|

市場調查報告書

商品編碼

1693819

英國工程塑膠:市場佔有率分析、產業趨勢和成長預測(2024-2029)United Kingdom Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

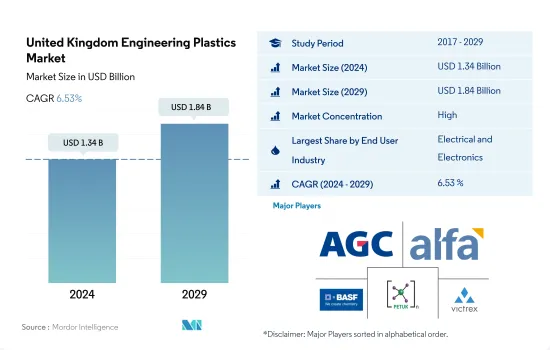

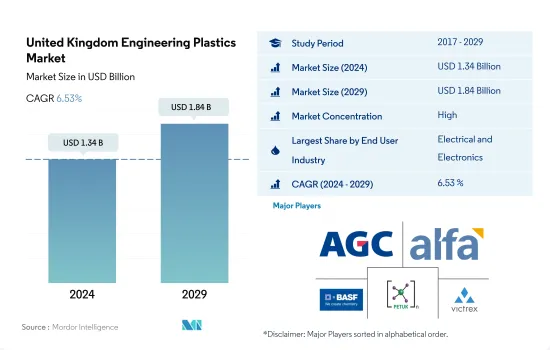

英國工程塑膠市場規模預計在 2024 年達到 13.4 億美元,預計到 2029 年將達到 18.4 億美元,預測期內(2024-2029 年)的複合年成長率為 6.53%。

先進材料的應用日益廣泛,推動了工程塑膠的需求

- 工程塑膠,也稱為熱塑性聚合物,是一種合成樹脂,與傳統塑膠相比,具有高性能和改進的塑膠性能。它在很寬的溫度範圍內都很穩定,可以承受很大的機械應力和氣候變化。

- 包裝製造業每年的銷售額超過 136 億美元,這主要得益於食品和飲料、製藥、個人保健產品和家居用品等特定行業的高需求。包裝產業是該地區最大的工程塑膠消費產業,佔2022年工業總消費量的約39%。由於生活方式的不斷變化和塑膠包裝的多種用途,預計該行業在預測期內的以收益為準年成長率將達到5.73%。

- 電子電氣產業是中國工程塑膠的第二大消費產業,佔2022年工業總消費量的12%。該產業的發展受到行動電話、電腦、穿戴式裝置和電視等家用電子電器產品的推動。例如,預計家用電子電器產業在2023年將創造324.8億美元的收益。因此,預計該產業工程塑膠的消費量在預測期內將以6.77%的複合年成長率成長。

- 預計航太業在預測期內將達到8.27%的最高成長率。飛機變得更輕、更快的新技術發展正在推動工程塑膠的消費。

英國工程塑膠市場趨勢

科技創新推動家用電子電器市場

- 在英國,2020年至2021年間,電氣和電子設備產量增加了10.7%。電子產業在英國製造業中發揮重要作用,佔整個產業的4.7%。 2017年,附加價值毛額84億歐元,銷售收入為194億歐元。

- 過去20年,英國電子產業經歷了轉型,更加重視高科技和密集型的生產流程。該國國家微電子實驗室是歐洲最大的獨立半導體設計製造商,佔專用積體電路設計市場的50%和歐洲所有獨立電子設計的40%。這種轉變使得英國的電子業務從製造和組裝轉向了零件設計創新,主要企業的半導體軟體設計商 ARM 就是一個突出的例子。

- 電子產品佔英國研發製造業總支出的12%以上。前十大出口市場由知名的西方經濟體和中國、香港、阿拉伯聯合大公國等亞洲新興市場組成。然而,英國在2019年面臨脫歐、美國貿易戰、研發資金和網路安全問題等挑戰。

- 由於智慧型設備需求不斷成長、亞洲市場不斷擴大、醫療設備技術進步、節能技術、物聯網 (IoT)、5G 技術、虛擬和擴增實境的使用以及自動化,預計該國的電氣和電子設備產量將會增加。

英國工程塑膠產業概況。

英國工程塑膠市場相當集中,前五大公司佔100%的市場。該市場的主要企業包括 AGC Inc.、Alfa SAB de CV、 BASF SE、Polymer Extruding Technologies (UK) Ltd、Victrex 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 電氣和電子

- 包裝

- 進出口趨勢

- 價格趨勢

- 回收概述

- 聚醯胺(PA)回收趨勢

- 聚碳酸酯(PC)回收趨勢

- 聚對苯二甲酸乙二醇酯(PET)的回收趨勢

- 苯乙烯共聚物(ABS、SAN)的回收趨勢

- 法律規範

- 英國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 電氣和電子

- 工業/機械

- 包裝

- 其他

- 樹脂類型

- 氟樹脂

- 依亞型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯(PVF)

- 聚二氟亞乙烯(PVDF)

- 其他子樹脂類型

- 液晶聚合物(LCP)

- 聚醯胺(PA)

- 依樹脂類型分

- 芳香聚醯胺

- 聚醯胺(PA)6

- 聚醯胺(PA)66

- 聚鄰苯二甲醯胺

- 聚丁烯對苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 聚醚醚酮(PEEK)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚醯亞胺(PI)

- 聚甲基丙烯酸甲酯(PMMA)

- 聚甲醛(POM)

- 苯乙烯共聚物(ABS和SAN)

- 氟樹脂

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AGC Inc.

- Alfa SAB de CV

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- INEOS

- Mitsubishi Chemical Corporation

- Polymer Extrusion Technologies (UK) Ltd

- Radici Partecipazioni SpA

- Solvay

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Victrex

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 5000157

The United Kingdom Engineering Plastics Market size is estimated at 1.34 billion USD in 2024, and is expected to reach 1.84 billion USD by 2029, growing at a CAGR of 6.53% during the forecast period (2024-2029).

Rising adoption of advanced materials to drive the demand for engineering plastics

- Engineering plastics, also known as thermoplastic polymers, are a class of synthetic resins that offer high-performance capabilities and improved plastic properties compared to conventional plastics. They exhibit stability over a broad temperature range and can withstand significant mechanical stress and climatic changes.

- The packaging production industry generates annual sales of over USD 13.6 billion, driven by high demand from specific industries such as food and beverage, pharmaceuticals, and personal and household care products. The packaging industry is the largest consumer of engineering plastics in the region, accounting for approximately 39% of total consumption across all industries in 2022. With changing, fast-paced lifestyles and the versatility of plastic packaging, the industry is projected to record a CAGR of 5.73% in terms of revenue during the forecast period.

- The electrical and electronics industry is the second-largest consumer of engineering plastics in the country, representing 12% of total consumption across all industries in 2022. This industry is driven by consumer electronics such as mobile phones, computers, wearables, TVs, and similar products. For example, the consumer electronics industry is expected to generate USD 32.48 billion in revenue in 2023. Consequently, the consumption volume of engineering plastics in this industry is projected to increase at a CAGR of 6.77% during the forecast period.

- The aerospace industry is likely to exhibit the highest growth rate of 8.27% over the forecast period. The development of new technologies for lighter and faster aircraft is driving the consumption of engineering plastics.

United Kingdom Engineering Plastics Market Trends

Technological innovations to boost the consumer electronics market

- The United Kingdom witnessed a revenue increase of 10.7% in electrical and electronics production from 2020 to 2021. The electronics industry holds significant importance in UK manufacturing, accounting for 4.7% of the overall industry. In 2017, it generated EUR 8.4 billion in gross value added and EUR 19.4 billion in turnover.

- Over the past two decades, the electronics industry in the United Kingdom has undergone a transformation, focusing more on high-technology and knowledge-intensive production processes. The country's National Microelectronics Institute is the largest independent semiconductor design producer in Europe, commanding 50% of the market in application-specific integrated circuit design and 40% of Europe's independent electronics design overall. This shift has led to a transition in the UK's electronics activity from manufacturing and assembly to component design and innovation, with ARM, a major semiconductor and software design company, serving as a notable example.

- Electronics contributes more than 12% of the total R&D manufacturing expenditure in the country. The top 10 export markets consist of prominent Western economies, as well as emerging markets in Asia, including China, Hong Kong, and the United Arab Emirates. However, the United Kingdom faced challenges such as Brexit, the US-China trade war, R&D funding, and cybersecurity issues in 2019.

- The country is expected to witness an increase in the production of electrical and electronic equipment due to growing demand for smart devices, the expanding market in Asia, advancements in medical device technology, energy-efficient technologies, the Internet of Things (IoT), 5G technology, the use of virtual and augmented reality, and automation.

United Kingdom Engineering Plastics Industry Overview

The United Kingdom Engineering Plastics Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are AGC Inc., Alfa S.A.B. de C.V., BASF SE, Polymer Extrusion Technologies (UK) Ltd and Victrex (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 United Kingdom

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AGC Inc.

- 6.4.2 Alfa S.A.B. de C.V.

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Covestro AG

- 6.4.7 Domo Chemicals

- 6.4.8 INEOS

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Polymer Extrusion Technologies (UK) Ltd

- 6.4.11 Radici Partecipazioni SpA

- 6.4.12 Solvay

- 6.4.13 Sumitomo Chemical Co., Ltd.

- 6.4.14 Teijin Limited

- 6.4.15 Victrex

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219