|

市場調查報告書

商品編碼

1801853

加速度計市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Accelerometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

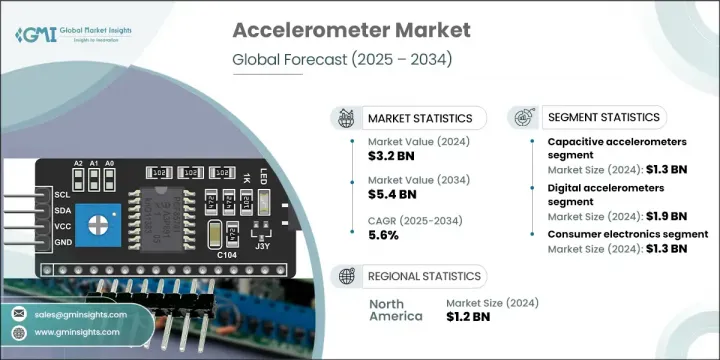

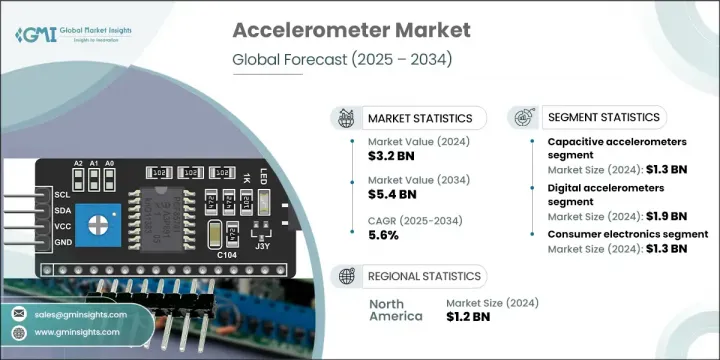

2024年,全球加速度計市場規模達32億美元,預估年複合成長率為5.6%,2034年將達54億美元。加速度計在消費性電子產品、智慧設備和工業系統中的整合度不斷提高,推動著市場的成長。加速度計廣泛應用於智慧穿戴裝置、醫療設備和下一代汽車系統(包括高級駕駛輔助技術),正在徹底改變運動、方向和力量的感知方式。加速度計越來越依賴即時資料採集,為航太、醫療保健和機器人等多個領域提供精準的測量。

加速度計在預測性維護系統中也變得至關重要,確保自動化工業環境中的性能和效率。隨著物聯網應用的不斷擴大,這些感測器在建構家庭、車輛和製造工廠的響應式互聯環境中發揮關鍵作用。隨著技術進步,加速度計的緊湊性和效能不斷提升,無論是在大批量消費應用領域還是在關鍵的企業級系統中,都持續受到廣泛關注。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 5.6% |

電容式加速度計市場在2024年創收13億美元。這類感測器因其緊湊的外形、具成本效益和低能耗而備受青睞。它們在安全氣囊和行動硬體等大眾市場設備中的應用日益廣泛,推動了市場需求。此外,電容式MEMS模型非常適合需要精確、可重複運動偵測的智慧平台。製造商正在投入研發資金,生產整合內建訊號處理功能的先進電容式加速度計,尤其是在汽車、物聯網和穿戴式裝置等快速成長的領域。

數位加速度計市場在2024年創造了19億美元的收入。這些組件因其易於與處理器整合、訊號清晰度高以及與數位通訊協定的兼容性而需求旺盛。從緊湊型電子產品到工業系統,它們的多功能性支援無縫連接。數位加速度計正在不斷改進,以滿足下一代設備對延長電池壽命和智慧功能的要求。各公司正致力於開發更有效率的嵌入式智慧模型,以滿足物聯網、健身技術和緊湊型消費性電子產品的需求。

2024年,北美加速度計市場規模達12億美元,預計到2034年將以5.2%的複合年成長率成長。該地區將繼續受益於雄厚的國防資金、先進的基礎設施以及消費科技的持續普及。製造業自動化程度的提高和智慧技術的日益普及進一步促進了市場的成長。為了鞏固市場地位,鼓勵製造商與本地原始設備製造商(OEM)合作,並參與公共部門的研發計劃。在採礦、航太和工業自動化等領域加強創新仍是重要的成長途徑。

全球加速度計市場的公司正透過專注於小型化、能源效率和增強訊號精度來鞏固其市場地位。策略投資用於研發,以生產整合數位介面和內建分析功能的智慧 MEMS 加速度計。向醫療穿戴式裝置和自動駕駛汽車等新興領域的擴張正在實現長期收入來源。一些關鍵參與者正在與原始設備製造商 (OEM) 建立合作關係,以確保與智慧型裝置和機械的無縫整合。公司還透過收購和本地合作夥伴關係擴大其全球影響力,以最佳化供應鏈並改善市場准入。強調遵守國際安全標準和開發行業特定模型有助於加速航太、汽車和工業自動化等垂直領域的採用。 STMicroelectronics NV、Bosch Sensortec GmbH、ROHM Semiconductor、TE Connectivity、ADI 公司、德州儀器公司、Microchip Technology Inc.、Kearfott Corporation、ASC GmbH、Safran、Hottinger Bruel & Kjaer GmbH、英飛凌科技公司、英飛凌科技公司、KTD. InvenSense、LITEF GmbH、泰雷茲集團、恩智浦半導體和奇石樂集團。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費性電子產品的普及

- 工業自動化和預測性維護的興起

- 航太和國防應用的成長

- 物聯網和智慧型設備的使用率增加

- 醫療保健和醫療器材整合激增

- 陷阱與挑戰

- 競爭激烈,價格壓力大

- 多感測器系統的整合複雜性

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 電容式加速度計

- 壓電加速度計

- 壓阻式加速度計

- 伺服加速度計

- 熱加速度計

- 其他

第6章:市場估計與預測:按軸配置,2021 - 2034 年

- 主要趨勢

- 單軸加速度計

- 雙軸加速度計

- 三軸加速度計

- 6軸及以上

第7章:市場估計與預測:按輸出類型,2021 - 2034

- 主要趨勢

- 模擬加速度計

- 數位加速度計

第8章:市場估計與預測:按最終用途應用,2021 - 2034 年

- 主要趨勢

- 消費性電子產品

- 智慧型手機和平板電腦

- 穿戴式裝置

- 遊戲裝置

- 其他

- 汽車

- 安全氣囊系統

- 車輛穩定控制

- 導航和遠端資訊處理

- 其他

- 工業和製造業

- 機器人和自動化

- 狀態監測

- 結構健康監測

- 其他

- 衛生保健

- 病人監護設備

- 活動追蹤器

- 其他

- 航太和國防

- 飛機導航系統

- 飛彈導

- 無人機和無人駕駛飛機

- 其他

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球關鍵參與者

- Bosch Sensortec GmbH

- Infineon Technologies AG

- Kearfott Corporation

- NXP Semiconductors

- OMEGA Engineering Inc.

- Rockwell Automation Inc.

- Safran

- STMicroelectronics NV

- TE Connectivity

- Texas Instruments Incorporated

- Thales Group

- 區域關鍵參與者

- 北美洲

- Analog Devices, Inc.

- Honeywell International Inc.

- Microchip Technology Inc.

- 歐洲

- ASC GmbH

- Hottinger Bruel & Kjaer GmbH

- Kistler Group

- Asia-Pacific

- Murata Manufacturing Co., Ltd.

- ROHM Semiconductor

- TDK InvenSense

- 北美洲

- 顛覆者/利基市場參與者

- LITEF GmbH

The Global Accelerometer Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 5.4 billion by 2034. The rising integration of accelerometers across consumer electronics, smart gadgets, and industrial systems is fueling growth. Their widespread application in smart wearables, medical devices, and next-gen automotive systems-including those used in advanced driver assistance technologies-is transforming how motion, direction, and force are sensed. Accelerometers are increasingly relied on for real-time data collection, offering precision across multiple fields such as aerospace, healthcare, and robotics.

Accelerometers are also becoming essential in predictive maintenance systems, ensuring performance and efficiency in automated industrial settings. As IoT adoption scales up, these sensors are playing a key role in enabling responsive, connected environments across homes, vehicles, and manufacturing plants. With technological advancements enhancing their compactness and performance, accelerometers continue to attract widespread interest across both high-volume consumer applications and critical enterprise-grade systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.6% |

The capacitive accelerometers segment generated USD 1.3 billion in 2024. These sensors are gaining traction for their compact form factor, cost-effectiveness, and low energy usage. Their growing use in mass-market devices such as airbags and mobile hardware is driving demand. Additionally, capacitive MEMS models are well-suited for intelligent platforms requiring accurate, repeatable motion detection. Manufacturers are channeling R&D into producing advanced capacitive accelerometers that integrate built-in signal processing, especially for fast-growing sectors like automotive, IoT, and wearables.

The digital accelerometers segment generated USD 1.9 billion in 2024. These components are in high demand due to their ease of integration with processors, strong signal clarity, and compatibility with digital communication protocols. From compact electronics to industrial systems, their versatility supports seamless connectivity. Digital accelerometers are being refined to meet next-gen requirements in devices that prioritize extended battery life and smart functionality. Companies are focusing on developing more efficient models with embedded intelligence to align with demand across IoT, fitness tech, and compact consumer gadgets.

North America Accelerometer Market was valued at USD 1.2 billion in 2024 and is projected to grow at a CAGR of 5.2% through 2034. The region continues to benefit from strong defense funding, advanced infrastructure, and increasing penetration of consumer tech. Growth is further reinforced by heightened automation in manufacturing and the growing adoption of smart technologies. To strengthen their position, manufacturers are encouraged to partner with local OEMs and participate in public sector R&D initiatives. Expanding innovation efforts in sectors like mining, aerospace, and industrial automation remains a key growth avenue.

Companies in the Global Accelerometer Market are strengthening their market position by focusing on miniaturization, energy efficiency, and enhanced signal accuracy. Strategic investments are directed toward R&D to produce intelligent MEMS accelerometers integrated with digital interfaces and built-in analytics. Expansion into emerging sectors like healthcare wearables and autonomous vehicles is enabling long-term revenue streams. Several key players are forming collaborations with OEMs to ensure seamless integration into smart devices and machinery. Companies are also increasing their global footprint through acquisitions and local partnerships to optimize supply chains and improve market access. Emphasis on compliance with international safety standards and development of industry-specific models helps accelerate adoption across verticals such as aerospace, automotive, and industrial automation. STMicroelectronics N.V., Bosch Sensortec GmbH, ROHM Semiconductor, TE Connectivity, Analog Devices, Inc., Texas Instruments Incorporated, Microchip Technology Inc., Kearfott Corporation, ASC GmbH, Safran, Hottinger Bruel & Kjaer GmbH, Infineon Technologies AG, Honeywell International Inc., Rockwell Automation Inc., Murata Manufacturing Co., Ltd., OMEGA Engineering Inc., TDK InvenSense, LITEF GmbH, Thales Group, NXP Semiconductors, and Kistler Group.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type trend

- 2.2.2 Axis configuration trends

- 2.2.3 Output type trends

- 2.2.4 End use application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Proliferation of Consumer Electronics

- 3.3.1.2 Rise in Industrial Automation and Predictive Maintenance

- 3.3.1.3 Growth in Aerospace and Defense Applications

- 3.3.1.4 Increased Usage in IoT and Smart Devices

- 3.3.1.5 Surge in Healthcare and Medical Device Integration

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 High Competition and Price Pressure

- 3.3.2.2 Integration Complexity with Multi-Sensor Systems

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Sustainability measures

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, by Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Capacitive accelerometers

- 5.3 Piezoelectric accelerometers

- 5.4 Piezoresistive accelerometers

- 5.5 Servo accelerometers

- 5.6 Thermal accelerometers

- 5.7 Others

Chapter 6 Market estimates and forecast, by Axis Configuration, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 1-axis accelerometers

- 6.3 2-axis accelerometers

- 6.4 3-axis accelerometers

- 6.5 6-axis and above

Chapter 7 Market estimates and forecast, by Output Type, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Analog Accelerometers

- 7.3 Digital Accelerometers

Chapter 8 Market estimates and forecast, by End Use Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.2.1 Smartphones and tablets

- 8.2.2 Wearables

- 8.2.3 Gaming devices

- 8.2.4 Others

- 8.3 Automotive

- 8.3.1 Airbag systems

- 8.3.2 Vehicle stability control

- 8.3.3 Navigation and telematics

- 8.3.4 Others

- 8.4 Industrial & manufacturing

- 8.4.1 Robotics and automation

- 8.4.2 Condition monitoring

- 8.4.3 Structural health monitoring

- 8.4.4 Others

- 8.5 Healthcare

- 8.5.1 Patient monitoring devices

- 8.5.2 Activity trackers

- 8.5.3 Others

- 8.6 Aerospace and defense

- 8.6.1 Aircraft navigation systems

- 8.6.2 Missile guidance

- 8.6.3 UAVs and drones

- 8.6.4 Others

- 8.7 Others

Chapter 9 Market estimates and forecast, by Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company profiles

- 10.1 Global Key Players

- 10.1.1 Bosch Sensortec GmbH

- 10.1.2 Infineon Technologies AG

- 10.1.3 Kearfott Corporation

- 10.1.4 NXP Semiconductors

- 10.1.5 OMEGA Engineering Inc.

- 10.1.6 Rockwell Automation Inc.

- 10.1.7 Safran

- 10.1.8 STMicroelectronics N.V.

- 10.1.9 TE Connectivity

- 10.1.10 Texas Instruments Incorporated

- 10.1.11 Thales Group

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Analog Devices, Inc.

- 10.2.1.2 Honeywell International Inc.

- 10.2.1.3 Microchip Technology Inc.

- 10.2.2 Europe

- 10.2.2.1 ASC GmbH

- 10.2.2.2 Hottinger Bruel & Kjaer GmbH

- 10.2.2.3 Kistler Group

- 10.2.3 Asia-Pacific

- 10.2.3.1 Murata Manufacturing Co., Ltd.

- 10.2.3.2 ROHM Semiconductor

- 10.2.3.3 TDK InvenSense

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 LITEF GmbH