|

市場調查報告書

商品編碼

1694029

汽車產業 NOR 快閃記憶體:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)NOR Flash Memory For The Automotive Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

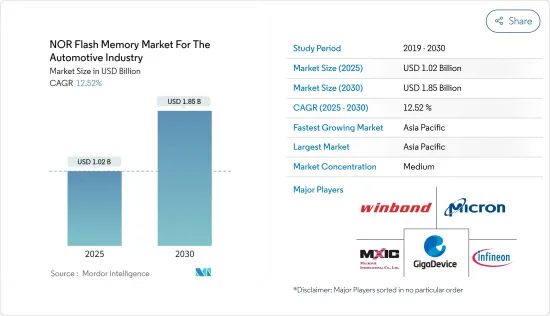

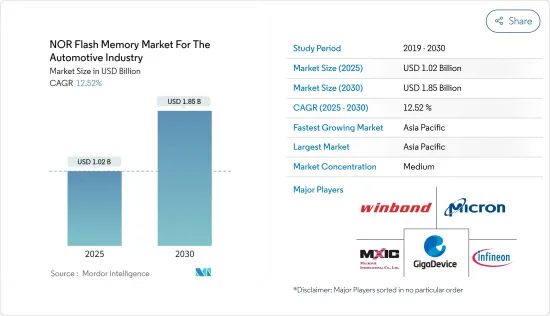

預計汽車產業 NOR 快閃記憶體市場將從 2025 年的 10.2 億美元成長到 2030 年的 18.5 億美元,預測期內(2025-2030 年)的複合年成長率為 12.52%。

由於從資訊娛樂到儀表板等多種應用領域的需求不斷成長,NOR 快閃記憶體領域呈現出快速的成長率。

關鍵亮點

- NOR Flash 是一種記憶體,也是一種非揮發性儲存技術。它用於需要以 1 位元組為單位寫入和讀取資料的應用程式。該產品旨在提供比 NAND 更低的記憶體密度,並在最終用戶裝置中消耗更高的功率。

- 傳統汽車技術的發展雖然注重速度、安全性、舒適性和能源效率,但現在的重點正逐漸轉向開發更多能夠利用新能源的創新車型。作為道路上的移動設備,汽車曾經是獨立的實體,與外部設備沒有任何互動。

- 然而,隨著行動網路的快速發展,這一障礙已經被打破,汽車不再只是道路上孤立的設備。汽車的遠端控制,或汽車與設備(如交通燈)之間的通訊,在可預見的未來是可以實現的。智慧汽車的歷史可以追溯到1990年代初,當時的瑞士手錶公司Swatch。發明家尼古拉斯·哈耶克對開發高效能、都市化的汽車的想法很感興趣。他最初將這個想法帶給了大眾汽車。

- 因此,包括比亞迪、特斯拉、蔚來、小鵬和華為在內的許多電動車製造商都投資了智慧汽車技術,將其視為電動車的關鍵賣點。最近,2024 年 1 月,中國電動車巨頭比亞迪推出了璇璣智慧汽車系統,旨在透過自動停車和語音辨識等功能追趕競爭對手。

- 隨著終端用戶對 NOR 快閃記憶體的需求增加,研發成本預計也會增加。美光等供應商已投資 150 億美元在愛達荷州博伊西建立新製造工廠,用於生產記憶體。

- 此外,該公司計劃將新製造工廠與美光總部研發中心設在同一地點,以加強技術部署並透過提高營運效率來縮短產品上市時間,從而服務於汽車、資料中心、人工智慧和 5G 記憶體應用等行業。這意味著研究、開發和製造設置成本高昂,從而帶來挑戰。

- 世界各國政府都採取量化寬鬆措施,印鈔票刺激經濟。這項舉措在過去幾年發揮了作用,但隨著通膨擔憂的加劇,過去的獎勵策略這次可能不再奏效。晶片產業正處於超級週期,即在強勁需求的推動下經歷長期擴張。

- 同時,新冠疫情導致從物流到原料等所有領域成本普遍上漲。俄羅斯突然入侵烏克蘭,導致能源和原物料市場大幅波動,進一步加劇通膨壓力。例如,由於持續的地緣政治緊張局勢、戰爭和通貨膨脹率上升,旺宏電子 2023 年第四季的 NOR 收入與去年同期(2022 年)相比下降了 29%。

NOR快閃記憶體市場趨勢

ADAS成為成長最快的應用

- ADAS(進階駕駛輔助系統)利用科技協助駕駛安全駕駛。透過利用人機介面,ADAS 正在提高車輛和道路的安全性。這些系統依靠感測器和攝影機等自動化技術來識別潛在的障礙物或駕駛員錯誤並做出適當的反應。 ADAS 使車輛能夠了解周圍環境並管理轉向、煞車和停車等駕駛任務。在ADAS中,NOR Flash記憶體和裝置的重要性至關重要。

- 近年來,汽車應用對 NOR 快閃記憶體的需求不斷增加。一個典型的例子是 ADAS,其中 NOR Flash 的使用量預計將大幅增加。 NOR 快閃記憶體對於安全關鍵型系統至關重要,因此在各種 ADAS(進階駕駛輔助系統)中至關重要。它的非揮發性、可編程性和速度使其成為可靠而高效的選擇。透過讓主機處理器能夠直接從快閃記憶體執行程式碼,無需將程式碼傳輸到外部 DRAM。

- ADAS 在汽車產業正經歷顯著的市場成長。如今,許多 ADAS 應用都使用攝影機(尤其是倒車攝影機)來幫助駕駛員識別附近的危險。先進的感測攝影機可實現更先進的功能,包括自動避碰、車道變換和停車輔助。感測攝影機比觀看攝影機需要更複雜的處理,因此高效的 SoC 對於維持這項先進技術至關重要。隨著程式規模的不斷擴大,對於兼具高密度和高性能的NOR快閃記憶體的需求也不斷成長。

- ADAS 的整合正在推動對乘用車安全性和舒適性的巨大需求。這一成長主要受到美國、日本、中國和德國等已開發國家政府法規的推動,這些法規要求實施 ADAS 以確保乘客安全。

- 此外,自動駕駛汽車的日益普及也推動了市場擴張。例如,英特爾預測,到 2030 年,全球汽車銷售將超過 1.014 億輛,預計自動駕駛汽車將佔同年汽車註冊量的 12% 左右。與此轉變同步,支援 ADAS(進階駕駛輔助系統)出現所必需的工具和儲存設備(如 NOR Flash 產品)也取得了重大發展。

- 亞太地區、北美和歐洲的許多國家都已實施法規,要求在車輛中整合各種 ADAS 技術,以減少道路事故。例如,歐盟推出了「零事故願景」計劃,旨在到2050年消除道路交通事故死亡人數,到2030年將傷亡人數減少50%。歐盟已強制要求使用ADAS、自動緊急煞車等基本安全功能,市場前景龐大。

中國佔主要市場佔有率

- 中國汽車製造業的成長推動了汽車產業對 NOR 快閃記憶體的需求。國內汽車廠商數量的增加以及汽車投資的不斷成長,使得汽車採用先進電子系統的趨勢日益明顯。這種趨勢對 NOR 快閃記憶體提出了更高的要求,它有助於能源管理、提高系統可靠性並實現汽車電子產品的緊湊設計。

- 同樣,國際能源總署 (IEA) 預測,在淨零情境下,到 2030 年電動車 (EV) 銷量將佔汽車銷量的 65% 左右。為實現此目標,2023年至2030年間,電動車銷量需要以每年約25%的速度成長。到2022年,中國將佔全球電動車新註冊量的近60%。在中國,電動車在國內汽車總銷量中的佔比預計將從2021年的16%成長到2022年的29%,超過2025年達到20%的全國目標。此外,到2023年,中國電動車銷量將達到800萬輛。

- 根據中國工業協會預測,2022年中國汽車銷量將達到近2,690萬輛,與前一年同期比較去年同期成長2.1%。這一成長標誌著2022年銷售額連續第二年成長。隨著汽車銷售的成長,對具有先進功能的汽車的需求也在成長,這反過來又推動了對NOR快閃記憶體的需求。

- 根據OICA稱,汽車產量將從2019年的5%成長到2022年的7%。中國政府正在向電動車製造商提供財政獎勵,以鼓勵他們使用電動車。純電動車,單次充電可行駛 400 公里以上,可獲得 12,600 元人民幣(約 2,000 美元)的補貼。續航里程300-400公里的電動車將獲得9,100元人民幣(約1,400美元)的補貼。

- 車用NOR Flash記憶體廣泛應用於智慧網聯、馬達、電池、電控系統、智慧駕駛座、新能源汽車ADAS等領域。

- 無人商店配備了先進的電子系統和技術,並依靠 NOR 快閃記憶體實現多種用途,包括管理和儲存感測器資料以及為即時決策演算法提供支援。

- 例如,2024年3月,提供人工智慧和網路技術的公司百度在武漢推出了名為Apollo Go的24/7機器人計程車服務,代表了中國的自動駕駛產業。此舉是百度擴大自動駕駛叫車服務平台策略努力的一部分。因此,這些功能需要NOR快閃記憶體來存儲軟體應用程式,從而增加了對NOR快閃記憶體的需求。

NOR快閃記憶體產業概況

汽車產業的 NOR 快閃記憶體市場處於半固體,主要企業包括華邦電子股份有限公司、旺宏電子國際、英飛凌科技股份公司、美光科技公司和兆易創新半導體公司。該市場的參與企業正在透過夥伴關係和收購來加強其產品供應並獲得永續的競爭優勢。

- 2024年3月-聚辰科技宣布推出最新的Nor Flash功能安全解決方案,為汽車產業帶來一場技術革命。 Giantec 最新的 Nor Flash 功能安全解決方案採用發達的技術和嚴格的品管標準,以實現更高的安全性和可靠性。

- 2023 年 9 月-旺宏電子國際宣布其 OctaFlash 記憶體系列已獲得 SGS TUV Saar 頒發的 ISO 26262 ASIL D(汽車安全完整性等級)認證。此次 ISO 26262 ASIL D 認證體現了旺宏電子的持續成功,OctaFlash 已發展成為汽車市場強大的快閃記憶體解決方案,在最大限度地提高汽車功能安全性方面發揮關鍵作用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 科技趨勢

- 工業供應鏈分析

- 宏觀趨勢如何影響市場

第5章市場動態

- 市場促進因素

- 智慧汽車的演變

- 研發和製造高成本

第6章市場區隔

- 按密度

- 低密度(32MB或更少)

- 中等密度(32MB至128MB)

- 高密度(128MB 或更大)

- 按應用

- ADAS

- 資訊娛樂

- 儀表叢集等

- 按地區

- 美洲

- 歐洲

- 日本

- 中國

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Winbond Electronics Corporation

- Macronix International Co. Ltd

- Infineon Technologies AG

- Micron Technology Inc.

- Gigadevice Semiconductor Inc.

- Giantec Semiconductor Co.,ltd

第 8 章 供應商排名分析

第9章 市場機會與未來趨勢

The NOR Flash Memory Market For The Automotive Industry is expected to grow from USD 1.02 billion in 2025 to USD 1.85 billion by 2030, at a CAGR of 12.52% during the forecast period (2025-2030).

The NOR flash memory sectors are witnessing a rapid growth rate due to the demand growth in multiple applications, from infotainment to instrument clusters.

Key Highlights

- NOR flash is a memory and one of the types of non-volatile storage technologies. It is used for applications where individual bytes of data need to be written and read. The products are built to offer lower memory densities compared to NAND and enhance the power consumption in end-user devices.

- Conventional automotive technology development usually emphasizes speed, safety, comfort, and energy-saving ability; however, the current focus has gradually shifted to developing a more innovative model capable of using new energy. As a mobile device on the road, the car used to be a separate individual without any interaction with any external device.

- However, with the rapid development of mobile networks, this barrier has broken through, and the vehicle is no longer simply an isolated device on the road. The remote control of a car, or even the communication between vehicles or cars and devices (such as traffic signals,) is in the foreseeable future. The story of the Smart Car can be traced back to the early 90s and the Swiss watch company Swatch, where inventor Nicolas Hayek was interested in the idea of developing an efficient and urbanized vehicle. He initially brought the idea to Volkswagen.

- Thus, many EV manufacturers, such as BYD, Tesla, Nio, Xpeng, and Huawei, have been investing in smart car technologies, seeing them as major selling points for their EVs. Recently, in January 2024, Chinese electric vehicle (EV) giant BYD launched its Xuanji smart car system, seeking to catch up with rivals with functions such as automated parking and voice recognition.

- Research and development costs are expected to increase with the growing end-user requirements for NOR flash memory. Vendors like Micron have invested USD 15 billion in constructing a new fabrication facility for memory manufacturing in Boise, Idaho.

- In addition, the company is also planning to co-locate the new manufacturing fab with Micron's R&D center at the company's headquarters to enhance the technology deployment and improve time to market with operational efficiency to cater to industries like automotive, data centers, and memory applications in artificial intelligence and 5G. This indicates the costly research, development, and fabrication setup and drives the challenges.

- Governments worldwide have been printing money and adopting quantitative easing measures to stimulate economies. This has worked over the past few years, but with looming inflation concerns, all those stimulus measures in the past might not work this time. The chip industry is in a super cycle, a period of prolonged expansion driven by robust demand.

- At the same time, COVID-19 disruptions have brought wide-ranging rises in the cost of everything from logistics to raw materials. The sudden outbreak of the Russian invasion of Ukraine has sparked huge fluctuations in energy and materials markets, further adding to inflationary pressure. For instance, Macronix International Co., Ltd. NOR revenue in Q4 2023 declined by 29% compared to the same period in the previous year(2022) due to ongoing geopolitical tensions, war, and increased inflation.

NOR Flash Memory Market Trends

ADAS to be the Fastest Growing Application

- Advanced driver-assistance systems (ADAS) utilize technologies to aid drivers in safely operating a vehicle. By utilizing a human-machine interface, ADAS enhances both car and road safety. These systems rely on automated technology, including sensors and cameras, to identify potential obstacles or driver mistakes and react appropriately. ADAS empowers a vehicle to understand its environment and manage driving tasks like steering, braking, parking, etc. The importance of NOR Flash memory and devices is crucial in ADAS.

- The need for NOR flash memory in automotive applications has increased recently. A prime example of this is ADAS, where the utilization of NOR Flash is projected to increase significantly. NOR flash memory is crucial in various advanced driver-assistance systems (ADAS) as it is integral to safety-critical systems. Its non-volatile nature, programmability, and speed make it a dependable and efficient choice. Allowing the host processor to run code directly from the flash memory eliminates the need to transfer it to an external DRAM.

- ADAS has experienced a significant market expansion in the automotive industry. Currently, numerous ADAS applications use cameras, particularly backup cameras, to aid drivers in recognizing nearby dangers. Advanced sensing cameras offer even more sophisticated features, such as automated collision avoidance, lane changing, parking assistance, etc. Since sensing cameras necessitate more intricate processing than viewing cameras, highly efficient SoCs will be essential to sustain this advanced technology. The need for NOR Flash memory that offers both high density and high performance will persistently rise alongside the expansion in program size.

- The rise in demand for safety and comfort in passenger cars due to the integration of ADAS has been significant. This growth is primarily fueled by government regulations in developed countries like the United States, Japan, China, and Germany mandating the implementation of ADAS for passenger safety.

- Moreover, the increasing popularity of autonomous vehicles is also driving market expansion. For example, Intel predicts global car sales will exceed 101.4 million units by 2030, with autonomous vehicles expected to represent around 12% of car registrations by the same year. Alongside this shift, there has been a noticeable advancement in the development of essential tools and memory devices like NOR flash products to support the emergence of advanced driver assistance systems (ADAS).

- Many countries in Asia Pacific, North America, and Europe have enforced rules mandating the integration of different ADAS technologies in cars to reduce road accidents. For instance, the European Union has introduced Vision Zero, a project to eliminate road fatalities by 2050. The governing body aims to decrease injuries and deaths by 50% by 2030. It has made it compulsory to include essential safety features like ADAS and automatic emergency braking, creating substantial market prospects.

China to Hold Major Market Share

- The demand for NOR flash memory in China's automotive industry is fueled by the country's growing automotive manufacturing sector. The increasing number of domestic automotive manufacturers and rising investments in automobiles are leading to the trend of incorporating advanced electronic systems into automobiles. This trend results in a higher requirement for NOR flash memory, which aids energy management, improves system dependability, and allows for compact designs in automotive electronics.

- Similarly, the International Energy Agency (IEA) has projected that electric vehicle (EV) sales will make up approximately 65% of total car sales by 2030 in the Net Zero Scenario. To achieve this, there should be an annual growth rate of around 25% in EV sales from 2023 to 2030. China accounted for nearly 60% of all new electric car registrations worldwide in 2022. Within China, the proportion of electric cars in total domestic car sales increased from 16% in 2021 to 29% in 2022, surpassing the national target of a 20% sales share by 2025. Also, in 2023, Eight million electric vehicles were sold in China.

- According to the CAAM (China Association of Automobile Manufacturers), in 2022, the total number of vehicle sales in China reached nearly 26.9 million, representing a 2.1% growth from the year before. This growth indicates the second consecutive year of increasing sales in 2022. As automotive sales increase, the demand for automobiles with advanced features grows, consequently driving the demand for NOR flash memory.

- According to OICA, the motor vehicle production grew from 5% in 2019 to 7% in 2022. The Chinese government offers financial incentives to electric vehicle manufacturers to encourage their use. Vehicles that are completely electric and can travel over 400 km on a single charge qualify for subsidies of RMB 12,600 (around USD 2000). Electric vehicles ranging from 300-400 km are eligible for subsidies of RMB 9100 (approximately USD 1400).

- The automotive NOR flash memories are extensively utilized in intelligent networking, motors, batteries, electronic control systems, intelligent cockpits, and ADAS for new energy vehicles.

- Autonomous vehicles incorporate advanced electronic systems and technologies that rely on Nor flash memory for various purposes, such as managing and storing the sensor data and facilitating real-time decision-making algorithms.

- For instance, in March 2024, Baidu Inc., a provider of AI and internet technologies, introduced a 24/7 robot taxi service called Apollo Go in Wuhan, representing China's autonomous driving industry. This move is part of Baidu's strategic efforts to expand its autonomous ride-hailing service platform. Thus, these features require NOR flash memory for storing software applications, contributing to the demand for NOR flash memory.

NOR Flash Memory Industry Overview

The NOR flash memory market for the automotive industry is semi-consolidated with the presence of significant players like Winbond Electronics Corporation, Macronix International Co. Ltd, Infineon Technologies AG, Micron Technology Inc., and Gigadevice Semiconductor Inc. Players in the market are adopting partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - Giantec announced the launch of the latest Nor Flash functional safety solution, bringing a technological revolution to the automotive industry. Giantec's latest Nor Flash functional safety solution incorporates developed technology and strict quality control standards for higher safety and reliability.

- September 2023 - Macronix International Co. Ltd announced that its OctaFlash memory line has received ISO 26262 ASIL D (Automotive Safety Integrity Level) certification from SGS TUV Saar, ensuring makers of automotive electronic systems that OctaFlash meets the highest level of safety in automotive electronics. This ISO 26262 ASIL D certification reflects how Macronix is building on our success both in OctaFlash's evolution as a powerful Flash-storage solution for the automotive market and in playing a key role in maximizing the functional safety of vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Trends

- 4.4 Industry Supply Chain Analysis

- 4.5 Impact of Macro Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Evolution of Smart Vehicles

- 5.1.2 High Cost of R&D and Fabrication

6 MARKET SEGMENTATION

- 6.1 By Density

- 6.1.1 Low (Less Than 32mb)

- 6.1.2 Medium (32mb to 128mb)

- 6.1.3 High (> 128mb)

- 6.2 By Application

- 6.2.1 ADAS

- 6.2.2 Infotainment

- 6.2.3 Instrument Cluster and Other

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Winbond Electronics Corporation

- 7.1.2 Macronix International Co. Ltd

- 7.1.3 Infineon Technologies AG

- 7.1.4 Micron Technology Inc.

- 7.1.5 Gigadevice Semiconductor Inc.

- 7.1.6 Giantec Semiconductor Co.,ltd