|

市場調查報告書

商品編碼

1836474

貨櫃運輸:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Shipping Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

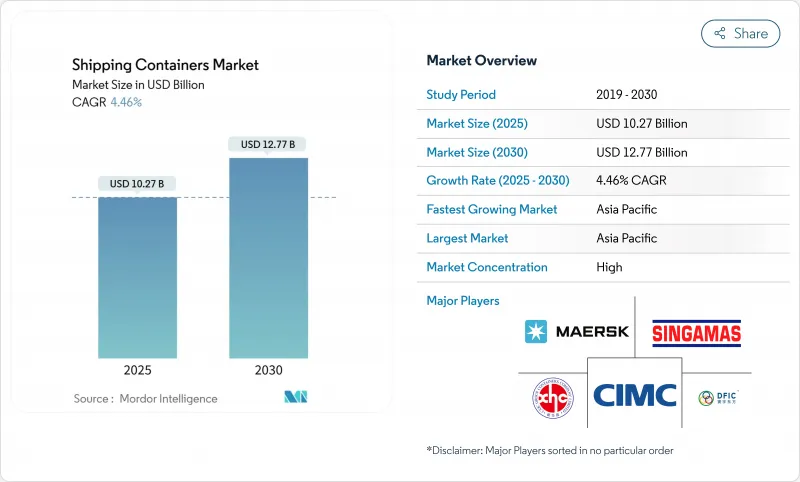

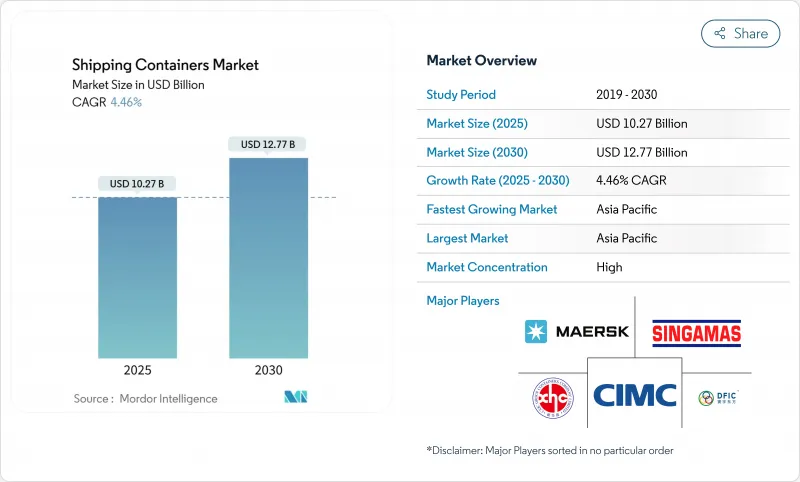

預計 2025 年貨櫃市場價值將達到 102.7 億美元,到 2030 年預計將達到 127.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.46%。

電子商務履約、不斷擴展的醫藥低溫運輸以及更有效率的多式聯運正在推動穩定的結構性需求。容器化在處理90%的全球貿易中發揮著重要作用,支撐著這一成長,而數位化追蹤工具和更聰明的設計則有助於營運商縮短港口停留時間並提高周轉率。永續性目標正在推動材料創新,轉向更輕質的複合材料,航運公司之間的聯盟重組正在重塑運力部署策略,以支持規模更大、技術型船隊的發展。地緣政治動盪不僅加劇了短期波動,也凸顯了多元化貿易航線和動態航線的重要性。

全球貨櫃運輸市場趨勢與洞察

跨境電子商務的爆炸性成長推動了24小時週轉時間的期望

電子商務的擴張推動了貨運頻率的提升和小批量運輸的出現,將焦點從船舶運力轉向港口速度。航運公司正在為高頻次航線增添設備,港口也在投資自動化起重機,以便在一個班次內完成船舶清關。智慧追蹤使托運人能夠在貨物抵達前完成清關並預留鐵路艙位。這些營運優勢縮短了庫存週期,增強了對標準乾箱的偏好,即使在貿易量波動的情況下也能保持較高的運轉率。隨著線上市場滲透到新興經濟體,貨櫃運輸市場在各貿易航線上都經歷了持續的基準需求。

低溫運輸的全球擴張加速了先進冷藏貨物的訂單

製藥商正在將遠距運輸從空運轉向海運,以降低成本和排放,同時不影響溫度控制。最新的冷藏船保持±0.5 度C的精度,並整合遙測技術,可即時標記偏差,從而能夠在航行途中採取糾正措施。易腐食品出口商也正在採用類似的技術,以最大限度地減少腐敗並送達遠距離消費者。提供雙燃料冷凍設備的製造商透過降低能耗並滿足低全球暖化潛勢 (GWP) 法規,實現了更高的單箱價格。隨著雜貨電商拓展到新的市場,對先進冷藏船的需求持續超過普通貨物的需求成長。

疫情後,箱子供應過剩將導致利用率下降

2021年至2023年期間創紀錄的新造船數量將造成暫時的供過於求,從而壓低租賃費率,並促使營運商推遲新訂單。貿易疲軟將導致門戶港口閒置庫存積壓,迫使堆場降低倉儲費以吸引船舶調配業務。製造商將透過減少生產班次並將產能轉向需求更穩定的專業設計來適應這項變化。一旦報廢船隊趕上老化船隊的速度,貿易恢復正常,預計這項調整將得以解決。

報告中分析的其他促進因素和限制因素

- D2C 品牌要求客製化帶有標誌的容器

- 企業 ESG 義務推動採用可重複使用包裝

- 熱捲鋼價格波動帶來預算不確定性

細分分析

高櫃產品的需求日益成長,因為其13%的餘量可以最大限度地提升電商小包裹和輕型家電等物品的運輸容量。累計成長52.64%,顯示其在海運領域將繼續受到歡迎,而到2030年,40英尺高櫃產品的複合年成長率預計將達到5.61%。高櫃貨櫃的市場規模反映了托運人對更大容量且不違反重量限制的偏好。

港口基礎設施升級可容納更高的堆垛,碼頭營運商正在增加正面吊運機,以有效處理這些貨物。物流整合商正在推動40英尺貨櫃的標準化,以簡化鐵路貨車分配和場站交換。 Triton Containers正在推廣並推廣高櫃租賃,並提供靈活的取貨選項,以減少搬遷。總體而言,托運人正專注於貨櫃效率和包裝整合,這將使高櫃貨櫃在主要貿易走廊中持續受到青睞。

到2024年,乾貨倉儲箱將佔到出貨量的72.75%,凸顯其作為全球商品流通支柱的地位。相較之下,隨著生鮮食品出口商和製藥商拓展其海運航線,到2030年,冷藏貨櫃的複合年成長率將達到6.42%。目前,冷藏貨櫃是貨櫃運輸市場的高階產品,租金比乾貨貨櫃高出兩到三倍。

技術升級包括變速壓縮機和太陽能輔助電源模組,以降低空轉期間的能耗。藥品運輸商需要冗餘溫度探頭和門感測器,以便在出現偏差的幾秒鐘內發出警報,從而推動製造商之間的差異化。冷藏貨櫃也受益於脫碳,因為將對溫度敏感的貨物從空運轉移到海運可以避免高達 80% 的相關排放。

貨櫃運輸市場按尺寸(20 英尺 (TEU)、40 英尺 (FEU)、其他)、貨櫃類型(乾式儲運(標準)、冷藏、其他)、材質(耐候鋼、不銹鋼、其他)、終端行業(消費品/零售、其他)、運輸方式(近海/深海、其他地區)和地區(北美、南美、其他地區)。市場預測以美元計算。

區域分析

到2024年,亞太地區將佔全球貨櫃總收入的60.50%,到2030年,複合年成長率將達到5.67%。中國將繼續保持製造業主導,而隨著企業採購多元化,東南亞地區的貨櫃吞吐量正在不斷成長。馬來西亞和印度的大型港口計劃每年將新增超過2500萬個標準箱的吞吐量,從而穩定區域吞吐量,並刺激支線網路的貨櫃需求。貨幣穩定和有利的貿易協定也鼓勵區域租賃市場擴大船隊規模。

北美將受益於近岸外包,將電子產品和汽車組裝轉移到更靠近消費市場的地方。美國港口當局已核准數十億美元的疏浚和泊位電氣化項目,增強了其與墨西哥和加拿大港口的競爭力。美國中西部地區的鐵路多式聯運發展將在八天內建造連接大西洋和太平洋的經濟高效的陸橋,從而推動與堆疊列車相容的貨櫃設計的採用。

歐洲地區成長喜憂參半,地緣政治緊張局勢導致亞歐航線繞道非洲,導致運輸時間延長,而地中海樞紐的停靠次數則增加。倫敦門戶港和鹿特丹馬斯平原港的自動化投資將提高每台起重機的小時作業能力,並降低每箱成本指標。更嚴格的環保法規正在加速淘汰老舊、重型貨櫃,轉而使用可回收集裝箱,儘管貿易量低迷,但仍支撐了更換需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 跨境電子商務的爆炸性成長使得人們對標準乾貨貨櫃24小時送達時間的期望越來越高。

- 低溫運輸在新鮮食品和食材自煮包宅配領域的興起加速了先進冷藏箱的訂單。

- 直接面對消費者 (D2C) 的品牌要求為行動快閃店和履約中心提供客製化的、印有標誌的容器。

- 由於托運人尋求可重複使用的多模態貨櫃而非一次性托盤包裝,企業 ESG 要求正在推動更換需求。

- 採用支援物聯網的智慧箱來提供即時位置和狀況數據將增加托運人購買優質設備的意願。

- 訂閱式和模組化住房概念正在推動退役貨櫃的二次利用。

- 市場限制

- 疫情爆發後,貨櫃供應過剩導致運轉率下降,並抑制了新的建設投資。

- 熱軋鋼卷鋼價格的波動給了貨櫃買家預算不確定性。

- 從搖籃到墳墓的監管和延伸生產者責任 (EPR) 規則正在推高終身所有權成本。

- 替代性折疊式容器的迅速出現已經蠶食了傳統硬質箱的需求。

- 價值/供應鏈分析

- 監管和技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析-標準貨櫃與專用貨櫃

- 焦點:多式聯運與鐵路使用

- 全球貨櫃情勢

- 地緣政治事件如何影響市場

第5章市場規模與成長預測(價值、數量)

- 按尺寸

- 20英尺(標準箱)

- 40英尺(FEU)

- 40英尺高立方體

- 其他(>45 英尺等)

- 依貨櫃類型

- 乾式(標準)

- 冷藏(冷藏箱)

- 儲槽(ISO 儲槽、低溫儲槽)

- 平板架和開頂架

- 特殊應用(側門、隧道、絕緣、折疊式)

- 按材質

- 耐候鋼

- 防鏽的

- 鋁合金

- 玻璃纖維/複合材料

- 其他

- 按行業

- 消費品和零售

- 飲食

- 工業機械和汽車

- 化工/石油

- 製藥和醫療保健

- 其他

- 交通方式

- 海上運輸

- 近海/海岸

- 鐵路聯運

- 陸運及現場倉儲

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 其他南美

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 其他亞太地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- Nordix(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢(併購、合資、土地儲備收購、IPO)

- 市佔率分析

- 公司簡介

- China International Marine Containers(CIMC)

- Dong Fang International Containers

- CXIC Group(CSSC)

- Maersk Container Industry A/S

- Singamas Container Holdings

- W&K Container

- Sea Box Inc.

- TLS Offshore Containers

- Storstac Inc.

- CARU Containers BV

- China Eastern Containers

- Valisons & Co.

- YMC Container Solutions

- American Intermodal Container Manufacturing

- Triton International

- Textainer Group Holdings

- Florens Container Services

- CAI International

- Touax Group

- UES International

第7章 市場機會與未來展望

The Shipping Containers Market size is estimated at USD 10.27 billion in 2025, and is expected to reach USD 12.77 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

E-commerce fulfillment, pharmaceutical cold-chain expansion, and rising intermodal efficiency provide stable, structural demand. Containerization's role in handling 90% of global trade underpins this growth, while digital tracking tools and smarter designs help operators shorten port stays and boost asset turnover. Sustainability targets are pushing material innovation toward lighter composites, and alliance restructuring among carriers is reshaping capacity deployment strategies in favor of larger, technology-enabled fleets. Geopolitical disruptions add short-term volatility but also reinforce the importance of diversified trade lanes and dynamic routing.

Global Shipping Containers Market Trends and Insights

Explosive Growth of Cross-Border E-Commerce Creating 24-Hour Turnaround Expectations

E-commerce expansion drives more frequent, smaller shipments, shifting focus from vessel capacity toward port velocity. Carriers commit additional equipment to high-frequency loops, while ports invest in automated cranes that clear vessels inside one shift. Smart tracking allows shippers to pre-clear customs and book rail slots before docking. These operational gains shorten inventory cycles and reinforce preference for standard dry boxes, keeping utilization high even when trade volumes fluctuate. As online marketplaces penetrate emerging economies, the shipping container market sees sustained baseline demand across diverse trade lanes.

Worldwide Cold-Chain Penetration Accelerates Advanced Reefer Orders

Pharmaceutical producers are migrating long-haul shipments from air to ocean to cut costs and emissions without compromising temperature control. Modern reefers maintain +-0.5 °C accuracy and integrate telemetry that flags deviations in real time, allowing corrective actions mid-voyage. Fresh grocery exporters adopt similar technology to reach distant consumers with minimal spoilage. Manufacturers offering dual-fuel refrigeration units reduce energy consumption and meet low-GWP regulations, enabling higher price realisation per box. As grocery e-commerce extends to new markets, advanced reefer demand continues to outpace general cargo growth.

Post-Pandemic Oversupply of Boxes Eroding Utilization Rates

Record new builds made during 2021-2023 create a temporary surplus, pushing lease rates down and prompting operators to delay fresh orders. Idle inventories accumulate in gateway ports when trade softens, forcing depots to lower storage fees to attract repositioning business. Manufacturers adapt by trimming production shifts and redirecting capacity toward specialized designs with steadier demand. The correction is expected to resolve once scrappage catches up with ageing fleets and trade normalizes.

Other drivers and restraints analyzed in the detailed report include:

- Direct-to-Consumer Brands Demanding Bespoke, Logo-Printed Containers

- Corporate ESG Mandates Pushing Reusable Container Adoption

- Volatility in Hot-Rolled Coil Steel Prices Creating Budget Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-cube offerings are capturing incremental demand because their 13% extra headroom maximizes volumetric loads such as e-commerce parcels and lightweight consumer electronics. 40-ft formats generated 52.64% revenue in 2024, demonstrating entrenched popularity for ocean freight, whereas 40-ft high-cube units are forecast to grow at 5.61% CAGR to 2030. The shipping container market size for high-cube units reflects shipper preference for greater capacity without breaching weight restrictions.

Port infrastructure upgrades accommodate taller stacks, and terminal operators add reach-stackers with extended lifting heights to handle these units efficiently. Logistics integrators promote standardization on the 40-ft profile to streamline rail wagon allocation and depot interchange. Triton Containers markets high-cube leases with flexible pick-up options to reduce repositioning, reinforcing adoption. Overall, shipper focus on cubic efficiency and consolidation of packaging drives continued high-cube traction across primary trade corridors.

Dry storage boxes accounted for 72.75% of 2024 shipments, underscoring their status as the backbone of global commodity flows. In contrast, reefer units record a 6.42% CAGR to 2030 as fresh produce exporters and drug makers scale ocean routes. Refrigerated boxes currently represent the premium slice of the shipping container market, commanding rental rates two to three times higher than dry units.

Technology upgrades include variable-speed compressors and solar-assisted power modules that cut energy draw during idle periods. Pharmaceutical shippers require redundant temperature probes and door sensors that trigger alerts within seconds of deviation, driving differentiation among manufacturers. Reefers also benefit from decarbonization, as shifting temperature-sensitive goods from air to sea avoids up to 80% of related emissions.

The Shipping Container Market is Segmented by Size (20-Ft (TEU), 40-Ft (FEU) and More), by Container Type (Dry Storage (Standard), Refrigerated, and More), by Material (Corten Steel, Stainless Steel and More), End-Use Industry (Consumer Goods & Retail and More), by Mode of Transport (Maritime Deep-Sea and More), by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 60.50% revenue in 2024 and is set to grow at a 5.67% CAGR to 2030. China retains manufacturing leadership, yet Southeast Asia captures incremental volumes as firms diversify sourcing. Malaysian and Indian mega-port projects add more than 25 million TEU of annual capacity, anchoring regional throughput and stimulating container demand across feeder networks. Currency stability and supportive trade agreements also encourage regional leasing pools to expand their fleets.

North America benefits from nearshoring that shifts electronics and automotive assembly closer to consumption markets. United States port authorities approve multi-billion-dollar dredging and berth electrification programs, enhancing competitiveness against Mexican and Canadian gateways. The rail intermodal build-out across the Midwest unlocks cost-effective land bridges that connect Atlantic and Pacific basins in under eight days, driving uptake of stack-train compatible container designs.

Europe records mixed growth as geopolitical tensions divert Asia-Europe sailings around Africa, extending transit times but also directing additional calls to Mediterranean hubs. Investments in automation at London Gateway and Rotterdam Maasvlakte raise throughput per crane hour, cushioning cost-per-box metrics. Stringent environmental regulations accelerate the retirement of older, heavier boxes in favor of recycled-content steel units, supporting replacement demand despite subdued trade volume growth.

- China International Marine Containers (CIMC)

- Dong Fang International Containers

- CXIC Group (CSSC)

- Maersk Container Industry A/S

- Singamas Container Holdings

- W&K Container

- Sea Box Inc.

- TLS Offshore Containers

- Storstac Inc.

- CARU Containers B.V.

- China Eastern Containers

- Valisons & Co.

- YMC Container Solutions

- American Intermodal Container Manufacturing

- Triton International

- Textainer Group Holdings

- Florens Container Services

- CAI International

- Touax Group

- UES International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth of cross-border e-commerce creating 24-hour turnaround expectations for standard dry containers.

- 4.2.2 Worldwide cold-chain penetration of fresh grocery and meal-kit delivery accelerating orders for advanced reefer boxes.

- 4.2.3 Direct-to-consumer (D2C) brands demanding bespoke, logo-printed containers to double as mobile pop-up stores and fulfilment hubs.

- 4.2.4 Corporate ESG mandates pushing shippers toward reusable, multimodal containers over single-use pallet wrap, lifting replacement demand.

- 4.2.5 Adoption of IoT-enabled -smart- boxes providing real-time location & condition data, raising shipper's willingness to pay for premium units.

- 4.2.6 Subscription-based and modular housing concepts spurring second-life conversions of retired shipping containers.

- 4.3 Market Restraints

- 4.3.1 Post-pandemic oversupply of boxes eroding utilisation rates and discouraging new-build investment.

- 4.3.2 Volatility in hot-rolled coil steel prices creating budget uncertainty for container purchasers.

- 4.3.3 Stricter cradle-to-grave regulations and extended-producer-responsibility (EPR) rules inflating lifetime ownership costs.

- 4.3.4 Rapid emergence of foldable and collapsible container alternatives cannibalising demand for conventional rigid boxes.

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis - Standard vs. Special Containers

- 4.8 Spotlight: Intermodal & Rail Uptake

- 4.9 Global Container Leasing Landscape

- 4.10 Impact of Geopolitical Events on the Market

5 Market Size & Growth Forecasts (Value, Volume)

- 5.1 By Size

- 5.1.1 20-ft (TEU)

- 5.1.2 40-ft (FEU)

- 5.1.3 40-ft High-Cube,

- 5.1.4 Others ( >45-ft, etc)

- 5.2 By Container Type

- 5.2.1 Dry Storage (Standard)

- 5.2.2 Refrigerated (Reefer)

- 5.2.3 Tank (ISO Tank, Cryogenic)

- 5.2.4 Flat-Rack & Open-Top

- 5.2.5 Special Purpose (Side-Door, Tunnel, Insulated, Collapsible)

- 5.3 By Material

- 5.3.1 Corten Steel

- 5.3.2 Stainless Steel

- 5.3.3 Aluminium Alloy

- 5.3.4 FRP & Composite

- 5.3.5 Others

- 5.4 By End-Use Industry

- 5.4.1 Consumer Goods & Retail

- 5.4.2 Food & Beverage

- 5.4.3 Industrial Machinery & Automotive

- 5.4.4 Chemicals & Petroleum

- 5.4.5 Pharmaceuticals & Healthcare

- 5.4.6 Others

- 5.5 By Mode of Transport

- 5.5.1 Maritime Deep-Sea

- 5.5.2 Short-Sea & Coastal

- 5.5.3 Rail Intermodal

- 5.5.4 Road Inland Haulage & Off-Site Storage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Europe

- 5.6.4.1 United Kingdom

- 5.6.4.2 Germany

- 5.6.4.3 France

- 5.6.4.4 Spain

- 5.6.4.5 Italy

- 5.6.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.4.8 Rest of Europe

- 5.6.5 Middle East And Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Capacity Expansion, Leasing Deals)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 China International Marine Containers (CIMC)

- 6.4.2 Dong Fang International Containers

- 6.4.3 CXIC Group (CSSC)

- 6.4.4 Maersk Container Industry A/S

- 6.4.5 Singamas Container Holdings

- 6.4.6 W&K Container

- 6.4.7 Sea Box Inc.

- 6.4.8 TLS Offshore Containers

- 6.4.9 Storstac Inc.

- 6.4.10 CARU Containers B.V.

- 6.4.11 China Eastern Containers

- 6.4.12 Valisons & Co.

- 6.4.13 YMC Container Solutions

- 6.4.14 American Intermodal Container Manufacturing

- 6.4.15 Triton International

- 6.4.16 Textainer Group Holdings

- 6.4.17 Florens Container Services

- 6.4.18 CAI International

- 6.4.19 Touax Group

- 6.4.20 UES International

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment