|

市場調查報告書

商品編碼

1693852

聚醯胺(PA)6:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Polyamide (PA) 6 - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

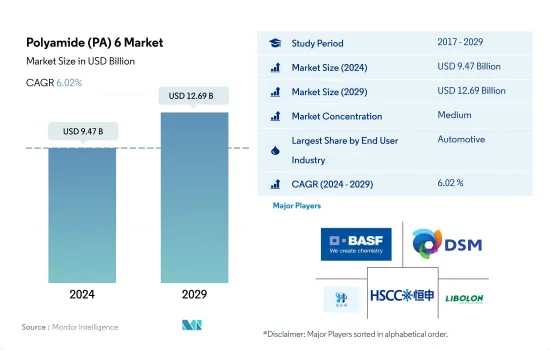

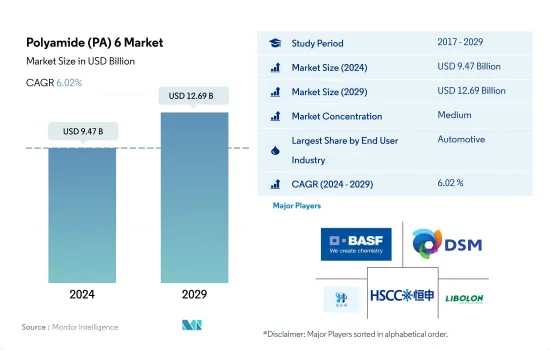

聚醯胺 (PA) 6 市場規模預計在 2024 年為 94.7 億美元,預計到 2029 年將達到 126.9 億美元,預測期內(2024-2029 年)的複合年成長率為 6.02%。

航太領域推動市場成長

- 聚醯胺 6(尼龍)樹脂因其韌性和耐磨性而在幾乎所有行業中都有許多用途。尼龍 6 用於韌性、潤滑性和耐磨性很重要的地方。到 2022 年,全球聚醯胺 (PA)6 市場的收入將佔聚醯胺總消費量的 50%。

- 聚醯胺 6 廣泛應用於汽車工業的各種用途。進氣歧管閥和引擎罩是 PA 6 的常見應用。汽車對高強度、輕質複合材料的日益成長的趨勢推動了對 PA 6 的需求。 2022 年全球汽車產量為 1.43 億輛。預計 2023 年至 2029 年期間的複合年成長率將達到 3.16%。

- 電氣和電子產業是聚醯胺 6 的第二大消費產業。預計電氣和電子行業的收益將在 2022 年達到 5800 億美元的峰值,2023 年至 2029 年的複合年成長率為 6.61%。例如,全球家用電子電器產品銷售額預計將從 2023 年的 6,660 億美元成長到 2027 年的 1,0,710 億美元。

- 航太是全球成長最快的聚醯胺 6 終端用戶產業,預計在預測期內(2023-2029 年)以金額為準將以 7.48% 的最高複合年成長率成長。預計未來幾年全球航太零件產量的成長將推動對聚醯胺 6 的需求。例如,全球航太零件製造業收益預計將從 2023 年的 5,055 億美元成長到 2029 年的 7,235 億美元。

預測期內亞太地區將繼續佔據主導地位

- 聚醯胺 6 具有耐高溫和耐腐蝕環境等多種特性,適用於航太、汽車、電氣和電子產業。

- 2022年,亞太地區將在PA 6消費量市場佔有率。 2022年,中國將佔聚醯胺6消費量的61%,其次是日本,佔11%,預計預測期內的複合年成長率為6.81% (以金額為準)。中國汽車產業是聚醯胺6的主要消費產業,2022年汽車產業將佔全國聚醯胺6總消費量的32%。隨著國內需求的激增和外商投資的下降,尤其是在電動車市場,中國汽車產業可能會繼續成長,導致對聚醯胺6的需求增加。例如,預計2029年中國汽車產量將達到6,400萬輛,而2022年為4,600萬輛。

- 中東是聚醯胺 6 成長最快的消費地區,預計預測期內以金額為準複合年成長率為 7.18%。這是由於電氣和電子、包裝和航太行業的成長,預計這些行業的複合年成長率分別為 8.88%、7.16% 和 8.08%。中東各國政府正透過數位轉型實現國家轉型目標,加大對電氣電子領域的投入,帶動電氣電子生產收入大幅成長。各國政府正在不斷增加對航太和國防的投資,以促進該地區的零件製造業。

全球聚醯胺(PA)6大市場趨勢

電子產業的技術進步可能推動成長

- 電子產品技術創新的快速步伐推動著對更新、更快的電氣和電子產品的持續需求。 2022年,全球電氣及電子產品銷售額預計達到5.807兆美元,其中亞太地區佔74%的市場佔有率,其次是歐洲,佔13%的市場佔有率。預計預測期內全球電氣和電子設備市場複合年成長率將達到 6.61%。

- 2018年,亞太地區經濟成長強勁,受中國、韓國、日本、印度和東南亞國協快速工業化的推動。 2020年,受疫情影響,晶片短缺、供應鏈效率低等因素導致全球電子電氣生產放緩,營收與前一年同期比較增僅0.1%。由於疫情期間人們被迫待在室內,對遠距工作和家庭娛樂家用電子電器產品的需求推動了這一成長。

- 預測期內,對數位化、機器人、虛擬實境、擴增實境、物聯網 (IoT) 和 5G 連接等先進技術的需求預計將成長。預計 2027 年全球電氣和電子設備產量將成長 5.9%。由於技術進步,預測期內對消費性電子產品的需求預計將上升。例如,預計 2027 年全球消費性電子產業收益將達到約 9,046 億美元,而 2023 年為 7,191 億美元。因此,預計技術發展將在預測期內引領對電氣和電子產品的需求。

聚醯胺(PA)6產業概覽

聚醯胺(PA)6市場適度整合,前五大公司佔49.52%的市佔率。市場的主要企業包括BASF、帝斯曼、杭州聚和順新資料、海印控股集團、力寶龍等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 電氣和電子

- 包裝

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中國

- EU

- 印度

- 日本

- 馬來西亞

- 墨西哥

- 奈及利亞

- 俄羅斯

- 沙烏地阿拉伯

- 南非

- 韓國

- 阿拉伯聯合大公國

- 英國

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 電氣和電子

- 工業/機械

- 包裝

- 其他

- 地區

- 非洲

- 按國家

- 奈及利亞

- 南非

- 其他非洲國家

- 亞太地區

- 按國家

- 澳洲

- 中國

- 印度

- 日本

- 馬來西亞

- 韓國

- 其他亞太地區

- 歐洲

- 按國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 英國

- 其他歐洲國家

- 中東

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 北美洲

- 按國家

- 加拿大

- 墨西哥

- 美國

- 南美洲

- 按國家

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BASF SE

- Domo Chemicals

- DSM

- Guangdong Xinhui Meida Nylon Co.,Ltd

- Hangzhou Juheshun New Materials Co., Ltd.

- Highsun Holding Group

- KuibyshevAzot

- LANXESS

- LIBOLON

- UBE Corporation

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 5000192

The Polyamide (PA) 6 Market size is estimated at 9.47 billion USD in 2024, and is expected to reach 12.69 billion USD by 2029, growing at a CAGR of 6.02% during the forecast period (2024-2029).

Aerospace sector to lead the market's growth

- Polyamide 6 (nylon) resins have many applications in almost every industry due to their toughness and abrasion resistance. Nylon 6 is used in applications where toughness, lubricity, and wear are important. The global polyamide (PA) 6 market accounted for 50% of the overall polyamide consumption by revenue in 2022.

- Polyamide 6 is widely used in the automotive industry for a variety of applications. Air intake manifold valves and engine covers are frequent applications of PA 6. The rising trend of high-strength and lightweight composites in automotive is driving the demand for PA 6. Global vehicle production was at 143 million units in 2022. It is expected to record a CAGR of 3.16% by volume between 2023 and 2029.

- The electrical and electronics industry is the second-largest consumer of polyamide 6. The revenue from electrical and electronics production peaked in 2022 at USD 580 billion, recording a CAGR of 6.61% between 2023 and 2029 due to an increase in the demand for consumer electronics with increasing technological innovations across different regions. For instance, consumer electronics worldwide are projected to reach a revenue of USD 1071.0 billion by 2027 from USD 666.0 billion in 2023.

- Aerospace is expected to be the fastest-growing end-user industry for polyamide 6 at the global level, with the highest CAGR of 7.48% in terms of value during the forecast period (2023-2029). The rising aerospace components production across the world is expected to drive the demand for polyamide 6 in the coming years. For instance, the aerospace components production revenue at the global level is projected to reach USD 723.5 billion by 2029 from USD 505.5 billion in 2023.

Asia-Pacific to remain dominant during the forecast period

- Polyamide 6 exhibits versatile properties like resistance to high temperatures and corrosive environments, making it suitable for the aerospace, automotive, and electrical and electronics industries.

- Asia-Pacific held the largest market share in terms of PA 6 consumption in 2022. It is projected to register a CAGR of 6.81% in terms of value during the forecast period, attributed to countries like China and Japan, which accounted for 61% and 11%, respectively, of the region's overall polyamide 6 consumption in 2022. China's automotive industry is the major consumer of polyamide 6, accounting for 32% of the country's overall polyamide 6 consumption in 2022. Owing to a surge in local demand and reduced foreign investments, particularly in the EV market, the Chinese automotive industry may continue to grow, thus increasing the demand for polyamide 6. For instance, China's vehicle production is expected to reach 64 million units by 2029 compared to 46 million units in 2022.

- Middle East is the fastest-growing consumer of PA 6. It is likely to record a CAGR of 7.18% in terms of value during the forecast period, attributed to growing electrical and electronics industry, packaging and aerospace industry, which is expected to grow at a CAGR of 8.88%, 7.16% and 8.08% respectively. The governments in the Middle East are applying digital transformation to achieve the national transformation goals, it has increased investments in electrical and electronics segment and there has been a significant increase in the electrical and electronics production revenue. The governments have been consistently increasing their aerospace and defense investment to boost the component manufacturing in the region.

Global Polyamide (PA) 6 Market Trends

Technological advancements in electronics industry may foster the growth

- The rapid pace of technological innovation in electronic products is driving the consistent demand for new and fast electrical and electronic products. In 2022, the global revenue of electrical and electronics stood at USD 5,807 billion, with Asia-Pacific holding a 74% market share, followed by Europe with a 13% share. The global electrical and electronics market is expected to record a CAGR of 6.61% during the forecast period.

- In 2018, the Asia-Pacific region witnessed strong economic growth owing to rapid industrialization in China, South Korea, Japan, India, and ASEAN countries. In 2020, due to the pandemic, there was a slowdown in global electrical and electronics production due to the shortage of chips and inefficiencies in the supply chain, which led to a stagnant growth rate of 0.1% in revenue compared to the previous year. This growth was driven by the demand for consumer electronics for remote working and home entertainment as people were forced to remain indoors during the pandemic.

- The demand for advanced technologies, such as digitalization, robotics, virtual reality, augmented reality, IoT (Internet of Things), and 5G connectivity, is expected to grow during the forecast period. Global electrical and electronics production is expected to register a growth rate of 5.9% in 2027. As a result of technological advancements, the demand for consumer electronics is expected to rise during the forecast period. For instance, the global consumer electronics industry is projected to witness a revenue reach of around USD 904.6 billion in 2027, compared to USD 719.1 billion in 2023. As a result, technological development is projected to lead the demand for electrical and electronic products during the forecast period.

Polyamide (PA) 6 Industry Overview

The Polyamide (PA) 6 Market is moderately consolidated, with the top five companies occupying 49.52%. The major players in this market are BASF SE, DSM, Hangzhou Juheshun New Materials Co., Ltd., Highsun Holding Group and LIBOLON (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Japan

- 4.2.9 Malaysia

- 4.2.10 Mexico

- 4.2.11 Nigeria

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 South Africa

- 4.2.15 South Korea

- 4.2.16 United Arab Emirates

- 4.2.17 United Kingdom

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Country

- 5.2.1.1.1 Nigeria

- 5.2.1.1.2 South Africa

- 5.2.1.1.3 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Country

- 5.2.2.1.1 Australia

- 5.2.2.1.2 China

- 5.2.2.1.3 India

- 5.2.2.1.4 Japan

- 5.2.2.1.5 Malaysia

- 5.2.2.1.6 South Korea

- 5.2.2.1.7 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Country

- 5.2.3.1.1 France

- 5.2.3.1.2 Germany

- 5.2.3.1.3 Italy

- 5.2.3.1.4 Russia

- 5.2.3.1.5 United Kingdom

- 5.2.3.1.6 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Country

- 5.2.4.1.1 Saudi Arabia

- 5.2.4.1.2 United Arab Emirates

- 5.2.4.1.3 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Country

- 5.2.5.1.1 Canada

- 5.2.5.1.2 Mexico

- 5.2.5.1.3 United States

- 5.2.6 South America

- 5.2.6.1 By Country

- 5.2.6.1.1 Argentina

- 5.2.6.1.2 Brazil

- 5.2.6.1.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 BASF SE

- 6.4.2 Domo Chemicals

- 6.4.3 DSM

- 6.4.4 Guangdong Xinhui Meida Nylon Co.,Ltd

- 6.4.5 Hangzhou Juheshun New Materials Co., Ltd.

- 6.4.6 Highsun Holding Group

- 6.4.7 KuibyshevAzot

- 6.4.8 LANXESS

- 6.4.9 LIBOLON

- 6.4.10 UBE Corporation

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219