|

市場調查報告書

商品編碼

1694024

歐洲托盤包裝機:市場佔有率分析、行業趨勢和成長預測(2025-2030)Europe Pallet Wrapping Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

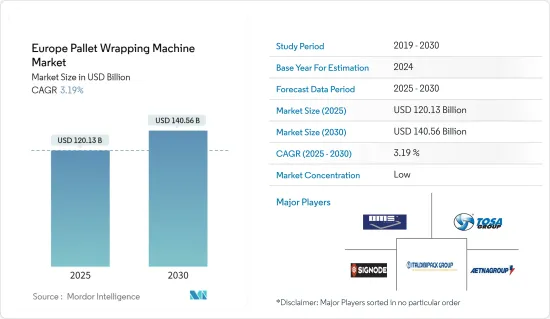

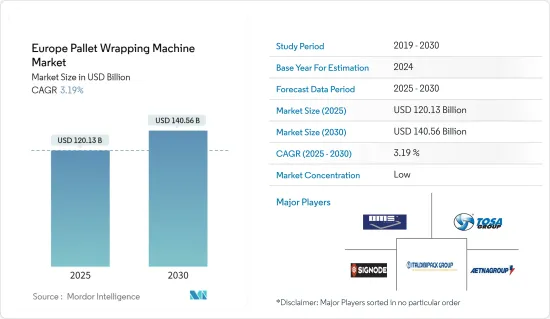

預計 2025 年歐洲托盤包裝機市場規模為 1,201.3 億美元,到 2030 年將達到 1,405.6 億美元,預測期內(2025-2030 年)的複合年成長率為 3.19%。

關鍵亮點

- 托盤是物流環節的主要元素之一。托盤是一種實現貨物機械化運輸、流通和分配的運輸單元。它也是一種可有效用於裝卸、搬運、倉儲、運輸和配送的儲存設備。

- 此外,托盤的價值也轉化為庫存管理利潤。現代生產企業的倉庫管理認知到塑膠托盤的包裝、儲存、裝卸、運輸、配送一體化。托盤的價值正在從物流行業迅速擴大到各類生產加工企業,預計在預測期內托盤將在市場中佔據不可或缺的地位。

- 此外,由於降低物流成本、淘汰以及減少購買、管理和收集托盤的麻煩的需求不斷成長,預計托盤共享的銷售額將會增加。此外,技術進步為托盤共享市場參與企業創造了成長前景。各托盤共享公司正致力於引入帶有無線射頻識別 (RFID) 標籤的托盤。托盤共享市場有望受益於自動化和各個終端用途領域的需求。

- 一次性塑膠包裝通常用於固定托盤上的貨物,但這並不環保。此外,雖然這種方法的成本效益最初看起來很有吸引力,但在高容量倉庫中成本會迅速累積。

- 此外,托盤不合適或包裝過度可能會損壞產品和包裝並影響貨物的結構完整性。在最壞的情況下,浪費的貨物和損壞的產品可能會造成重大的經濟損失。隨著消費者越來越重視永續性,供應鏈經理正在積極尋求可重複使用的環保包裝選擇來取代塑膠包裝和托盤包裝技術。

歐洲托盤包裝機市場趨勢

食品和飲料顯著成長

- 食品和飲料在運輸和儲存過程中通常需要防止變質、污染和損壞。托盤包裝機確保產品安全包裝並免受濕氣、灰塵和害蟲等外部因素的影響。

- 食品和飲料行業是歐洲經濟中最大的製造業之一,與汽車和機械設備行業並列。根據德國聯邦統計局的數據,2019年至2023年期間,德國家庭的食品消費支出增加。從數據來看,2023年私人家庭在食品上的支出將達到約2,033億歐元(2,223.5美元),高於2022年的約1,894億歐元(2,072.4美元)。

- 在食品和飲料行業,托盤包裝由於其易於移動,是運輸大量貨物最實用的方式之一。

- 托盤包裝領域的新創新為歐洲食品和飲料製造商帶來了更高的效率和成本的節省。許多食品和飲料製造商傾向於採用自動化托盤包裝解決方案來改善產品包裝。

英國經濟強勁成長

- 受工業活動激增以及物流和倉儲領域自動化廣泛應用的推動,英國對托盤包裝機的需求將穩定成長。對高效、經濟的包裝解決方案的需求,以及對托盤包裝機在減少運輸過程中的產品損壞和提高整個供應鏈效率方面的作用的認知不斷提高,進一步推動了這一成長軌跡。

- 此外,蓬勃發展的電子商務和快速成長的線上零售業正在推動對托盤包裝機的需求不斷成長,因為企業希望簡化包裝操作,以便將貨物無縫地交付給消費者。例如,英國DHL集團的一項調查發現,31%的消費者使用訂閱式電商模式。線上產品訂購涵蓋各種各樣的產品,從服飾和剃須用品到食品和美容產品。

- 自動化在加強托盤包裝市場方面發揮關鍵作用。人們對作為整體生產設備一部分的包裝機或可以與現有機械一起安裝的系統的需求日益成長。

- 例如,紗線和織物蒸汽定型和調理設備專家 Xorella 將透過在其系統中額外整合托盤包裝機來增強其操作。新機器配備轉盤、稱重站、標籤印表機、安全圍欄和安全系統,形成全面且高效的托盤包裝系統。

歐洲托盤纏繞機產業概況

歐洲托盤包裝機市場細分化,國內和參與企業的競爭十分激烈。主要參與企業有 Robopac(Aetna Group SPA)、Signode Industrial Group LLC(Crown Holdings Inc.)、Tosa Group、Italidibipack SPA 和 Officina Meccanica Sestese SPA(OMS Group)。

- 2023 年 12 月,紙袋製造商 Sentrex 為其托盤採用了 Mondi 的 Advantage StretchWrap 紙包裝解決方案,旨在簡化物流、精簡包裝流程並逐步淘汰不必要的塑膠。 Advantage 拉伸 Wrap 是一種完全可回收的牛皮紙,由負責任的來源材料製成。 Mondi 的 Advantage Stretchwrap 具有高度可拉伸性和抗穿刺性,使其成為傳統用於托盤包裝和運輸的塑膠拉伸膜的理想替代品。

- 2023 年 10 月,包裝技術和機械專家英國亞特蘭大公司推出了 NovaCompact 環形托盤包裝機,這是亞特蘭大集團公司的最新創新產品。 Nova 以其緊湊的設計脫穎而出,可無縫融入傳統包裝機所佔據的空間。這消除了更改設定時出現的物流問題。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 生態系分析

- 行業標準和法規

- 最近的新產品開發和創新趨勢

- 進出口分析

- 包裝器材行業現狀分析

第5章市場動態

- 市場促進因素

- 運輸和物流業的成長以及對保護性包裝的需求

- 托盤作為第三級包裝的需求不斷增加

- 市場問題

- 替代包裝技術的可用性

第6章市場區隔

- 按機器類型

- 自動的

- 半自動

- 手動的

- 依技術

- 戒指

- 手臂

- 轉盤

- 其他

- 按最終用戶產業

- 飲食

- 製藥

- 消費品

- 車

- 紙

- 纖維

- 建造

- 其他

- 按國家

- 法國

- 德國

- 義大利

- 英國

- 比荷盧經濟聯盟

- 比利時

- 盧森堡

- 荷蘭

- 東歐

- 其他歐洲國家

第7章競爭格局

- 公司簡介

- Robopac(Aetna Group SPA)

- Signode Industrial Group LLC(crown Holdings Inc.)

- TOSA Group

- Officina Meccanica Sestese SpA(OMS Group)

- Italdibipack SpA

- Atlanta Stretch SpA

- Siat SpA

- Strema Maschinenbau GmbH

- SYMACH BV(Barry-Wehmiller Group, Inc.)

- Matco International Holding BV

- Cyklop UK Limited

- C& C Group SRL

- Movitec Wrapping Systems SLU

- 公司排名分析

第8章:未來市場展望

The Europe Pallet Wrapping Machine Market size is estimated at USD 120.13 billion in 2025, and is expected to reach USD 140.56 billion by 2030, at a CAGR of 3.19% during the forecast period (2025-2030).

Key Highlights

- The pallet is one of the primary elements of the logistics sector. It is a carrier unit that acknowledges the mechanized transportation, circulation, and distribution of goods. It is also a storage appliance that can be used effectively in loading and unloading, handling, warehouse storage, transportation, and distribution.

- Moreover, the value of pallets is also reflected in the benefit of inventory management. In the warehouse management of modern production firms, the unitized packaging, storage, loading and unloading, transportation, and distribution of plastic pallets have been recognized. The value of pallets has rapidly extended from the logistics industry to various production and processing enterprises, and pallets are expected to occupy an essential position in the market during the forecast period.

- Furthermore, sales in pallet pooling are expected to increase development due to rising demand for lowering logistic costs, eliminating the need for managing pallet distribution and reducing the complexity of pallet purchase, management, and retrieval. Also, technological advancements create growth prospects for the pallet pooling market players. Various pallet pooling companies are focusing on introducing pallets covered in radio frequency identification (RFID) tags. The pallet pooling market is poised to benefit from automation and demand from various end-use sectors.

- Single-use plastic wrap is commonly used to secure pallet loads, which is not environmentally friendly. In addition, the cost-effectiveness of this approach may seem appealing initially, but expenses can accumulate rapidly in warehouses with high volumes.

- Furthermore, poorly or excessively wrapping a pallet can cause damage to both the product and packaging, which can affect the load's structural integrity. In the worst-case scenario, this can result in significant financial losses due to wasted shipments and damaged products. As consumers increasingly prioritize sustainability, supply chain managers are actively seeking reusable and environmentally-conscious alternative packaging options to plastic wrap and pallet wrapping machine technology.

Europe Pallet Wrapping Machine Market Trends

Food and Beverage to Witness Significant Growth

- Food and beverage products often require protection from spoilage, contamination, and damage during transportation and storage. Pallet wrapping machines ensure that products are securely wrapped, preventing exposure to external elements such as moisture, dust, and pests.

- The food and beverages industry is one of the largest manufacturing sectors in the European economy, alongside the automotive, machinery, and equipment industries. According to Statistisches Bundesamt, private household consumer spending on food in Germany increased from 2019 to 2023. In 2023, based on figures, private households spent roughly 203.3 billion euros (USD 222.35) on food, up from around 189.4 billion euros in 2022 (USD 207.24).

- In the food and beverages industry, pallet wrapping is one of the most practical ways to transport large amounts of goods owing to ease of mobility.

- New Innovations in pallet wrapping are offering high efficiency and cost reduction to Europe's food and beverage manufacturers. Many food and beverage manufacturers are inclined toward using automated pallet wrapping solutions to improve the containment of their products.

United Kingdom to Register Significant Growth

- The United Kingdom is poised to experience steady growth in the demand for pallet wrapping machines, propelled by a surge in industrial activities and the widespread adoption of automation within logistics and warehousing sectors. This growth trajectory is further fueled by the imperative for efficient and economical packaging solutions, as well as an increasing recognition of the role of pallet wrapping machines in mitigating product damage during transit and enhancing overall supply chain efficiency.

- Moreover, the flourishing e-commerce landscape and the burgeoning online retail sector drive heightened demand for pallet wrapping machines as businesses seek to streamline packaging operations for the seamless shipment of goods to consumers. For Instance, a DHL Group survey in the United Kingdom shows that 31 % of consumers use the subscription e-commerce model. Online product subscriptions exist for a large variety of products, from clothing and shaving products to food and beauty products.

- Automation plays an important part in enhancing the pallet wrapping market. Wrapping machines that are a part of the production machines as a whole or the systems that can be installed alongside existing machinery are more in demand.

- For example, Xorella, a steam setting and conditioning equipment specialist for yarns and fabrics, will enhance its operations by integrating an additional pallet wrapping machine into its system. This new machine will feature a turntable, weighing station, label printer, safety fence, and security system, forming a comprehensive and efficient pallet wrapping system.

Europe Pallet Wrapping Machine Industry Overview

The European pallet wrapping machine market is fragmented and characterized by intense competition among both domestic and international players. Key players such as Robopac (Aetna Group SPA), Signode Industrial Group LLC (Crown Holdings Inc.), Tosa Group, Italidibipack SPA, Officina Meccanica Sestese SPA (OMS Group) are continuously innovating to improve machine efficiency, reliability, and cost-effectiveness. Market consolidation through mergers and acquisitions is common as companies strive to expand their market share. Additionally, there's a trend toward offering integrated packaging solutions, including pallet wrapping machines, intensifying competition further.

- In December 2023, paper bag manufacturer Sentrex adopted Mondi's Advantage StretchWrap paper wrapping solution for its pallets to simplify logistics, optimize efficiency in the wrapping process, and phase out unnecessary plastics. Advantage Stretchwrap is a fully recyclable kraft paper made from responsibly sourced materials. Mondi developed it to stretch and resist punctures, making it ideal for replacing the plastic stretch film that has traditionally been used for pallet wrapping and transportation.

- In October 2023, Atlanta, UK, a specialist in packaging technology and machinery, introduced the Nova compact ring pallet wrapper, the newest innovative product from the Atlanta group of companies. The Nova stands out for its compact design, which allows it to seamlessly fit into the spaces previously occupied by older wrapping machines. This eliminates any logistical issues that businesses may encounter when changing their setup.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards & Regulations

- 4.5 Recent New Product Development & Innovations

- 4.6 Import-Export Analysis

- 4.7 Insights On Packaging Machinery Industry Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Transportation and Logistics Industry and Need for Protective Packaging

- 5.1.2 Increasing Demand for Pallets as Tertiary Packaging

- 5.2 Market Challenges

- 5.2.1 Presence of Alternative Packaging Technologies

6 MARKET SEGMENTATION

- 6.1 By Machine Type

- 6.1.1 Automatic

- 6.1.2 semi-automatic

- 6.1.3 Manual

- 6.2 By Technology

- 6.2.1 Ring

- 6.2.2 Arm

- 6.2.3 Turntable

- 6.2.4 Other Technologies

- 6.3 By End-user Industries

- 6.3.1 Food and Beverages

- 6.3.2 Pharmaceutical

- 6.3.3 Consumer Products

- 6.3.4 Automotive

- 6.3.5 Paper

- 6.3.6 Textile

- 6.3.7 Construction

- 6.3.8 Others End-user Industries

- 6.4 By Country

- 6.4.1 France

- 6.4.2 Germany

- 6.4.3 Italy

- 6.4.4 United Kingdom

- 6.4.5 Benelux

- 6.4.5.1 Belgium

- 6.4.5.2 Luxembourg

- 6.4.5.3 Netherlands

- 6.4.6 Eastern Europe

- 6.4.7 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robopac (Aetna Group SPA)

- 7.1.2 Signode Industrial Group LLC (crown Holdings Inc.)

- 7.1.3 TOSA Group

- 7.1.4 Officina Meccanica Sestese S.p.A. (OMS Group)

- 7.1.5 Italdibipack S.p.A.

- 7.1.6 Atlanta Stretch SpA

- 7.1.7 Siat S.p.A.

- 7.1.8 Strema Maschinenbau GmbH

- 7.1.9 SYMACH BV (Barry-Wehmiller Group, Inc.)

- 7.1.10 Matco International Holding BV

- 7.1.11 Cyklop UK Limited

- 7.1.12 C&C Group SRL

- 7.1.13 Movitec Wrapping Systems SLU

- 7.2 Company Ranking Analysis