|

市場調查報告書

商品編碼

1836428

汽車引擎:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

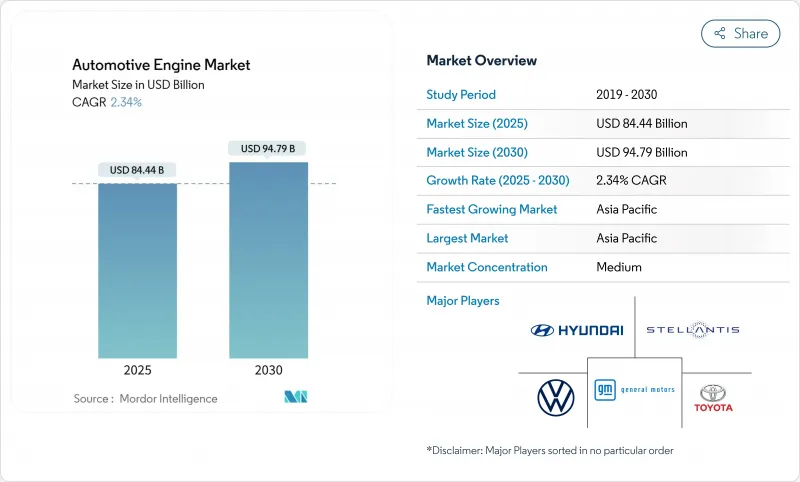

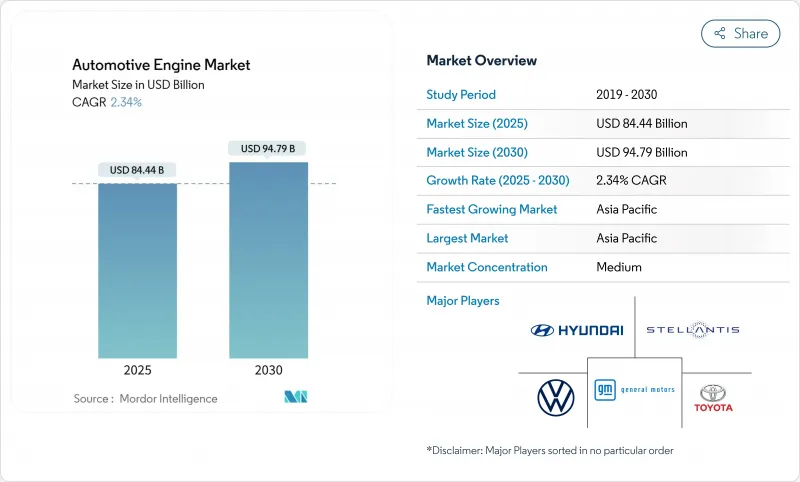

預計 2025 年汽車引擎市場價值將達到 844.4 億美元,到 2030 年預計將達到 947.9 億美元,複合年成長率為 2.34%。

這一穩健的發展軌跡表明,汽車引擎市場正在適應更嚴格的排放法規,同時透過更清潔的燃燒、混合整合和選擇性採用替代燃料來維持規模。亞太地區引領需求與生產,氫燃料內燃機試驗計畫加速推進,合成電子燃料的出現則是為了對沖電氣化的不確定性。隨著純電動車銷量的擴大,汽車製造商正在透過架構分散風險、提高熱效率並與能源供應商合作,以擴大汽車引擎市場的相關性。供應鏈的彈性,尤其是稀土和後處理基板,正成為一個關鍵的差異化因素,因為製造商正努力在競爭日益激烈但又分散的市場中維持淨利率。

全球汽車引擎市場趨勢與洞察

更嚴格的全球排放氣體法規加速了效率的提高

與歐盟6相比,歐7法規將允許的氮氧化物排放量降低了35%,並引入了新的煞車和輪胎顆粒物限值,要求使用更大的觸媒轉換器、電加熱後後處理裝置和可變壓縮燃燒策略。北美和亞太地區的主要市場正在實施類似的措施,從而推動全球動力傳動系統標準化。可變氣門正時、米勒循環校準和低溫燃燒正在從高階配置轉向基準配置。由此帶來的效率提升,以及與可再生燃料混合後,可以幫助縮小電池電力傳動系統的碳排放差距。總之,這些法規確保合規性,同時又不放棄液體燃料,從而增強了汽車引擎市場。

亞太新興經濟體汽車產量不斷成長

2023年4月至2024年3月,乘用車、商用車、三輪車、二輪車和四輪車的總合達28,434,742輛。具有競爭力的人事費用、有利的產業政策以及日益壯大的中階的需求,正在形成一個自我強化的生產循環。即使在成熟經濟體電氣化加速發展的背景下,這一勢頭也支撐著區域車型的內燃機投資,從而支撐了汽車引擎市場的成長。

純電動車的快速普及將使研發預算從內燃機汽車轉移

到2024年,純電動車的銷量將在幾個主要市場超過新車銷量,這將吸引工程人才和資本轉向軟體和電力電子領域。內燃機專案的更新周期將縮短,預算也將減少,即使電動車的效率不斷提高,技術差距仍有可能進一步擴大。面對訂單量的下降,一級供應商可能會加速工廠向電氣化零件的轉型,這將對剩餘的內燃機生產帶來成本壓力,並給汽車引擎市場帶來壓力。

報告中分析的其他促進因素和限制因素

- 電商物流推動輕型商用車需求

- 合成電子燃料延長內燃機壽命

- 零排放都市區區域抑制內燃機汽車銷售

細分分析

憑藉成熟的模具和封裝優勢,直列式引擎佈局將在 2024 年佔據 45.12% 的汽車引擎市場佔有率,繼續成為大眾乘用車的首選結構。對置活塞引擎的複合年成長率為 4.48%,原型機的熱效率實現了兩位數的提升,且運動部件更少。在研引擎的功率現已超過 1,000 匹馬力,同時降低了油耗和排放氣體。商業和國防領域日益成長的興趣表明,該結構很可能在 2020 年代後期實現大規模應用。 V 型配置在高階 SUV 和重型卡車中保持佔有率,因為功率密度可以抵消複雜性。平頭引擎繼續用於小批量跑車和越野車,因為其重心較低。

對創新佈局的需求標誌著整個產業正轉向無需完全電氣化即可實現高效運作的架構。因此,汽車引擎市場正在支援多樣化的工程藍圖,以降低單一技術風險,並實現動力傳動系統總成組合的區域最佳化。

由於無處不在的加油網路和持續的燃燒系統升級,汽油在2024年將維持60.84%的市場佔有率。氫燃料內燃機將成為成長最快的細分市場,到2030年,其複合年成長率將達到13.42%。現場測試表明,氫燃料的二氧化碳排放量接近零,引擎可靠性也相當可靠。國家對綠色氫氣生產的補貼,加上其適用於重型卡車的作業循環,已使其在商業性上站穩了腳跟。雖然柴油仍然是遠距貨運的主要燃料,但更嚴格的氮氧化物排放法規將提高系統成本,從而為天然氣和氫氣創造公平的競爭環境。

天然氣燃氣引擎仍然受到擁有加油站加油選項的車隊用戶的青睞,而支援電燃料的引擎則為原始設備製造商提供了一種無需更改設計即可滿足合規要求的途徑。這種燃料多樣化使汽車引擎市場能夠靈活應對基礎設施和政策的快速變化。

汽車引擎市場報告按安裝類型(直列、V型、W型、水平對置/水平對置、其他)、燃料類型(汽油、柴油、天然氣/壓縮天然氣、其他)、車輛類型(乘用車、輕型商用車、其他)、引擎排氣量(1.5公升以下、1.5-3升、其他)和地區細分。市場預測以金額(美元)和數量(單位)提供。

區域分析

亞太地區佔全球銷售額的41.66%,複合年成長率達3.06%,是其他地區中最高的。中國持續擴大出口,印度力爭提升全球排名,東南亞則正在實現供應多元化,印尼和馬來西亞的產量不斷增加。成本優勢、支持性政策框架以及家庭收入的不斷成長,正在增強該地區內燃機(ICE)的生產。

由於更換週期、商用車更新換代以及多引擎汽車生產使工廠保持繁忙,北美將維持2.1%的複合年成長率。關稅風險和資金籌措成本上升限制了成長,但內燃機汽車仍佔總產量的90%以上。汽車製造商正在規劃靈活的生產線,以滿足未來十年混合驅動系統的需求。

歐洲將經歷1.8%的複合年成長率,這反映了最嚴格的法規環境、不斷上漲的能源成本以及疫情後的緩慢復甦。然而,該地區擁有主要的內燃機研發中心,專注於超低排放氣體和可相容電燃料的引擎,這些引擎在滿足合規要求的同時,還能保住國內就業機會。

總體而言,區域細分顯示汽車引擎市場正在以不同的速度發展,平衡成熟市場對電氣化的需求與新興市場對成熟的燃燒動力的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 更嚴格的全球排放法規推動內燃機效率提升

- 亞太新興國家汽車產量不斷成長

- 電商物流推動輕型商用車引擎需求成長

- 合成電子燃料延長內燃機的生命週期

- 48V微混合動力系統增強與內燃機的聯繫

- 中重型卡車氫燃料內燃機試運行

- 市場限制

- 純電動車的快速普及分散了研發預算

- 零排放都市區區域抑制內燃機汽車銷售

- 關鍵合金短缺推高引擎成本

- OTA主導電力電子價值轉變

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模與成長預測(價值,十億美元)

- 按展示位置類型

- 排隊

- V型

- W型

- 平角褲/平底鞋

- 對置活塞

- 按燃料類型

- 汽油

- 柴油引擎

- 天然氣/壓縮天然氣

- 混合動力 ICE(輕度、全混合動力、插電式)

- 替代燃料(乙醇、液化石油氣、電子燃料)

- 氫動力內燃機

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 摩托車和強力運動

- 越野/農業/建築

- 按引擎排氣量

- 1.5升或更少

- 1.5~3 L

- 3公升以上

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Toyota Motor Corporation

- Volkswagen AG

- Hyundai Motor Group

- General Motors

- Stellantis NV

- Ford Motor Company

- Mercedes-Benz Group AG

- BMW AG

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- Cummins Inc.

- Volvo Group

- Tata Motors Limited

- Scania AB

- Caterpillar Inc.

第7章 市場機會與未來展望

The automotive engine market is valued at USD 84.44 billion in 2025 and is forecast to climb to USD 94.79 billion in 2030, expanding at a 2.34% CAGR.

This measured trajectory shows that the automotive engine market is adapting to stricter emission rules while retaining scale through cleaner combustion, hybrid integration, and selective deployment of alternative fuels. Asia-Pacific leads demand and production, hydrogen internal-combustion pilots are gathering pace, and synthetic e-fuels are emerging to hedge against electrification uncertainty. Automakers are spreading risk across architectures, improving thermal efficiency, and partnering with energy suppliers to extend the relevance of the automotive engine market amid growing battery-electric sales. Supply-chain resilience, especially for rare earths and after-treatment substrates, is becoming a critical differentiator as manufacturers aim to hold margins in a competitive yet fragmented landscape.

Global Automotive Engine Market Trends and Insights

Stricter Global Emission Rules Accelerate Efficiency Upgrades

Euro 7 limits cut permissible NOx by 35% versus Euro 6 and introduce fresh particulate caps for brakes and tires, prompting bigger catalytic converters, electrically heated after-treaters, and variable-compression combustion strategies. Similar measures in North America and key Asia-Pacific markets are forcing global power-train standardization, which helps scale next-gen components. Variable valve timing, Miller-cycle calibrations, and low-temperature combustion are shifting from premium options to baseline fitments. The resulting efficiency gains narrow the carbon gap with battery-electric drivetrains when renewable fuels are blended. Altogether, these regulations reinforce the automotive engine market by ensuring compliance without abandoning liquid fuels.

Rising Vehicle Production in Emerging Asia-Pacific Economies

From April 2023 to March 2024, the combined production of Passenger Vehicles, Commercial Vehicles, Three-Wheelers, Two-Wheelers, and Quadricycles reached 28,434,742 units. Competitive labor costs, supportive industrial policies, and expanding middle-class demand create a self-reinforcing production loop. Such momentum sustains internal-combustion investment for regional models even as electrification accelerates in mature economies, thereby underpinning growth in the automotive engine market.

Rapid BEV Adoption Diverts R&D Budgets from ICE

Battery-electric volumes topped new-car sales in several major markets during 2024, pulling engineering talent and capital toward software and power electronics. Internal-combustion programs face shorter refresh cycles and leaner budgets, which risks widening a technology gap against ever-improving EV efficiency. Tier-one suppliers confronted with smaller order volumes may accelerate factory retooling toward electrified components, placing cost pressure on remaining ICE output and weighing on the automotive engine market.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Logistics Boosts Light-Commercial-Vehicle Demand

- Synthetic E-fuels Extend the Combustion Engine Lifecycle

- Zero-Emission Urban Zones Curb ICE Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Due to established tooling and packaging advantages, the in-line layout secured 45.12% of 2024 revenue in the automotive engine market and remains the preferred architecture for mass-market passenger cars. Opposed-piston units are expanding at a 4.48% CAGR; prototypes demonstrate double-digit thermal-efficiency gains and fewer moving parts. Research engines now exceed 1,000 hp while cutting fuel use and emissions. Growing interest from commercial and defence segments suggests a viable pathway to volume adoption in the late 2020s. V-type configurations hold share in premium SUVs and heavy-duty trucks, where power density offsets complexity. Flat engines continue in low-volume sports and off-road vehicles that benefit from a low centre of gravity.

Demand for innovative layouts signals a wider industry pivot toward architectures that deliver efficiency without full electrification. The automotive engine market, therefore, supports diversified engineering roadmaps, mitigating single-technology risk and allowing regional optimisation of power-train portfolios.

Gasoline retained 60.84% share in 2024, bolstered by ubiquitous refuelling networks and continuous combustion-system upgrades. Hydrogen internal-combustion variants are the fastest-growing segment with a 13.42% CAGR through 2030; field tests demonstrate near-zero CO2 alongside familiar engine reliability. National subsidies for green-hydrogen production, combined with heavy-truck duty-cycle suitability, create an early commercial beachhead. Diesel still dominates long-haul freight, yet tightening NOx caps raise system cost, levelling the field for gas and hydrogen.

Natural-gas engines maintain relevance for fleet users with depot refuelling, whereas e-fuel-ready engines give OEMs a route to compliance without redesign. This fuel diversification keeps the automotive engine market resilient against rapid shifts in infrastructure and policy.

The Automotive Engine Market Report is Segmented by Placement Type (In-Line, V-Type, W-Type, Boxer / Flat, and More), Fuel Type (Gasoline, Diesel, Natural Gas / CNG, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Engine Capacity (Below 1. 5 L, 1. 5 To 3 L, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific holds 41.66% of global turnover and posts a 3.06% CAGR that outpaces every other region. China continues to scale exports, India aspires to top world rankings, and Southeast Asia diversifies supply with Indonesia and Malaysia stepping up output. Cost advantages, supportive policy frameworks, and rising household incomes reinforce regional ICE production.

North America sustains a 2.1% CAGR as replacement cycles, commercial-fleet renewal, and multipropulsion manufacturing keep plants busy. Tariff risks and elevated financing costs curb upside, but ICE still commands more than 90% of output today. Automakers plan flexible lines to serve mixed propulsion demand into the next decade.

Europe records a 1.8% CAGR, reflecting the toughest regulatory climate, higher energy costs, and slower post-pandemic recovery. The bloc nevertheless hosts leading combustion R&D centres focused on ultra-low emission and e-fuel-ready engines that enable compliance while retaining domestic employment.

Overall, geography segmentation shows that the automotive engine market evolves at different speeds, balancing mature-market electrification with developing-market demand for proven combustion power.

- Toyota Motor Corporation

- Volkswagen AG

- Hyundai Motor Group

- General Motors

- Stellantis N.V.

- Ford Motor Company

- Mercedes-Benz Group AG

- BMW AG

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- Cummins Inc.

- Volvo Group

- Tata Motors Limited

- Scania AB

- Caterpillar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter global emission regulations driving ICE efficiency upgrades

- 4.2.2 Rising vehicle production in emerging Asia-Pacific economies

- 4.2.3 E-commerce logistics boosting LCV engine demand

- 4.2.4 Emergence of synthetic e-fuels extending ICE lifecycle

- 4.2.5 48-V micro-hybrid systems reinforcing ICE relevance

- 4.2.6 Hydrogen-fueled ICE pilots for medium & heavy trucks

- 4.3 Market Restraints

- 4.3.1 Rapid BEV adoption diverting R&D budgets

- 4.3.2 Zero-emission urban zones curbing ICE sales

- 4.3.3 Critical alloy shortages inflating engine costs

- 4.3.4 OTA-driven value shift toward power electronics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Bn)

- 5.1 By Placement Type

- 5.1.1 In-line

- 5.1.2 V-type

- 5.1.3 W-type

- 5.1.4 Boxer / Flat

- 5.1.5 Opposed-piston

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Natural Gas / CNG

- 5.2.4 Hybrid-ICE (Mild, Full, Plug-in)

- 5.2.5 Alternative Fuels (Ethanol, LPG, e-Fuels)

- 5.2.6 Hydrogen ICE

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Two-Wheelers and Powersports

- 5.3.5 Off-road / Agricultural / Construction

- 5.4 By Engine Capacity

- 5.4.1 Below 1.5 L

- 5.4.2 1.5 to 3 L

- 5.4.3 Over 3 L

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of the Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Toyota Motor Corporation

- 6.4.2 Volkswagen AG

- 6.4.3 Hyundai Motor Group

- 6.4.4 General Motors

- 6.4.5 Stellantis N.V.

- 6.4.6 Ford Motor Company

- 6.4.7 Mercedes-Benz Group AG

- 6.4.8 BMW AG

- 6.4.9 Honda Motor Co., Ltd.

- 6.4.10 Nissan Motor Co., Ltd.

- 6.4.11 Cummins Inc.

- 6.4.12 Volvo Group

- 6.4.13 Tata Motors Limited

- 6.4.14 Scania AB

- 6.4.15 Caterpillar Inc.