|

市場調查報告書

商品編碼

1693892

北美矽砂:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)North America Silica Sand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

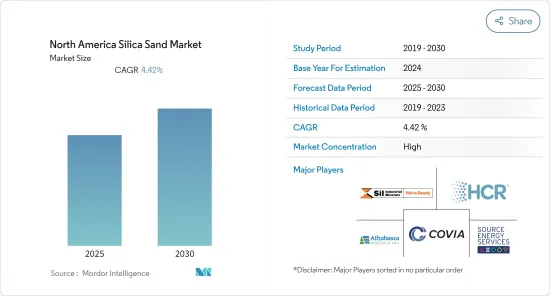

預計北美矽砂市場在預測期內的複合年成長率將達到 4.42%

關鍵亮點

- COVID-19 疫情對多個行業產生了不利影響。北美大部分地區的封鎖擾亂了基礎設施、建設活動、採礦作業和貨運,擾亂了供應鏈。不過,2021年情況開始好轉,市場恢復成長軌跡。

- 北美玻璃製造業的需求成長和鑄造業的消費是推動研究市場成長的關鍵因素。

- 然而,非法開採沙和矽砂替代品的出現可能會抑制所研究市場的成長。

- 牙科和生物技術領域的沙基治療的發展可能為所研究的市場提供豐厚的成長機會。

- 由於石油天然氣和玻璃製造業的矽砂消耗量最高,美國是該地區最大的矽砂市場。

北美矽砂市場趨勢

石油和天然氣產業佔市場主導地位

- 矽砂也被稱為“水力壓裂砂”,因其在水力壓裂中的應用而得名,水力壓裂是石油和天然氣公司用來從頁岩等傳統型低儲存儲層中生產天然氣、液態天然氣和石油的一種完井方法。

- 在頁岩壓裂過程中,矽砂對於從岩石孔隙中釋放天然氣、石油和天然氣液體至關重要。當高壓水流將微小的孔眼推入較大的裂縫時,破碎的沙子會使這些裂縫保持打開狀態,從而繼續釋放石化燃料。當使用白沙來打開這些裂縫時,它被稱為支撐劑。支撐劑越能承受裂縫的巨大壓力,就能開採越多的石油。可以開採更多的石油並最大限度地提高油井的效率。

- 美國和加拿大是世界上最大的石油和天然氣生產國之一。加拿大是世界第四大石油生產國。加拿大的石油和天然氣產業在 12 個省和地區有直接和間接的業務(包括海上業務)。

- 根據能源研究所《2023年世界能源統計評論》,2022年加拿大石油產量將達到2.74億噸,佔全球佔有率的6.2%。此外,這比與前一年同期比較的產量增加了近2.8%。

- 此外,據加拿大石油生產商協會稱,預計到 2023 年加拿大的支出將增至 400 億美元,比 2022 年成長 11%。預計到 2023 年,油砂投資將達到 115 億美元,而傳統型石油和天然氣資本支出為 285 億美元。

- 預計 2022 年北美原油和液體燃料總產量將達到每天 2,781 萬桶,而 2021 年為每天 2,644 萬桶。

- 美國是全球傳統型原油蘊藏量探勘的主要國家之一,其探勘市場蘊藏著巨大的機會。

- 美國是世界上最大的石油和天然氣消費國和出口國之一。根據美國能源資訊署 (EIA) 的數據,2022 年美國原油產量將平均達到 1,190 萬桶/日,比 2021 年增加 70 萬桶/日。此外,預計2023年的產量將超過1,280萬桶/日,打破2019年創下的1,230萬桶/日的年均產量紀錄。

- 考慮到該地區石油和天然氣產量的穩定成長,預測期內對矽砂的需求可能會擴大。

美國主導區域市場

- 石油和天然氣產業是該國矽砂的主要消費者。根據美國能源資訊署的數據,2022 年原油產量為 1,190 萬桶/日。預計到 2023 年這一數字將增至平均每天 1,241 萬桶,到 2024 年將增至平均每天 1,280 萬桶。為了滿足日益成長的人口熱量消耗和工業需求,預計需求將飆升。

- 近年來,美國對全穀矽的需求不斷增加。新道路和建築的發展促進了全穀二氧化矽市場的發展。

- 建築業是矽砂的最大消費者之一。矽砂的物理特性與一般建築用砂不同。矽砂的特性包括化學和物理特性的結合,例如二氧化矽含量高且有害雜質含量極低,因此近年來建築業對矽砂的需求增加。

- 此外,根據美國人口普查局的統計數據,美國每年的新建築投資預計將從 2021 年的 1.5 兆美元增加到 2022 年的 1.66 兆美元。

- 2022年美國住宅建築年價值為8.4916億美元,而2021年為7.4065億美元。矽砂消費量短期內將會增加,2022年將達到8.0843億美元,而2021年為7.5918億美元。

- 鑄造砂是一種高黏度的均質矽砂,用於生產黑色和非鐵金屬的模具和型芯。通常由80%以上的優質矽砂、5-10%的膨潤土、2-5%的水、少於5%的海煤組成。石英砂中高含量的二氧化矽使鑄造業能夠生產出無缺陷且具有優良表面光潔度的高完整性鑄件。汽車、建築和電子等各行業對鋼鐵和鋁的需求不斷增加,預計將推動鑄造廠對矽砂的消費。

- 隨著建築業的成長,國內陶瓷業也有望快速成長。根據美國商務部和北美磁磚委員會(TCNA)的數據,2022年美國磁磚總消費量為2.854億平方公尺。 2022年國內磁磚產量約8,730萬平方公尺,較2021年成長2.3%。

- 因此,考慮到該國各個終端用戶產業的需求和成長,預計美國矽砂市場在未來幾年將穩定成長。

北美矽砂產業概況

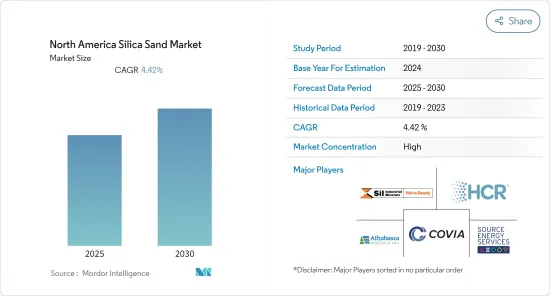

北美矽砂市場趨於整合。主要企業(排名不分先後)包括 Covia Holdings LLC、Hi-Crush Inc.、Source Energy Services Ltd.、Sil Industrial Minerals 和 Athabasca Minerals Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 玻璃產業需求不斷成長

- 鑄造業消費增加

- 其他促進因素

- 限制因素

- 替代產品的可用性

- 非法採砂

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 最終用戶產業

- 玻璃製造

- 鑄件

- 化學製造

- 建設業

- 油漆和塗料

- 陶瓷和耐火材料

- 濾

- 石油和天然氣回收

- 其他終端用戶產業(食品加工、工業磨料、運動領域)

- 地區

- 美國

- 加拿大

- 墨西哥

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Athabasca Minerals Inc.

- Atlas Sand Company, LLC

- Badger Mining Corporation

- Capital Sand Company

- Covia Holdings LLC

- Hi-Crush Inc.

- Sibelco

- Signal Peak Silica LLC

- Sil Industrial Minerals

- Source Energy Services Ltd.

- Superior Silica Sands

- US Silica

第7章 市場機會與未來趨勢

- 水處理產業的未來機會

- 牙科和生物技術領域沙基治療的發展

簡介目錄

Product Code: 50000792

The North America Silica Sand Market is expected to register a CAGR of 4.42% during the forecast period.

Key Highlights

- The COVID-19 pandemic affected several industries negatively. The lockdown in most countries in North America caused disruptions in infrastructure and construction activities, mining operations, and freight transportation which disturbed the supply chain. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

- The growing demand from the glass production industry in North America and consumption in the foundry industry are major factors driving the growth of the market studied.

- However, the illegal mining of sand and the availability of substitutes for silica sand are likely to restrain the growth of the studied market.

- Nevertheless, the development of sand-based treatments in dentistry and biotechnology is likely to create lucrative growth opportunities for the studied market.

- The United States represents the largest market for silica sand in the region owing to the highest consumption of silica sand from the oil and gas and glass production industries.

North America Silica Sand Market Trends

Oil and Gas Industry to Dominate the Market

- Silica sand, also known as "frac sand," comes from its use in hydraulic fracturing, a completion method used by oil and gas companies to produce natural gas, natural gas liquids, and oil from unconventional, low permeability reservoirs such as shale.

- Silica sand is essential in the process of fracturing shale to release natural gas, oil, and natural gas liquids from pores in the rock. When the high-pressure water stream forces the small perforations to become larger fractures, fracking sand keeps these fractures open to continue releasing fossil fuels. When white sand is used to prop open these fractures, it is referred to as a proppant. The longer the proppant can withstand the enormous pressure of the fractures. The more petroleum can be extracted, maximizing the well's efficiency.

- The United States and Canada are among the world's largest Oil and Gas producers. Canada is the world's fourth-largest producer of oil. The Canadian oil and gas industry has direct and indirect operations (including offshore) in twelve provinces and territories.

- According to the Energy Institute Statistical Review of World Energy 2023, Canada's oil production in 2022 was 274 million tonnes, accounting for 6.2% of the global share. Further, this represents a nearly 2.8% increase in production over the previous year.

- Additionally, according to the Canadian Association of Petroleum Producers, spending in Canada is expected to rise to USD 40 billion in 2023, 11% more compared to 2022. Oil sands investment for 2023 is expected to reach USD 11.5 billion, whereas conventional oil and natural gas capital investment is projected at USD 28.5 billion.

- The total production of crude oil and liquid fuels in North America was 27.81 million barrels per day in 2022, compared to 26.44 million barrels per day in 2021.

- The United States is one of the leading countries globally in the exploration of unconventional crude oil reserves, indicating a massive opportunity for the studied market in the country.

- The United States is one of the world's largest consumers and exporters of oil and gas. According to U.S. Energy Information Administration (EIA), crude oil production in the United States was an average of 11.9 million barrels per day (b/d) in 2022, up 0.7 million b/d from 2021. Also, the output will is expected to exceed 12.8 million b/d in 2023, breaking the previous annual average record of 12.3 million b/d set in 2019.

- Considering the steady growth of oil and gas production in the region, the demand for silica sand is likely to grow during the forecast period.

United States to Dominate the Regional Market

- The oil and gas industry is the country's major consumer of silica sand. According to the US Energy Information Administration, the crude oil output was 11.9 million bpd (barrels per day) in 2022. This is estimated to average 12.41 million bpd by 2023 and 12.8 million bpd in 2024. With the increase in heat consumption by the population and to meet the industrial requirement, the demand is expected to surge.

- The demand for whole-grain silica has increased in the United States in recent years. The market for whole-grain silica is being boosted by the development of new roads and buildings.

- The construction industry is one of the largest consumers of silica sand. The physical properties of silica sands are different from the normal construction sands. The properties of silica sand include the combination of chemical and physical properties, such as high silica content and very low levels of deleterious impurities, for which the demand for silica sand has been increasing in the construction industry in recent times.

- Additionally, as per further statistics generated by the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1.66 trillion in 2022, compared to USD 1.50 trillion in 2021.

- The annual value of residential construction put in place in the United States was valued at USD 849.16 million in 2022, compared to USD 740.65 million in 2021. The annual value of non-residential construction put in place in the country was valued at USD 808.43 million in 2022, compared to USD 759.18 million in 2021, thereby increasing the consumption of silica sand in the short term.

- Foundry sand is a uniform silica sand of high consistency that is used to produce molds and cores for ferrous and nonferrous metal castings. It typically comprises more than 80% high-quality silica sand, 5-10% bentonite clay, 2 to 5% water, and less than 5% sea coal. Because of the high silica levels of silica sand, the foundry industry can produce high-integrity castings, free of defects and with superior surface finishes. The rising demand for steel and aluminum in various industries, including automotive, construction, and electronics, is projected to boost the consumption of silica sand in the foundry.

- With the growing construction industry, the ceramic industry in the country is expected to grow rapidly. According to the US Department of Commerce and Tile Council of North America (TCNA), total ceramic tile consumption in the United States was 285.4 million square meters in 2022. The volume of domestically produced tile was around 87.3 million square meters in 2022, up 2.3% in 2021.

- Consequently, given the demand and growth across various end-user industries in the country, the silica sand market in the United States is forecasted to witness steady growth in the coming years.

North America Silica Sand Industry Overview

The North America silica sand market is consolidated in nature. The major players (not in any particular order) include Covia Holdings LLC, Hi-Crush Inc., Source Energy Services Ltd., Sil Industrial Minerals, and Athabasca Minerals Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Glass Industry

- 4.1.2 Increasing Consumption in the Foundry Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Illegal Mining of Sand

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-User Industry

- 5.1.1 Glass Manufacturing

- 5.1.2 Foundry

- 5.1.3 Chemical Production

- 5.1.4 Construction

- 5.1.5 Paints and Coatings

- 5.1.6 Ceramics and Refractories

- 5.1.7 Filtration

- 5.1.8 Oil and Gas Recovery

- 5.1.9 Other End User Industries (Food Processing, Industrial Abrasives and Sports Fields)

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Merger & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Athabasca Minerals Inc.

- 6.4.2 Atlas Sand Company, LLC

- 6.4.3 Badger Mining Corporation

- 6.4.4 Capital Sand Company

- 6.4.5 Covia Holdings LLC

- 6.4.6 Hi-Crush Inc.

- 6.4.7 Sibelco

- 6.4.8 Signal Peak Silica LLC

- 6.4.9 Sil Industrial Minerals

- 6.4.10 Source Energy Services Ltd.

- 6.4.11 Superior Silica Sands

- 6.4.12 U.S. Silica

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Opportunities in the Water Treatment Industry

- 7.2 Development of Sand-based Treatments in Dentistry and Biotechnology

02-2729-4219

+886-2-2729-4219