|

市場調查報告書

商品編碼

1692520

越南容器玻璃市場:市場佔有率分析、產業趨勢與成長預測(2025-2030)Vietnam Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

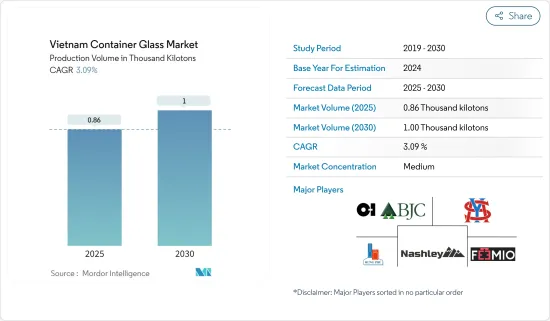

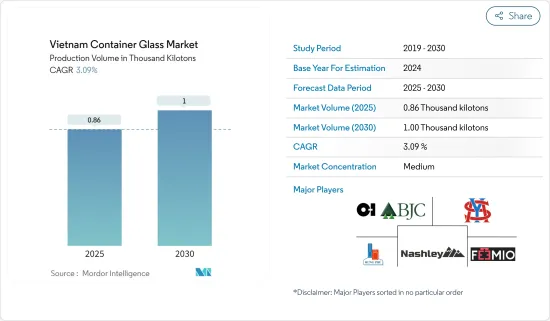

根據產量計算,越南容器玻璃市場規模預計將從 2025 年的 86 萬噸擴大到 2030 年的 100 萬噸,預測期內(2025-2030 年)的複合年成長率為 3.09%。

關鍵亮點

- 隨著越南都市化進程不斷加快,人們對各種食品和飲料的需求也日益成長。該國民眾對外出用餐和簡便食品的偏好正在取代傳統的家庭烹飪和雜貨店購物。推動這一轉變的主要因素包括中產階級的快速成長和人口結構的年輕化。隨著便利商店、咖啡店、小吃店以及更多一般零售和餐旅服務業的蓬勃發展,對玻璃瓶包裝的需求預計將大幅成長。

- 食品和飲料消費量的增加是推動玻璃瓶和各種其他包裝形式需求的主要因素。該國食品和飲料消費量的增加直接影響零售業的成長,為玻璃瓶製造商將越南視為東南亞的重要市場提供了豐厚的機會。例如,根據越南統計總局的數據,2022年該國食品和飲料消費量達到1,027兆越南盾(約421.1億美元),2023年將增加至1,123兆越南盾(約460.4億美元)。

- 此外,消費者對安全和環保包裝的偏好日益成長,推動了越南各領域的玻璃包裝的成長。此外,壓花、模塑和藝術加工等技術進步也增加了玻璃包裝的吸引力。

- 值得注意的是,對環保解決方案的需求不斷成長以及食品和飲料行業的需求不斷成長,進一步推動了越南玻璃包裝市場的發展。此外,對玻璃包裝研發和技術創新的投入不斷增加也在推動市場的發展。

- 然而,塑膠、鋁和軟材料等替代包裝的興起正在阻礙市場成長。這些替代品往往對製造商和消費者都有吸引力,因為它們經濟實惠、重量輕且易於運輸。此外,可回收塑膠和生物分解性包裝等材料的進步正在減少對傳統玻璃容器的需求。

越南容器玻璃市場趨勢

飲料消費量增加推動市場

- 消費者越來越意識到包裝對環境的影響。玻璃可回收,與塑膠相比,被認為是更永續的選擇。這種對環保包裝的偏好可能會刺激對容器玻璃的需求。

- 隨著飲料消費量的增加,對飲料包裝解決方案(包括玻璃瓶)的需求也增加。玻璃能夠保持口味和品質,使其成為多種飲料的首選包裝材料,包括軟性飲料、啤酒、葡萄酒和烈酒。

- 根據美國農業部對外農業服務局和越南統計總局的數據,越南飲料業預計2023年將成長101.3%,在2020年和2021年因疫情而下滑之後,將實現復甦並接近疫情前的水平。不過,2022年強勁復甦,飆升至132.3%,顯示進入強勁復甦階段。

- 日益嚴格的健康和安全法規也會影響包裝的選擇。玻璃具有化學惰性,不會與內容物發生反應,因此是更安全的飲料包裝選擇。遵守這些法規將推動對容器玻璃的需求。

- 對各種口味飲料(尤其是蘇打水)的需求不斷成長,可能會對越南玻璃瓶的成長做出重大貢獻。調味蘇打水通常被宣傳為高檔、健康的飲料。尋求異國風和異國風味的消費者可能會更喜歡能夠維持產品品質和口味的優質包裝。玻璃瓶非常適合此用途,因為它們不會發生反應,並且比塑膠瓶更好地保留飲料的風味和碳酸化。

化妝品領域成長率最高

- 化妝品品牌經常使用獨特、美觀的玻璃罐和瓶子來在擁擠的市場中區分其產品,無論是護膚還是香水。隨著電子商務領域的成長,品牌之間的競爭將會加劇,從而導致擴大使用獨特的玻璃包裝來脫穎而出。

- 隨著越來越多的國內美容和個人護理品牌的出現和發展,這可能會促進對國產玻璃罐和玻璃瓶的需求不斷成長。這種成長將在越南美容產業和容器玻璃製造商之間建立共生關係,進而對容器玻璃市場的成長產生正面影響。

- 化妝品行業線上和線下通路的銷售額都在成長,預計這將增加對容器玻璃的需求。據韓國貿易協會稱,2023 年第三季度,越南從韓國進口了價值約 3.05 億美元的化妝品,高於 2022 年的 3.2702 億美元。越南對化妝品的穩定需求表明市場正在成長,並為國內供應商提供了向國內化妝品製造商供應容器玻璃包裝的機會。

- 2023年12月,越南衛生署(MoH)提案了一項旨在加強化妝品管理的新法令。衛生部已正式向政府提交必要文件,徵求其對提案法令的意見和核准。預計新法令將對化妝品實施更嚴格的品質和安全標準。玻璃瓶惰性,不會與內容物相互作用,因此通常更受青睞,因為它們能夠保持高品質化妝品配方的完整性。因此,更嚴格的法規可能會推動偏好玻璃包裝容器。

越南容器玻璃產業概況

越南的容器玻璃市場相當集中,擁有相對較少的大型公司,例如OI BJC Vietnam Glass Co.、San Miguel Yamamura Packaging Corporation和越南Nashley Technology Joint Stock Company。然而,由於每家公司都生產類似的產品,因此產業內的競爭非常激烈。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 注重循環經濟的工業生態系分析

- 越南玻璃包裝產業標準與法規

- 原料價格趨勢分析:玻璃屑、沙子、容器用玻璃

- 貿易分析

- 越南的容器玻璃產業

第5章市場動態

- 市場促進因素

- 響應生產者延伸責任(EPR),提高民眾環保意識

- 越南飲料消費量增加

- 市場限制

- 替代包裝選擇挑戰市場成長

第6章 玻璃瓶的替代見解與替代品

第7章玻璃收集與回收的經濟分析

第8章市場區隔

- 按最終用戶產業

- 飲料

- 酒精

- 啤酒和蘋果酒

- 葡萄酒和烈酒

- 其他酒精飲料

- 非酒精性

- 碳酸飲料

- 牛奶

- 水和其他非酒精飲料(例如果汁)

- 食物

- 化妝品

- 製藥

- 其他

- 飲料

第9章競爭格局

- 公司簡介

- OI BJC Vietnam Glass Co.

- San Miguel Yamamura Packaging Corporation

- Hung Phu Glass Joint Stock Company

- Vietnam Nashley Technology Joint Stock Company

- Feemio Group Co. Ltd

- Pavico Co. Ltd

第10章:未來市場展望

The Vietnam Container Glass Market size in terms of production volume is expected to grow from 0.86 thousand kilotons in 2025 to 1.00 thousand kilotons by 2030, at a CAGR of 3.09% during the forecast period (2025-2030).

Key Highlights

- Vietnam's increasing urbanization spurs a growing appetite for diverse food and beverages. The country's inclination towards dining out and favouring convenience foods is eclipsing its traditional emphasis on home-cooked meals and grocery shopping. This transition is chiefly propelled by factors such as the swift growth of the middle class and the country's predominantly youthful population. With convenience stores, coffee shops, snack outlets, and the more comprehensive retail and hospitality landscape thriving, the demand for glass bottle packaging is poised for a significant upswing.

- The country's increasing consumption of food and beverages is the primary driver behind the significant demand for various packaging modes, notably glass bottles. The rising consumption of food and beverages in the country has directly influenced the growth of the retail industry, presenting a lucrative opportunity for glass bottle manufacturers to view Vietnam as a significant market in Southeast Asia. For instance, according to the General Statistics Office of Vietnam, the country's food and beverage consumption was VND 1,027 trillion (USD 42.11 billion) in 2022, and it is increased to VND 1,123 trillion (USD 46.04 billion) by 2023.

- Furthermore, the rising consumer preferences for safe and eco-friendly packaging are propelling the growth of glass packaging across various segments in Vietnam. Additionally, technological advancements, including embossing, shaping, and artistic finishes, enhance the appeal of glass packaging.

- Notably, the escalating demand for eco-friendly solutions and a surging appetite from the food and beverage sector are further fueling Vietnam's glass packaging market. The market is also benefiting from increased investments in research and development, which are driving innovations in glass packaging.

- However, the rise of alternative packaging options, including plastic, aluminum, and flexible materials, is hindering market growth. These alternatives tend to be more cost-effective, lighter, and easier to transport, appealing to both manufacturers and consumers. Further Additionally more, advancements in materials, such as recyclable plastics and biodegradable packaging, are diminishing the demand for conventional glass containers.

Vietnam Container Glass Market Trends

Increasing Beverage Consumption in the Country to Drive the Market

- Consumers are increasingly aware of the environmental impact of packaging materials. Glass is recyclable and perceived as a more sustainable option compared to plastics. This preference for environmentally friendly packaging can drive up the demand for container glass.

- With the increase in beverage consumption, there is a higher demand for beverage packaging solutions, including glass bottles. Glass is a preferred packaging material for many types of beverages, including soft drinks, beer, wine, and spirits, due to its ability to preserve taste and quality.

- According to the USDA Foreign Agricultural Service and General Statistics Office of Vietnam, in 2023, the beverage industry experienced a growth rate of 101.3% , showing recovery and nearing pre-pandemic levels after decline in 2020 and 2021 due to pandemic. However, the industry saw a major rebound in 2022 with a notable spik to 132.3%, indicating strong recovery phase.

- Stricter health and safety regulations can also influence packaging choices. Glass is chemically inert and does not interact with the contents, making it a safer choice for beverage packaging. Compliance with these regulations can thus boost the demand for container glass.

- The increasing demand for a diverse range of flavored beverages, particularly sparkling water, can significantly contribute to the growth of glass bottles in Vietnam. Flavored sparkling water is often marketed as a premium, health-conscious beverage. Consumers looking for unique and exotic flavors are likely to prefer premium packaging that maintains the quality and taste of the product. Glass bottles are ideal for this purpose due to their non-reactive nature, preserving the beverage's flavor and carbonation better than plastic.

Cosmetics Segment to Witness Highest Growth Rate

- Brands often use unique and aesthetically glass jars and bottles to differentiate their products, such as skincare and fragrances, in a crowded market. As the e-commerce sector grows, the competition among brands will increase, leading to greater use of distinctive glass packaging to stand out.

- As more domestic beauty and personal care brands emerge and grow, they will contribute to increasing the demand for locally produced glass jars and bottles. This growth can also create a symbiotic relationship between the beauty industry and container glass manufacturers in Vietnam, consequently positively impacting the container glass market growth.

- With the cosmetics industry experiencing increased sales through both online and offline channels, the demand for container glass is expected to rise. According to the Korea International Trade Association, Vietnam imported around USD 305 million worth of cosmetics from South Korea in the third quarter of 2023, compared to USD 327.02 million in 2022. This consistent demand for cosmetics in Vietnam indicates a growing market, offering opportunities for domestic vendors to supply container glass packaging to cosmetics manufacturers in the country.

- In December 2023, the Vietnam Ministry of Health (MoH) proposed a new Decree aimed at enhancing the management of cosmetics. The MoH has formally submitted the necessary documentation to the Government, seeking feedback and approval for the proposed Decree. The new decree is likely to impose stricter quality and safety standards on cosmetic products. Glass jars, which are inert and do not interact with their contents, are often preferred for their ability to maintain the integrity of high-quality cosmetic formulations. As a result, stricter regulations could lead to an increased preference for container glass packaging.

Vietnam Container Glass Industry Overview

The Vietnam container glass market is moderately consolidated with the presence of relatively small number of large companies like O-I BJC Vietnam Glass Co., San Miguel Yamamura Packaging Corporation, and Vietnam Nashley Technology Joint Stock Company, which tend to operate in several regions and diversify their portfolios. However, companies create similar products, thus increasing competition in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Ecosystem Analysis with Emphasis on Circular Economy

- 4.4 Industry Standards and Regulations for Glass Packaging in Vietnam

- 4.5 Raw Material Price Trend Analysis Cullet, Sand, and Container Glass

- 4.6 Trade Analysis

- 4.7 Vietnam Container Glass Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Awareness among the Population in Response to Extended Producer Responsibility (EPR)

- 5.1.2 The Increasing Beverage Consumption in the Country

- 5.2 Market Restraints

- 5.2.1 Alternative Packaging Options Challenging the Market Growth

6 SUBSTITUTION INSIGHTS OF GLASS BOTTLES WITH ALTERNATIVES

7 ECONOMIC ANALYSIS OF GLASS COLLECTION AND RECYCLING

8 MARKET SEGMENTATION

- 8.1 By End-user Industry

- 8.1.1 Beverage

- 8.1.1.1 Alcoholic

- 8.1.1.1.1 Beer and Cider

- 8.1.1.1.2 Wine and Spirits

- 8.1.1.1.3 Other Alcoholic Beverages

- 8.1.1.2 Non-Alcoholic

- 8.1.1.2.1 Carbonated Soft Drinks

- 8.1.1.2.2 Milk

- 8.1.1.2.3 Water and Other Non-alcoholic Beverages (Juices, Among others)

- 8.1.2 Food

- 8.1.3 Cosmetics

- 8.1.4 Pharmaceuticals

- 8.1.5 Other End-user Industries

- 8.1.1 Beverage

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 O-I BJC Vietnam Glass Co.

- 9.1.2 San Miguel Yamamura Packaging Corporation

- 9.1.3 Hung Phu Glass Joint Stock Company

- 9.1.4 Vietnam Nashley Technology Joint Stock Company

- 9.1.5 Feemio Group Co. Ltd

- 9.1.6 Pavico Co. Ltd