|

市場調查報告書

商品編碼

1773378

托盤搬運車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pallet Jacks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

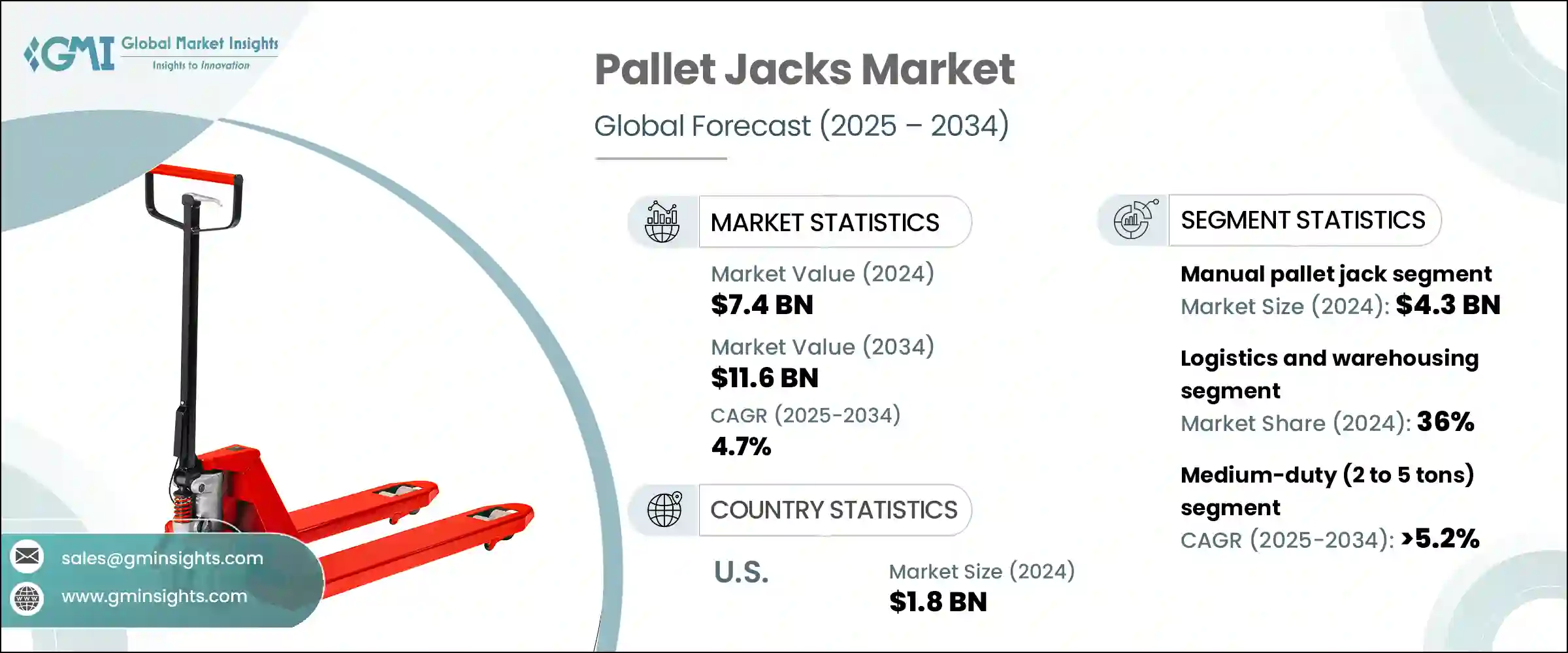

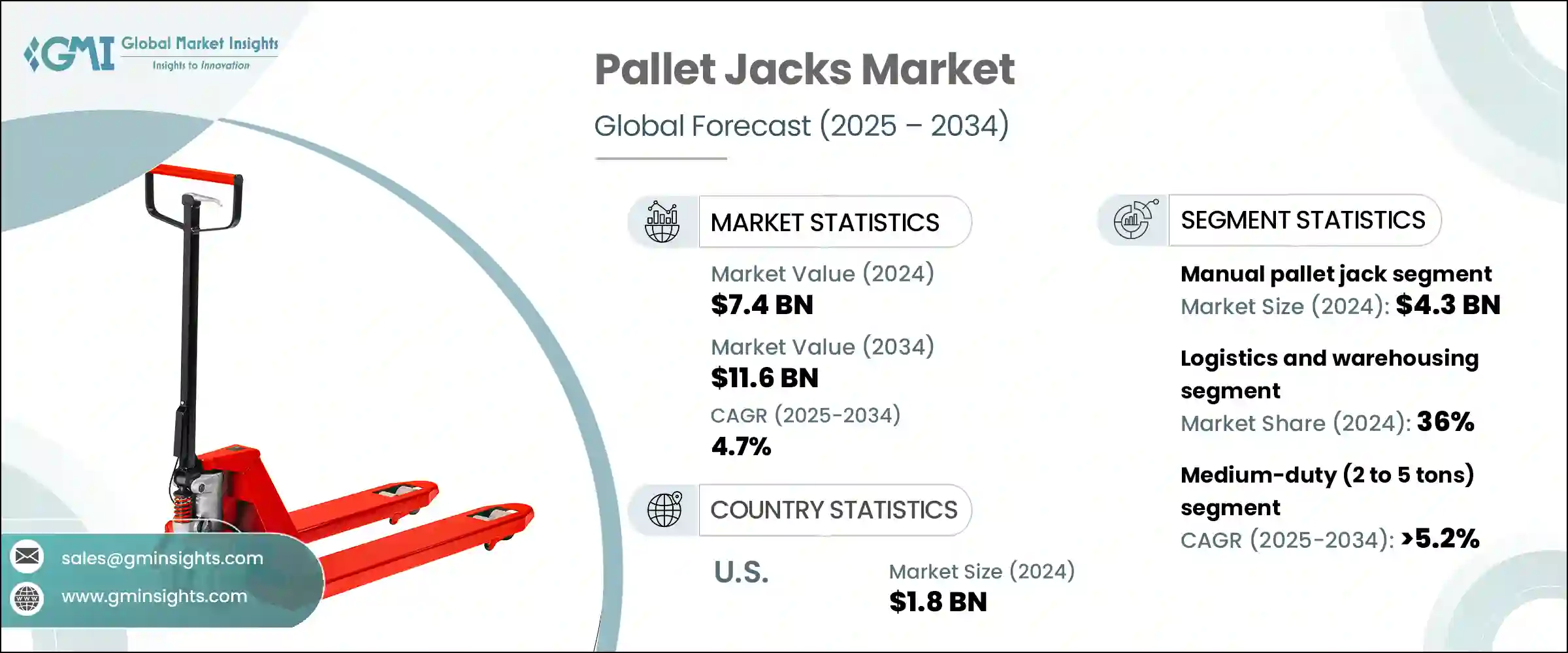

2024年,全球托盤搬運車市場規模達74億美元,預計到2034年將以4.7%的複合年成長率成長,達到116億美元。這一成長主要得益於對物料搬運設備需求的不斷成長以及倉庫和配送中心的快速擴張,尤其是在新興市場。隨著企業尋求提高營運效率和縮短交貨時間,對包括托盤搬運車在內的先進物料搬運解決方案的需求正在不斷成長。全球倉儲產業,尤其是在英國和愛爾蘭等地區,正在經歷重大轉型。

例如,愛爾蘭持續的經濟擴張推動了對倉儲空間的需求成長,因為企業希望擴大營運規模,滿足國內外市場日益成長的需求。經濟擴張不僅刺激了對更多倉儲空間的需求,也促進了物流和供應鏈管理的創新,以確保更順暢、更有效率的配送流程。隨著企業適應新的貿易法規和供應鏈挑戰,他們優先考慮在境內投資倉庫和配送中心。這種轉變對物流格局產生了深遠的影響,促使企業建立更具彈性、更自給自足的供應鏈。英國的物流業是歐洲最成熟、最先進的物流業之一,在應對這些挑戰的過程中實現了加速成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 74億美元 |

| 預測值 | 116億美元 |

| 複合年成長率 | 4.7% |

物流和倉儲領域在2024年佔據36%的市場佔有率,預計2025年至2034年期間的複合年成長率將達到5%。這一成長主要得益於全球貿易的激增、第三方物流供應商的擴張以及對高效物料搬運解決方案日益成長的需求。在這些不斷發展的行業中,托盤搬運車在最佳化供應鏈、提高營運效率和減少人力需求方面正變得不可或缺。此外,電子商務產業的持續擴張也推動了全球對增強型物流和倉儲營運的巨大需求。

就產品類別而言,中型(2 至 5 噸)托盤搬運車市場預計在 2025 年至 2034 年期間的複合年成長率為 5.2%,這主要得益於其在不同行業中處理各種負載的多功能性。電動系統在這些托盤搬運車中的應用也有望進一步推動其普及,因為它們可以提高操作性能、減少人工操作並提升用戶便利性。

美國托盤搬運車市場佔了82%的市場佔有率,2024年市場規模達18億美元。這一主導地位主要歸功於全球倉庫和配送中心的快速擴張。隨著對更快庫存週轉率和更高效儲存解決方案的需求不斷成長,企業擴大投資於托盤搬運車等先進的物料搬運設備,以在蓬勃發展的市場中保持競爭力。美國物流行業自動化和數位化的廣泛趨勢也推動了托盤搬運車的需求。

全球托盤搬運車市場的主要參與者包括 Howard Handling、Jungheinrich、CUBLIFT、Toyota Material Handling、Doosan、Linde Material Handling、Hyster-Yale Materials Handling、Allman、Raymond Corporation、Vestil、Crown Equipment Corporation、RICO、HU-LIFT 和 ots Industrial Robots。為了鞏固市場地位,托盤搬運車行業的公司正在採取各種策略,包括擴展產品組合,包括電動和自動化托盤搬運車,以及專注於產品創新以滿足客戶不斷變化的需求。

與主要物流公司(尤其是第三方物流供應商)建立合作關係,有助於企業增強分銷管道。此外,研發投入也使企業能夠提供更有效率、更具成本效益的解決方案。拓展新興市場並透過本地生產增強製造能力,是企業利用不斷成長的需求的其他策略舉措。強調托盤搬運車營運優勢(包括降低人力成本和提高效率)的行銷策略,也在提升市場地位方面發揮關鍵作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 駕駛式托盤搬運車

- 中心騎乘式托盤搬運車

- 稱重托盤搬運車

- 低矮型托盤搬運車

- 全地形堆高機

- 其他(多向托盤搬運車等)

第6章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 手動托盤搬運車

- 電動托盤搬運車

第7章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 輕型(2噸以下)

- 中型(2至5噸)

- 重型(5噸以上)

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 零售

- 物流和倉儲

- 食品和飲料

- 汽車

- 鋼鐵廠

- 其他(製造商等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Allman

- Clark

- Crown Equipment Corporation

- CUBLIFT

- Doosan

- Howard Handling

- HU-LIFT

- Hyster-Yale Materials Handling

- Jungheinrich

- Linde Material Handling

- Mobile Industrial Robots

- Raymond Corporation

- RICO

- Toyota Material Handling

- Vestil

The Global Pallet Jacks Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 11.6 billion by 2034. This growth is largely driven by the increasing demand for material handling equipment and the rapid expansion of warehouses and distribution centers, particularly in emerging markets. As businesses seek to improve operational efficiency and reduce lead times, the need for advanced material handling solutions, including pallet jacks, is on the rise. The global warehousing industry, particularly in regions such as the UK and Ireland, is undergoing a significant transformation.

For example, Ireland's ongoing economic expansion is driving an increased demand for warehousing space, as businesses look to scale their operations and meet the growing needs of both domestic and international markets. The expansion is not only fueling the demand for more storage but also encouraging innovations in logistics and supply chain management to ensure smoother, more efficient distribution processes. As companies adapt to new trade regulations and supply chain challenges, they are prioritizing investments in warehouses and distribution centers within their borders. This shift has had a profound effect on the logistics landscape, pushing businesses to secure more resilient, self-sufficient supply chains. The UK's logistics sector, one of the most established and advanced in Europe, has seen accelerated growth in response to these challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 4.7% |

The logistics and warehousing segment held a 36% share in 2024 and is forecasted to grow at a CAGR of 5% from 2025 to 2034. This growth is primarily fueled by the surge in global trade, the expansion of third-party logistics providers, and the increasing need for efficient material handling solutions. Pallet jacks are becoming indispensable in optimizing supply chains, improving operational efficiency, and reducing the need for manual labor in these growing sectors. Additionally, the continuous expansion of the e-commerce industry is driving significant demand for enhanced logistics and warehousing operations worldwide.

Regarding product categories, the medium-duty (2 to 5 tons) pallet jacks segment is expected to grow at a CAGR of 5.2% from 2025 to 2034, primarily due to its versatility in handling a variety of loads across different industries. The incorporation of electric-powered systems into these pallet jacks is also expected to drive adoption further, as they improve operational performance, reduce manual effort, and enhance user convenience.

U.S. Pallet Jacks Market held an 82% share and generated USD 1.8 billion in 2024. This dominance is largely attributed to the rapid expansion of warehouses and distribution centers worldwide. With the growing demand for faster inventory turnover and more efficient storage solutions, businesses are increasingly investing in advanced material handling equipment, like pallet jacks, to stay competitive in a booming market. The demand for pallet jacks is also driven by the broader trends of automation and digitization within the U.S. logistics industry.

Key players in the Global Pallet Jacks Market include Howard Handling, Jungheinrich, CUBLIFT, Toyota Material Handling, Doosan, Linde Material Handling, Hyster-Yale Materials Handling, Allman, Raymond Corporation, Vestil, Crown Equipment Corporation, RICO, HU-LIFT, and Mobile Industrial Robots. To strengthen their market presence, companies in the pallet jacks industry are adopting a variety of strategies. These include expanding their product portfolios to include electric-powered and automated pallet jacks, as well as focusing on product innovation to meet the evolving needs of customers.

Partnerships and collaborations with key logistics players, especially third-party logistics providers, help companies enhance their distribution channels. Additionally, investments in research and development are enabling companies to offer more efficient, cost-effective solutions. Expanding into emerging markets and strengthening their manufacturing capabilities through local production are other strategic moves to tap into growing demand. Marketing strategies that emphasize the operational benefits of pallet jacks, including reduced labor costs and increased efficiency, also play a crucial role in boosting their market position.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By type

- 2.2.3 By operation

- 2.2.4 By capacity

- 2.2.5 By end use industry

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Rider pallet jack

- 5.3 Center rider pallet jack

- 5.4 Weighing scale pallet jack

- 5.5 Low profile pallet jack

- 5.6 All-terrain pallet jack

- 5.7 Others (multi-directional pallet jack etc.)

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual pallet jack

- 6.3 Electric pallet jack

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Light duty (below 2 tons)

- 7.3 Medium-duty (2 to 5 tons)

- 7.4 Heavy-duty (above 5 tons)

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Retail

- 8.3 Logistics and warehousing

- 8.4 Food and beverages

- 8.5 Automotive

- 8.6 Steel plants

- 8.7 Others (manufacturers etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Allman

- 11.2 Clark

- 11.3 Crown Equipment Corporation

- 11.4 CUBLIFT

- 11.5 Doosan

- 11.6 Howard Handling

- 11.7 HU-LIFT

- 11.8 Hyster-Yale Materials Handling

- 11.9 Jungheinrich

- 11.10 Linde Material Handling

- 11.11 Mobile Industrial Robots

- 11.12 Raymond Corporation

- 11.13 RICO

- 11.14 Toyota Material Handling

- 11.15 Vestil