|

市場調查報告書

商品編碼

1836576

近距離場通訊(NFC):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Near Field Communication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

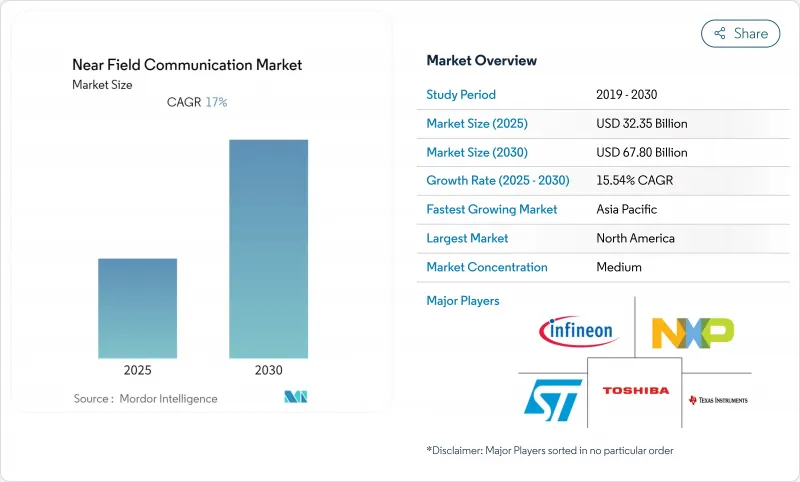

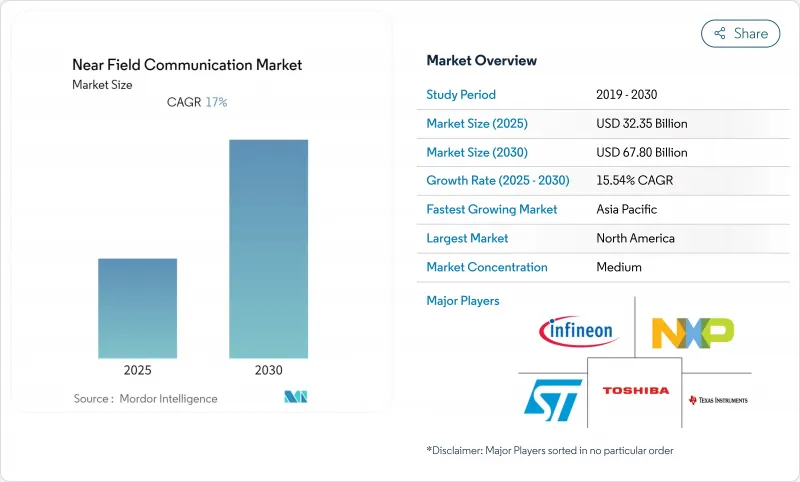

近距離場通訊(NFC) 市場預計在 2025 年價值為 323.5 億美元,到 2030 年將達到 678 億美元,複合年成長率為 15.54%。

智慧型手機製造商正在將NFC晶片整合標準化,以涵蓋中高階設備,從而拓寬行動電子錢包和新興身分服務的選項範圍。歐洲強制要求行動裝置開放NFC介面,這正在刺激銀行和金融科技公司之間的競爭,而亞太地區「行動優先」的經濟體則透過高普及率的數位錢包持續擴大規模。在供應方面,13.56 MHz前端組件製造商正在競相提高產量,以滿足日益成長的讀取器和標籤需求。電動車充電、智慧城市基礎設施和數位產品護照的同步發展,凸顯了NFC正從以支付為中心的工具轉向多用途、安全的近距離平台的轉變。

全球近距離場通訊(NFC) 市場趨勢與洞察

新冠疫情後非接觸式支付的興起

疫情期間,消費者欣然接受「一觸即付」(Tap-to-Pay),並認為其快速便捷。萬事達卡數據顯示,74% 的用戶計劃未來繼續使用非接觸式支付。法國的現金提領大幅下降,顯示對 ATM 的依賴度正在結構性下降。超過 50 個市場提高了非接觸式支付限額,進一步提升了平均交易額。在新興市場,商家正在同時採用基於2D碼的錢包和支援 NFC 的終端,從而超越磁條基礎設施。支付網路代幣化藍圖的目標是到 2030 年在電子商務中消除手動輸入卡片的環節,將 NFC 定位為無摩擦線上結帳,同時強化其作為主要店內身份驗證方法的地位。

智慧型手機 OEM 預載 NFC 晶片

更廣泛的晶片整合將使NFC從高階附加功能轉變為行動商務、交通票務和數位鑰匙的預設通道。 NFC論壇的多用途觸碰(Multi-Purpose Tap)規範將於2024年發布,該規範將支援一次觸碰即可同時啟動支付、會員積分和訪問等操作,從而提升日常用戶參與度。新的Release 15安全升級已於2025年6月完成,將擴展加密靈活性並提高互通性,鼓勵OEM廠商深化系統級整合。由此產生的NFC行動電話裝置量將為開發者提供巨大的規模,使他們能夠瞄準數十億台設備,而不會造成硬體碎片化。

資料安全和隱私問題

交易量的不斷成長加劇了學術文獻中記錄的NFC中繼、克隆和盜刷攻擊的後果。令牌化憑證可以減輕卡號盜竊的風險,但仍有25%的線上交易繞過了令牌化,暴露了安全鏈中的漏洞。英飛凌的生物辨識卡和正在開發的距離限制通訊協定有望增強防禦能力,但也增加了部署成本和整合複雜性。歐盟監管機構正在收緊PSD3合規性要求,強制發卡機構採用多因素身分驗證和持續詐欺監控。額外的步驟可能會增加結帳時的摩擦,這可能會減緩那些更注重無摩擦流程而非最高安全性的行業(例如快餐零售)的採用。

報告中分析的其他促進因素和限制因素

- 行動NFC監管對第三方錢包EV開放

- 透過 NFC 進行「即插即充」身份驗證

- BLE 和 UWB 的短距離/干擾有限

細分分析

到 2024 年,讀卡機將佔據近距離場通訊(NFC) 市場佔有率的 41.2%,這反映了商家對符合 EMV 標準的 POS 硬體的大力投資。責任轉移授權推動零售商青睞支援磁條、晶片和感應卡的一體化終端,從而提高了單位銷售額和平均售價。印度、印尼和巴西政府對中小企業 (SME)數位化的獎勵策略進一步推動了市場發展。讀卡機部分還受益於軟體可更新的韌體,該韌體可使終端與不斷發展的卡片計劃要求保持同步。相反,標籤雖然以收益為準較小,但預計到 2030 年將以 16.9% 的複合年成長率成長,是近距離場通訊(NFC) 市場中成長最快的。歐洲的數位產品護照法規要求奢侈品、電子產品和汽車品牌將不可變的可追溯性納入產品中,而 NFC 標籤則提供了一種低成本、符合標準的方法。亞洲各地擴大採用智慧貨架、互動式包裝和防偽標籤,進一步擴大了可尋址標籤池。

天線和分離式積體電路等二級硬體產品線正受益於穿戴式裝置和醫療設備領域的設計勝利,並緊跟著主要細分市場的步伐。微型天線陣列如今已能夠無縫整合到智慧型手錶的金屬機殼中。軟體和服務雖然仍佔收入的個位數百分比,但透過在已安裝硬體之上疊加令牌生命週期管理、分析儀錶板、忠誠度引擎等功能,實現了更高的毛利率。使用宣傳活動關聯標籤的零售商報告稱,在用NFC取代QR碼後,轉換率提高了近30%,這表明部署服務後具有持續的收益潛力。

讀/寫模式將在 2024 年佔據近距離場通訊(NFC) 市場的主導地位,市佔率為 46%,這要歸功於其在門禁卡、海報輕觸和檔案傳輸的傳統普及。這種模式的簡單性(只需要標籤和閱讀器)支持其在圖書館、博物館和智慧海報中的應用,這些地方的安全性優先於成本。然而,在開放式錢包計畫和數位身分計劃的推動下,卡片模擬預計將以 17.13% 的複合年成長率加速發展。主機卡模擬允許在沒有實體安全元件的情況下在軟體中複製卡小程序,從而降低量販店行動電話的物料清單成本。第 15 版增強了基於安全通道的對等身份驗證,使銀行和運輸機構能夠自信地部署基於軟體的票務。雖然P2P正在被藍牙中更快的檔案傳輸速度所取代,但它對裝置對配置仍然很重要,其中必須在沒有雲端連線的情況下安全地傳遞 Wi-Fi 憑證和 Zigbee 金鑰。

隨著消費者對無摩擦互動的興趣日益濃厚,NFC 論壇的「多用途觸碰」 (Multipurpose Tap) 有望透過將模擬和讀寫操作整合到單一手勢中,模糊模式界限。零售試點研究表明,結帳時間最多可縮短 15%,這充分說明了用戶體驗的提升如何再形成模式偏好。開發人員也正在將遠端檢測上傳、軟體啟動和忠誠度獲取功能整合到單一觸碰中,從而避免切換應用的疲勞。

區域分析

亞太地區將在2024年引領近距離場通訊(NFC) 市場,市佔率達37.8%,預計到2030年複合年成長率將達到17.02%。在行動優先的經濟體中,智慧型手機普及率超過63%,行動服務已為該地區的GDP貢獻了5.3%。 2024年,中國公車業者將處理超過600億次NFC地鐵出行,印度統一支付介面的每日點擊支付交易量較去年同期成長三倍。政府電子身份證計劃和國家健康卡計劃正在進一步刺激身份和身份驗證用例,幫助該地區超越全球平均水平。

歐洲在價值方面排名第二,這得益於鼓勵開放行動級NFC(近場通訊)和推行強客戶身份驗證的法規。歐盟的《數位產品護照》法規要求奢侈品和汽車零件必須使用可追溯標籤,推動了標籤供應鏈的擴張。卡網路的代幣化舉措旨在十年內消除手動卡片輸入,並有望推動瀏覽器內點擊支付的激增。北歐銀行報告稱,非接觸式金融卡的市場滲透率已達到90%,顯示交易量成長健康且成熟。

得益於電動車充電基礎設施的快速普及和企業安全升級,北美正以中等速度穩定成長。聯邦政府的「通用即插即充」框架將於2025年生效,預計將為全國範圍內的互通性奠定基準,並推動充電讀卡機部署的激增。 《晶片法案》(CHIPS Act)的製造業在岸化計畫和稅額扣抵鼓勵了國內NFC組件的製造,從而緩解了部分全球供應限制。同時,中東和非洲地區正處於早期應用階段,受制於分散的監管和較低的POS機普及率,但得益於優先考慮低成本、安全的近場支付的行動貨幣計劃。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 新冠疫情後非接觸式支付的興起

- 智慧型手機OEM預載NFC晶片

- 向第三方錢包開放行動電話NFC

- NFC用於電動車「即插即充」認證

- 歐盟數位產品護照強制使用NFC標籤

- 折疊式/XR穿戴裝置使用NFC實現空間使用者體驗

- 市場限制

- 資料安全和隱私問題

- BLE 和 UWB 的短距離/干擾限制

- 13.56MHz前端晶片供應受限

- 商戶代幣化費用減緩了新興市場的採用

- 價值鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業相關人員分析

- 新冠疫情與宏觀經濟逆風的影響

- 地緣政治緊張局勢的影響

第5章市場規模及成長預測(金額)

- 依產品類型

- NFC標籤

- NFC IC/安全元件

- NFC 讀取器

- NFC天線

- 軟體和服務

- 按運轉方式

- 讀/寫

- P2P

- 卡模擬

- 按用途

- 支付

- 存取控制

- 配對和性能驗證

- 身份和身份驗證

- 智慧海報和行銷

- 物聯網配置及更多

- 透過終端設備

- 智慧型手機

- 穿戴式裝置

- 個人電腦及其他家用電器

- 醫療設備

- 車載資訊娛樂系統/電動車充電器

- 其他設備

- 按行業

- BFSI

- 資訊科技/通訊

- 零售與電子商務

- 衛生保健

- 飯店和交通

- 政府/公共部門

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 其他亞太地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度分析

- 策略性措施和採購

- 市佔率分析

- 公司簡介

- NXP Semiconductors

- STMicroelectronics NV

- Infineon Technologies AG

- Broadcom Inc.

- Sony Group Corp.

- Samsung Electronics

- Qualcomm Technologies

- Toshiba Electronic Devices and Storage Corp.

- Texas Instruments Inc.

- Zebra Technologies Corp.

- HID Global

- Thales(Gemalto)

- Renesas Electronics

- Shanghai Fudan Microelectronics

- Identiv Inc.

- Smartrac Technology

- Marvell Technology Group

- Inside Secure(Verimatrix)

- Huawei Technologies

- Apple Inc.

第7章 市場機會與未來展望

The Near Field Communication market is valued at USD 32.35 billion in 2025 and is forecast to reach USD 67.80 billion by 2030, reflecting a brisk 15.54% CAGR.

Growth is powered by the permanent shift toward touch-free commerce, with contactless payments now representing 79% of day-to-day consumer purchases worldwide.Smartphone makers have normalised NFC chip integration across mid-tier and premium devices, broadening the addressable base for mobile wallets and emerging identity services. Europe's decision to compel open access to handset NFC interfaces is accelerating competition among banks and fintechs, while Asia Pacific's mobile-first economies continue to drive scale through high digital-wallet penetration. On the supply side, makers of 13.56 MHz front-end components are scrambling to lift output to meet surging reader and tag demand. Parallel progress in EV charging, smart city infrastructure, and digital product passports underscores NFC's transition from a payment-centric tool to a multipurpose secure-proximity platform.

Global Near Field Communication Market Trends and Insights

Proliferation of Contactless Payments Post-COVID-19

Consumers embraced tap-to-pay behaviour during the pandemic and have retained it for speed and convenience. Mastercard reports that 74% of users plan to keep paying contactlessly in the future. Cash withdrawals in France have fallen sharply, signalling a structural decline in ATM reliance. Rising contactless limits in more than 50 markets further lift average transaction values. In emerging economies, merchants leapfrog mag-stripe infrastructure by adopting QR-based wallets and NFC-enabled terminals in tandem. Payment networks' tokenisation roadmaps, aimed at removing manual card entry for e-commerce by 2030, cement NFC's role as the foremost in-store authentication method while positioning it for friction-free online checkout.

Smartphone OEMs Pre-Installing NFC Chips

Apple's decision to include NFC in every iPhone since 2018 set an industry baseline, and Android brands quickly followed suit with secure-element support in Snapdragon and Exynos platforms.Broader chip integration turns NFC from a premium extra into default plumbing for mobile commerce, transit ticketing, and digital keys. The NFC Forum's Multi-Purpose Tap specification, published in 2024, lets a single tap launch payment, loyalty, and access actions simultaneously, boosting daily user engagement. New Release 15 security upgrades, finalised in June 2025, extend cryptographic agility and improve interoperability, encouraging OEMs to deepen system-level integration. As a result, the installed base of NFC-ready phones provides critical mass for developers who can target billions of devices without hardware fragmentation.

Data-Security and Privacy Concerns

Higher transaction volumes magnify the consequences of NFC relay, cloning, and skimming attacks documented in academic literature. While tokenised credentials mitigate card-number theft, 25% of online transactions still bypass tokenisation, exposing gaps in the security chain. Biometric cards from Infineon and distance-bounding protocols under development promise stronger defences, yet they also raise deployment costs and integration complexity. Regulators in the EU are tightening PSD3 compliance requirements, obliging issuers to adopt multifactor authentication and continuous fraud monitoring. The extra steps can increase friction at checkout and may slow adoption in sectors that favour frictionless flows over maximum security, such as quick-service retail.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Opening of Handset NFC to Third-Party Wallets

- EV "Plug-and-Charge" Authentication via NFC

- Short-Range / Interference Limits versus BLE and UWB

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, readers captured 41.2% of the Near Field Communication market share, reflecting heavy merchant investment in EMV-compliant point-of-sale hardware. Mandatory liability-shift deadlines nudged retailers to favour all-in-one terminals that support mag-stripe, chip and tap, boosting unit volumes and ASPs. Government stimulus for small-business digitisation in India, Indonesia and Brazil added further momentum. The reader segment also benefits from software-updatable firmware that keeps terminals current with evolving card-scheme requirements. Conversely, tags-although accounting for a smaller revenue base-are forecast to register a 16.9% CAGR to 2030, the fastest within the Near Field Communication market. Europe's Digital Product Passport regulation obliges luxury-goods, electronics and automotive brands to embed immutable traceability into items, and NFC tags supply a low-cost, standards-based method to comply. Growing adoption of smart shelves, interactive packaging, and anti-counterfeit labels across Asia further widens the addressable tag pool.

Second-tier hardware lines such as antennas and discrete ICs trail the main segments yet profit from design-win richness in wearables and medical devices. Miniaturised antenna arrays now support metal-backed smartwatch casings without detuning. Software and services-though only a single-digit slice of revenue-record higher gross margins by layering token-lifecycle management, analytical dashboards and loyalty engines on top of installed hardware. Retailers using campaign-linked tags report conversion-rate uplifts approaching 30% after replacing QR codes with NFC, illustrating the recurring-revenue potential of post-deployment services.

Read/write mode dominated the Near Field Communication market size with 46% share in 2024, thanks to legacy uptake in access cards, poster tapping and file transfer. The mode's simplicity, requiring only a tag and a reader, underpins adoption in libraries, museums and smart posters where cost trumps security. Card emulation, however, is projected to accelerate at a 17.13% CAGR on the back of open-wallet initiatives and digital-ID projects. Host Card Emulation lets software replicate a card applet without a physical secure element, cutting bill-of-materials for mass-market phones. Release 15 elevates secure-channel-based peer authentication, persuading banks and transit authorities to roll out software-based tickets confidently. Peer-to-peer lags due to Bluetooth's faster file-transfer speeds, yet it remains relevant in device-pair provisioning where Wi-Fi credentials or Zigbee keys must pass securely without cloud connectivity.

As consumer interest in frictionless interactions grows, the NFC Forum's Multi-Purpose Tap could blur mode boundaries by chaining emulation and read/write operations into a single gesture. Retail pilots indicate checkout time reductions of up to 15%, illustrating how UX gains may reshape mode preferences. Developers are likewise bundling telemetry upload, software licence validation and loyalty accrual into one tap to avoid app-switching fatigue

The Near Field Communication Market Report is Segmented by Product Type (NFC Tags, NFC Readers, and More), Operating Mode (Read / Write, Peer-To-Peer, and More), Application (Payments, Access Control, Pairing and Commissioning, and More), End-Device (Smartphones, Wearables, Medical Equipment, and More), End-User Vertical (BFSI, Healthcare, and More), and Geography

Geography Analysis

Asia Pacific leads the Near Field Communication market with 37.8% share in 2024 and an estimated 17.02% CAGR to 2030. Mobile-first economies benefit from smartphone penetration exceeding 63% of the population, and mobile services already contribute 5.3% to regional GDP. China's transit operators processed more than 60 billion NFC metro rides in 2024, while India's Unified Payments Interface saw daily tap-and-pay volumes triple year-on-year. Government e-ID and national health-card schemes further stimulate identity and authentication use cases, helping the region outpace global averages.

Europe sits second in value thanks to regulatory tailwinds that force handset-level NFC openness and push strong customer authentication. The EU's Digital Product Passport regulation mandates traceability tags for luxury goods and automotive components, catalysing a tag supply-chain ramp. Tokenisation initiatives by card networks aim to eradicate manual card entry by decade's end, promising a surge in in-browser tap-to-pay flows. Nordic banks have already reported 90% market penetration for contactless debit, signalling maturity yet still healthy transaction-value expansion.

North America records steady mid-teen growth, buoyed by its rapid roll-out of EV charging infrastructure and enterprise security upgrades. The federal universal plug-and-charge framework, effective 2025, sets a baseline for nationwide interoperability and is expected to lift charger-reader deployments sharply. Manufacturing onshoring programmes and tax credits under the CHIPS Act encourage domestic NFC component fabrication, partly mitigating global supply tightness. Meanwhile, Middle East and Africa exhibit early-stage adoption, constrained by fragmented regulation and lower POS penetration but aided by mobile-money initiatives that prioritise low-cost, secure proximity payments.

- NXP Semiconductors

- STMicroelectronics N.V.

- Infineon Technologies AG

- Broadcom Inc.

- Sony Group Corp.

- Samsung Electronics

- Qualcomm Technologies

- Toshiba Electronic Devices and Storage Corp.

- Texas Instruments Inc.

- Zebra Technologies Corp.

- HID Global

- Thales (Gemalto)

- Renesas Electronics

- Shanghai Fudan Microelectronics

- Identiv Inc.

- Smartrac Technology

- Marvell Technology Group

- Inside Secure (Verimatrix)

- Huawei Technologies

- Apple Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of contactless payments post-COVID-19

- 4.2.2 Smartphone OEMs pre-installing NFC chips

- 4.2.3 Regulatory opening of handset NFC to third-party wallets

- 4.2.4 EV "plug-and-charge" authentication via NFC

- 4.2.5 EU Digital Product Passport mandates for embedded NFC tags

- 4.2.6 Foldable/XR wearables adopting NFC for spatial UX

- 4.3 Market Restraints

- 4.3.1 Data-security and privacy concerns

- 4.3.2 Short-range/interference limits vs BLE and UWB

- 4.3.3 13.56 MHz front-end chip supply constraints

- 4.3.4 Merchant tokenisation fees slowing acceptance in emerging markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 Impact of COVID-19 and Macroeconomic Headwinds

- 4.10 Impact of Geopolitical Tensions

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 NFC Tags

- 5.1.2 NFC ICs / Secure Elements

- 5.1.3 NFC Readers

- 5.1.4 NFC Antennas

- 5.1.5 Software and Services

- 5.2 By Operating Mode

- 5.2.1 Read / Write

- 5.2.2 Peer-to-Peer

- 5.2.3 Card Emulation

- 5.3 By Application

- 5.3.1 Payments

- 5.3.2 Access Control

- 5.3.3 Pairing and Commissioning

- 5.3.4 Identity and Authentication

- 5.3.5 Smart Posters and Marketing

- 5.3.6 IoT Provisioning and Others

- 5.4 By End-Device

- 5.4.1 Smartphones

- 5.4.2 Wearables

- 5.4.3 PCs and Other Consumer Electronics

- 5.4.4 Medical Equipment

- 5.4.5 Automotive Infotainment / EV Chargers

- 5.4.6 Other Devices

- 5.5 By End-User Vertical

- 5.5.1 BFSI

- 5.5.2 IT and Telecommunications

- 5.5.3 Retail and e-Commerce

- 5.5.4 Healthcare

- 5.5.5 Hospitality and Transportation

- 5.5.6 Government and Public Sector

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NXP Semiconductors

- 6.4.2 STMicroelectronics N.V.

- 6.4.3 Infineon Technologies AG

- 6.4.4 Broadcom Inc.

- 6.4.5 Sony Group Corp.

- 6.4.6 Samsung Electronics

- 6.4.7 Qualcomm Technologies

- 6.4.8 Toshiba Electronic Devices and Storage Corp.

- 6.4.9 Texas Instruments Inc.

- 6.4.10 Zebra Technologies Corp.

- 6.4.11 HID Global

- 6.4.12 Thales (Gemalto)

- 6.4.13 Renesas Electronics

- 6.4.14 Shanghai Fudan Microelectronics

- 6.4.15 Identiv Inc.

- 6.4.16 Smartrac Technology

- 6.4.17 Marvell Technology Group

- 6.4.18 Inside Secure (Verimatrix)

- 6.4.19 Huawei Technologies

- 6.4.20 Apple Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment