|

市場調查報告書

商品編碼

1692459

頻率控制與定時裝置:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Frequency Control And Timing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

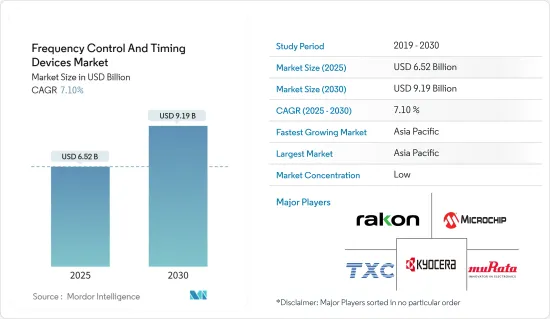

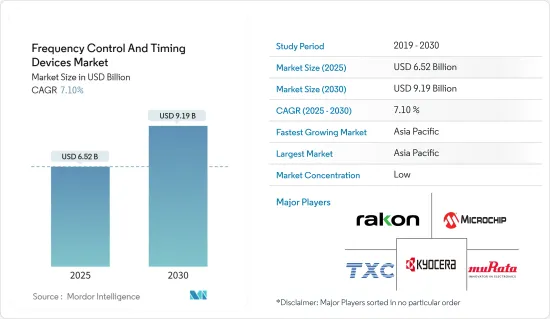

頻率控制和計時設備市場規模預計在 2025 年為 65.2 億美元,預計到 2030 年將達到 91.9 億美元,預測期內(2025-2030 年)的複合年成長率為 7.1%。

頻率控制和定時裝置 (FCTD) 是在各種電子系統中產生、控制和同步定時訊號的電子元件。這對於確保這些系統內操作的精確計時、同步和協調至關重要。透過將定時裝置的原理應用於石英晶體共振器、MEMS和陶瓷共振器,可以實現穩定的頻率振盪。這些計時設備有助於確保 Zigbee、藍牙和其他無線應用(例如智慧型手機)、汽車、醫療設備等設備的精確運作。

印刷電路基板(PCB)的普及率激增是推動頻率控制和計時設備市場成長的主要因素。現代 PCB 變得越來越複雜,元件密度更高,並且更多的功能被封裝在更小的空間內。這種複雜性需要精確的時間和訊號完整性來確保正常運作。 FCTD 透過提供穩定的頻率參考和訊號完整性,在管理這些複雜性方面發揮關鍵作用。

產業加速數位轉型的努力正在推動市場成長。這包括向「工業 4.0」概念的過渡,該概念規定在工業設置中更多地採用自動化、機器人、人工智慧和 IIoT 等先進解決方案。

全球 5G 技術的日益普及正在推動頻率控制和計時設備的成長。 5G 網路將使用更高的頻寬,包括毫米波頻率(24 GHz 及以上),這將需要精確的頻率控制裝置來保持訊號完整性和效能。 5G頻寬的增加意味著精確的計時對於傳輸和接收大量資料至關重要,這需要先進的振盪器和時脈產生器。

頻率控制和計時設備市場是電子產業的一個重要領域,為各種各樣的應用提供必要的組件。然而,開發和生產頻率控制和計時設備的高成本對市場的成長構成了挑戰。

多種宏觀經濟趨勢影響各國的國防預算,包括經濟成長、通貨膨脹、政府支出重點、全球貿易和地緣政治動態。根據美國預算辦公室的數據,預計到2033年,美國國防支出將逐年增加。預計到2023年,美國國防支出將達7,460億美元,2033年將增加至1.1兆美元。

頻率控制與定時裝置市場趨勢

建築業的成長將推動家具產品的需求

- 家電領域,頻率控制、定時裝置應用於智慧型手機、平板電腦、穿戴式裝置、智慧家庭設備、電視、機上盒、遊戲機、數位相機等。

- 家用電子電器變得越來越小、性能越來越最佳化、能源效率越來越高。這些變化直接影響共振器等內部組件。石英晶體共振器廣泛應用於各種產品,包括穿戴式裝置、智慧型手機、個人電腦、遊戲機和電視,為精確的資料處理提供關鍵的時間訊號。石英晶共振器的可靠性提高了設備性能並有助於節省能源,從而延長電池壽命。這種準確性在建立用戶信任方面起著關鍵作用,也是穿戴式裝置和其他先進電子設備普及的驅動力。

- 智慧型手機的廣泛普及在市場成長中發揮關鍵作用。晶體振盪器對於向智慧型手機、平板電腦和其他電子設備提供精確的定時訊號至關重要。隨著技術的進步和電子元件的小型化,晶體振盪器已成為確保最佳性能標準的必需品。

- 根據愛立信行動報告,5G 的採用依然強勁,2023 年全球將新契約,這表明儘管某些市場面臨持續的經濟挑戰和地緣政治不確定性,但對高性能連接的需求仍保持彈性。根據愛立信預測,到2029年,全球5G用戶數預計將超過53億,佔所有行動用戶的58%。此外,預計到 2029 年,北美和海灣合作理事會的 5G 普及率將最高,達到 92%,其次是西歐,達到 85%。

亞太地區預計將佔據主要市場佔有率

- 由於智慧型手機消費者數量、資料中心、5G 技術的日益普及以及工業自動化的不斷增加,亞太地區預計將經歷快速成長,尤其是印度和中國等主要經濟體。晶體振盪器的最新進展在提高其整體效率和顯著提高其在各種應用中的準確性方面發揮了關鍵作用。

- 中國智慧型手機產業由華為、蘋果、三星、小米、聯想等主要公司組成。中國大部分智慧型手機製造廠位於廣東省、北京、天津和上海。預計未來幾年中國智慧型手機銷量將大幅成長。這推動了對晶體振盪器的需求,以改善智慧型手機應用中 WiFi 和藍牙複合晶片晶片組的使用。

- 在亞太地區,韓國是頻率控制和計時設備的重要市場。這主要得益於該技術在國內各行各業的廣泛應用,包括家電、工業機器人、通訊設備、5G服務等。這些產業被公認為晶體振盪器的主要驅動力。

- 此外,市場競爭加劇導致電子設備產量增加,進一步推動了對晶體振盪器的需求。此外,VCO 在電子音樂設備生產中的日益普及也對這一成長做出了重大貢獻。

- 該地區的汽車行業產量正在大幅成長,從而推動了市場的成長。安全系統中採用頻率控制和定時裝置來提供精確的定時和同步。這些系統包括安全氣囊展開、防鎖死煞車系統、電子穩定控制、防撞系統等。

頻率控制和調速設備產業概況

頻率控制和計時設備市場分散且競爭激烈。市場高度分散,主要企業採用產品創新、新產品發布、夥伴關係、聯盟和併購等策略。市場的主要企業包括村田製作所、京瓷、Rakon Limited、Microchip Technology Inc. 和 TXC Corporation。

2024 年 4 月—先進電子元件製造商京瓷 Avx 宣布成立一個新的製造和設計中心,以「京瓷 Avx Components Corporation (Erie)」的名義生產高品質、低噪音共振器頻率控制產品。新製造廠預計將生產超過 120 萬台該公司專利的、無與倫比的低功耗 OCXO(恆溫控制晶體振盪器)以及各種 TCXO(溫控晶體振盪器)和 VCXO(壓控晶體振盪器)。

2024 年 2 月 - Lacon 將在 2024 年巴塞隆納 MWC 上展示其針對現代無線網路和 IT 及通訊資料中心的早期擴展保持解決方案。 Error Exchange OCXO(MercuryXE2)是 Lacon 最近發布的微型 IC-OCXO Mercury 的一個版本。頻率誤差交換處理和老化補償的結合提高了網路同步器評估板上系統的當前同步能力,從而提高了保持效能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- 市場宏觀經濟走勢分析

第5章市場動態

- 市場促進因素

- 在全球擴大 5G 的採用

- 先進汽車應用的需求不斷成長

- 市場挑戰

- 開發成本高

第6章市場區隔

- 按類型

- 石英晶共振器

- 振盪器

- 溫度補償晶體振盪器(TCXO)

- 電壓調節器晶體振盪器(VCXO)

- 恆溫晶體振盪器(OCXO)

- 微機電振盪器

- 其他振盪器

- 共振器

- 按最終用戶產業

- 車

- 電腦及周邊設備

- 通訊/伺服器/資料存儲

- 家電

- 工業的

- 軍事和航太

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Murata Manufacturing Co. Ltd

- Kyocera Corporation

- Rakon Limited

- Microchip Technology Inc.

- TXC Corporation

- Seiko Epson Corporation

- Daishinku Corporation

- Hosonic Technology(Group)Co. Ltd

- Nihon Dempa Kogyo Co. Ltd

- SiTime Corporation

- SIWARD Crystal Technology Co. Ltd.

- Texas Instruments Inc.

- NXP Semiconductors

- Abracon LLC

第8章投資分析

第9章 市場機會與未來趨勢

The Frequency Control And Timing Devices Market size is estimated at USD 6.52 billion in 2025, and is expected to reach USD 9.19 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Frequency control and timing devices (FCTD) are electronic components that generate, control, and synchronize timing signals in various electronic systems. They are crucial in ensuring accurate timing, synchronization, and coordination of operations within these systems. Applying the principles of timing devices to quartz crystals, MEMS, and ceramic resonators makes it possible to generate oscillations with stable frequencies. These timing devices help to ensure the precise operation of devices in Zigbee, Bluetooth, and other wireless applications (such as smartphones), automobiles, and medical equipment.

The surging popularity of printed circuit boards (PCBs) is a key driver for the growth of the frequency control and timing devices market. Modern PCBs are becoming increasingly complex, with higher component density and functionality packed into smaller spaces. This complexity necessitates precise timing and signal integrity to ensure proper operation. FCTDs are important in managing these complexities by providing stable reference frequencies and signal integrity.

Industrial organizations' efforts to accelerate digital transformation drive the market's growth. This includes shifting to the "industry 4.0" concept, which governs a higher adoption of automation, robotics, and advanced solutions such as AI and IIoT in industrial setups.

The growing adoption of 5G technology worldwide significantly drives the growth of frequency control and timing devices. 5G networks utilize higher frequency bands, including millimeter-wave frequencies (24GHz and above), which require exact frequency control devices to maintain signal integrity and performance. With the expanded bandwidth capabilities of 5G, precise timing is essential to handle large amounts of data being transmitted and received, necessitating advanced oscillators and clock generators.

The frequency control and timing devices market is a critical segment within the electronics industry, providing essential components for various applications. However, the high costs associated with developing and producing frequency control and timing devices are challenging the market's growth.

Several macroeconomic trends, like economic growth, inflation, government spending priorities, global trade, and geopolitical dynamics, affect the defense budgets of various countries. According to the US Congressional Budget Office, defense spending in the United States is predicted to increase yearly until 2033. Defense outlays in the United States amounted to USD 746 billion in 2023, and the forecast predicts an increase to USD 1.1 trillion in 2033.

Frequency Control And Timing Devices Market Trends

Growth in the Construction Sector Boosting the Demand for Furniture Products

- Consumer electronics, frequency control, and timing devices find applications in smartphones and tablets, wearable devices, smart home devices, television and set-top boxes, gaming consoles, and digital cameras.

- Consumer electronics are becoming more compact, optimized for performance, and energy-efficient. These changes directly impact internal components such as crystals. Crystals are utilized in various products, including wearables, smartphones, PCs, gaming consoles, and TVs, to provide crucial timing signals for accurate data processing. Their reliability improves device performance and helps conserve energy, leading to extended battery life. This precision plays a vital role in establishing user confidence, driving the increasing popularity of wearables and other sophisticated electronics.

- The increase in smartphone adoption has played a key role in the market's growth. Crystal oscillators are essential in providing accurate timing signals for smartphones, tablets, and other electronic gadgets. As technology progresses and electronic components become smaller, crystal oscillators have become vital in ensuring optimal performance standards.

- According to Ericsson's mobility report, the continued strong uptake of 5G, with around 600 million new subscriptions added globally during 2023, shows that demand for high-performance connectivity remains resilient despite ongoing economic challenges and geopolitical unrest in some markets. As per Ericsson, the global 5G subscriptions are forecast to exceed 5.3 billion in 2029, making up 58% of all mobile subscriptions. It is also projected that North America and GCC will have the highest 5G penetration in 2029 at 92%, followed by Western Europe at 85%.

Asia-Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region is expected to witness rapid growth due to the rising number of smartphone consumers, data centers, rising adoption of 5G technology, industrial automation, etc., particularly in major economies like India and China. The recent advancements in crystal oscillators play a crucial role in enhancing overall efficiency and greatly improving accuracy in various applications.

- The Chinese smartphone industry is comprised of major players such as Huawei, Apple, Samsung, Xiaomi, and Lenovo. Most smartphone manufacturing facilities in China are in Guangdong Province, Beijing, Tianjin, and Shanghai. They are expected to sell significantly more smartphones in China in the coming years. This leads to the demand for crystal oscillators to improve the use of WiFi and Bluetooth combo chipsets in smartphone applications.

- In the Asia-Pacific region, South Korea holds a prominent position as a crucial market for frequency control and timing devices. This is primarily due to the extensive utilization of this technology by various industries in the country, such as consumer electronics, industrial robots, telecommunication equipment, and 5G services. These industries are recognized as major proponents of crystal oscillators.

- In addition, the escalating competition in the market has led to an increased production of electronic devices, further fueling the demand for crystal oscillators. Furthermore, the growing popularity of VCOs in the production of electronic music devices has also contributed significantly to this growth.

- The automotive sector across the region has witnessed significant growth in production, which fuels the market growth. Frequency control and timing devices are used in safety systems to provide accurate timing and synchronization. These systems include airbag deployment, anti-lock braking, electronic stability control, and collision avoidance systems.

Frequency Control And Timing Devices Industry Overview

The frequency control and timing devices market is fragmented and highly competitive. The market appears to be highly fragmented, with significant players adopting strategies like product innovation, new product launches, partnerships, collaborations, and mergers and acquisitions. Some of the major players in the market are Murata Manufacturing Co. Ltd, Kyocera Corporation, Rakon Limited, Microchip Technology Inc., and TXC Corporation.

April 2024 - Kyocera Avx, a manufacturer of advanced electronic components, unveiled a new manufacturing and design center for high-quality, low-noise quartz crystal frequency control products under the name Kyocera Avx Components Corporation (Erie). The newly established production facility is expected to manufacture over 1.2 million patented and unparalleled low-power OCXO (oven-controlled crystal oscillators) and a range of TCXO (temperature-computed crystal oscillators) and VCXO (voltage-computed crystal oscillators).

February 2024 - Rakon displays its initial extended holdover solution for modern radio networks and telecommunications data centers at MWC Barcelona 2024. The Error Exchange OCXO (MercuryXE2) is a version of Rakon's recently launched Mercury compact IC-OCXO. It improves the system's current synchronization abilities on a network synchronizer evaluation board by incorporating frequency error exchange processing and aging compensation, thereby increasing the holdover performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Analysis of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of 5G Across the World

- 5.1.2 Rising Demand from Advanced Automotive Applications

- 5.2 Market Challenges

- 5.2.1 High Cost of Development

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Crystals

- 6.1.2 Oscillators

- 6.1.2.1 Temperature Compensated Crystal Oscillator (TCXO)

- 6.1.2.2 Voltage-controlled Crystal Oscillator (VCXO)

- 6.1.2.3 Oven-controlled Crystal Oscillator (OCXO)

- 6.1.2.4 MEMS Oscillator

- 6.1.2.5 Other Types of Oscillators

- 6.1.3 Resonators

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Computer and Peripherals

- 6.2.3 Communications/Server/Data Storage

- 6.2.4 Consumer Electronics

- 6.2.5 Industrial

- 6.2.6 Military and Aerospace

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Kyocera Corporation

- 7.1.3 Rakon Limited

- 7.1.4 Microchip Technology Inc.

- 7.1.5 TXC Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 Daishinku Corporation

- 7.1.8 Hosonic Technology (Group) Co. Ltd

- 7.1.9 Nihon Dempa Kogyo Co. Ltd

- 7.1.10 SiTime Corporation

- 7.1.11 SIWARD Crystal Technology Co. Ltd.

- 7.1.12 Texas Instruments Inc.

- 7.1.13 NXP Semiconductors

- 7.1.14 Abracon LLC