|

市場調查報告書

商品編碼

1694038

歐洲、中東和非洲頻率控制和定時設備:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)EMEA Frequency Control And Timing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

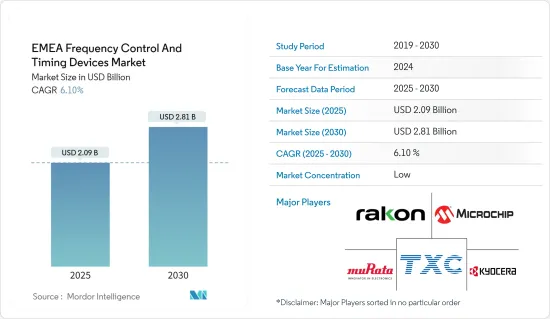

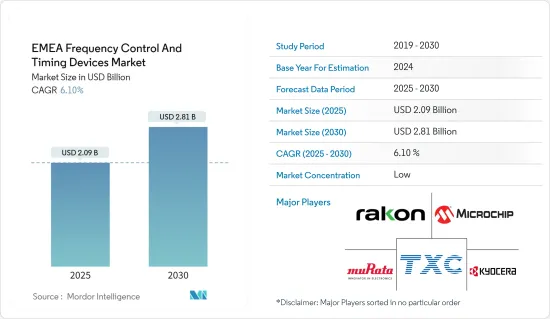

歐洲、中東和非洲頻率控制和計時設備市場規模預計在 2025 年為 20.9 億美元,預計到 2030 年將達到 28.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.1%。

由於俄羅斯與烏克蘭的衝突和經濟放緩,頻率控制和計時設備市場面臨嚴重混亂。通貨膨脹和利率上升抑制了消費者支出,削弱了對半導體的需求並減緩了 FCTD 的成長。衝突之後,歐洲將重點轉向國防和航太領域,增加了對 FCTD 的需求並開闢了新的成長途徑。

關鍵亮點

- 智慧家庭科技的日益普及為市場成長帶來了光明的前景。智慧家庭由連網設備組成,例如智慧恆溫器、照明系統、安全攝影機和家用電子電器產品,這些設備必須無縫通訊和協同工作。頻率控制和定時裝置保證這些設備的同步,並為資料傳輸、控制訊號和事件調度提供精確的定時訊號。

- 根據GSMA的報告,中東和北非地區的智慧型手機普及率預計將從2018年的54%成長到2025年的74%。至2025年,智慧型手機將佔撒哈拉以南非洲所有連線的61%。值得注意的是,到 2025 年,中東和北非地區的 5G 連線數量預計將達到 4,500 萬,撒哈拉以南非洲地區的 5G 連線數量預計將達到 4,100 萬。

- 機器人使用振盪器實現同步運動和時間敏感任務。由於工業機器人能夠提高精度和適應性、最大限度地減少產品損壞、提高速度並最終最佳化業務效率,該地區許多終端用戶和應用程式對工業機器人的使用正在增加。

- 先進汽車應用的興起是歐洲、中東和非洲地區汽車產業頻率控制和計時設備成長的主要驅動力。 ADAS 的日益普及也為市場成長做出了重大貢獻。這些系統依靠即時感測器數據處理實現自動緊急煞車、車道偏離警告和主動車距控制巡航系統。頻率控制設備為這些系統指定了精確的時間,以便快速且準確地做出反應。

- 頻率控制和定時設備市場是電子產業的一個重要領域,為各種各樣的應用提供必要的組件。然而,開發和生產這些設備的高成本對市場成長構成了挑戰。

- GDP成長、政府預算限制、地緣政治因素和財政政策等因素顯著影響歐洲、中東和非洲的軍事支出。根據北約估計,西班牙2023年的國防開支預計為191.8億美元,為2014年以來的最高支出,而前一年的國防開支預計為149億美元。這些數字使得西班牙成為北約成員國中國國防費用第八大的國家。

歐洲、中東和非洲頻率控制和定時設備市場趨勢

汽車產業作為最終用戶正在快速成長

- 在汽車產業,頻率控制和定時裝置用於ADAS的主動車距控制巡航系統、車道輔助和防撞;在資訊娛樂系統中實現流暢的音樂播放和精確的 GPS 功能;以及用於即時追蹤和連網汽車的遠端資訊處理。它們也用於電動車中,以調節馬達的運作。

- 對於在歐洲、中東和非洲的頻率控制和計時設備市場營運的供應商來說,汽車領域是一個前景光明的市場。

- 自動駕駛、電氣化、互聯互通和共享汽車是推動汽車市場成長的趨勢。現今的汽車配備了多種高性能電子系統,這些系統依靠精密定時技術對數位組件(從應用處理器到微控制器再到 FPGA)進行穩定、準確的頻率控制。據領先的頻率控制和定時裝置供應商 SiTime 稱,一輛典型的車輛包含多達 70 個定時裝置,以保持電氣和電子系統平穩運行。

- 歐洲、中東和非洲市場的成長可歸因於消費者偏好的變化、技術進步以及電動車的日益普及。隨著汽車產業向電動和聯網汽車轉變,對振盪器的需求預計會增加。這要求製造商和供應商投資創新技術,以確保車輛的安全性、性能和競爭力。

- 例如,預計2023年歐盟汽車市場將較去年與前一年同期比較大幅成長13.9%,全年總銷售量將達到1,050萬輛。此數據由歐洲汽車工業協會(ACEA)發布。

- 純電動車已成為2023年最受買家歡迎的第三大選擇。光是12月份,其市場佔有率就飆升至18.5%,全年整體佔有率達到14.6%。這超過了柴油13.6%的穩定市場佔有率。汽油車繼續保持主導地位,市場佔有率為 35.3%,而混合動力車則以 25.8% 的市場佔有率位居第二。

德國佔據主要市場佔有率

- 德國是工業 4.0 的領導者,自動化、資料交換和物聯網技術在製造業中融合。在這些「智慧工廠」中,精確的時間安排是關鍵。同步機器、機器人和感測器以最佳化生產和資源效率。隨著工業4.0的深入,工業自動化和智慧製造對先進計時設備的需求將會飆升。

- 德國家用電子電器和穿戴式裝置市場受到消費者對創新設備和連網設備的需求的推動。智慧型手機、穿戴式裝置和家用電子電器產品通常包含計時設備,用於時鐘同步、資料處理和連接。隨著消費者偏好轉向智慧和連網設備,對能夠滿足最新家用電子電器產品要求的緊湊、低功耗計時解決方案的需求不斷成長。

- 根據GSMA Intelligence的數據,德國將成為歐洲領先的智慧型手機市場,以連線數計算,其市場規模預計到2025年將達到1.05億美元。預計德國智慧型手機普及率將從2021年的80%上升到2025年的84%。

- 在德國,國防和航太領域對高效能計時解決方案的需求日益成長。這些解決方案應用於雷達系統、通訊網路和衛星有效載荷。隨著國防需求不斷發展以應對新的威脅,需求正在轉向先進的計時設備。這些設備必須提供強大的性能並具有增強的可靠性和安全功能。專門提供計時解決方案的供應商可以透過客製化其產品來滿足這些關鍵任務應用的嚴格要求,從而受益。

- 根據上述摘要,政府對國防工業發展的過度投資將為研究市場創造新的成長機會。據斯德哥爾摩國際和平研究所稱,2023年政府在國防預算中投入的資金約為3.08%。

- 該國正在促進產學合作,以促進創新和技術發展。合作研究舉措和夥伴關係為計時設備供應商創造了參與尖端研究計劃、開發新技術和將創新解決方案商業化的機會。透過利用協力網路提供的專業知識和資源,公司可以獲得優勢並加速先進計時解決方案的開發和採用。預計這些趨勢和舉措將在預測期內推動市場成長。

歐洲、中東和非洲頻率控制和定時設備產業概況

歐洲、中東和非洲頻率控制和計時設備市場較為分散,主要企業包括村田製作所、京瓷、Rakon Limited、Microchip Technology Inc. 和 TXC Corporation。市場主要企業正在採取收購和聯盟等策略來加強其產品供應並獲得永續的競爭優勢。

2024 年 4 月,先進電子元件製造商京瓷 AVX 宣布成立一個新的製造和設計中心,以京瓷 AVX Components Corporation (Erie) 的名義生產高品質、低噪音共振器頻率控制產品。新生產工廠將能夠生產超過 120 萬個該公司專利的、無與倫比的低功率 OCXO(恆溫控制晶體振盪器)。我們也生產 TCXO(溫控晶體振盪器)和 VCXO(電壓調節器晶體振盪器)。

2024 年 2 月錯誤交換 OCXO(MercuryXE2)是 Lacon 最近推出的 Mercury 微型 IC-OCXO 的一個版本。透過結合頻率誤差交換處理和老化補償,提高了網路同步器評估板上系統的當前同步能力,從而實現了更好的保持效能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠疫情和宏觀經濟趨勢對該產業的影響

第5章市場動態

- 市場促進因素

- 新興應用增加(物聯網設備、機器人等)

- 先進汽車應用的需求不斷成長

- 市場限制

- 開發成本高

第6章市場區隔

- 按類型

- 石英晶共振器

- 振盪器

- 溫度補償晶體振盪器(TCXO)

- 電壓調節器晶體振盪器(VCXO)

- 恆溫晶體振盪器(OCXO)

- 微機電振盪器

- 其他振盪器

- 共振器

- 鋸齒濾波器

- 即時時鐘

- 按最終用戶產業

- 車

- 電腦及周邊設備

- 通訊/伺服器/數據存儲

- 消費性電子產品

- 產業

- 國防與航太

- IoT

- 其他

- 按國家

- 英國

- 德國

- 法國

- 義大利

- 海灣合作理事會國家

- 南非

第7章競爭格局

- 公司簡介

- Murata Manufacturing Co. Ltd

- Kyocera Corporation

- Rakon Limited

- Microchip Technology Inc.

- TXC Corporation

- Seiko Epson Corporation

- Daishinku Corporation

- Hosonic Technology(group)Co. Ltd

- Nihon Dempa Kogyo Co. Ltd

- Sitime Corporation

- Stmicroelectronics NV

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Abracon Llc

- Jauch Quartz

- IQD Frequency Products Ltd

- Euroquartz Ltd

- Geyer Electronic GmbH

- ACT

第8章投資分析

第9章 市場機會與未來趨勢

The EMEA Frequency Control And Timing Devices Market size is estimated at USD 2.09 billion in 2025, and is expected to reach USD 2.81 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

The frequency control and timing device market faced significant disruptions due to the Russo-Ukraine conflict and an economic slowdown. Rising inflation and interest rates curtailed consumer spending, dampened semiconductor demand, and slowed the growth of FCTDs. In response to the conflict, Europe has shifted its focus toward the defense and aerospace sectors, leading to heightened demand for these components and opening up new growth avenues.

Key Highlights

- The rising adoption of smart home technologies creates a positive outlook for market growth. Smart homes consist of interconnected devices such as smart thermostats, lighting systems, security cameras, and appliances that need to communicate and operate seamlessly together. Frequency control and timing devices ensure the synchronization of these devices, providing accurate timing signals for data transmission, control signals, and event scheduling.

- According to the GSMA report, smartphone adoption in the MENA region is expected to increase from 54% in 2018 to 74% in 2025. By 2025, smartphones will make up 61% of all connections in Sub-Saharan Africa. Noticeably, the number of 5G connections is expected to reach 45 million and 41 million by 2025 in the MENA and Sub-Saharan African regions, respectively.

- Robots use oscillators for synchronized operation and time-sensitive tasks. The utilization of industrial robots in the region has been on the rise in numerous end-users and applications due to their ability to improve precision and adaptability, minimize product damage, enhance speed, and ultimately optimize operational efficiency.

- The rise of advanced automotive applications is a significant driver for the growth of EMEA frequency control and timing devices in the automotive industry. The increasing adoption of ADAS is a substantial contributor to the market growth. These systems rely on real-time sensor data processing for automatic emergency braking, lane departure warning, and adaptive cruise control. Frequency control devices provide the accurate timing for these systems to respond promptly and accurately.

- The frequency control and timing devices market is a critical segment within the electronics industry, providing essential components for various applications. However, the high costs of developing and producing these devices challenge the market's growth.

- Factors like GDP growth, government budget constraints, geopolitical factors, and fiscal policies significantly impact military spending in EMEA. According to NATO, in 2023, Spain's defense expenditure was estimated at USD 19.18 billion, the highest spending since 2014. The expenditure was estimated to be USD 14.90 billion in the previous year. Such figures gave Spain the eighth-highest defense expenditure among NATO members.

EMEA Frequency Control And Timing Devices Market Trends

Automotive Industry to be the Fastest Growing End User

- In the automotive industry, frequency control and timing devices are used in ADAS for adaptive cruise control, lane assistance, and collision avoidance, infotainment systems for smooth music playback and accurate GPS functionality, telematics for real-time tracking and connected vehicles, and others. They are also used in electric vehicles to coordinate the operations of electric motors.

- The automotive segment presents promising opportunities for vendors operating in the EMEA frequency control and timing devices market, as the importance of these devices has been increasing in modern automobiles.

- Autonomous driving, electrification, connectivity, and shared vehicles are the trends driving market growth in the automotive sector. Automobiles today contain several high-performance electronic systems that rely on precision timing technology for stable, accurate frequency control of digital components, ranging from application processors to microcontrollers to FPGAs. According to SiTime, a leading frequency control and timing device provider, a typical automobile uses up to 70 timing devices to keep the electrical and electronic systems operating smoothly.

- The market growth in the EMEA region may be attributed to changing consumer preferences, technological advancements, and the increasing popularity of electric vehicles. With the automotive sector shifting toward electric and connected vehicles, there will be a growing demand for oscillators. This will require manufacturers and suppliers to invest in innovative technologies to ensure vehicle safety, performance, and competitiveness.

- For instance, the car market in the European Union experienced a significant growth of 13.9% in 2023 compared to the previous year, resulting in a total sales volume of 10.5 million units for the entire year. This data was reported by the European Automobile Manufacturers' Association (ACEA).

- Battery-electric cars emerged as the third most popular choice among buyers in 2023. In December alone, their market share skyrocketed to 18.5%, contributing to an overall share of 14.6% for the entire year. This surpassed the steady market share of diesel cars, which remained at 13.6%. Petrol cars maintained their dominance with a market share of 35.3%, while hybrid-electric cars secured the second position with a commanding market share of 25.8%.

Germany to Hold Major Market Share

- Germany leads the way in Industry 4.0, where automation, data exchange, and IoT technologies converge in manufacturing. In these 'smart factories,' precise timing is crucial. It synchronizes machines, robotics, and sensors, optimizing production and resource efficiency. As Industry 4.0 takes hold, the need for advanced timing devices in industrial automation and smart manufacturing surges.

- Germany's consumer electronics and wearable devices market is driven by consumer demand for innovative gadgets and connected devices. Smartphones, wearables, and consumer electronics often incorporate timing devices for clock synchronization, data processing, and connectivity. As consumer preferences shift towards intelligent and connected devices, there's a continuous demand for compact, low-power timing solutions that may meet the requirements of modern consumer electronics products.

- According to data provided by GSMA Intelligence, Germany is projected to emerge as the leading smartphone market in Europe in terms of the number of connections, with a value of USD 105 million, by 2025. Germany's smartphone adoption rate is expected to rise from 80% in 2021 to 84% in 2025.

- In Germany, the defense and aerospace sectors increasingly demand high-performance timing solutions. These solutions find applications in radar systems, communication networks, and satellite payloads. With evolving defense needs to combat emerging threats, the demand is shifting toward advanced timing devices. These devices must deliver robust performance and boast enhanced reliability and security features. Suppliers specializing in timing solutions stand to benefit by tailoring their offerings to meet the stringent demands of these mission-critical applications.

- Adhering to the above synopsis, the government's excess investments towards advancing its defense industry will create new growth opportunities for the studied market. According to SIPRI, in 2023, the government invested around 3.08% in its defense budget.

- The country fosters collaborations between industry, academia, and research institutions to drive innovation and technology development. Collaborative research initiatives and partnerships create opportunities for suppliers of timing devices to participate in cutting-edge research projects, develop new technologies, and commercialize innovative solutions. By leveraging the expertise and resources available through collaborative networks, companies can gain a competitive edge and accelerate developing and adopting advanced timing solutions. Such trends and initiatives are expected to drive the market growth in the projected period.

EMEA Frequency Control And Timing Devices Industry Overview

The EMEA Frequency Control And Timing Devices Market is fragmented with the presence of key players like Murata Manufacturing Co. Ltd, Kyocera Corporation, Rakon Limited, Microchip Technology Inc., and TXC Corporation. Key players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

In April 2024, KYOCERA AVX, a manufacturer of advanced electronic components, unveiled a new manufacturing and design center for high-quality, low-noise quartz crystal frequency control products under the name KYOCERA AVX Components Corporation (Erie). The newly established production facility could manufacture over 1.2 million patented and unparalleled low-power OCXO (oven-controlled crystal oscillators). It would produce a range of TCXO (temperature-computed crystal oscillators) and VCXO (voltage-computed crystal oscillators).

In February 2024, the Error Exchange OCXO (MercuryXE2) is a version of Rakon's recently launched Mercury compact IC-OCXO. It improves the system's current synchronization abilities on a network synchronizer evaluation board by incorporating frequency error exchange processing and aging compensation, thereby increasing the holdover performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Emerging Applications (such as IoT Devices, Robotics, etc.)

- 5.1.2 Rising Demand from Advanced Automotive Applications

- 5.2 Market Restraint

- 5.2.1 High Cost of Development

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Crystals

- 6.1.2 Oscillators

- 6.1.2.1 Temperature Compensated Crystal Oscillator (TCXO)

- 6.1.2.2 Voltage-controlled Crystal Oscillator (VCXO)

- 6.1.2.3 Oven-controlled Crystal Oscillator (OCXO)

- 6.1.2.4 MEMS Oscillator

- 6.1.2.5 Other Types of Oscillators

- 6.1.3 Resonators

- 6.1.4 Saw Filters

- 6.1.5 Real Time Clocks

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Computer and Peripherals

- 6.2.3 Communications/Server/Data Storage

- 6.2.4 Consumer Electronics

- 6.2.5 Industrial

- 6.2.6 Defense and Aerospace

- 6.2.7 IoT

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 GCC

- 6.3.6 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Kyocera Corporation

- 7.1.3 Rakon Limited

- 7.1.4 Microchip Technology Inc.

- 7.1.5 TXC Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 Daishinku Corporation

- 7.1.8 Hosonic Technology (group) Co. Ltd

- 7.1.9 Nihon Dempa Kogyo Co. Ltd

- 7.1.10 Sitime Corporation

- 7.1.11 Stmicroelectronics NV

- 7.1.12 Texas Instruments Incorporated

- 7.1.13 NXP Semiconductors NV

- 7.1.14 Abracon Llc

- 7.1.15 Jauch Quartz

- 7.1.16 IQD Frequency Products Ltd

- 7.1.17 Euroquartz Ltd

- 7.1.18 Geyer Electronic GmbH

- 7.1.19 ACT