|

市場調查報告書

商品編碼

1693961

美國工業感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States (US) Industrial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

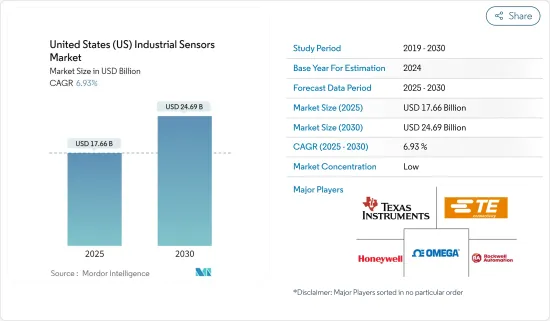

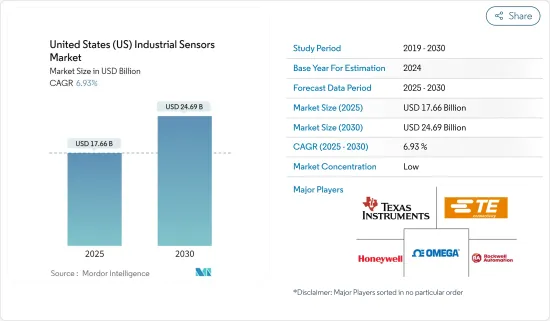

預計 2025 年美國工業感測器市場規模為 176.6 億美元,到 2030 年將達到 246.9 億美元,預測期內(2025-2030 年)的複合年成長率為 6.93%。

工業感測器是工廠自動化和工業 4.0 的重要組成部分。運動、環境和振動感測器等感測器用於監測設備的健康狀況,包括線性和角度定位、傾斜檢測、水平、衝擊和跌落檢測。美國工業有望在經濟和人口方面加強其營運,從而為國內利潤和出口潛力做出貢獻。

關鍵亮點

- 工業感測器系統通常由 24V DC 供電,這與由 3V 或 5V 供電的消費系統中的感測器有很大不同。因此,工業感測器系統需要額外的電源管理來有效驅動感測器。這些系統使用 IO-Link 等數位輸出直接連接到微控制器或無線電收發器。

- 美國物聯網的日益普及可以歸因於快速數位化、技術進步、政府措施、政策和旨在促進數位轉型和工業 4.0 的投資等因素。隨著工業 4.0 和物聯網的普及,製造業的重大轉變要求企業採用更敏捷、更聰明、更具創新性的方式來推動生產,利用自動化和技術補充和增強人力,以減少因製程故障而導致的工業事故。連網型設備和感測器的高度滲透以及 M2M通訊的實現正在製造業中產生越來越資料點。

- 過去兩年,全球汽車產業受到低迷的打擊,美國也出現了同樣的趨勢。該部門的感測器和感測器組件數量有所增加。過去幾年,MEMS 壓力感測器在智慧汽車領域得到了廣泛應用。為此,Asystom 推出了一系列自主性不斷增強的多感測器 IIoT 裝置。

- 多感測器功能將新型機載、連網、節能電子設備與動態分析功能結合,滿足了各種工業設備的預測性維護需求。除了性能提升之外,這些創新產品還環保且可 100% 升級。

- 儘管感測器整合提高了工業自動化水平,但它需要額外的成本,限制了其在成本敏感的應用中的使用。此外,新產品研發活動的高開發成本對於缺乏資金的中小型感測器製造商來說是一個重大挑戰。近年來,成本差距不斷縮小,但仍然昂貴。然而,由於生產力在某些工業環境中至關重要,這些感測器正被全部區域的多個組織廣泛採用。然而,高昂的初始投資仍是市場成長的主要障礙。

美國工業感測器市場趨勢

物聯網的日益普及導致對感測元件的需求正在推動市場

- 物聯網 (IoT) 是工業 4.0 的關鍵組成部分。它廣泛用於製造業和服務業的生產系統監控。透過提高性能,這項技術為製造業開闢了新的創新可能性。物聯網的採用和使用已經改變了各行各業運作、通訊和利用數據的方式,而且其成長沒有放緩的跡象。

- 工業物聯網使各行各業能夠重新思考經營模式,並從工業物聯網設備中獲得可操作的資訊和知識。數據共用生態系統已經開始形成新的收益來源和夥伴關係。

- 同時,從感測器收集的即時數據使工業物聯網能夠為「決策」設備提供動力,從而開發出能夠利用這些內建功能採取特定行動的機器人。這是在倉庫中發生的,是機器人物聯網 (IoRT) 的一部分。物聯網技術作為數位轉型的重要方面,在製造業中的重要性日益凸顯。

- 感測器穩定可靠的性能連接重工業業務資產,每天驅動重要指標。製造商不斷監控其生產線上資產的運作。 IIoT 透過 IIoT 平台和工業連接整合這些複雜產業中常見的傳統機械,以滿足各種使用案例、角色和應用。

- IIoT 使用智慧感測器來監控和改進工業流程和設備。這些感測器即時捕獲和分析有關機器、組件和技術的數據,然後儲存該數據以供進一步分析或發送以通知技術人員或操作員出現問題。根據全球行動通訊系統協會的數據,到 2025 年,北美消費者和工業物聯網 (IoT) 連接總數預計將成長到 54 億。

- 此外,各製造商正在為物聯網設備配備感測器以提高其效能。例如,2023 年 5 月,美國物聯網 (IoT) 解決方案供應商 iMatrix Systems 推出了一系列專為食品和農業儲存、運輸監控、製藥和農業應用而設計的溫度和濕度感測器。 NEO系列感測器能夠快速且準確地測量溫度和濕度的變化,非常適合用於冷藏和冷藏運輸等動態冷藏環境。

壓力感測器佔很大市場佔有率

- 壓力感測器用於許多製程應用和液壓和氣壓設備中,以監測相對系統壓力。這些感測器由於在航太、汽車、醫療和消費品等各行業的應用不斷擴大,多年來經歷了顯著的成長。從實驗室應用到工廠和機械工程,由於測量技術的發展,壓力和液位測量設備與其應用領域一樣多樣化。

- 在過去的幾年裡,越野車和越野車都配備了創新的輪胎壓力控制系統。例如,在梅賽德斯 G63 AMG 6X6 中,駕駛可以分別檢查和改變前軸和後軸的輪胎壓力。據悉,該系統可在不到20秒的時間內將輪胎壓力從0.5巴提升至1.8巴。此類應用,加上對輪胎壓力監測系統 (TMPS) 日益成長的需求,預計將在預測期內佔據輪胎壓力應用中對壓力感測器需求的主導地位。

- 壓阻式和電容式感測器在壓力感測器市場佔據主導地位,因為它們在汽車、醫療、石化和石油天然氣行業的應用日益廣泛。由於光學感測器和諧振固態感測器在危險環境中的應用,預計在預測期內將出現成長。

- 例如,2023年9月,能源科技公司貝克休斯宣布推出最新產品-氫能藥物氫額定壓力感測器。氫氣壓力感測器旨在提供長期穩定性並承受惡劣環境,可用於各種應用,包括燃氣渦輪機、氫氣生產電解和氫氣加氣站。

- 由於人口老化加劇、醫療支出增加以及人口慢性病增多,醫療保健產業也迎來了巨大的成長機會。美國的人均醫療保健支出比世界上任何其他國家都多。美國有明確的醫療保健系統資金來源,大部分費用由私人保險承擔。 2023會計年度,私人保險將承擔約三分之一的醫療保健費用。

美國工業感測器市場概況

美國工業感測器市場高度細分,主要參與者包括 TE Connectivity Ltd.、Omega Engineering Inc.、Honeywell International Inc.、Rockwell Automation Inc. 和 Siemens AG。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 6 月-義法半導體面向工業市場推出首款 MEMS 防水/防液體絕對壓力感測器,並宣稱具有 10 年長壽命計畫。最新的防水壓力感測器提供數位轉型所需的環境穩健性以及保護客戶 MEMS 設計所需的長期可用性。

- 2023 年 1 月 - Quadric 和 ams Osram 建立合作夥伴關係,開發整合感測模組,將最先進的 Mira 系列可見光和紅外線CMOS 感測器與 Quadric 先進的 Chimera GPNPU 處理器結合。整合的超低功耗模組實現了穿戴式科技中新型的智慧感應。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 物聯網的日益普及推動了對感測組件的需求

- 更重視預測性維護和遠端監控

- 市場挑戰/限制

- 高成本和營運問題

第6章市場區隔

- 連結性別

- 有線解決方案

- 無線解決方案

- 按類型

- 流量感測器

- 市場概覽

- 最終用戶產業

- 溫度感測器

- 市場概覽

- 最終用戶產業

- 液位感測器

- 市場概覽

- 最終用戶產業

- 壓力感測器

- 市場概覽

- 最終用戶產業

- 氣體感測器

- 市場概覽

- 最終用戶產業

- 其他感測器

- 流量感測器

第7章競爭格局

- 公司簡介

- Texas Instruments Incorporated

- TE Connectivity Ltd

- Omega Engineering Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- Stmicroelectronics Inc.

- Ams-osram AG

- NXP Semiconductors NV

- Bosch Sensortec GMBH(Bosch Internationals)

- Sick AG

- ABB Ltd

- Omron Corporation

- Emerson Electric Co.

- Endress+Hauser AG

- The Krohne Group

- Yokogawa Electric Corporation

- Meggitt Sensing Systems

- Vega Grieshaber KG

- Analog Devices, Inc.

- Sensata Technologies Inc.

- Infineon Technologies AG

第8章 市場展望

- 當前地緣政治情勢如何影響市場

- 經濟放緩/衰退的預期影響

The United States Industrial Sensors Market size is estimated at USD 17.66 billion in 2025, and is expected to reach USD 24.69 billion by 2030, at a CAGR of 6.93% during the forecast period (2025-2030).

Industrial sensors are a crucial part of factory automation and Industry 4.0. Sensors such as motion, environmental, and vibration sensors are used to monitor equipment health, from linear or angular positioning, tilt sensing, leveling, shock, or fall detection. United States industries are positioned to augment their operations economically and demographically, serving both domestic interests and export possibilities, which will rise soon.

Key Highlights

- An industrial sensor system is often powered by a 24V DC source, which is very different from a sensor in a consumer system that is powered by a 3V or 5V source. As a result, industrial sensor systems require additional power management to drive the sensors effectively. These use digital outputs such as IO-Link directly to a microcontroller or the wireless transceiver.

- The increasing adoption of IoT in the United States can be attributed to factors like rapid digitalization, technological advancements, government initiatives, policies, and investments aimed at promoting digital transformation and Industry 4.0. Due to Industry 4.0 and the acceptance of IoT, massive shifts in manufacturing require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with automation and reduce industrial accidents caused by process failure. With the high adoption rate of connected devices and sensors and the enabling of M2M communication, there has been an increase in the data points generated in the manufacturing industry.

- Although the global automotive sector witnessed a recession in the past two years, the trend was also reflected in the United States. The number of sensors and sensor components increased in the sector. MEMS pressure sensors have witnessed significant adoption in the smart automotive sector in the last few years. For the same, Asystom launched a range of multi-sensor IIoT devices featuring increased autonomy.

- The multi-sensor capability has addressed the predictive maintenance needs of a wide array of industrial equipment, integrating new on-board, connected, energy-saving electronics performing in situ analysis. Apart from increased performance, these innovative products are eco-responsible and 100% upgradeable.

- Although the integration of sensors increases the industrial automation level, it incurs an additional cost, which limits the use in cost-sensitive applications. Additionally, high development costs involved in the research and development activities to manufacture new products act as a critical challenge, mainly for the cash-deficient small and medium-sized sensor manufacturers. While the cost disparity has been declining in the past few years, they still cost more. However, as productivity is crucial in several industrial settings, these sensors have been widely adopted by multiple organizations across the region. However, higher initial investment still poses a significant challenge to the market's growth.

United States (US) Industrial Sensors Market Trends

Growing Adoption of IoT Leading to Demand for Sensing Components Drives the Market

- The Internet of Things (IoT) is a critical component of Industry 4.0. It has extensive applications in the monitoring of production systems in manufacturing and services. This technology opens up new and innovative possibilities in manufacturing by facilitating higher performance. The implementation and use of the Internet of Things transformed how industries operate, communicate, and utilize data, and it is only continuing to grow.

- The Industrial Internet of Things enabled industries to rethink business models, generating actionable information and knowledge from IIoT devices. A data-sharing ecosystem started to build new revenue streams and partnerships.

- On the other hand, aggregated and real-time data from sensors led to the development of robots that can take specific actions because of these built-in capabilities, whereby IIoT becomes a driver of 'decision-making' devices. This happened in warehouses as the Internet of Robotic Things (IoRT). As an essential aspect of digital transformation, IoT technology is becoming increasingly important in the manufacturing industry.

- The consistent and reliable performance of sensors has led the assets in heavy industrial operations to drive critical daily metrics. Manufacturers are constantly monitoring the uptime of assets along their production lines. IIoT integrates legacy machinery commonplace within these complex industries via industrial connectivity with IIoT platforms for different use cases, roles, and applications.

- IIoT uses smart sensors to monitor and improve industrial processes and equipment. These sensors capture and analyze data about machines, components, and techniques in real time and then transmit that data for storage, further analysis, or to notify a technician or operator that something is going wrong. According to the Global System for Mobile Communications Association, by 2025, North America's total number of consumer and industrial Internet of Things (IoT) connections is forecast to grow to 5.4 billion.

- Moreover, various manufacturers are deploying sensors in IoT devices to boost their performance. For instance, in May 2023, iMatrix Systems, a US-based provider of Internet of Things (IoT) solutions, launched a range of temperature and humidity sensors designed for use in food and produce storage, transport monitoring, pharmaceutical, and agriculture applications. The NEO series sensors can quickly and accurately measure changes in temperature and humidity, making them ideal for use in dynamic refrigeration environments like cold storage and refrigerated transportation.

Pressure Sensors to Hold Significant Market Share

- Pressure sensors are utilized to monitor relative system pressure in many process applications, as well as hydraulics and pneumatics. These sensors have witnessed significant growth over the years owing to the increasing applications across various industries, such as aerospace, automotive, healthcare, consumer goods, etc. Ranging from laboratory applications to plant and mechanical engineering, pressure and level measuring devices have become as diverse as their areas of application, thanks to the evolution of measurement technologies.

- In the past few years, exclusive cross-country and off-road cars have been installed with an innovative tire pressure control system. For instance, the G63 AMG 6X6 from the Mercedes enables the driver to check and vary the tire pressure of both the front and rear axles separately. Reportedly, the system takes less than 20 seconds to raise the tire pressure from 0.5 bar to 1.8 bar. Such applications, coupled with increasing demand for Tire Pressure Monitoring Systems (TMPS), are expected to govern the need for pressure sensors in tire pressure applications over the forecast period.

- Piezoresistive and capacitive sensors dominate the pressure sensors market as they are increasingly used in the automotive, medical, petrochemical, oil, and gas industries. Optical and resonant solid-state sensors are anticipated to exhibit increased growth over the forecast period due to their applications in hazardous environments.

- For instance, in September 2023, Baker Hughes, an energy technology company, announced the launch of its latest product for hydrogen-druck hydrogen-rated pressure sensors. Designed to offer longer-term stability and withstand harsh environments, the hydrogen pressure sensors can be used in various applications, including gas turbines, hydrogen production electrolysis, and hydrogen filling stations.

- The medical industry is also observing significant growth opportunities owing to rising geriatric populations, increasing healthcare expenditures, and growing chronic diseases among the considerable population. The USA spends more money on healthcare per person than any other country in the world. Nevertheless, the United States has a distinct method of funding their healthcare system, with most of the costs being covered by private insurance. In the fiscal year 2023, private insurance covers approximately one third of total health spending.

United States (US) Industrial Sensors Market Overview

The United States Industrial Sensors Market is highly fragmented, with the presence of major players like TE Connectivity Ltd, Omega Engineering Inc., Honeywell International Inc., Rockwell Automation Inc., and Siemens AG. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - STMicroelectronics introduced the first MEMS water/liquid-proof absolute pressure sensor with a declared 10-year longevity program for the industrial market. The latest waterproof pressure sensors provide the environmental robustness needed to power digital transformation with the long-term availability necessary to protect customers' MEMS designs.

- January 2023 - Quadric and ams OSRAM established a collaborative partnership to create integrated sensing modules that combine the cutting-edge Mira Family of CMOS sensors for visible and infrared light with Quadric's advanced Chimera GPNPU processors. The integrated ultra-low power modules will allow wearable technology to use new types of smart sensing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Leading to Demand for Sensing Components

- 5.1.2 Growing Emphasis on the Use of Predictive Maintenance and Remote Monitoring

- 5.2 Market Challenges/Restraints

- 5.2.1 High Cost and Operational Concern

6 MARKET SEGMENTATION

- 6.1 By Connectivity

- 6.1.1 Wired Solutions

- 6.1.2 Wireless Solutions

- 6.2 By Type

- 6.2.1 Flow Sensors

- 6.2.1.1 Market Overview

- 6.2.1.2 End-user Industry

- 6.2.2 Temperature Sensors

- 6.2.2.1 Market Overview

- 6.2.2.2 End-user Industry

- 6.2.3 Level Sensors

- 6.2.3.1 Market Overview

- 6.2.3.2 End-user Industry

- 6.2.4 Pressure Sensors

- 6.2.4.1 Market Overview

- 6.2.4.2 End-user Industry

- 6.2.5 Gas Sensors

- 6.2.5.1 Market Overview

- 6.2.5.2 End-user Industry

- 6.2.6 Other Sensors

- 6.2.1 Flow Sensors

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 TE Connectivity Ltd

- 7.1.3 Omega Engineering Inc.

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Siemens AG

- 7.1.7 Stmicroelectronics Inc.

- 7.1.8 Ams-osram AG

- 7.1.9 NXP Semiconductors N.V.

- 7.1.10 Bosch Sensortec GMBH (Bosch Internationals)

- 7.1.11 Sick AG

- 7.1.12 ABB Ltd

- 7.1.13 Omron Corporation

- 7.1.14 Emerson Electric Co.

- 7.1.15 Endress + Hauser AG

- 7.1.16 The Krohne Group

- 7.1.17 Yokogawa Electric Corporation

- 7.1.18 Meggitt Sensing Systems

- 7.1.19 Vega Grieshaber KG

- 7.1.20 Analog Devices, Inc.

- 7.1.21 Sensata Technologies Inc.

- 7.1.22 Infineon Technologies AG

8 MARKET OUTLOOK

- 8.1 Impact of Current Geopolitical Scenarios on the Market

- 8.2 Impact of Anticipated Economic Slowdown/Recession