|

市場調查報告書

商品編碼

1693912

英國玻璃瓶和容器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United Kingdom (UK) Glass Bottles and Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

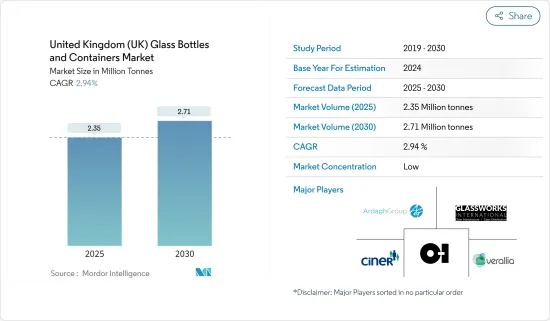

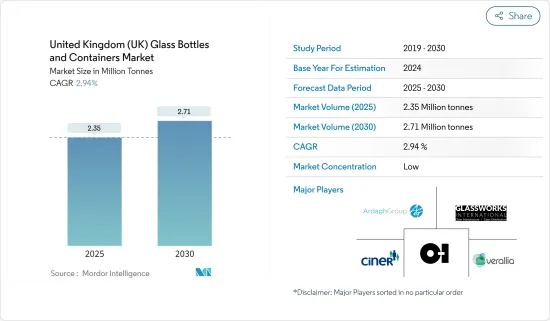

英國玻璃瓶和容器市場規模預計在 2025 年為 235 萬噸,預計在 2030 年達到 271 萬噸,預測期內(2025-2030 年)的複合年成長率為 2.94%。

近年來,塑膠包裝技術取得了長足的進步。儘管如此,玻璃仍然在高階酒精和非酒精飲料包裝中佔據主導地位。玻璃是烈酒和其他酒精飲料最受歡迎的包裝材料之一。需求是由玻璃瓶保存產品香氣和風味的能力所驅動。

關鍵亮點

- 客戶對安全健康包裝的需求不斷成長,推動了各類玻璃包裝的成長。此外,在玻璃上壓花、塑形和添加藝術飾面的創新技術也使玻璃包裝更受最終用戶的青睞。此外,對環保產品的需求以及食品和飲料市場日益成長的需求等因素也在推動市場成長。

- 此外,消費者開始轉向啤酒和葡萄酒,導致玻璃包裝製造商調整生產。高階食品和飲料品牌喜歡玻璃而不是塑膠等其他包裝材料,因為玻璃具有化學惰性、無孔且不滲透的特性。

- 擴大採用塑膠和金屬等替代包裝形式是預測期內影響市場成長的主要因素之一。此外,政府鼓勵使用再生塑膠(rPET)瓶也為玻璃包裝的採用創造了挑戰條件。

- 根據 Argus Media 報導,2022 年 5 月,英國快速消費品 (FMCG) 領域的許多公司和品牌都計劃增加其塑膠包裝的再生成分。英國塑膠聯合會(BPF)估計,目前英國寶特瓶市場的平均回收率在 15% 至 20% 之間。

- 根據歐洲玻璃聯盟的數據,兩年前的產量為 3,950 萬噸。這表明,玻璃製造商除了面臨來自第三國的激烈競爭外,還面臨能源問題。與2021年相比,2022年歐盟27國出口量下降4.6%至430萬噸,但成長14.9%。歐盟27國出口額最大的四大目的地是歐洲其他國家(59.5%),其中包括英國(20%)等等。

- 全國各地擴大採用紙張、塑膠和金屬等替代包裝形式是預測期內影響市場成長的主要因素之一。塑膠製造技術的進步和生質塑膠等高度可回收塑膠的出現預計將進一步推動塑膠包裝的成長。

英國玻璃瓶與容器市場趨勢

最大的終端用戶產業是飲料

- 玻璃是烈酒和其他酒精飲料最受歡迎的包裝材料之一。需求是由玻璃瓶保存產品香氣和風味的能力所驅動。消費者對安全健康包裝的需求不斷成長,推動了各類玻璃包裝的成長。此外,在玻璃上壓花、塑形和添加藝術飾面的創新技術也使玻璃包裝更受最終用戶的青睞。

- 玻璃瓶和容器因其化學無菌性和滲透性主要用於盛裝酒精和非酒精飲料。玻璃也是一種重要的阻隔材料,在包裝透明度方面具有很高的地位。它可用於製造能夠承受二氧化碳損失和氧氣侵入的包裝,從而實現長期儲存。透過新工藝和塗層,玻璃瓶的凸緣性得到了改善。現代輕量化和強化技術提高了玻璃的強度和消費者的便利性。

- 此外,疫情期間,葡萄酒的銷量和消費量成長了好幾倍,大多數葡萄酒都是以標準的 750 毫升瓶裝出售的,儘管小瓶裝等替代品正在興起。疫情期間該地區酒精消費量的增加對玻璃瓶的需求產生了正面影響。

- 根據經濟複雜性觀察站(OEC)的數據,2023 年 4 月英國玻璃瓶出口額為 1,580 萬英鎊(1,948 萬美元),進口額為 4,070 萬英鎊(5,018 萬美元),導致整體虧損為 2,490 萬英鎊(3,070 萬美元)。 2022年4月至2023年4月,英國玻璃瓶出口量從1670萬英鎊(2059萬美元)減少至1580萬英鎊(1948萬美元),減少了93.1萬英鎊(114.7965萬美元),降幅5.57%;進口量從3040萬英鎊(3748萬美元)增加至4007萬英鎊(4940萬美元),增加了1000萬英鎊(123.34562萬美元),降幅33.9%。

- 主要來自酒精和非酒精飲料行業的需求推動了該國玻璃瓶進口量的增加。預計這一成長趨勢在預測期內仍將持續。

弗林特在彩色印刷市場佔有率

- 透明包裝對於葡萄酒、牛奶、啤酒和果汁等食品來說越來越普遍。這項決定是由「顧客喜歡在購買前檢查產品」這項行銷提案所驅動的。

- 在英國,再生玻璃生產的挑戰並不在於其難度,而是製造高度再生的透明玻璃瓶所需的高品質再生透明玻璃(玻璃屑)供應不足。對於需要高回收率玻璃瓶的產品,綠色玻璃是唯一的選擇。深色玻璃也是一個可行的選擇,但可能不適合所有產品和品牌。食品和飲料行業尤其青睞被稱為火石或特火石的最高品質透明玻璃。

- 在回收廠對混色玻璃進行分類是一個耗時且昂貴的過程。因此,破碎的混合玻璃碎片不會被製成新的瓶子,而是被重新利用來製造用作隔熱材料的玻璃纖維產品。多流回收是生產與其他回收材料分離的高品質玻璃玻璃屑的最有效方法。

- 流體的純度至關重要,尤其是對於所加工玻璃的顏色而言。綠色玻璃可由高達 95% 的再生玻璃製成,而白色玻璃和火石玻璃的品質要求更為嚴格。在這種情況下,由於存在污染風險以及對最終產品品質的負面影響,最多只允許使用 60% 的回收玻璃。

- 在葡萄酒行業,瓶子的顏色通常為綠色或琥珀色。然而,最近,出於對環境問題的考慮和商業性需求,人們對更輕、更薄的玻璃瓶的需求也隨之增加。使用更輕的瓶子旨在減少能源消耗、運輸成本和回收成本。此外,使用火石玻璃瓶可以突出玫瑰紅葡萄酒和白葡萄酒的色澤,提高包裝整體的美感。此外,英國啤酒消費量的增加也有望推動市場成長。

英國玻璃瓶與容器市場概況

英國玻璃瓶和容器市場由 Verallia UK Limited(Verallia Packaging SAS)、Ciner Glass Ltd.、OI Glass, Inc. 和 Ardagh Group 等多家主要參與者瓜分。該行業的公司正專注於透過合作、投資、產品創新等方式擴大業務。

- 2023 年 5 月 - Ardagh Glass Packaging (AGP) -英國宣佈建造一座永續性高效的熔爐,以最大限度地減少玻璃生產過程中的溫室氣體排放。

- 2023 年 2 月 - Sinner Glass 簽署水晶公園 III 240,000 平方米土地轉讓協議。透過該協議,Sinner Glass 完成了 2021 年開始的購買流程,並獲得了 LRM 之前擁有的土地的全部使用權。這將使這家玻璃瓶製造商能夠在洛默爾建造一座最先進的工廠,並邁出進一步發展的下一步。選擇洛默爾是因為其與玻璃產業的歷史淵源和傳統以及其戰略位置。這些策略舉措將有助於 Sinner 未來幾年的收益成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 注重循環經濟的工業生態系分析

- 容器玻璃 - 產業現狀

- 俄烏衝突對市場生態系的影響

- 進出口分析

- 按關鍵促進因素(組件和能源消費量)進行的成本分析

第5章市場動態

- 市場促進因素

- 飲料業對玻璃包裝的需求不斷增加

- 玻璃包裝具有可回收優勢,有利於永續性

- 市場問題

- 替代包裝選擇推動市場成長

- 英國更加重視玻璃回收,並對目前回收率進行分析

- 英國與歐洲玻璃容器收集回收市場的比較分析

- 英國玻璃製造業整體分析

- 法律規範

- 零售和餐飲服務業對玻璃容器和瓶子的需求

- 玻璃容器和包裝的消費者趨勢和偏好

- 行業標準 - 瓶子尺寸和形狀

- 英國玻璃產量分析

第6章市場區隔

- 按最終用戶產業

- 飲料

- 酒精飲料

- 啤酒和蘋果酒

- 葡萄酒和烈酒

- 其他酒精飲料

- 非酒精性

- 碳酸飲料

- 牛奶

- 水和其他非酒精飲料

- 食物

- 化妝品

- 其他

- 飲料

- 按顏色

- 琥珀色

- 燧石

- 綠色的

第7章競爭格局

- 公司簡介

- Verallia Packaging(Verallia SA)

- Ciner Glass Ltd

- OI Glass Inc.

- Ardagh Group SA

- Glassworks International

- Gaasch Packaging

- Berlin Packaging

- Vidrala SA

- Beatson Clark

- Stoelzle Flaconnage

第8章投資分析

第9章:市場的未來

The United Kingdom Glass Bottles and Containers Market size is estimated at 2.35 million tonnes in 2025, and is expected to reach 2.71 million tonnes by 2030, at a CAGR of 2.94% during the forecast period (2025-2030).

Plastic packaging technologies have come a long way in recent years. Still, glass continues to dominate upscale alcoholic and non-alcoholic beverage packaging. Glass is among the most preferred packaging materials for alcoholic beverages, such as spirits. The ability of glass bottles to preserve the aroma and flavor of the product is driving the demand.

Key Highlights

- Increasing customer needs for safe and healthier packaging supports glass packaging growth in different categories. Also, innovative technologies for embossing, shaping, and adding artistic finishes to glass make glass packaging more desirable among end users. Furthermore, factors such as the demand for eco-friendly products and the rising need from the food and beverage market are boosting the market's growth.

- Besides, consumers increasingly prefer beer and wine, and glass packaging manufacturers have adjusted their production. Premium food and beverage brands prefer glass (container glass) over other packaging options, such as plastic, as glass is chemically inert, non-porous, and impermeable.

- The growing adoption of alternative forms of packaging, such as plastic and metal, is among the prominent factors affecting the market's growth over the forecast period. In addition, the increase in recycled plastic (rPET) bottles encouraged by the government also leads to challenging conditions for the adoption of glass packaging.

- According to Argus Media, in May 2022, many companies and brands in the UK's fast-moving consumer goods (FMCG) sector aim to increase recycled content in plastic packaging. The British Plastics Federation (BPF) estimates the current average level of recycled content in the United Kingdom PET bottle market is 15%-20%.

- According to Glass Alliance Europe, production with 39.5 million tonnes were produced two years back. This indicates that the glass manufacturers suffered from energy concerns on top of high competition from third countries. Compared with 2021, 2022 extra EU-27 exports decreased by 4.6% in volume at 4.3 million tonnes but increased by 14.9%. The EU-27's four significant clients in volume are the rest of Europe (59.5%), including the UK (20%), and more countries.

- The growing adoption of alternative forms of packaging, such as paper, plastic, and metal, in different parts of the country is among the prominent factors affecting the market's growth over the forecast period. The advancement in plastic manufacturing technologies and the emergence of highly recyclable plastics, such as bio-plastics, are further expected to drive the growth of plastic packaging, as plastic packaging offers a significant cost advantage compared to glass packaging.

United Kingdom (UK) Glass Bottles and Containers Market Trends

Beverages to be the Largest End-user Industry

- Glass is among the most preferred packaging materials for alcoholic beverages, such as spirits. The ability of glass bottles to preserve the aroma and flavor of the product is driving the demand. Rising consumer demand for safe and healthier packaging helps glass packaging grow in different categories. Also, innovative technologies for embossing, shaping, and adding artistic finishes to glass make glass packaging more desirable among end-users.

- Glass bottles and containers are mainly used in alcohol and nonalcoholic beverages because of their chemical sterility and non-permeability. Also, glass is a significant barrier material and ranks highly for transparency in packaging. It creates an extended shelf-life package because it resists CO2 loss and O2 invasion. The glass bottle frangibility has been improved by new processing and coatings. Modern lightweight and strengthening techniques have improved the strength and consumer-friendliness of glass.

- Furthermore, wine sales and consumption have grown manifolds during the pandemic, and while most of the wines sold are packaged in the standard 750-milliliter format, alternatives such as small format bottles are on the rise. The increase in the consumption of liquor in the region during the pandemic has positively impacted the demand for glass bottles.

- According to the Observatory of Economic Complexity (OEC), in April 2023, United Kingdom exports of Glass Bottles totaled GBP 15.8 million (USD 19.48 million), while imports totaled GBP 40.7 million (USD 50.18 million), resulting in an overall trade deficit of GBP 24.9 million (USD 30.70 million). From April 2022 to April 2023, the United Kingdom's export of Glass Bottles decreased by GBP 931,000 (USD 1,147,965), or 5.57%, from GBP 16.7 million (USD 20.59 million) to GBP 15.8 million (USD 19.48 million), while its imports rose by GBP 10,000,000 (USD 12,330,456.2), or 33.9%, from GBP 30.4 million (USD 37.48 million) to GBP 40.07 million (USD 49.40 million).

- The demand from the alcoholic and nonalcoholic beverage industry primarily drives the increase in the import of glass bottles in the country. This upswing is expected to be witnessed in the forecast period also.

Flint to Hold Major Market Share in Colors

- The utilization of transparent packaging is on the rise for food items such as wine, milk, beer, and juice. This decision is driven by the marketing suggestion that customers prefer to inspect the product before purchase.

- In the United Kingdom, the challenge in producing recycled glass is not in its difficulty but rather the insufficient supply of high-quality recycled clear glass (cullet) necessary for making clear glass bottles with high recycled content. Green glass is the only option if a product requires a glass bottle with a high recycled content. While dark glass is a viable alternative, it may not be suitable for certain products and brands, particularly in the food and beverages industry, where a crystal-clear glass of the highest quality, known as flint or extra-flint, is preferred.

- Frequently, the process of segregating mixed-colored glass at a recycling plant is excessively time-consuming and costly. Consequently, the shattered fragments of mixed glass are repurposed to manufacture glass fiber products, which can serve as an insulation material rather than being transformed into fresh bottles. Multi-stream recycling is the most effective method for producing high-quality glass cullet, which is free from other recyclables.

- The purity of the stream is crucially important, particularly with regard to the color of the glass being processed. Green glass can use up to 95% recycled glass, but there are much stricter quality requirements for white or flint glass. In this case, the maximum level of recycled glass permitted is only 60% due to the risk of contamination and its detrimental effect on the final product's quality.

- In the wine industry, the usual bottle colors are green or amber. However, there has been a recent push for lighter and thinner glass bottles due to environmental concerns and commercial demands. This shift towards lighter bottles aims to reduce energy consumption, transportation costs, and recycling expenses. Furthermore, the use of flint glass bottles responds to the need to highlight the color of rose or white wines and improve the overall aesthetics of the packaging. Furthermore, the increasing consumption of beer in the United Kingdom is also expected to boost the growth of the market.

United Kingdom (UK) Glass Bottles and Containers Market Overview

The United Kingdom Glass Bottles and Containers Market is fragmented with various significant players such as Verallia UK Limited (Verallia Packaging SAS), Ciner Glass Ltd., O-I Glass, Inc., Ardagh Group, and more. Companies operating in the industry are focused on expanding their business through collaborations, investments, product innovations, and more.

- May 2023 - Ardagh Glass Packaging (AGP) - United Kingdom announced the building of a highly sustainable, efficient furnace that is set to minimize greenhouse gas emissions from the glass production process.

- February 2023 - Ciner Glass signed a land transfer agreement for 240,000 m2 at Kristalpark III. With this agreement, Ciner Glass finalized the purchase process that started in 2021 and acquired the full right to use the land previously owned by LRM. This will enable the glass bottle manufacturer to constitute the next step in the further development of building a state-of-the-art facility in Lommel. In addition to its historical connection and heritage with the glass industry, Lommel was chosen for its strategic location. Such strategic initiatives are set to help Ciner in revenue growth in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Eco-system Analysis With an Emphasis on Circular Economy

- 4.4 Container Glass - Industry Landscape

- 4.5 Russia-Ukraine Conflict - Impact on the Market Eco-System

- 4.6 Import and Export Analysis

- 4.7 Cost Analysis With Key Drivers (Components and Energy Consumption)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Glass Packaging in Beverage Industry

- 5.1.2 Recyclability Benefits Offered by Glass Packaging Drive Sustainability

- 5.2 Market Challenges

- 5.2.1 Alternative Packaging Options Challenging the Market Growth

- 5.3 Analysis of the Increasing Emphasis on Glass Recycling and the Current Recyclability Rate in the United Kingdom

- 5.4 Comparative Analysis of Collection and Recycling of Container Glass in the United Kingdom as Opposed to the European Market

- 5.5 Analysis of the Overall Glass Manufacturing Industry in the United Kingdom

- 5.6 Regulatory Framework

- 5.7 Demand for Glass Containers and Bottles - Retail and Foodservice Industries

- 5.8 Consumer Trends and Preference for Glass Packaging

- 5.9 Industry Standards - Bottle Sizes and Shapes

- 5.10 United Kingdom Glass Production Analysis

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Beverages

- 6.1.1.1 Alcoholic

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.1.3 Other Alcoholic Beverages

- 6.1.1.2 Non-alcoholic

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Milk

- 6.1.1.2.3 Water and Other Non-alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Other End-user Industries

- 6.1.1 Beverages

- 6.2 By Color

- 6.2.1 Amber

- 6.2.2 Flint

- 6.2.3 Green

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verallia Packaging (Verallia SA)

- 7.1.2 Ciner Glass Ltd

- 7.1.3 O-I Glass Inc.

- 7.1.4 Ardagh Group SA

- 7.1.5 Glassworks International

- 7.1.6 Gaasch Packaging

- 7.1.7 Berlin Packaging

- 7.1.8 Vidrala SA

- 7.1.9 Beatson Clark

- 7.1.10 Stoelzle Flaconnage