|

市場調查報告書

商品編碼

1836612

加速計:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Accelerometer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

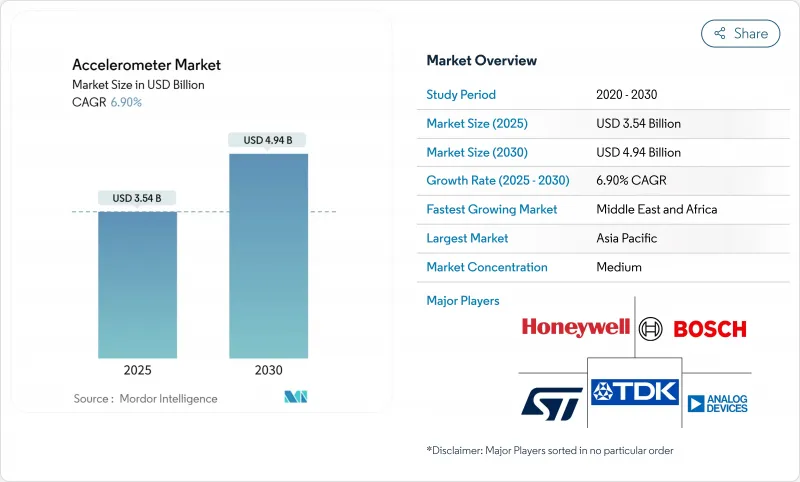

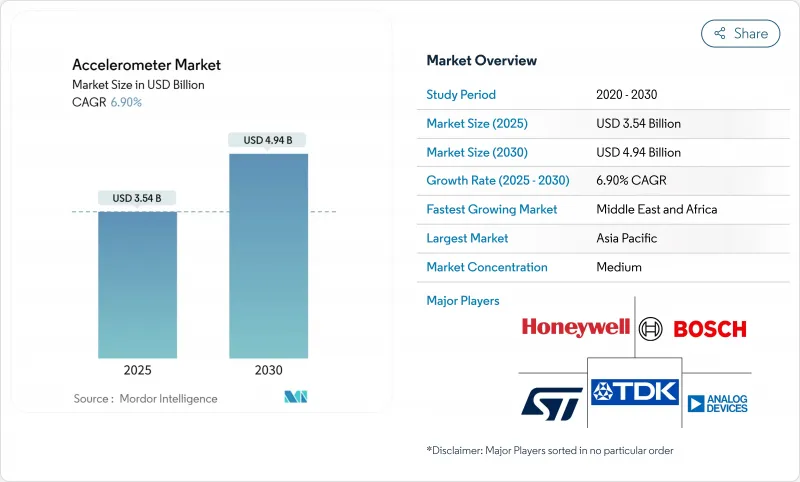

預計 2025 年加速計市場價值將達到 35.4 億美元,到 2030 年將達到 49.4 億美元,在此期間的複合年成長率為 6.9%。

隨著感測器在消費性設備、汽車安全系統和工業監控領域發揮日益重要的作用,其需求也不斷成長。 MEMS 的持續小型化降低了系統成本,同時使其能夠整合到空間受限的產品中,而 AI 增強型片上處理功能使加速計能夠在邊緣提供即時洞察。汽車產業的一級供應商正在將高 g 值變體納入 ADAS 感測器融合套件,而加速感應器級壓電裝置在航太和國防領域的細分市場中保持著差異化價值。供應側風險包括 8 吋 MEMS 晶圓的持續限制以及商品化消費性市場的價格壓縮,但醫療穿戴式裝置和可再生能源基礎設施領域的設計成功支撐了整體成長前景。

全球加速計市場趨勢與洞察

MEMS的小型化和成本降低

第三代MEMS製程現已生產亞毫米級檢測品質結構,可在不影響雜訊密度的情況下縮小晶粒尺寸和功耗。博世的微型2024系列加速計展示了晶圓級晶片封裝如何在保持+2g至+16g動態範圍的同時降低材料成本。更大的300毫米MEMS晶圓廠有望進一步實現規模經濟,使OEM能夠在更緊張的材料預算內配置額外的感測功能。意法半導體的LIS2DUXS12整合了機器學習核心,可實現微瓦級事件分類,無需配套MCU並節省基板空間。隨著代工廠轉向更大晶圓,平均售價將會下降,從而釋放對成本敏感的物聯網節點的潛在需求,並增強加速計市場的成長循環。

家用電器和穿戴式裝置的繁榮

雖然智慧型手機、耳機和健身追蹤器仍可實現量產,但2025年的設計藍圖顯示,穿戴式裝置正在加速向醫療級穿戴裝置的轉變,這些裝置需要在低於30 μg/√Hz的本底噪音下持續運行,並擁有長達數天的電池續航力。 ADI公司的ADXL380面向具有雙訊號路徑的真無線耳機,透過單一感測器支援主動降噪回授和頭部手勢姿態辨識。在醫療設備領域,感測器內建的AI推理功能可減輕雲端處理負擔,從而支援符合IEC 60601-1認證的跌倒偵測穿戴式設備,供醫院使用。更高價值的臨床應用緩解了利潤壓力,並將加速計市場拓展到受監管的醫療管道,這些管道更重視品質而非最低價格。

價格壓力與商品化

在智慧型手機領域,慣性感測零件數量預計將在2022年至2024年間下降近30%,這迫使供應商透過嵌入式機器學習核心和低功耗掛起模式來實現差異化。 Kionix的KX224系列每百萬件售價低於0.30美元,證實了傳統零件平均售價的持續下降。供應商正在投資自動化校準以彌補利潤,但工廠的例行調整會增加資本支出並侵蝕利潤。這種不平衡導致許多競爭對手處於損益平衡狀態,限制了加速計市場的短期收益成長。

報告中分析的其他促進因素和限制因素

- 汽車ADAS/安全整合

- 工業4.0中狀態監測的興起

- 精度極限和壓電高重力

細分分析

到2024年,MEMS裝置將憑藉其無與倫比的性價比佔據加速計市場72%的佔有率。 200毫米晶圓的量產和晶圓級構裝將使MEMS成為智慧型手機、穿戴式裝置和汽車ECU的核心。壓電裝置由於基數小,且國防和航太製造商對低於1µg的偏壓穩定性和耐輻射性的需求,將以每年7.8%的速度成長。壓阻式和電容式裝置將服務於利基工業應用,在這些應用中,抗衝擊性和超低功耗比絕對精度更重要。

MEMS 的領先地位源自於其整合優勢。意法半導體的感測器中樞架構將數位機器學習核心和 FIFO 緩衝器直接整合在晶粒上,從而減少了外部元件數量。然而,當加速度範圍、極端溫度或偏壓穩定性超出 MEMS 的極限時,設計人員會轉而採用壓電堆疊。

在全六自由度測量趨勢的推動下,三軸加速器將在2024年達到64.5%的收入佔有率。原始設備製造商更傾向於統一的XYZ讀數,以支援手勢姿態辨識和振動診斷,同時最大限度地降低感測器融合的開銷。同時,整合六軸或九軸功能的組合IMU將呈現8.4%的成長軌跡,這主要得益於無人機、AR/ VR頭戴裝置和機器人技術的推動。用於傾斜開關和汽車安全氣囊觸發器的單軸裝置的佔有率正在穩步下降。

柯林斯航空航太的 SiIMU02 在手掌MEMS 組件中實現了接近光纖陀螺儀的精度,展現了多軸整合的高階水平。中端消費產品將加速計、陀螺儀以及某些情況下的地磁感測器整合到單一 ASIC 中,並配備可程式數位濾波器。這種整合減少了 PCB 面積和物料清單成本,從而在應用複雜性不斷增加的情況下維持了加速計市場的強勁成長動能。

區域分析

亞太地區受惠於中國家用電子電器出口基地和8吋MEMS晶圓代工廠的集中,預計2024年將佔全球銷售額的46.8%。總部位於深圳的美新半導體(MEMSIC)實現了三位數成長,專注於為國內智慧型手機OEM廠商提供電容式加速計。日本和韓國為汽車和工業領域提供高可靠性產品,而台灣的代工廠則支持契約製造。該地區的加速計市場將以6.4%的複合年成長率穩定成長,但晶圓產能限制和人事費用上升將抑製成長。

到2030年,中東和非洲地區的複合年成長率將達到8.7%,是最快的。沙烏地阿拉伯的「2030願景」獎勵策略將為當地半導體計畫提供資金,並擴大需要渦輪機振動監測的可再生能源資產規模。埃及和摩洛哥的風電場正在採用三軸加速器,以滿足ISO 10816預測性維護基準。與歐洲感測器製造商的官民合作關係正在促進技術轉讓,本地生產正在推動加速計市場的發展。

受汽車ADAS強制要求和先進的工業IoT裝置量的推動,北美保持著強勁的第二大市場地位。石油天然氣、化學和金屬行業採用工業4.0維護策略,推動了對堅固耐用、適用於危險區域的加速感應器的需求。歐洲緊隨其後,儘管平均售價較高,但由於原始設備製造商(OEM)優先考慮品質和功能安全。歐盟「地平線歐洲」機器人計劃的資金支持進一步刺激了精密級感測器的採用,加強了區域在加速計市場的參與度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- MEMS的小型化和成本降低

- 消費性電子產品和穿戴式裝置的繁榮

- 汽車ADAS/安全整合

- 工業4.0狀態監測的興起

- 採用精密農業無人機

- 傾斜振動對可再生能源的需求

- 市場限制

- 價格壓力與商品化

- 精度限值與壓電g的比較

- 8吋MEMS鑄造產能瓶頸

- 韌體/安全漏洞

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按類型

- MEMS加速計

- 壓電加速計

- 壓阻式加速計

- 電容式加速計

- 熱和其他類型

- 按尺寸

- 1軸

- 2軸

- 3軸

- 6 軸或更多軸(組合 IMU)

- 按最終用戶

- 消費性電子產品

- 車

- 航太/國防

- 工業和製造業

- 醫療保健和醫療設備

- 其他最終用戶

- 按性能等級

- 消費級

- 工業級

- 戰術級

- 導航等級

- 太空級

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- APAC

- 中國

- 日本

- 印度

- 韓國

- 台灣

- 東南亞

- 亞太地區其他國家

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Analog Devices Inc.

- Robert Bosch GmbH

- STMicroelectronics

- TDK InvenSense

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.(Kionix)

- NXP Semiconductors NV

- MEMSIC Inc.

- TE Connectivity(Measurement Specialties)

- Silicon Sensing Systems Ltd.

- Sensonor AS

- PCB Piezotronics(MTS Systems)

- Northrop Grumman LITEF GmbH

- Rockwell Automation Inc.

- Kearfott Corporation

- Meggitt PLC(Endevco)

- Dytran Instruments Inc.

- Al Cielo Inertial Solutions Ltd.

- Atlantic Inertial Systems Ltd.

- LORD MicroStrain(HBK)

- QST Corporation

第7章 市場機會與未來展望

The accelerometer market is valued at USD 3.54 billion in 2025 and is forecast to reach USD 4.94 billion in 2030, representing a 6.9% CAGR over the period.

Demand scales with the sensor's increasingly critical role in consumer devices, automotive safety systems and industrial monitoring. Continuous MEMS miniaturization lowers system cost while enabling integration into space-constrained products, and AI-enhanced on-chip processing now lets accelerometers deliver real-time insights at the edge. Tier-1 automotive suppliers are embedding high-g variants in ADAS sensor-fusion suites, while precision-grade piezoelectric devices sustain differentiated value in aerospace and defense niches. Supply-side risks include lingering 8-inch MEMS wafer constraints and price compression in commoditized consumer segments, but design wins in healthcare wearables and renewable-energy infrastructure keep the overall growth outlook intact.

Global Accelerometer Market Trends and Insights

MEMS Miniaturization and Cost Reduction

Third-generation MEMS processes now fabricate sub-millimeter proof-mass structures that cut die size and power draw without degrading noise density. Bosch's miniature 2024 accelerometer series exemplifies how wafer-level chip-scale packaging lowers material cost while sustaining +-2 g to +-16 g dynamic range. Larger 300 mm MEMS fabs promise further scale economies, allowing OEMs to allocate tighter bill-of-materials budgets to additional sensing functions. STMicroelectronics' LIS2DUXS12 integrates a machine-learning core enabling event classification at microwatt levels, removing the need for a companion MCU and shrinking board footprint. As foundries migrate to larger wafers, average selling prices decline and unlock latent demand in cost-sensitive IoT nodes, reinforcing the growth loop for the accelerometer market.

Consumer Electronics and Wearables Boom

Smartphones, earbuds and fitness trackers remain volume engines, but 2025 design roadmaps reveal an accelerating pivot toward medical-grade wearables that require sub-30 μg/√Hz noise floors and continuous operation for multi-day battery life. Analog Devices' ADXL380 targets true-wireless earbuds with dual signal paths so a single sensor supports both active-noise-cancellation feedback and head-gesture recognition. In medical devices, AI-inference embedded in the sensor offloads cloud processing, enabling fall-detection wearables certified under IEC 60601-1 for hospital use. Higher-value clinical applications ease margin pressure and expand the accelerometer market into regulated healthcare channels that favor quality over lowest price.

Price Pressure and Commoditization

In smartphones the bill-of-materials allotment for inertial sensing shrank by nearly 30% between 2022 and 2024, pushing suppliers to differentiate with embedded ML cores and lower power-suspend modes. Kionix's KX224 series sells below USD 0.30 at million-piece volumes, underscoring deteriorating average selling prices for legacy parts. Vendors invest in automated calibration to recoup margin; however, factory-trim routines raise capex and erode benefit. The imbalance confines many competitors to break-even PandL positions, tempering near-term revenue expansion for the accelerometer market.

Other drivers and restraints analyzed in the detailed report include:

- Automotive ADAS / Safety Integration

- Industry-4.0 Condition Monitoring Uptake

- Accuracy Limits vs. Piezoelectric High-G

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MEMS devices captured 72% accelerometer market share in 2024 owing to unmatched cost-performance balance. Volume manufacturing on 200 mm wafers combined with wafer-level packaging positions MEMS at the heart of smartphones, wearables and automotive ECUs. Piezoelectric units, while representing a smaller base, advance at 7.8% annually as defense and aerospace operators demand sub-1 µg bias stability and radiation tolerance. Piezoresistive and capacitive variants serve niche industrial uses where shock survivability or ultra-low power trumps absolute precision.

MEMS leadership rests on integration advantages. STMicroelectronics' sensor-hub architecture merges a digital machine-learning core and FIFO buffers directly on the die, trimming external component count. Still, when g-range, temperature extremes or bias stability exceed MEMS limits, designers revert to piezoelectric stacks.

The trend toward full-six-degree-of-freedom measurement places 3-axis accelerometers at 64.5% revenue share in 2024. OEMs prefer unified X-Y-Z readings to support gesture recognition and vibration diagnostics with minimal sensor fusion overhead. Meanwhile, combo IMUs embedding 6-axis or 9-axis capability demonstrate an 8.4% growth trajectory, driven by drones, AR/VR headsets and robotics, where synchronized gyro-accelerometer data simplifies algorithm tuning. Single-axis devices persist in tilt switches and automotive airbag triggers, but share steadily erodes.

Collins Aerospace's SiIMU02 illustrates the premium end of multi-axis integration, achieving near-fiber-optic gyro accuracy in a palm-sized MEMS assembly. For mid-tier consumer products, suppliers consolidate accelerometer, gyroscope and sometimes magnetometer on a single ASIC with programmable digital filters. This convergence compresses PCB area and bill-of-materials cost, ensuring the accelerometer market maintains momentum as application complexity rises.

Accelerometer Market is Segmented by Type (MEMS Accelerometers, Piezoelectric Accelerometers, and More), Dimension (1-Axis, 2-Axis, and More), End User (Consumer Electronics, Automotive, and More), Performance Grade (Consumer Grade, Industrial Grade, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 46.8% of global revenue in 2024, anchored by China's consumer-electronics export base and a dense 8-inch MEMS foundry footprint. Shenzhen-headquartered MEMSIC recorded triple-digit growth after focusing capacitor-type accelerometers on domestic smartphone OEMs. Japan and South Korea contribute high-reliability variants for automotive and industrial sectors, while Taiwan's pure-play foundries support contract manufacturing. The region's accelerometer market will expand at a steady 6.4% CAGR, although wafer-capacity constraints and rising labor costs temper upside.

The Middle East and Africa represents the fastest 8.7% CAGR through 2030 as Saudi Arabia's Vision 2030 stimulus funds local semiconductor initiatives and scales renewable-energy assets requiring turbine vibration monitoring. Wind farms across Egypt and Morocco adopt triaxial accelerometers to meet ISO 10816 predictive-maintenance benchmarks. Regional public-private partnerships with European sensor makers expedite technology transfer, accelerating indigenous production and lifting the local accelerometer market trajectory.

North America holds a strong second position driven by automotive ADAS mandates and an advanced industrial IoT install base. Adoption of Industry-4.0 maintenance strategies across oil and gas, chemicals and metals drives demand for rugged, hazardous-area-rated accelerometers. Europe trails marginally yet enjoys higher average selling prices as OEMs prioritize quality and functional safety. EU funding for Horizon Europe robotics projects further stimulates precision-grade sensor uptake, reinforcing regional participation in the accelerometer market.

- Analog Devices Inc.

- Robert Bosch GmbH

- STMicroelectronics

- TDK InvenSense

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd. (Kionix)

- NXP Semiconductors N.V.

- MEMSIC Inc.

- TE Connectivity (Measurement Specialties)

- Silicon Sensing Systems Ltd.

- Sensonor AS

- PCB Piezotronics (MTS Systems)

- Northrop Grumman LITEF GmbH

- Rockwell Automation Inc.

- Kearfott Corporation

- Meggitt PLC (Endevco)

- Dytran Instruments Inc.

- Al Cielo Inertial Solutions Ltd.

- Atlantic Inertial Systems Ltd.

- LORD MicroStrain (HBK)

- QST Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 MEMS miniaturization and cost reduction

- 4.2.2 Consumer-electronics and wearables boom

- 4.2.3 Automotive ADAS / safety integration

- 4.2.4 Industry-4.0 condition monitoring uptake

- 4.2.5 Precision-agriculture drone adoption

- 4.2.6 Renewable-energy tilt/vibration demand

- 4.3 Market Restraints

- 4.3.1 Price pressure and commoditization

- 4.3.2 Accuracy limits vs. piezoelectric high-g

- 4.3.3 8-inch MEMS foundry capacity bottlenecks

- 4.3.4 Firmware/security vulnerabilities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Type

- 5.1.1 MEMS Accelerometers

- 5.1.2 Piezoelectric Accelerometers

- 5.1.3 Piezoresistive Accelerometers

- 5.1.4 Capacitive Accelerometers

- 5.1.5 Thermal and Other Types

- 5.2 By Dimension

- 5.2.1 1-Axis

- 5.2.2 2-Axis

- 5.2.3 3-Axis

- 5.2.4 6-Axis and Above (Combo IMUs)

- 5.3 By End User

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Aerospace and Defense

- 5.3.4 Industrial and Manufacturing

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other End Users

- 5.4 By Performance Grade

- 5.4.1 Consumer Grade

- 5.4.2 Industrial Grade

- 5.4.3 Tactical Grade

- 5.4.4 Navigation Grade

- 5.4.5 Space Grade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Taiwan

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Analog Devices Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 STMicroelectronics

- 6.4.4 TDK InvenSense

- 6.4.5 Honeywell International Inc.

- 6.4.6 Murata Manufacturing Co., Ltd. (Kionix)

- 6.4.7 NXP Semiconductors N.V.

- 6.4.8 MEMSIC Inc.

- 6.4.9 TE Connectivity (Measurement Specialties)

- 6.4.10 Silicon Sensing Systems Ltd.

- 6.4.11 Sensonor AS

- 6.4.12 PCB Piezotronics (MTS Systems)

- 6.4.13 Northrop Grumman LITEF GmbH

- 6.4.14 Rockwell Automation Inc.

- 6.4.15 Kearfott Corporation

- 6.4.16 Meggitt PLC (Endevco)

- 6.4.17 Dytran Instruments Inc.

- 6.4.18 Al Cielo Inertial Solutions Ltd.

- 6.4.19 Atlantic Inertial Systems Ltd.

- 6.4.20 LORD MicroStrain (HBK)

- 6.4.21 QST Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment