|

市場調查報告書

商品編碼

1693724

電動貨運自行車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)E-cargo Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

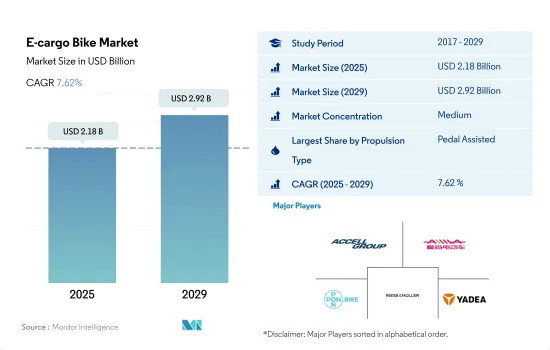

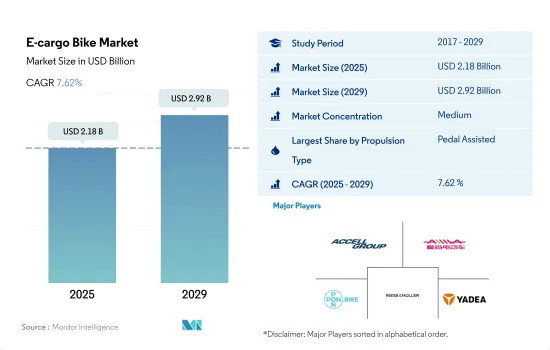

電動貨運自行車市場規模預計在 2025 年為 21.8 億美元,預計到 2029 年將達到 29.2 億美元,預測期內(2025-2029 年)的複合年成長率為 7.62%。

推進系統細分市場概覽

- 2017 年至 2023 年,電動貨運自行車的銷量將實現 17.16% 的複合年成長率,其中德國、英國、法國和美國等市場佔據全球市場的很大佔有率。隨著城市面臨交通堵塞,造成噪音和空氣污染,電動貨運自行車和自行車物流領域正在成為首末班車配送、一般物流服務提供和家庭交通的一種便捷、永續、無堵塞和包容的替代方案。

- 北美是全球成長最快的電子商務市場,由於其脆弱的地理位置和廣闊的城市景觀,與其他地區相比,它面臨著特殊的物流挑戰。 2022年,墨西哥的電子商務市場規模達到了379.9億美元。然而,墨西哥運輸和物流公司Estafeta等公司在2017年底實施了“綠色配送”,在某些城市引入電動自行車進行最後一英里的配送。透過這些措施,預計未來幾年電動貨運自行車的使用量將會增加。

- 線上訂單的成長正在推動最後一哩配送業務的成長。政府應該歡迎創新和變革,使未來減少依賴、更永續。中國、印度和日本等亞洲國家人口密度極高,因此電動貨運自行車可望成為未來最實用、最環保的選擇。

國家層級概述

- 預計預測期內全球電動貨運自行車市場的複合年成長率將達到 7.73%。由於電動自行車具有健康益處、經濟的交通選擇和騎乘便利等優點,市場銷售量正在激增。

- 在亞太地區,中國、日本和印尼在過去一段時間佔據了總銷量的很大佔有率。 2022年,中國佔全球電動自行車市場90%以上的佔有率。然而,此後成長停滯,市場基本飽和。

- 在歐洲,電動自行車銷售近年來快速成長,其中德國、比利時和荷蘭的銷售量最大。其背景是人們越來越偏好使用電動自行車進行交通、運動和休閒。此外,瑞典、比利時和法國對電動自行車的補貼和稅收優惠預計將在預測期內進一步推動歐洲電動自行車市場的顯著成長。

- 近年來,北美地區對低速自行車的偏好不斷提升,電動自行車市場呈現成長態勢。隨著各共享單車營運商將更多電動自行車納入其車隊擴張的一部分,預計這將在不久的將來支持這些自行車的銷售成長。

全球電動貨運自行車市場趨勢

全球電動自行車普及率的穩定成長反映了全球向永續、高效的個人行動解決方案的轉變。

- 近年來,許多國家對電動自行車的需求不斷增加。汽油價格上漲、交通高峰期擁擠以及運動對健康的益處正在推動英國和美國等多個國家採用電動自行車。歐洲是 2019 年電動機車銷售的主要市場,其採用率高於其他地區。與 2018 年相比,2019 年對電動自行車的需求不斷成長,加速了電動自行車的普及率。

- 新冠肺炎疫情在全球迅速蔓延,對自行車產業產生了正面影響。與其他交通方式相比,電動自行車是日常通勤和前往中東和北非其他地區最實用、最經濟的解決方案之一,並且徹底改變了消費者的通勤方式。這鼓勵了人們投資電動自行車,與 2019 年相比,2020 年全球電動自行車的普及率正在加速。

- 商業營運的恢復和停工等貿易限制的解除加速了世界各國對電動自行車的普及。進出口活動的改善是全球貿易壁壘消除的結果。根據估計和預測,在預測期內,電動自行車在全球許多國家的受歡迎程度預計將會增加,因為消費者對電動自行車的興趣越來越大,因為它們具有騎行時鍛煉、無燃料成本和清潔騎行等特點和優勢。

全球超當地語系化配送市場正在經歷顯著成長,主要受美國和亞太地區(尤其是中國)的顯著趨勢所推動。

- 電動自行車在世界多個國家越來越受歡迎。過去五年來,由於網路購物的興起,污染和交通堵塞顯著增加。為了因應這種情況,網路購物選擇更快、更環保的電動自行車送貨方式。全球整體,亞太地區的電動自行車交付量最多,其次是北美。這些因素解釋了為什麼 2019 年全球使用電動自行車進行本地配送的數量與 2018 年相比有所增加。

- 為了擴大電動自行車市場,政府採取的回扣和補貼等措施也為全球電動自行車市場提供了支持。例如,在北美,政府提供價值 1,000 美元的獎勵來鼓勵人們選擇電動自行車。這些因素推動了對電動自行車的需求,2021 年北美國家的電動自行車出貨量與 2020 年相比成長了 19.70%。類似因素導致 2021 年全球電動自行車交付量與 2020 年相比增加。

- 由於電動機車相對於其他燃料驅動汽車具有成本優勢,因此電動自行車業務在全球呈現爆炸性成長。由於電動自行車具有省時、省油、環保和降低維護成本等優點,企業正在投資電動自行車用於本地配送。由於上述因素,預計在預測期內,最後一哩本地配送中使用電動自行車的數量將會增加。

電動貨運自行車產業概況

電動貨運自行車市場適度整合,前五大公司佔47.73%的市場。該市場的主要企業包括 Accell Group、Aima Technology Group、Pon Holding BV、Riese & Muller、Yadea Group Holdings Ltd 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 自行車銷量

- 人均GDP

- 通貨膨脹率

- 電動自行車普及率

- 每天出遊 5-15 公里的人口/通勤者百分比

- 自行車租賃

- 電動自行車電池價格

- 電池化學價格表

- 超本地化配送

- 自行車道

- 電池充電容量

- 交通堵塞指數

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 踏板輔助

- 高速電動自行車

- 油門輔助

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 地區

- 非洲

- 按國家

- 南非

- 非洲以外

- 亞太地區

- 按國家

- 澳洲

- 中國

- 印度

- 日本

- 紐西蘭

- 韓國

- 其他亞太地區

- 歐洲

- 按國家

- 奧地利

- 比利時

- 丹麥

- 法國

- 德國

- 義大利

- 盧森堡

- 荷蘭

- 挪威

- 波蘭

- 西班牙

- 瑞典

- 瑞士

- 英國

- 其他歐洲國家

- 中東

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 北美洲

- 按國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 按國家

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Accell Group

- Aima Technology Group Co. Ltd

- Bakfiets.nl

- CUBE Bikes

- DOUZE Factory SAS

- Giant Manufacturing Co. Ltd.

- Jiangsu Xinri E-Vehicle Co. Ltd

- Jinhua Jobo Technology Co.

- Pedego Electric Bikes

- Pon Holding BV

- Rad Power Bikes

- Riese & Muller

- RYTLE GmbH

- Smart Urban Mobility BV

- Tern Bicycles

- The Cargo Bike Company

- Xtracycle Inc.

- XYZ CARGO

- Yadea Group Holdings Ltd

- YUBA BICYCLES LLC

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93673

The E-cargo Bike Market size is estimated at 2.18 billion USD in 2025, and is expected to reach 2.92 billion USD by 2029, growing at a CAGR of 7.62% during the forecast period (2025-2029).

Propulsion Segment Market Overview

- Electric cargo bike sales recorded a CAGR of 17.16% between 2017 and 2023, with developed nations like Germany, the United Kingdom, France, and the United States accounting for a sizable percentage of the worldwide market. As cities struggle with traffic congestion that causes noise and air pollution, the electric cargo bike and bicycle logistic sectors are emerging as a useful, sustainable, non-congested, and inclusive alternative for first- and last-mile deliveries, general logistical service provision, and family vehicles.

- North America is the fastest-growing e-commerce market in the world and presents special logistics challenges compared to other regions due to its fraught geography and sprawling urban landscapes. The Mexican e-commerce market reached USD 37.99 billion in 2022. However, companies like Mexican transportation and logistics Estafeta implemented its "green deliveries" in late 2017, featuring e-bikes for last-mile deliveries in certain cities. Such steps are expected to increase the usage of the e-cargo bike in recent years.

- An increase in online orders is driving the growth of the last-mile delivery business. Governments should welcome technological innovation and change to reduce reliance and become more sustainable in the future. Because of the tremendously dense population in Asian countries such as China, India, and Japan, e-cargo bikes are expected to be the most practical and eco-friendly option in the future.

Country Level Overview

- The global e-cargo bike market is projected to witness a CAGR of 7.73% during the forecast period, mainly due to the increasing adoption of e-bikes as a daily mode of transportation globally. The market has witnessed an upsurge in the unit sales of e-bikes due to their beneficial characteristics, such as health benefits, economic mobility options, and convenience in riding.

- In Asia-Pacific China, Japan, and Indonesia accounted for a major share of the overall unit sales during the historical period. China held over 90% volume share in the global e-bike market in 2022. However, it has witnessed stagnant growth since, and the market is almost at a saturation point.

- In Europe, e-bike sales skyrocketed in recent years, with countries including Germany, Belgium, and the Netherlands selling major units of e-bikes. This is due to the growing preference for using e-bikes for transportation, sports, and leisure activities. Additionally, the subsidies and tax incentives programs on e-bikes in Sweden, Belgium, and France are anticipated to further support the significant growth of the European e-bike market during the forecast period.

- In North America, the e-bike market is emerging as the preference for using low-speed two-wheelers has grown in recent years. The increased inclusion of more e-bikes by various bike-sharing operators as part of their fleet expansion is expected to support the sales growth of these bikes in the near future.

Global E-cargo Bike Market Trends

The steady global increase in e-bike adoption rates reflects a worldwide shift toward sustainable and efficient personal mobility solutions

- There has been an increase in the demand for electric bicycles in many countries over the past several years. Increased gasoline costs, traffic congestion during rush hours, and the health advantages of exercise are driving the adoption of e-bikes in several countries, including the United Kingdom and the United States. With a greater adoption rate in 2019 compared to other regions, Europe was the primary market for the sales of electric bikes. The increasing demand for e-bikes accelerated the adoption rate in 2019 compared to 2018.

- The bicycle industry was favorably impacted by the rapid global expansion of COVID-19 cases. E-bikes are one of the most practical and affordable solutions for everyday commutes to work and other local locations compared to other means of transportation, which has revolutionized how consumers commute. This has encouraged people to invest in e-bikes, which accelerated their adoption rate in 2020 over 2019 in various countries worldwide.

- The return of commercial operations and the lifting of trade restrictions like lockouts have accelerated the adoption of e-bikes in numerous countries throughout the world. The improvement of import and export activities has been a result of the removal of trade obstacles globally. According to estimates, during the forecast period, the adoption rate of e-bikes will increase in a number of countries worldwide due to consumers' growing interest in them as a result of their features and advantages, such as the ability to exercise while riding, the lack of fuel costs, and cleaner rides.

The global Hyper-Local Delivery market is on a significant upward trend, driven mainly by substantial volumes in the US and Asia-Pacific, especially China

- E-bikes are becoming increasingly popular in several countries across the world. Due to increased online shopping, pollution and traffic congestion have increased significantly over the past five years. Due to these circumstances, online merchants are choosing the quicker and greener option of e-bike deliveries. Globally, Asia-Pacific recorded the highest number of e-bike deliveries, followed by North America. These factors account for the global increase in the use of e-bikes for local deliveries in 2019 over 2018.

- Focusing on e-bike market expansion, governments' efforts in the form of rebates and subsidies are also supporting the global e-bike market. For instance, in North America, the government provides incentives worth USD 1,000, encouraging people to choose e-bikes. These factors are driving the demand for e-bikes, which led to a 19.70% growth in e-bike deliveries in North American countries in 2021 over 2020. Similar factors drove global growth in e-bike delivery units in 2021 over 2020.

- The e-bike business is exploding in many nations across the world due to the cost advantages of electric bikes over other fuel-powered vehicles. Businesses are investing in e-bikes for local deliveries because of advantages like time efficiency, fuel efficiency, environmental friendliness, and lower maintenance costs. The use of e-bikes for last-mile local deliveries is anticipated to rise during the forecast period due to the aforementioned factors.

E-cargo Bike Industry Overview

The E-cargo Bike Market is moderately consolidated, with the top five companies occupying 47.73%. The major players in this market are Accell Group, Aima Technology Group Co. Ltd, Pon Holding B.V., Riese & Muller and Yadea Group Holdings Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Battery Charging Capacity

- 4.12 Traffic Congestion Index

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Battery Type

- 5.2.1 Lead Acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Others

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest-of-Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Japan

- 5.3.2.1.5 New Zealand

- 5.3.2.1.6 South Korea

- 5.3.2.1.7 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 Austria

- 5.3.3.1.2 Belgium

- 5.3.3.1.3 Denmark

- 5.3.3.1.4 France

- 5.3.3.1.5 Germany

- 5.3.3.1.6 Italy

- 5.3.3.1.7 Luxembourg

- 5.3.3.1.8 Netherlands

- 5.3.3.1.9 Norway

- 5.3.3.1.10 Poland

- 5.3.3.1.11 Spain

- 5.3.3.1.12 Sweden

- 5.3.3.1.13 Switzerland

- 5.3.3.1.14 UK

- 5.3.3.1.15 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Saudi Arabia

- 5.3.4.1.2 United Arab Emirates

- 5.3.4.1.3 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 US

- 5.3.5.1.4 Rest-of-North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accell Group

- 6.4.2 Aima Technology Group Co. Ltd

- 6.4.3 Bakfiets.nl

- 6.4.4 CUBE Bikes

- 6.4.5 DOUZE Factory SAS

- 6.4.6 Giant Manufacturing Co. Ltd.

- 6.4.7 Jiangsu Xinri E-Vehicle Co. Ltd

- 6.4.8 Jinhua Jobo Technology Co.

- 6.4.9 Pedego Electric Bikes

- 6.4.10 Pon Holding B.V.

- 6.4.11 Rad Power Bikes

- 6.4.12 Riese & Muller

- 6.4.13 RYTLE GmbH

- 6.4.14 Smart Urban Mobility B.V

- 6.4.15 Tern Bicycles

- 6.4.16 The Cargo Bike Company

- 6.4.17 Xtracycle Inc.

- 6.4.18 XYZ CARGO

- 6.4.19 Yadea Group Holdings Ltd

- 6.4.20 YUBA BICYCLES LLC

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219