|

市場調查報告書

商品編碼

1693816

電力設備-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Power Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

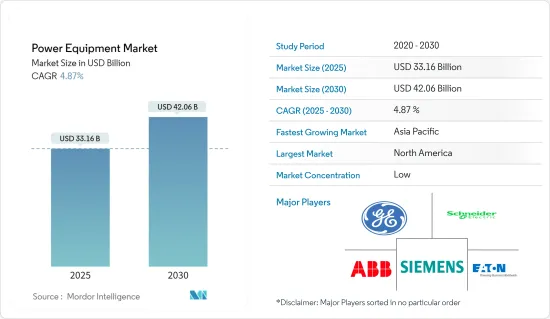

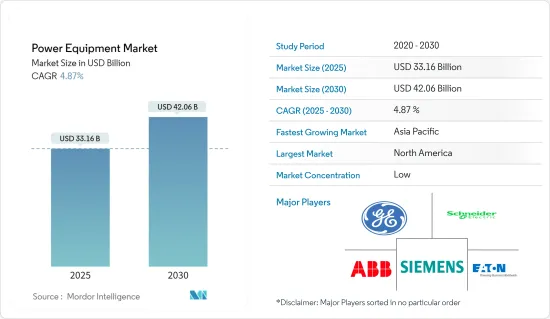

預計 2025 年電力設備市場規模為 331.6 億美元,到 2030 年將達到 420.6 億美元,預測期內(2025-2030 年)的複合年成長率為 4.87%。

2020年新冠疫情對市場產生了負面影響,目前市場已恢復到疫情前的水準。

關鍵亮點

- 從中期來看,由於人口成長和基礎設施發展,預計能源需求將增加,這將導致預測期內對電力設備的需求增加。

- 另一方面,高昂的營運和維護成本預計會阻礙市場成長。

- 加大對可再生能源和智慧電網基礎設施開發的技術投資預計將為電力設備市場創造重大機會。

電力設備市場趨勢

預計發電將主導市場

- 由於人口成長、都市化和工業化,全球對電力的需求正在增加。因此,發電設施在滿足日益成長的需求和確保穩定的電力供應方面發揮著至關重要的作用。

- 此外,人們對太陽能、風能、水力發電和地熱發電等可再生能源發電的日益關注也增強了發電設備的優勢。向更清潔、更永續的能源過渡需要專門的發電設備,如太陽能板、風力發電機和水力發電機。

- 例如,2022 年 6 月,Vestas AS 獲得一份契約,為 EnBW 的 900 MW He Dreiht離岸風力發電計劃供應 64 台 V235-15.0 MW風力發電機。維斯塔斯還與卡德勒簽署了渦輪機運輸和安裝契約,計劃於 2025 年第二季度開始。

- 世界各國政府也正在實施政策、獎勵和可再生能源發電目標,進一步刺激了對發電設備的需求,尤其是在可再生能源領域。

- 因此,全球可再生能源的裝置容量正在增加。根據國際可再生能源機構的預測,2022年全球可再生能源裝置容量將達到3,371.8吉瓦,而2021年為3,077.23吉瓦,2021年至2022年的成長率將超過9.5%。

- 因此,由於能源需求的增加、對可再生能源的關注、政府措施和發電,發電已成為電力設備市場的主導部分。

亞太地區成長強勁

- 亞太地區擁有世界相當一部分人口和許多世界最大城市。未來幾年,隨著數百萬新用戶用電範圍擴大,該地區的電力需求預計將激增。需求激增是由於人口快速成長和工業化程度不斷提高所致。

- 預計亞太地區將在不久的將來成為電力設備的主要市場。關鍵促進因素是再生能源來源的使用增加、電力消耗增加、電力供應增加以及電網基礎設施的持續改善。預計中國、印度、日本和澳洲等主要國家將在塑造該地區的電力設備市場方面發揮關鍵作用。

- 根據英國石油公司《世界能源統計評論》的數據,2021 年該地區的發電量為 13,994.4 TWh,比 2020 年成長 8.4%,比 2011 年至 2021 年間成長 4.7%。

- 此外,該地區的政府透過實施有利於發電和配電基礎設施的政策、措施和投資發揮關鍵作用。這些為確保能源安全、推廣可再生能源和改善電力供應所做的努力進一步推動了亞太地區對電力設備的需求。

- 例如,中國政府宣布了雄心勃勃的計劃,將於2022年在戈壁沙漠建造450吉瓦的太陽能和風能發電廠。該計劃旨在推動中國在2030年實現其可再生能源目標。

- 這些進步實現了高效和永續的電力管理,鞏固了該地區在電力設備市場中的地位。

- 由於經濟快速成長、都市化、政府措施、可再生能源的採用、基礎設施發展、工業需求和技術進步,亞太地區可望主導電力設備市場。

電力設備產業概況

全球電力設備市場正走向半固體化。該市場的主要企業(不分先後順序)包括通用電氣公司、施耐德電氣公司、ABB、伊頓公司和西門子。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 至2028年的市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 人口成長和基礎設施發展

- 限制因素

- 運作維護成本高

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章市場區隔

- 設備類型

- 發電機

- 變形金剛

- 開關設備

- 電路斷流器

- 電源線

- 其他設備

- 發電源

- 石化燃料為基礎

- 太陽熱

- 風

- 核能

- 水力發電

- 最終用戶

- 住宅

- 工商

- 公共產業

- 應用

- 發電

- 動力傳輸

- 配電

- 2028 年前的地區、市場規模和需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- General Electric Company

- Siemens AG

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Toshiba Corporation

- Honeywell International Inc.

- Bharat Heavy Electricals Limited

- Crompton Greaves Ltd.

- Larsen & Toubro Limited

- Fuji Electric Co., Ltd.

- Rockwell Automation, Inc.

- ABB Ltd.

第7章 市場機會與未來趨勢

- 增加對可再生能源和智慧電網基礎設施建設的技術投資

簡介目錄

Product Code: 5000125

The Power Equipment Market size is estimated at USD 33.16 billion in 2025, and is expected to reach USD 42.06 billion by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing population growth and infrastructure development are expected to increase energy demand, consequently increasing the demand for power equipment during the forecasted period.

- On the other hand, high operations and maintenance costs are expected to hinder market growth.

- Nevertheless, the increasing technological investments in developing renewable energy and smart grid infrastructure are expected to create huge opportunities for the power equipment market.

Power Equipment Market Trends

Power Generation Expected to Dominate the Market

- The global electricity demand is rising, driven by population growth, urbanization, and industrialization. As a result, power generation equipment plays a critical role in meeting this escalating demand and ensuring a consistent electricity supply.

- Moreover, the expanding focus on renewable energy sources, such as solar, wind, hydro, and geothermal power, further contributes to the dominance of power generation equipment. The transition towards cleaner and more sustainable energy necessitates specialized power generation equipment like solar panels, wind turbines, and hydroelectric generators.

- For instance, in June 2022, Vestas AS won a contract to supply 64 V235-15.0 MW wind turbines for EnBW's 900 MW He Dreiht offshore wind project. Vestas has also entered into an agreement with Cadeler for the transportation and installation of the turbines, which is planned to start in Q2 2025.

- Governments worldwide are also implementing policies, incentives, and renewable energy targets, further boosting the demand for power generation equipment, particularly in the renewable energy sector.

- This has led to an increase in renewable energy installed capacity globally. According to the International Renewable Energy Agency, in 2022 the global renewable energy installed capacity was 3371.8 GW, compared to 3077.23 GW in 2021, registering a growth rate of more than 9.5% between 2021 and 2022.

- Therefore, with increasing energy demand, the focus on renewable energy, government initiatives, and power generation, power generation emerges as the dominant segment within the power equipment market.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific houses a significant proportion of the global population and has numerous major cities. In the coming years, the region is expected to witness a surge in power demand due to the expanding access to electricity among millions of new customers. This escalating demand can be attributed to rapid population growth and the ongoing process of industrialization.

- The Asia-Pacific region is poised to emerge as a prominent market for power equipment in the foreseeable future. The main drivers are the increasing use of renewable energy sources, rising power consumption, increased access to electricity, and ongoing improvements to power grid infrastructure. Key countries such as China, India, Japan, and Australia are anticipated to play pivotal roles in shaping the power equipment market within the region.

- According to the BP statistical review of world energy, the electricity generation in the region was 13,994.4 TWh in 2021, an increase of 8.4% compared to 2020 and 4.7% between 2011 and 2021.

- Additionally, governments in the region are playing a crucial role by implementing favorable policies, initiatives, and investments in power generation and distribution infrastructure. This commitment to energy security, renewable energy promotion, and improved electricity access further propel the demand for power equipment in Asia-Pacific.

- For instance, the Chinese government unveiled its ambitious plan in 2022 to construct solar and wind energy power plants with a total capacity of 450 gigawatts in the Gobi desert regions. This initiative aims to propel the nation towards achieving its renewable energy target by 2030.

- These advancements enable efficient and sustainable power management, enhancing the region's prominence in the power equipment market.

- Asia Pacific is therefore poised to dominate the power equipment market due to rapid economic growth, urbanization, government initiatives, the deployment of renewable energy sources, infrastructure development, industrial demand, and technological advancements.

Power Equipment Industry Overview

The global power equipment market is semi-consolidted. Some of the key players in this market (in no particular order) are General Electric Company, Schneider SE, ABB Ltd., Eaton Corporation, and Siemens AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Population Growth and Infrastructure Development

- 4.5.2 Restraints

- 4.5.2.1 High Operational and Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment Type

- 5.1.1 Generator

- 5.1.2 Transformer

- 5.1.3 Switchgears

- 5.1.4 Circuit Breakers

- 5.1.5 Power Cable

- 5.1.6 Other Equipment Types

- 5.2 Power Generation Source

- 5.2.1 Fossil Fuel Based

- 5.2.2 Solar

- 5.2.3 Wind

- 5.2.4 Nuclear

- 5.2.5 Hydro

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Industrial and Commercial

- 5.3.3 Utility

- 5.4 Application

- 5.4.1 Power Generation

- 5.4.2 Transmission

- 5.4.3 Distribution

- 5.5 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Australia

- 5.5.3.4 Japan

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Nigeria

- 5.5.4.4 South Africa

- 5.5.4.5 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Chile

- 5.5.5.4 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Siemens AG

- 6.3.3 Schneider Electric SE

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 Eaton Corporation plc

- 6.3.6 Toshiba Corporation

- 6.3.7 Honeywell International Inc.

- 6.3.8 Bharat Heavy Electricals Limited

- 6.3.9 Crompton Greaves Ltd.

- 6.3.10 Larsen & Toubro Limited

- 6.3.11 Fuji Electric Co., Ltd.

- 6.3.12 Rockwell Automation, Inc.

- 6.3.13 ABB Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Investments in Developing Renewable Energy and Smart Grid Infrastructure

02-2729-4219

+886-2-2729-4219