-credit regime pushed BYD deliveries to 4.27 million units in 2024, more than doubling its EV tally in two years.

Thermal-management Limits

Current lithium-ion packs lose capacity rapidly above 60 °C, and extreme duty cycles in multi-motor setups can push cells to these thresholds in minutes. Liquid-cooling plates, phase-change composites, and refrigerant-based chillers add cost, weight, and service complexity. In the Persian Gulf, summer ambient temperatures already trim real-world range by up to 20% during spirited driving. OEMs are exploring structural cooling and immersion methods, yet short-term capex remains a hurdle for the automotive high performance EVs market.

Other drivers and restraints analyzed in the detailed report include:

- Ultra-fast Charging Corridors

- SiC Inverters for Track Duty

- Rare-earth Price Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery Electric Vehicles secured 71.27% of 2024 revenue, underscoring buyer preference for pure-electric thrust and simplified drivetrains. BEVs exploit instant torque and finer power modulation, exemplified by the Xiaomi SU7 Ultra's Nurburgring benchmark lap. The segment also benefits from lighter maintenance demand and OTA-driven performance tuning. Meanwhile, Plug-in Hybrid Electric Vehicles are expanding at a 13.26% CAGR, appealing to enthusiasts in regions where 350 kW public chargers remain scarce.

Europe's stricter CO2 fleet averages make PHEVs attractive for compliance, and premium marques integrate track-oriented electric boost modes that deliver sustained lap performance. Tax regimes in Germany and the U.K. favor PHEVs for company fleets, propelling adoption among executive buyers.

Passenger cars commanded 84.74% of 2024 revenue of the automotive high performance EVs market size, propelled by sports sedans and luxury SUVs that now out-accelerate legacy supercars. Battery floor mounting drops centers of gravity, and torque vectoring enhances handling, enabling Mercedes-AMG, BMW M, and Audi Sport to offer sub-3-second 0-60 mph times with four-door practicality. Customer willingness to pay for software-unlock extras further fortifies margins.

Commercial vehicles, led by performance-oriented pickups and delivery vans, record a 12.75% CAGR through 2030. Fleet managers appreciate torque for towing and payload while benefiting from lower fuel and service bills. Rivian's R1T and Ford's F-150 Lightning prove that workhorse fleets can extract premium value from propulsion systems designed for extremes. As duty-cycle data feeds predictive maintenance, residuals improve, inviting institutional capital into the automotive high performance EVs market.

The Automotive High Performance EVs Market Report is Segmented by Drive Type (Battery Electric and Plug-In Hybrid Electric), Vehicle Type (Passenger Cars and Commercial Vehicles), Motor Type (Permanent-Magnet Synchronous, Induction, and More), Battery Chemistry (Lithium-Ion (NMC/NCA) and More), Powertrain Architecture (Single-Motor RWD and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 46.85% 2024 revenue share, anchored by China where electric vehicles are slated to reach 60% of total light-duty sales in 2025. Japan remains hybrid-skewed, yet South Korea and Australia witness double-digit growth under expanded purchase rebates and 350 kW highway charger deployments. Integrated supply chains allow battery, inverter, and chip suppliers to co-locate, compressing lead times and securing a structural price edge for the automotive high performance EVs market in the region.

Europe rebounded with around 30% BEV sales growth in Q1 2025 after a 2024 plateau, supported by joint public-private funding that targets one million public charge points by 2030. Germany and the U.K. posted a decent respective gains, benefiting from residual-value guarantees and Formula E technology spillovers. Mexico's planned mini-EV hub for 2030 integrates NAFTA content rules and low labor costs, creating a contiguous supply belt that reinforces regional competitiveness. Such build-local trends align with national security narratives, shielding the automotive high performance EVs market from distant supply disruptions.

South America delivered the fastest 13.17% CAGR outlook as Latin American EV registrations doubled units in 2024. Uruguay tops regional per-capita adoption; Brazil cut import tariffs to accelerate domestic assembly programs, and Paraguay eyes battery-grade lithium business anchored on hydropower. Yet charging coverage remains patchy outside capital corridors, prompting fleets to prioritize depot-based operations. As renewable generation expands, the automotive high performance EVs market should find fertile ground in clean-energy branding for premium imports.

- Tesla

- BYD Auto

- Volkswagen Group

- BMW Group

- Mercedes-Benz Group

- General Motors

- Ford Motor Company

- Stellantis NV

- Hyundai Motor Group

- Toyota Motor Corporation

- Nissan Motor Co.

- Lucid Group

- Rivian Automotive

- Rimac Automobili

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Battery cost decline & 800 V adoption

- 4.2.2 Government incentives & emission norms

- 4.2.3 Ultra-fast charging corridors

- 4.2.4 SiC inverters for track duty

- 4.2.5 EV-only racing halo

- 4.2.6 OTA performance-upgrade revenue

- 4.3 Market Restraints

- 4.3.1 Thermal-management limits

- 4.3.2 Rare-earth price risk

- 4.3.3 Insurance-premium spike

- 4.3.4 Grid bottlenecks for MW chargers

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment & Funding Trends

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Drive Type

- 5.1.1 Battery Electric (BEV)

- 5.1.2 Plug-in Hybrid Electric (PHEV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Motor Type

- 5.3.1 Permanent-Magnet Synchronous

- 5.3.2 Induction

- 5.3.3 Switched Reluctance

- 5.3.4 Axial Flux

- 5.4 By Battery Chemistry

- 5.4.1 Lithium-ion (NMC/NCA)

- 5.4.2 Lithium Iron Phosphate (LFP)

- 5.4.3 Solid-state & Semi-solid

- 5.5 By Powertrain Architecture

- 5.5.1 Single-Motor RWD

- 5.5.2 Dual-Motor AWD

- 5.5.3 Tri-/Quad-Motor AWD

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Tesla

- 6.4.2 BYD Auto

- 6.4.3 Volkswagen Group

- 6.4.4 BMW Group

- 6.4.5 Mercedes-Benz Group

- 6.4.6 General Motors

- 6.4.7 Ford Motor Company

- 6.4.8 Stellantis NV

- 6.4.9 Hyundai Motor Group

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Nissan Motor Co.

- 6.4.12 Lucid Group

- 6.4.13 Rivian Automotive

- 6.4.14 Rimac Automobili

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment