|

市場調查報告書

商品編碼

1836602

太陽能控制窗膜:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Solar Control Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

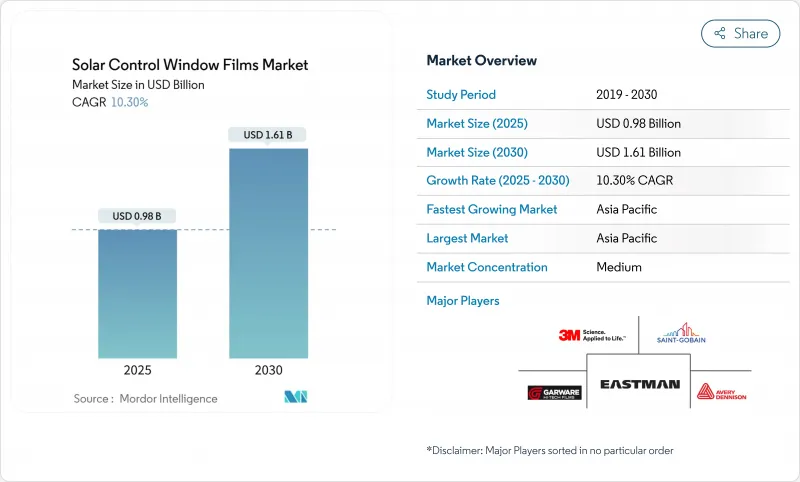

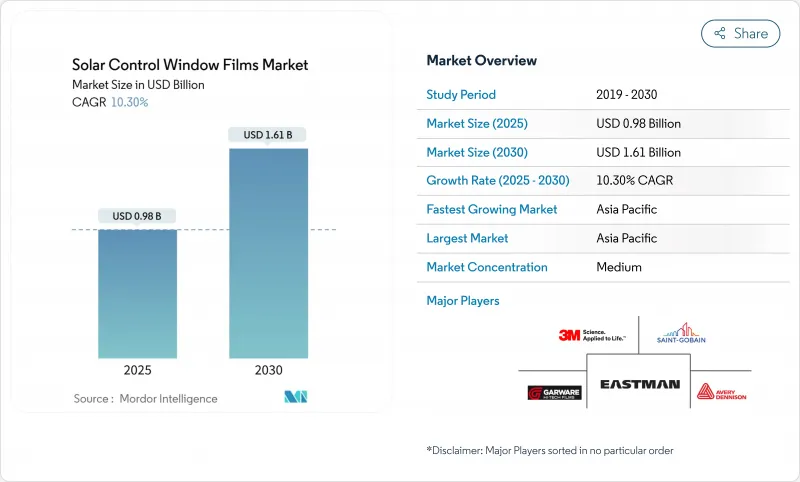

預計 2025 年太陽能控制窗膜市場規模為 9.8 億美元,到 2030 年將達到 16.1 億美元,預測期內(2025-2030 年)的複合年成長率為 10.30%。

真空鍍膜反射產品在目前的規格中佔據主導地位,兼具高紅外線阻隔性和中性美感,而陶瓷-金屬混合材料則在極端溫度波動的氣候條件下提升了性能閾值。亞太地區的建築熱潮、歐盟的淨零排放法規以及美國的財政激勵措施,都在共同推動銷售成長,即便原料成本波動。這些因素正在強化太陽能控制窗膜市場,使其成為提升更廣泛能源效率價值的關鍵槓桿。

全球太陽能控制窗膜市場趨勢與洞察

越來越重視減少碳足跡

企業氣候承諾正在推動太陽能控制窗膜市場的發展,因為這些薄膜可降低5-15%的冷卻負荷,並合格基於科學的排放目標。尖峰需求的降低與炎熱氣候下的電網彈性目標一致。房地產投資信託基金也將嵌裝玻璃升級視為資產增值手段,而非延期維護。隨著可再生能源的普及,像膜這樣的需求側解決方案因穩定負載曲線而聲名鵲起。即使在資本支出放緩的時期,這種定位也能穩固採購預算。

歐洲淨零建築標準推動Low-E薄膜的採用

主要亮點

- 歐盟修訂的《建築能源效率指令》要求成員國每年維修3%的公共部門占地面積,以在2050年前達到零排放標準。改造窗膜是一項關鍵目標,它可以在不更換昂貴窗框的情況下提高隔熱性能。跨國公司目前正在亞洲和北美複製相同的外牆標準,將歐洲基準輸出到世界各地。生命週期碳排放條款也更傾向於薄膜維修,而非高含量碳嵌裝玻璃替代品。因此,供應商預計將在公共競標中獲得更長的訂單。

高階商業大廈動態智慧嵌裝玻璃的替代風險

主要亮點

- 電致變色和感溫變色裝置可動態調節玻璃色調,達到靜態薄膜無法比擬的眩光抑制效果。隨著製造成本的下降,建築幕牆顧問擴大在高階計劃中將這些系統指定用於雙層幕牆和單元式幕牆。雖然價格溢價通常僅為薄膜安裝的3-5倍,但長期能源模擬結果通常更傾向於動態控制。薄膜製造商正加大對中階市場的行銷力度,並拓展智慧玻璃的維修管道,在這些領域,智慧玻璃的投資回收期可能超過12年。

報告中分析的其他促進因素和限制因素

- 亞太地區建設產業快速成長

- 紫外線防護與健康問題

- 在炎熱潮濕的氣候條件下發生分層的保固相關責任。

細分分析

真空鍍膜反射產品將佔2024年市場收入的43%,複合年成長率達10.62%,將推動該細分市場的太陽能控制窗膜市場規模遠超過有色和透明窗膜。建築師青睞能夠選擇性反射近紅外光並透射可見光的超薄金屬疊層。

薄膜製造商目前正在部署採用銀、銦和鎳合金的濺鍍腔體,以實現0.20或更低的發射率。對於多用戶住宅維修,染色聚酯薄膜因其初期價格實惠而仍然具有吸引力,但日益嚴格的能源法規正在逐步推動反射結構的應用。

陶瓷吸收器佔2024年銷售額的46%,這反映了其顏色穩定性、高熔點和可忽略的高頻干擾。汽車原始設備製造商青睞奈米陶瓷層,以避免遠端資訊處理天線的訊號衰減。然而,隨著精製金屬奈米顆粒分散體降低製造成本並恢復除霧器網格的導電優勢,陽光控制窗膜的市場佔有率優勢可能會下降。

純金屬薄膜的複合年成長率達10.56%,這得益於濺鍍堆疊技術的改進,該技術可有效減少虹彩效應。如今,混合架構將氧化鋁或二氧化矽沉積在銀種子層上,形成一種兼具低反射率和高紅外線阻隔率的複合光學堆疊。這些進步正在模糊歷史界限,推動該類別朝著特定功能配方、眩光抑制、防塗鴉和光伏覆蓋層的方向發展。

區域分析

亞太地區仍將是太陽能控制窗膜市場的重心,到2024年將佔全球太陽能控制窗膜市場收益的45%,複合年成長率為10.78%。中國綠色建築評估標準GB/T 50378和印度的Eco-Niwas標準都已規定了太陽能得熱係數,這將加速高選擇性膜材的普及。

北美已經建立了完善的維修獎勵,加州的第 24 條修正案提高了薄膜在不改變建築幕牆外觀的情況下可以滿足的外部遮陽係數閾值。

歐洲保持著成熟的滲透率,但也正在享受與 2030 年「適合 55 歲」氣候方案相關的第二波需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查結果

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 人們對減少碳足跡的興趣日益濃厚

- 歐洲淨零建築標準推動Low-E薄膜的廣泛應用

- 亞太地區建設產業的成長

- 紫外線防護與健康問題

- 亞太地區電子商務倉庫建設激增,需要採光控制

- 市場限制

- 高階商業大廈動態智慧嵌裝玻璃的替代風險

- 炎熱潮濕氣候下分層的保固相關責任

- 聚酯和奈米陶瓷原料價格不穩定

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

- 定價分析

第5章 市場規模及成長預測(金額)

- 按影片類型

- 透明(不反光)

- 染色(不反光)

- 真空鍍膜(反射型)

- 高性能薄膜

- 其他電影類型

- 按吸收劑類型

- 有機的

- 無機/陶瓷

- 金屬

- 按安裝階段

- 新建築

- 改裝

- 按最終用戶產業

- 建造

- 車

- 海洋

- 設計

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 西班牙

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3M

- Avery Dennison Corporation

- Decorative Films, LLC

- Eastman Chemical Company

- Garware Hi-Tech Films

- Johnson Window Films, Inc.

- LINTEC Corporation

- Madico

- Polytronix, Inc.

- Purlfrost

- Saint-Gobain

- Sharpline Converting, Inc.

- SOLAR CONTROL FILMS INC

- Thermolite, LLC

- TintFit Window Films Ltd.

- TORAY INDUSTRIES, INC.

- Ziebart International

第7章 市場機會與未來展望

The Solar Control Window Films Market size is estimated at USD 0.98 billion in 2025, and is expected to reach USD 1.61 billion by 2030, at a CAGR of 10.30% during the forecast period (2025-2030).International decarbonization rules, rising utility costs, and proven payback periods below three years keep demand resilient.

Vacuum-coated reflective products dominate current specifications because they combine high infrared rejection with neutral aesthetics, while ceramic-metallic hybrids push performance thresholds in climates with extreme temperature swings. Asia Pacific construction booms, EU net-zero mandates, and US fiscal incentives all converge to keep volumes expanding even when raw-material costs fluctuate. These forces collectively reinforce the solar control window films market as a pivotal lever in the wider energy-efficiency value.

Global Solar Control Window Films Market Trends and Insights

Growing Emphasis on Reducing Carbon Footprints

Corporate climate pledges elevate the solar control window films market because films shave 5-15% cooling loads and qualify for science-based emission targets. Peak-demand trimming aligns neatly with grid-resilience objectives in hot regions. Real-estate investment trusts also treat glazing upgrades as accretive to asset value rather than as deferred maintenance. As renewable penetration accelerates, demand-side solutions such as films gain prestige for stabilizing load profiles. This positioning solidifies procurement budgets even during capex slowdowns.

Net-Zero Building Codes in Europe Driving Low-E Film Adoption

Key Highlights

- The EU's recast Energy Performance of Buildings Directive compels member states to renovate 3% of public-sector floor area annually and to meet zero-emission standards by 2050. Retro-orientated targets elevate window films by boosting thermal performance without costly frame replacement. Multinationals now replicate the same envelope standards in Asia and North America, exporting European benchmarks worldwide. Lifecycle-carbon clauses also favor thin-film retrofits over high-embodied-carbon glazing swaps. Consequently, suppliers see longer order visibility in public tenders.

Substitution Risk from Dynamic Smart Glazing in Premium Commercial Towers

Key Highlights

- Electrochromic and thermochromic units dynamically tint glass, providing glare mitigation that static films cannot match. As manufacturing costs fall, facade consultants increasingly specify these systems for double-skin or unitized curtain walls in prestige projects. Although price premiums remain 3-5 times film installations, long-term energy simulations often favor dynamic controls. Film suppliers respond by sharpening mid-market pitches and expanding retrofit channels where smart glass paybacks extend beyond 12 years.

Other drivers and restraints analyzed in the detailed report include:

- Upsurge in the Asia-Pacific Construction Industry

- Awareness of UV Protection and Health Concerns

- Warranty-Linked Liability for Delamination in Hot-Humid Climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vacuum-coated reflective products captured 43% of 2024 revenue, and their 10.62% CAGR keeps the solar control window films market size for this segment well ahead of dyed and clear alternatives. Architects value the micro-thin metallic stack that selectively reflects near-infrared while admitting visible light.

Film manufacturers now deploy sputter chambers using silver, indium, and nickel alloys that achieve emissivity below 0.20. In mass-housing retrofits, dyed polyester films still appeal for initial affordability, yet energy-code tightening steadily redirects volume to reflective constructions.

Ceramic absorbers held 46% of 2024 revenue, reflecting their color stability, high melting point, and negligible radio-frequency interference. Automotive OEMs favor nano-ceramic layers because they avoid signal attenuation for telematics antennas. The solar control window films market share advantage may narrow, however, as refined metallic nanoparticle dispersions cut manufacturing costs and restore conductivity benefits for defogger grids.

Metallic-only films are marching at 10.56% CAGR, aided by sputter stack refinements that curb iridescence. Hybrid architectures now deposit alumina or silica atop silver seed layers, creating composite optical stacks that combine low reflectance with steep infrared rejection. Such progress blurs historic boundaries and pushes the category toward function-specific formulations, glare suppression, anti-graffiti, or photovoltaic overlay.

The Solar Control Window Films Market Report Segments the Industry by Film Type (Clear, Dyed, Vacuum Coated, and More), Absorber Type (Organic, Inorganic/Ceramic, and Metallic), Installation (New-Build and Retrofit), End-User Industry (Construction, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia Pacific commanded 45% of 2024 revenues and is expanding at a 10.78% CAGR, ensuring it remains the gravitational center of the solar control window films market. China's Green Building Evaluation Standard GB/T 50378 and India's Eco-Niwas mandate solar-heat-gain coefficients that accelerate high-selectivity film uptake.

Retrofit incentives anchor North America. The Inflation Reduction Act's enhanced tax deduction accelerates envelope upgrades across federal and private portfolios, and California's Title 24 revisions elevate exterior-shade coefficient thresholds that thin films meet without altering facade appearance.

Europe maintains mature penetration yet enjoys a second wave of demand tied to the 2030 "Fit-for-55" climate package.

- 3M

- Avery Dennison Corporation

- Decorative Films, LLC

- Eastman Chemical Company

- Garware Hi-Tech Films

- Johnson Window Films, Inc.

- LINTEC Corporation

- Madico

- Polytronix, Inc.

- Purlfrost

- Saint-Gobain

- Sharpline Converting, Inc.

- SOLAR CONTROL FILMS INC

- Thermolite, LLC

- TintFit Window Films Ltd.

- TORAY INDUSTRIES, INC.

- Ziebart International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Study Deliverables

- 1.3 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Emphasis on Reducing Carbon Footprints

- 4.2.2 Net-Zero Building Codes in Europe Driving Low-E Film Adoption

- 4.2.3 Upsurge in the Asia-Pacific Construction Industry

- 4.2.4 Awareness of UV Protection and Health Concerns

- 4.2.5 Rapid E-Commerce Warehouse Construction Requiring Day-Lighting Control in APAC

- 4.3 Market Restraints

- 4.3.1 Substitution Risk from Dynamic Smart Glazing in Premium Commercial Towers

- 4.3.2 Warranty-Linked Liability for Delamination in Hot-Humid Climates

- 4.3.3 Volatile Polyester and Nano-Ceramic Raw Material Prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

- 4.6 Pricing Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Film Type

- 5.1.1 Clear (Non-reflective)

- 5.1.2 Dyed (Non-reflective)

- 5.1.3 Vacuum-Coated (Reflective)

- 5.1.4 High Performance Films

- 5.1.5 Other Film Types

- 5.2 By Absorber Type

- 5.2.1 Organic

- 5.2.2 Inorganic / Ceramic

- 5.2.3 Metallic

- 5.3 By Installation Stage

- 5.3.1 New-Build

- 5.3.2 Retrofit

- 5.4 By End-user Industry

- 5.4.1 Construction

- 5.4.2 Automotive

- 5.4.3 Marine

- 5.4.4 Design

- 5.4.5 Other End-user Industry

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 Spain

- 5.5.3.5 France

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Decorative Films, LLC

- 6.4.4 Eastman Chemical Company

- 6.4.5 Garware Hi-Tech Films

- 6.4.6 Johnson Window Films, Inc.

- 6.4.7 LINTEC Corporation

- 6.4.8 Madico

- 6.4.9 Polytronix, Inc.

- 6.4.10 Purlfrost

- 6.4.11 Saint-Gobain

- 6.4.12 Sharpline Converting, Inc.

- 6.4.13 SOLAR CONTROL FILMS INC

- 6.4.14 Thermolite, LLC

- 6.4.15 TintFit Window Films Ltd.

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 Ziebart International

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing Concerns Regarding UV Protection